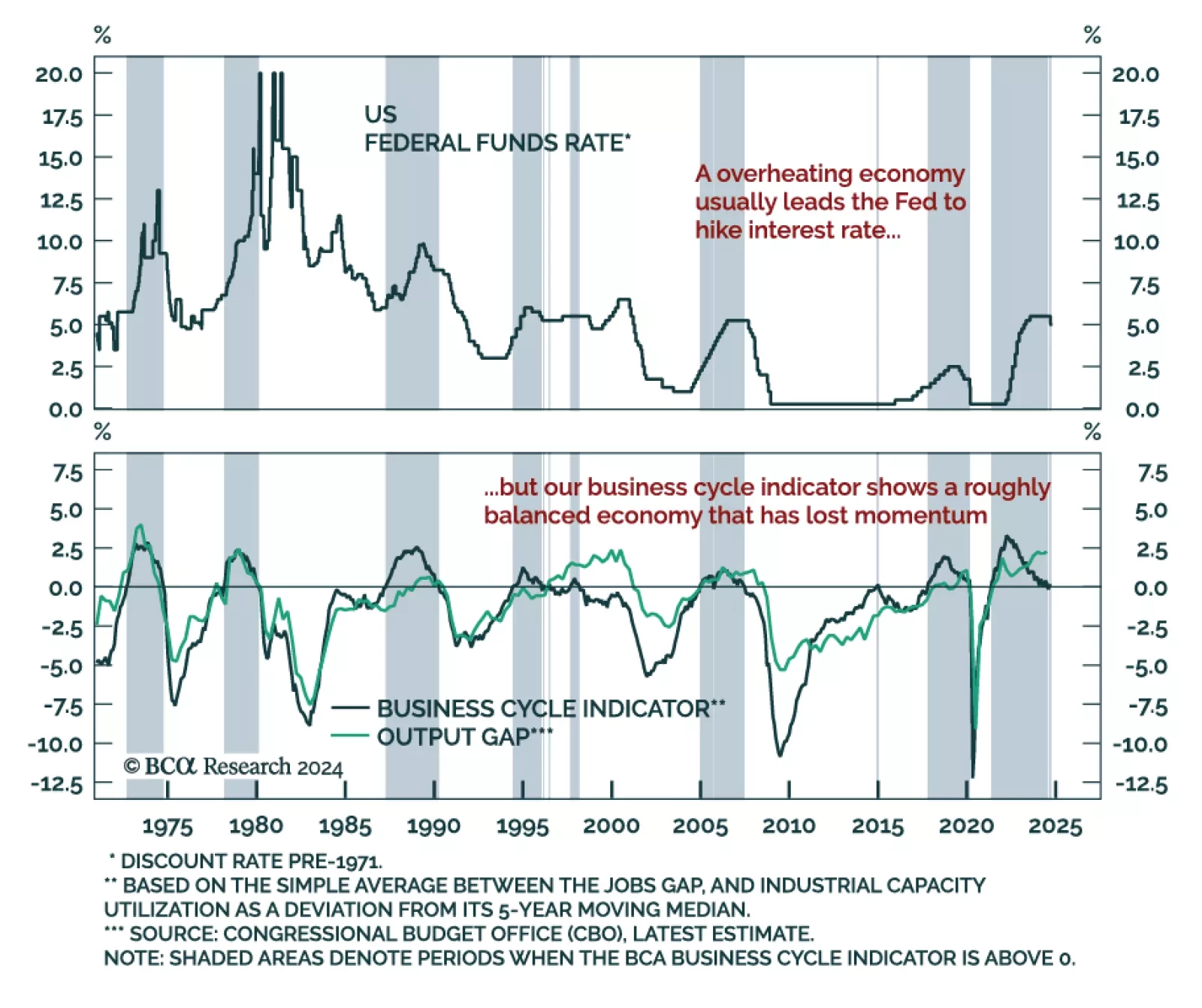

According to the latest estimate of the output gap, the US economy still operates above potential. Continued overheating – a no-landing scenario – would cause a drastic re-pricing across markets which expect a near-…

Dear client, We are launching a new type of Daily Insight titled “Cross-Asset Focus”, where we delve into the dynamics between multiple asset classes, tying them to the current macro and market regimes. The inaugural entry…

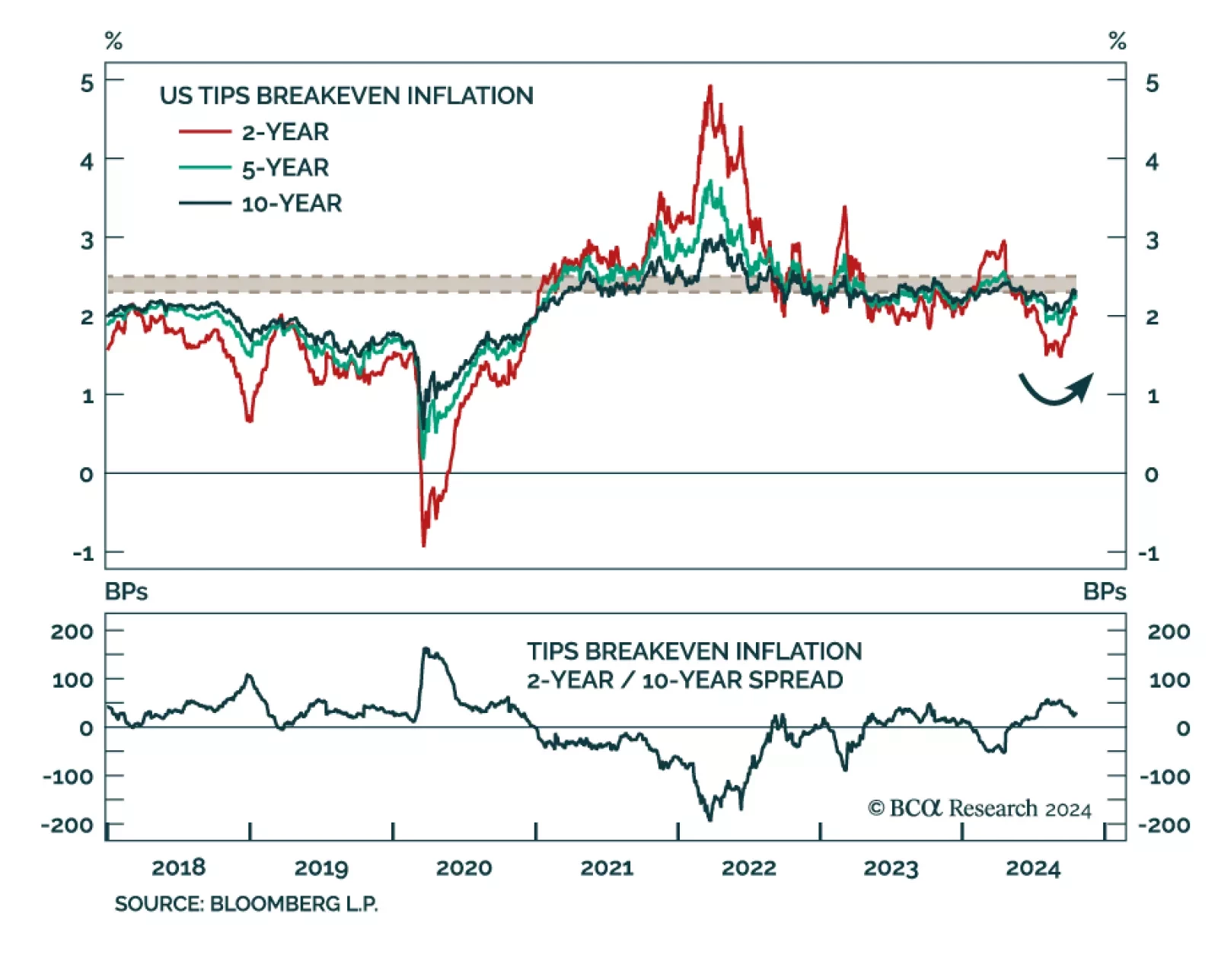

Since the August selloff in risk assets, the main cross-asset driver was the shift from inflation worries to growth worries. Some of that price action has reversed, as TIPS breakeven inflation rates swiftly rebounded since early…

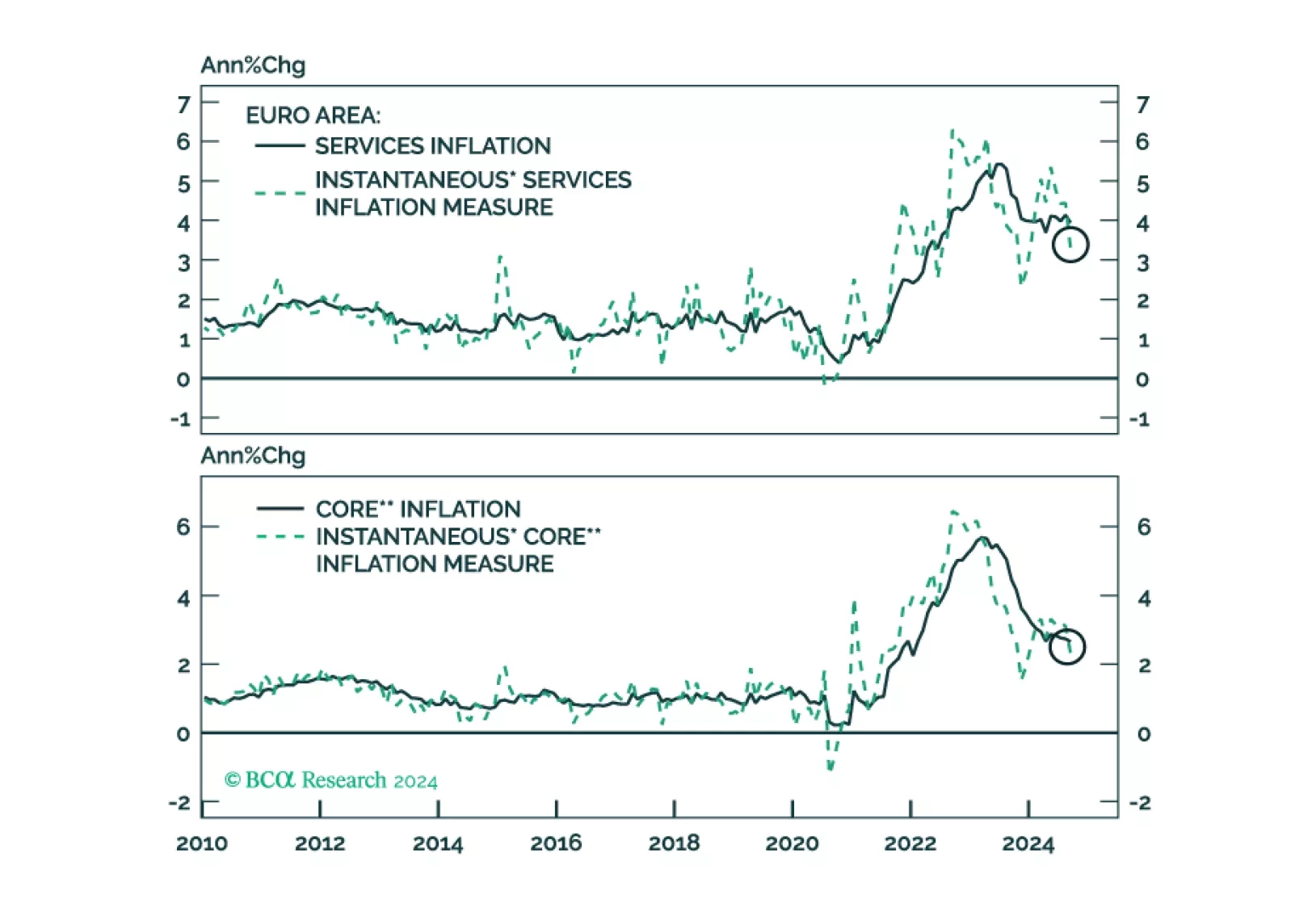

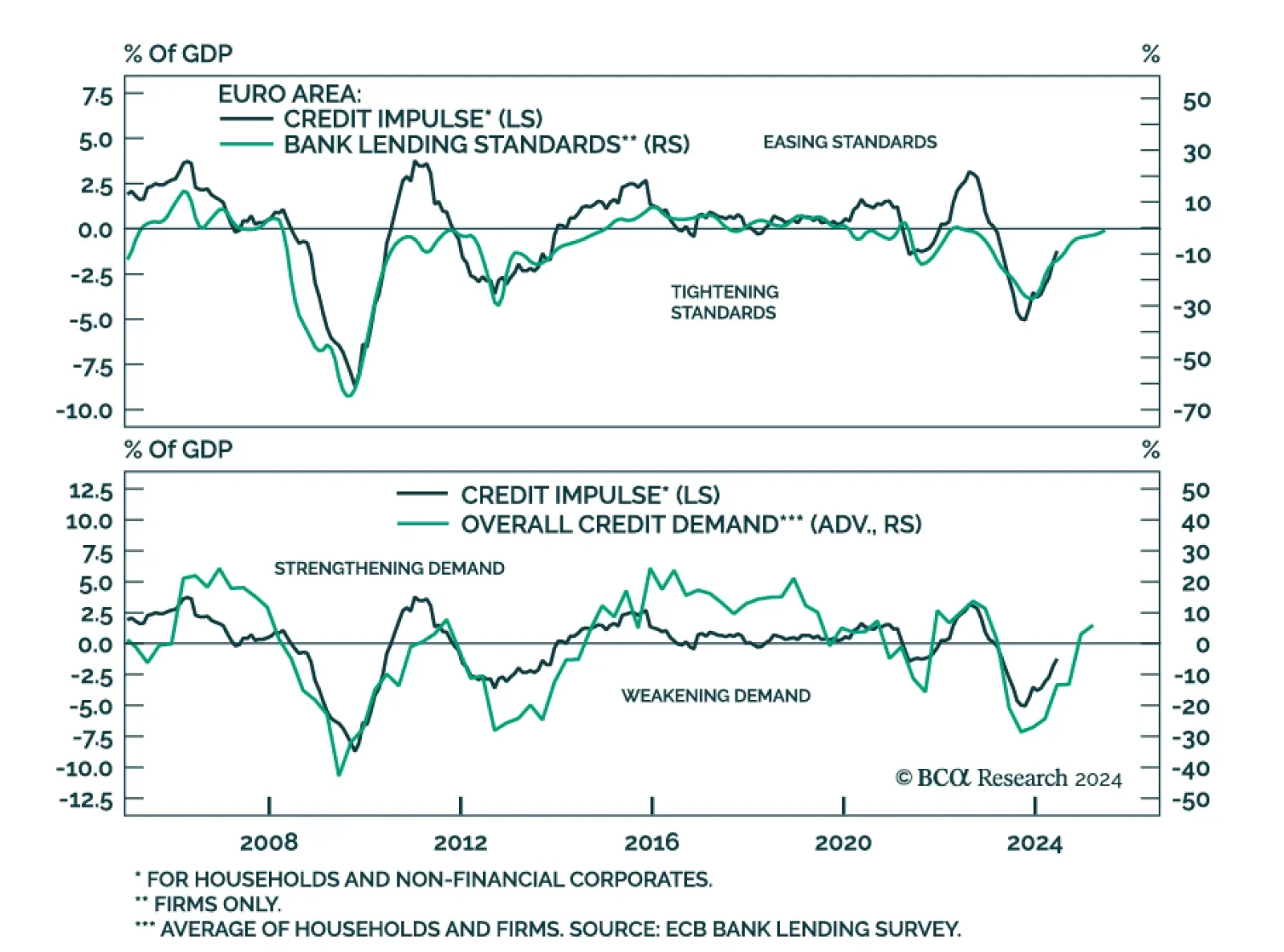

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

US retail sales beat expectations in September, rising 0.4% from August when growth was essentially flat. The control group also beat expectations at 0.7% month-on-month, accelerating from 0.3%. Growth was however somehow weak on…

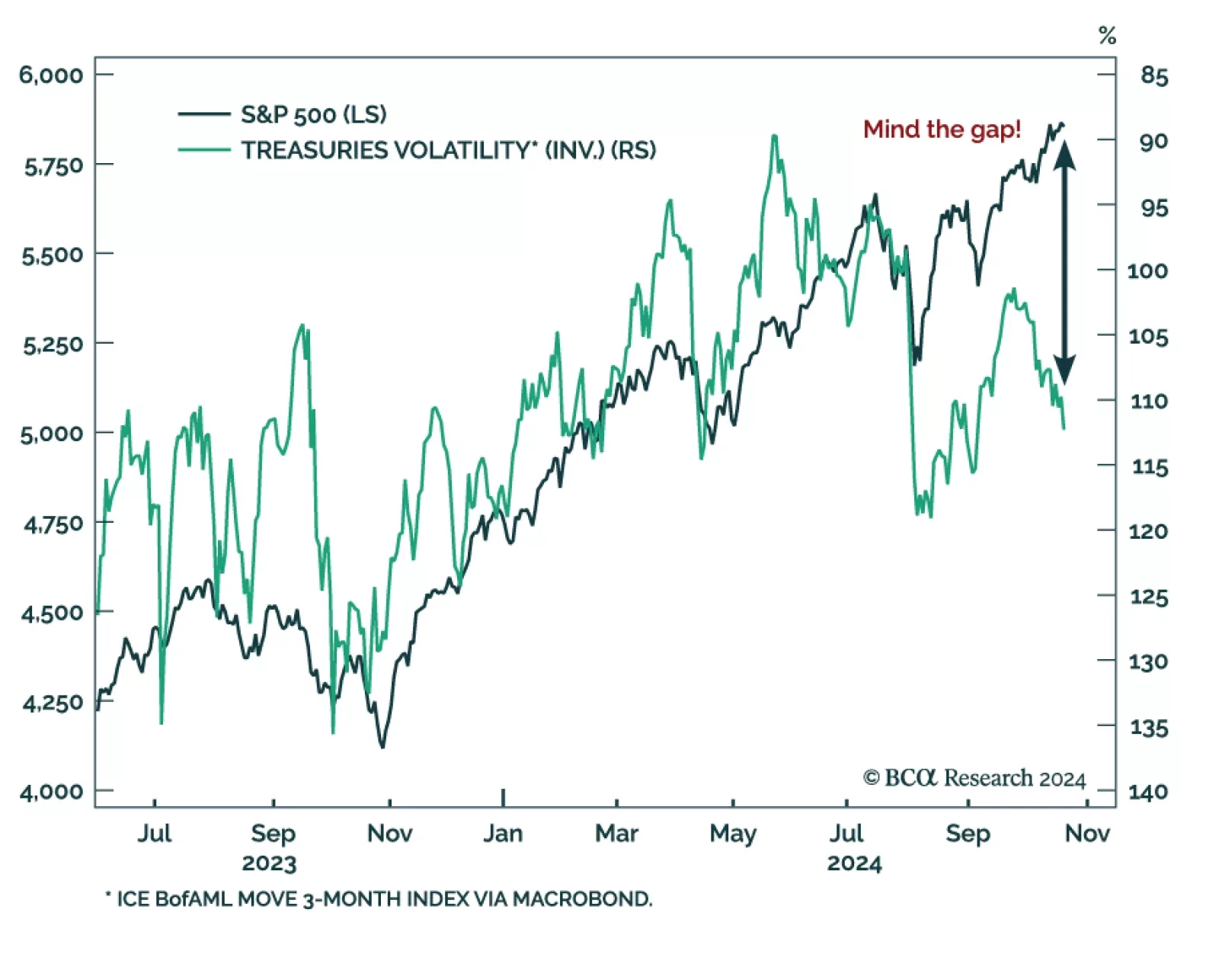

Recent positive US economic surprises drove cross-asset pricing, pushing both equities and Treasury yields higher. What do these yield levels mean for the Treasury market, and what path can we expect looking forward? Our US…

Banks reported an increase in loan demand from both firms and households in the European Central Bank’s Bank Lending Survey, marking the first rise since 2022. This demand increase occurred as lending standards for firms…

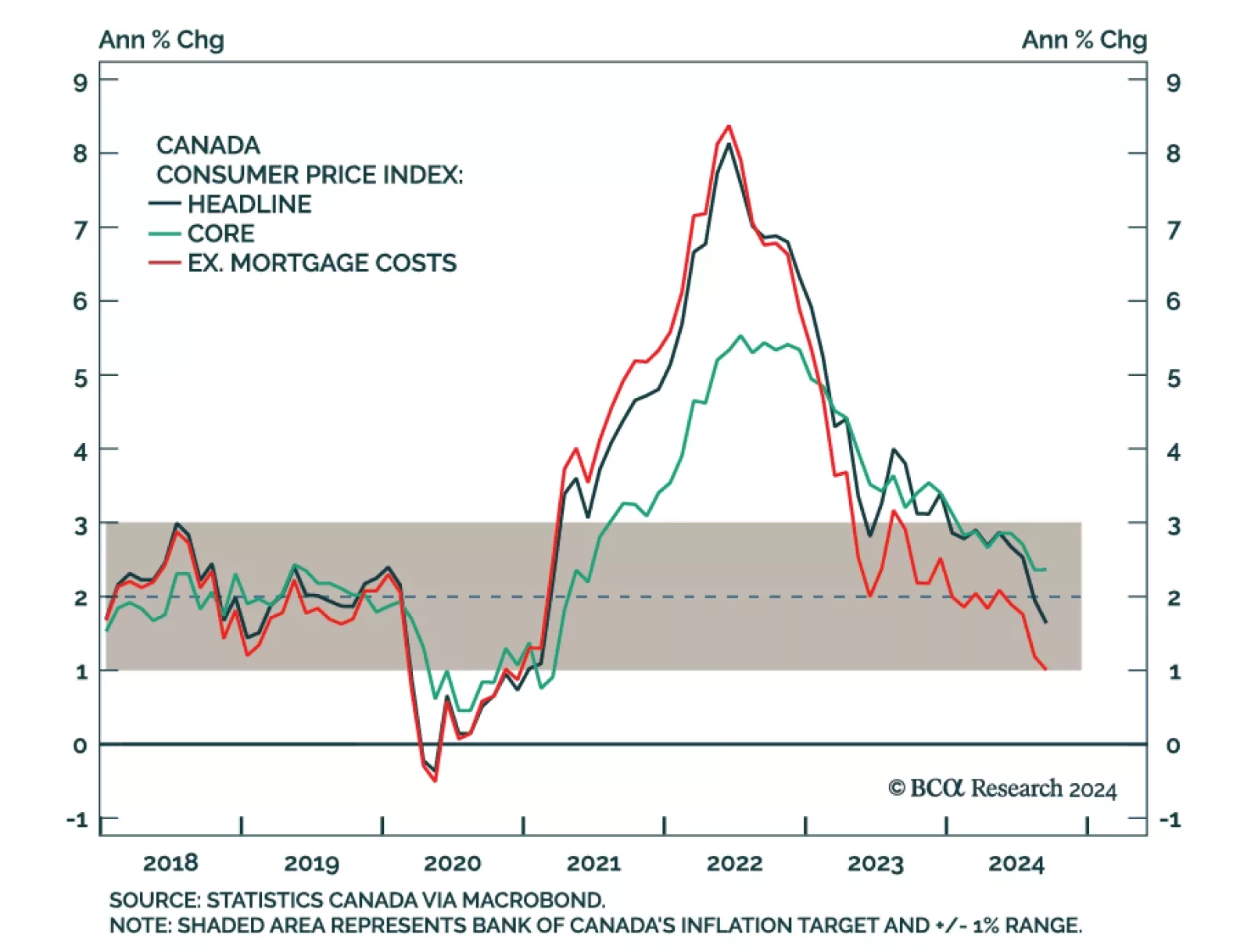

Canadian headline inflation rose 1.6% year-over-year in September, lower than the expected 1.8% and down from 2.0% in August. This was also its slowest pace since February 2021. The decrease was mainly driven by gasoline prices,…

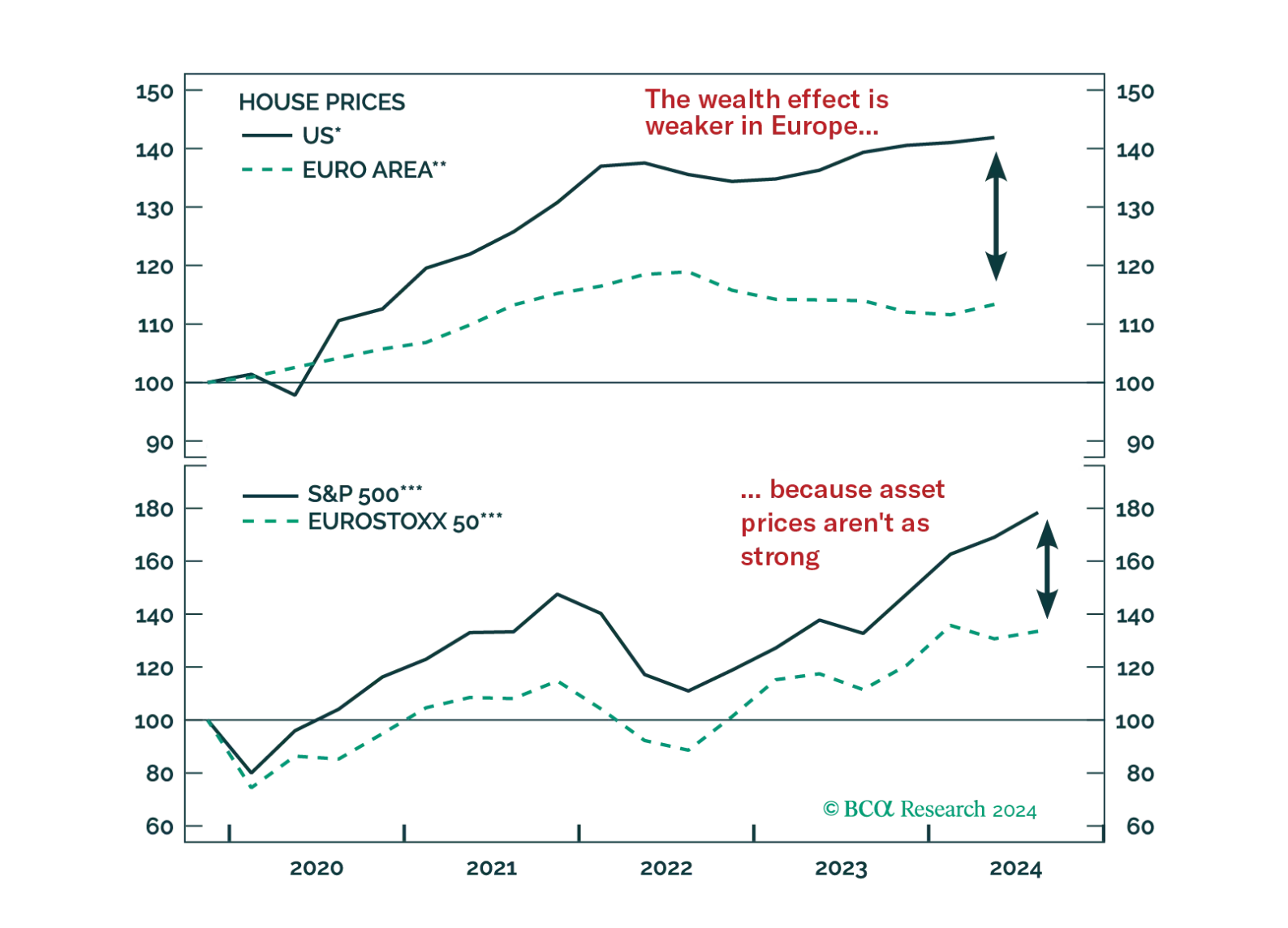

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

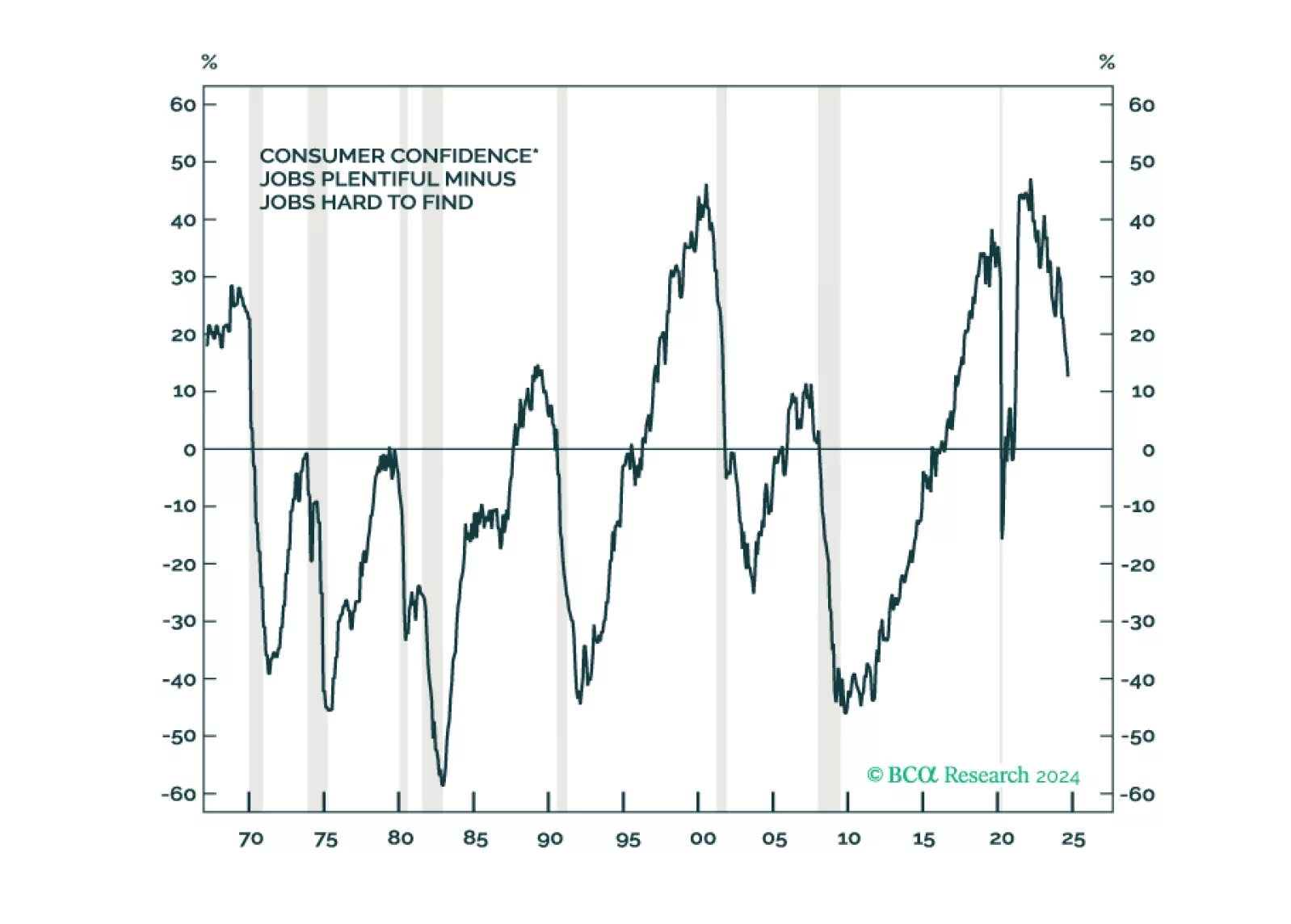

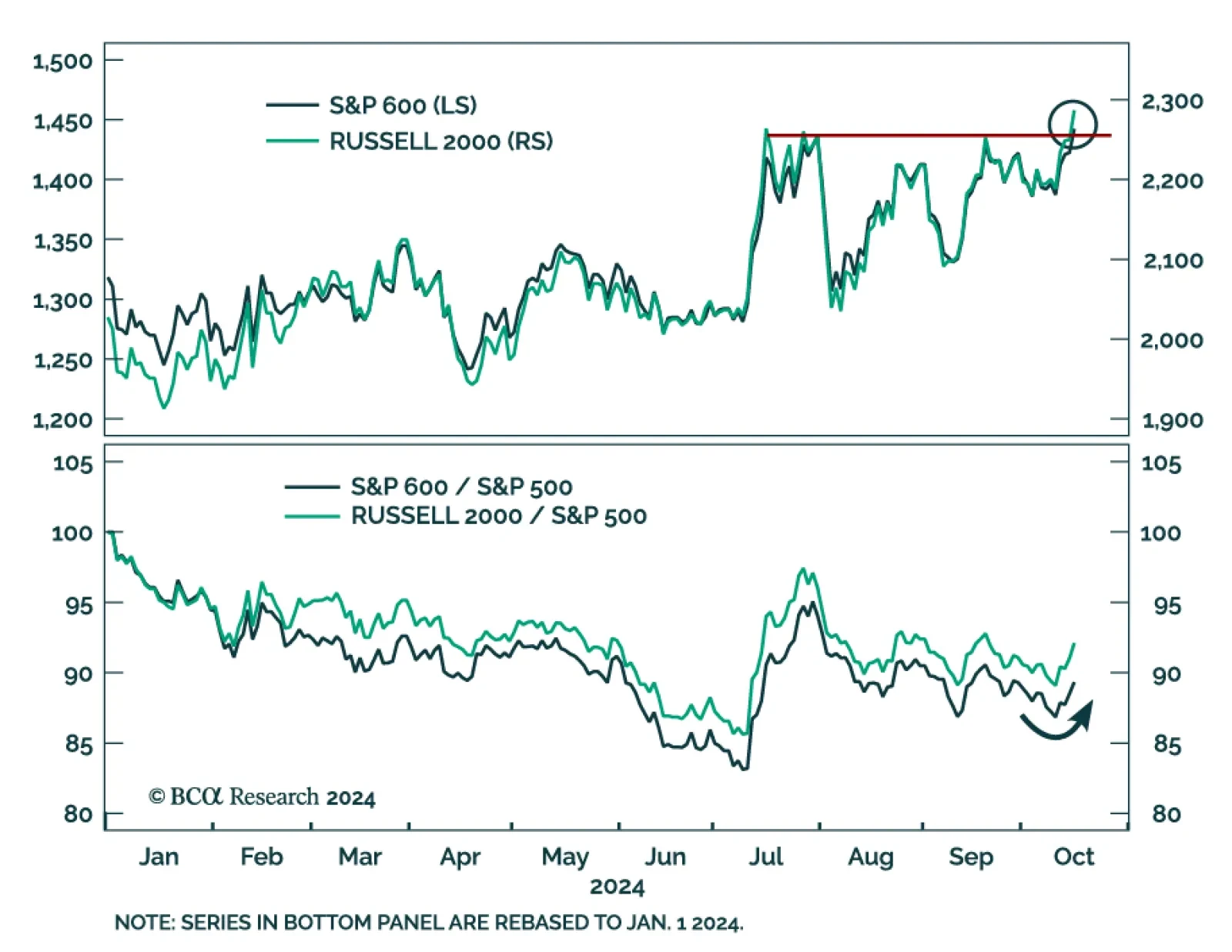

Rising stock prices and improving economic data have us re-examining our bearish thesis, but we still see deterioration in leading labor market indicators and expect it will eventually culminate in a recession. We reiterate our…