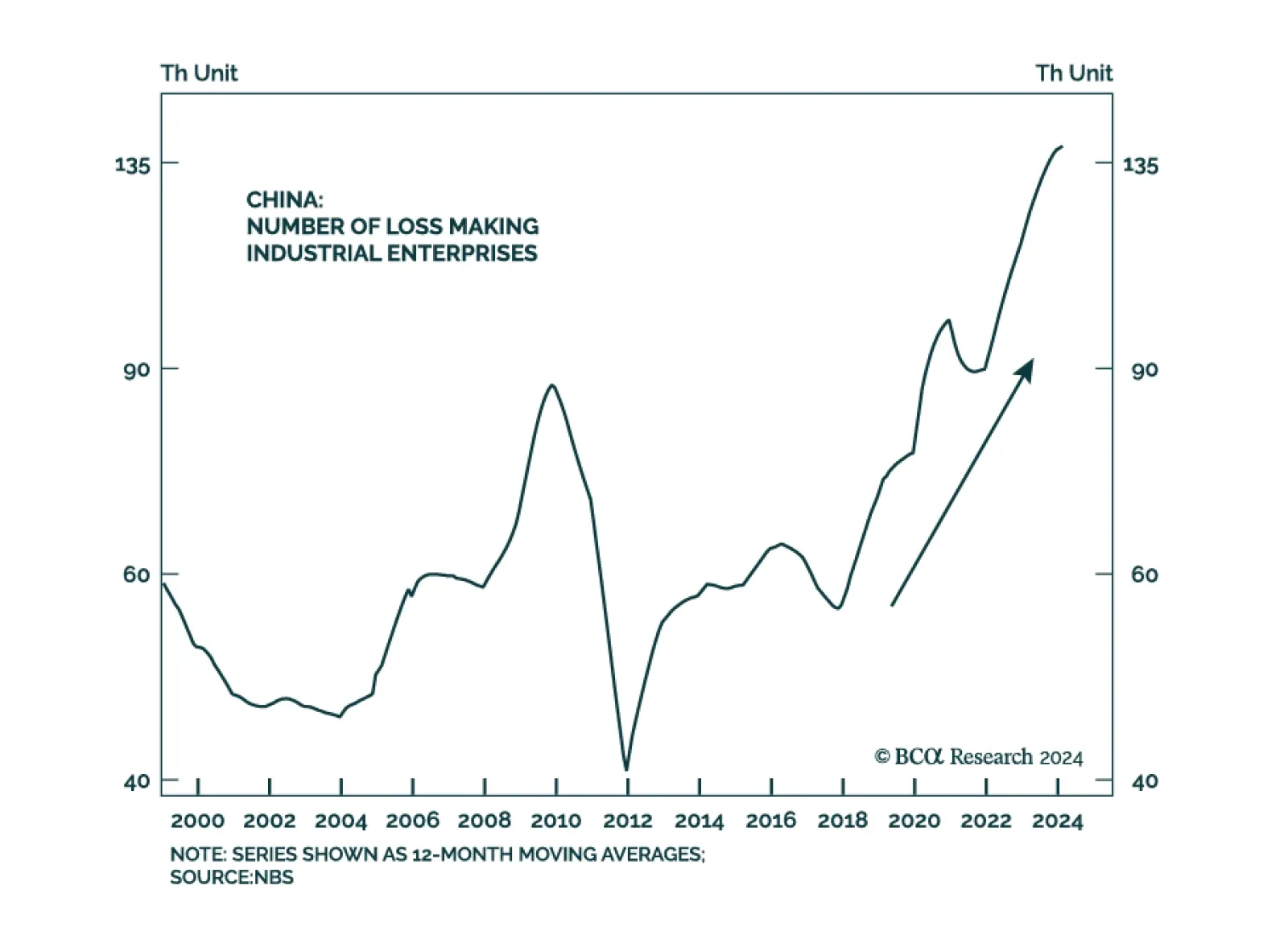

As highlighted in Wednesday’s edition of BCA Live & Unfiltered, the Chinese economy and its financial markets face several daunting challenges. Its demographic outlook is unfavorable, with a low birthrate stifling…

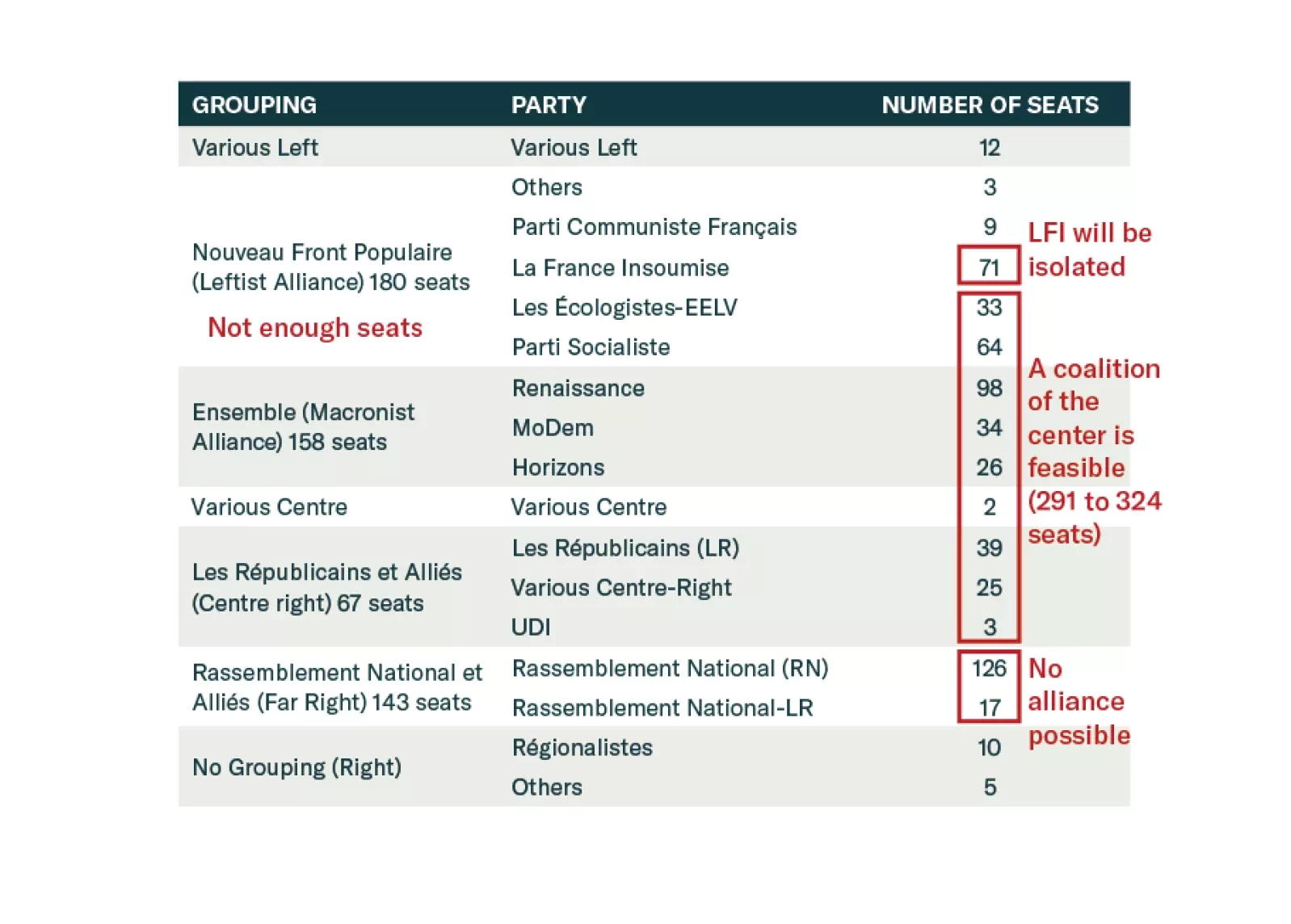

At first glance, France has moved to the far left. However, this coalition is fragile, and Macron’s allies still hold the balance of power. What are the assets that will benefit from this new political setup, and those that will not…

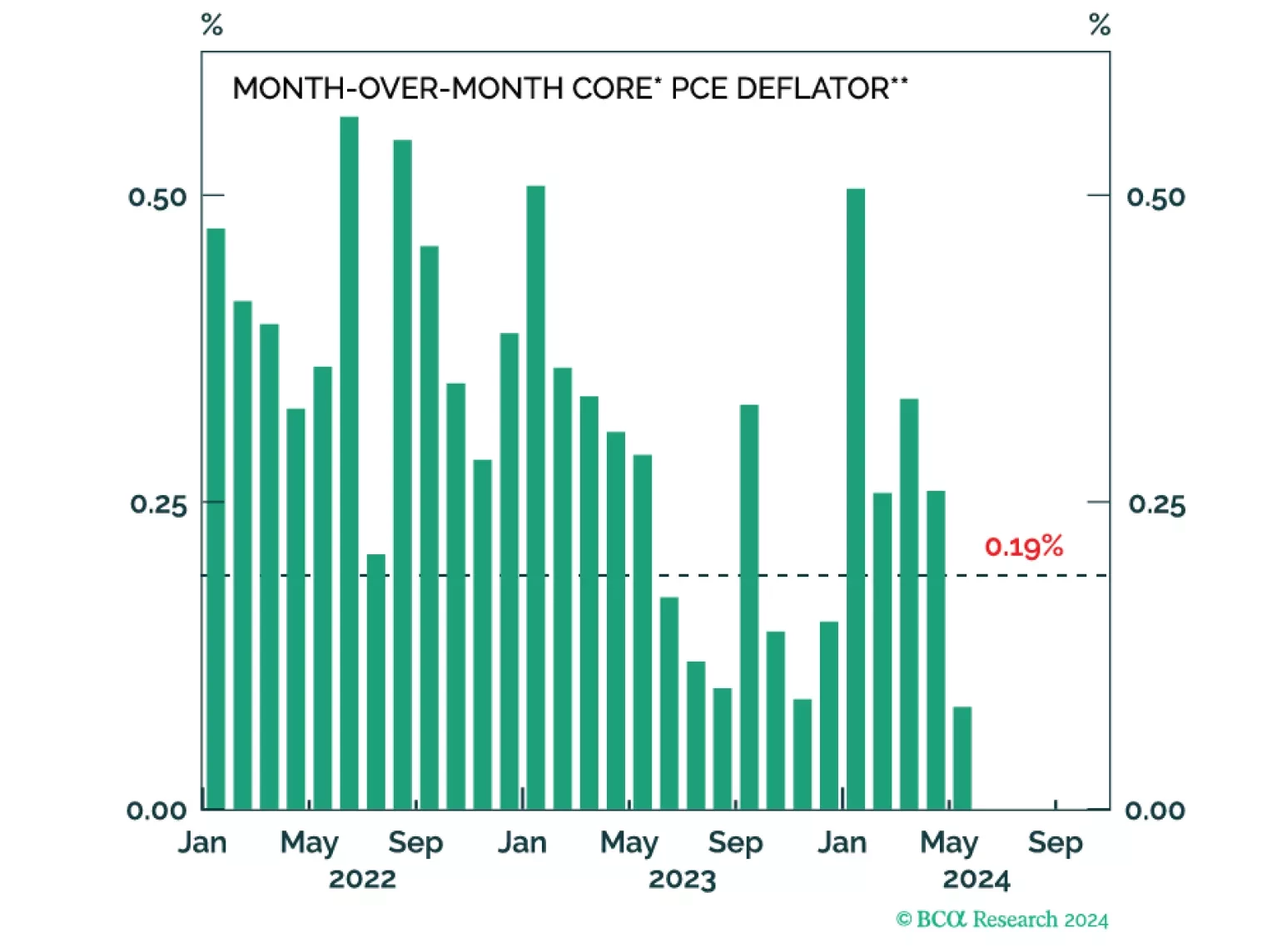

Our labor market indicators have softened meaningfully during the past month but aren’t yet signaling an imminent recession. That said, the Fed can no longer ignore the labor market with the unemployment rate above 4% and rising.

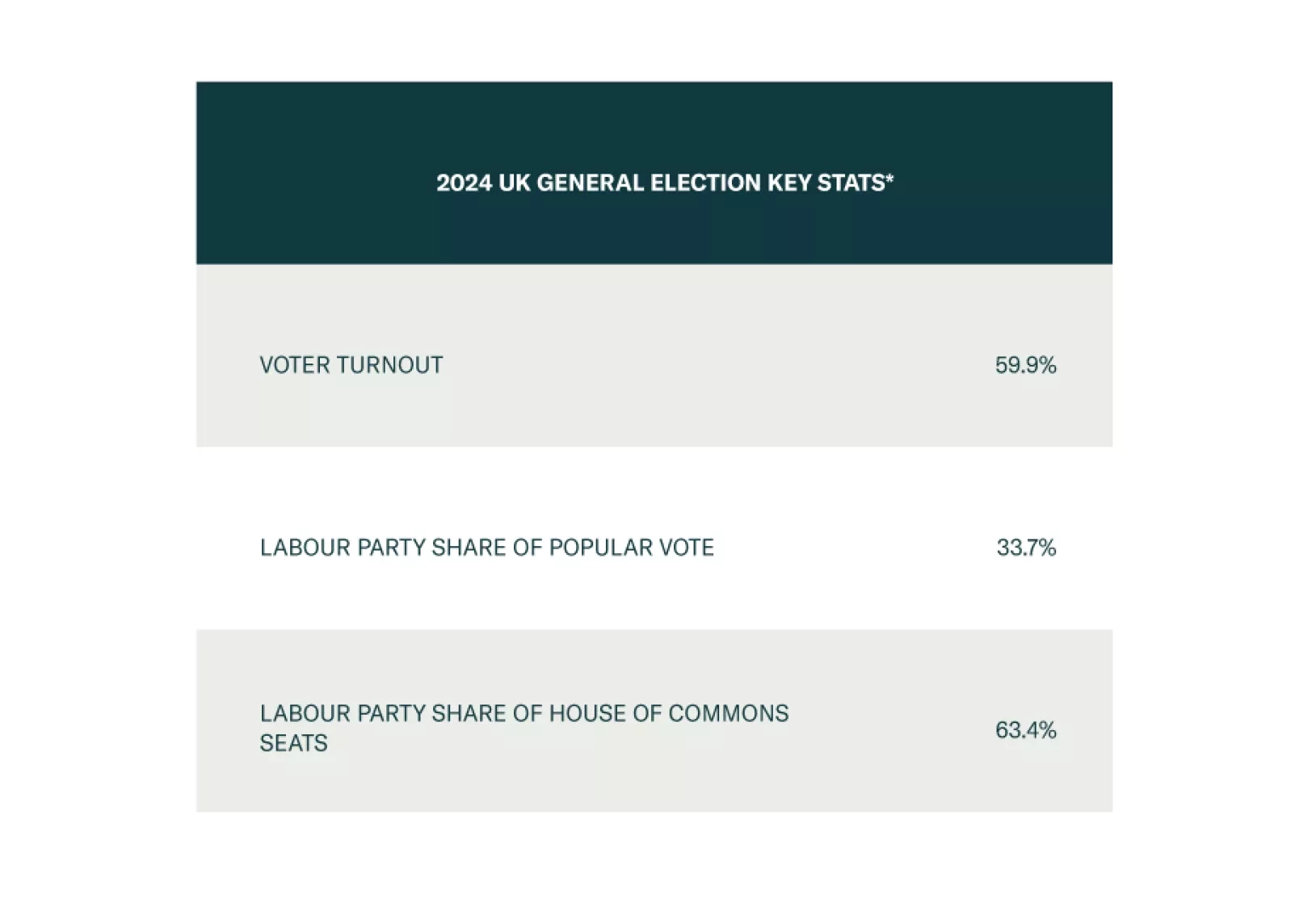

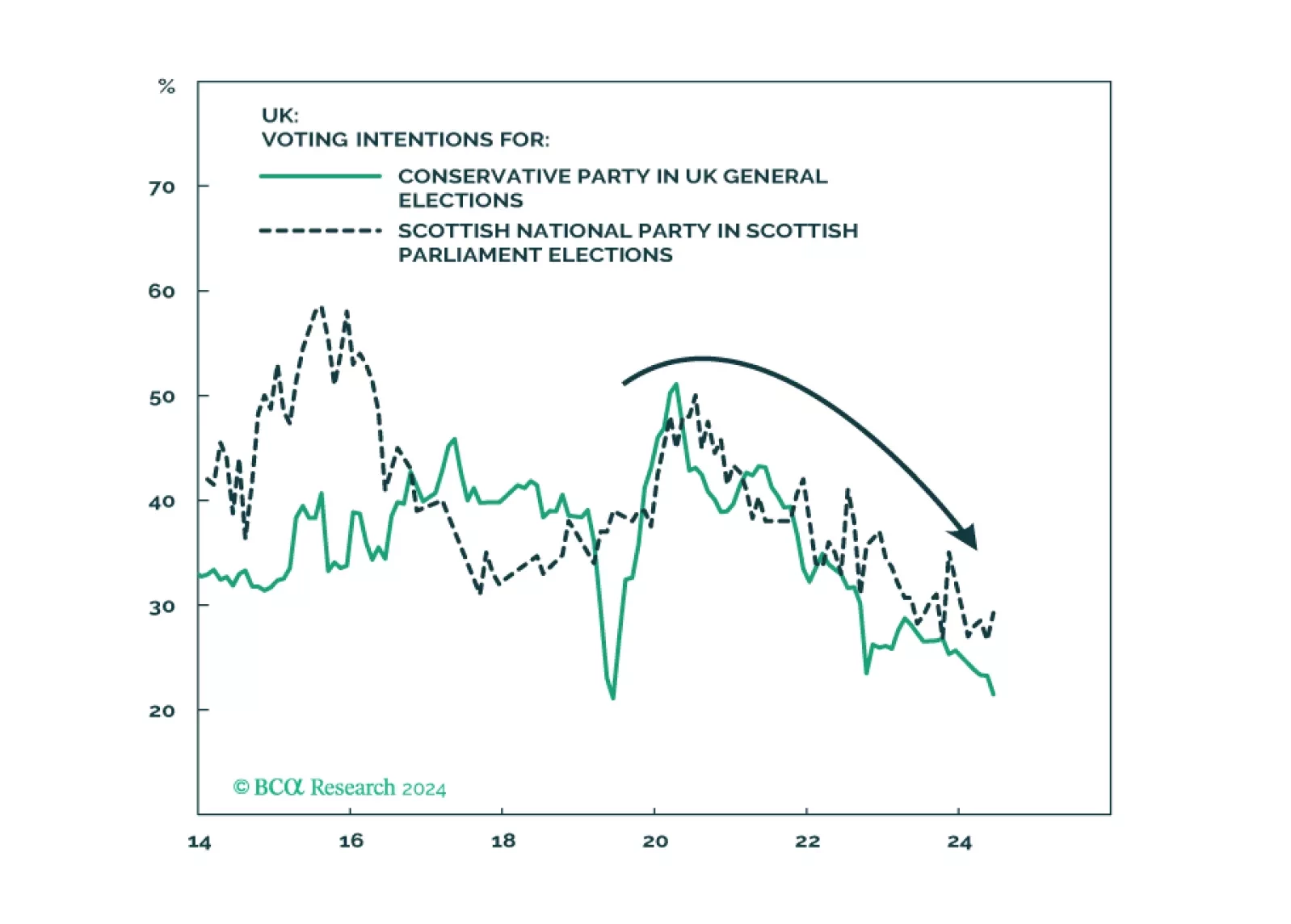

The new Labour government will have flexibility to respond to macro shocks, which is positive for the UK in general, namely GBP-EUR, and also gilts in absolute terms. But over the long run, tax hikes will likely surprise to the…

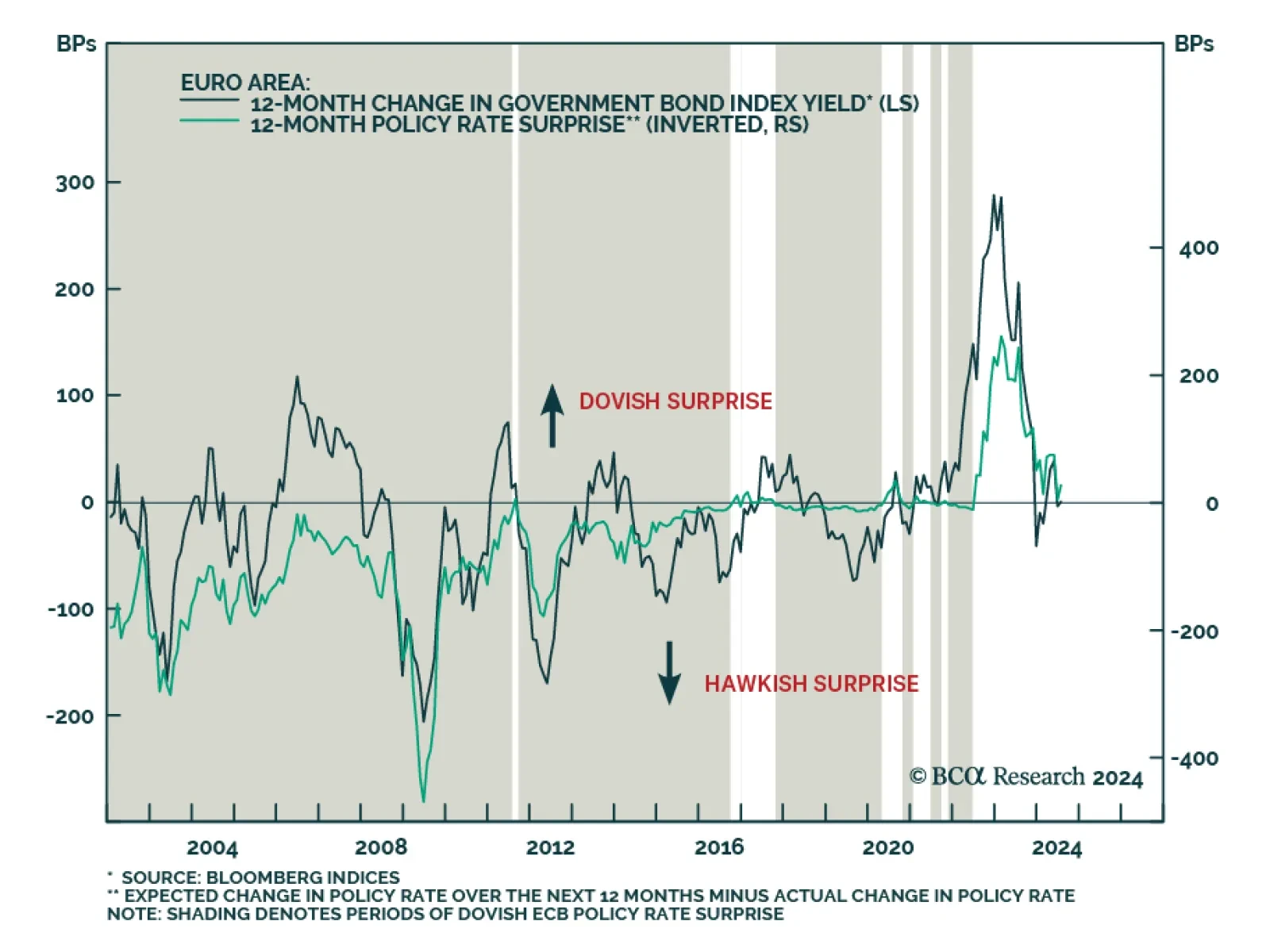

Does the incipient slowdown in European data herald a soft landing and a goldilocks period for equities? We have our doubts.

Eurozone headline inflation slowed from 2.6% y/y to 2.5% in June. Germany, its largest economy, saw price pressures ease from 2.4% to 2.2%, below expectations of 2.3% (or from 2.8% to 2.5% on an EU-Harmonized basis). However,…

Our Portfolio Allocation Summary for July 2024.

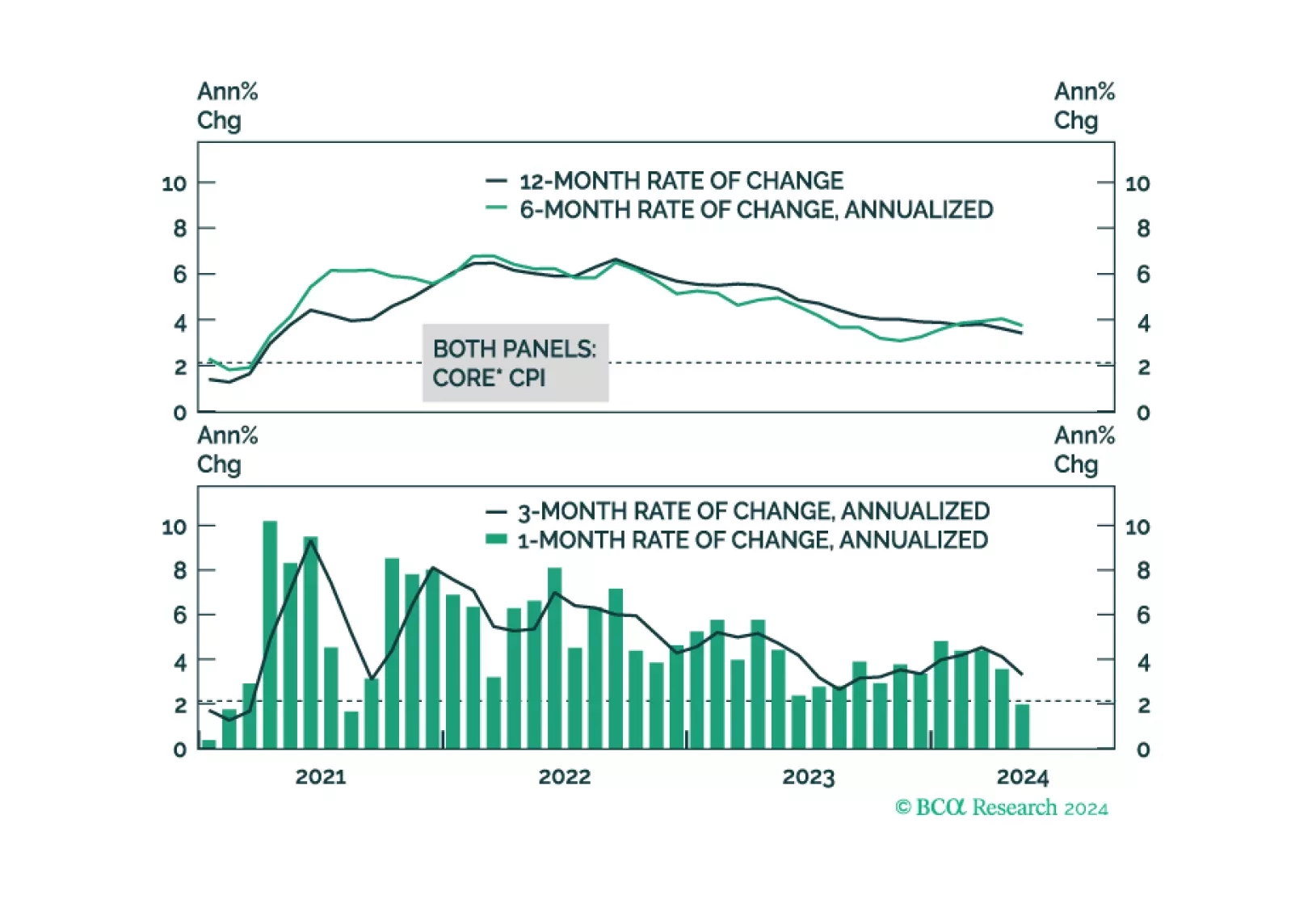

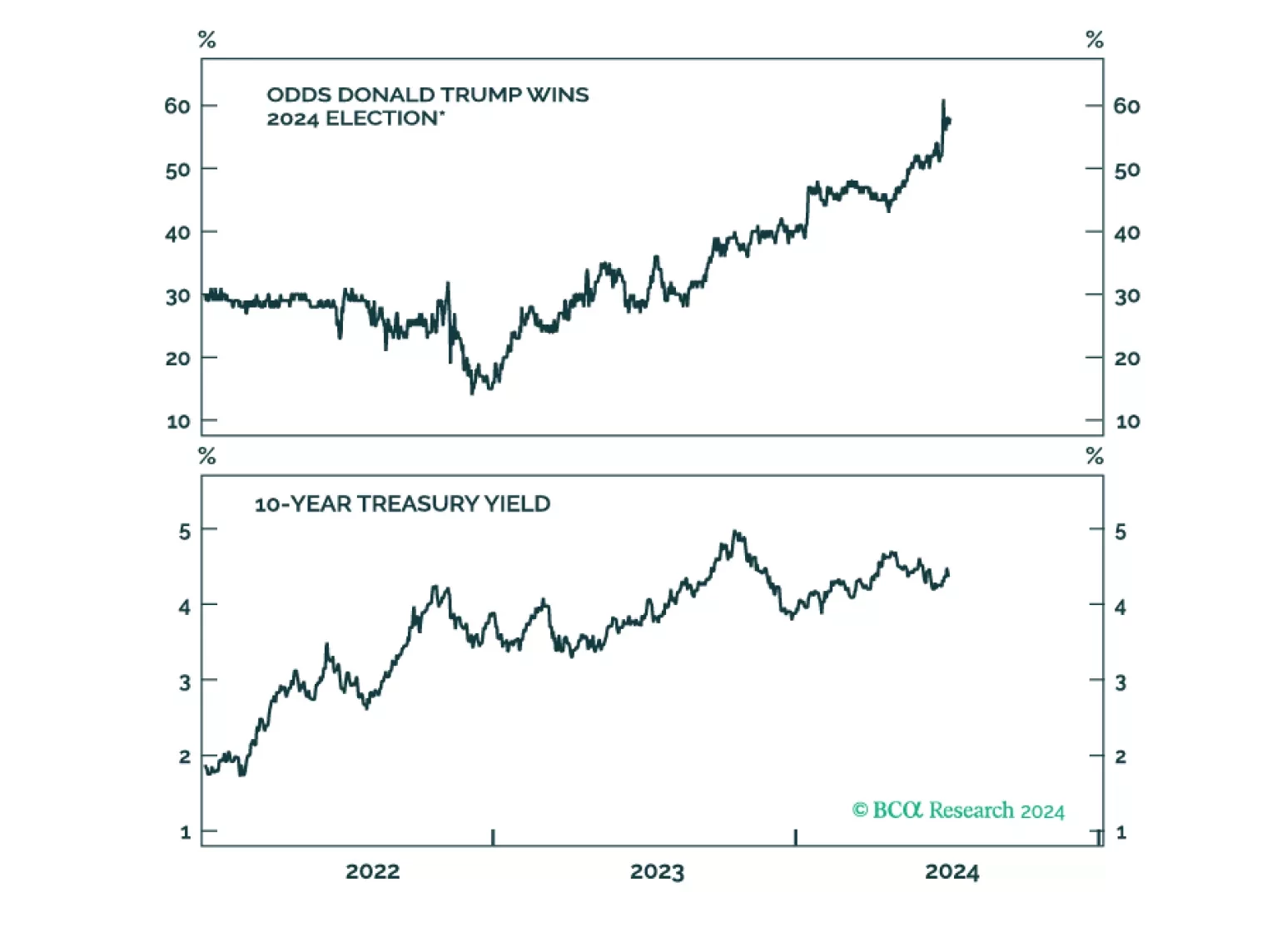

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.