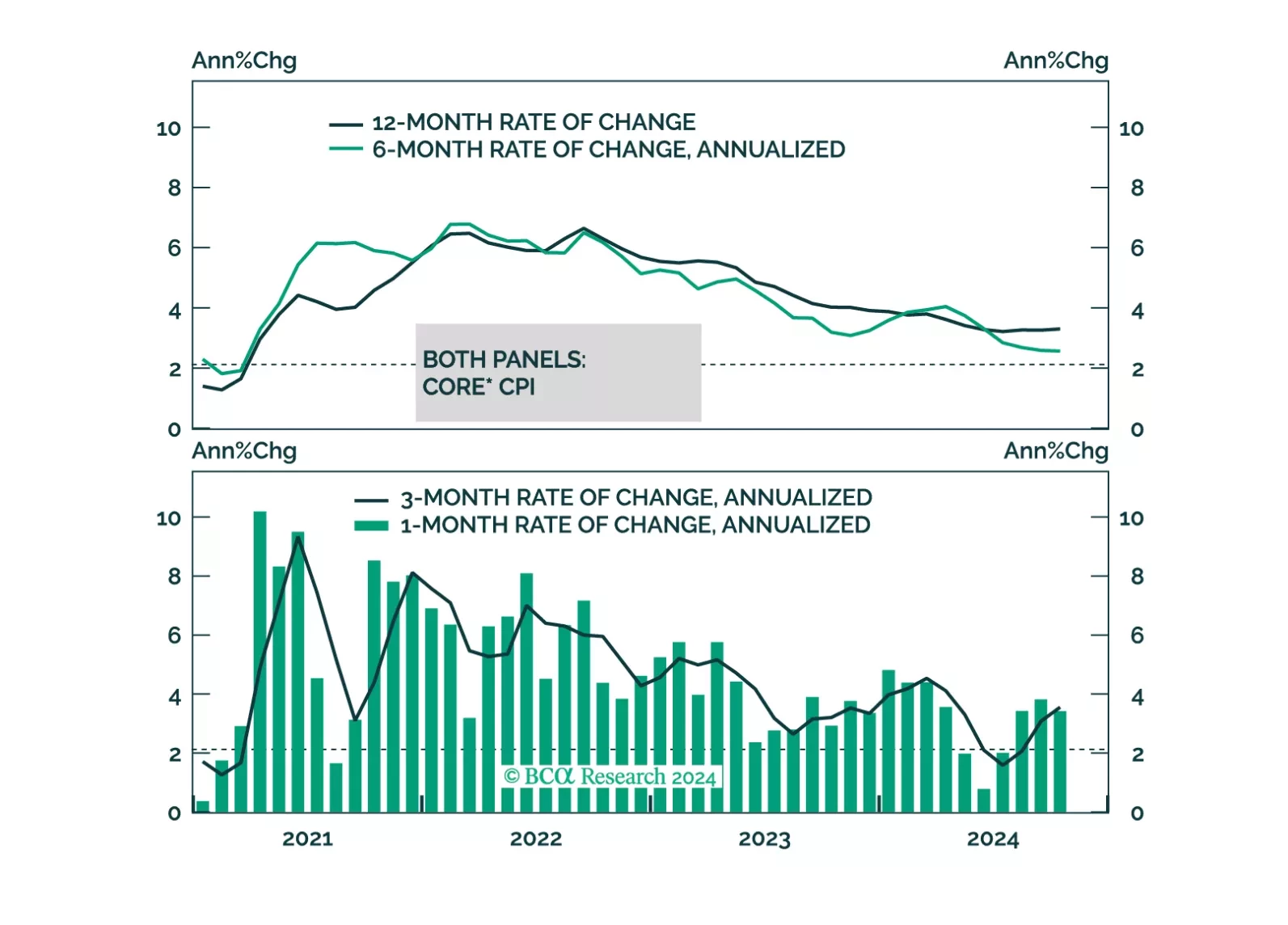

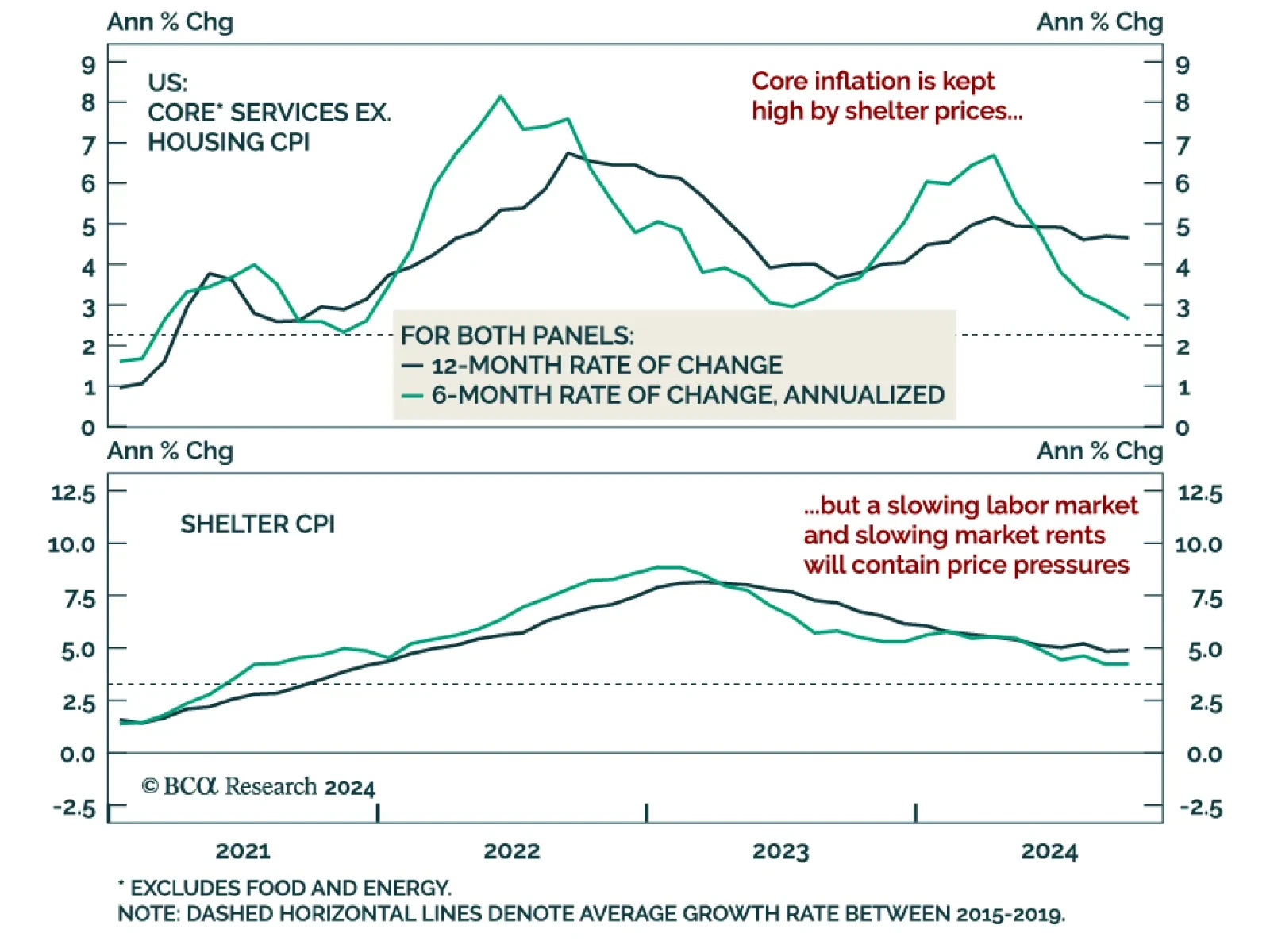

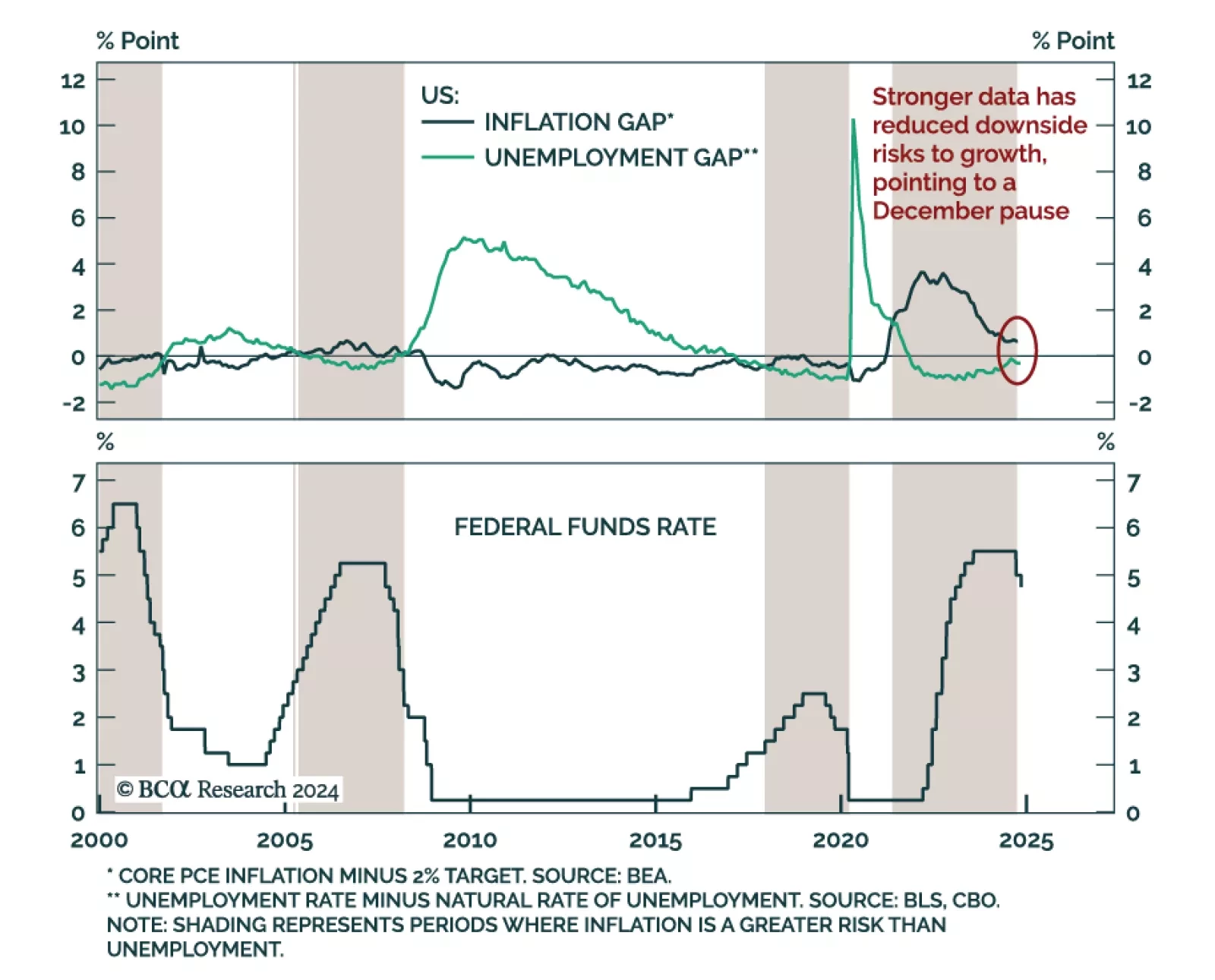

US CPI inflation for October printed in line with expectations and was unchanged from September, with headline at 0.2% month-over-month and core at 0.3%. Headline re-accelerated to 2.6% from 2.4% on an annual basis, and core…

We update our inflation forecast following this morning’s CPI release, concluding that TIPS breakeven inflation rates have room to fall.

Our Portfolio Allocation Summary for November 2024.

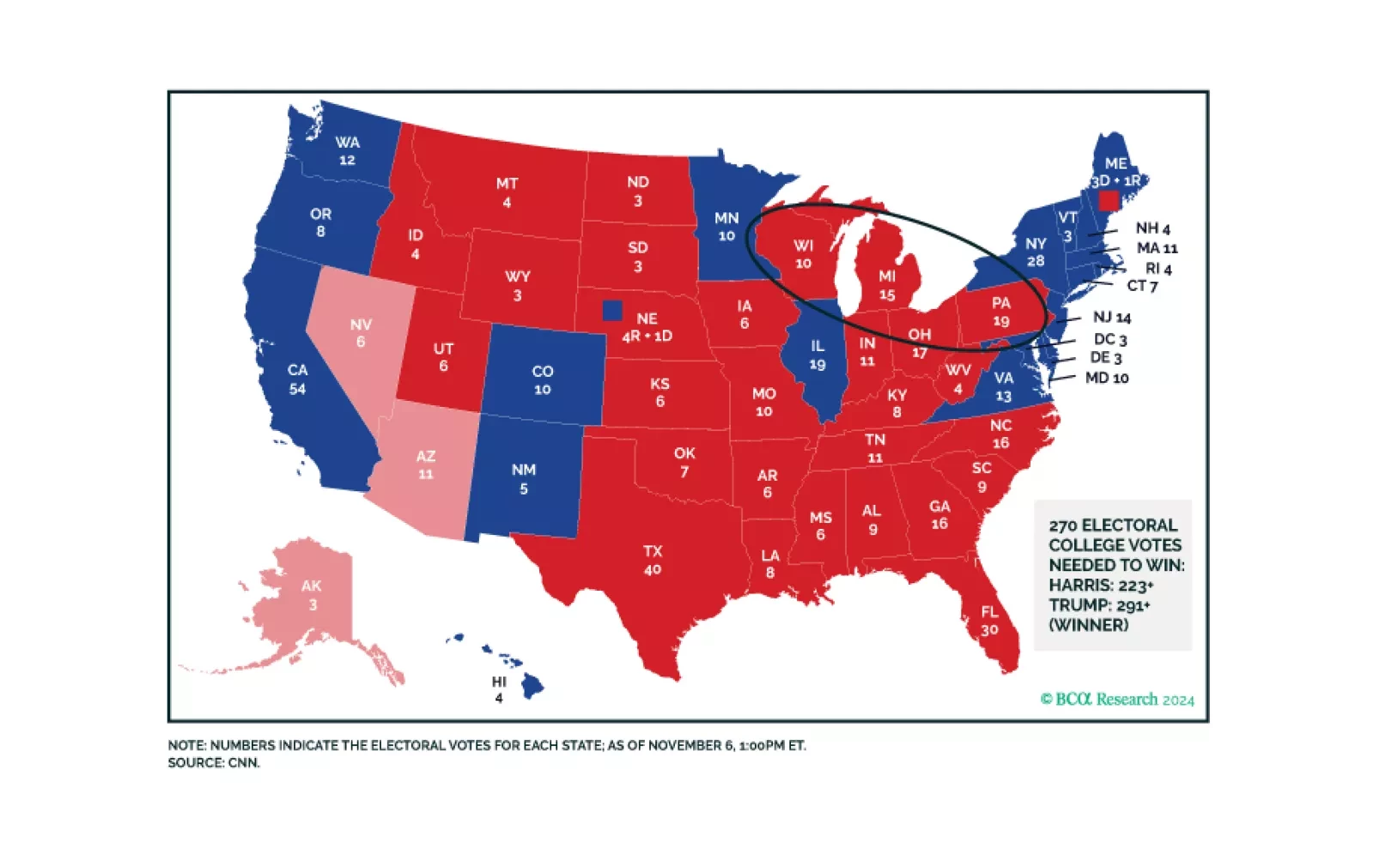

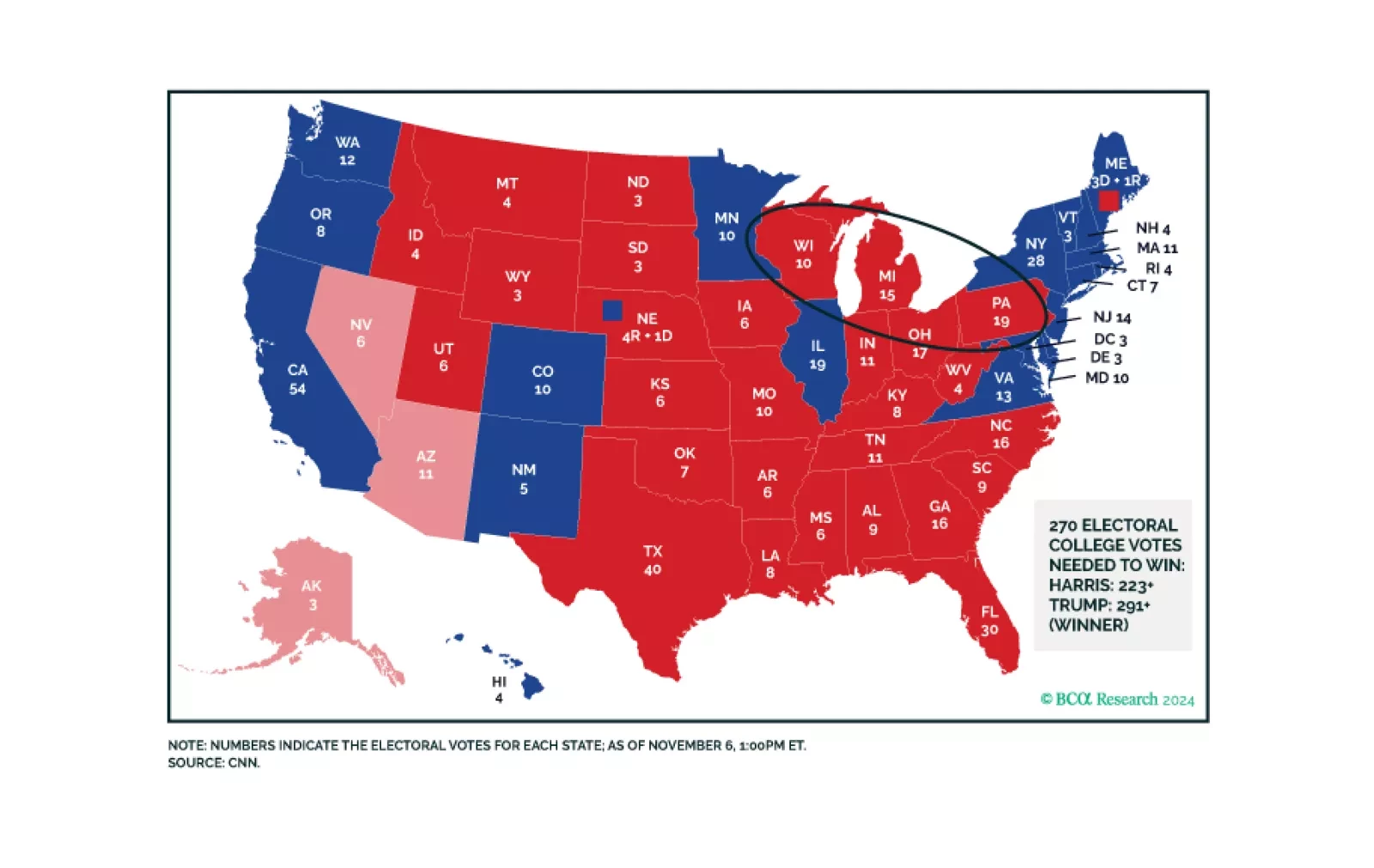

The force of the post-election momentum leads us to believe we could be stopped out of our defensive positioning before the week is out, but we still believe in our recession call. If we are eventually stopped out, we will seek a…

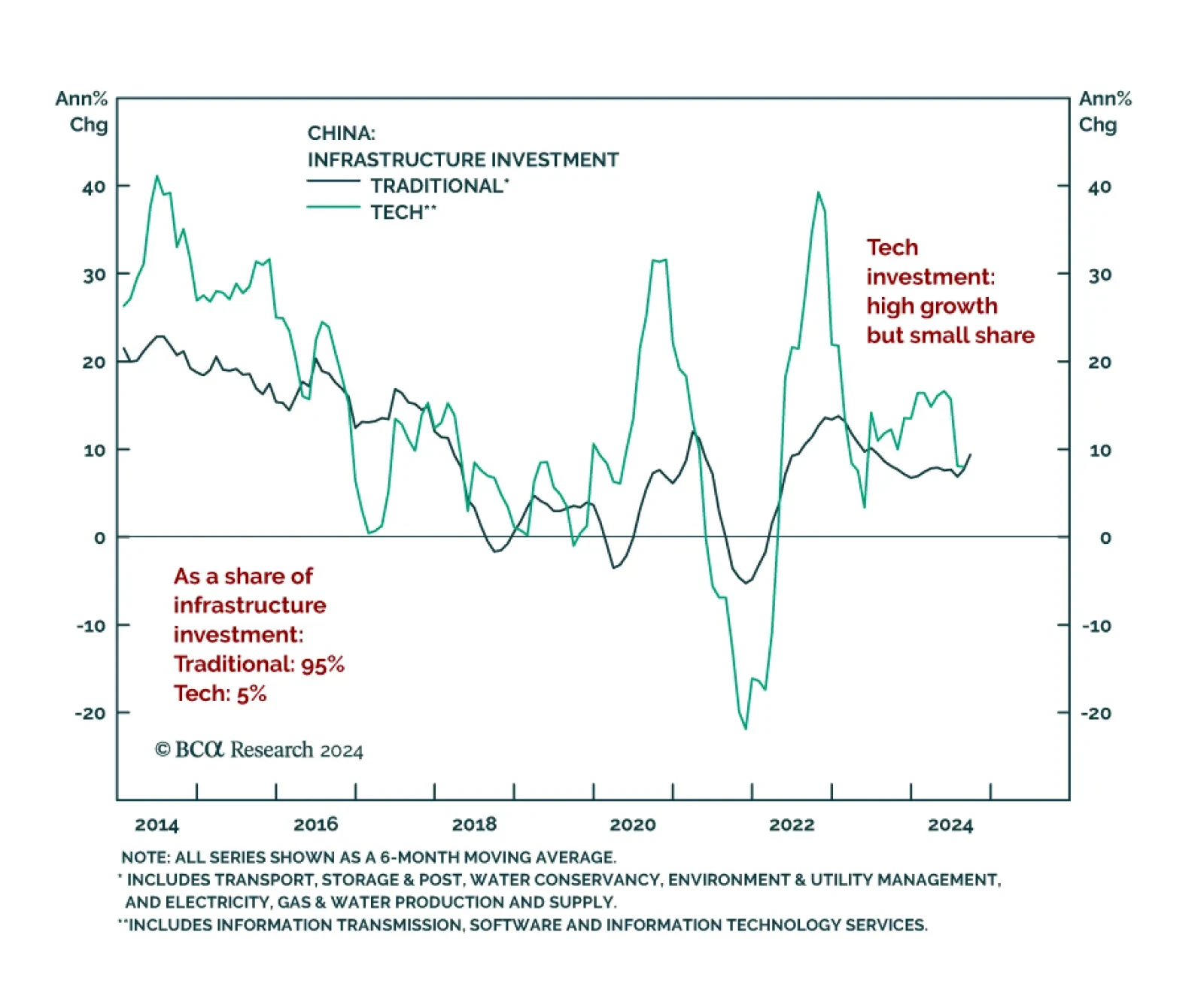

Our China Investment Strategy team recently met with clients in China to assess investor sentiment and discuss the outlook as Beijing unveils new stimulus measures. China’s economic recovery faces headwinds and is…

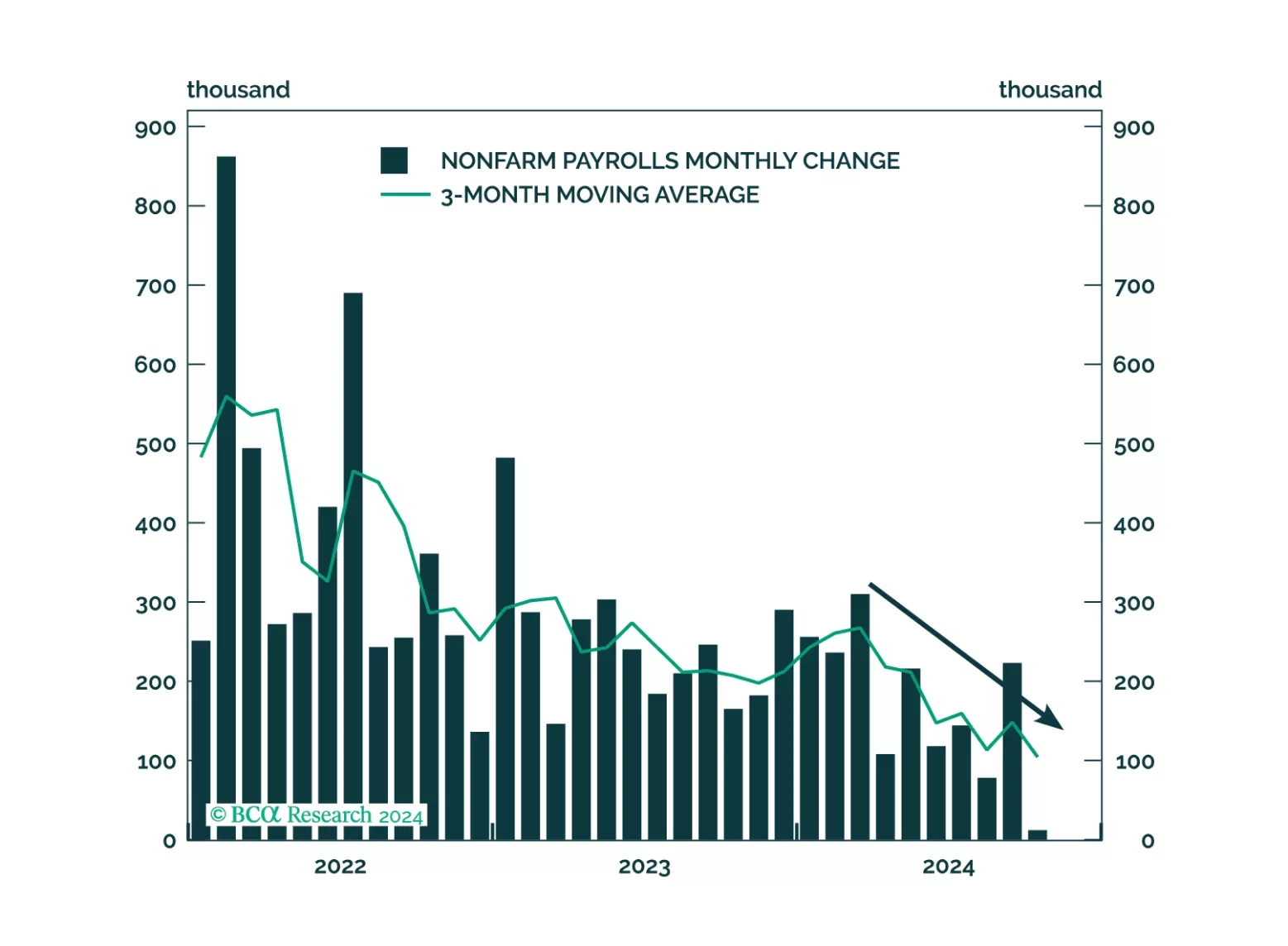

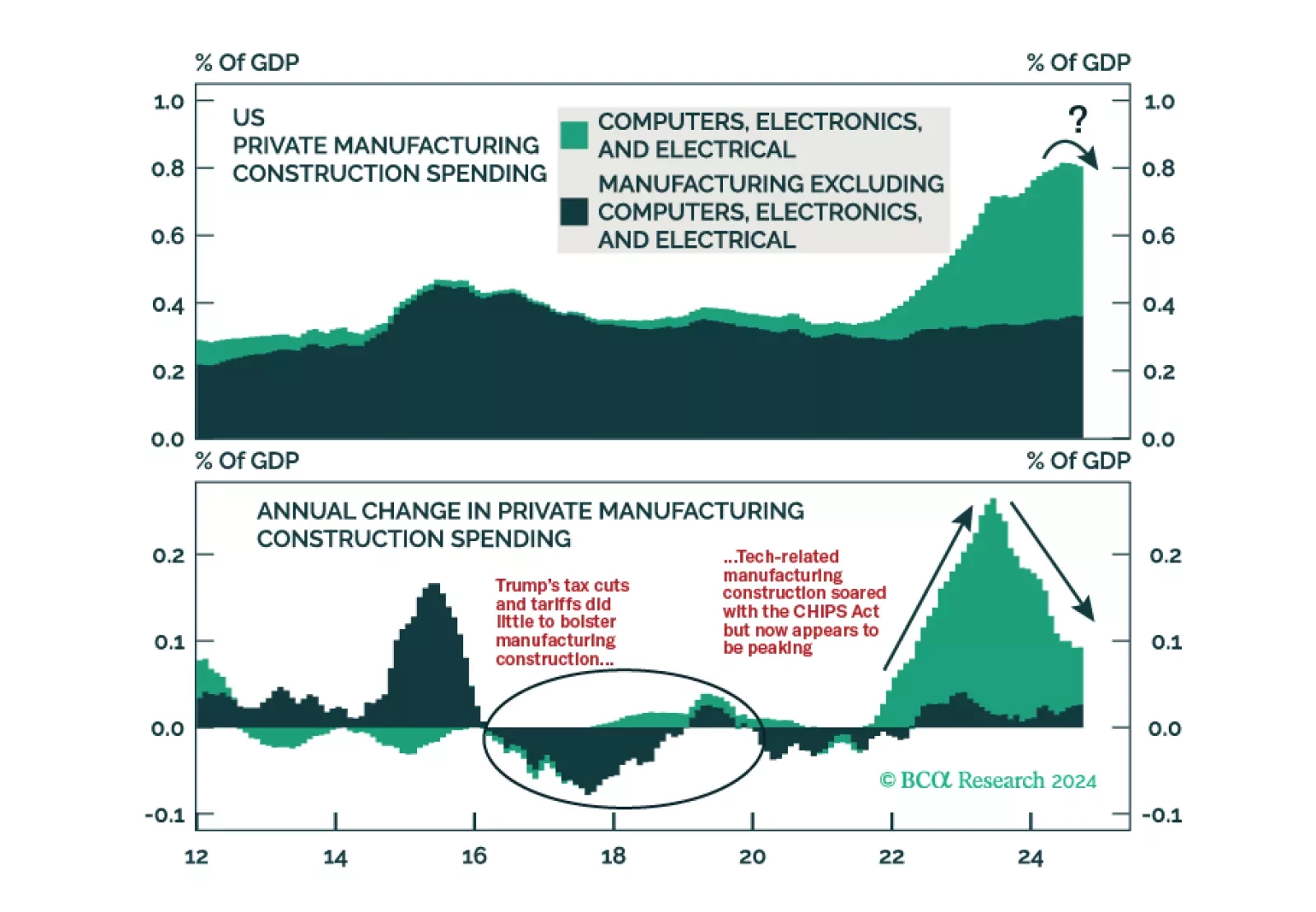

The prospect of a new trade war more than offsets the other pro-business parts of Trump’s agenda. With the labor market already weakening going into the election, we are raising our 12-month US recession probability from 65% to 75…

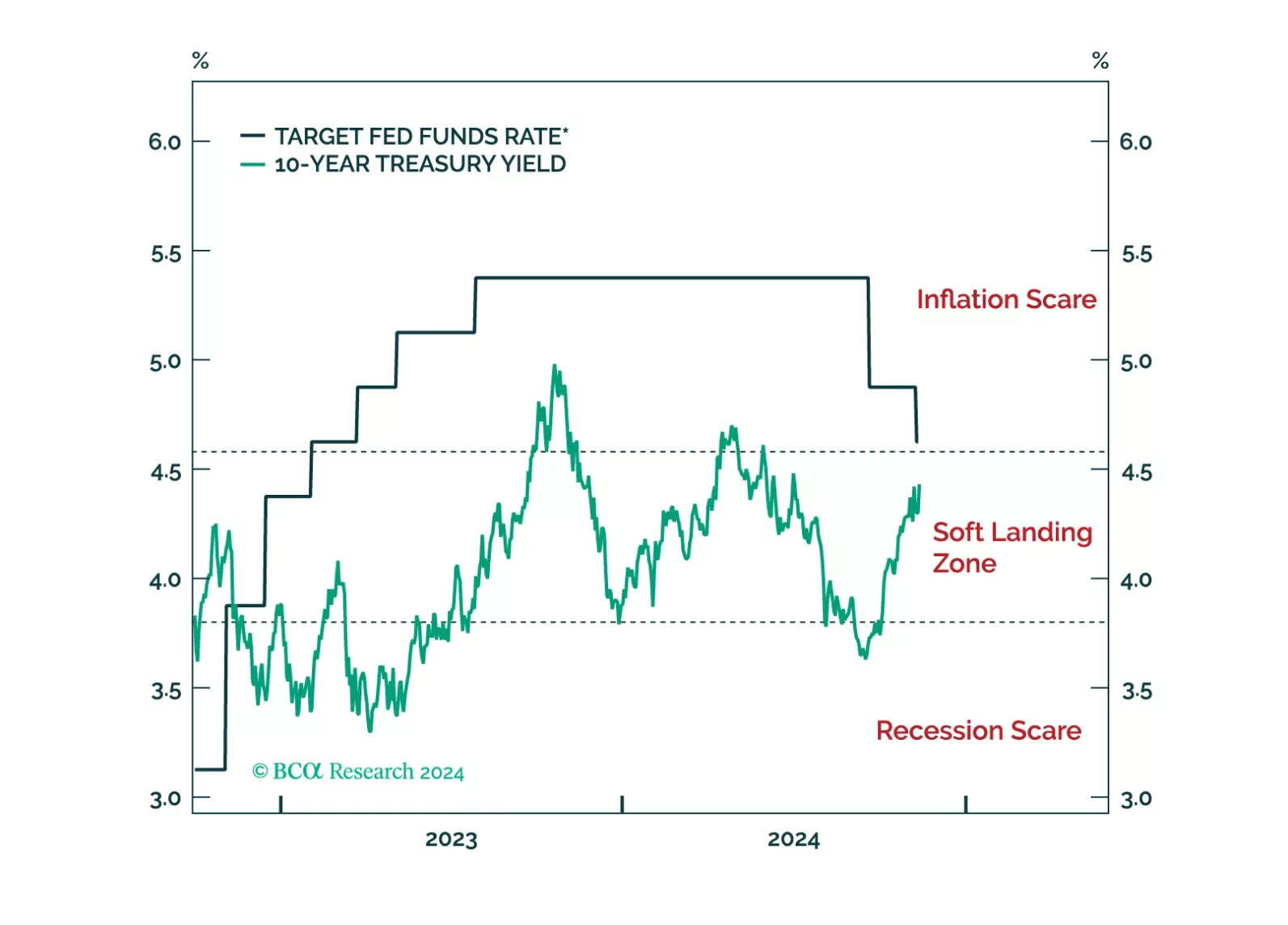

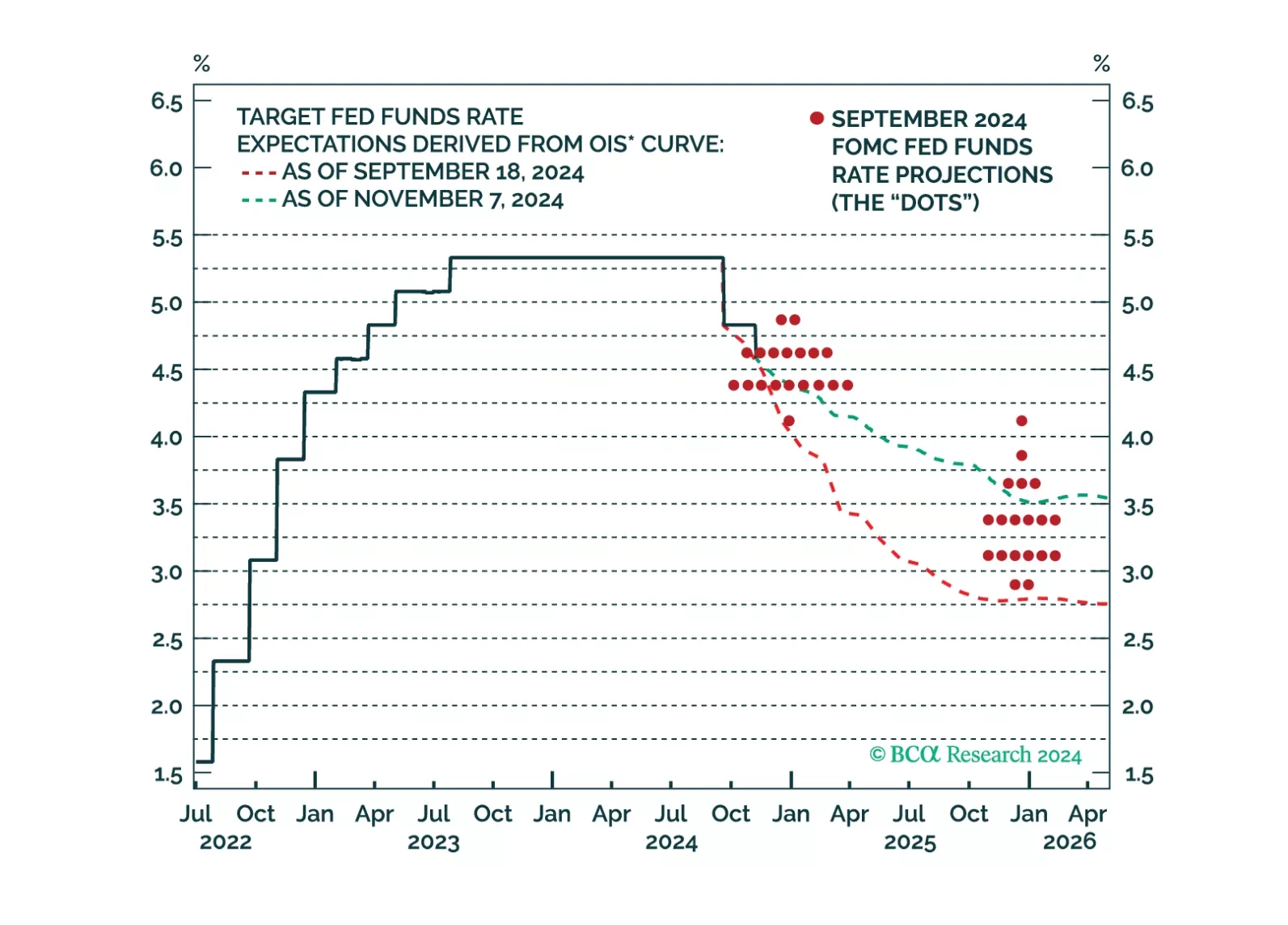

Our thoughts on the bond market’s reaction to the election and this afternoon’s FOMC meeting.

The Federal Reserve cut interest rates by 25 bps as expected yet introduced uncertainty on the timing of its next move. The statement was relatively unchanged, except for the removal of a segment from September highlighting they…