Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

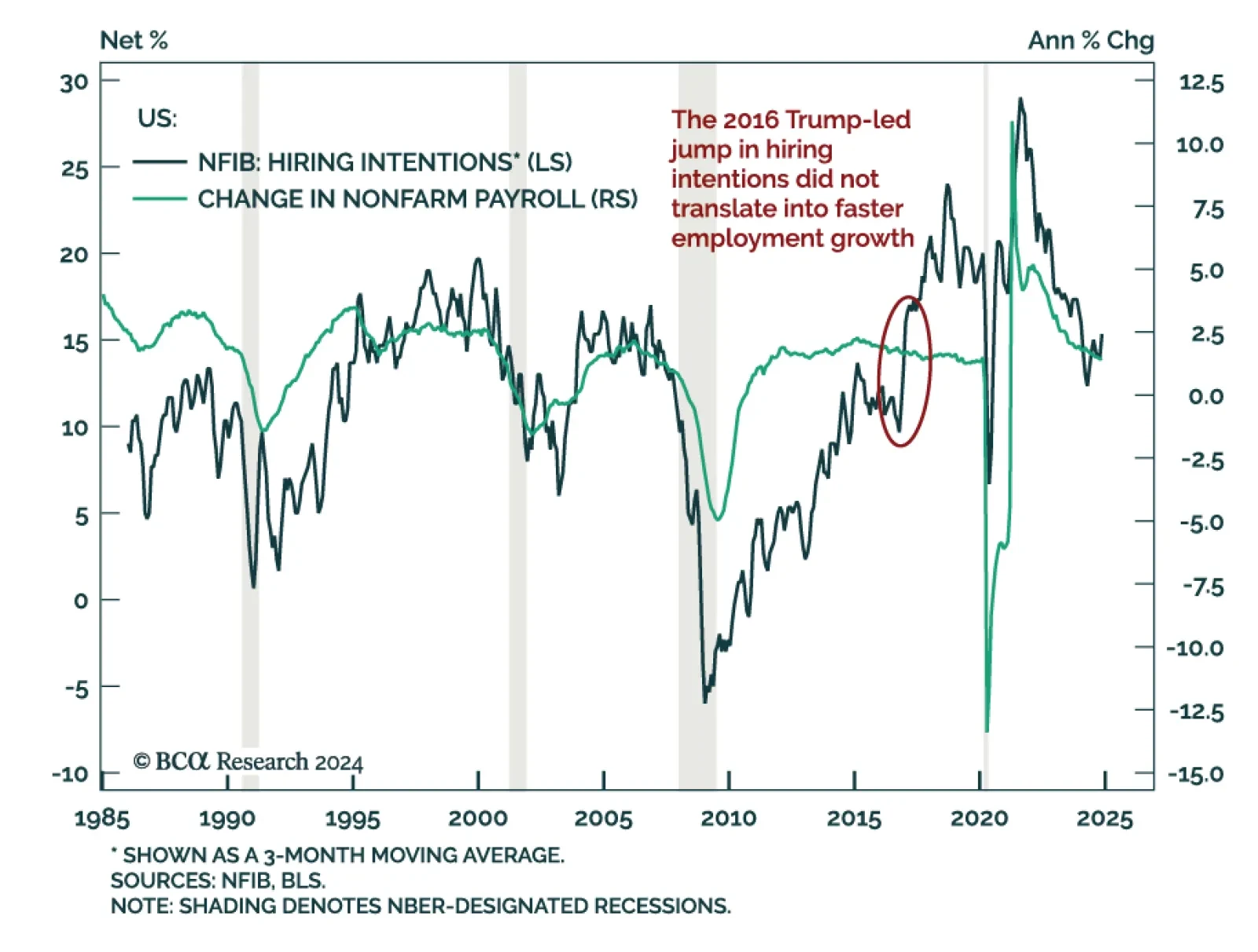

The November NFIB Small Business Optimism index beat expectations, jumping to 101.7 from 93.7 in October. Outside of inventory satisfaction, which was flat, all index subcomponents increased, led by measures of expectations. The…

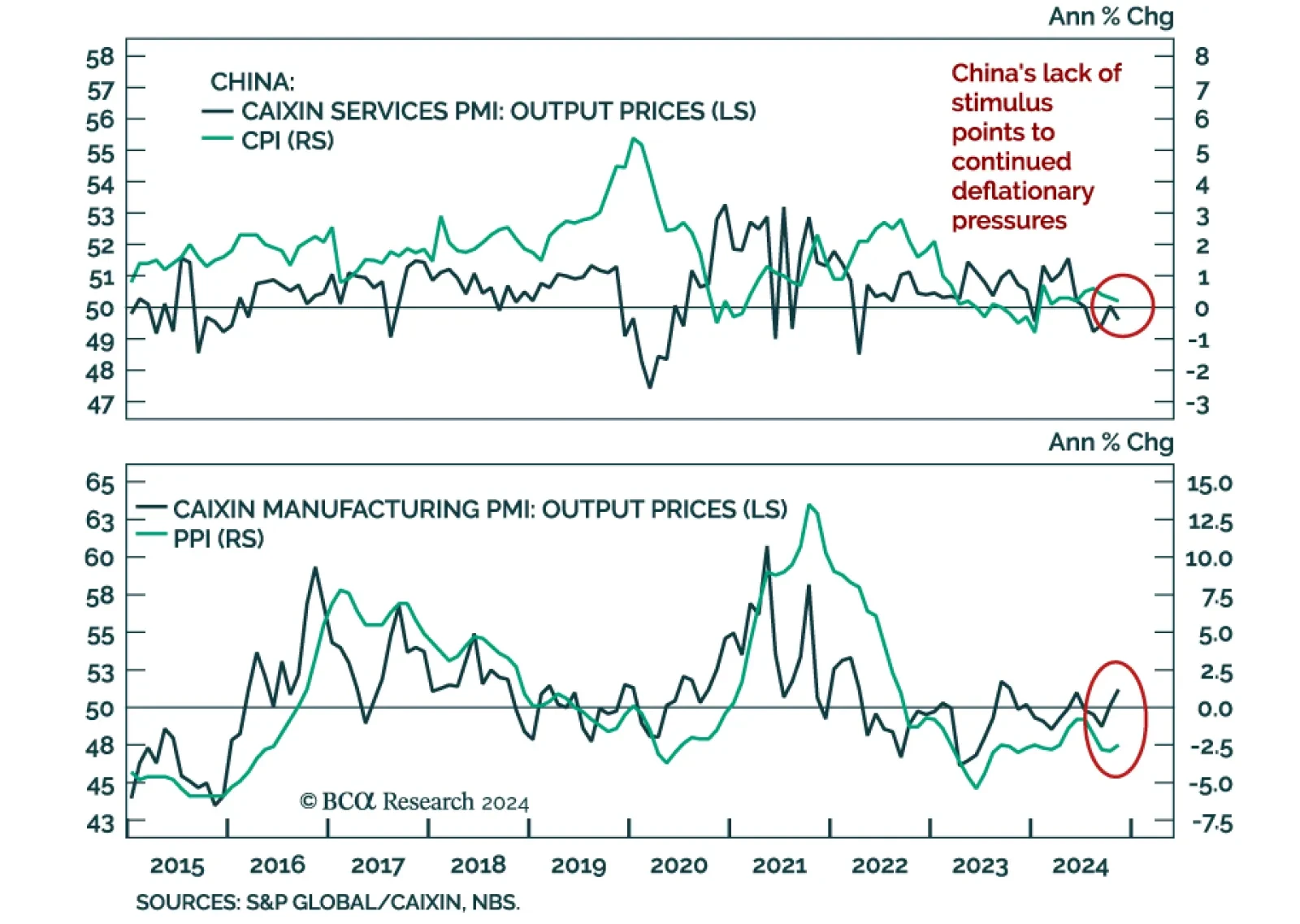

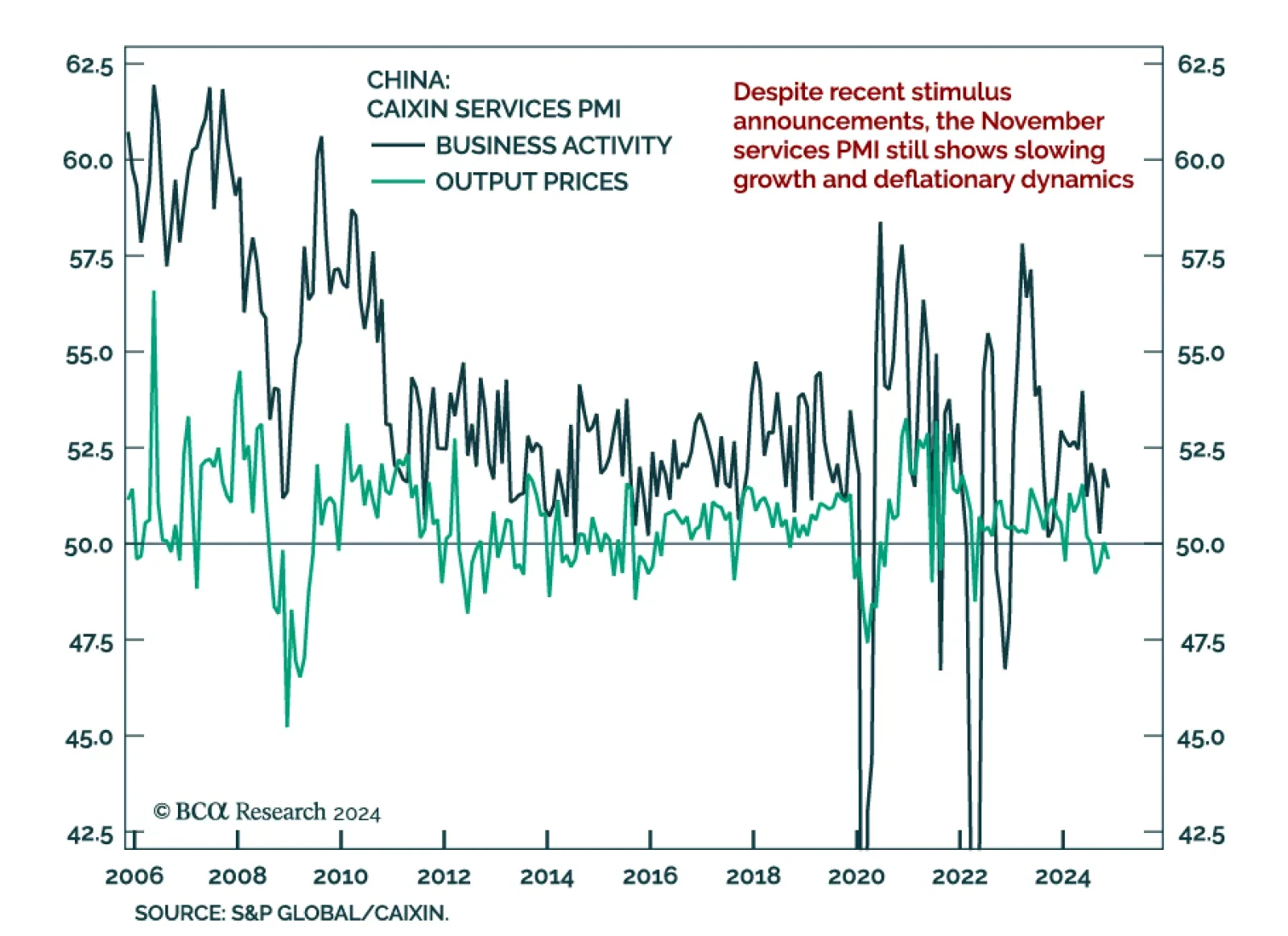

Chinese deflationary pressures intensified in November, with CPI ticking down to 0.2% y/y from 0.3% in October. Producer prices deflation eased, with prices falling 2.5% y/y, less than -2.9% y/y a month prior. The weak data…

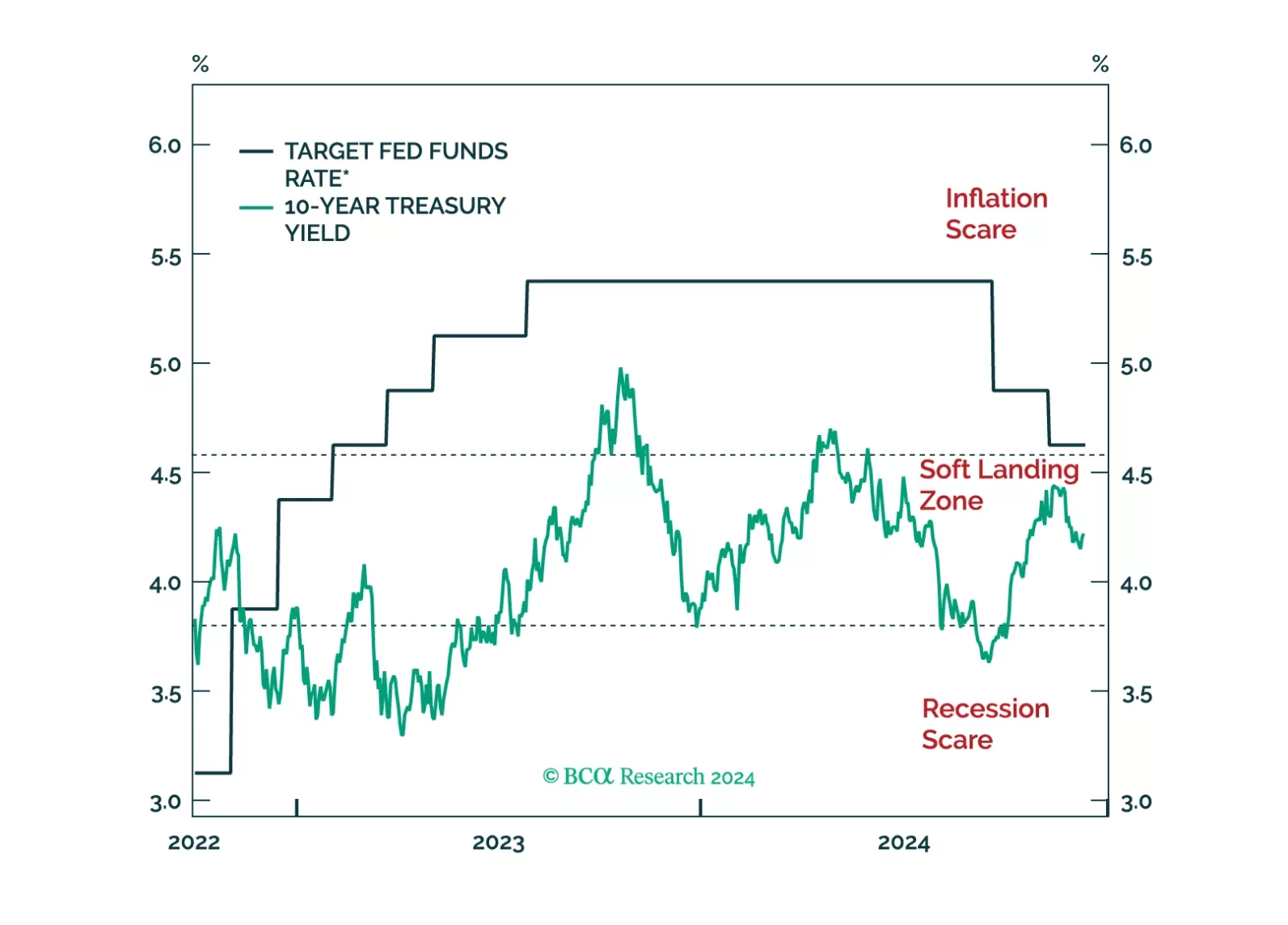

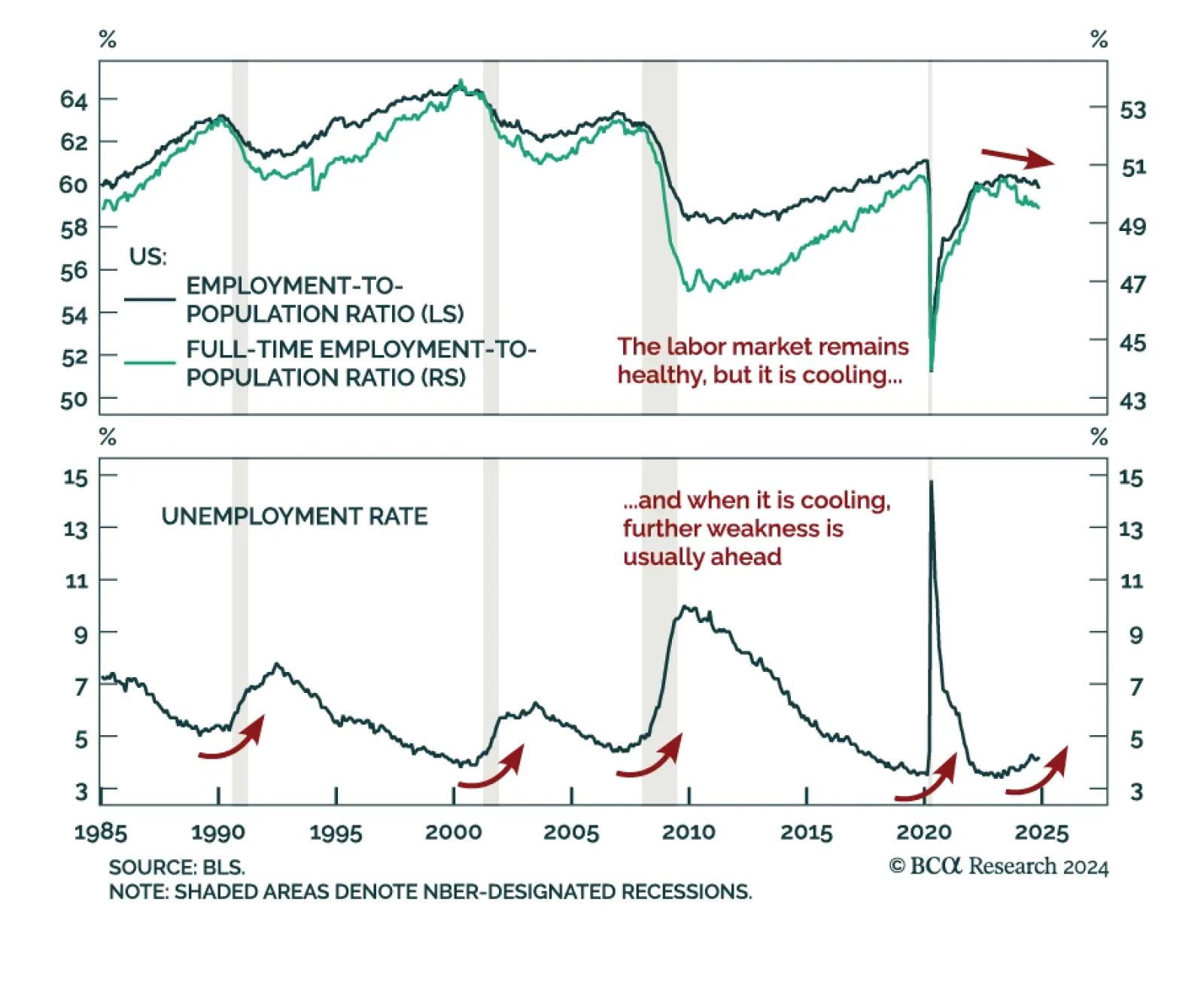

The US November jobs report was mixed. Payrolls rose by 227k vs. an upwardly revised 36k in October, leaving the 3-month moving average at 173k. The unemployment and underemployment rates however rose 0.1% to 4.2% and 7.8%,…

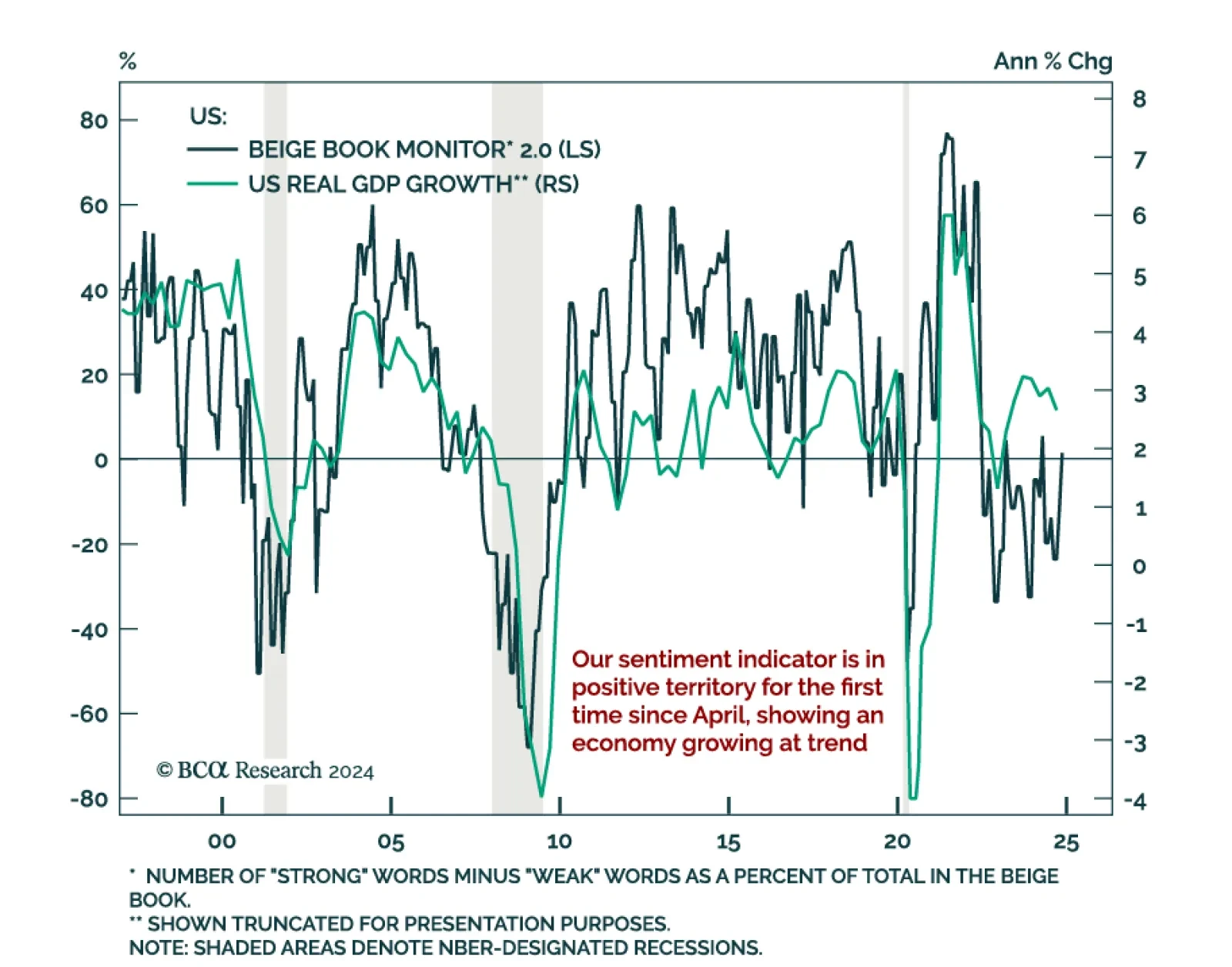

The Federal Reserve’s Beige Book shows a modestly growing economy imbued with post-election optimism, while highlighting some caution about employment. The latest Beige Book is in line with other sentiment indicators…

The November Caixin services PMI ticked down to 51.5, which along with a rising manufacturing PMI pushed the composite up to 52.3 from 51.9. Components such as new orders and employment also ticked down, and output prices fell to…

The November ISM Services PMI missed expectations, declining to 52.1 from 56 in October. All subcomponents declined, with new orders falling from 57.4 to 53.7. Employment also weakened but remains in expansion, while price…

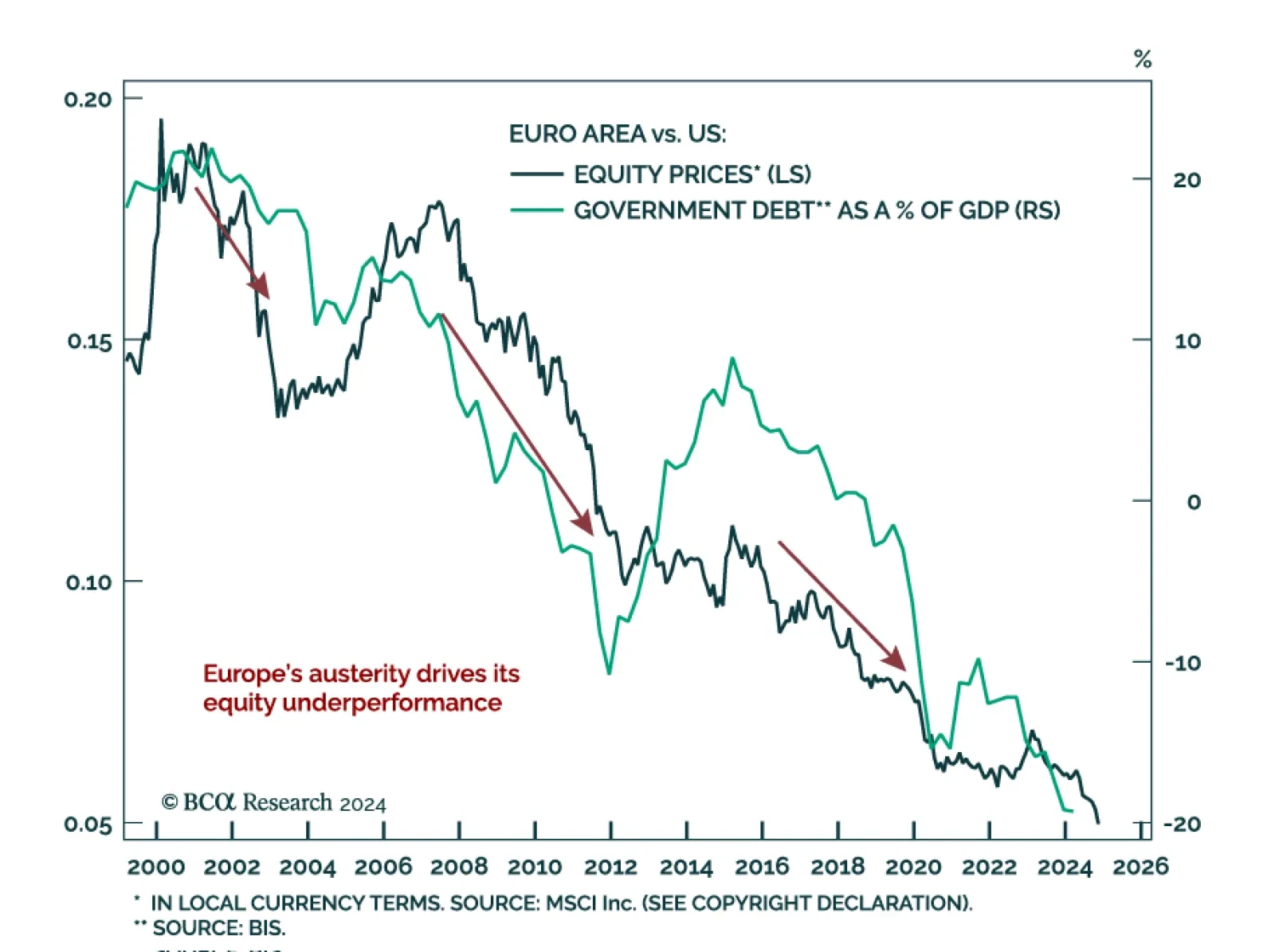

Our European Investment Strategy and GeoMacro Strategy teams published a joint report, digging into the structural challenges behind Europe’s economic underperformance, while pointing out to potential turnaround…

Job openings beat expectations in October, increasing to 7.74m from 7.44m in September. The details of the JOLTS report were mixed, however. Hires ticked down, driven by interest rate-sensitive sectors. Outside of hires, the rest…