The post-COVID recovery has been one of excesses. Government deficits have ballooned, tight labor markets have led to a windfall of consumer spending, and equity valuations have soared on the back of lofty growth expectations. But…

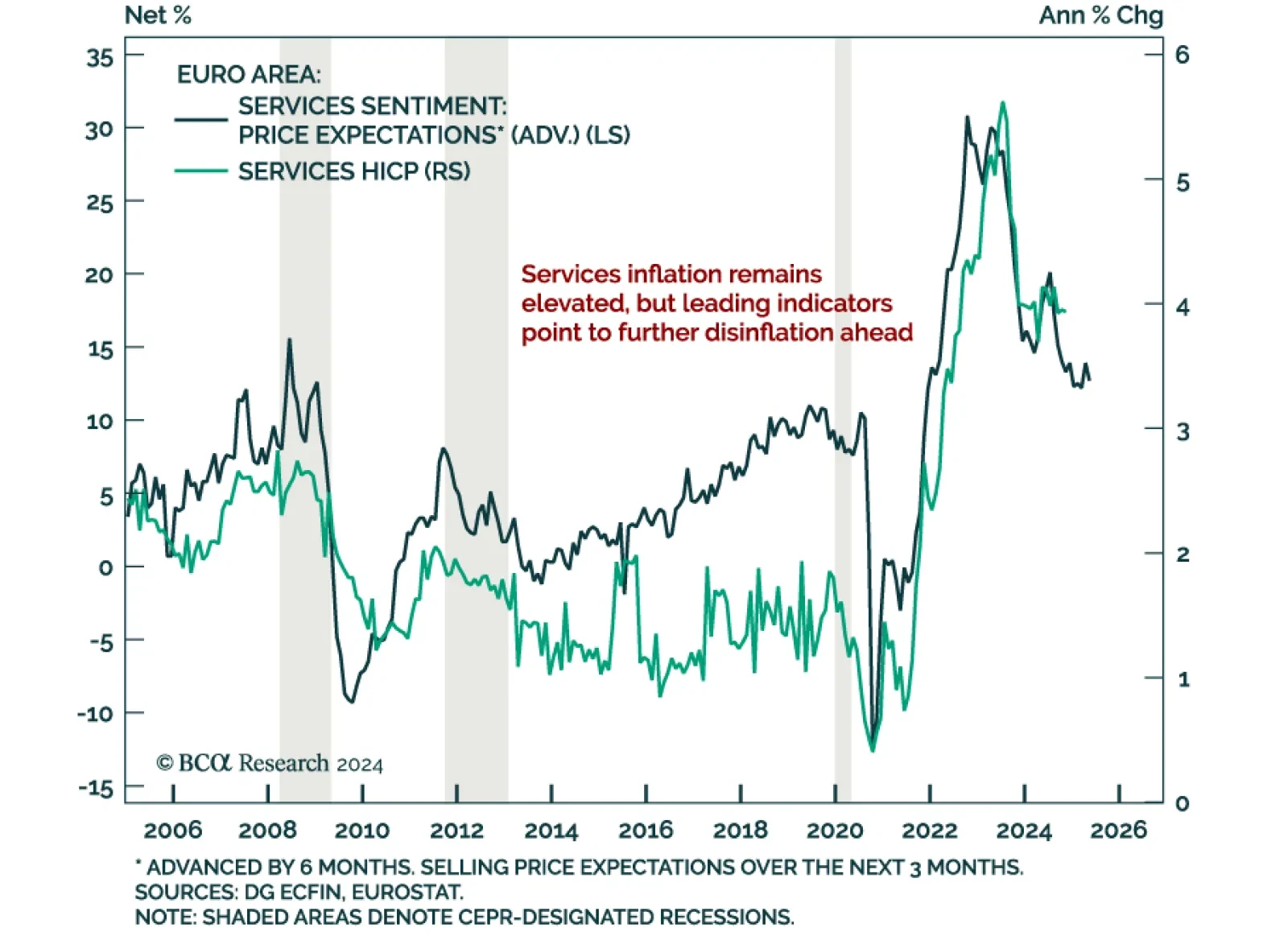

The November flash Eurozone inflation estimate met expectations, with headline HICP accelerating to 2.3% y/y from 2.0% in October, above the ECB’s target. Core inflation remained constant at 2.7%. At 3.9%, services…

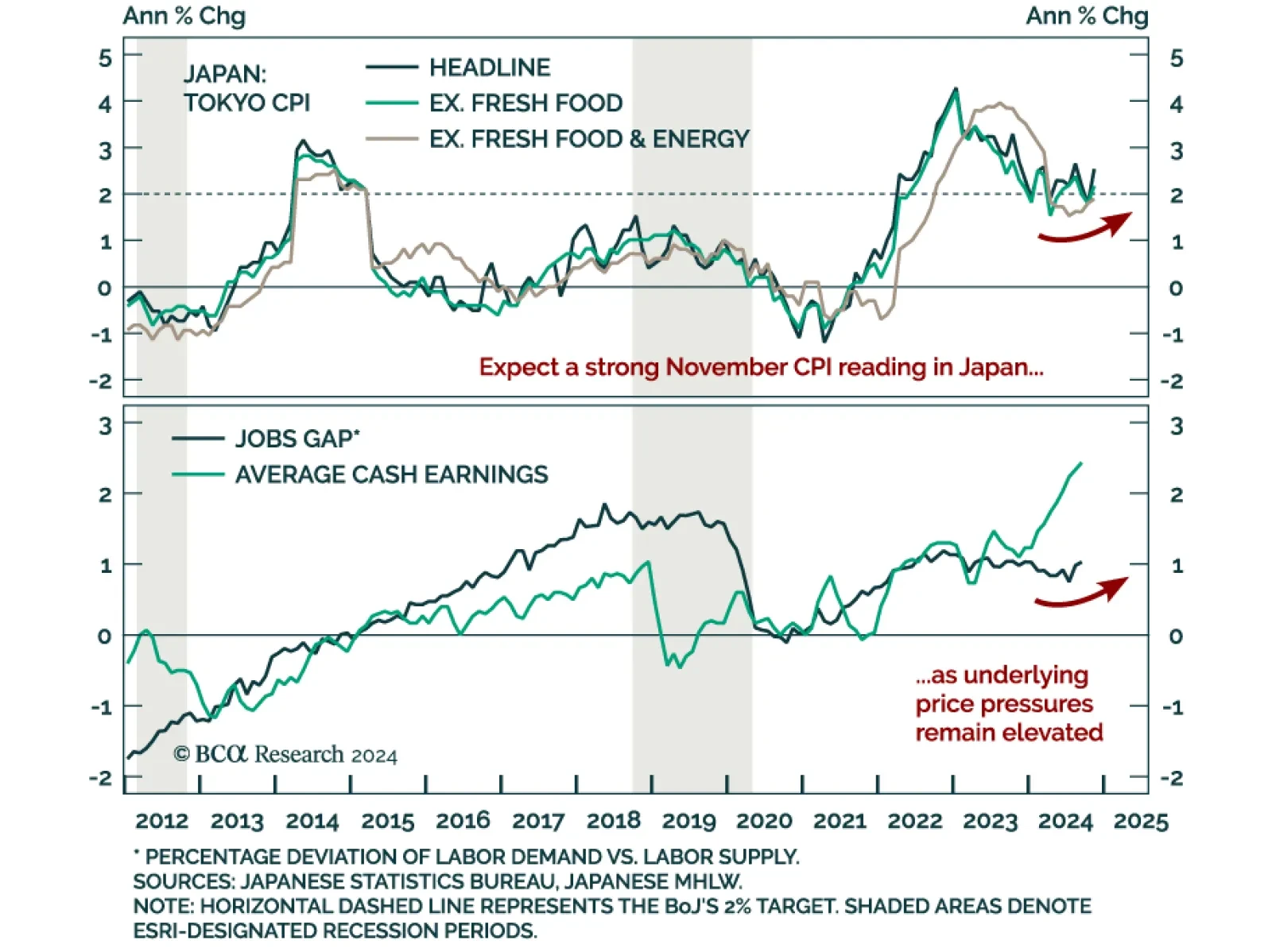

The November Tokyo CPI beat expectations, with headline inflation accelerating to 2.6% y/y from 1.8%. The core (ex. fresh food) and “core core” (ex. fresh food and energy) measures also reaccelerated to 2.2% and 1.9…

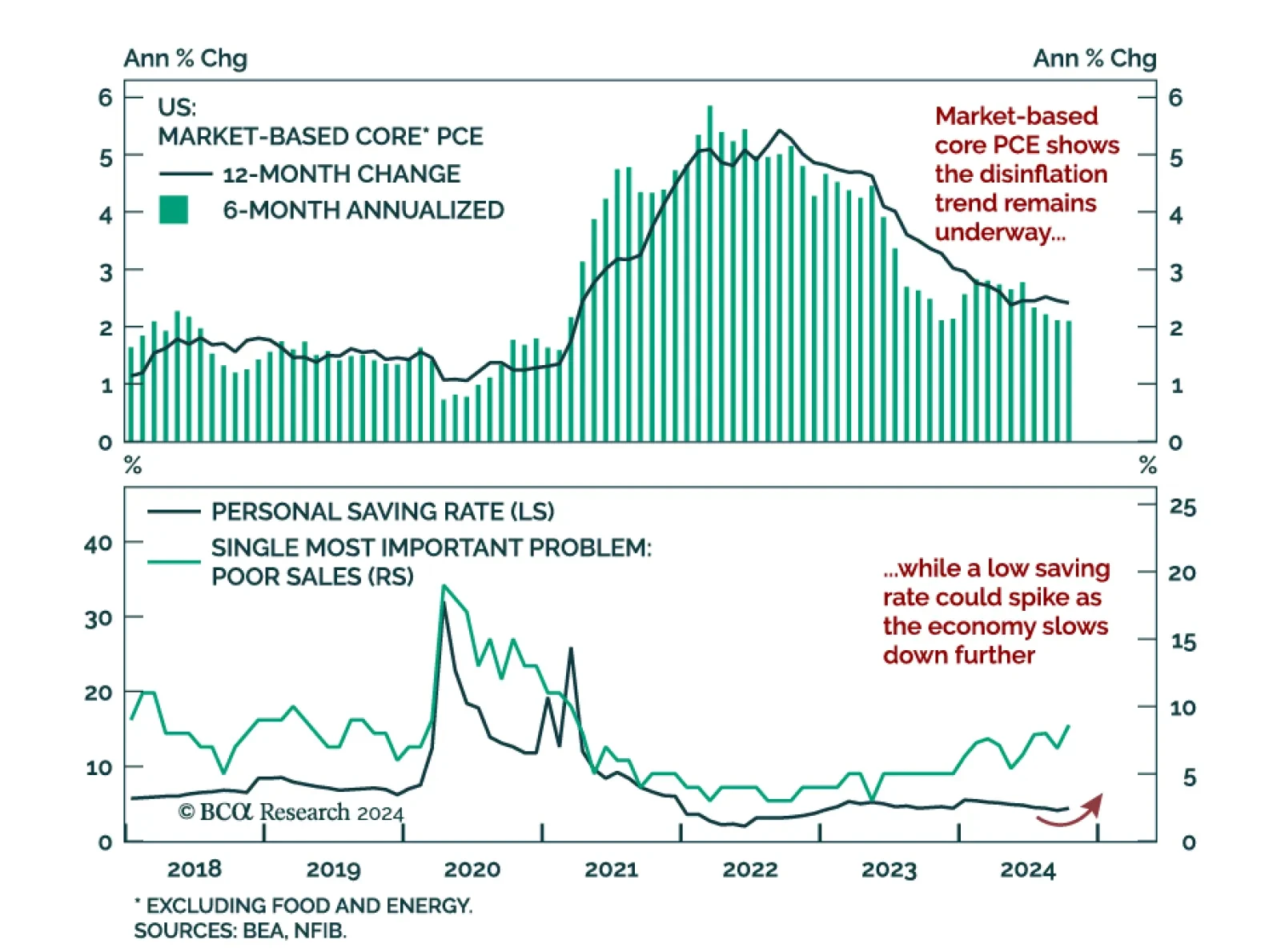

The Fed’s preferred measure of inflation, core PCE, met expectations of 0.3% m/m in October, and accelerated to 2.8% y/y from 2.7% in September. Inflation rose on the back of hot inputs from the PPI report, which is not…

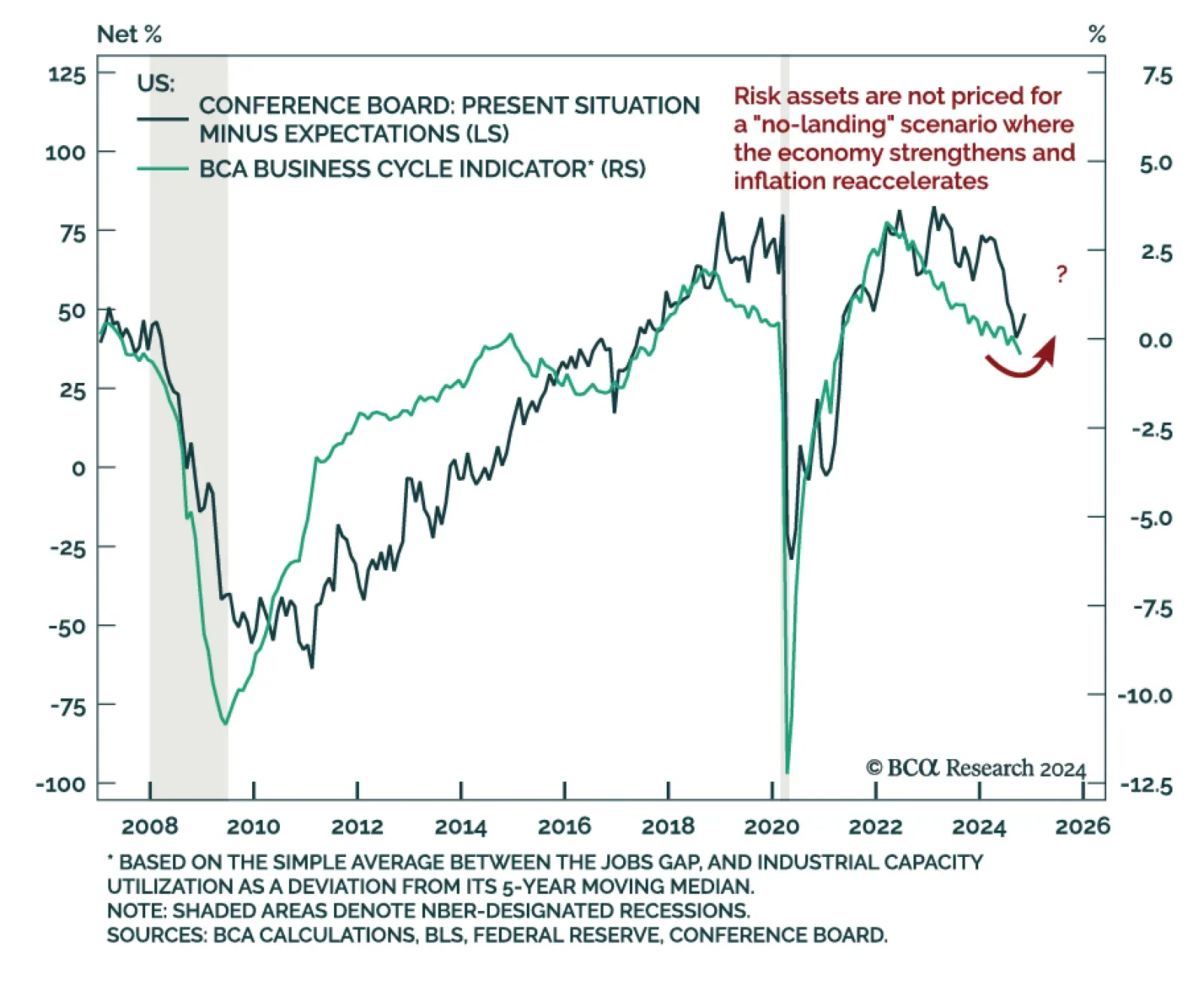

Consumer confidence came in as expected in November, with The Conference Board’s index rising to 111.7 from 108.7 in October, a level not seen since August 2023. Both the assessment of consumers’ present and future…

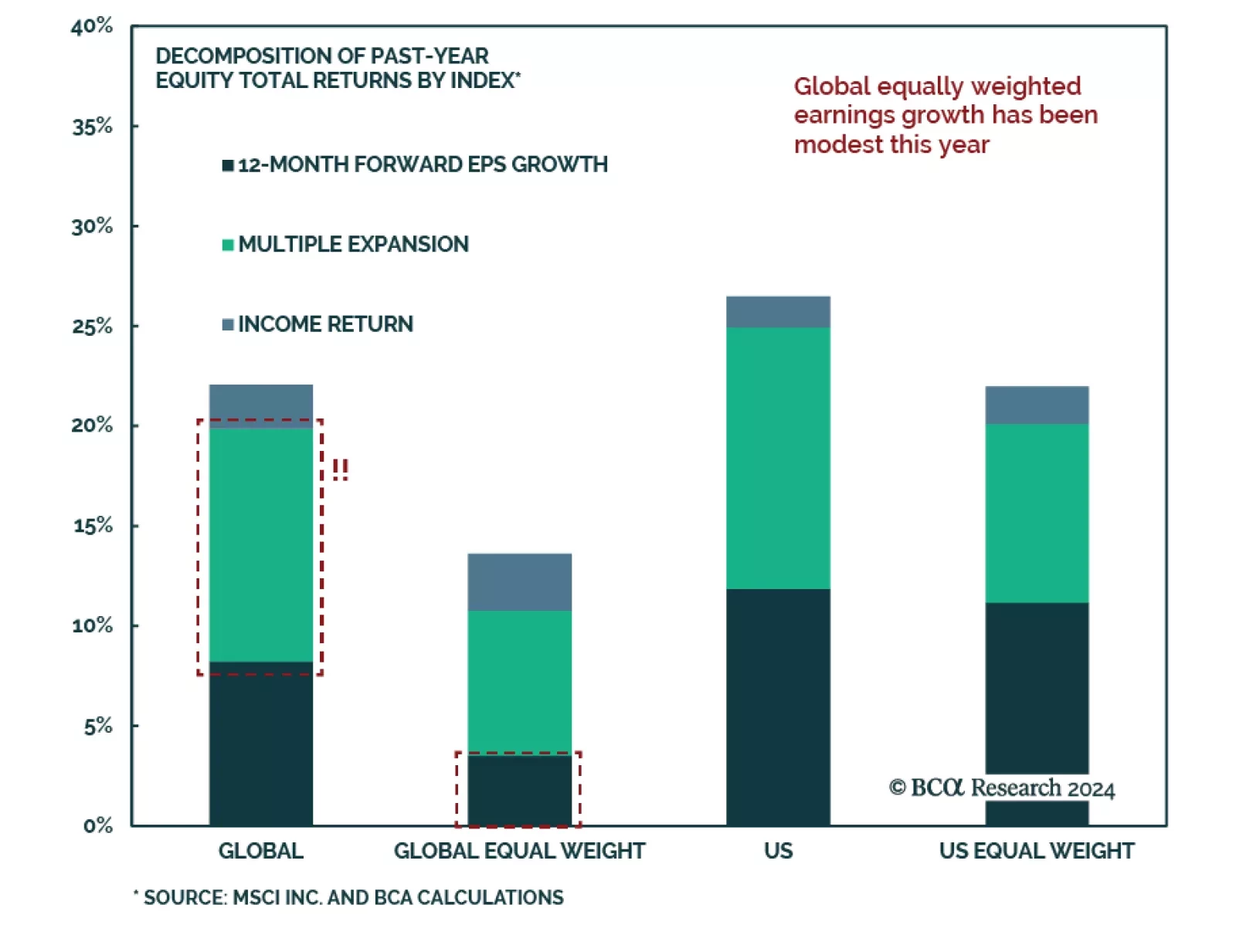

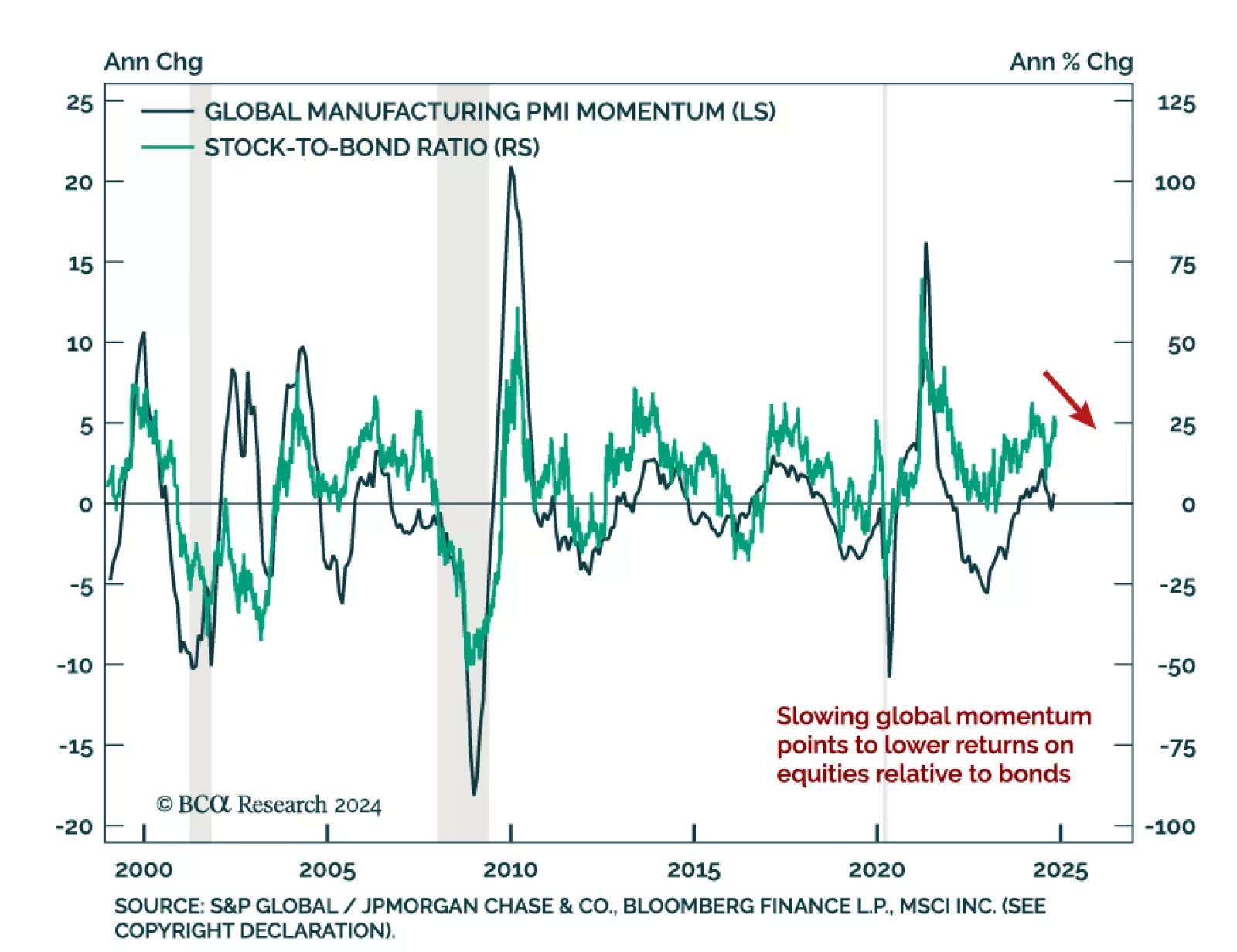

Our 2025 Outlook was just published. We revisit this year’s calls and discuss what we think is ahead for the global economy and markets for the next 12 months and beyond. The recent US election has significantly shifted…

After fueling the USD rally, price action from the past few weeks suggests Treasury yields might limit US equities’ upside. Following the post-COVID inflation, stocks and bond yields were negatively correlated,…

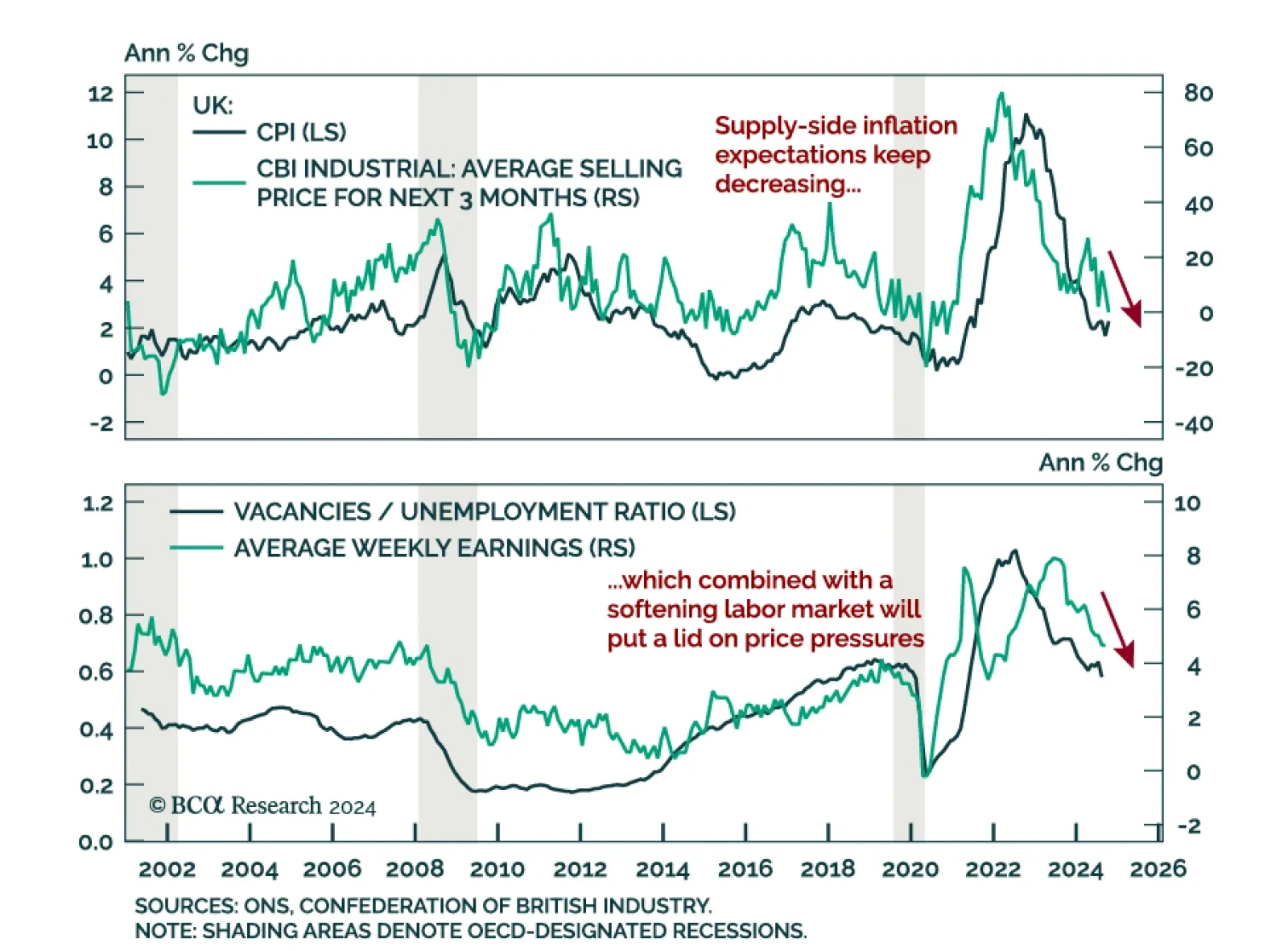

UK inflation was hotter than expected in October, rising to 0.6% m/m from being flat in September. Core inflation also ticked up, printing at 3.3% y/y vs. 3.2% a month prior. Services inflation remains elevated at 5.0% y/y.…

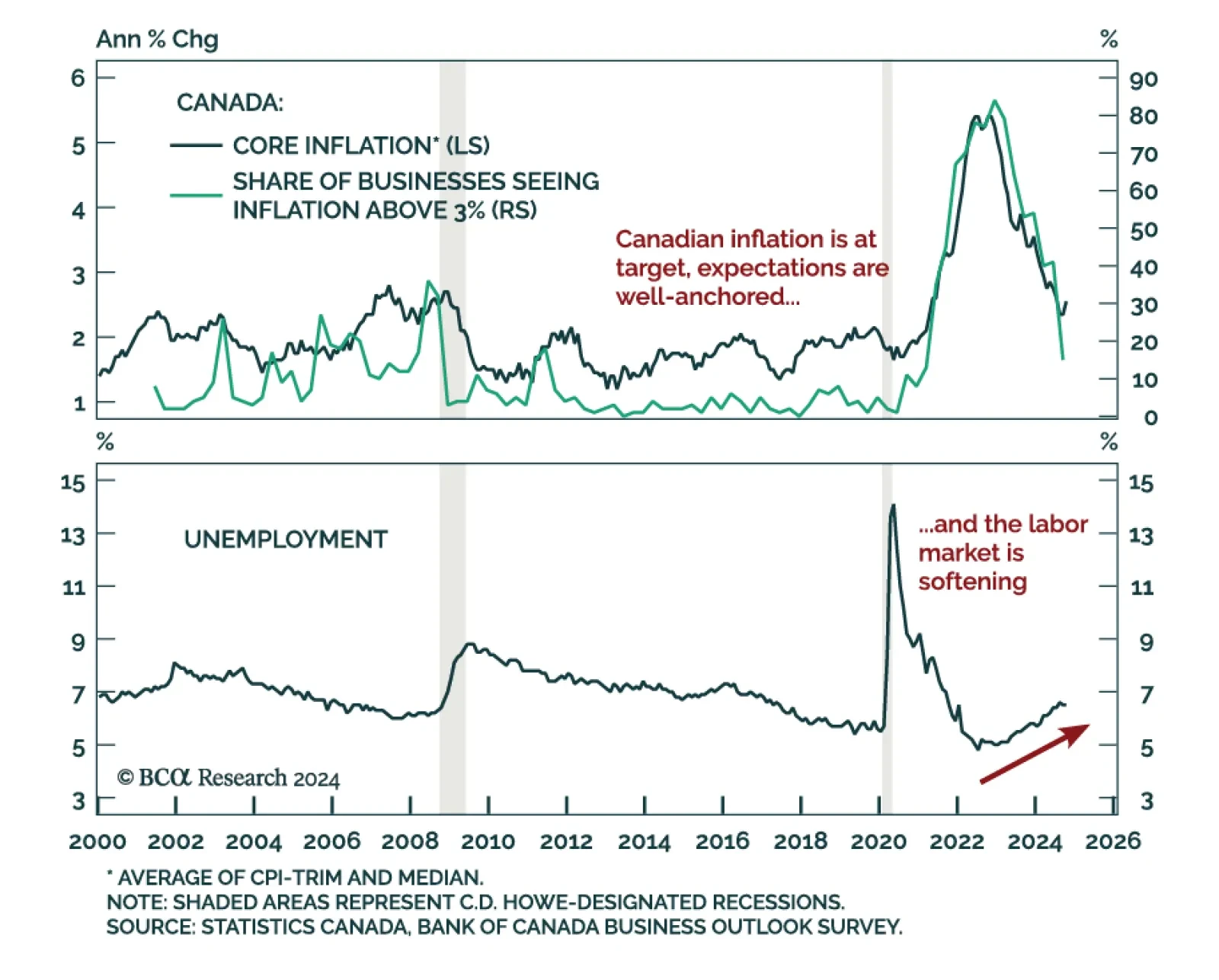

Canadian inflation was slightly hotter than expected in October, re-accelerating to 2.0% y/y from 1.6% in September. The BoC’s favored core measures, median and trim, re-accelerated to 2.5% and 2.6% respectively, and CPI-…

As talks of a market “meltup” abound, we used last Friday’s edition of our BCA Live & Unfiltered meeting to assess our asset allocation recommendations. Our House View has been underweight equities since…