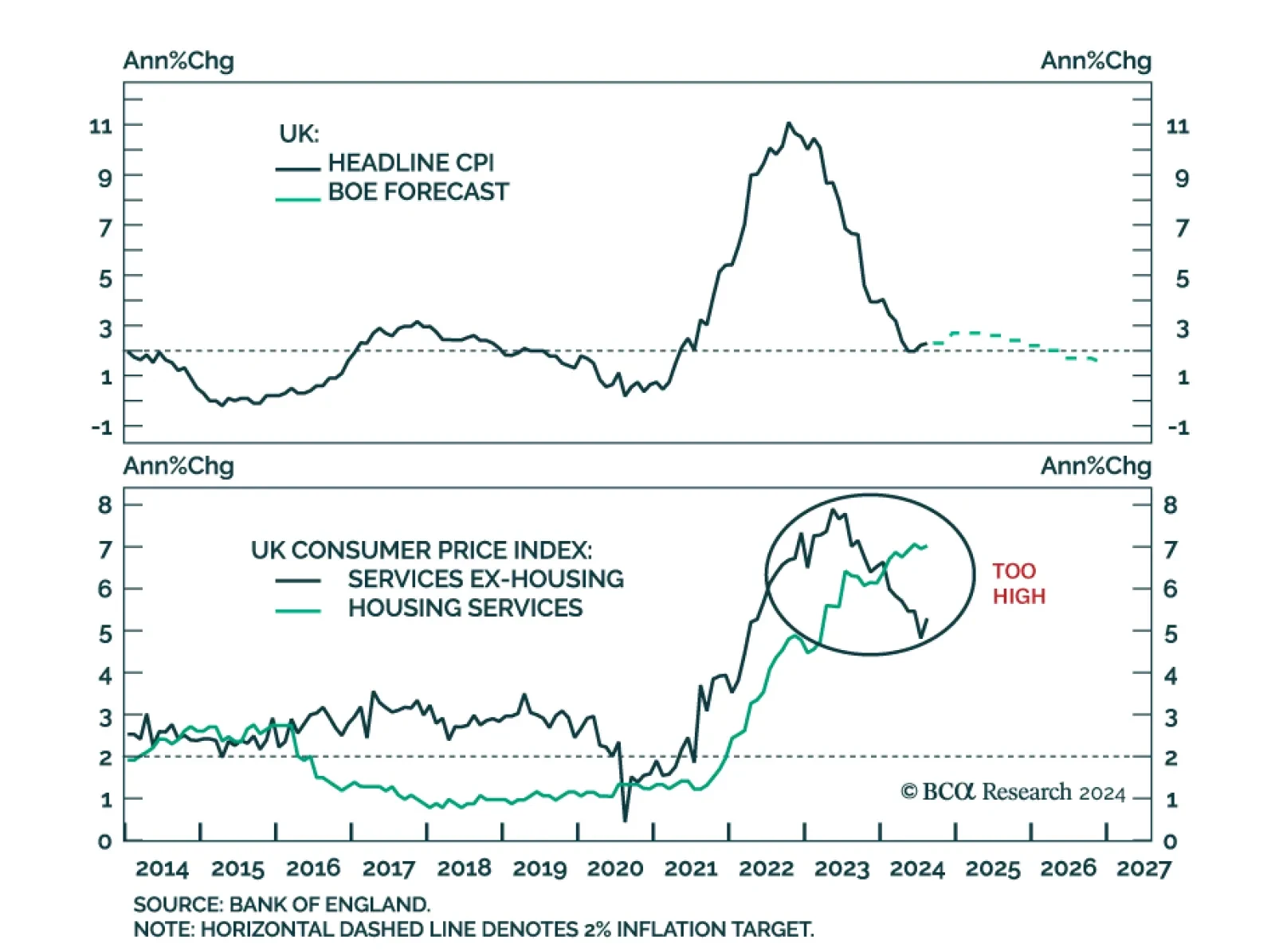

UK headline CPI grew at a stable 2.2% y/y in August, though the core measure accelerated from 3.3% to 3.6%, in line with expectations. An 11.6% annual increase in airfare largely drove core CPI higher, while offsetting…

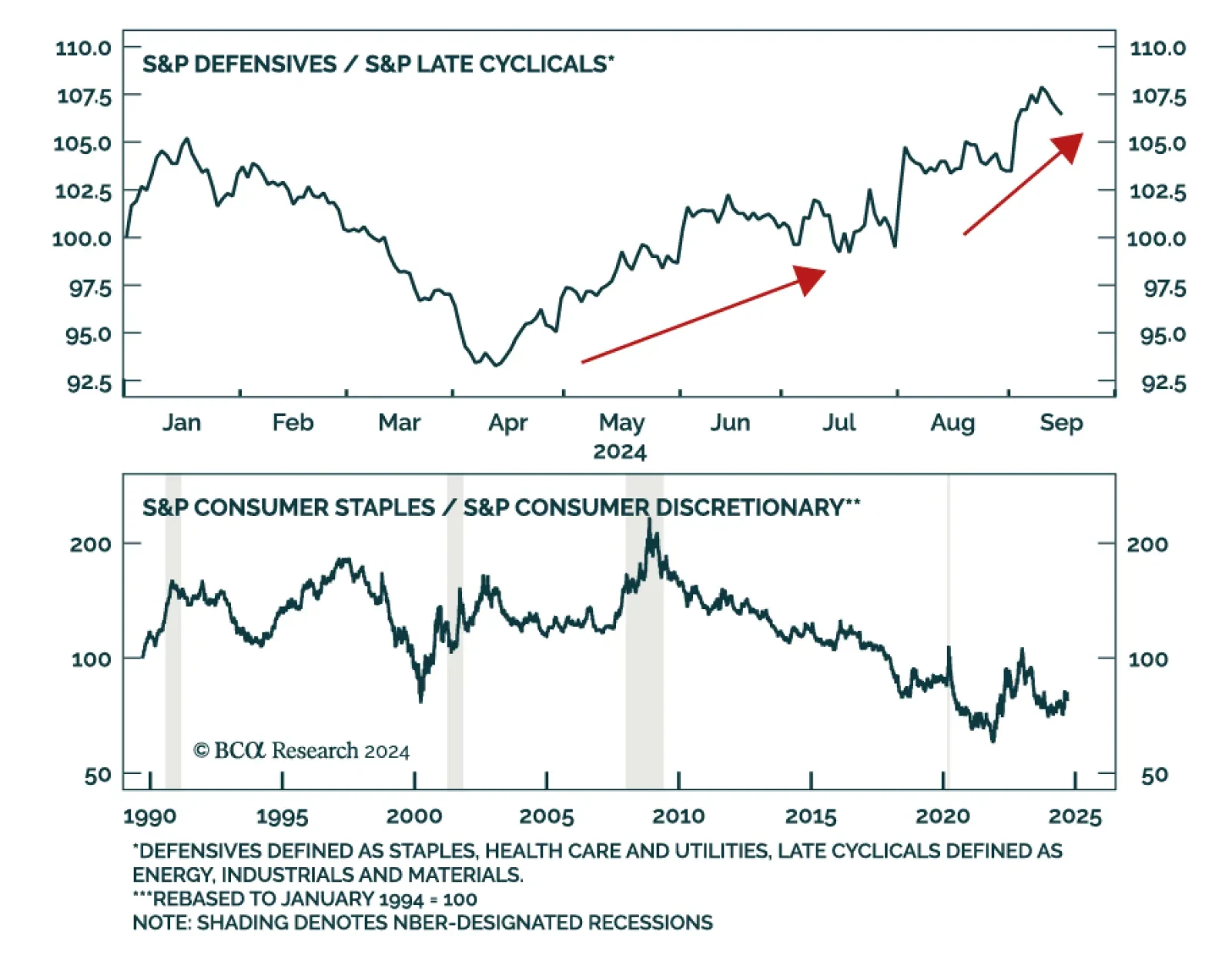

Stocks are a forward discounting mechanism and routinely top before recessions begin, even if they typically do not swoon until the recession has taken hold. According to BCA Research’s US Investment Strategy service, if…

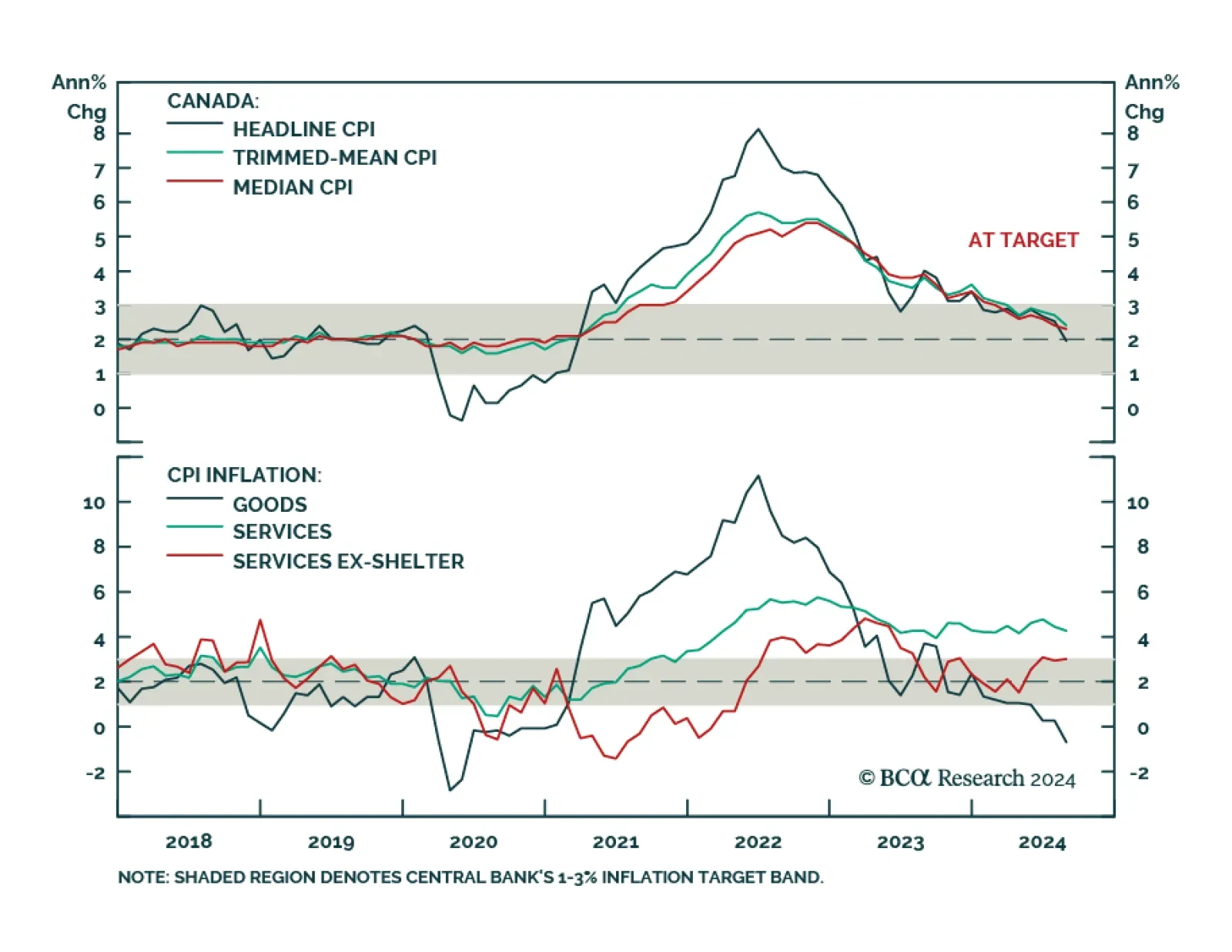

Canadian headline CPI inflation decelerated at a faster-than-anticipated pace from 2.5% y/y to 2.0% in August, the slowest since 2021. Notably, core median and trimmed-mean CPI ticked 0.1 ppt and 0.3 ppt lower to 2.3% and 2.4%,…

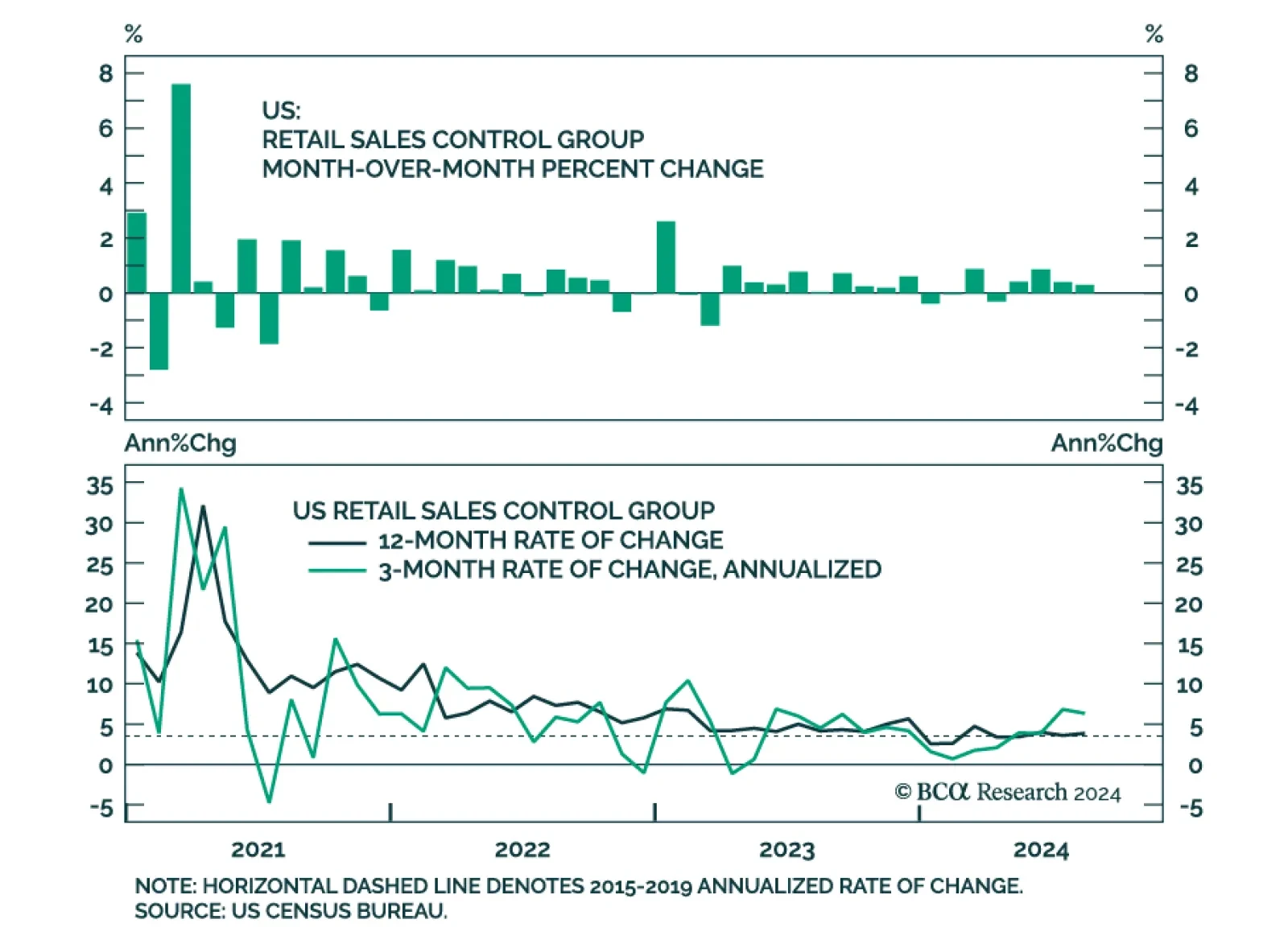

US retail sales grew 0.1% m/m in August and beat expectations of a 0.2% monthly contraction. The positive surprise seemingly spurred equity market gains on Tuesday morning. However, details do not paint as rosy a…

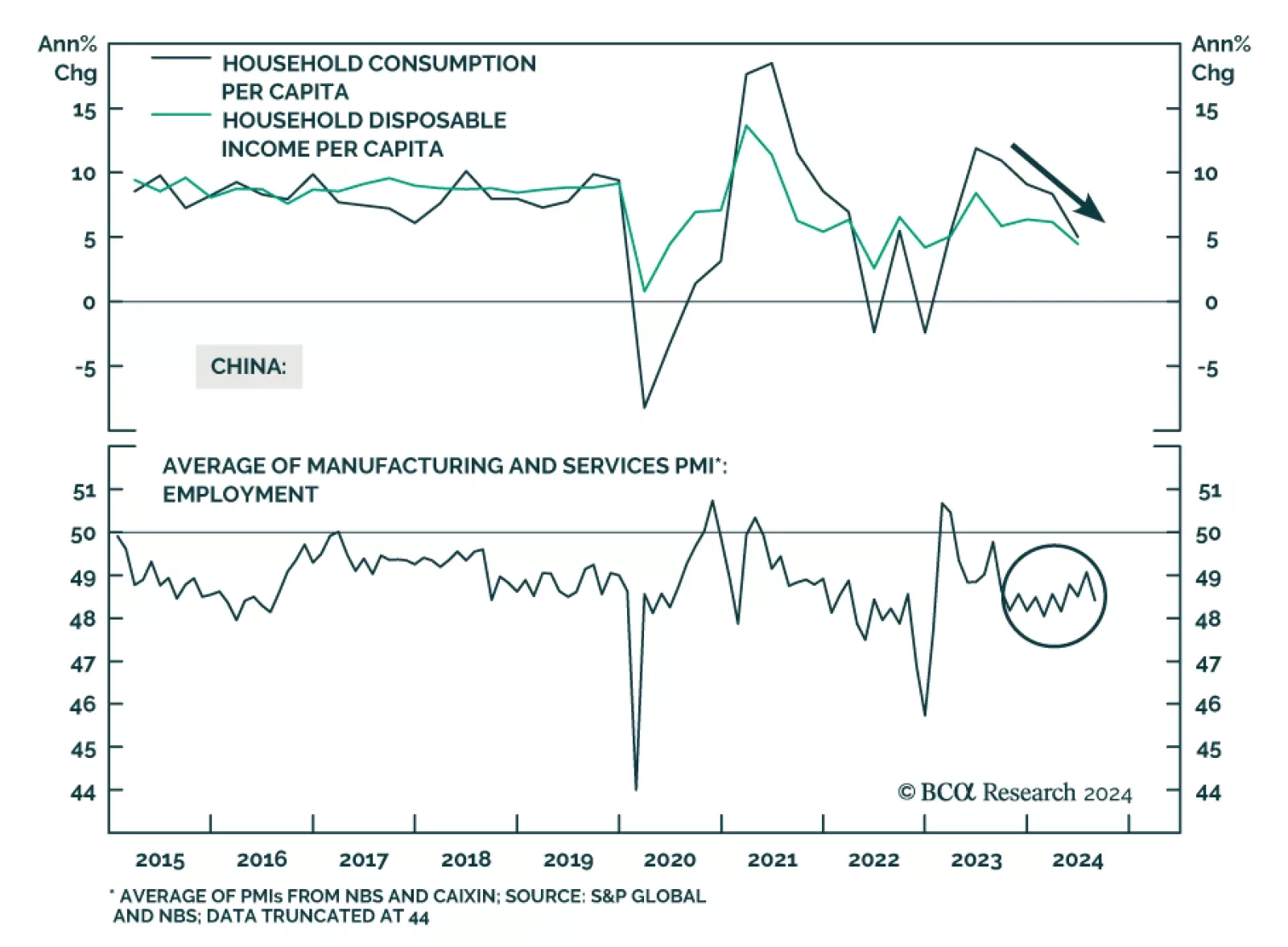

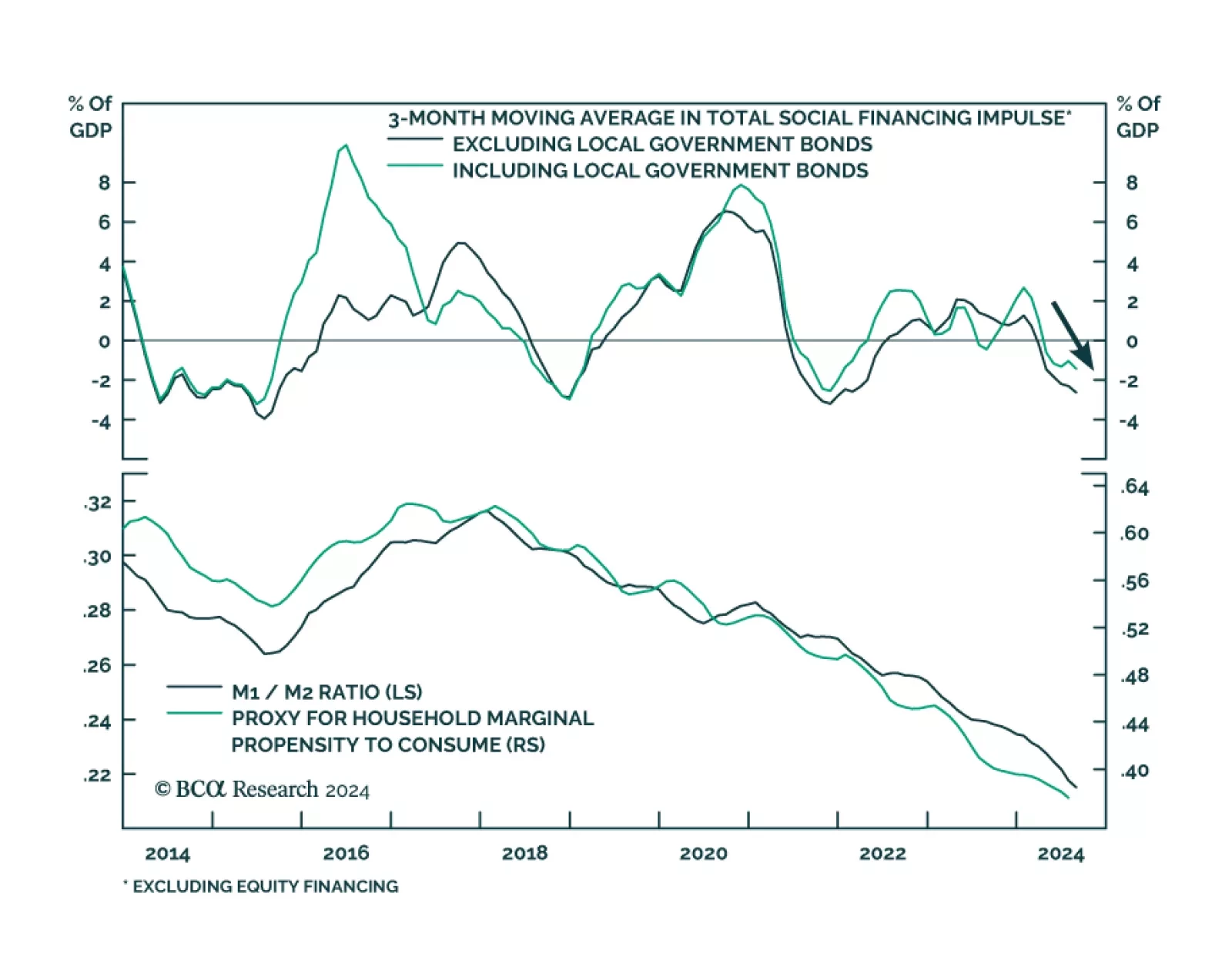

The Chinese economic data in its totality was uninspiring in August. Industrial production and retail sales growth decelerated year-on-year and corroborate the message from August’s import and credit growth data that…

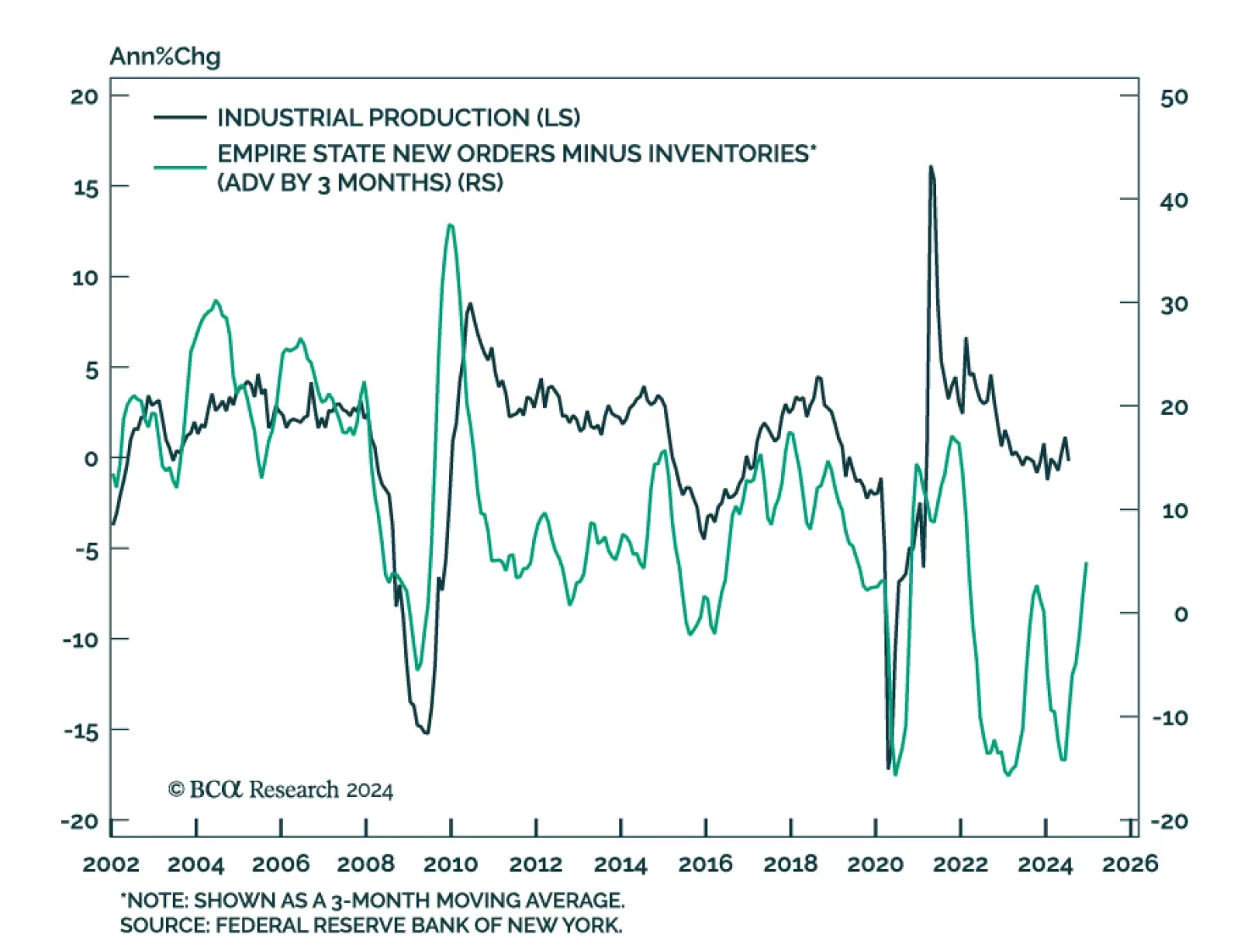

The timeliest of the regional Fed manufacturing surveys sent a positive signal about the state of US manufacturing activity in September. The Empire State manufacturing general business conditions index surprised positively.…

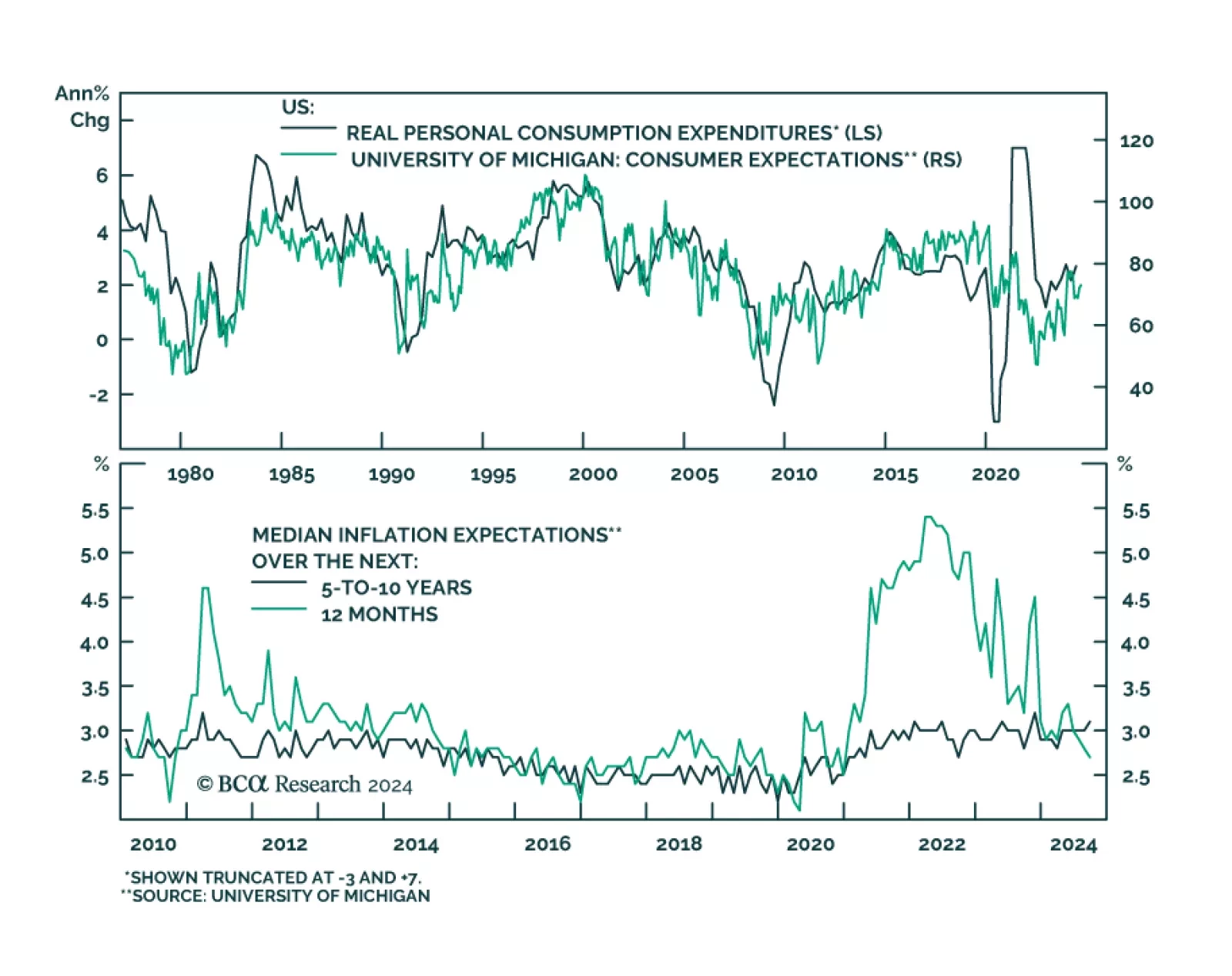

Preliminary estimates suggest that consumer sentiment improved in September. The headline University of Michigan consumer sentiment index increased from 67.9 to a higher-than-projected 68.5. Both the current conditions and…

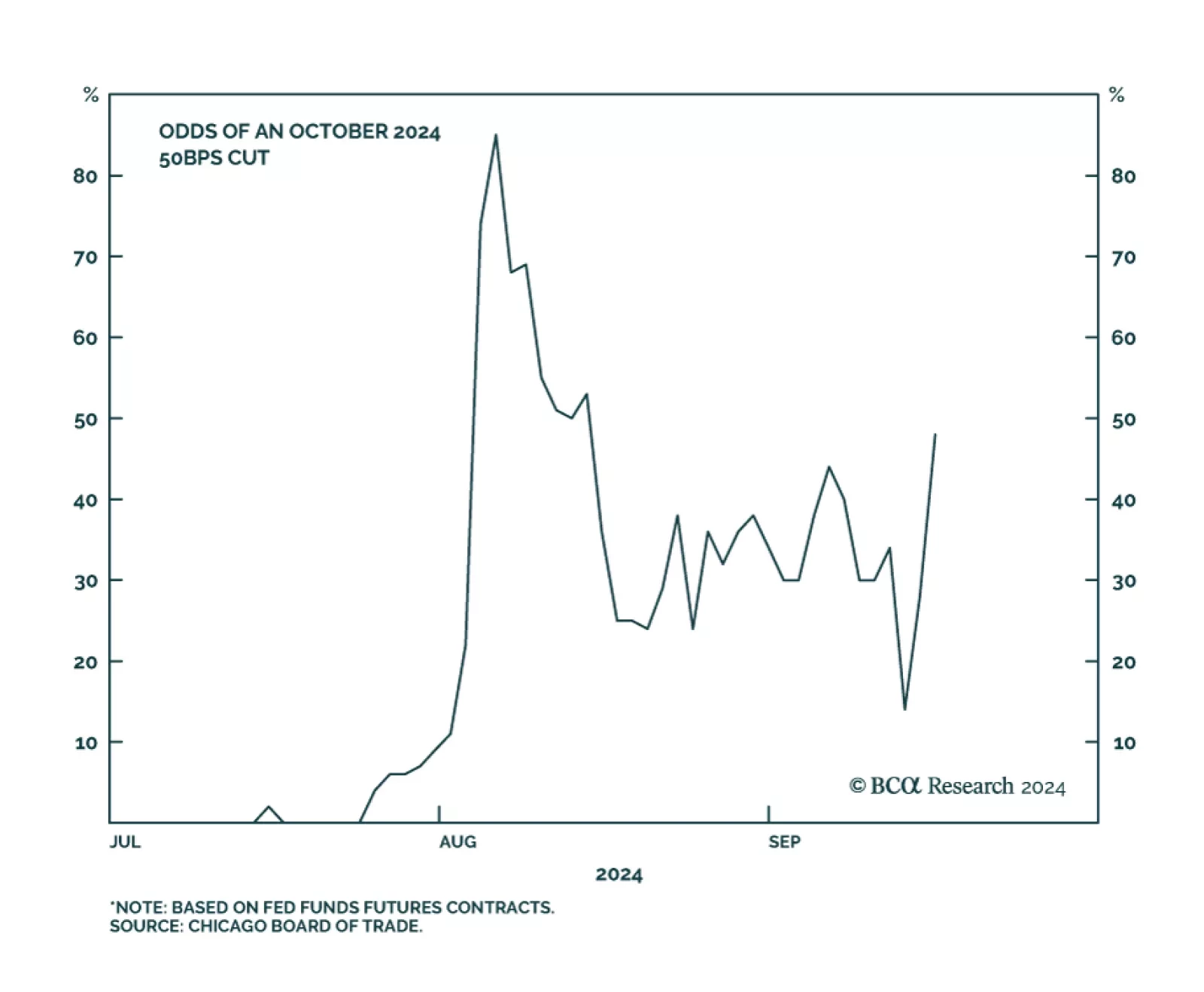

We noted earlier this month that the Fed would be unlikely to deliver a jumbo rate cut without telegraphing it first. President Williams' and Governor Waller’s September 6 speeches offered policymakers one last chance…

Subdued demand for credit among Chinese private-sector businesses and households persisted through August. Outstanding loan growth decelerated from 8.7% y/y to 8.5%. Moreover, M1’s contraction deepened, from 6.6% to 7.…

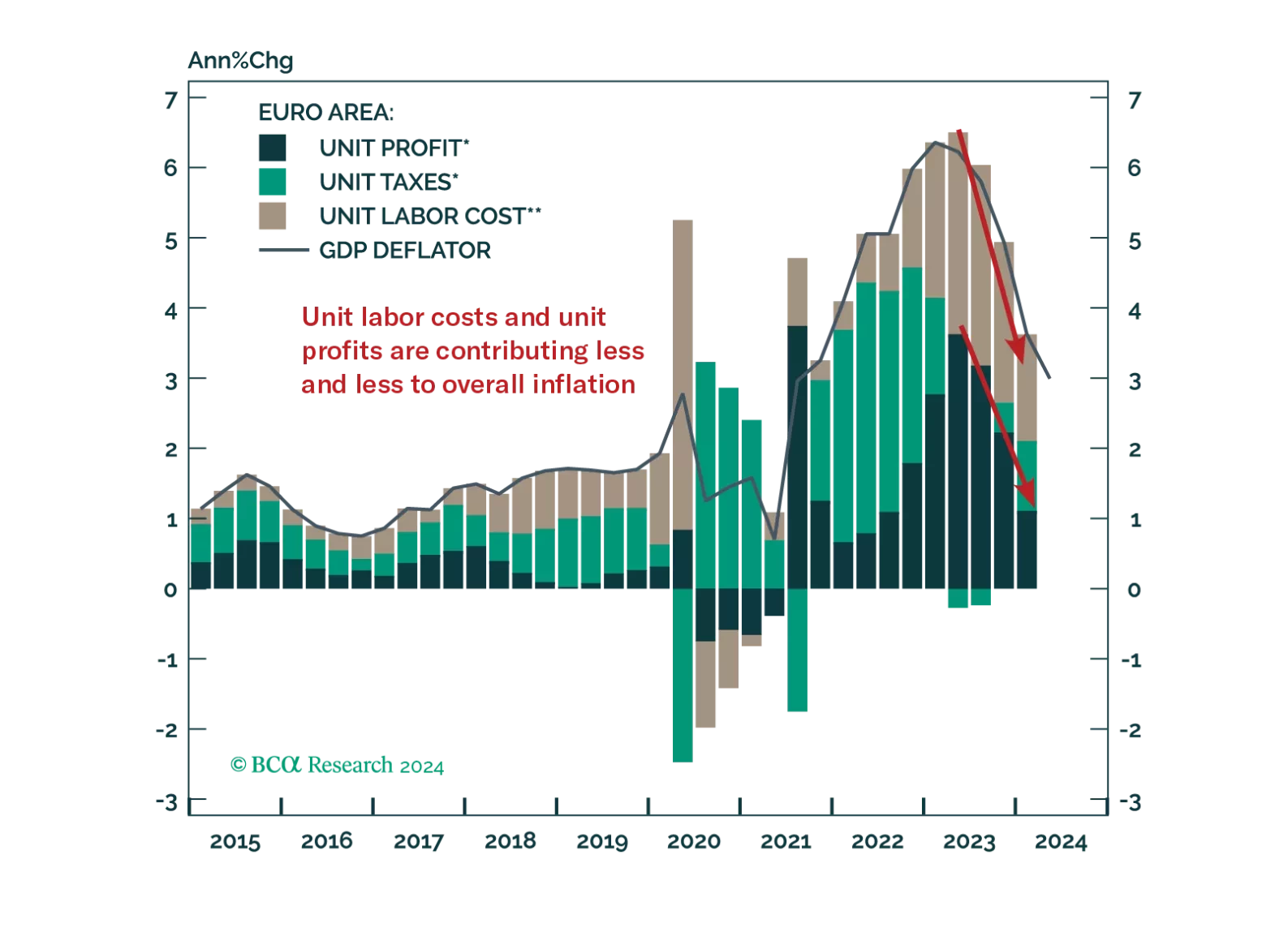

The ECB will cut rates once more this year; however, markets underprice how far it will ease next year.