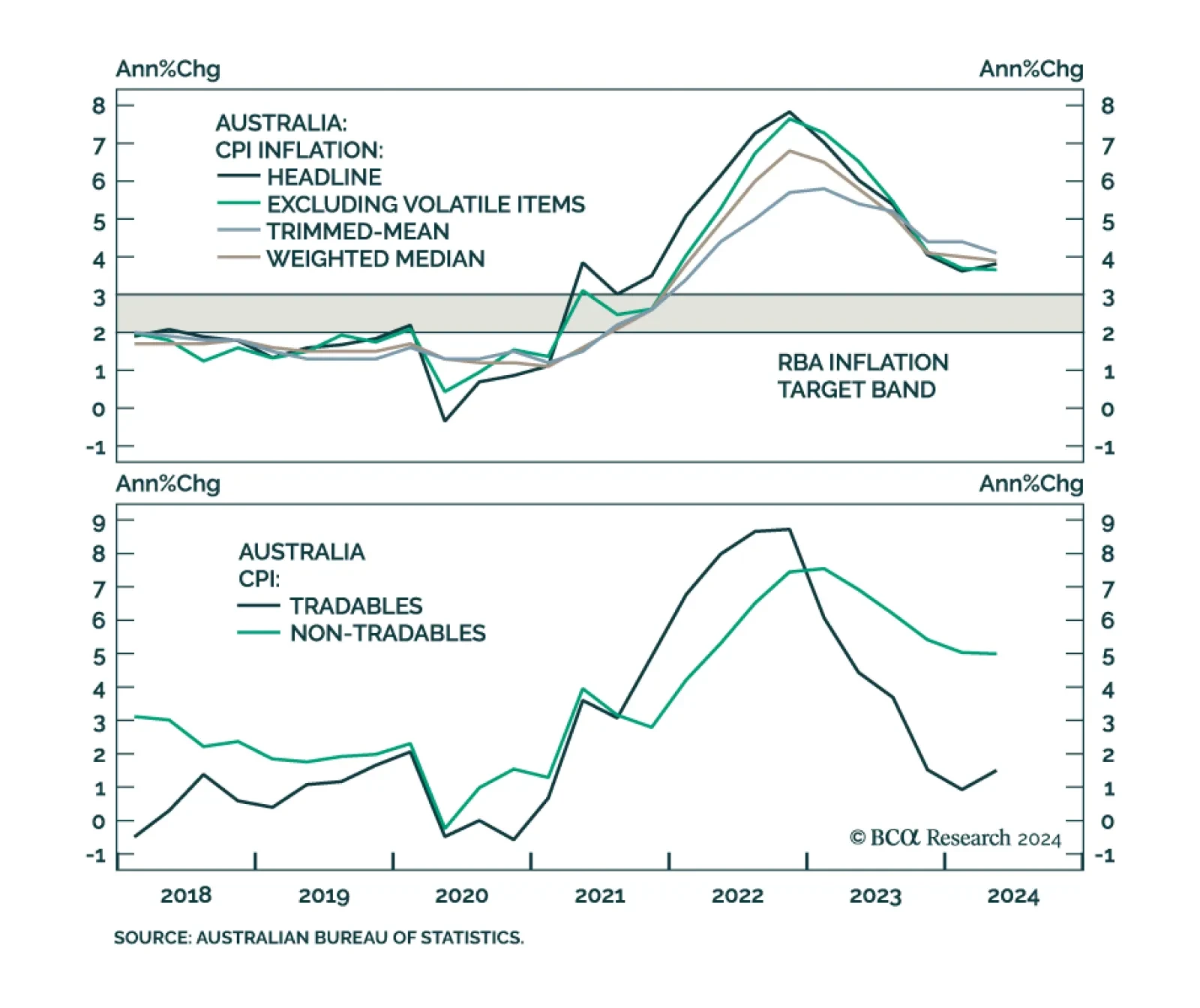

Australia’s CPI inflation eased from 3.8% y/y to a higher-than-expected 3.5% in July. The trimmed-mean measure eased from 4.1% to 3.8%. However, the Commonwealth Energy Bill Relief Fund rebates contributed to July’…

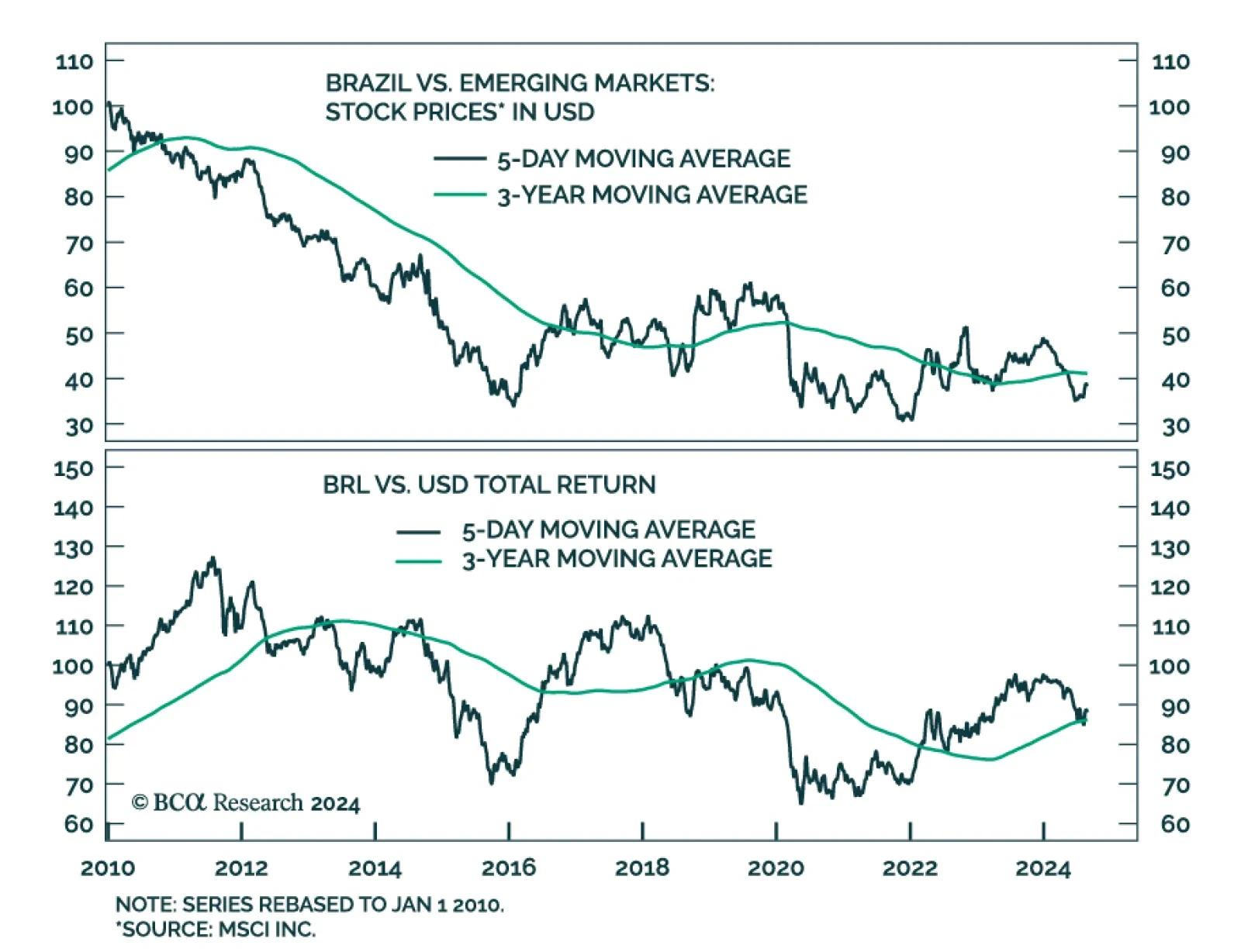

Brazilian equities have largely underperformed their EM peers in USD terms since the beginning of the year. Rising public debt and inflation are the two main forces weighing on the Brazilian bourse. Our Emerging Market…

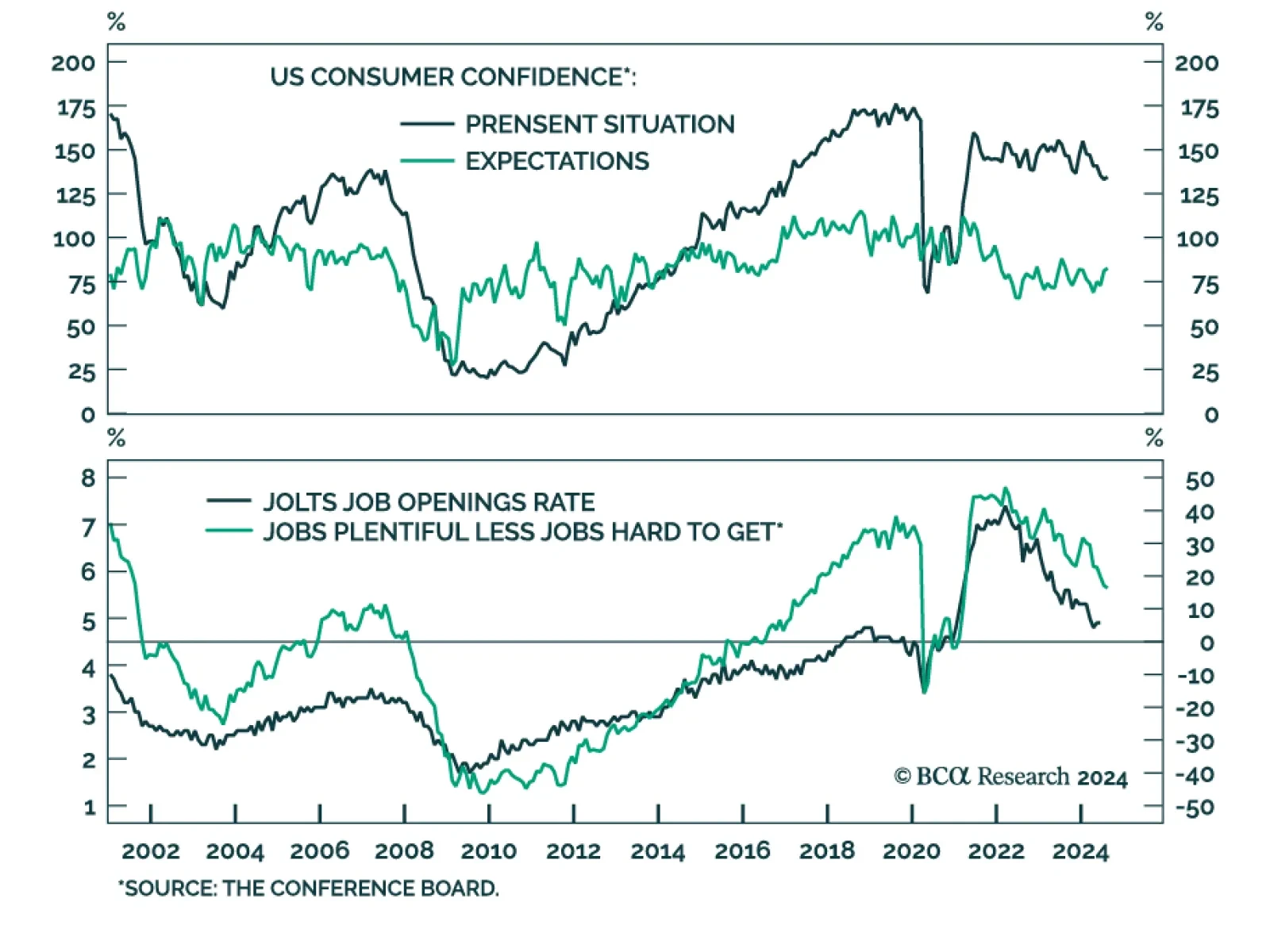

The Conference Board’s Consumer Confidence measure surprised to the upside in August, rising from 100.3 to 103.3, above expectations of 100.7. Consumers’ assessment of present economic conditions climbed 0.8 points to…

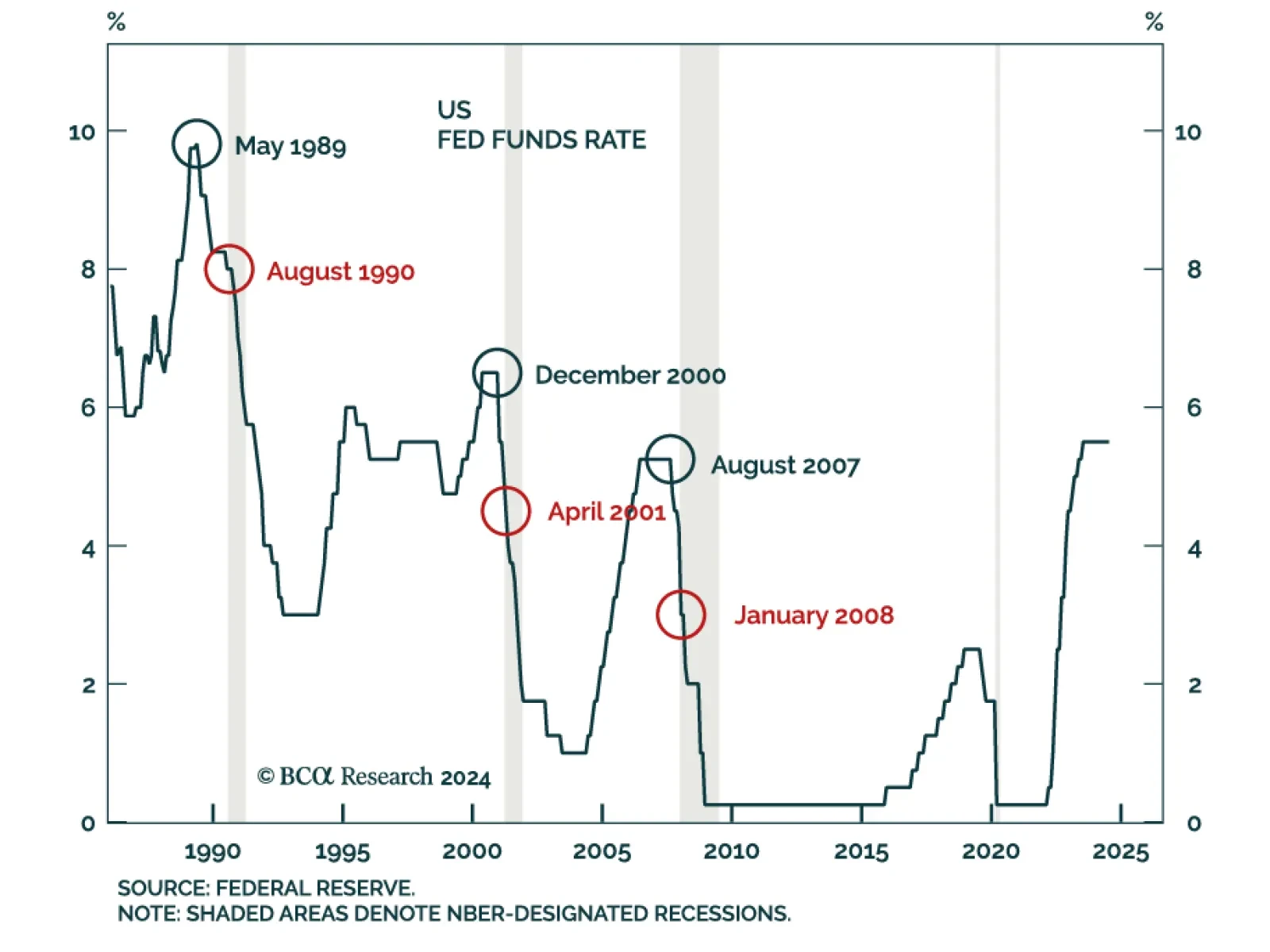

During his Jackson Hole speech, Chair Powell dispelled any remaining doubts about a September rate cut. Still, easing monetary policy is unlikely to result in a soft landing. First, recessions have historically started shortly…

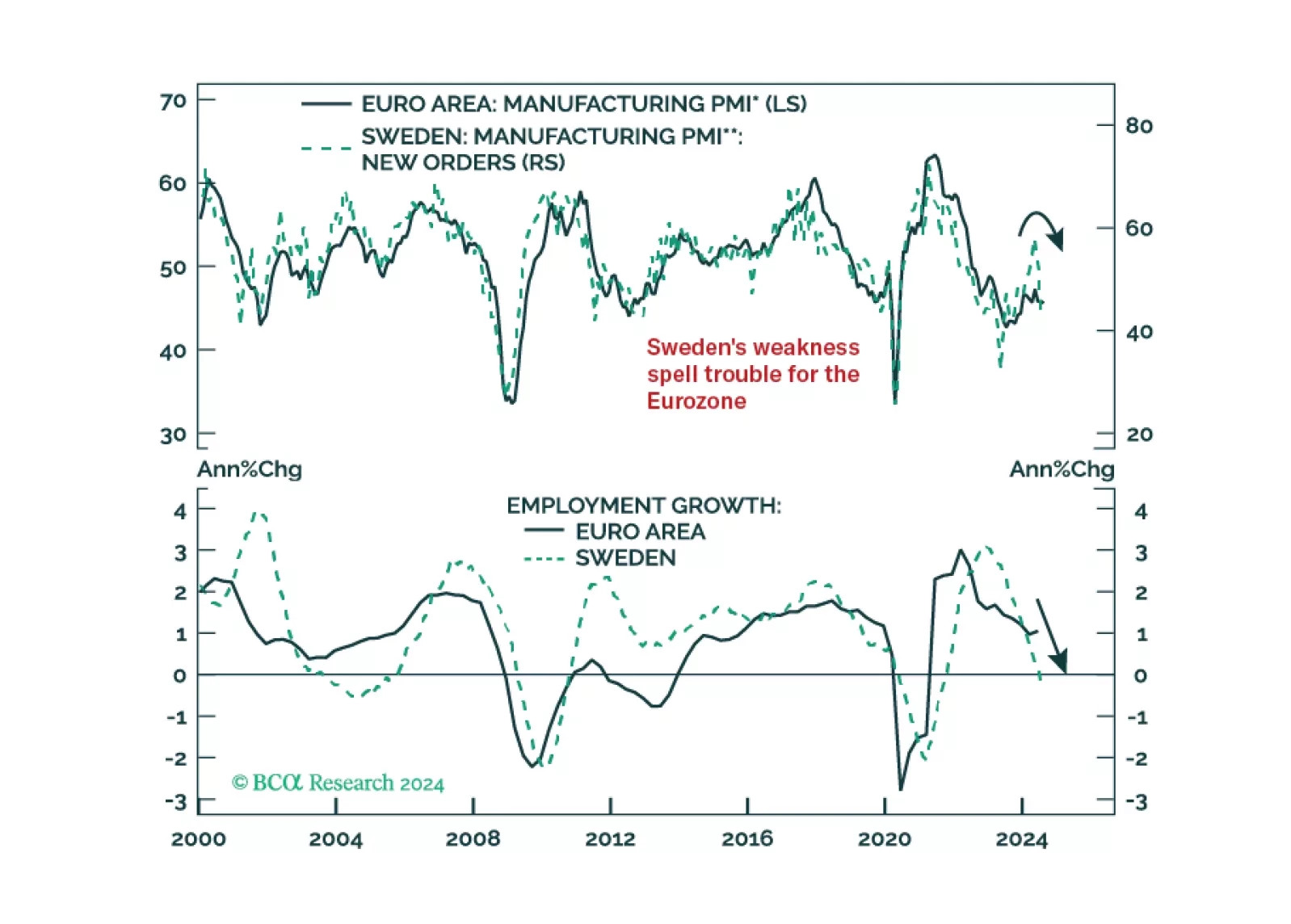

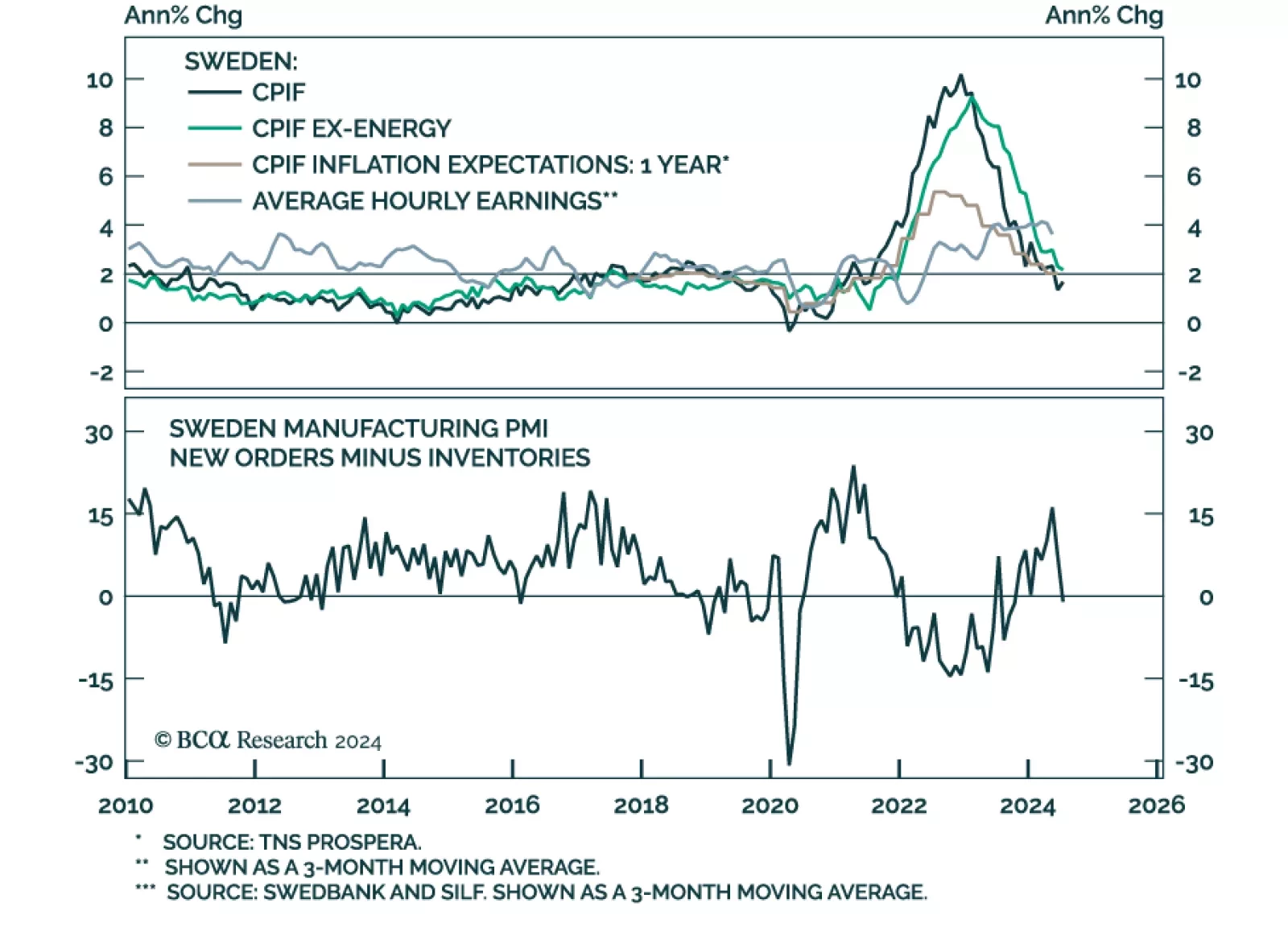

Our negative stance on European growth and assets is not devoid of risks. To gauge whether these risks warrant upgrading our growth outlook, we monitor Sweden closely. So, what is the current message from this Nordic economy?

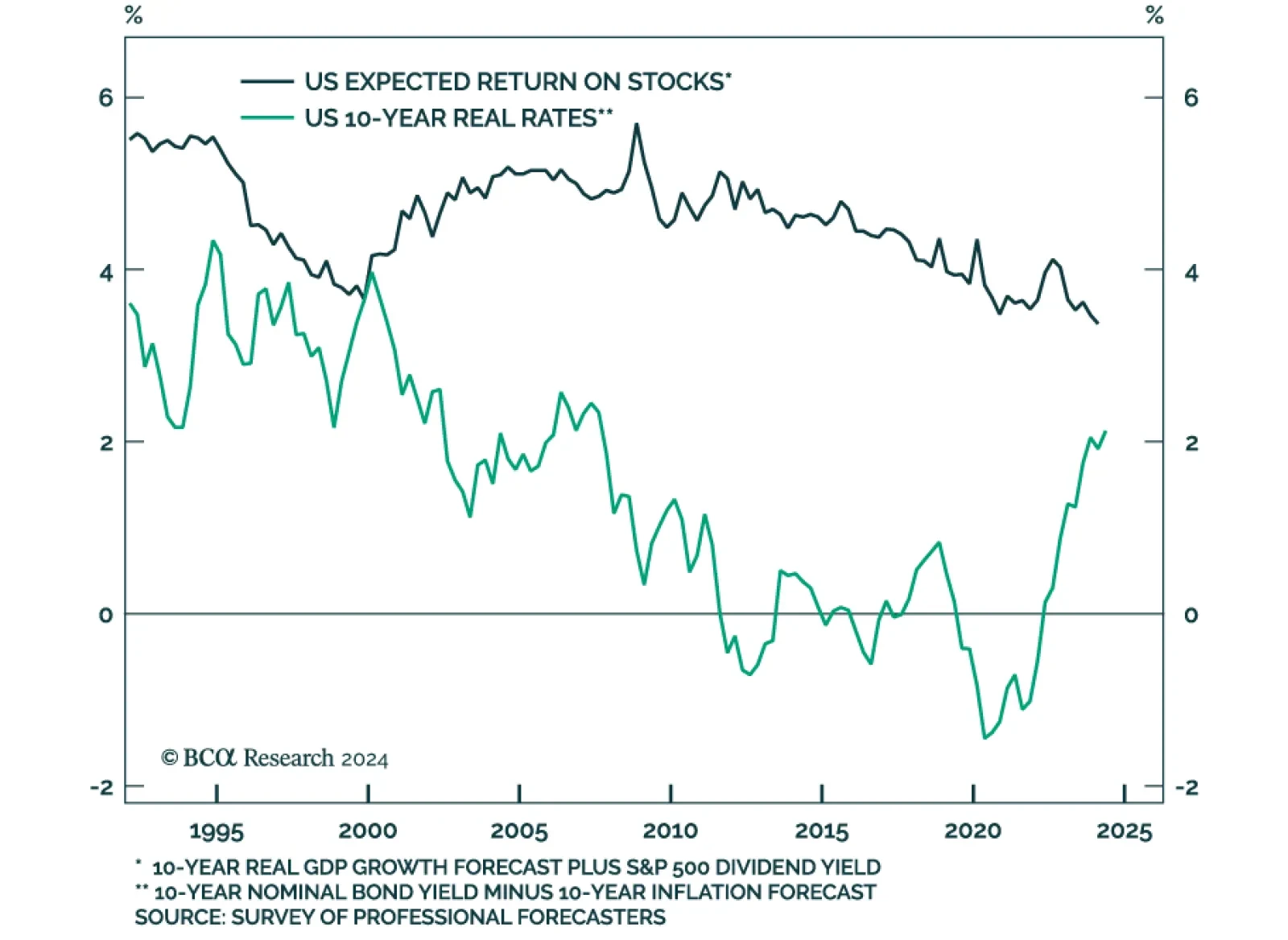

According to BCA Research’s US Investment Strategy and US Bond Strategy services, the drivers of the structural downtrend in real interest rates include: demographic trends (declining fertility rates, longer life…

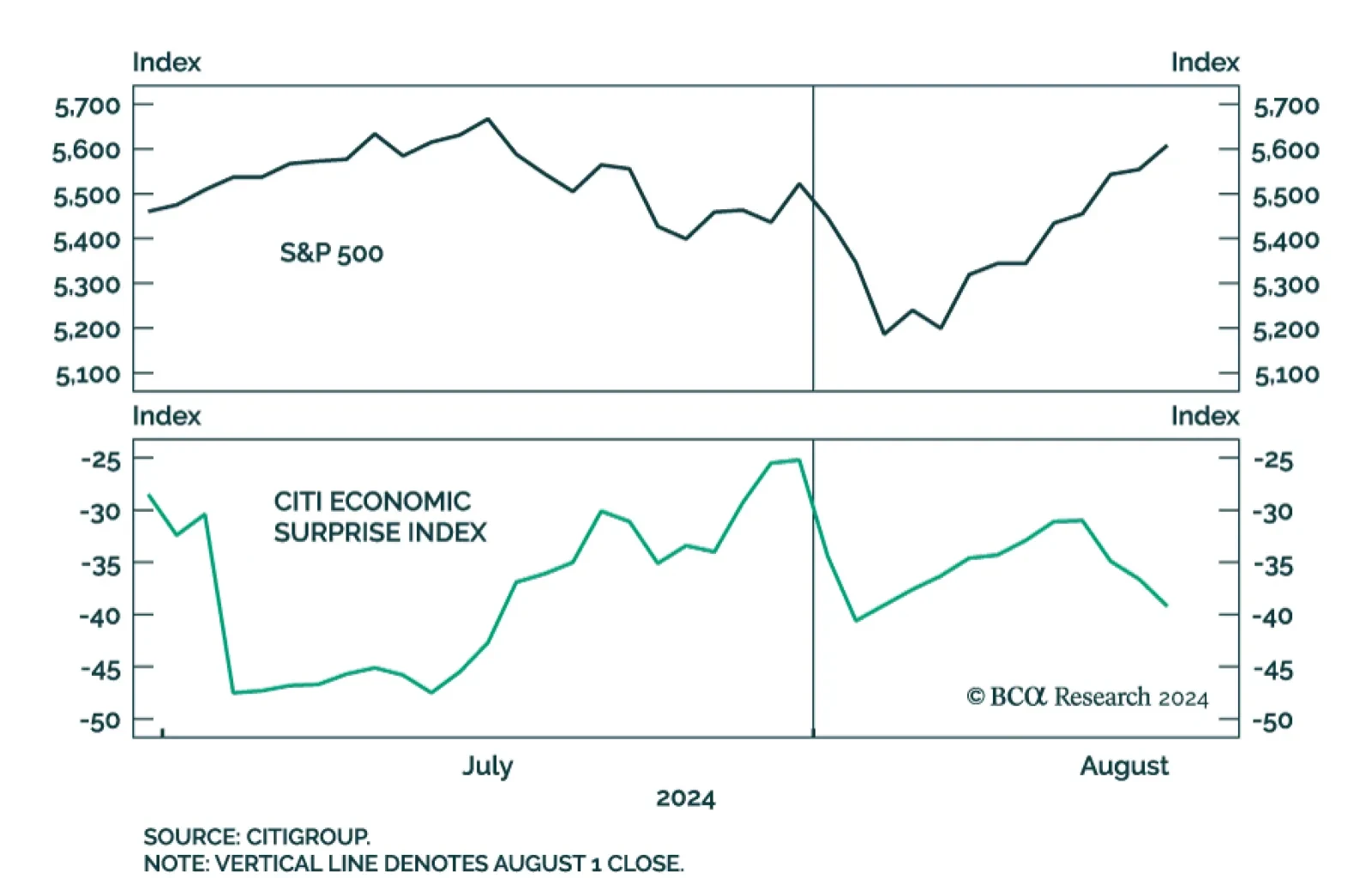

It didn't take long for markets to utterly shrug off the surprise rise in July's unemployment rate. On Tuesday, the S&P 500 closed higher than it was the day before the July Employment Situation report was released…

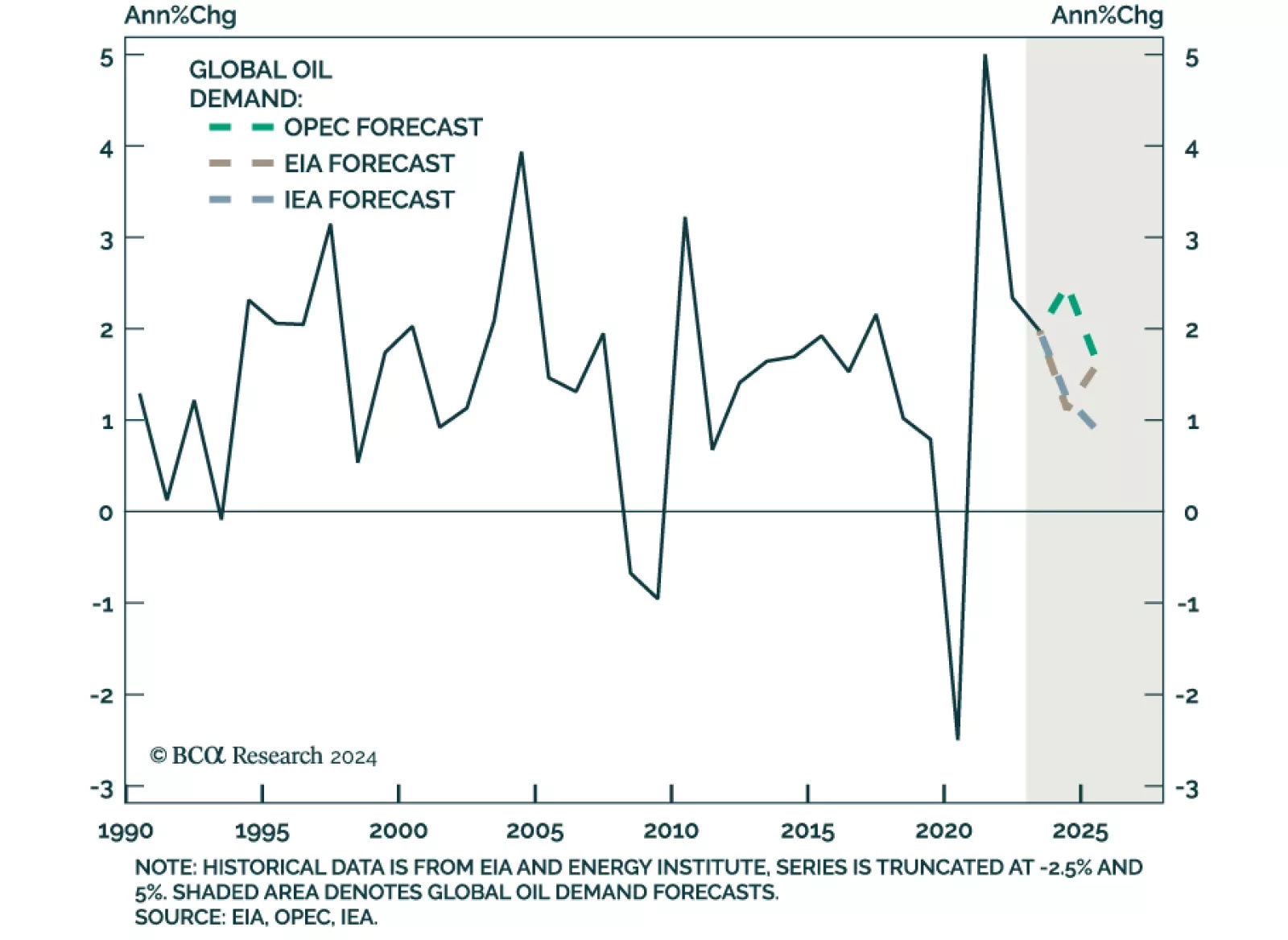

Back in May, our Commodity and Energy strategists argued that OPEC, EIA, and IEA oil demand forecasts were likely too optimistic. Indeed, while all three major oil price forecasters projected a moderation in demand this year,…

In a widely expected move, the Riksbank lowered its policy rate from 3.75% to 3.5% in August. It had kept rates on hold in June, after having led many other major DM central banks in easing policy in May. The Riksbank also…

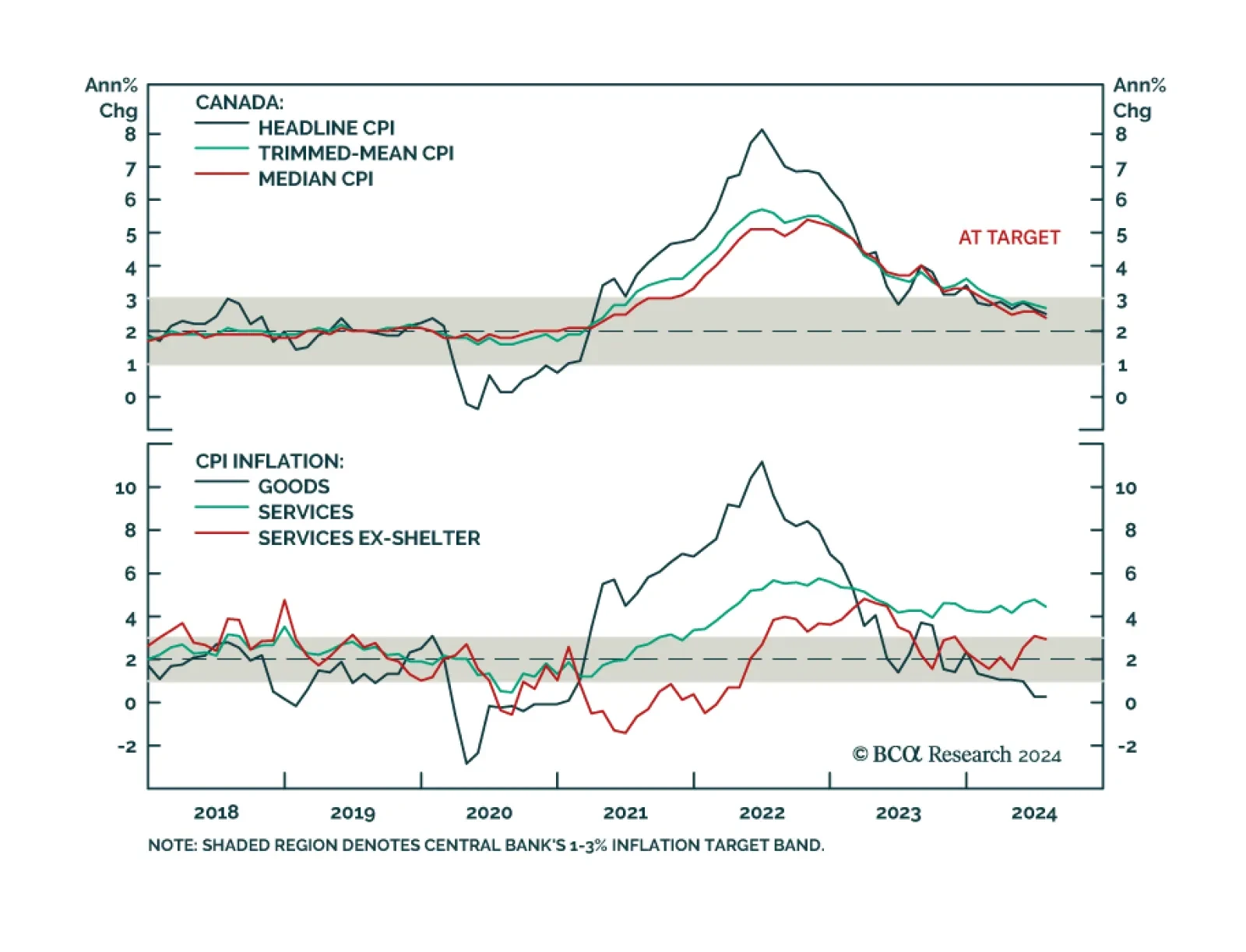

Canadian headline CPI decelerated from 2.7% y/y to 2.5% in July, the slowest pace in over 3 years. Notably, core median and trimmed-mean CPI eased further than expected, to 2.4% and 2.7% y/y respectively, 0.1 ppt below…