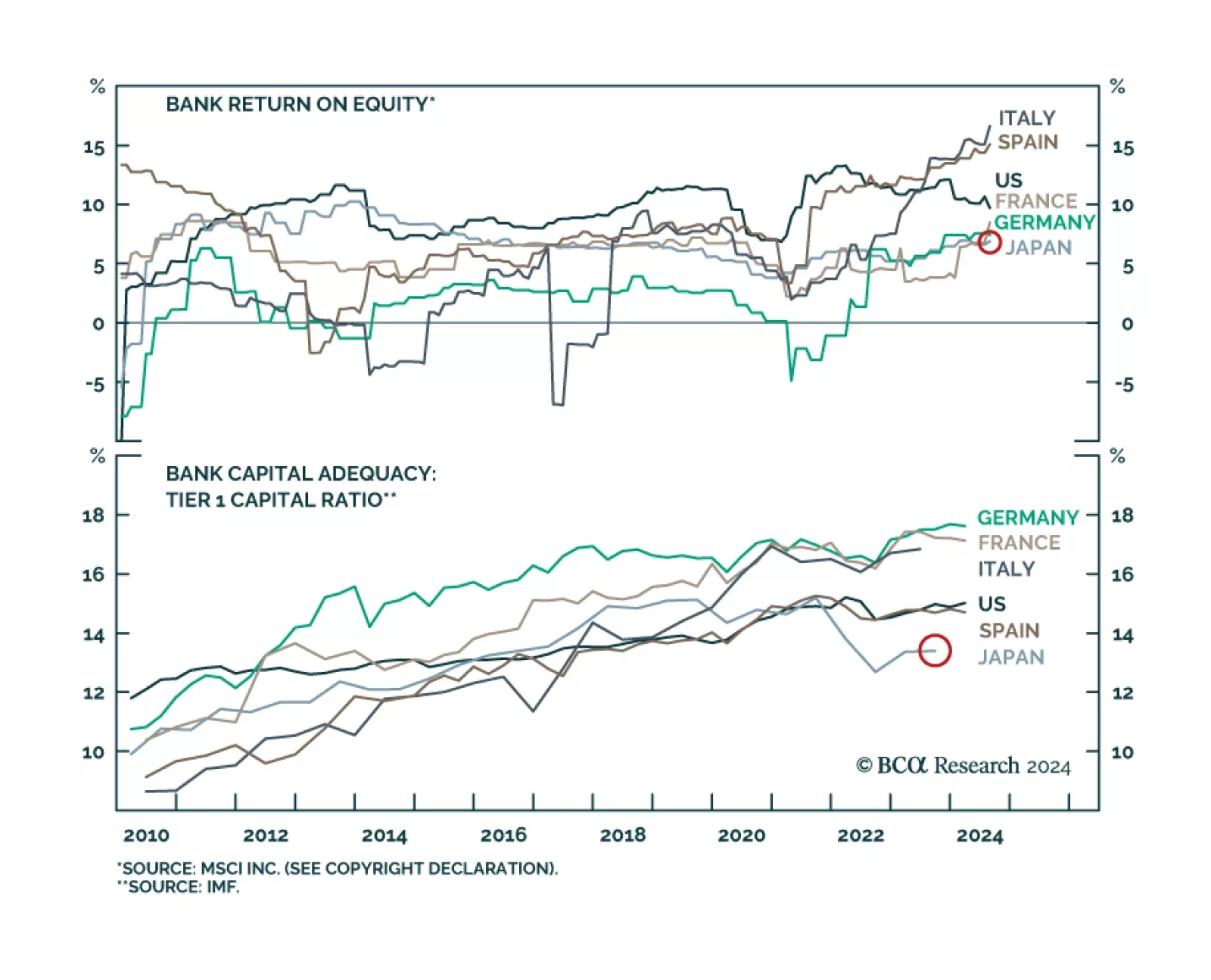

The Bank of Japan’s policy normalization has been accompanied by exceptional outperformance by Japanese banks. Japanese banks have outperformed both the country’s broader market as well as the MSCI ACW Banks index by…

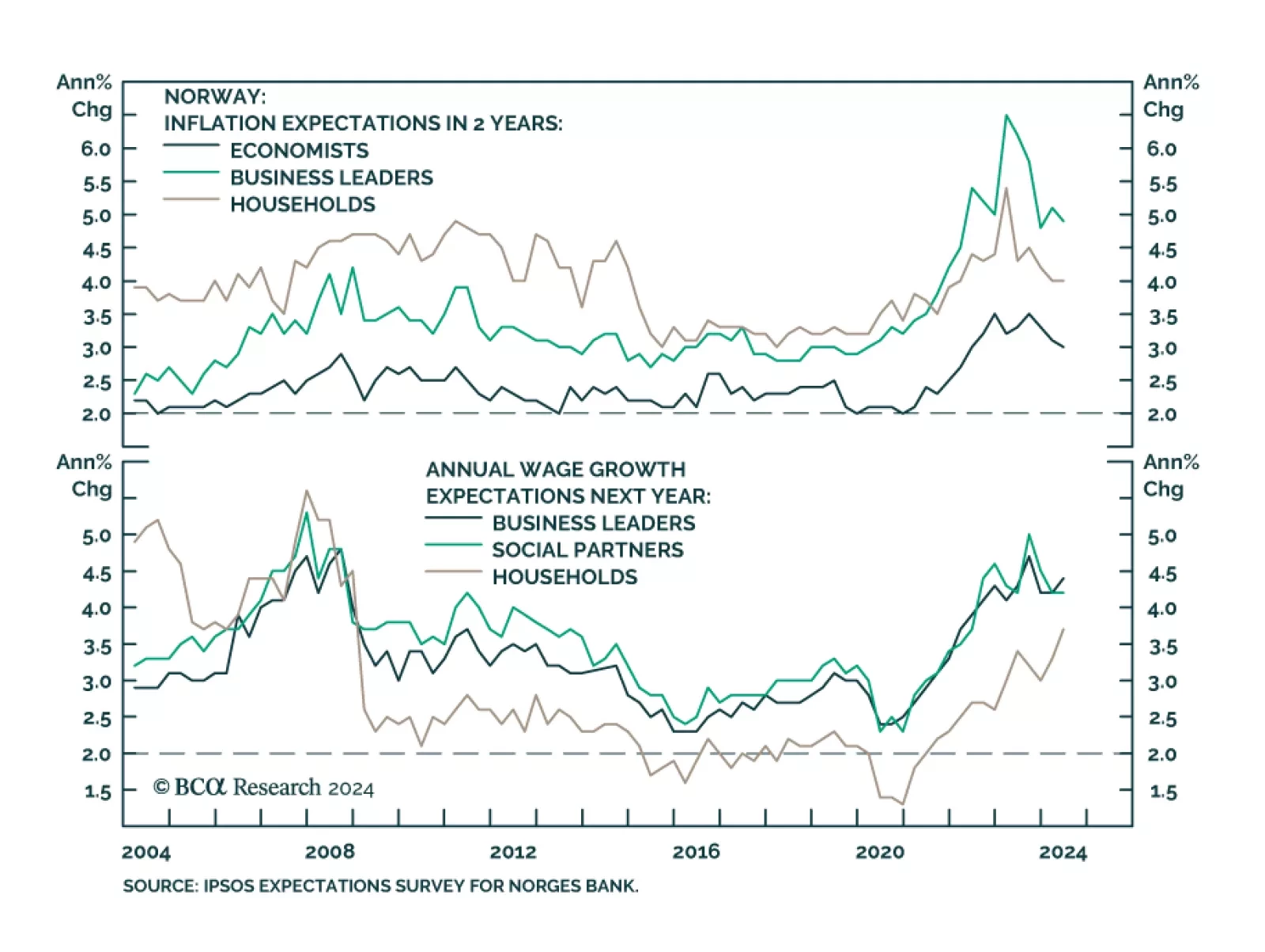

The Norges Bank kept its policy rate unchanged at 4.5% at its September meeting and signaled low odds of policy easing before the first quarter of 2025. The inflation backdrop does not warrant easing policy. Although core CPI…

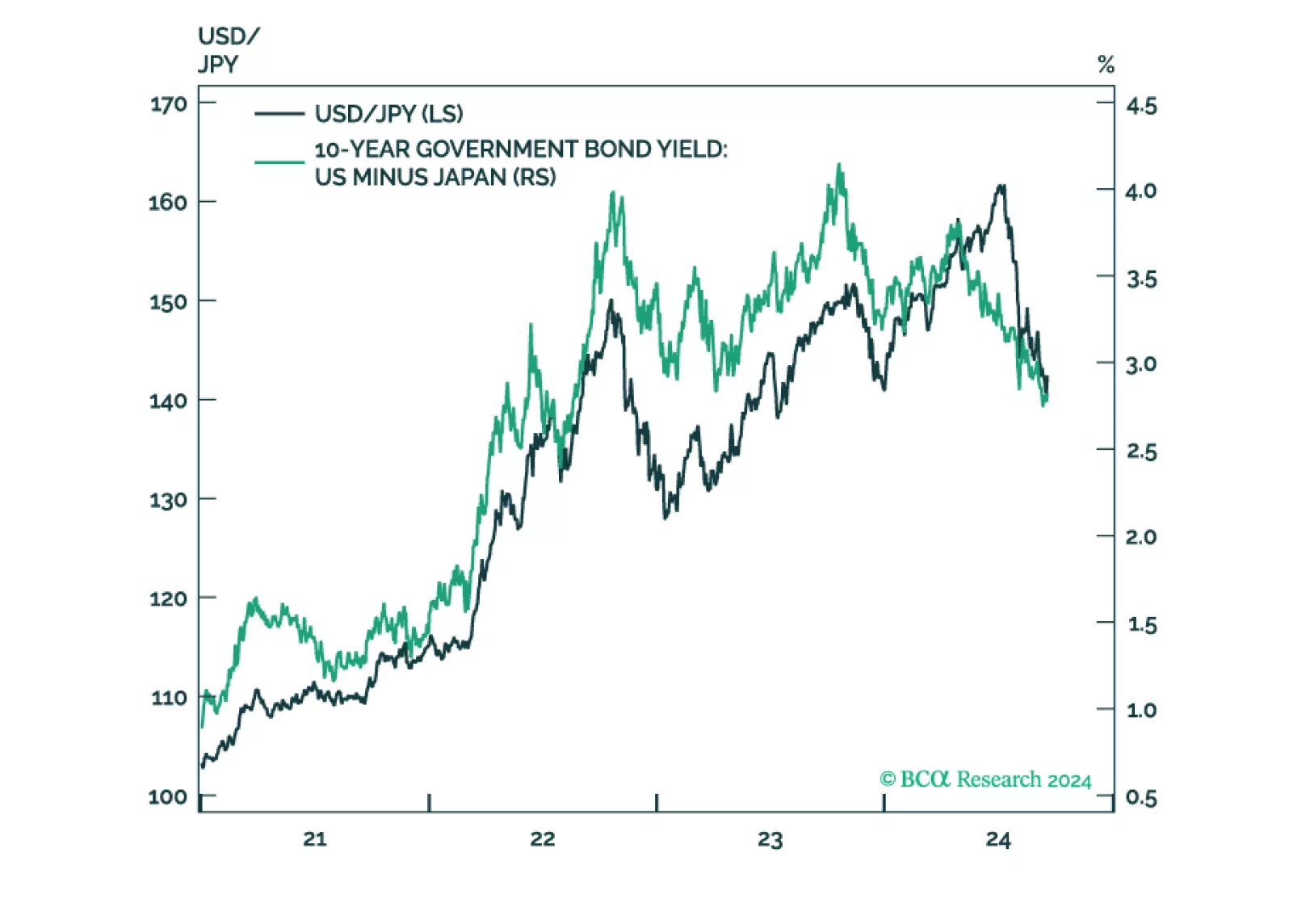

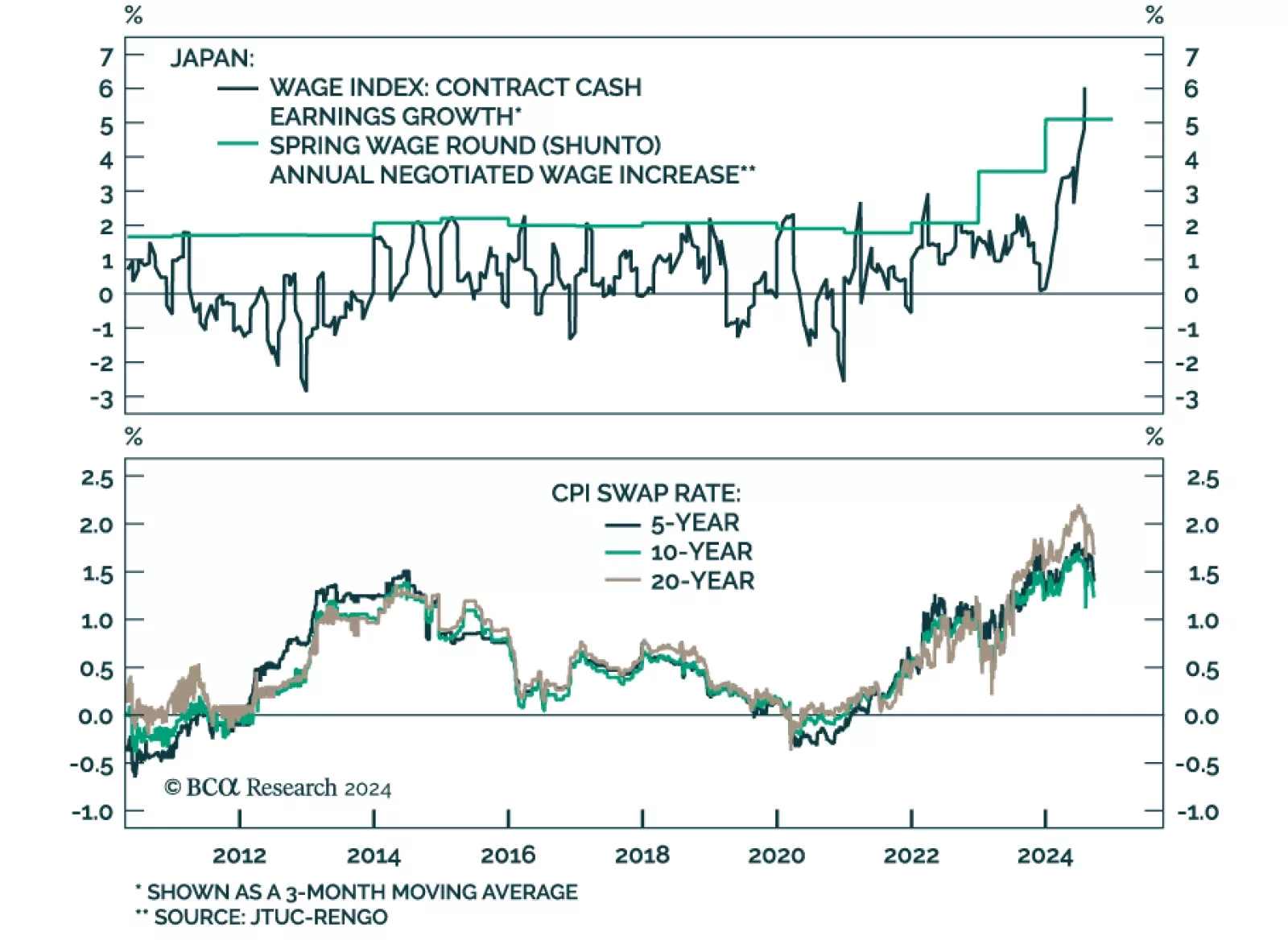

The Bank of Japan kept its policy rate unchanged at 0.25% in September and signaled it was in no rush to lift rates further. This move follows two hikes this year, one of them unanticipated. The signaling is consistent…

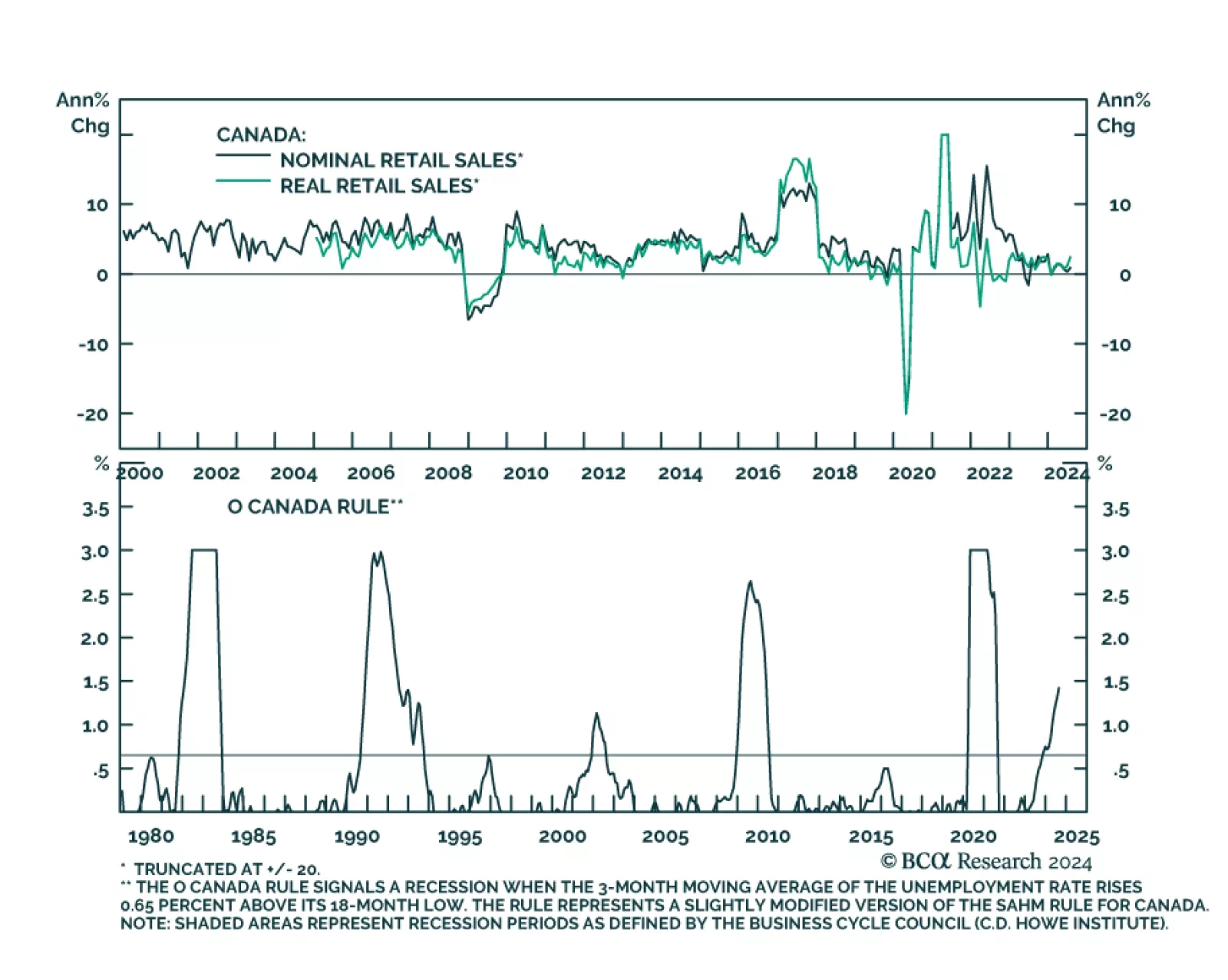

Canadian retail sales grew by a higher-than-expected 0.9% m/m in July from a 0.2% contraction in June. A 2.2% monthly rise in vehicle sales led an otherwise broad-based increase. Ex-auto retail sales also surprised positively,…

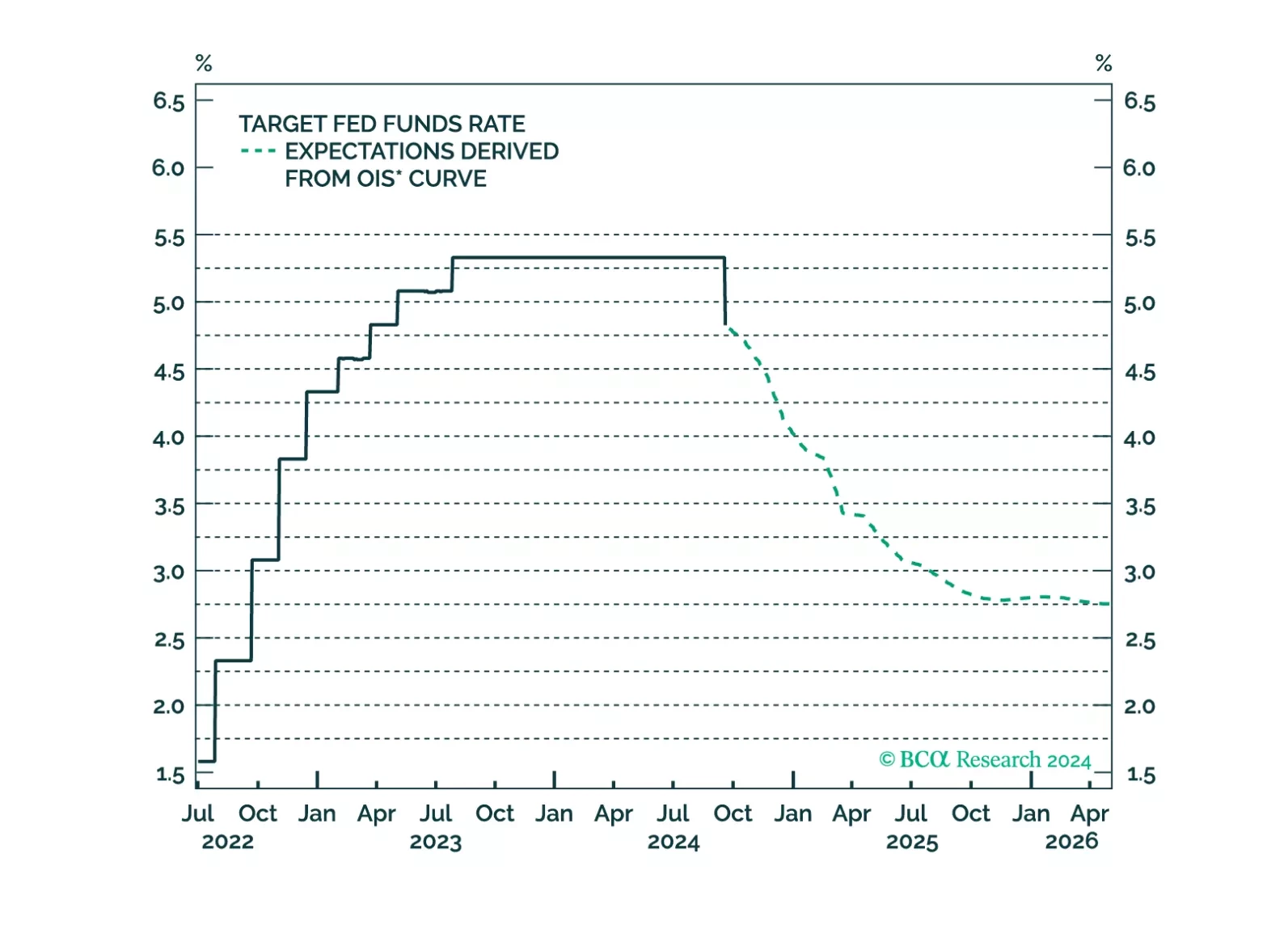

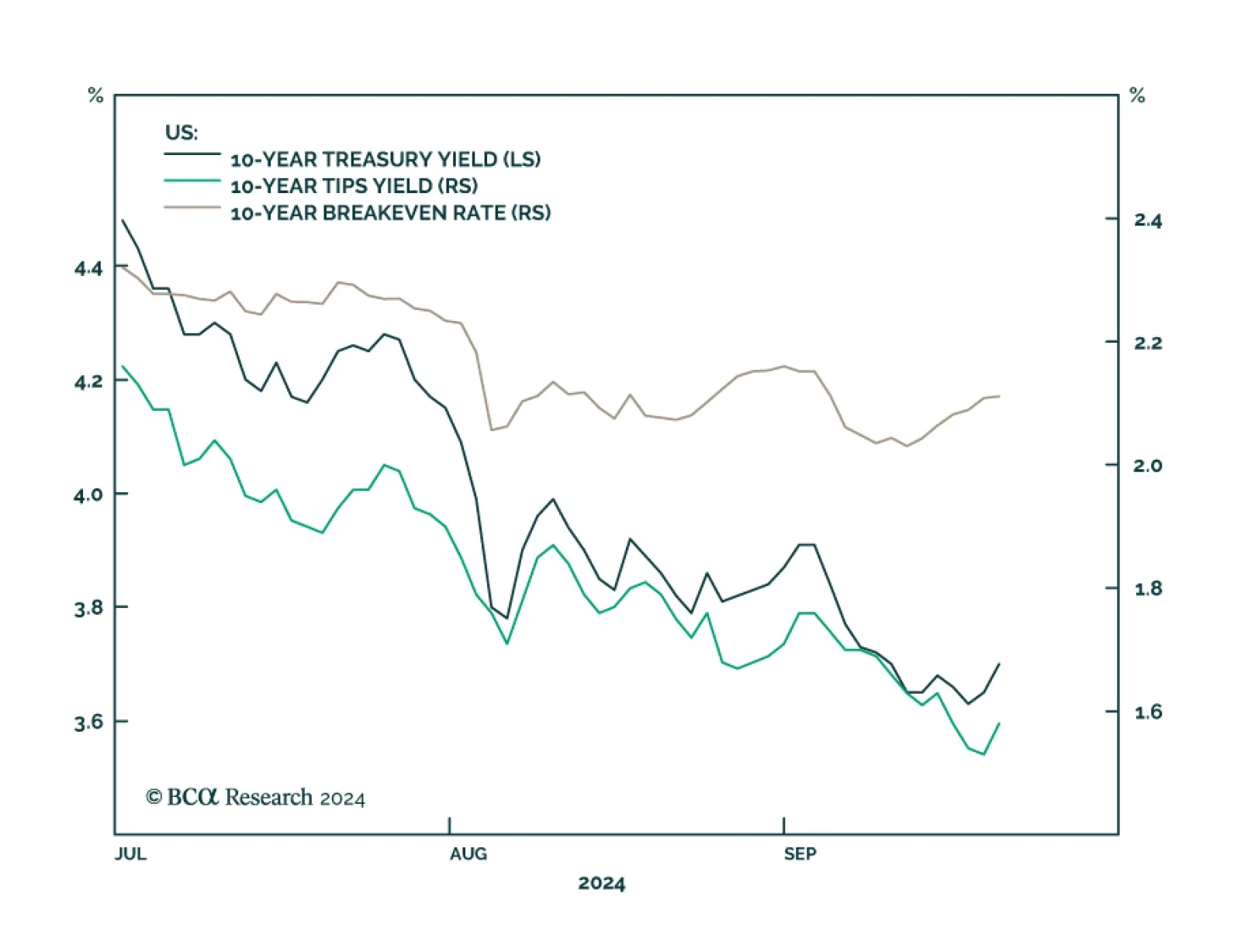

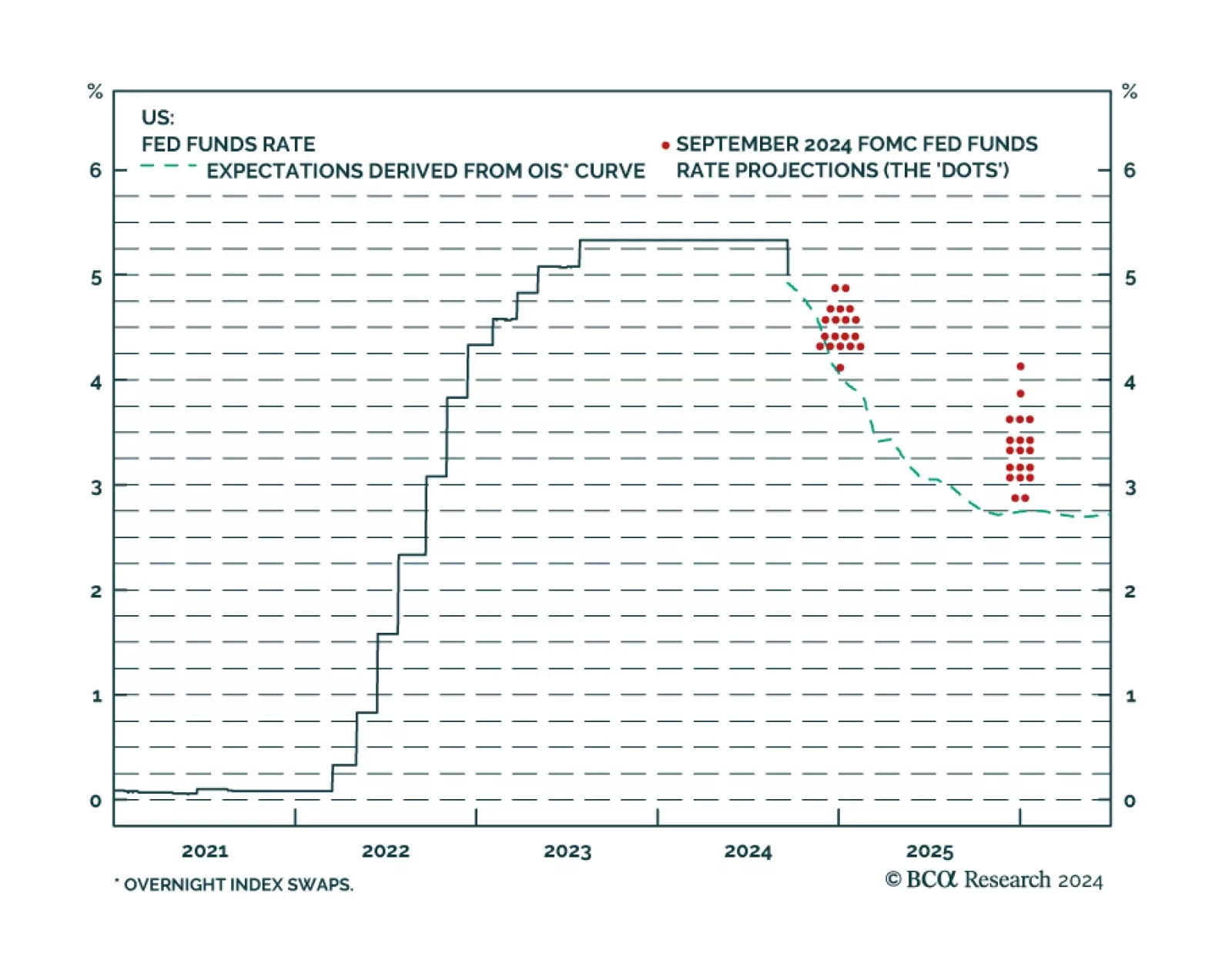

The 10-year Treasury yield rose in the aftermath of the Fed’s jumbo rate cut on Wednesday. Our US Bond strategists noted that this move reflects the fact that the downward revisions to the dots still fall short of the…

We update our bond views following today’s 50 bps rate cut.

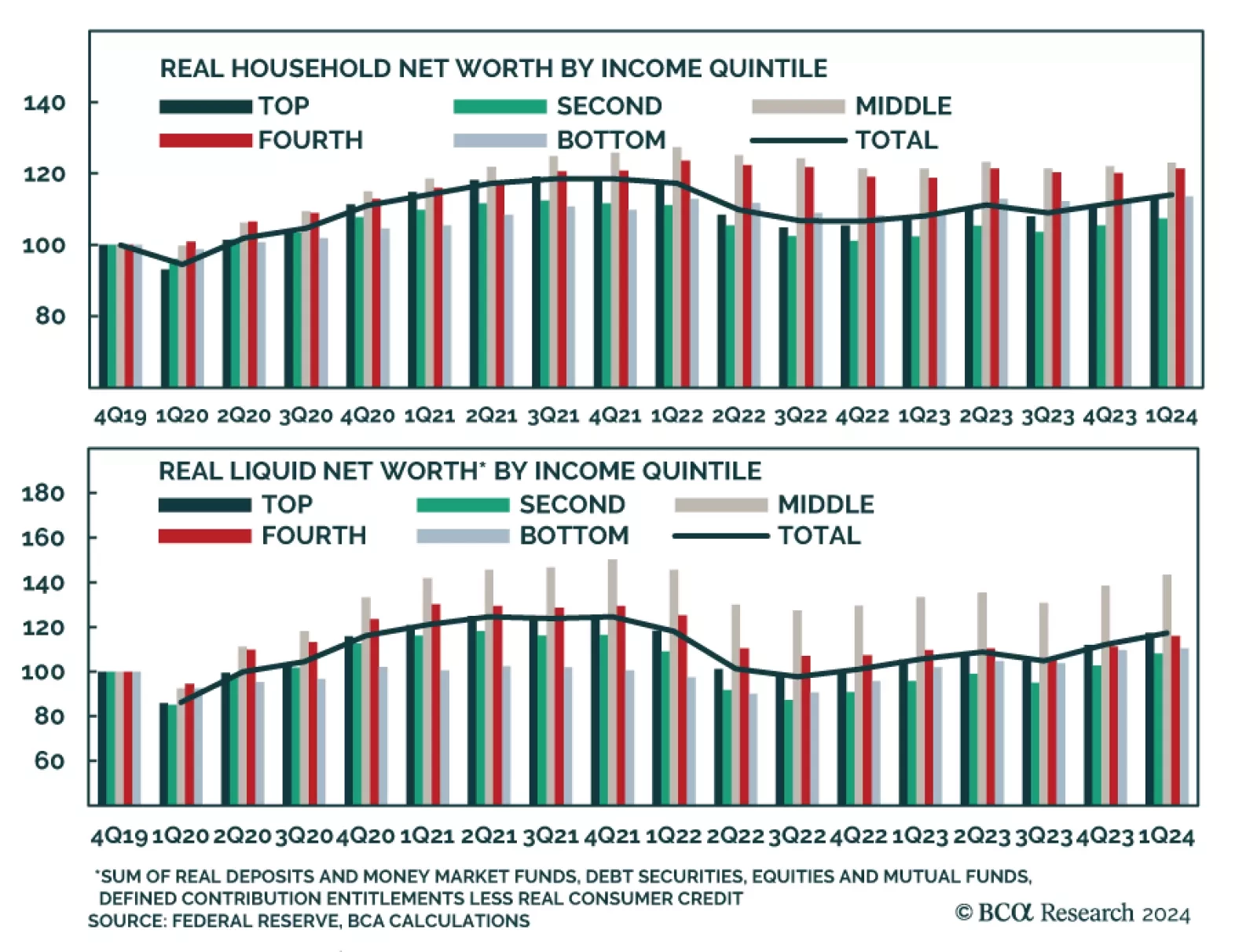

Stress among lower-income households is often cited as an early indication of deteriorating aggregate consumer fundamentals. The data indeed suggests that this cohort’s cash holdings are depleting. However, the Fed…

The Fed started its easing cycle with a bang, cutting the policy rate by 50 basis points in September, above consensus expectations but in line with odds embedded in the futures and OIS curves. Our US Bond strategists had…