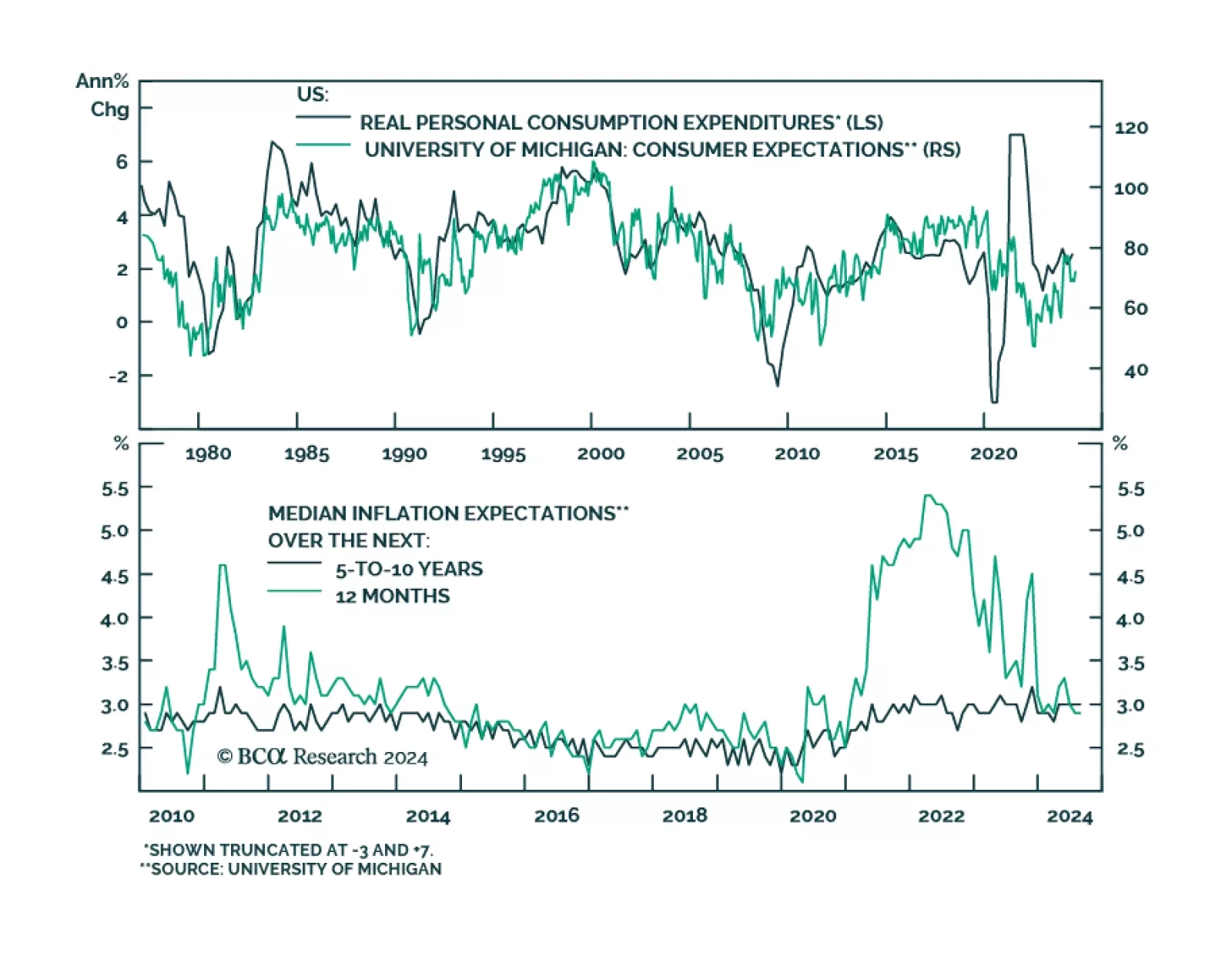

Preliminary estimates suggest that although consumers’ perceptions of current economic conditions unexpectedly deteriorated in August, they are becoming increasingly optimistic about the future. The University of…

What do the mixed signals sent by the UK economy mean for the Bank of England, and what are the implications for Gilts and the British pound?

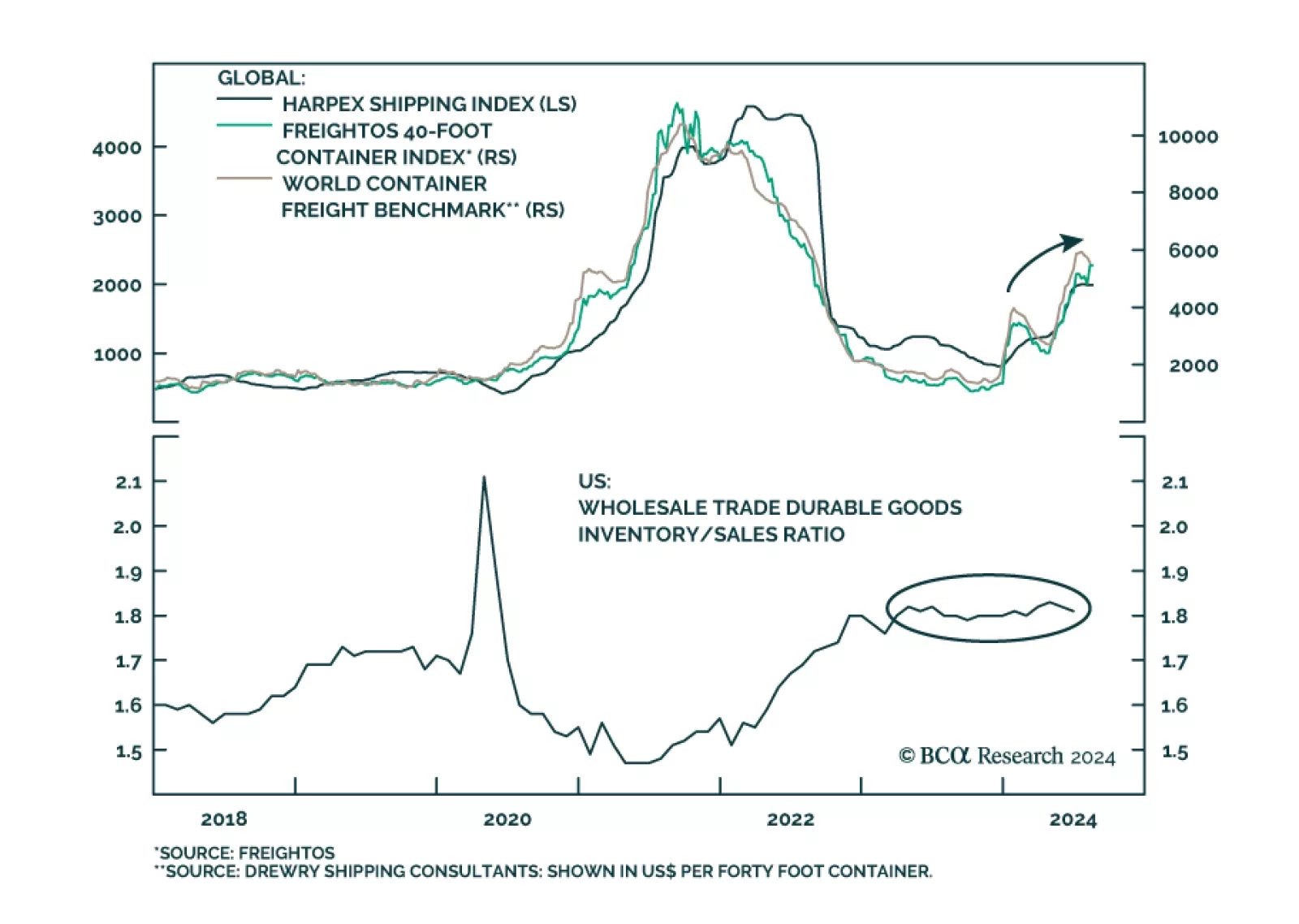

Goods prices have normalized following the pandemic binge on goods spending and have contributed to easing price pressures overall. A large drop in vehicle prices largely drove the decrease in July’s CPI and we have…

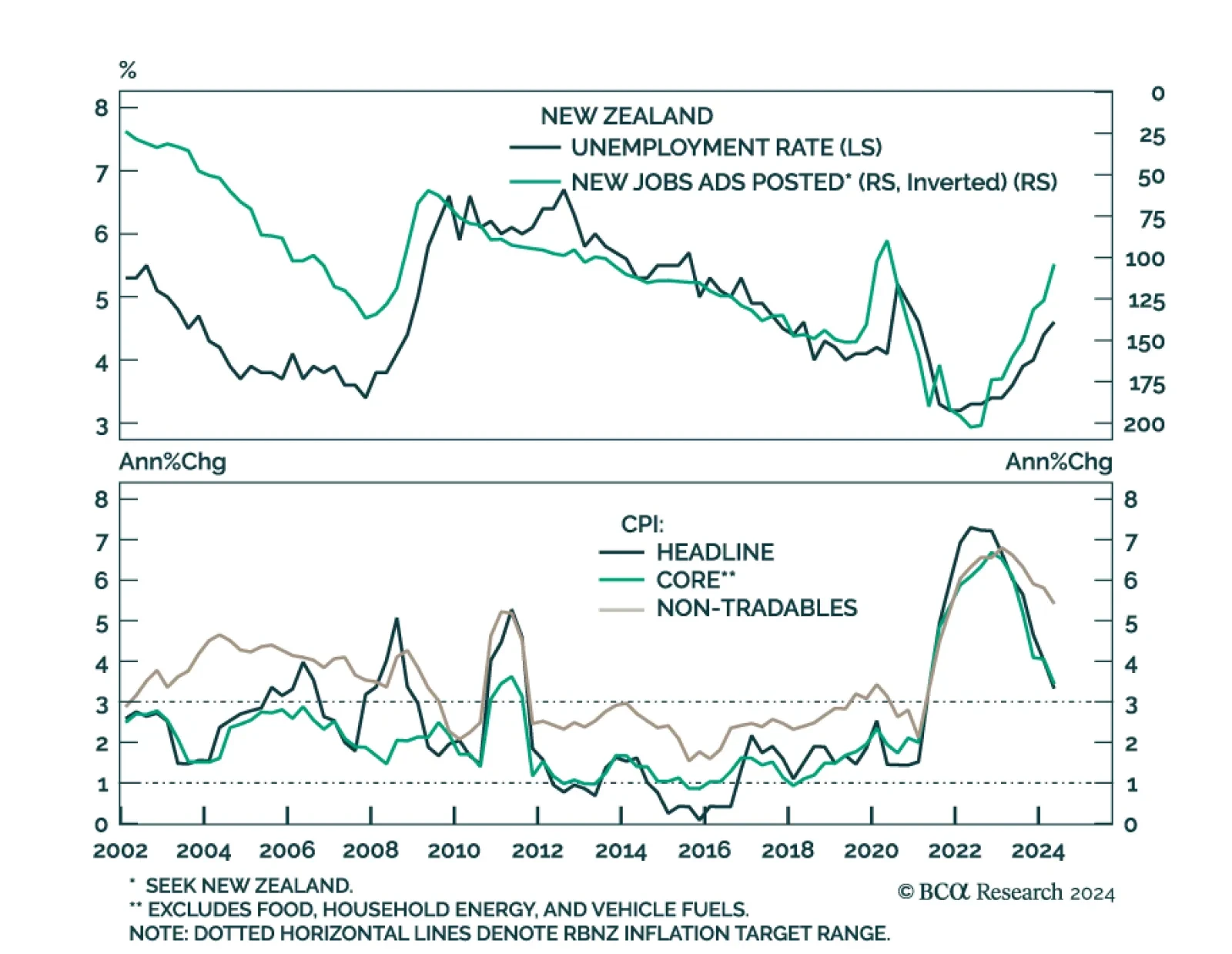

The Reserve Bank of New Zealand unexpectedly embarked on an easing pivot in August, cutting the Official Cash Rate by 25 bps to 5.25%. The central bank also signaled further rate cuts by lowering its rate benchmark forecast to 4.…

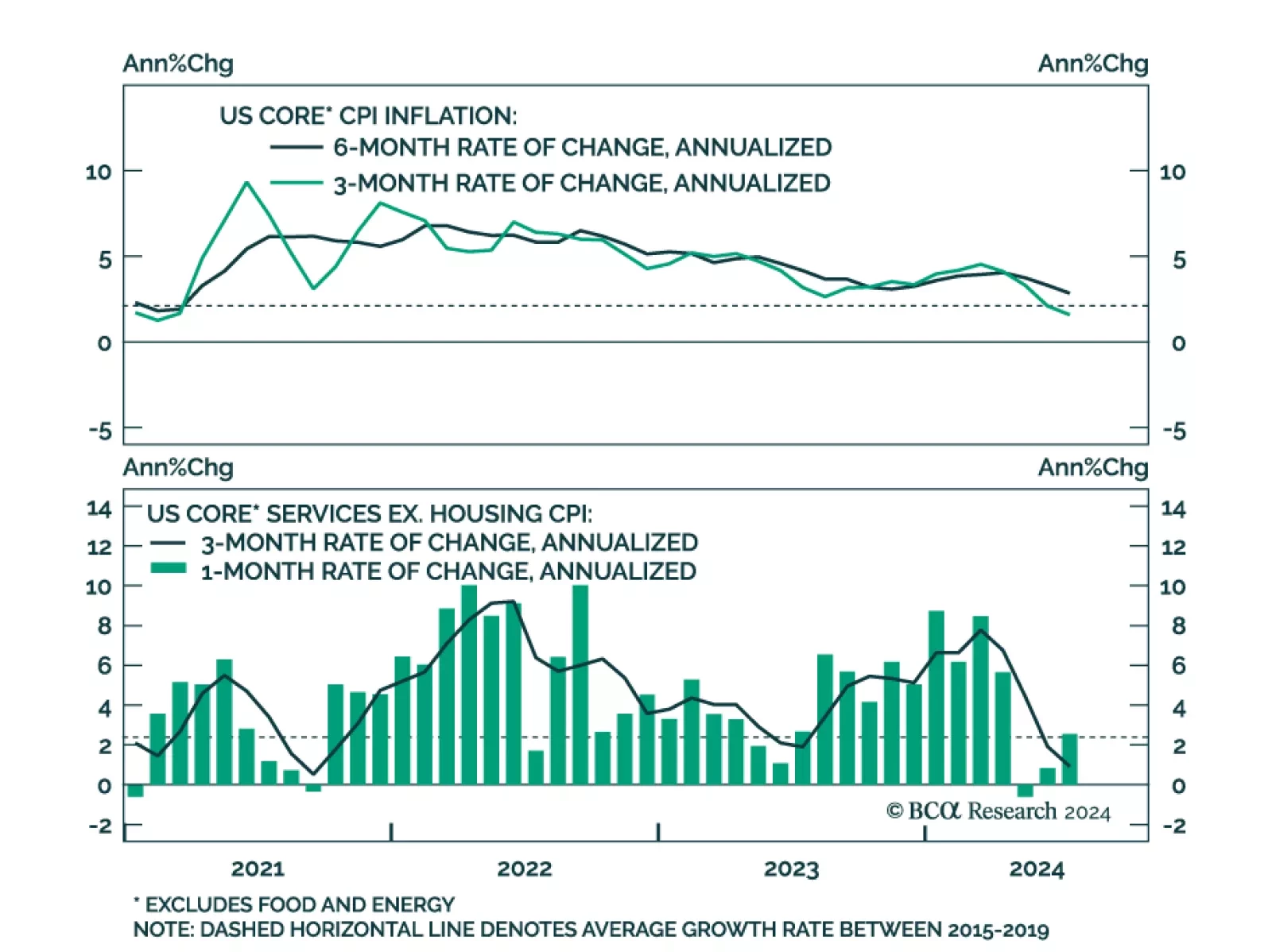

Headline and core CPI eased for the fourth consecutive month in July, ticking down 0.1 ppt to 2.9% and 3.2% y/y, respectively. The 3-month and 6-month moving averages continued to edge lower as a result, with the former now…

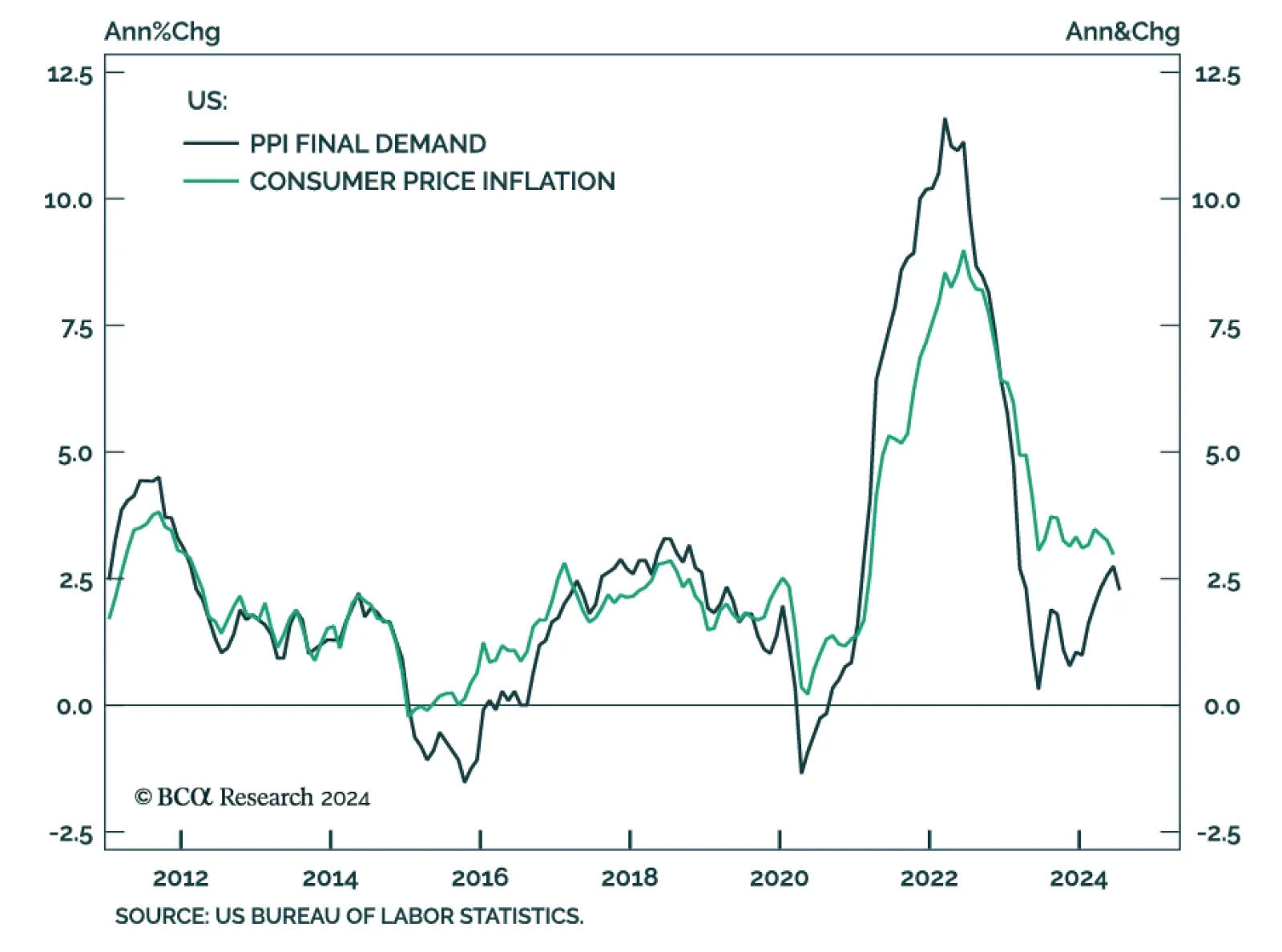

US producer prices rose by a softer-than-expected 0.1% m/m in July, from 0.2% in June. The core measure remained unchanged, the tamest reading in four months. Notably, the index for final demand services fell 0.2% m/m. Our US…

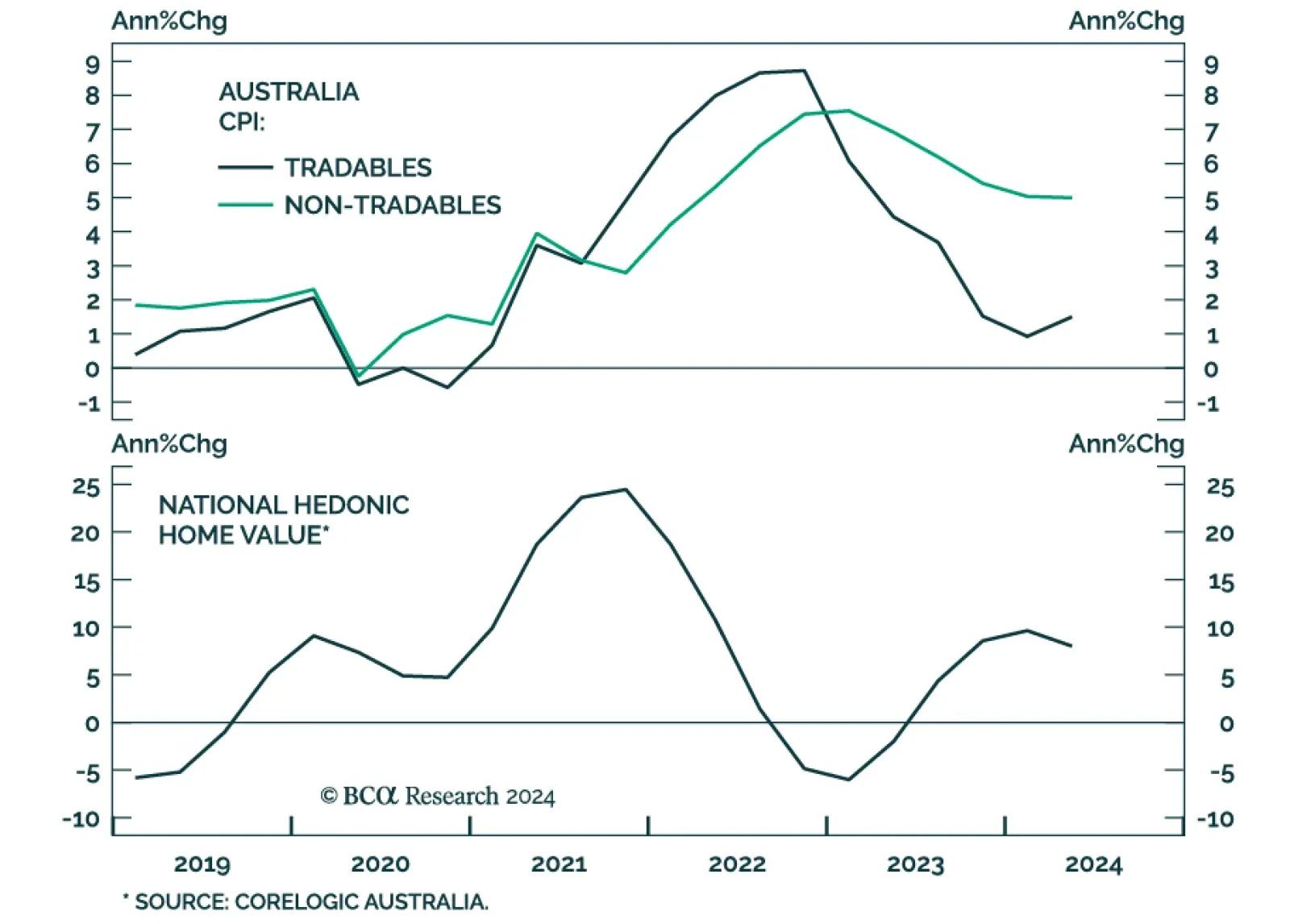

The RBA kept its cash rate unchanged at 4.35% in August, in line with expectations. However, it lifted its trimmed-mean inflation forecast to 3.5% y/y in Q4 2024 and to 2.9% by Q4 2025 (up from 3.4% and 2.8% in its May forecast,…

Our Portfolio Allocation Summary for August 2024.

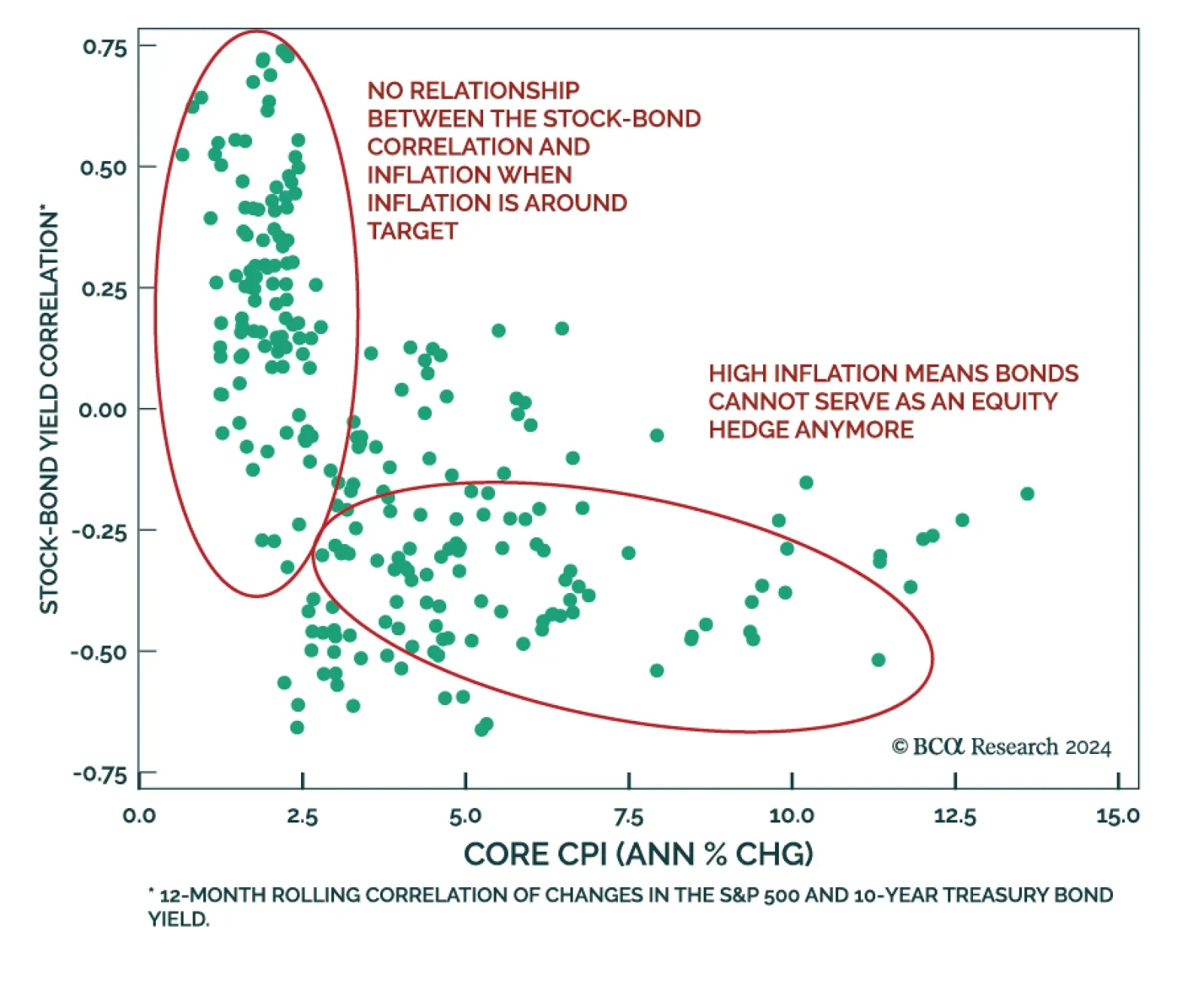

According to BCA Research’s Global Asset Allocation service, while the market action of the past few weeks is pointing to a return to a negative stock-bond correlation, more prints will be needed to confirm things are…