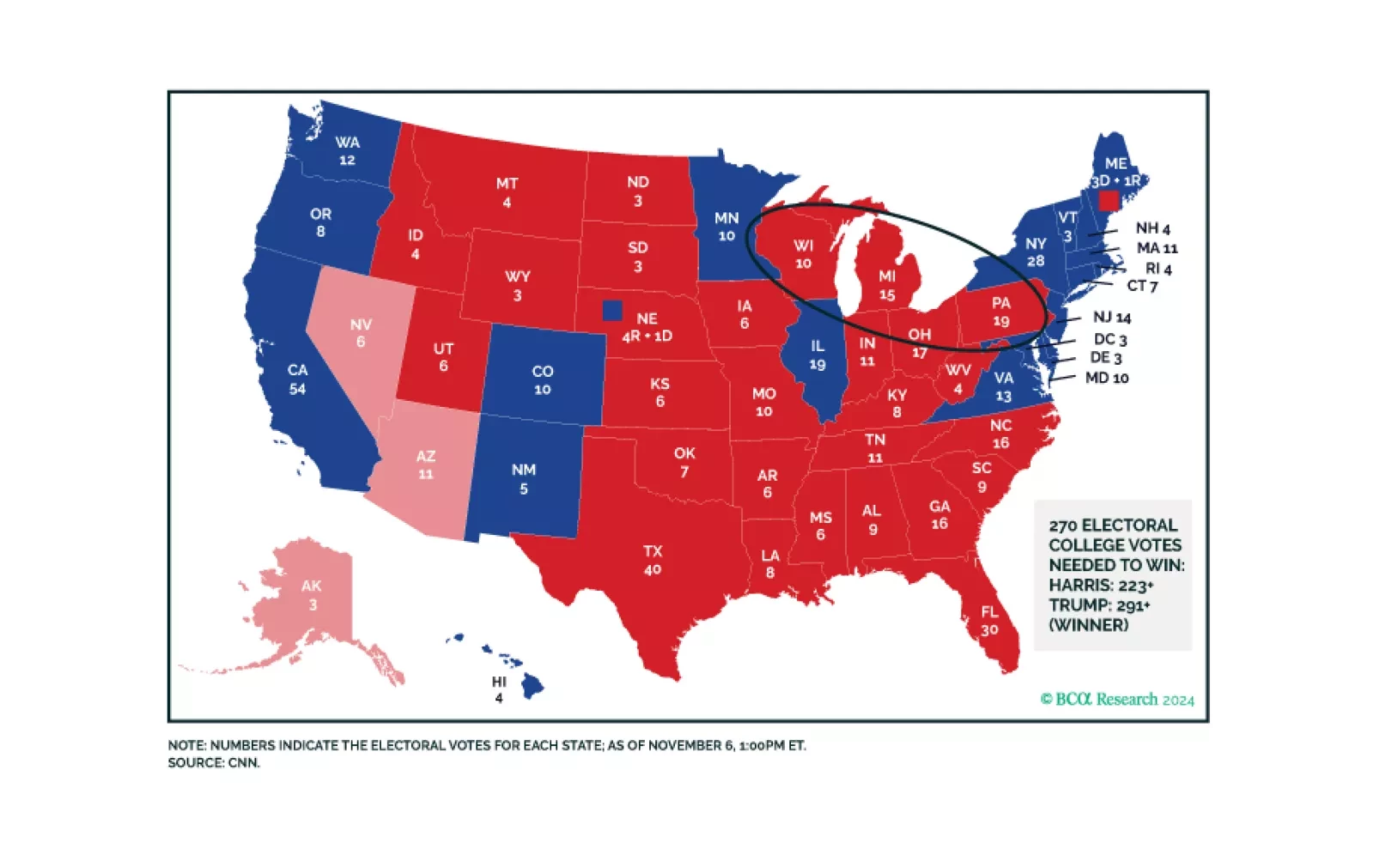

Trump’s resounding victory brings a popular mandate that ensures deregulation and higher trade tariffs. Higher budget deficit and immigration reform are also in the cards as the Republicans look like they may squeak a thin margin in…

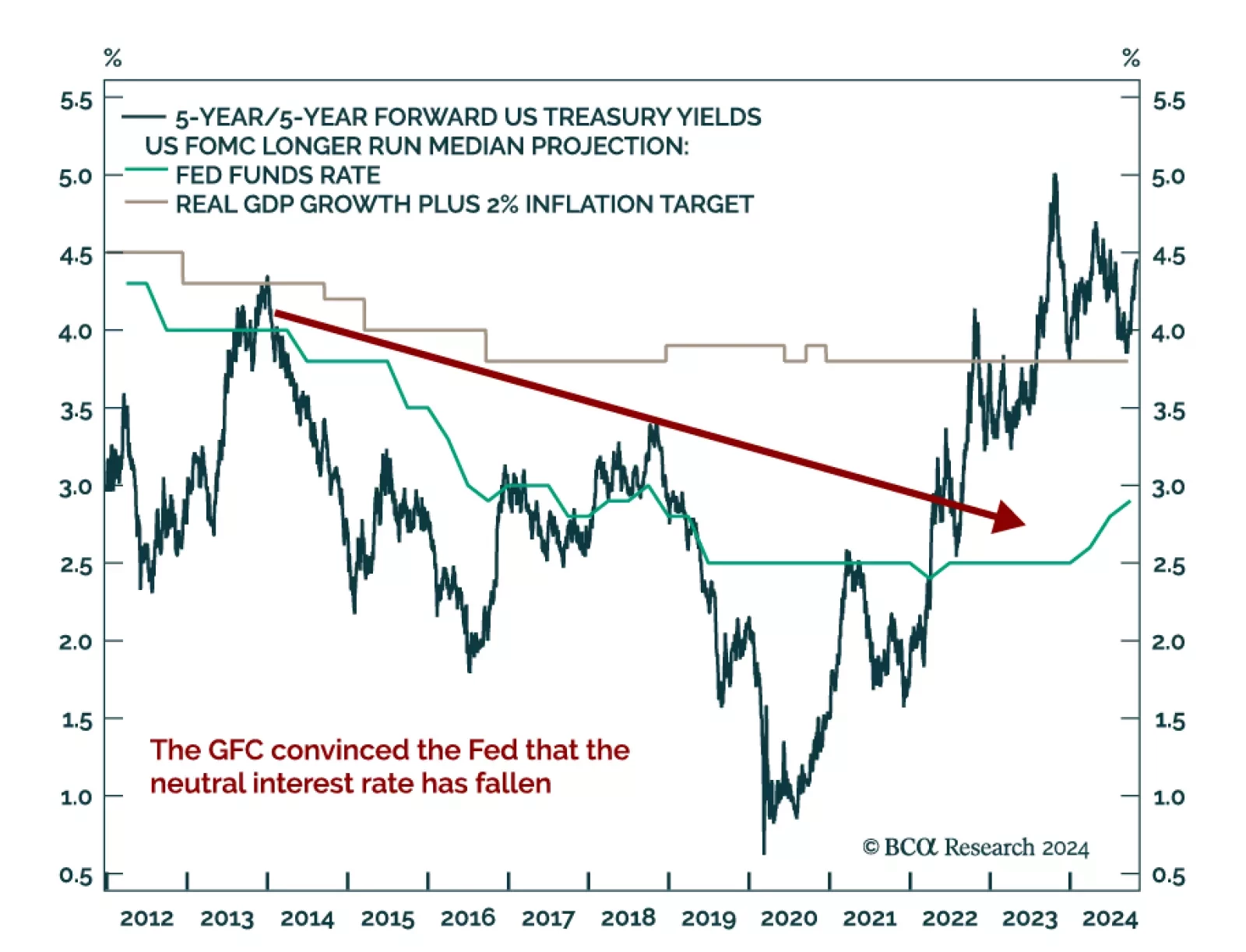

Given the charged atmosphere surrounding the US election, our Bank Credit Analyst colleagues investigate whether the Fed’s dovish pivot last December was politically motivated. The Fed’s actions appear overly…

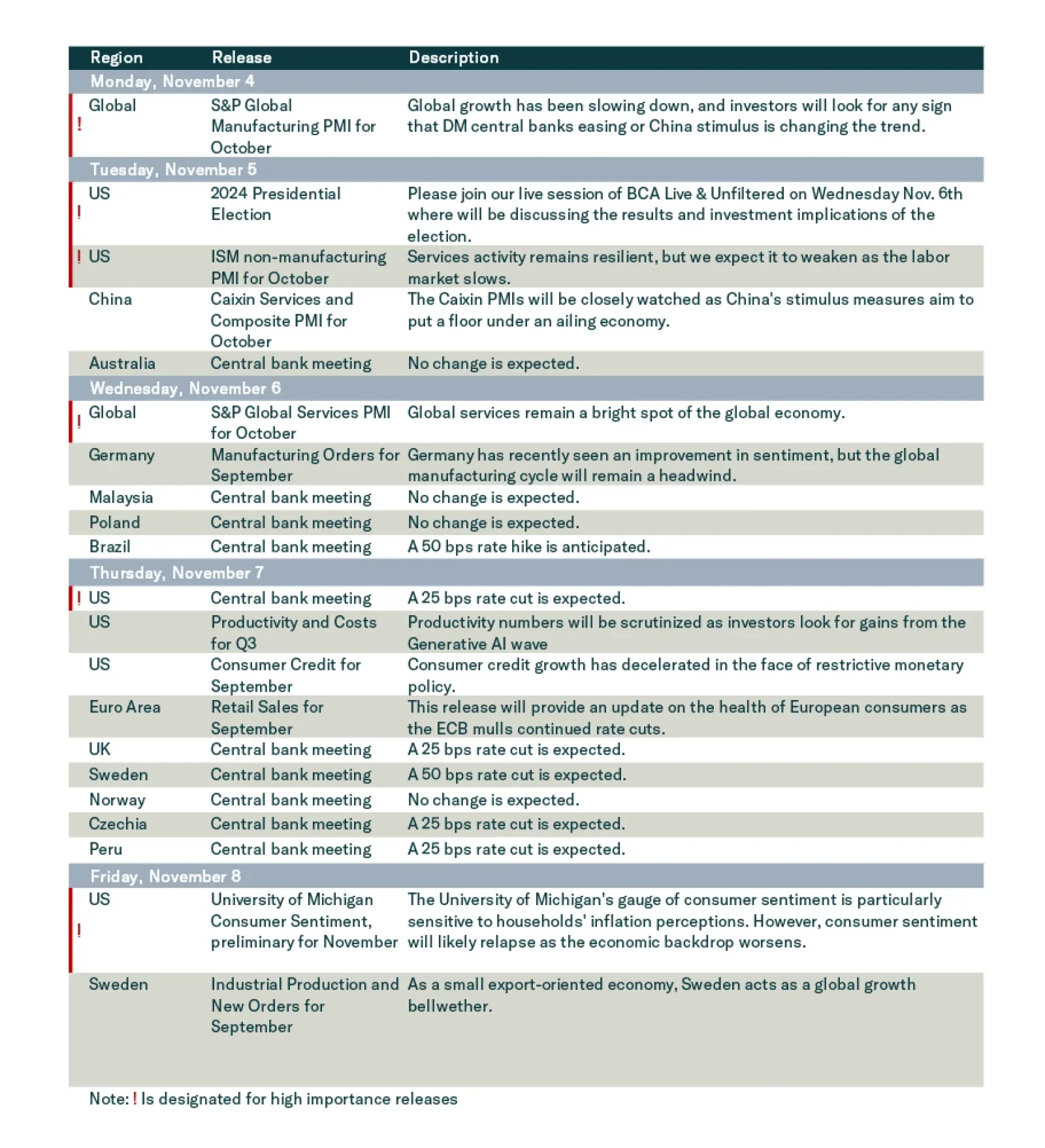

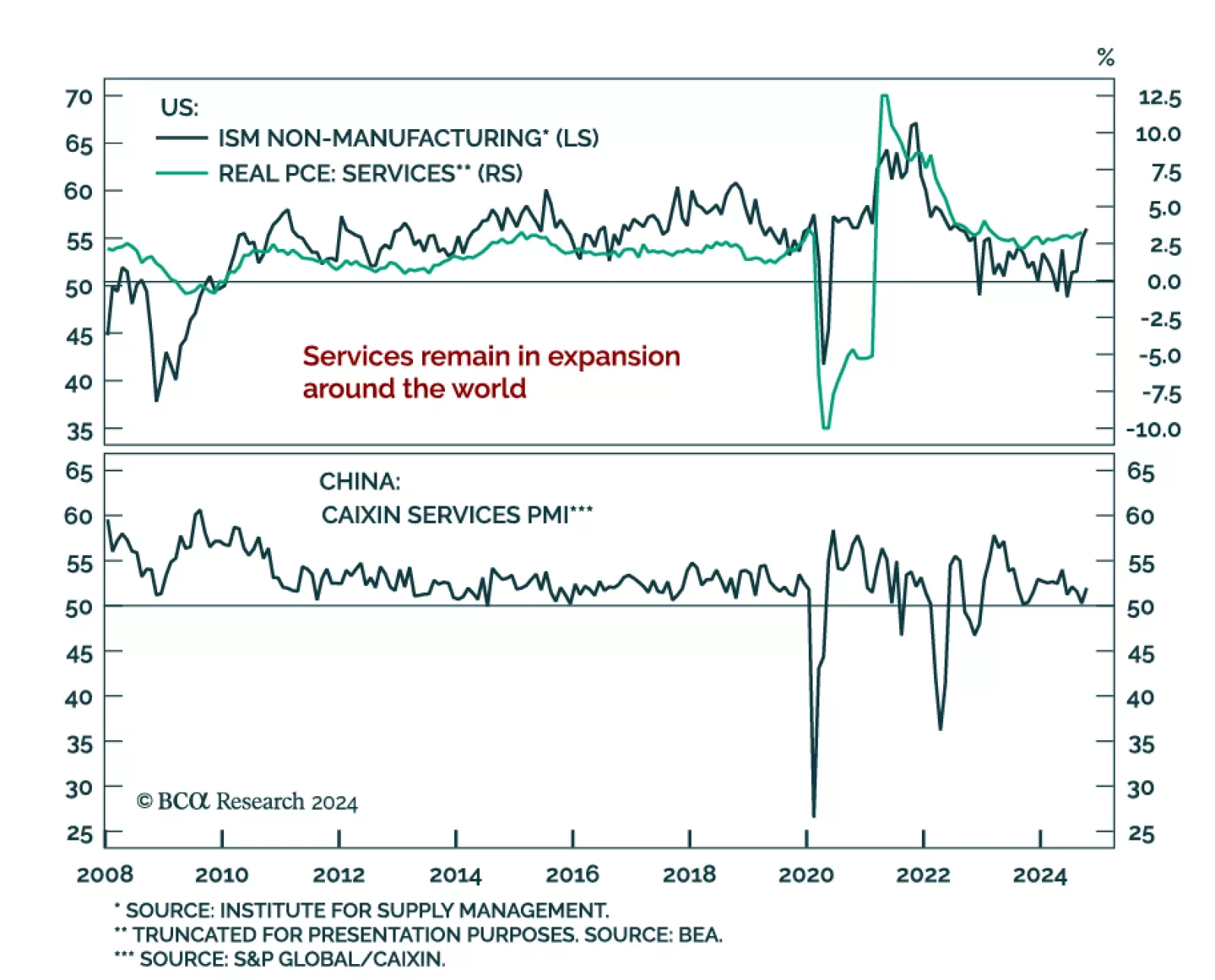

The October ISM non-manufacturing PMI beat expectations, rising to 56 from 54.9 in September, up from a sub-50 low in June. Most components indicate an expansion, but the only significant increase came from employment. New orders…

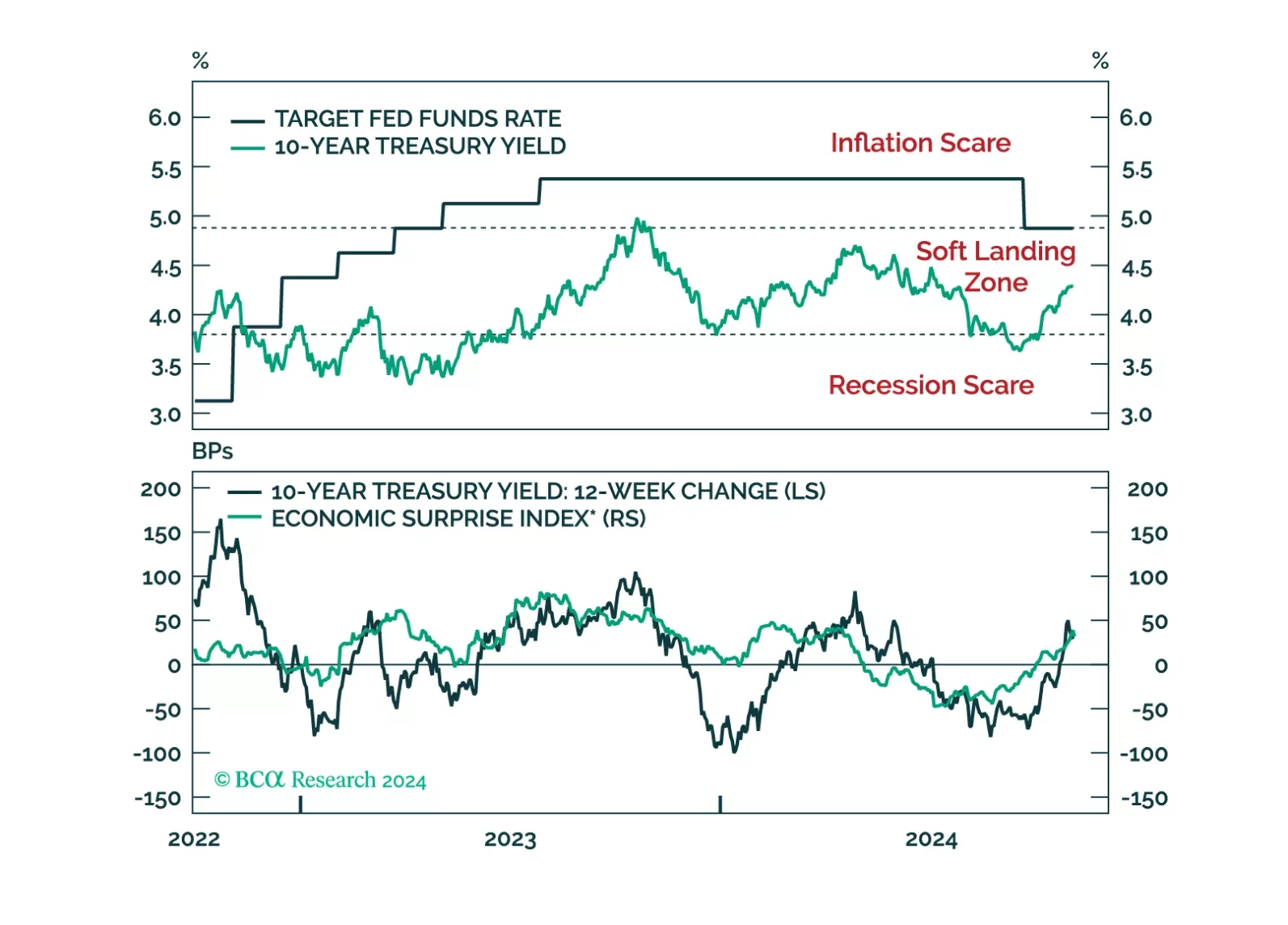

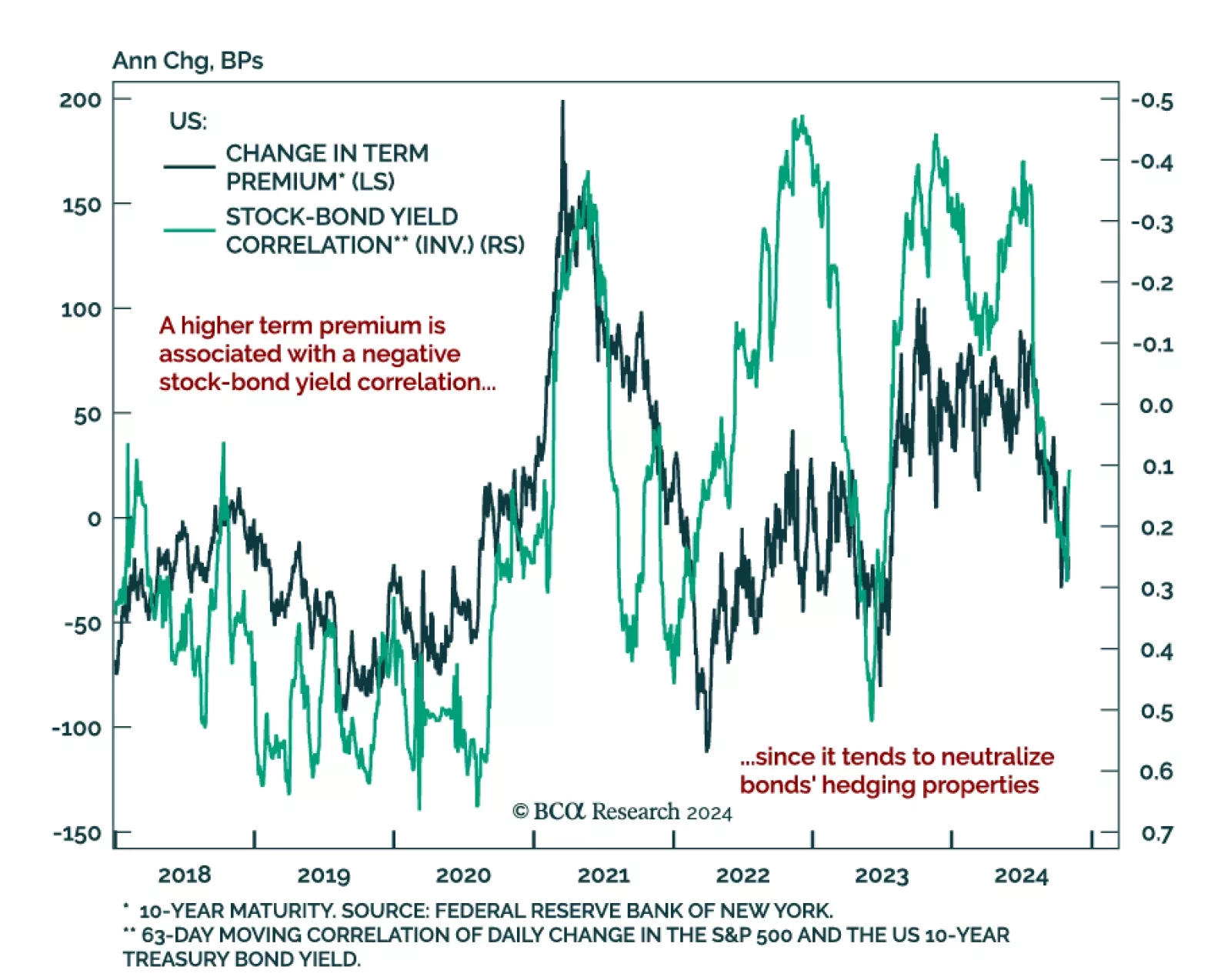

The post-COVID inflation pushed bond yields higher, turning the stock-bond yield correlation negative and taking away bonds’ hedging properties. The relationship normalized this summer as economic data surprised negatively…

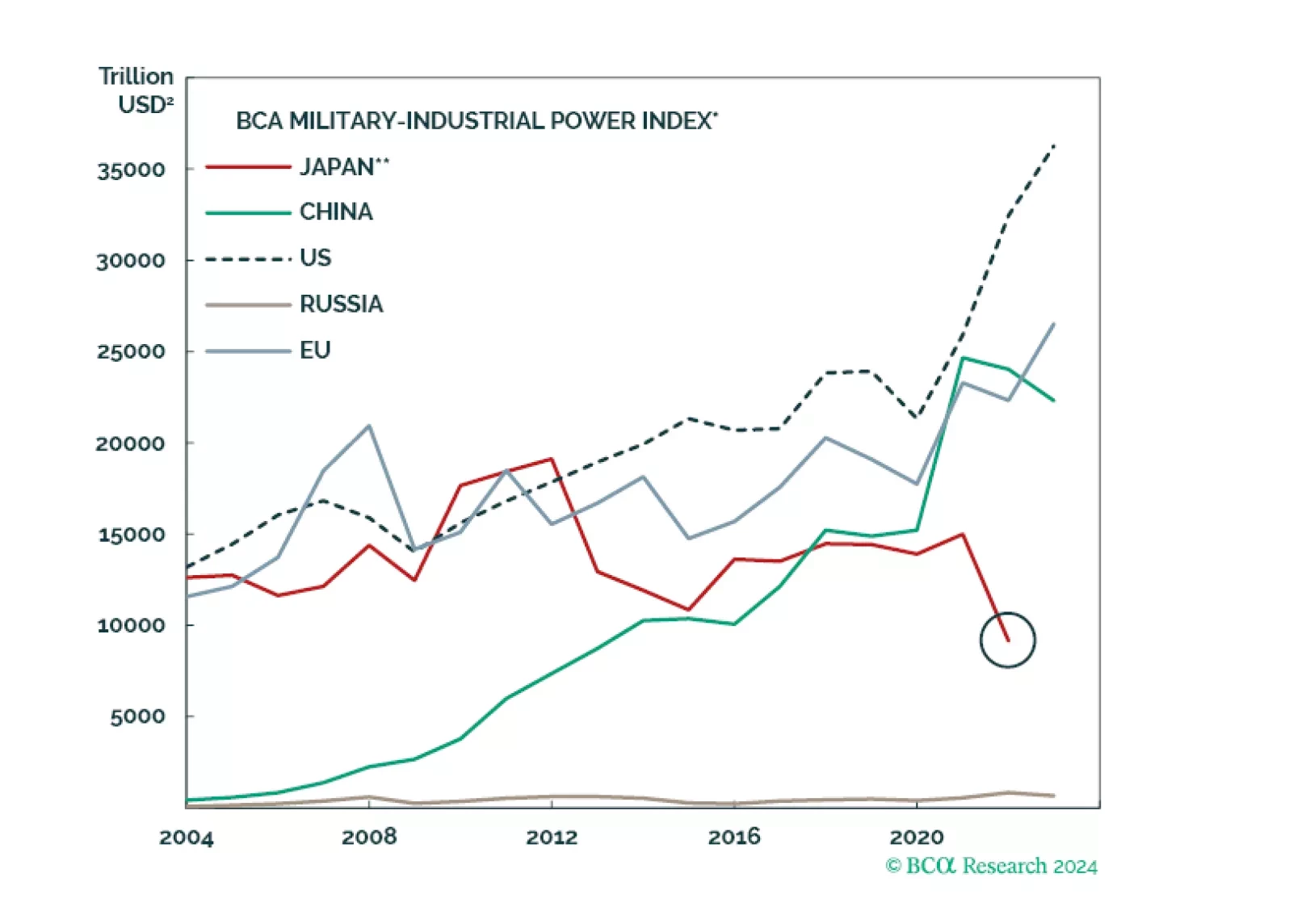

Over the next few months, Japan’s new government will ease fiscal policy, which will improve domestic demand on the margin. Monetary policy may tighten further in the short run but not too much over the long run. The geopolitical…

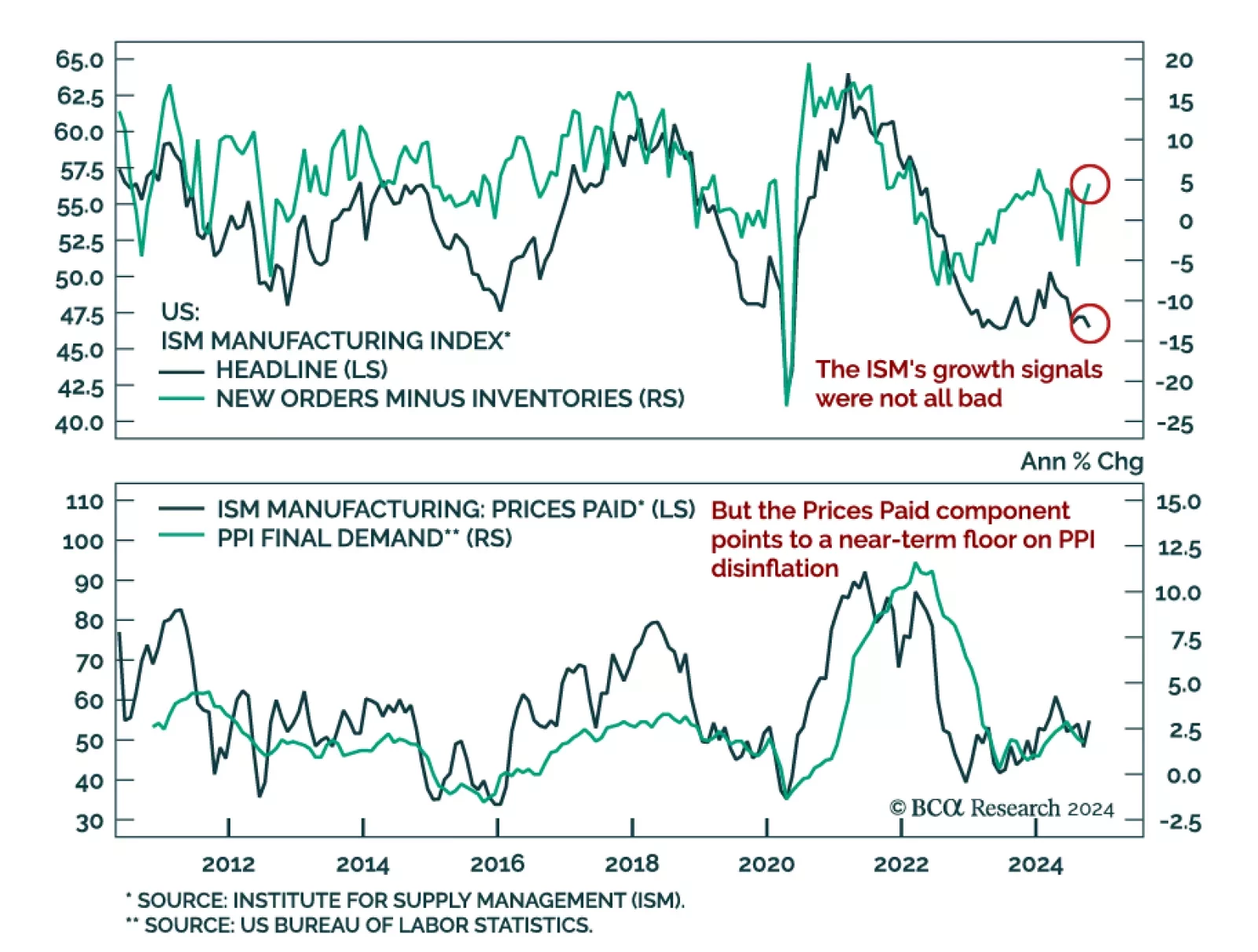

The October ISM Manufacturing missed expectations, decreasing to 46.5 from 47.2 in September. The Prices Paid component jumped, rising to 54.8 from 48.3 the month prior. New Orders showed a small upside surprise at 47.1, up 1…

A reaction to this morning’s employment report and a preview of the potential bond market implications of next week’s US election and FOMC meeting.

The Fed’s preferred measure of inflation, core PCE, met expectations of a reacceleration to 0.3% month-on-month, and reached 2.7% year-over-year. The rest of the Personal Income and Outlays report showed solid…

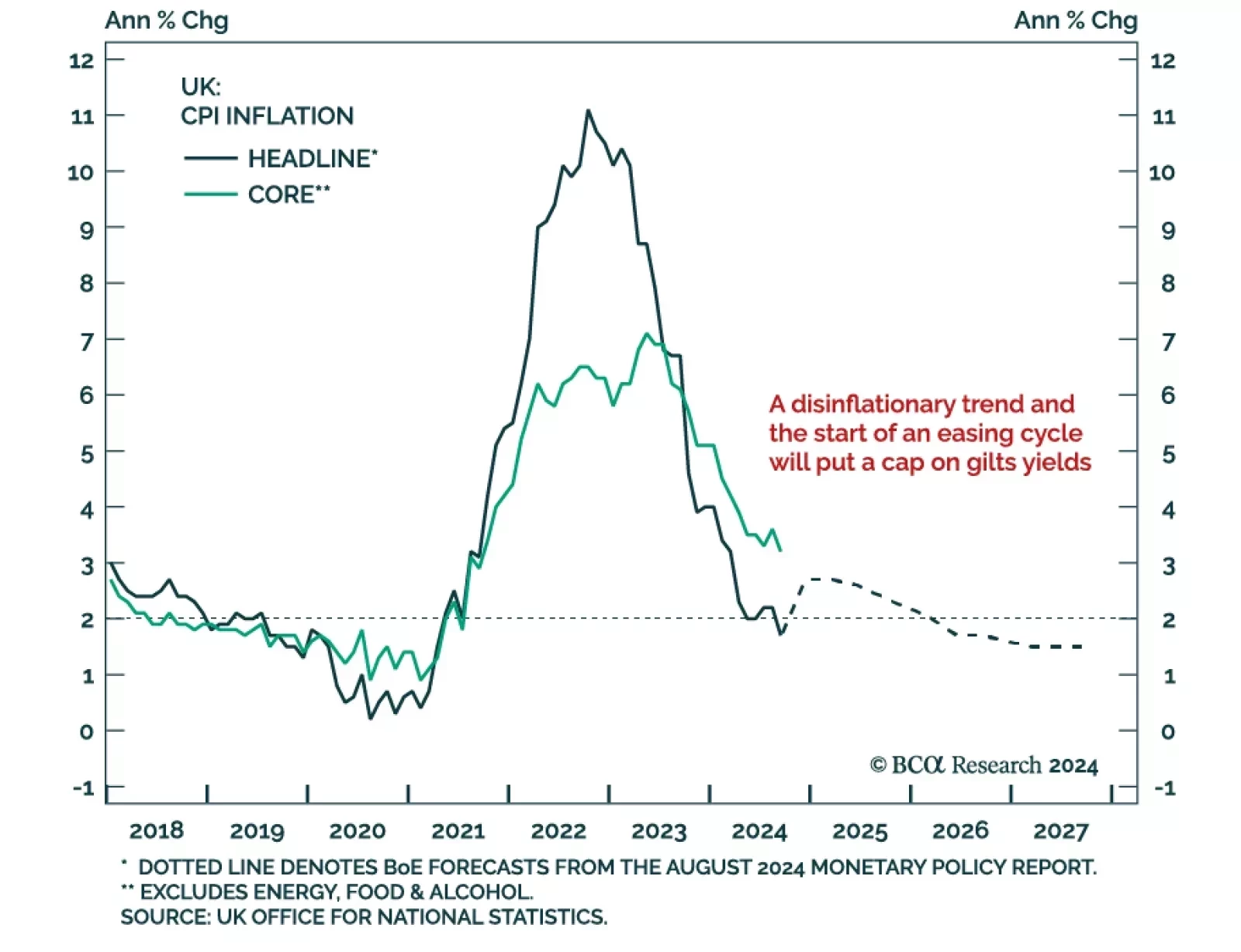

We recently pointed to the UK Budget announcement as a pivotal event for UK assets. Following an initially positive reception, the market has turned and priced in further fiscal premia in UK assets, with both gilts and the pound…