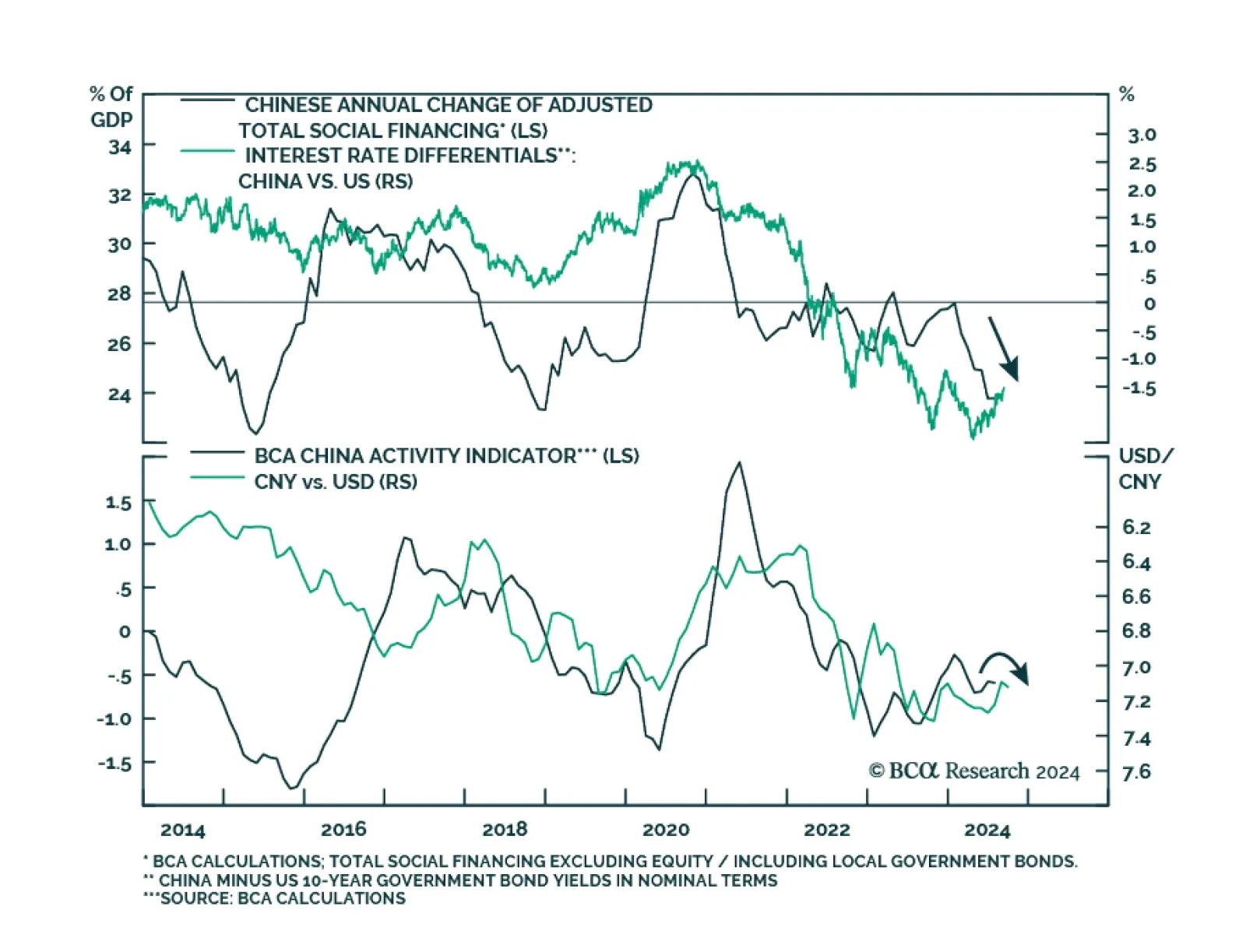

According to BCA Research’s China Investment Strategy service, the Fed’s upcoming rate cut will temporarily alleviate some of the downward pressure on the RMB, but beyond the short term the USD will likely rebound in…

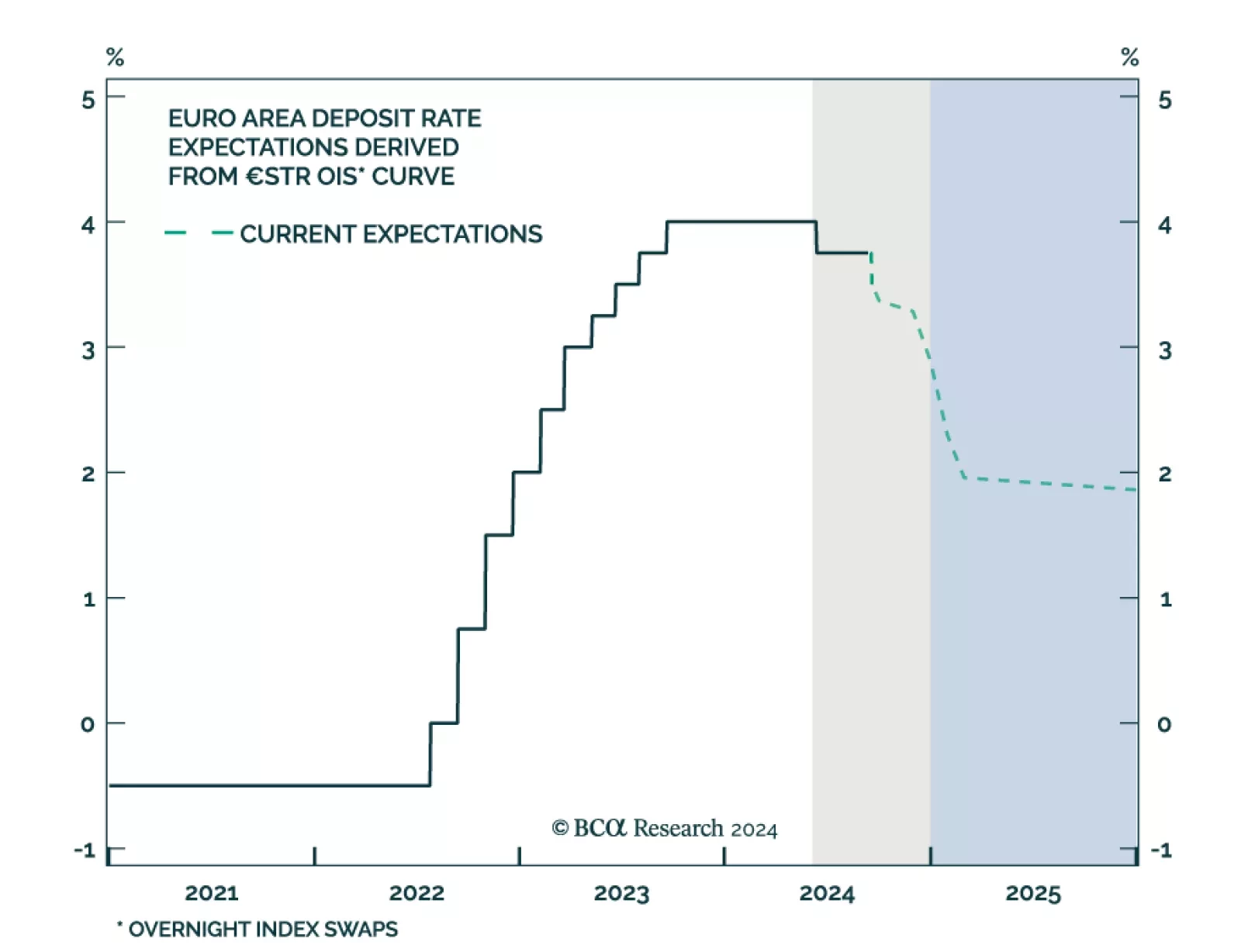

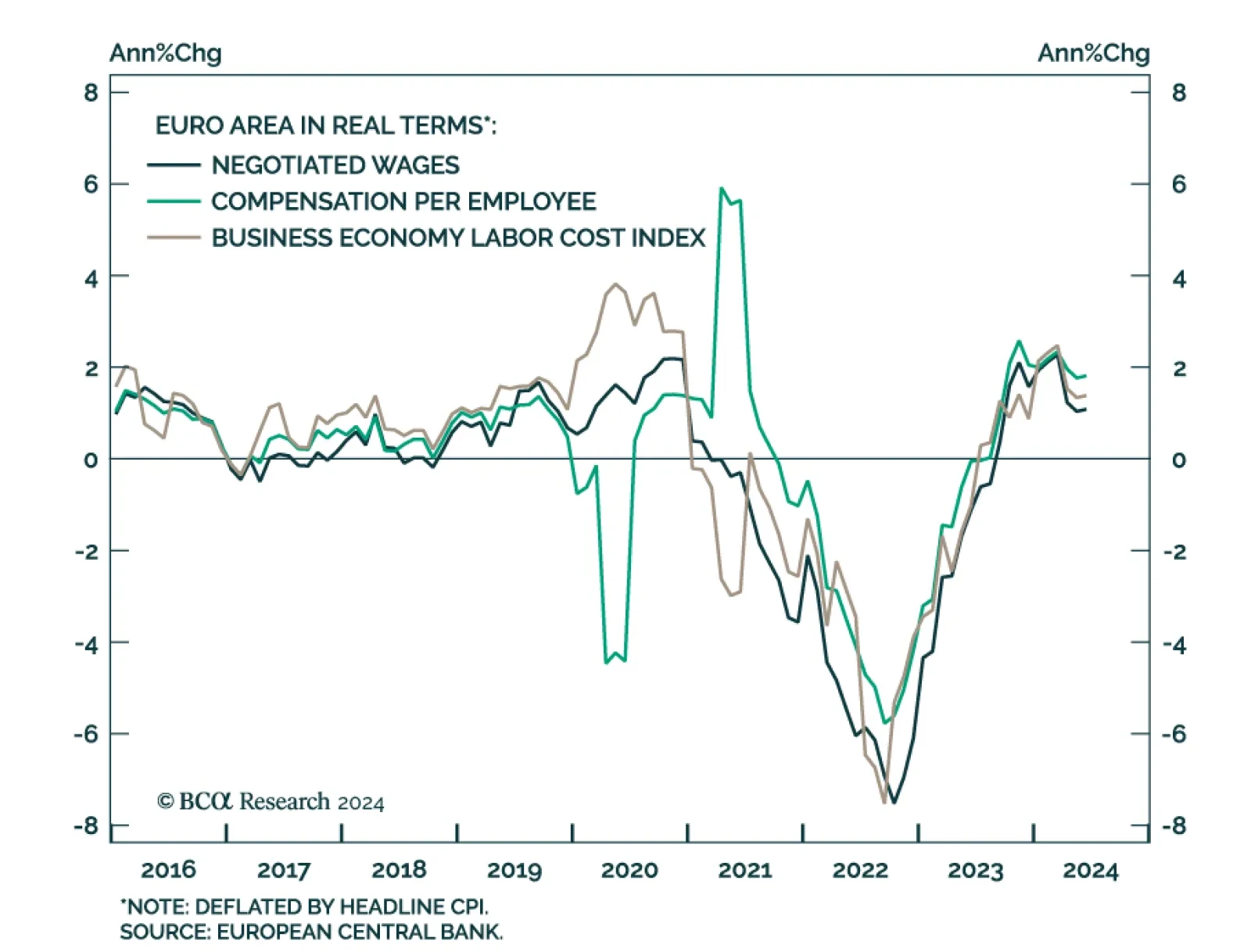

ECB Governing Council members unanimously voted in favor of lowering the deposit facility rate by 25 bps to 3.50% in September, marking the second cut this year. Moreover, expectations for weaker domestic demand led the ECB to…

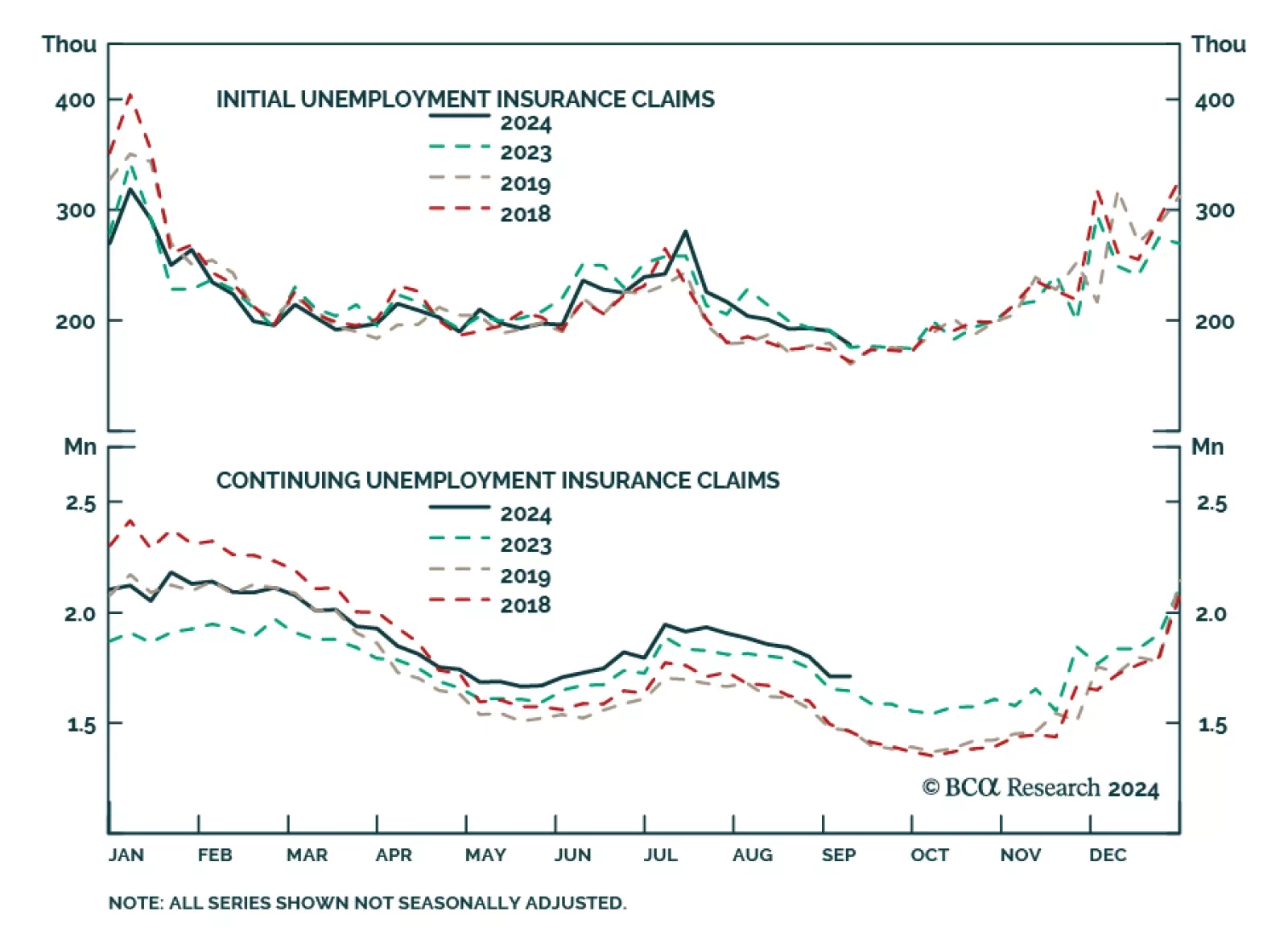

Continued deterioration in labor demand underpins our expectation for a US recession, as it will lead to slower compensation growth, hobbling consumption spending’s main driver. We also previously highlighted that the…

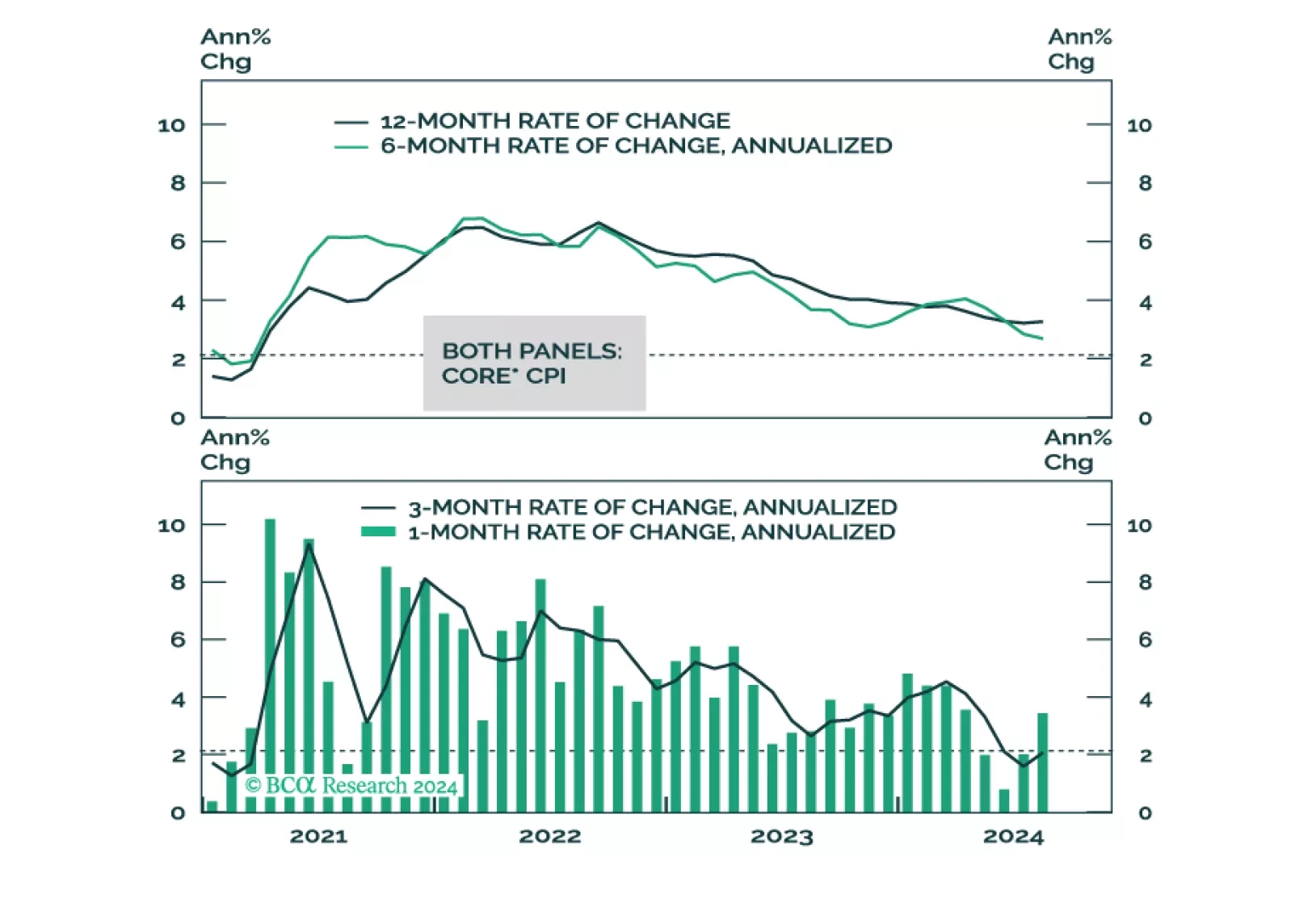

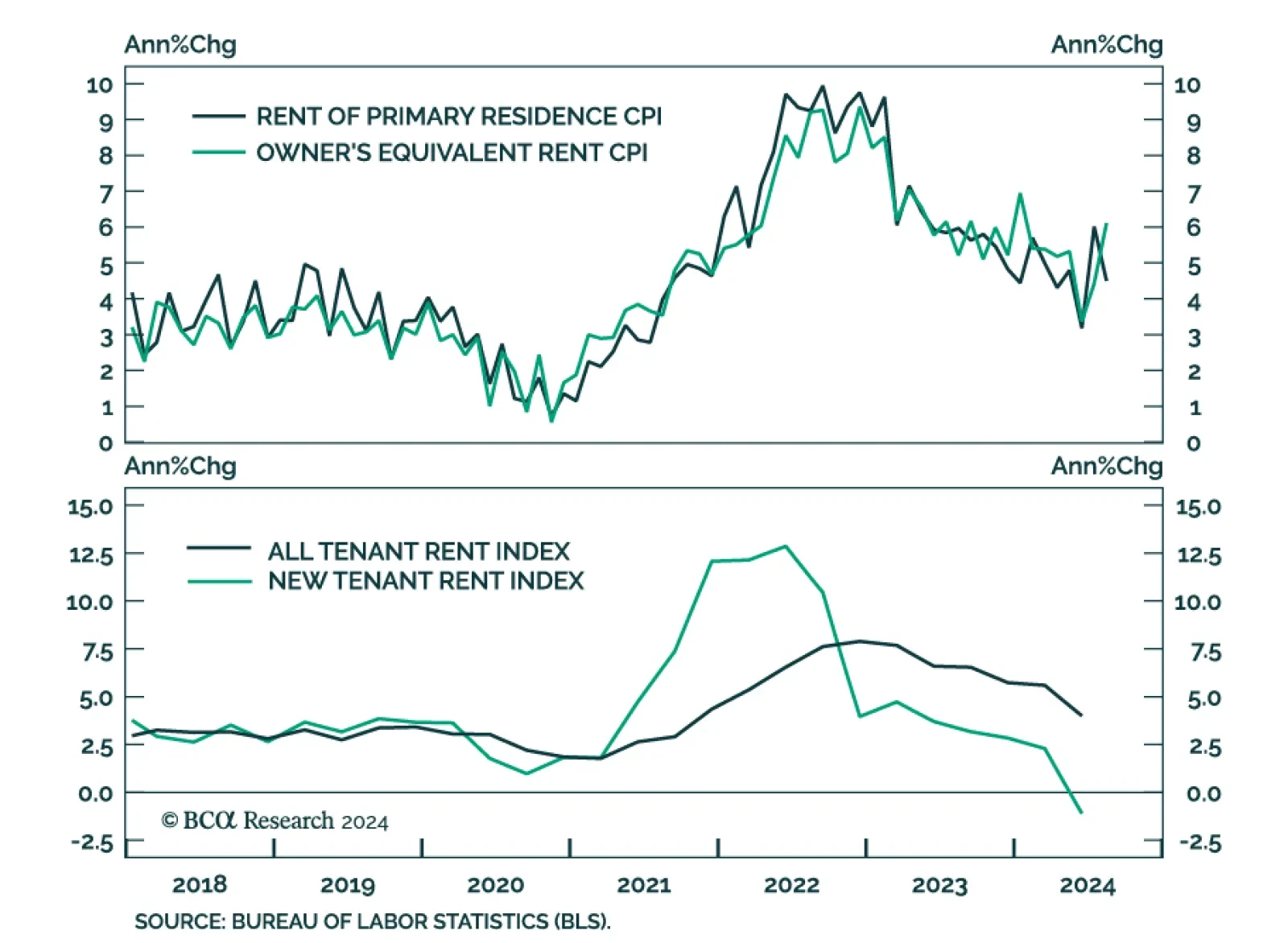

US headline CPI eased from 2.9% y/y to 2.5% in August in line with consensus predictions. However, core CPI unexpectedly accelerated from 0.2% m/m to 0.3%. Aside from airfares -- a highly volatile series which is likely to…

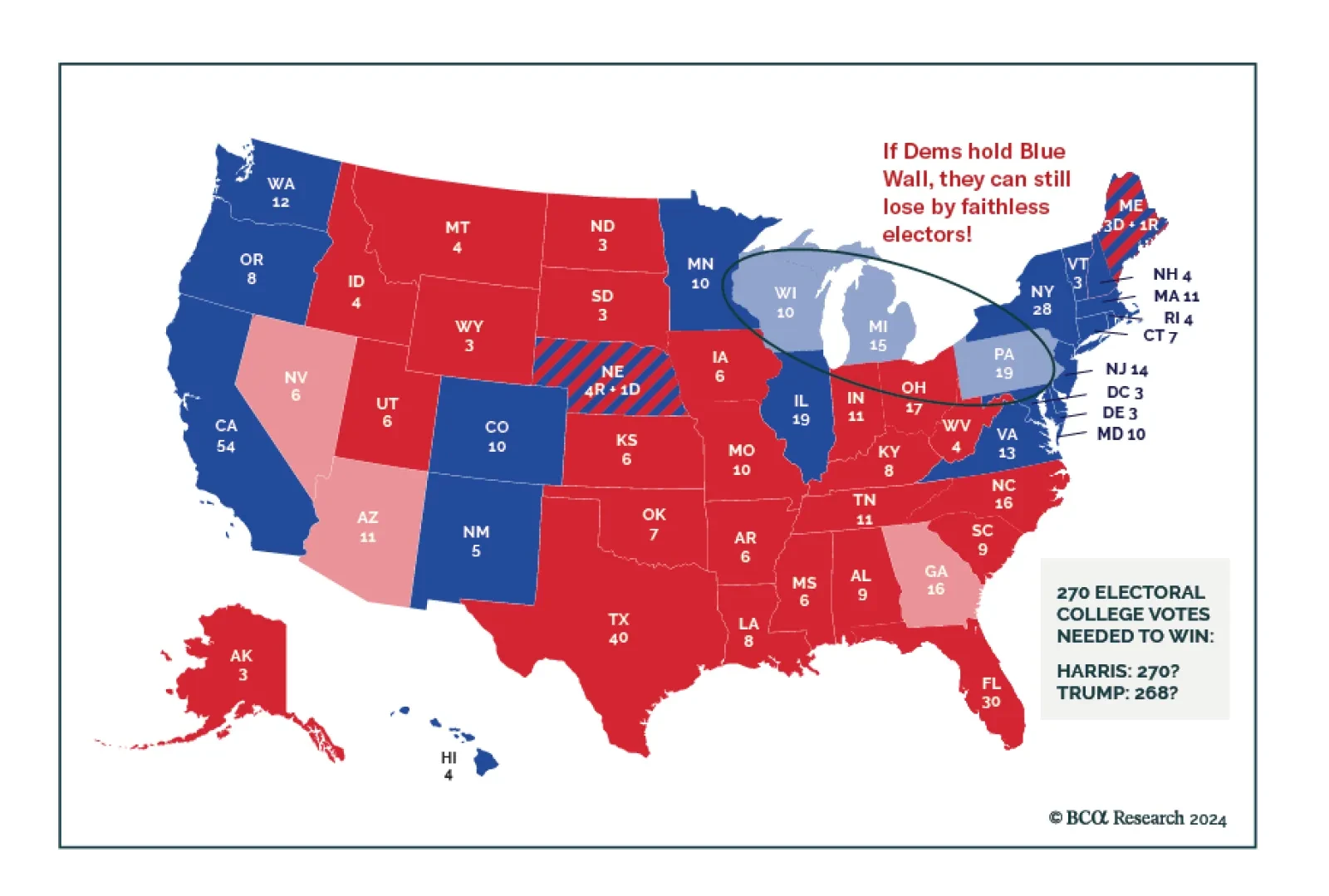

According to BCA Research’s US Political Strategy service, former President Trump still has a path to come back to power, despite his disastrous performance in the debate with Vice President Kamala Harris on September 10…

Our reaction to this morning’s CPI report and what it means for Fed policy.

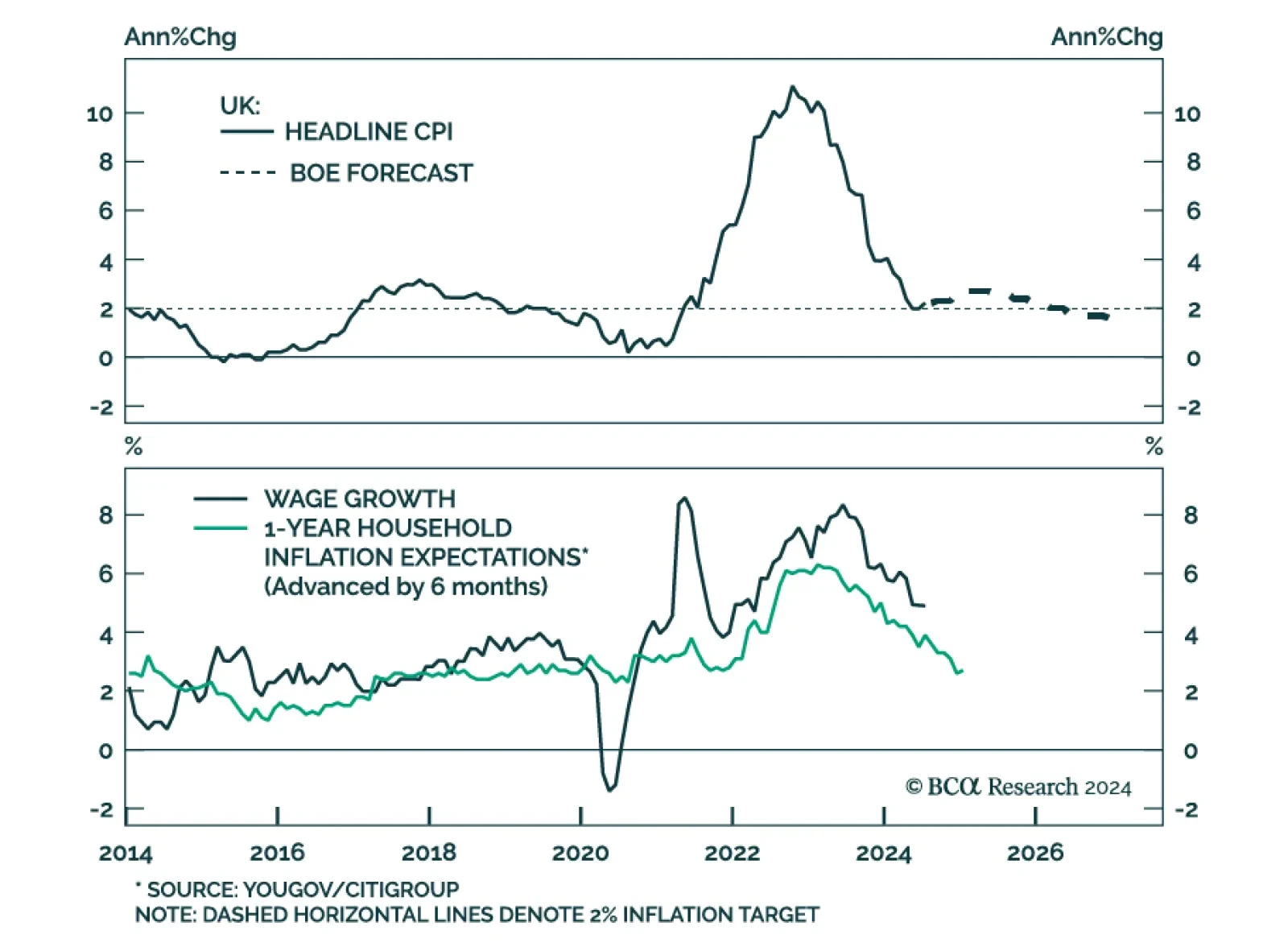

The BoE embarked on its easing cycle in August, delivering its first 25 bps rate cut. The decision was nowhere near unanimous, with 5 MPCs out of 9 voting in favor of lowering policy rates. Indeed, while headline inflation is…

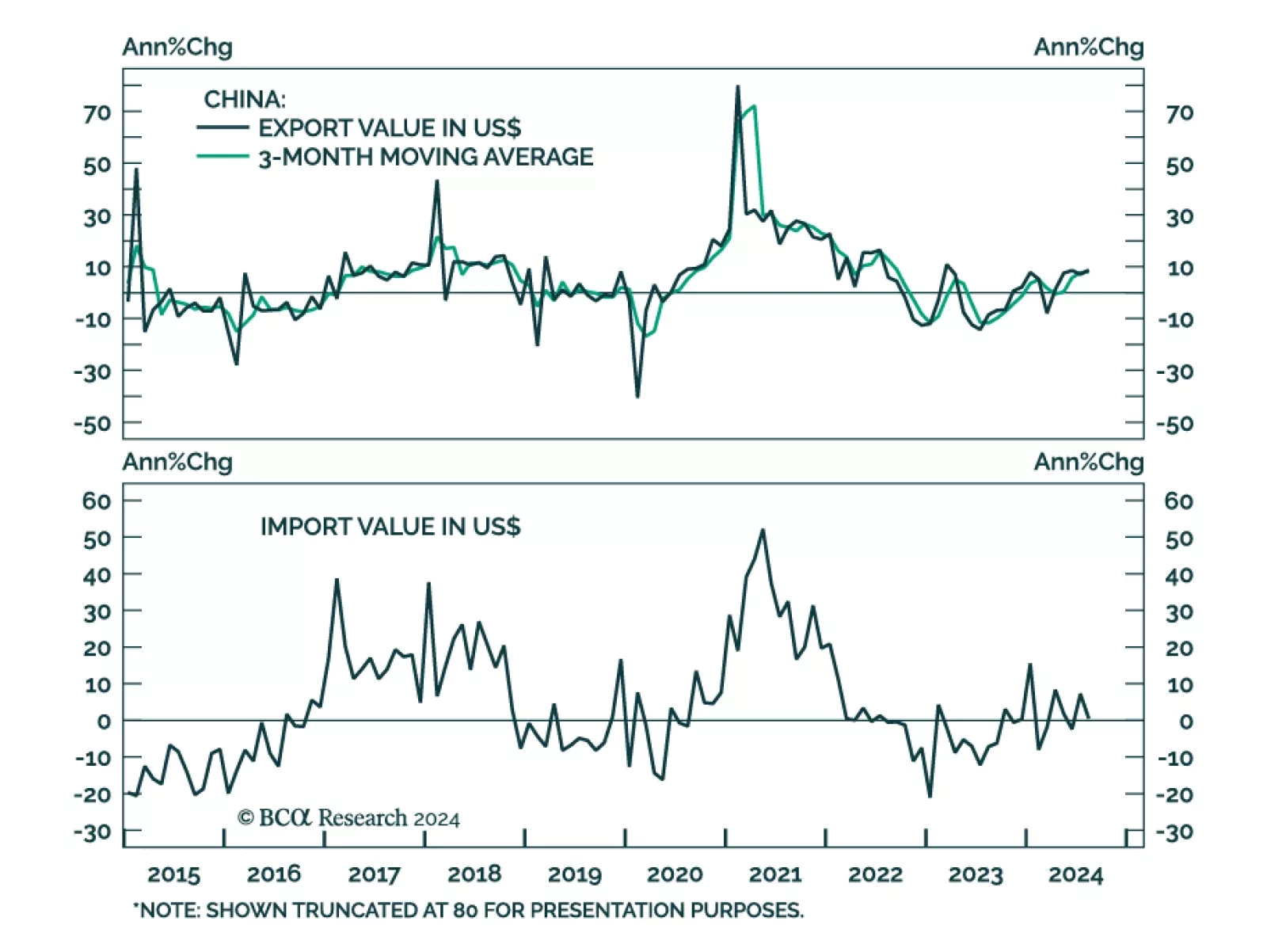

Chinese export growth in USD terms accelerated from 7.0% y/y to a larger-than-expected 8.7% in August. China’s exports to its major trading partners (US, EU and ASEAN) were all growing in August on a year-on-year basis,…

Eurozone GDP’s final estimate indicates that growth was slower than expected in Q2. Output grew 0.2% q/q in Q2, compared to 0.3% previously reported. A significant downward revision to capex (2.2% contraction against 1.8%…