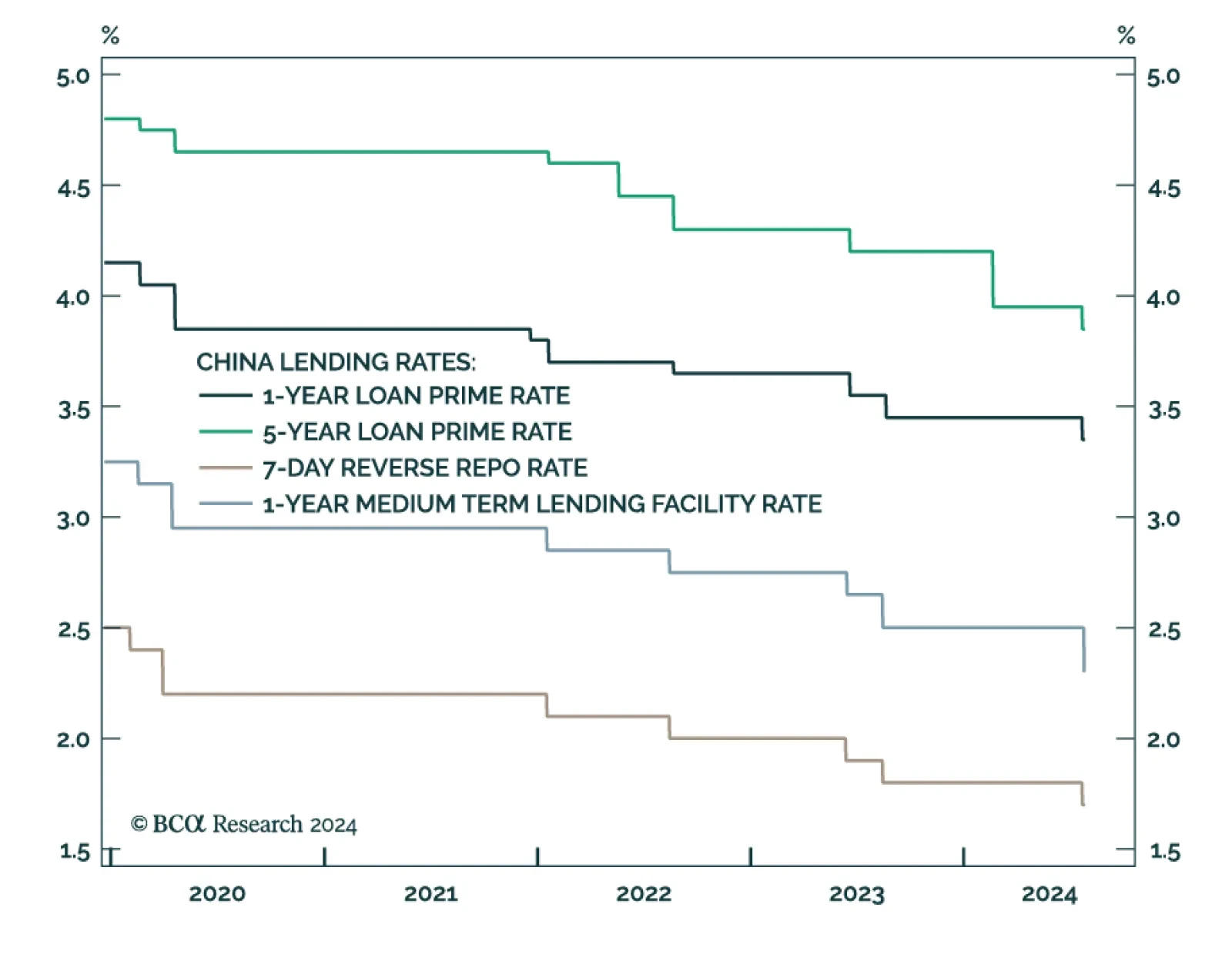

Just a few days after unexpectedly lowering three key borrowing rates by 10 basis points (bps), the PBoC cut the 1-year medium-term lending facility rate by 20 bps, from 2.50% to 2.30%. While the earlier cut lowered the…

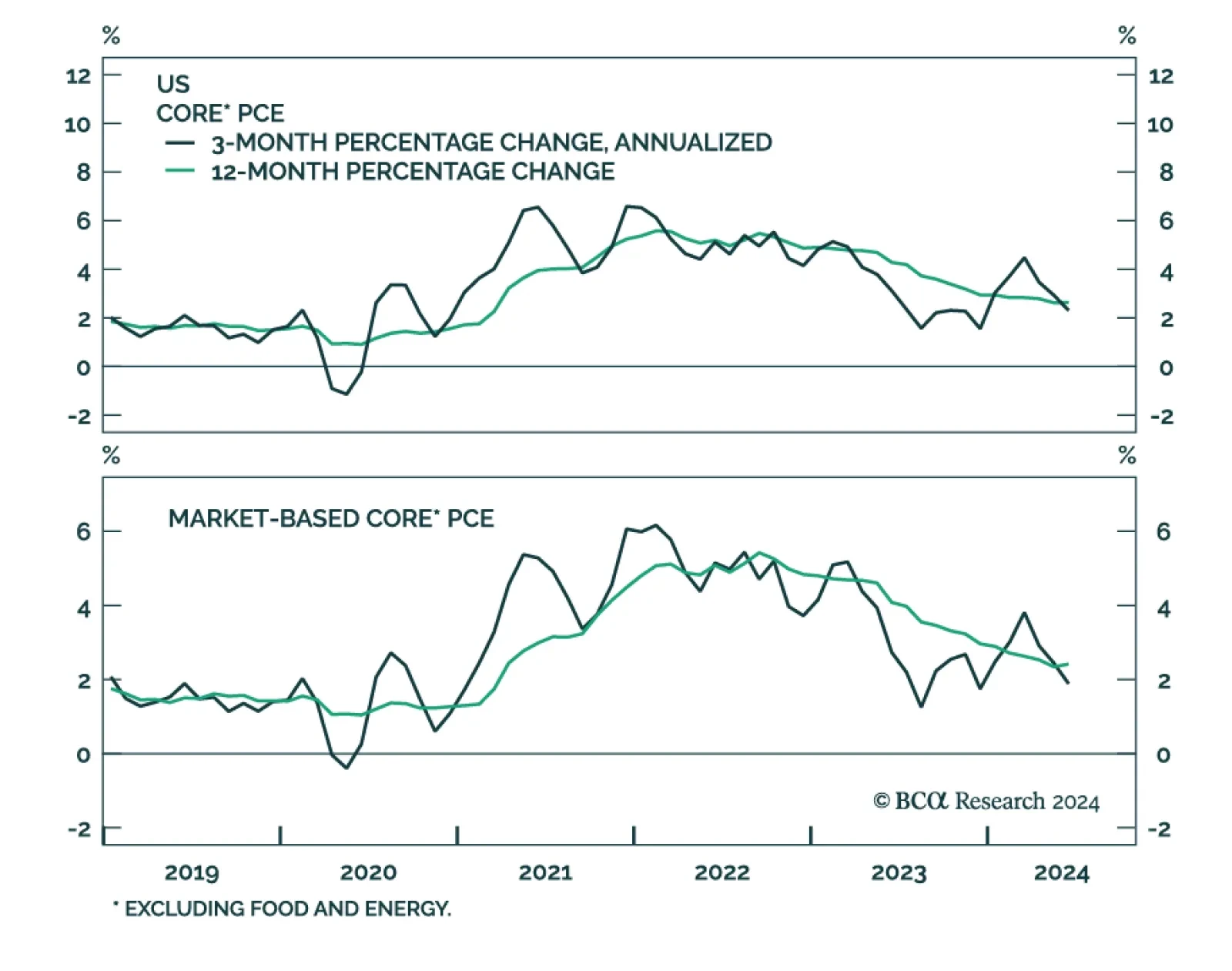

US nominal personal income growth and real personal spending decelerated at a faster-than-expected pace in June, both moderating to 0.2% m/m from 0.4% in May. Core PCE – the Fed’s favored inflation gauge –…

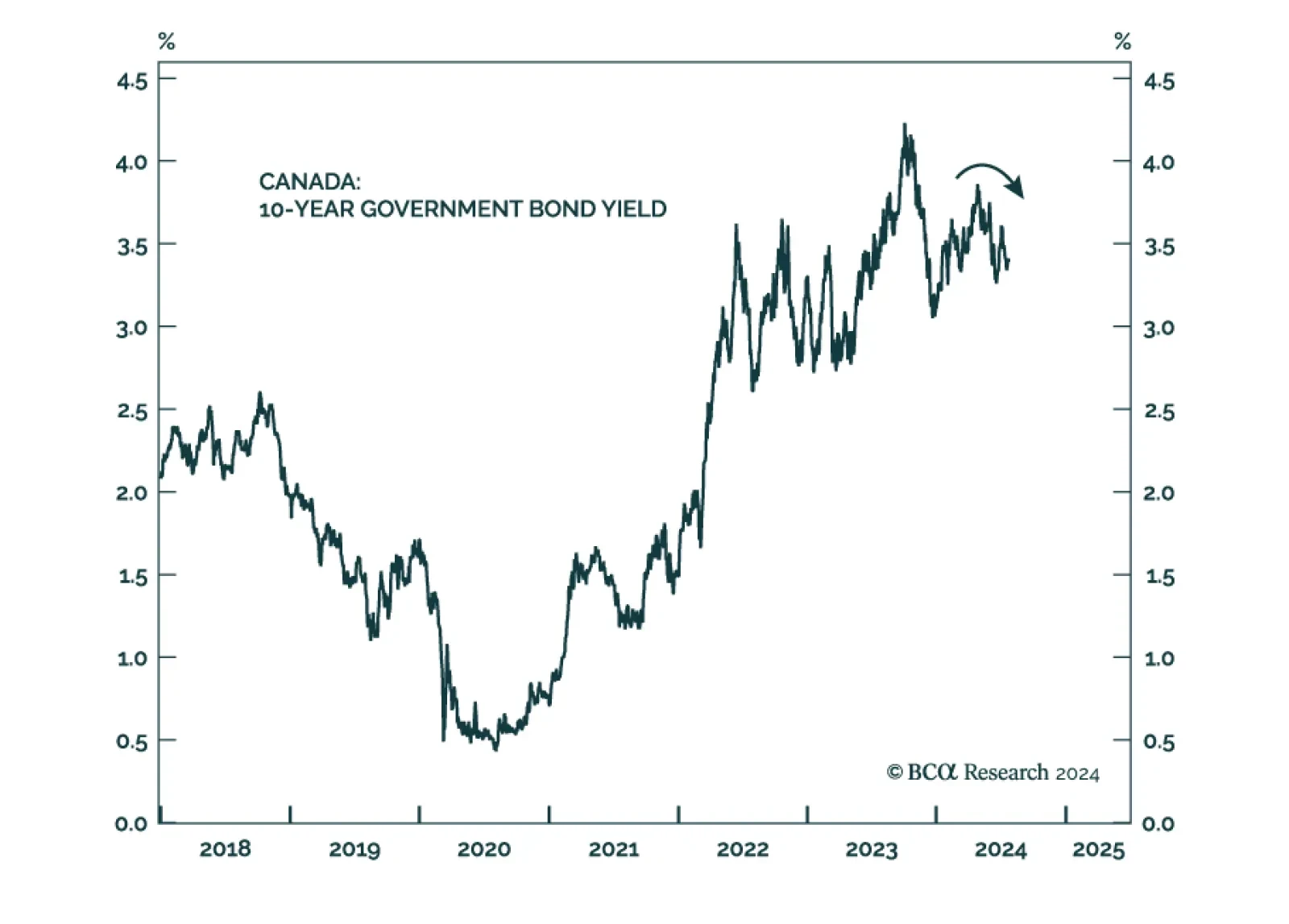

The Bank of Canada (BoC) reduced its policy rate by 25bps for the second meeting in a row on Wednesday. We highlighted in a recent Insight that the soft June inflation print and weakening labor market increased the odds of more…

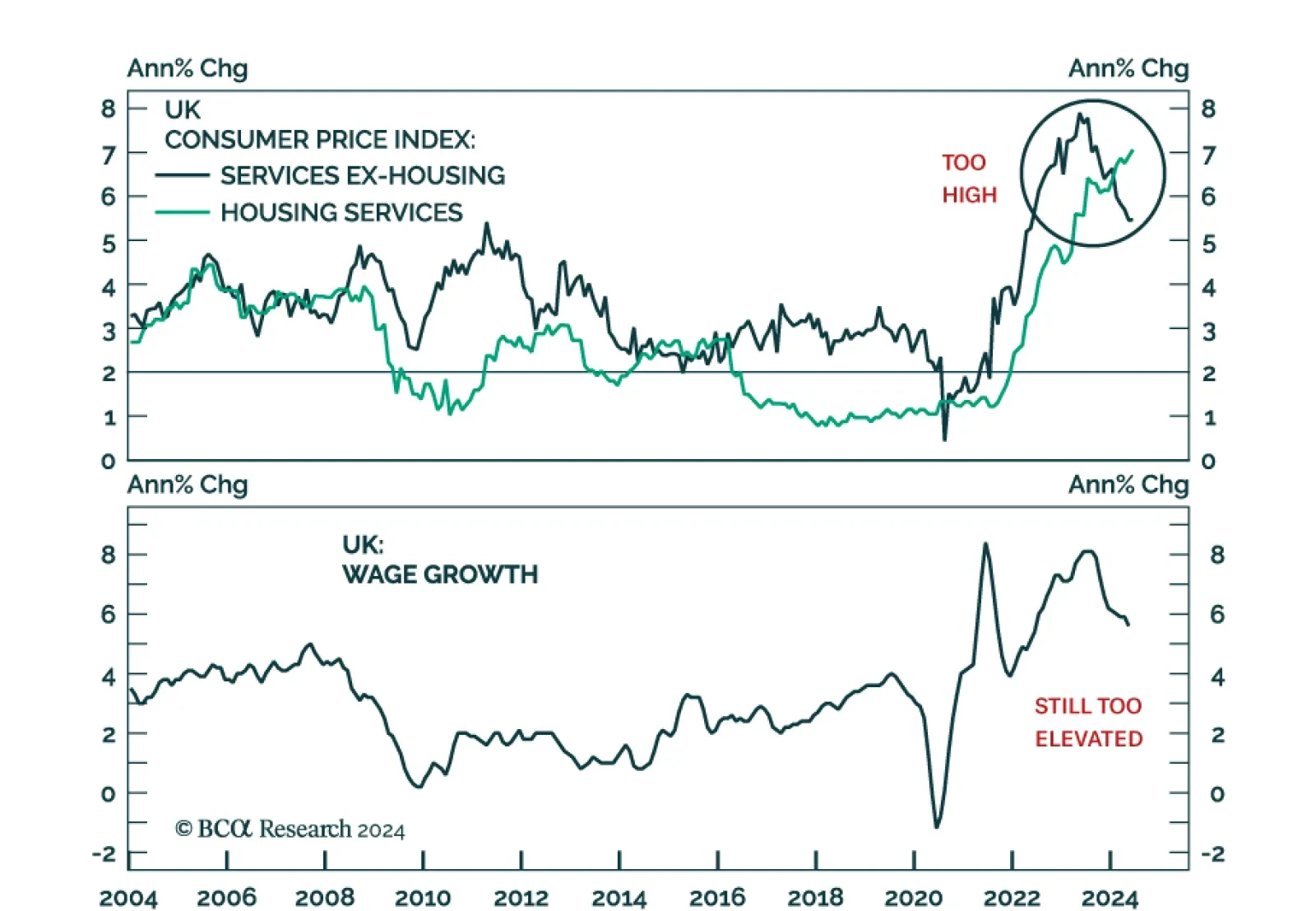

UK’s CPI growth stands right on the Bank of England’s (BoE) 2% target. However, services inflation remains sticky, growing at a constant 5.7% y/y in June. Moreover, the deceleration in wage growth remains insufficient…

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

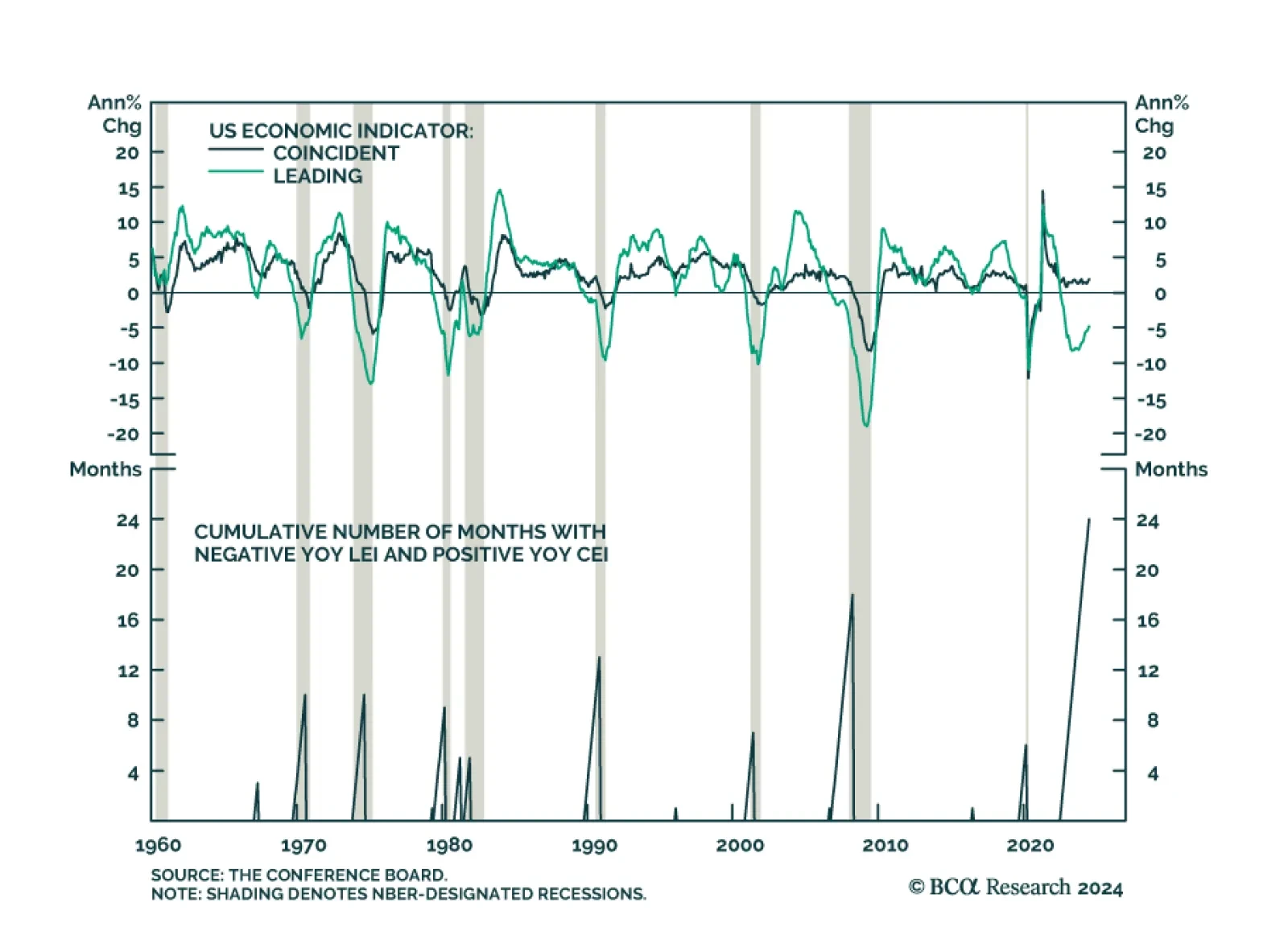

The Conference Board Leading Economic Index (LEI) for the U.S. declined by 0.2% in June from May, marking the smallest decrease in the past three months. Year-over-year, the US LEI remained negative but less so compared to prior…

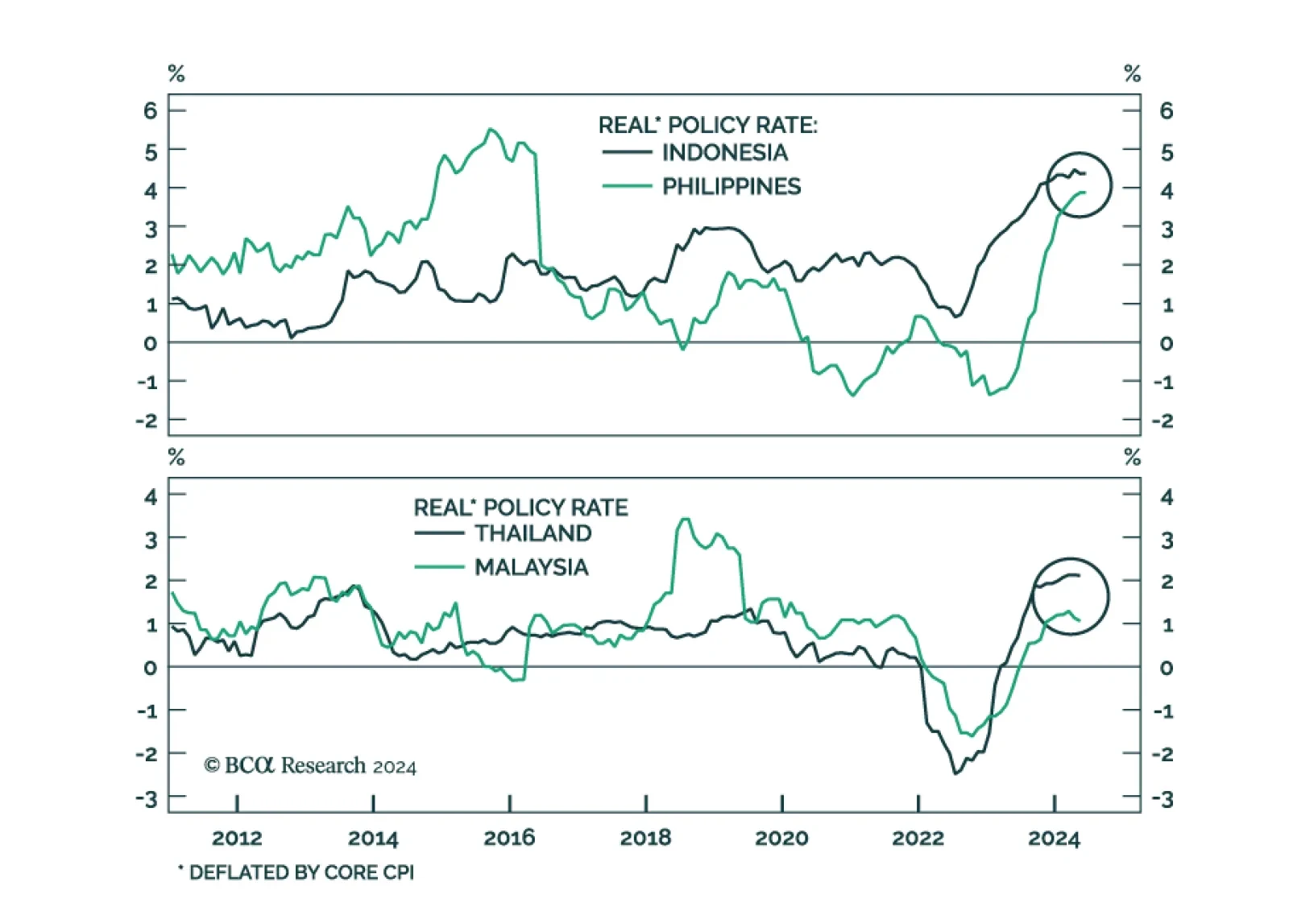

The four ASEAN stock markets (Indonesia, Malaysia, Thailand, and the Philippines) have fallen in absolute terms over the past year despite the powerful rally in the developed markets. They have also underperformed their EM…

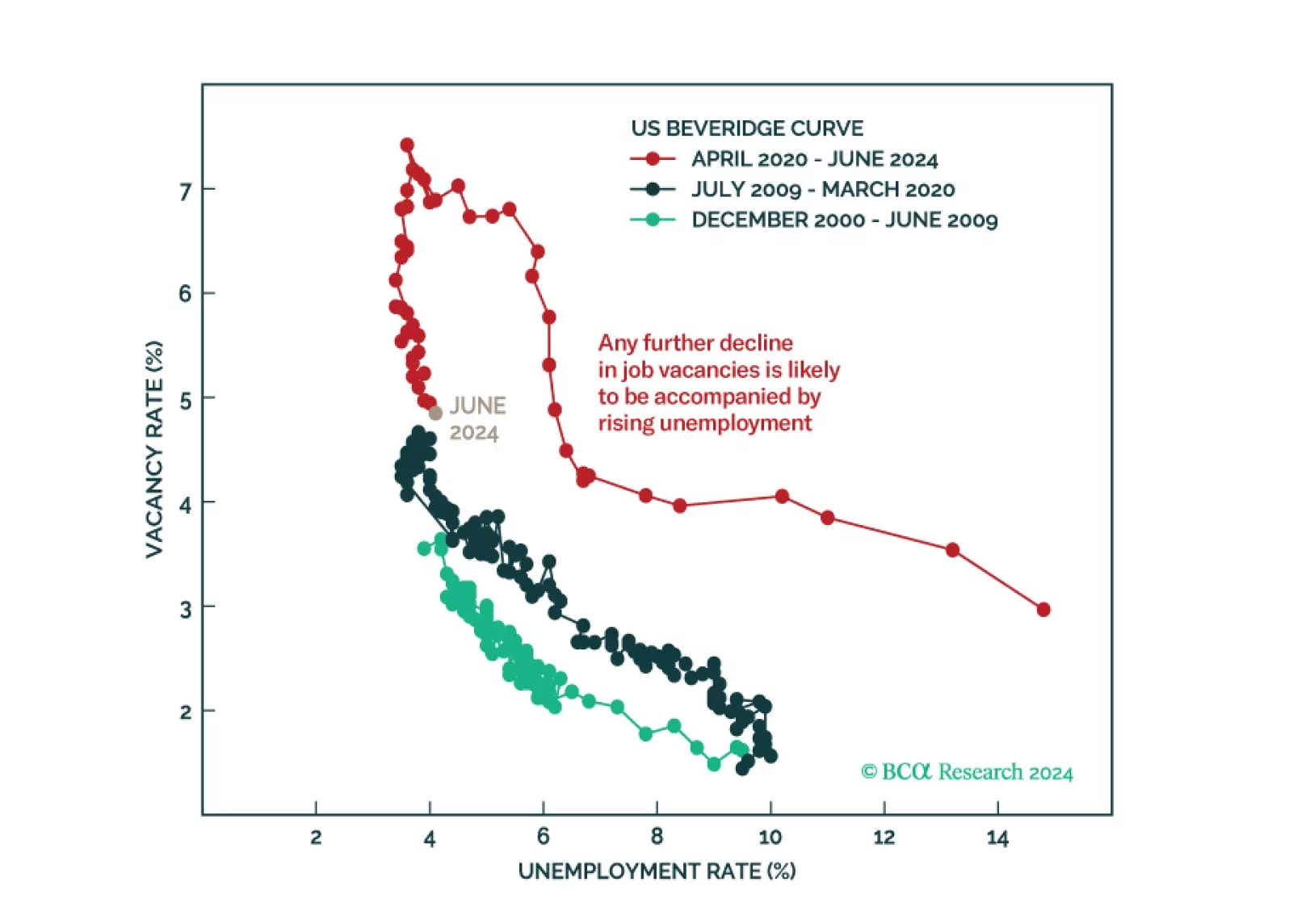

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

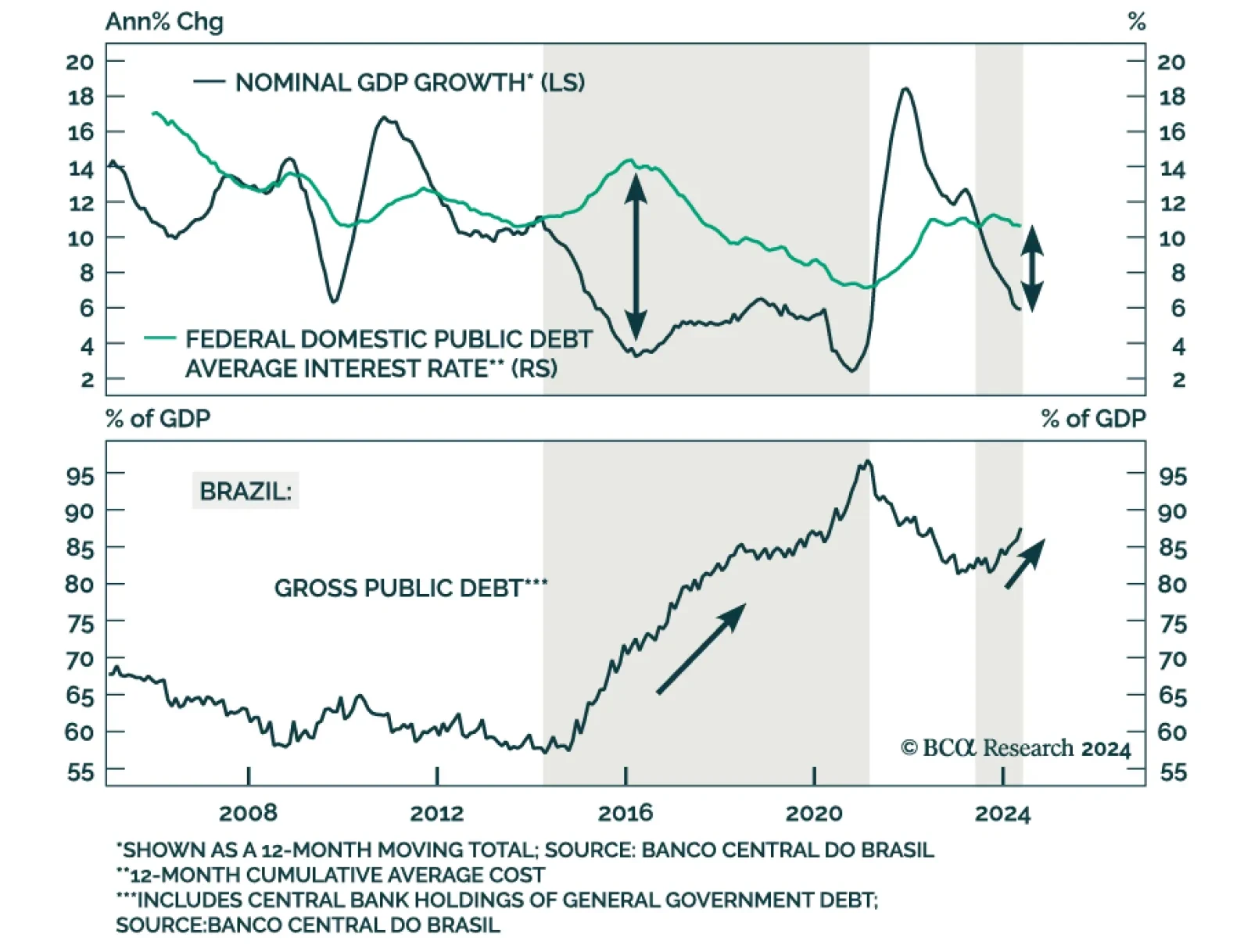

Two of Brazil’s ever-recurring demons have come back to haunt investors: public debt sustainability and persistent inflation. According to the latest report from our Emerging Markets Strategy (EMS) team, these troubles are…