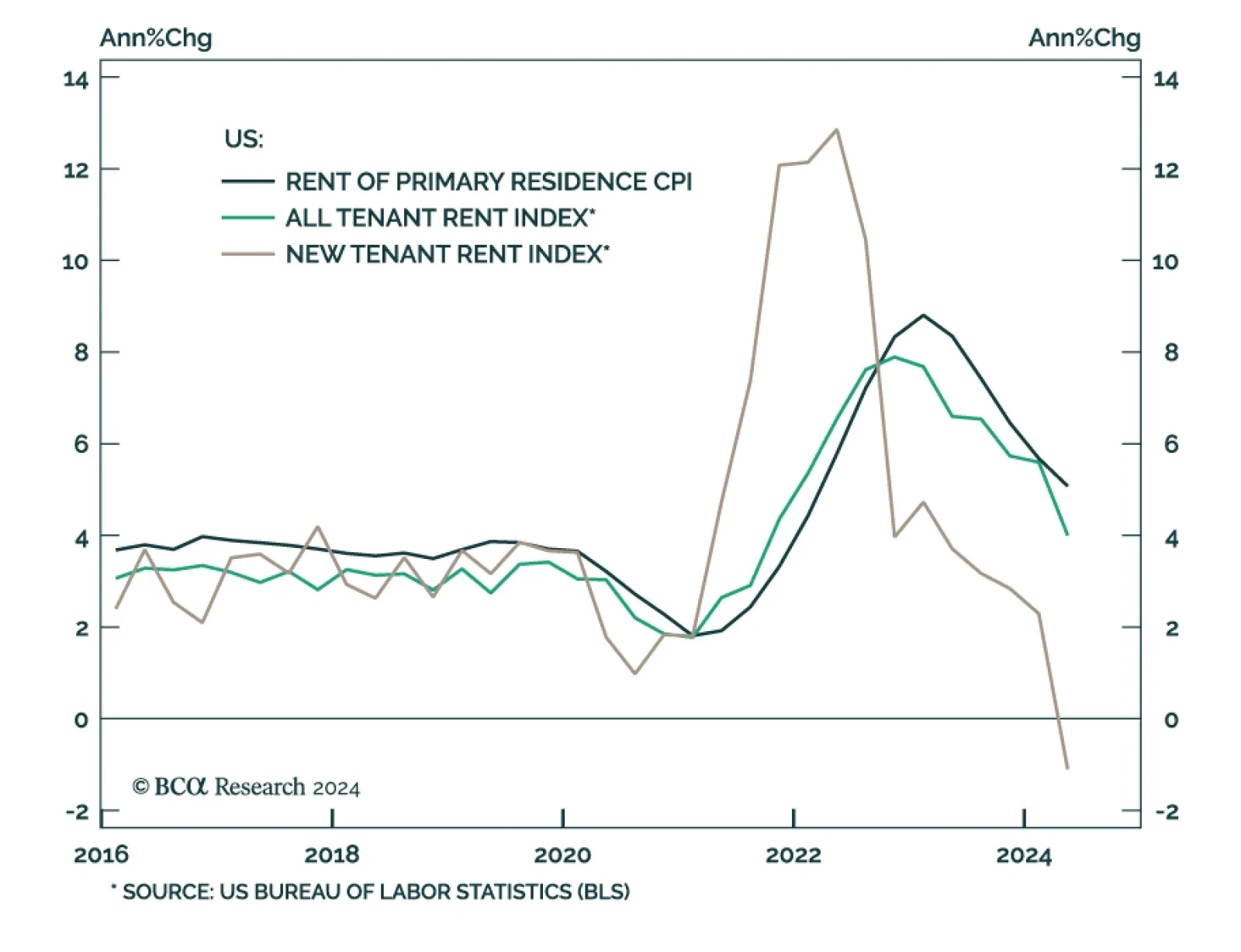

US shelter inflation has been stubbornly high for the past few years, but we finally saw a notable drop in the June CPI release. Given that shelter accounts for more than 40% of the core CPI index, the outlook for shelter…

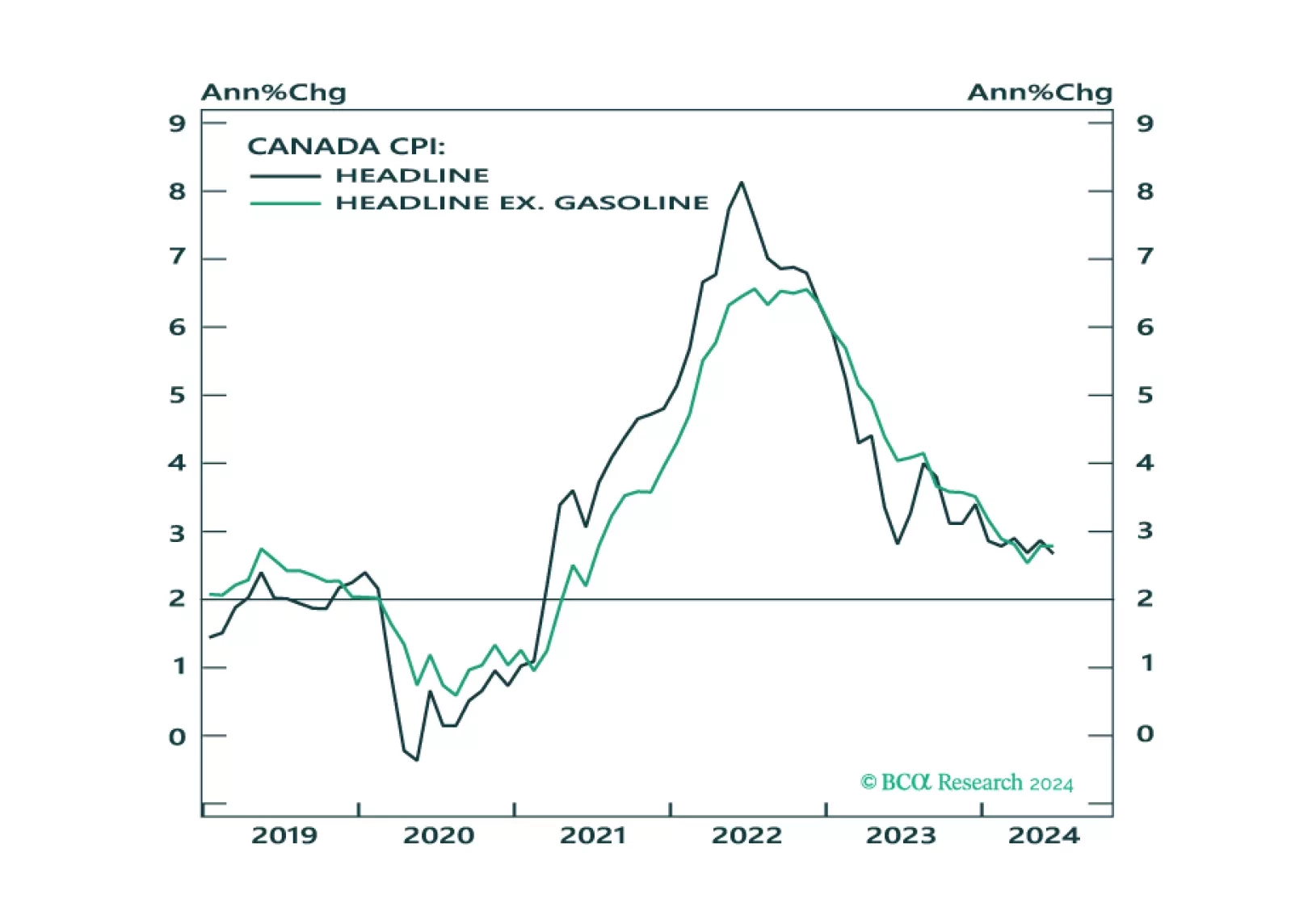

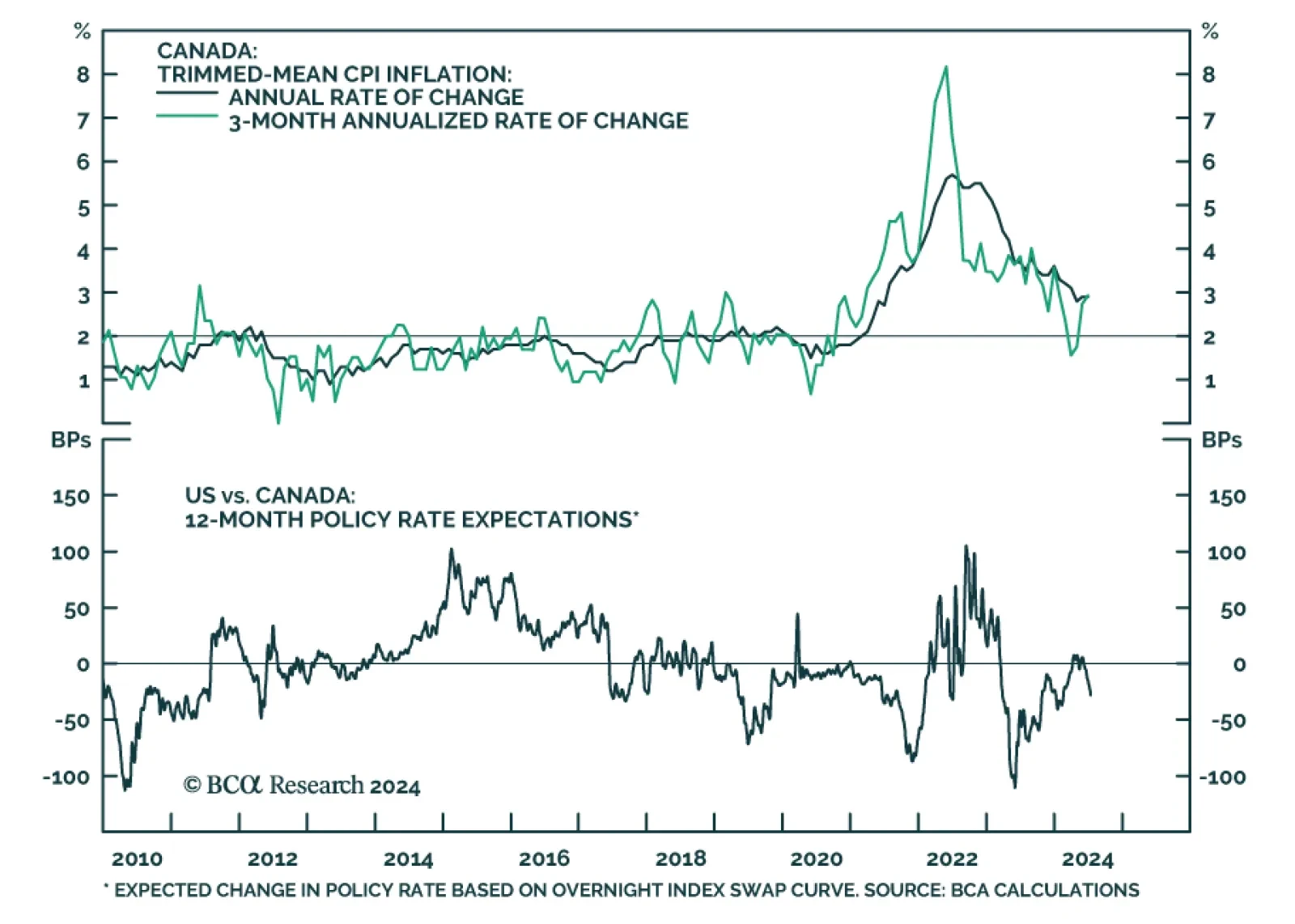

In this Insight, we look into the recent CPI release in Canada, and the possible implications for fixed-income market trades.

Markets had already been sussing out that the Bank of Canada (BoC) will cut rates for the second time when it meets next week, and this morning’s soft CPI report all but confirmed it. The last remaining obstacle in the…

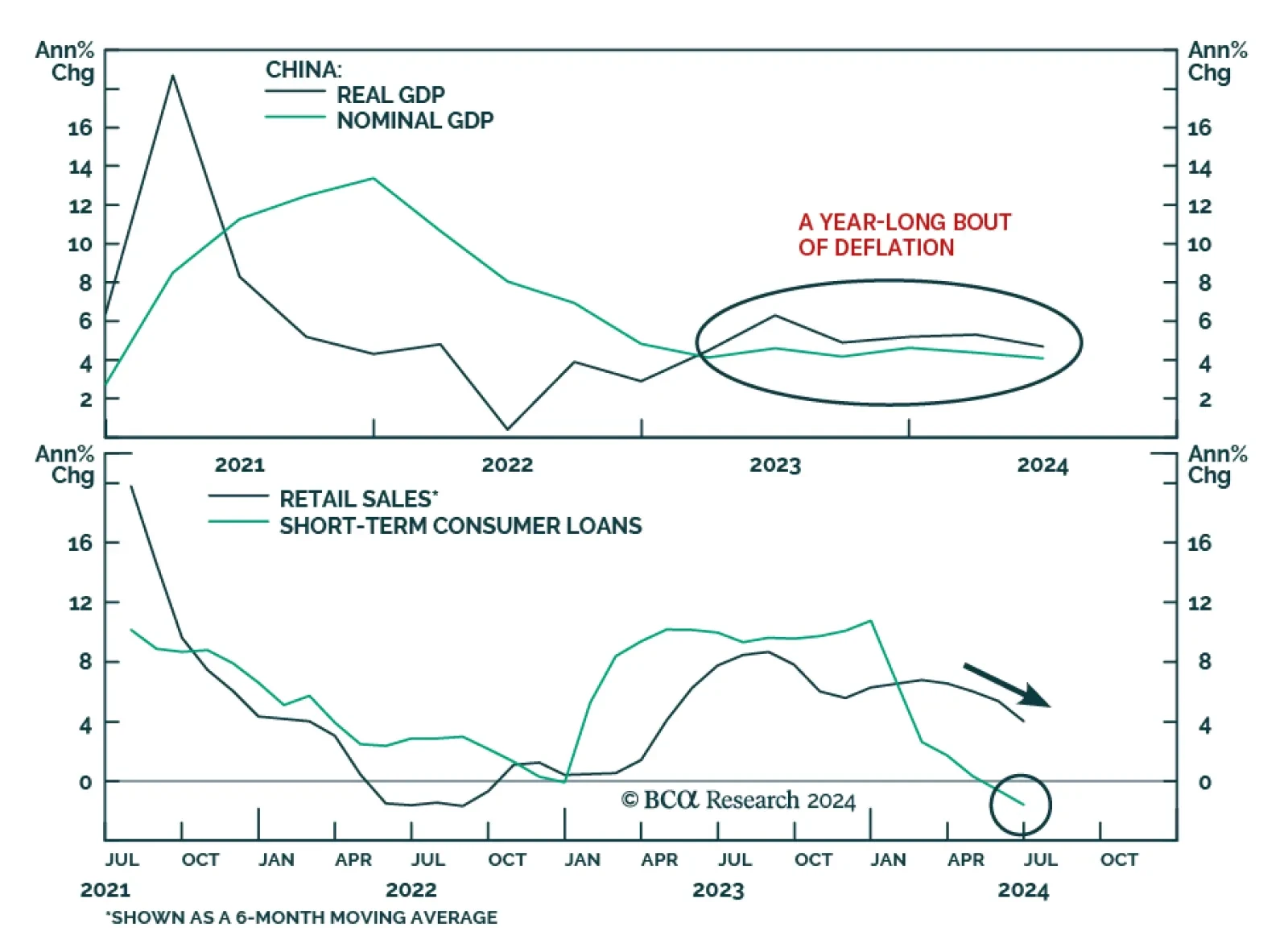

China's real GDP growth decelerated to 4.7% y/y in Q2, down from 5.3% in Q1 and below the consensus forecast of 5.1%. Domestic demand weakened, with retail sales growth sliding to 2% y/y in June, down from 3.7% in the…

The real threat to European equities is growth, not political risk. How low will Eurozone earnings fall during the coming recession and how much will equities decline in response?

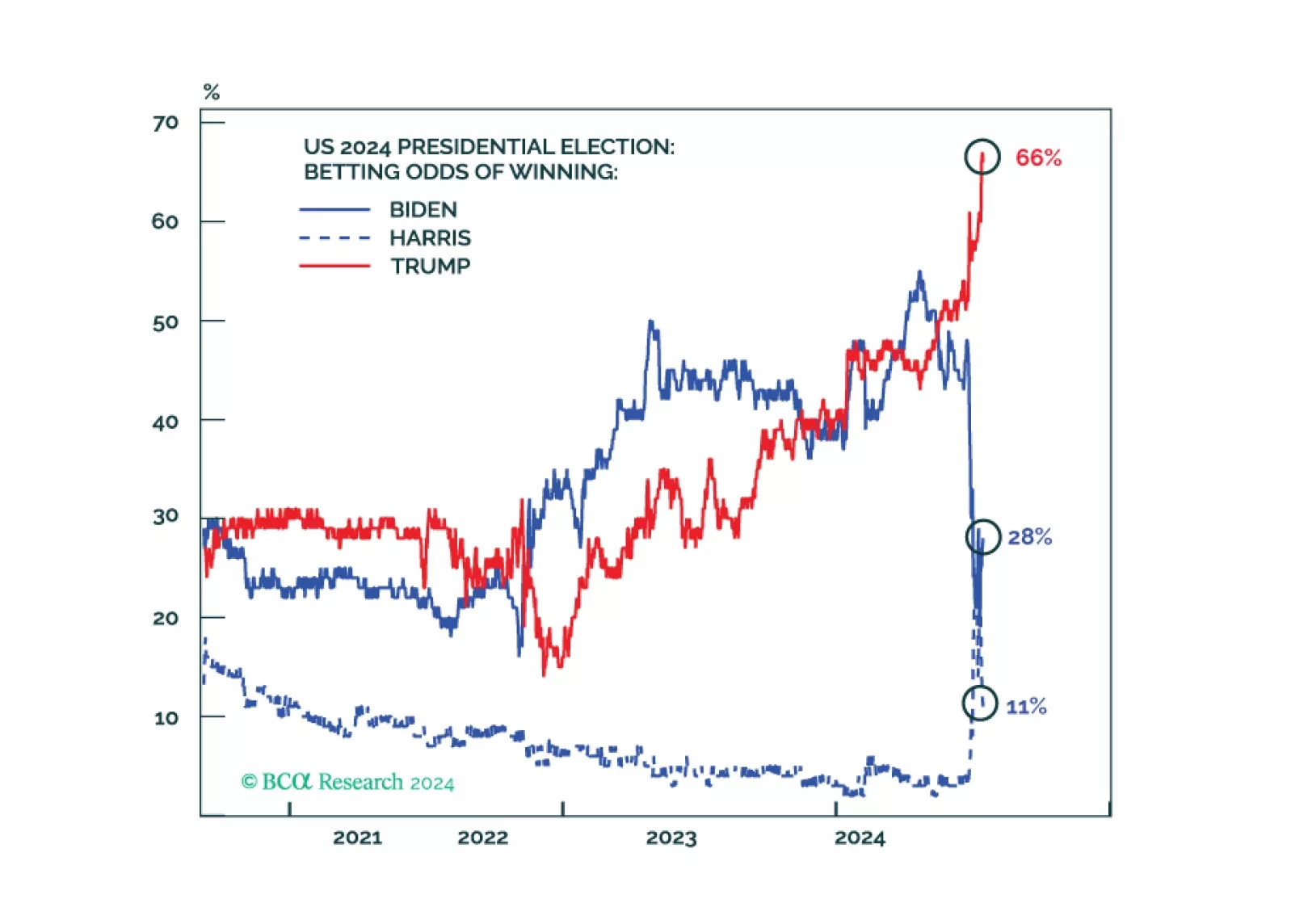

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

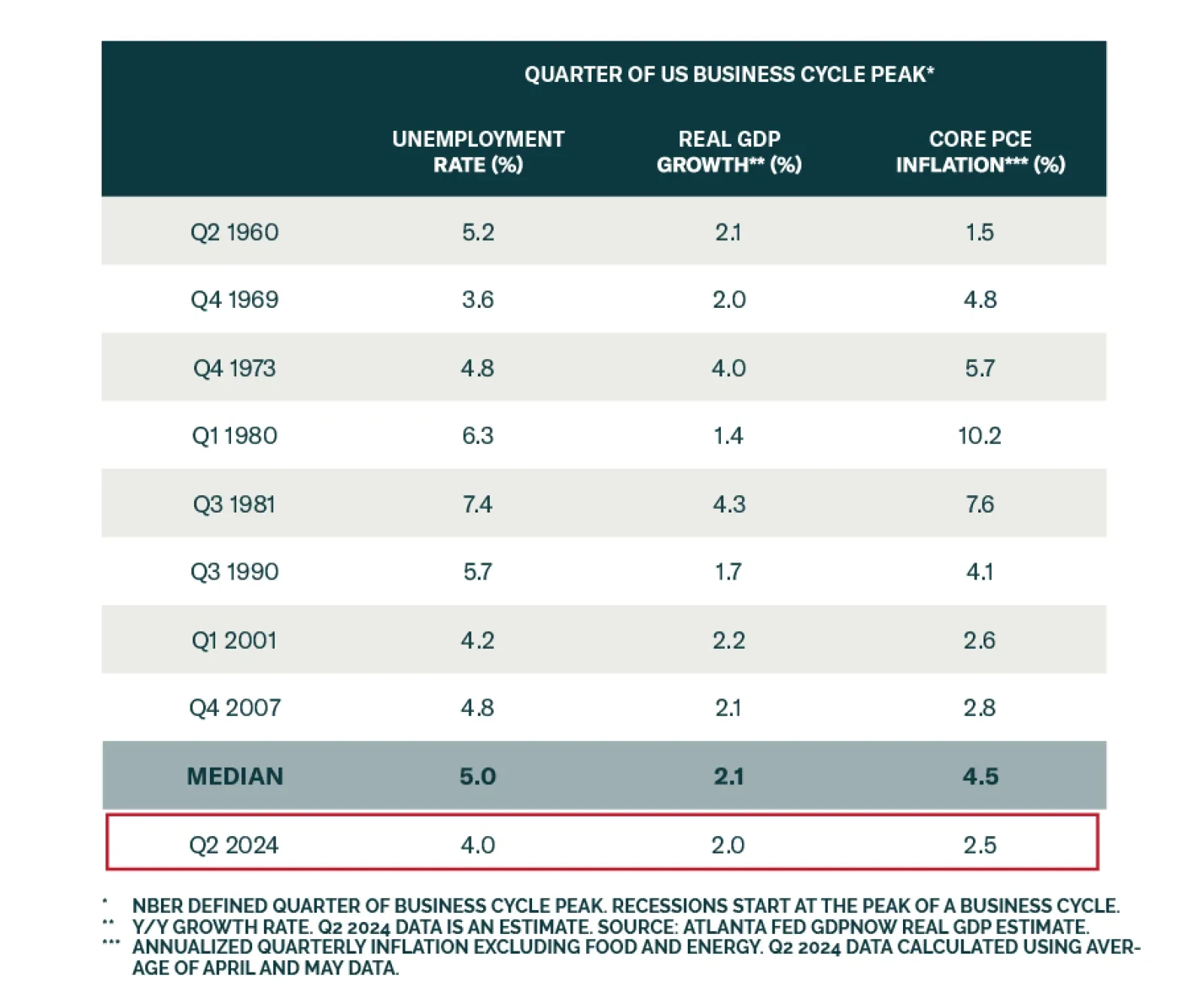

An investor looking at the low unemployment rate and elevated job vacancy rate could reasonably conclude that the US expansion will continue. However history suggests that recessions often start seemingly out of the blue.…

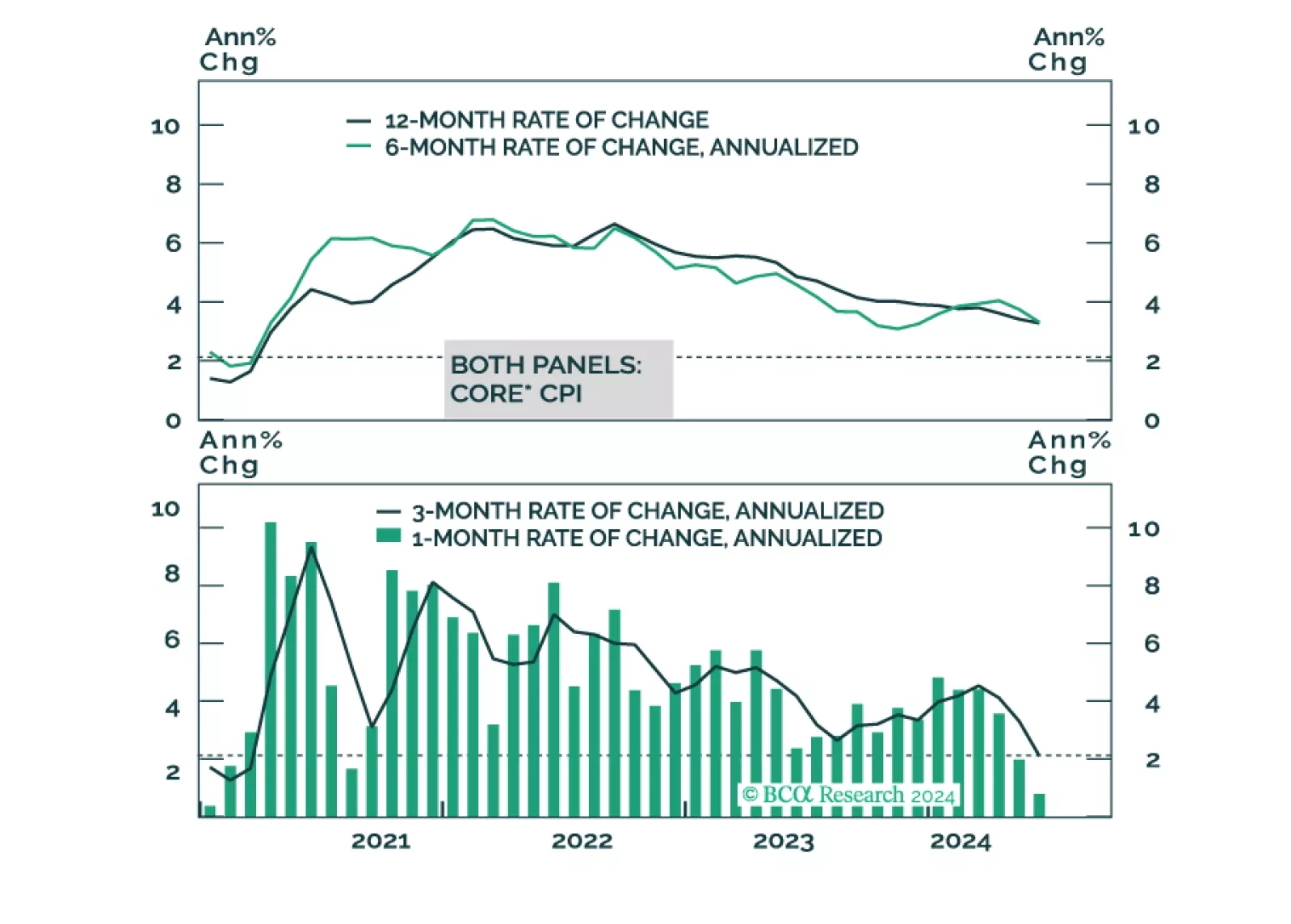

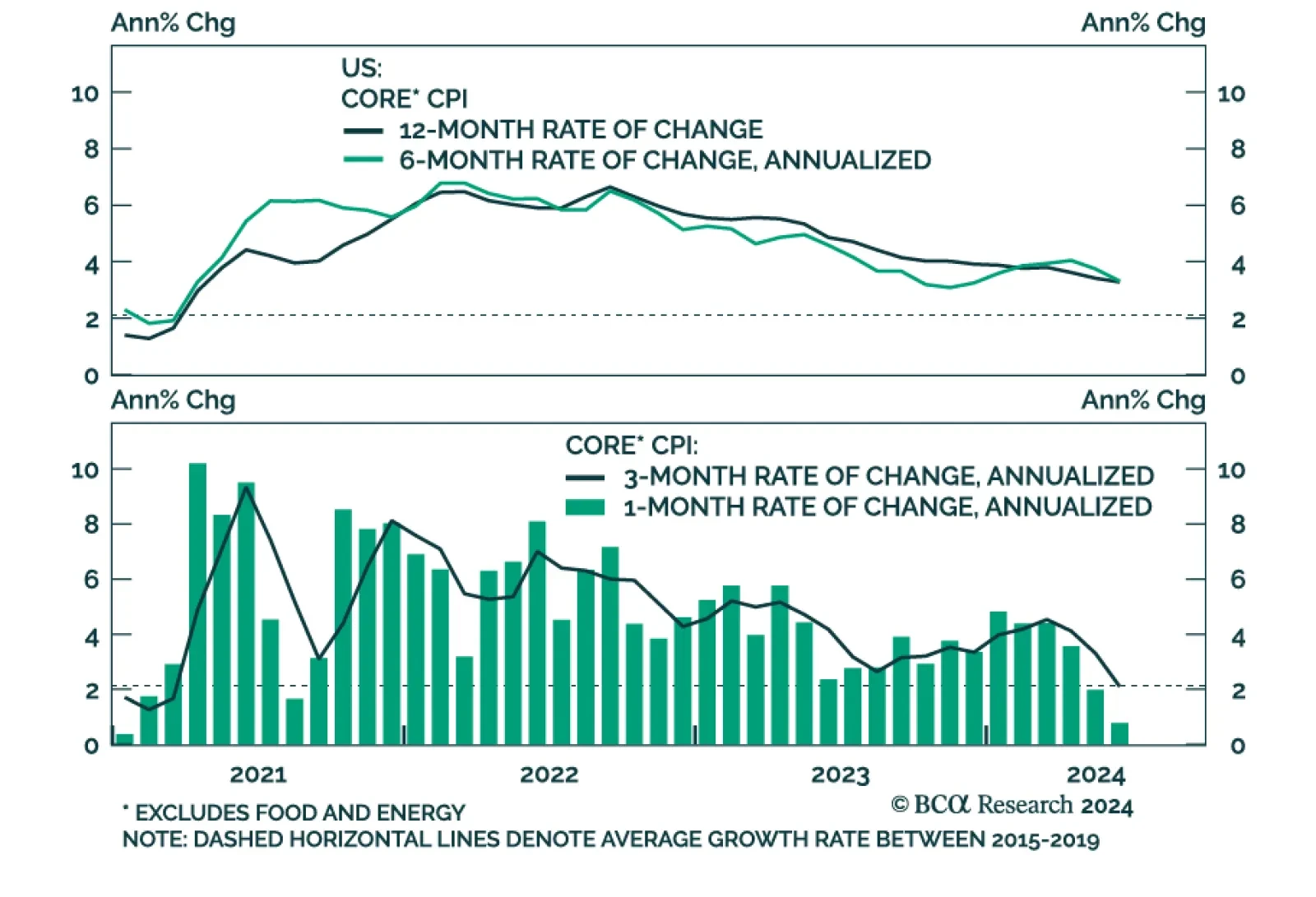

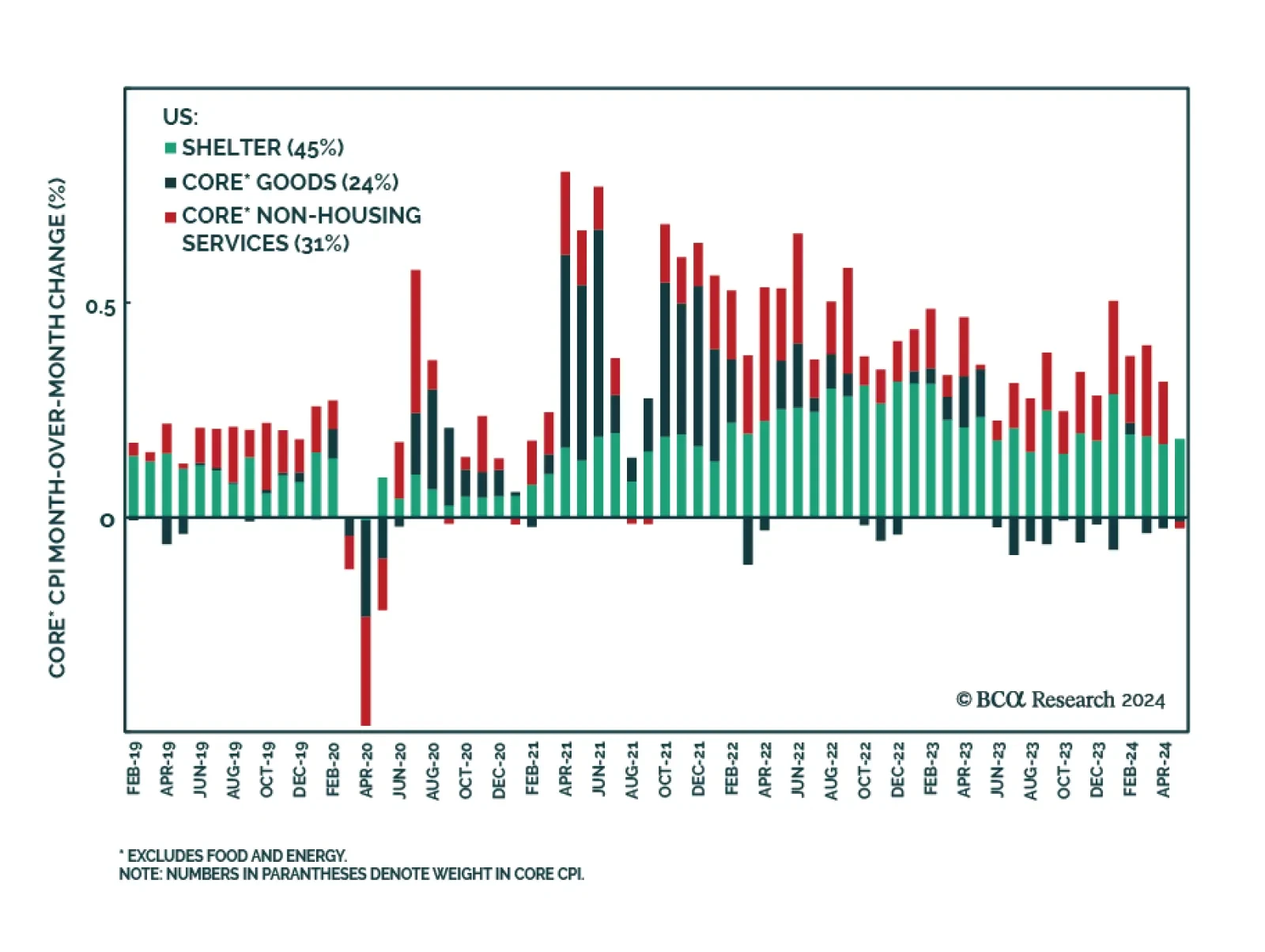

The disinflationary trend in US CPI continued in June as headline CPI dipped to 3% year-over-year, down from 3.3% in May, and core CPI declined by a tick to 3.3%. On a month-over-month basis, headline prices fell by 0.1% and core…

In light of last week’s employment report and this morning’s CPI, it’s time for the Federal Reserve to cut rates.

US Core CPI inflation has decelerated considerably from its year-over-year peak of 6.6% in September 2022 to 3.4% in May and the consensus expects it remained at 3.4% in June. The year-over-year number has come down continuously…