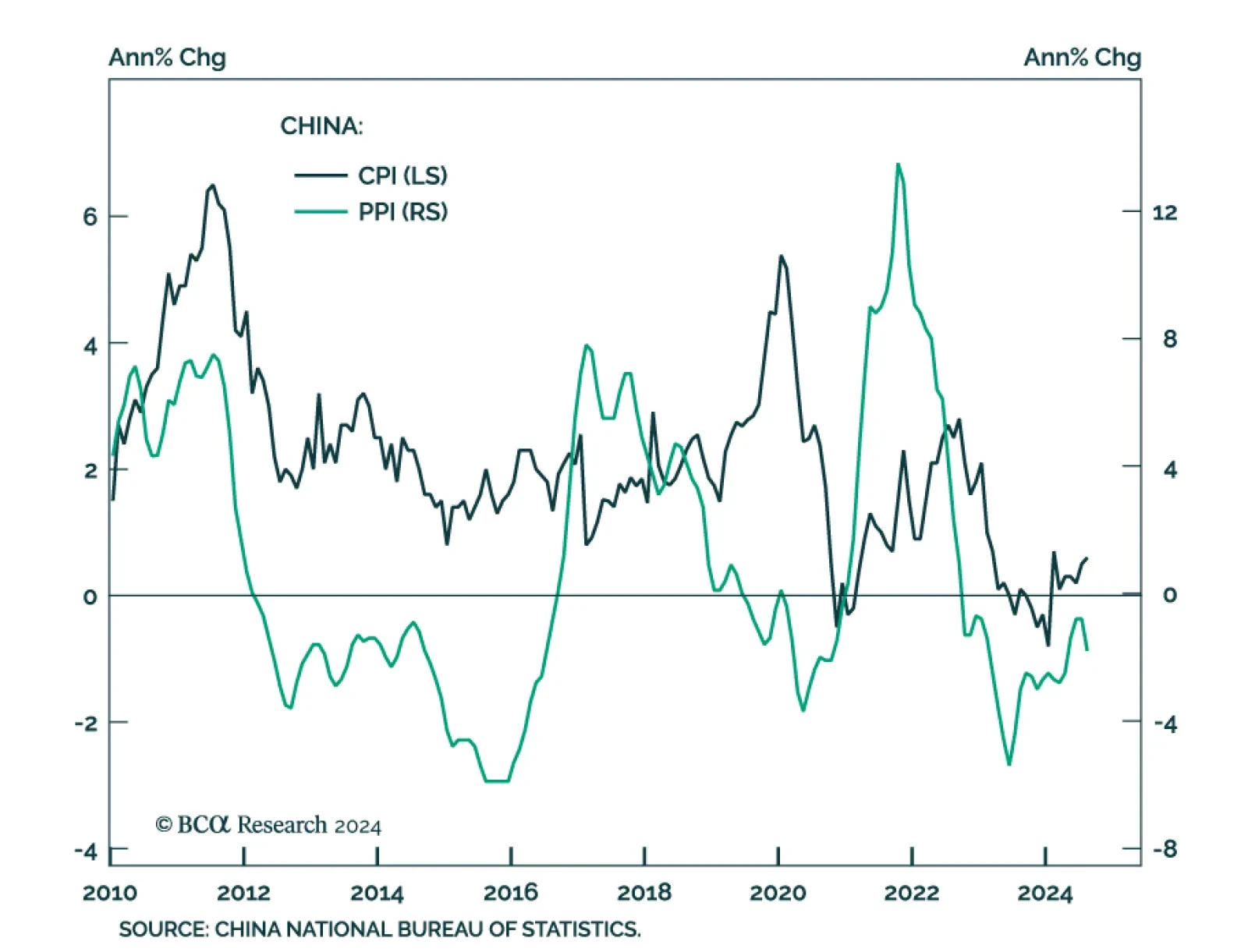

China’s CPI and PPI both surprised to the downside in August. Consumer prices grew from 0.5% y/y to 0.6%, below the 0.7% anticipated. However, a 2.8% y/y surge in food prices (the fastest pace so far this year)…

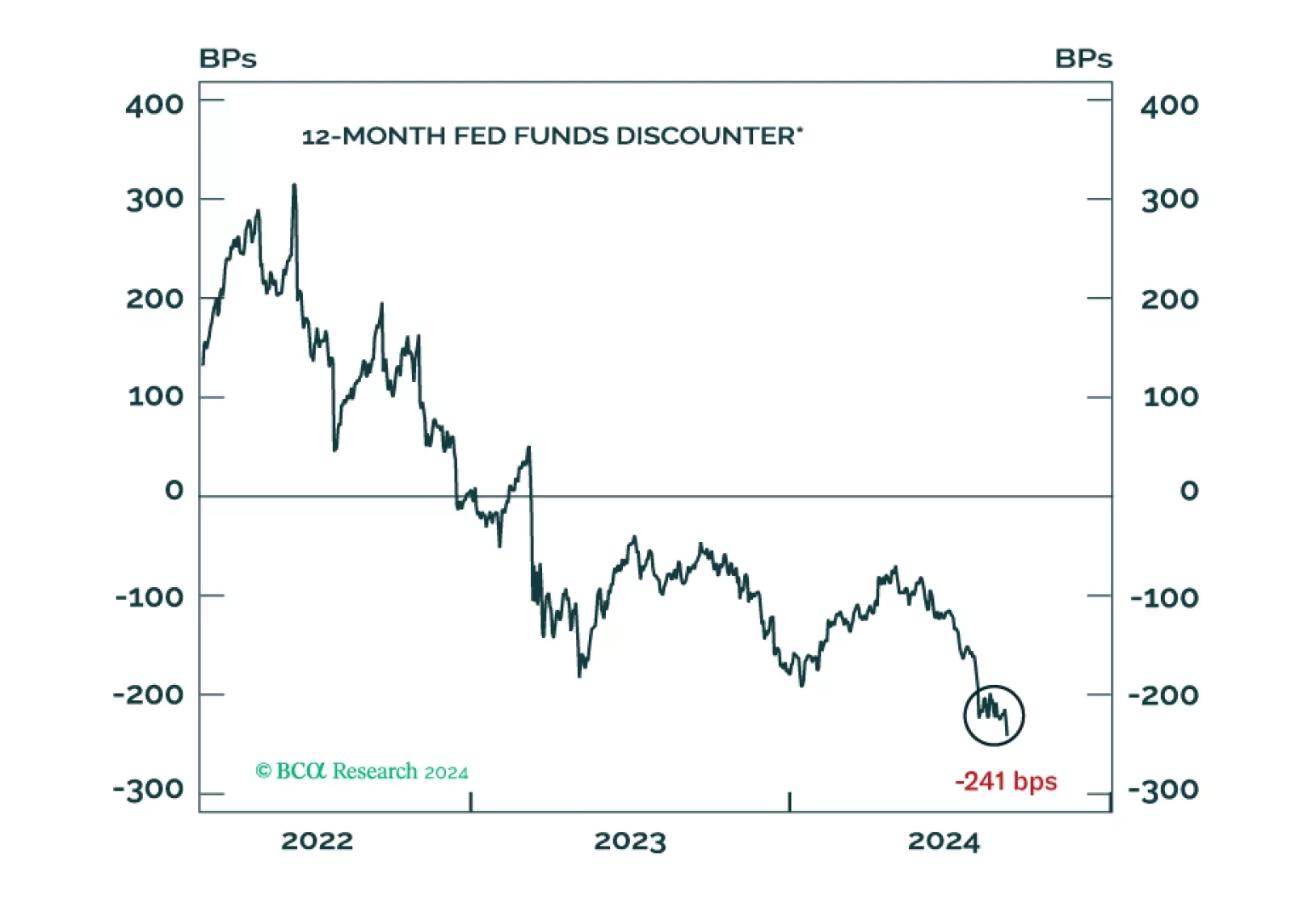

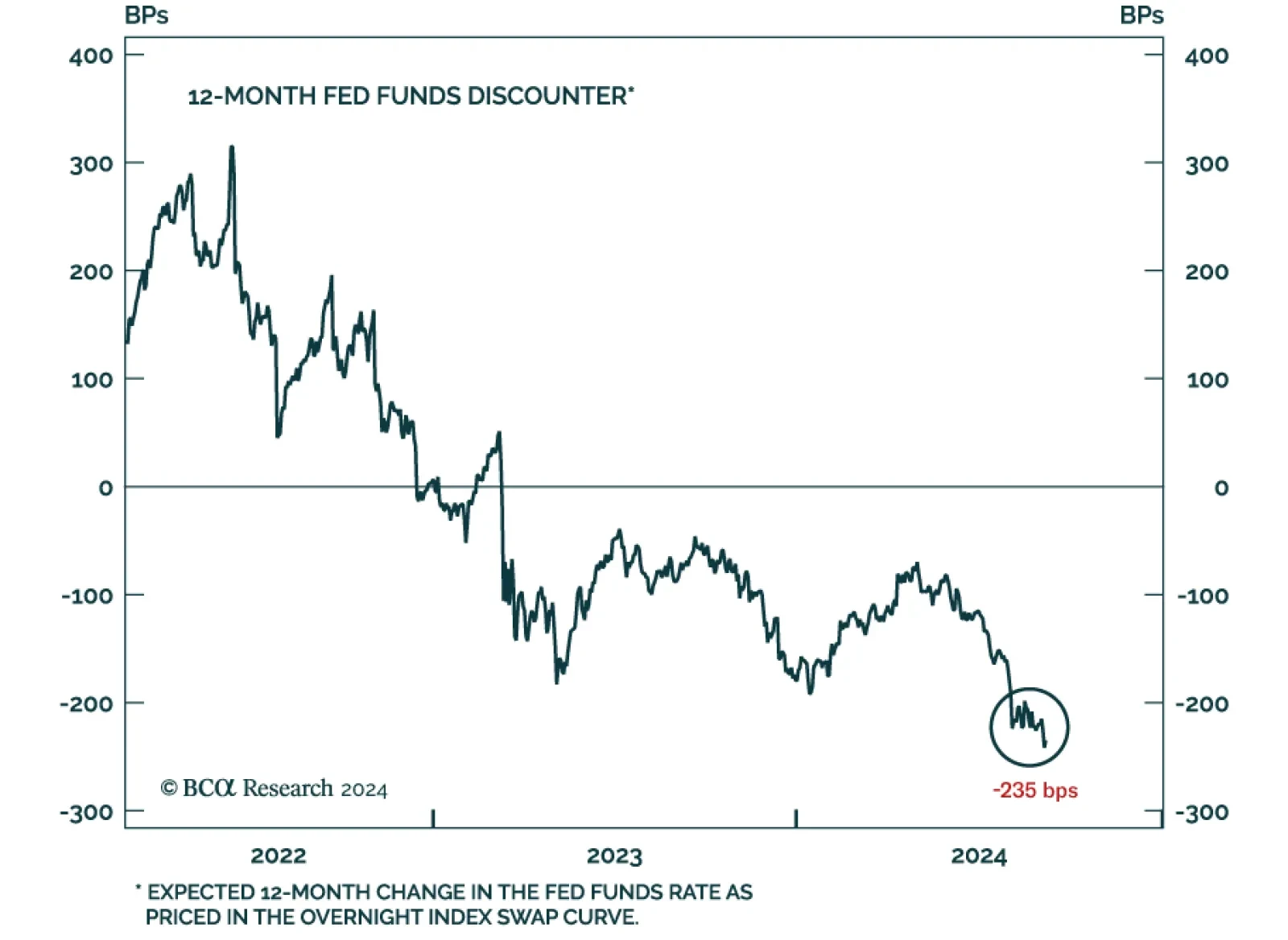

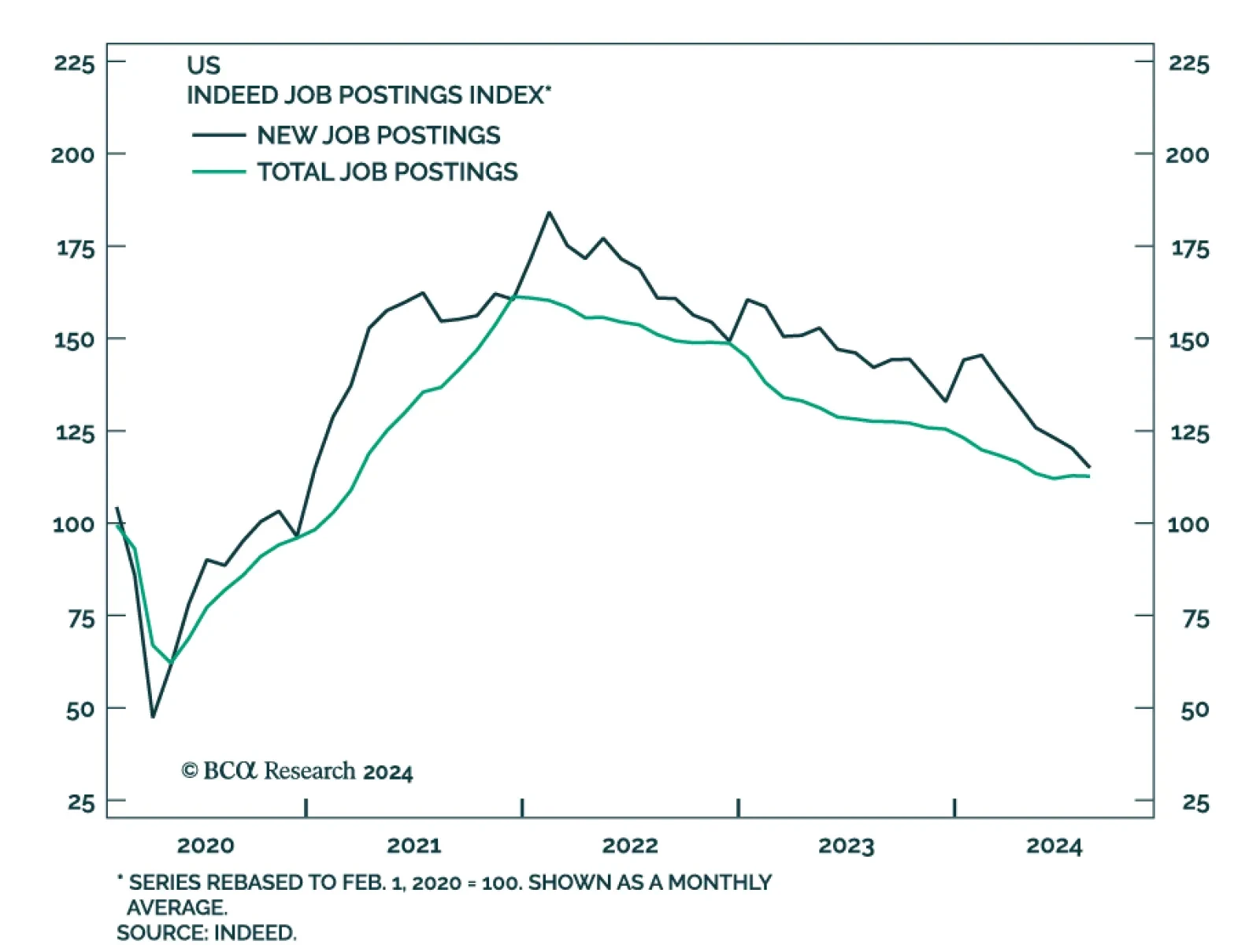

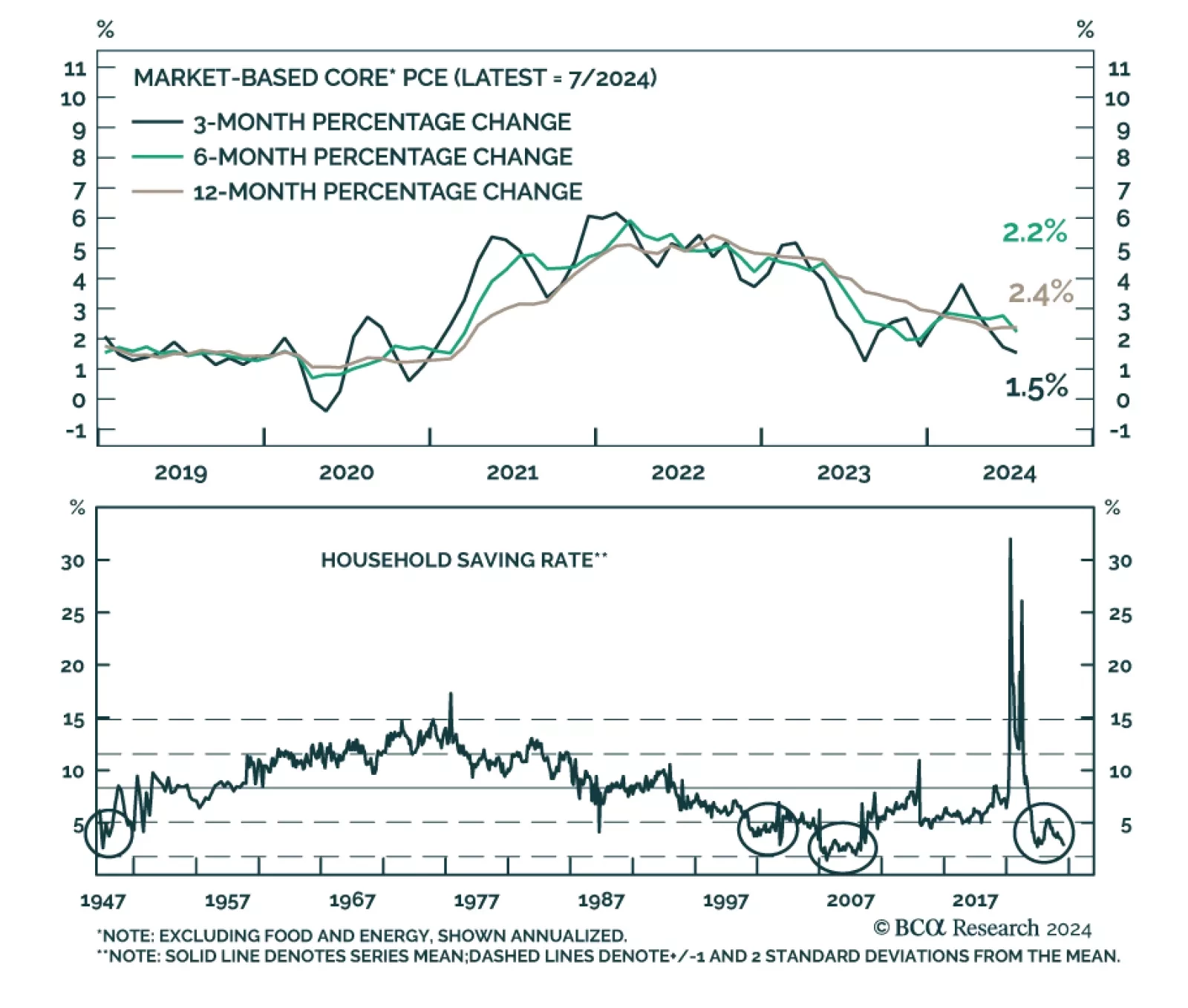

The July Employment Situation report had already cemented the case for a September rate cut and Chairman Powell’s Jackson Hole comments dispelled any remaining doubt about an imminent monetary easing cycle. All the labor…

Our Portfolio Allocation Summary for September 2024.

The Fed’s Beige Book compiles qualitative input sourced from business and other organizational contacts in each of its 12 Districts. It precedes FOMC meetings by a couple of weeks and is meant to help participants trace the…

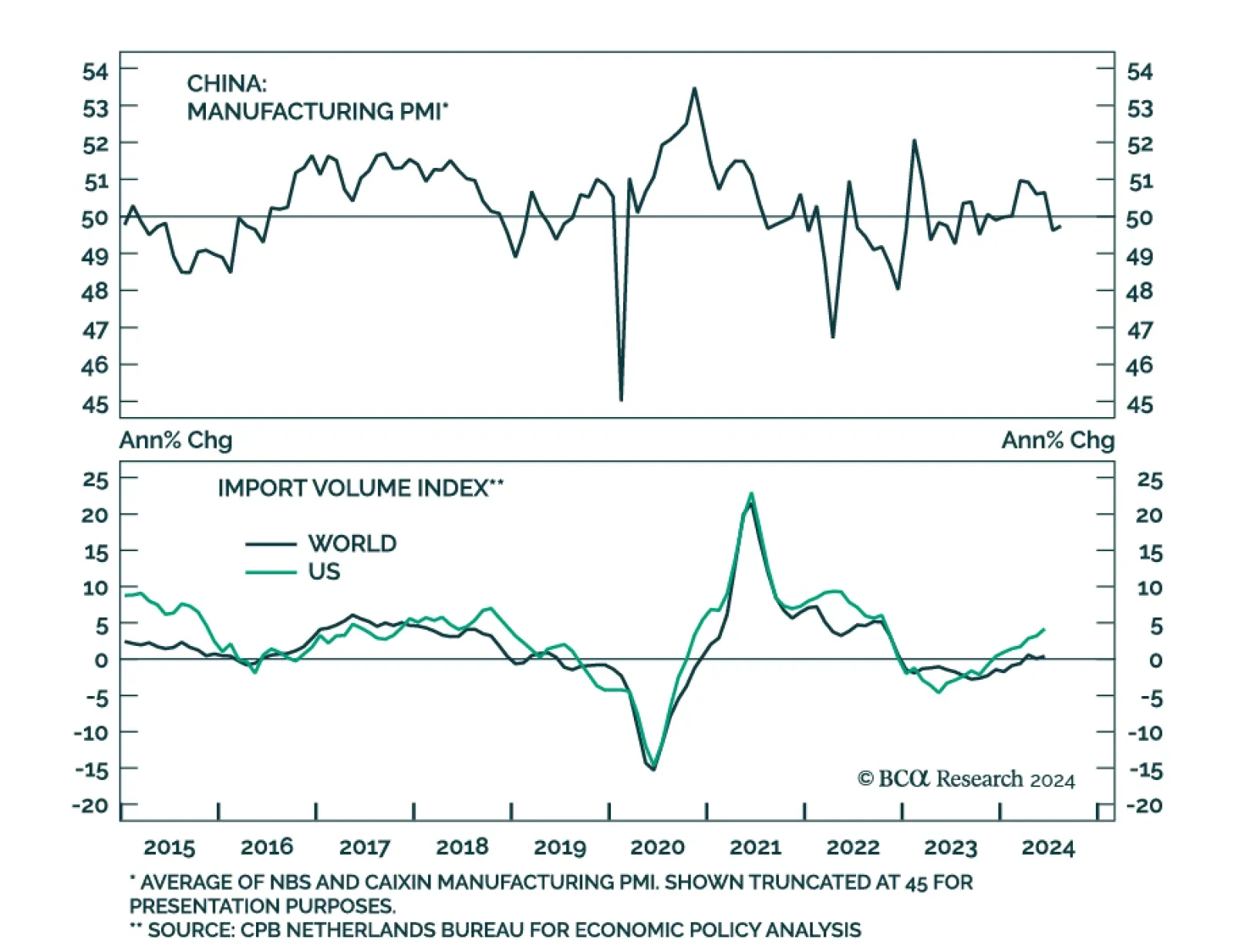

Both leading PMI measures painted a sluggish picture of China’s economic conditions in August. The NBS composite PMI suggested that overall activity barely expanded (50.1) and that the manufacturing sector’s…

In a widely expected move, the Bank of Canada (BoC) cut interest rates by a quarter of a percentage point for a third consecutive month in September, lowering the benchmark overnight rate to 4.25%. Policymakers also signaled…

Even after the Fed cuts rates, policy will remain restrictive for some time. Moreover, in history, stocks have tended to fall around the first rate cut. We remain cautious on the outlook for the economy and risk assets.

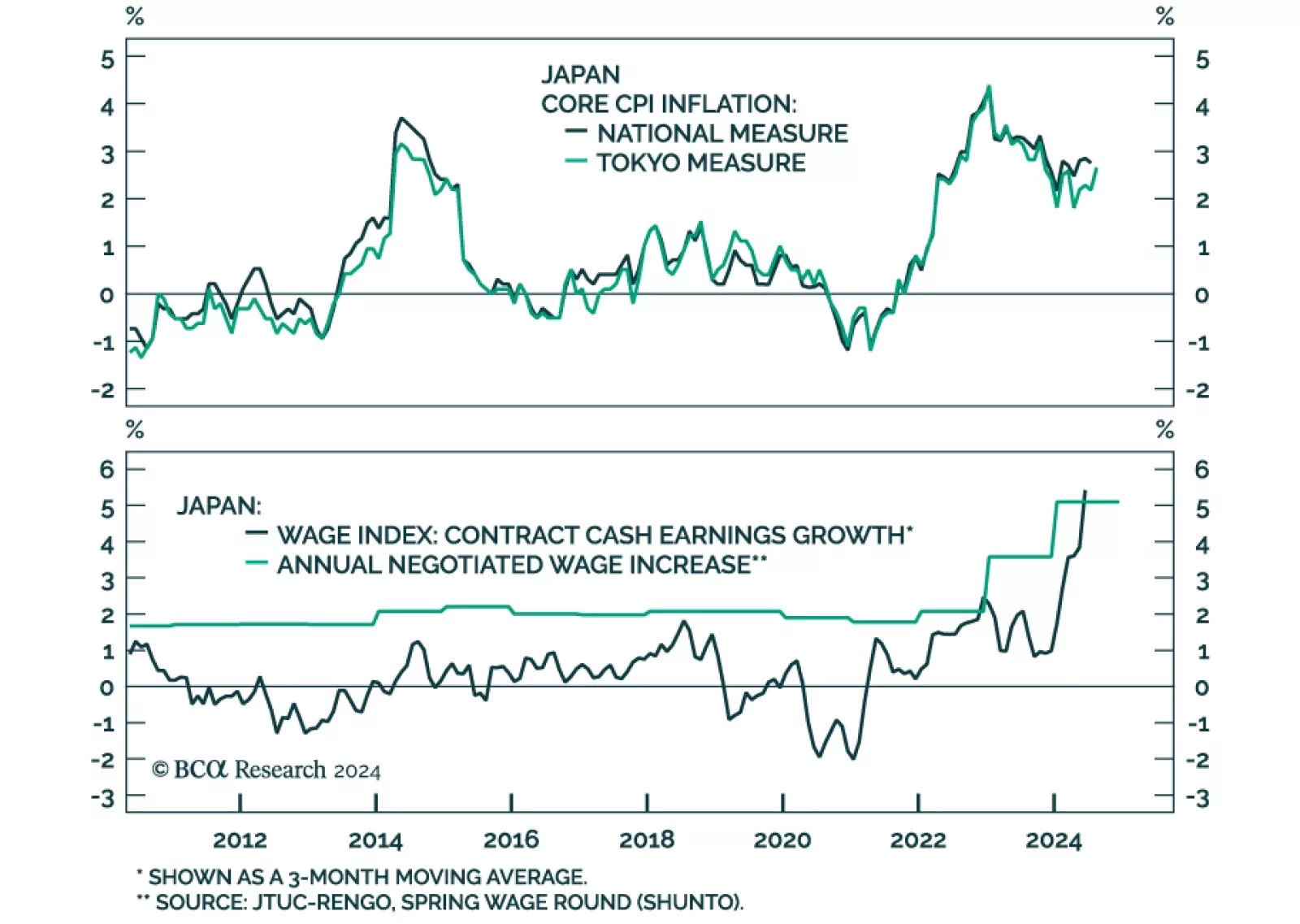

Tokyo’s CPI is a timely leading indicator of nationwide price pressures. In August, the headline, core (ex-food) and the “core core” (ex-food and energy) measures all accelerated by larger-than-expected margins…

After surprising to the upside in July on higher energy costs, Eurozone CPI resumed its deceleration in August. Headline and core CPI declined from 2.6% y/y to 2.2% and from 2.9% to 2.8%, respectively. Energy prices contracted…

US nominal personal income growth accelerated from 0.2% m/m to 0.3% in July, faster-than-anticipated, whereas personal spending accelerated from 0.3% to 0.5%, in line with expectations. The savings rate edged lower from 3.1% to a…