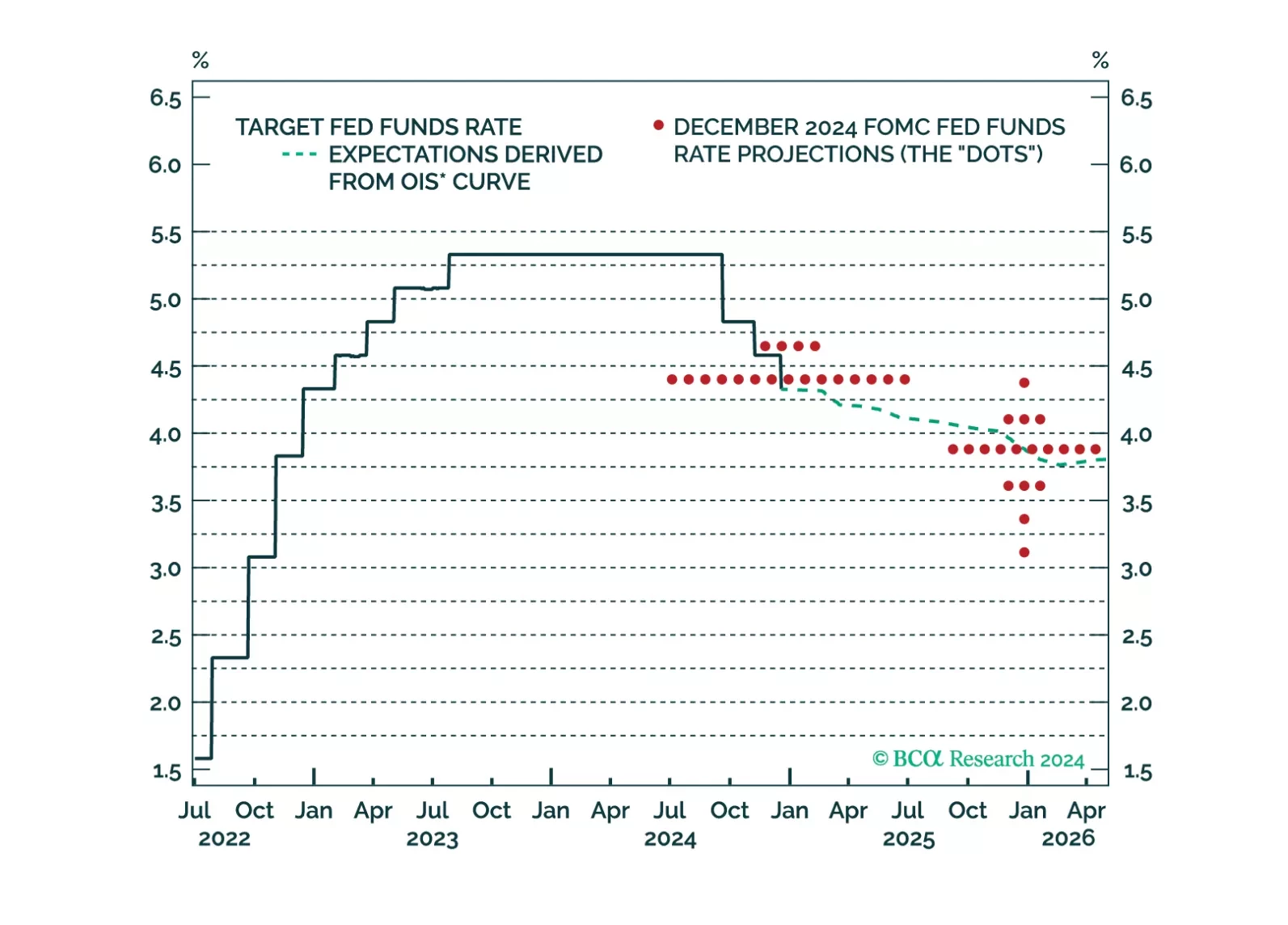

Our thoughts on this afternoon’s Fed decision and the bond market reaction.

November retail sales were roughly in line with expectations, with headline growth at 0.7% m/m vs. 0.4% in October. Vehicle sales were solid. Excluding auto and gas, sales rose a more modest 0.2% m/m, below expectations. The…

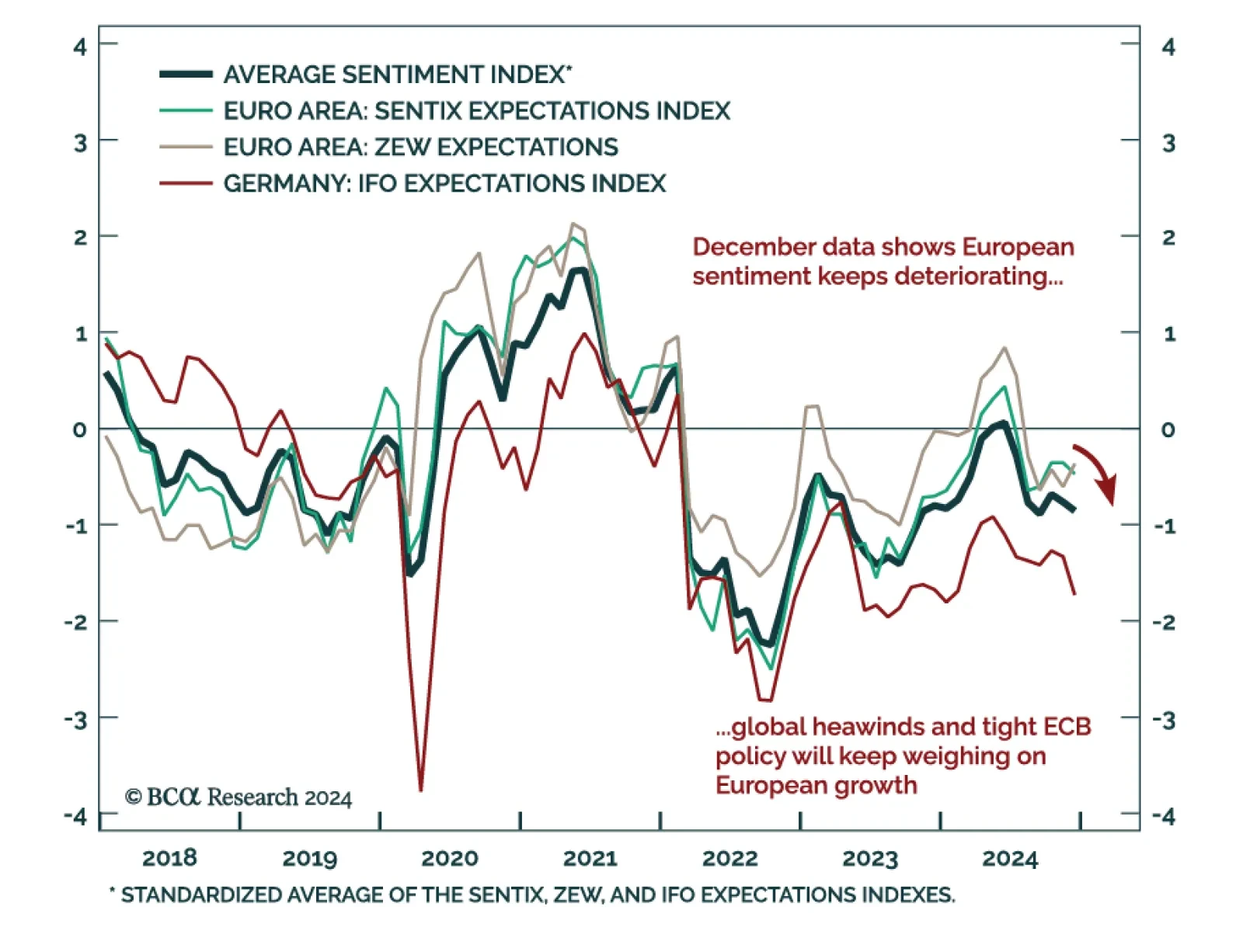

European sentiment data was mixed. The December Ifo Business Climate index for Germany missed estimates and was down 1 point to 84.7 from November. The decrease came from its expectations component, which fell to 84.4 from 87.2.…

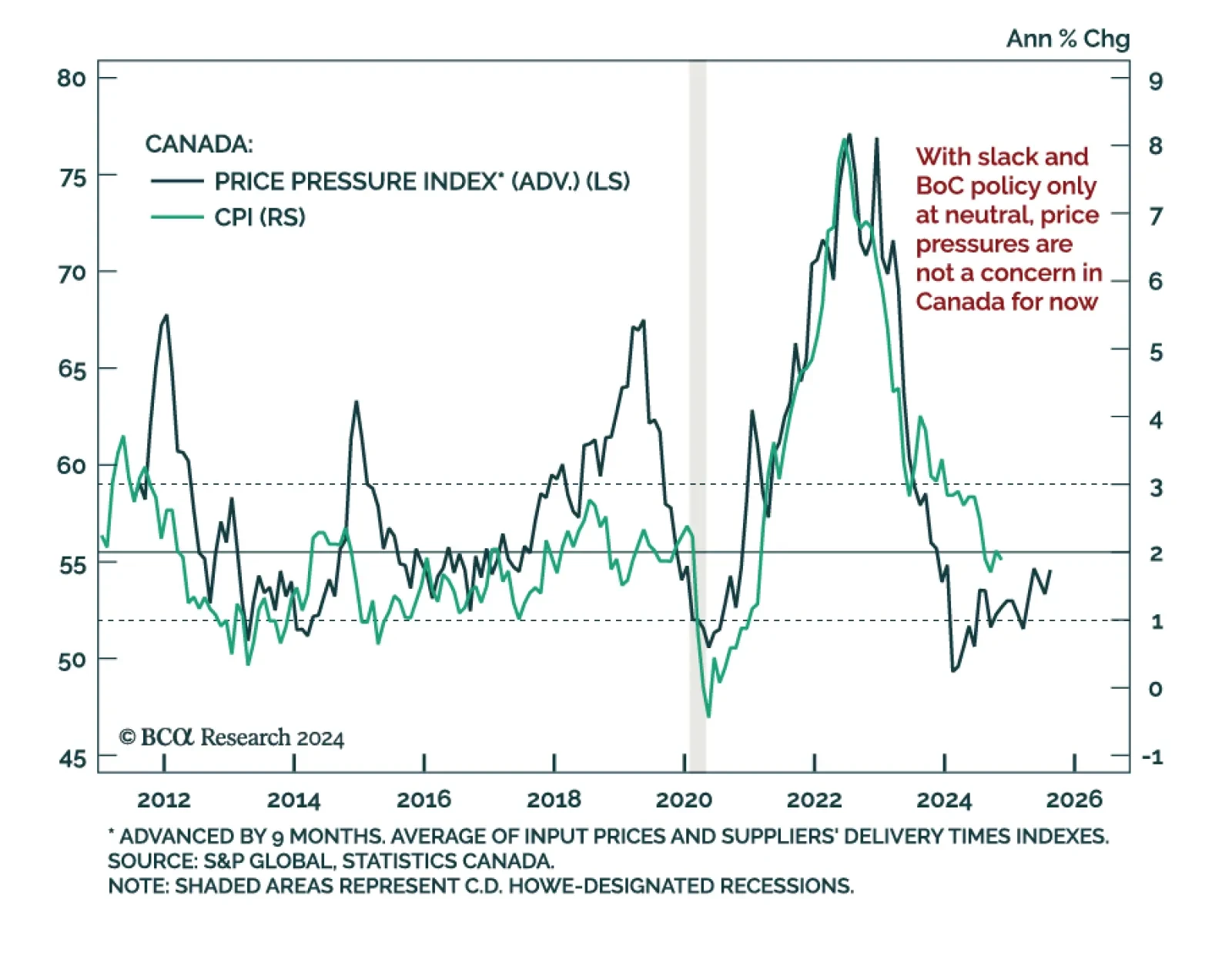

The November Canadian CPI was slightly below estimates, declining to 1.9% y/y from 2.0%, below the BoC’s 2% target but within the 1%-to-3% range. The BoC’s favored core measures, median and trim, were flat at 2.6% and…

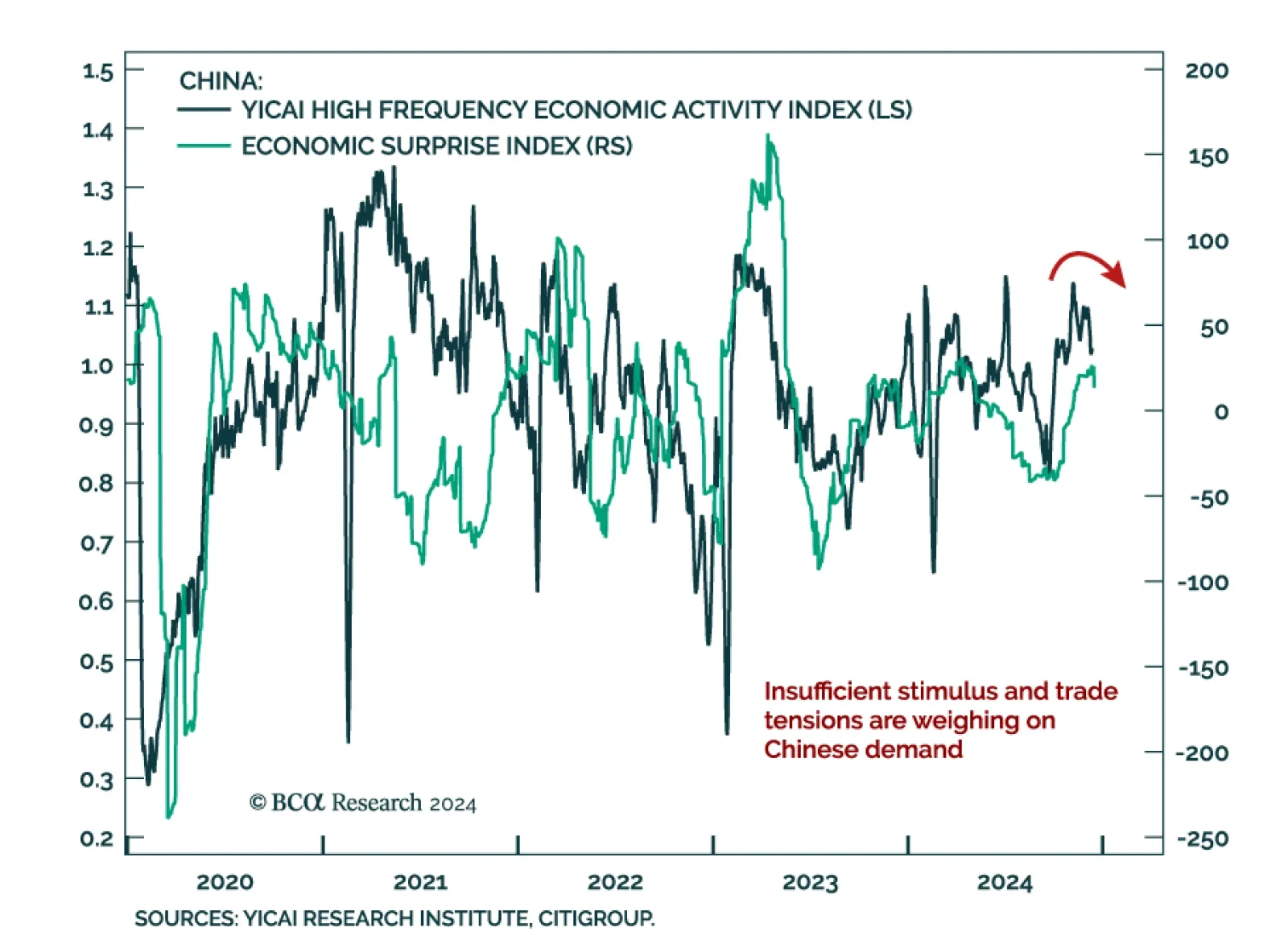

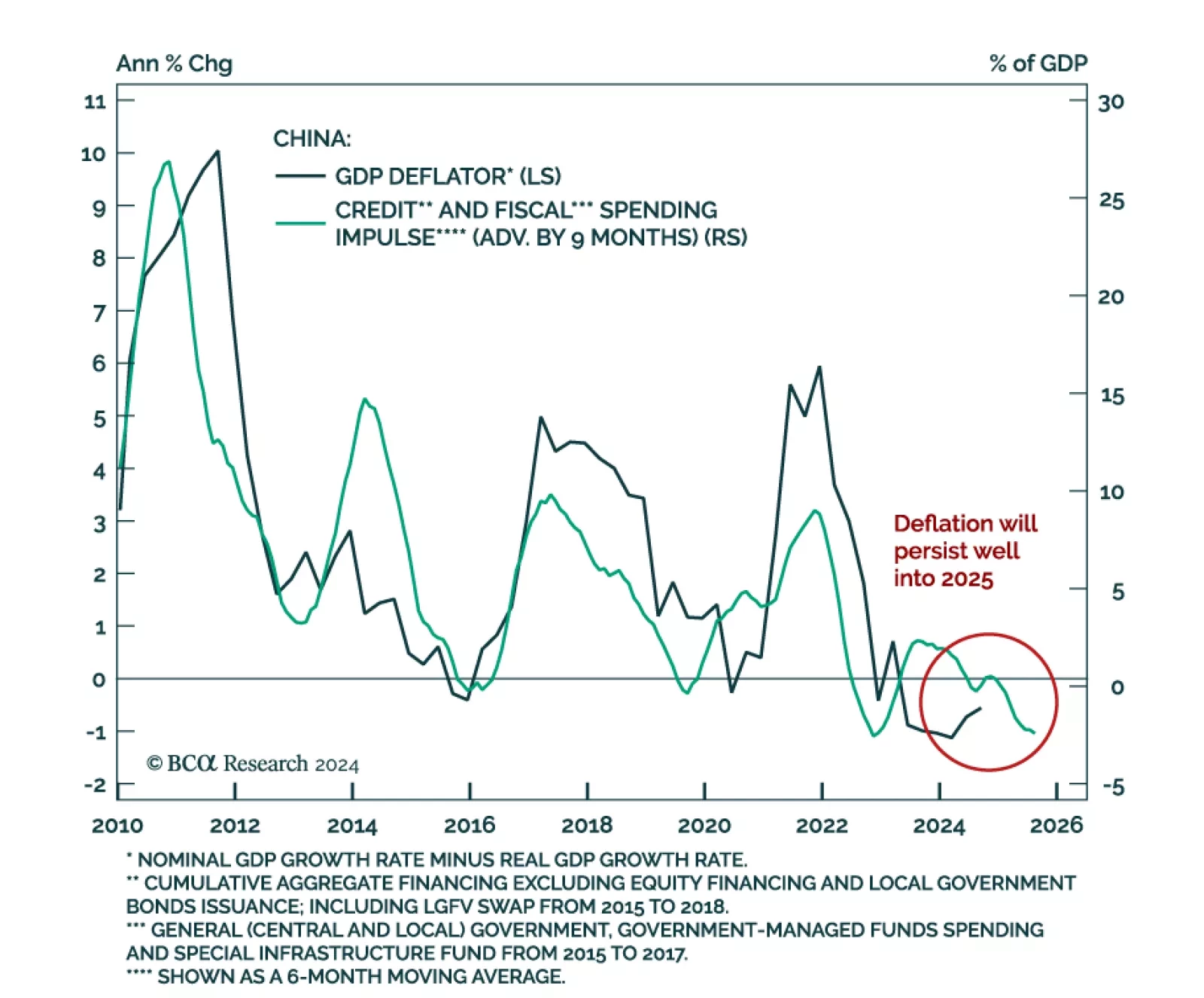

Chinese activity indicators were mixed in November, reflecting the dynamic of a resilient supply side coupled with weak demand. Industrial production growth was roughly flat at 5.4% y/y vs. 5.3% in October, while retail sales…

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

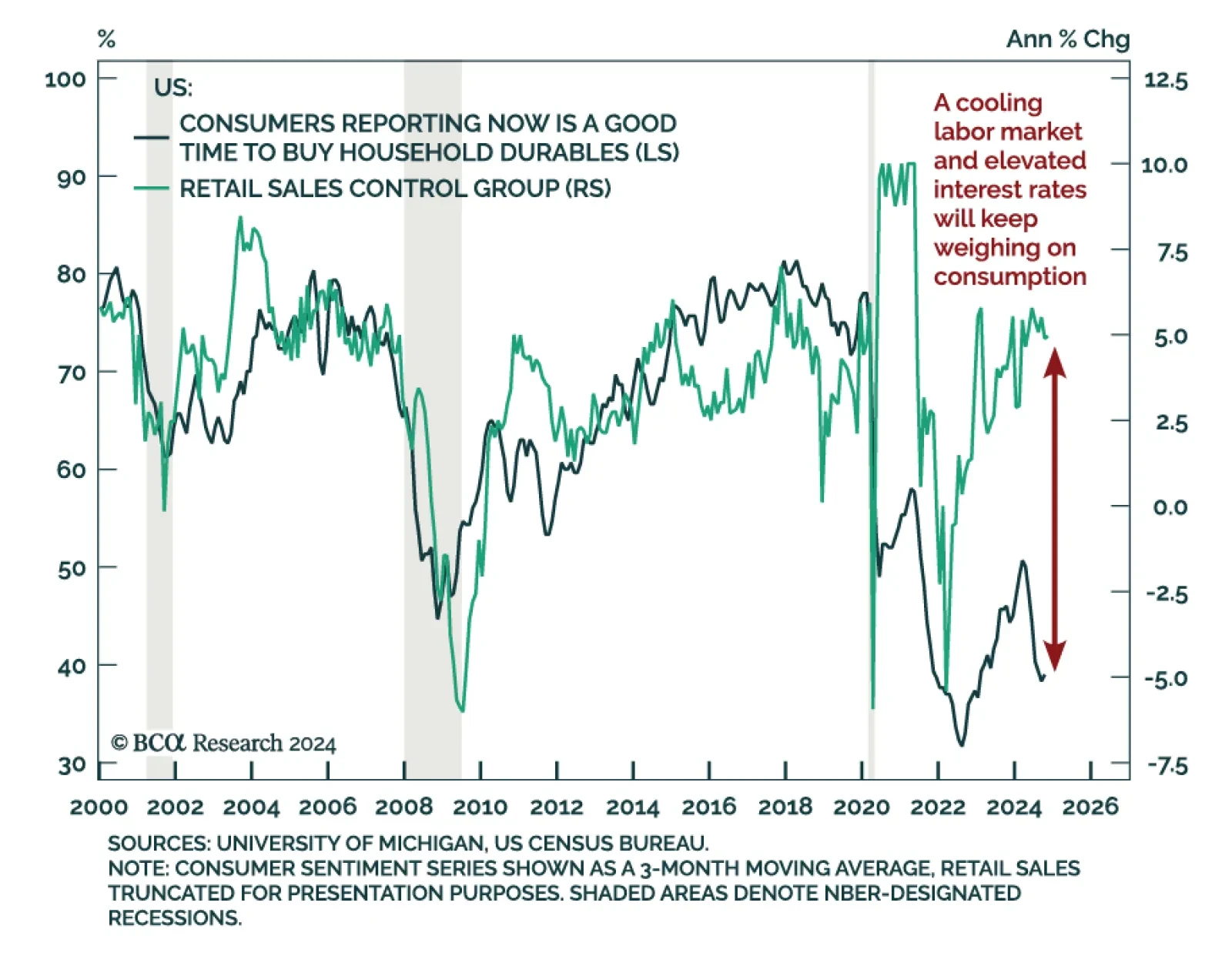

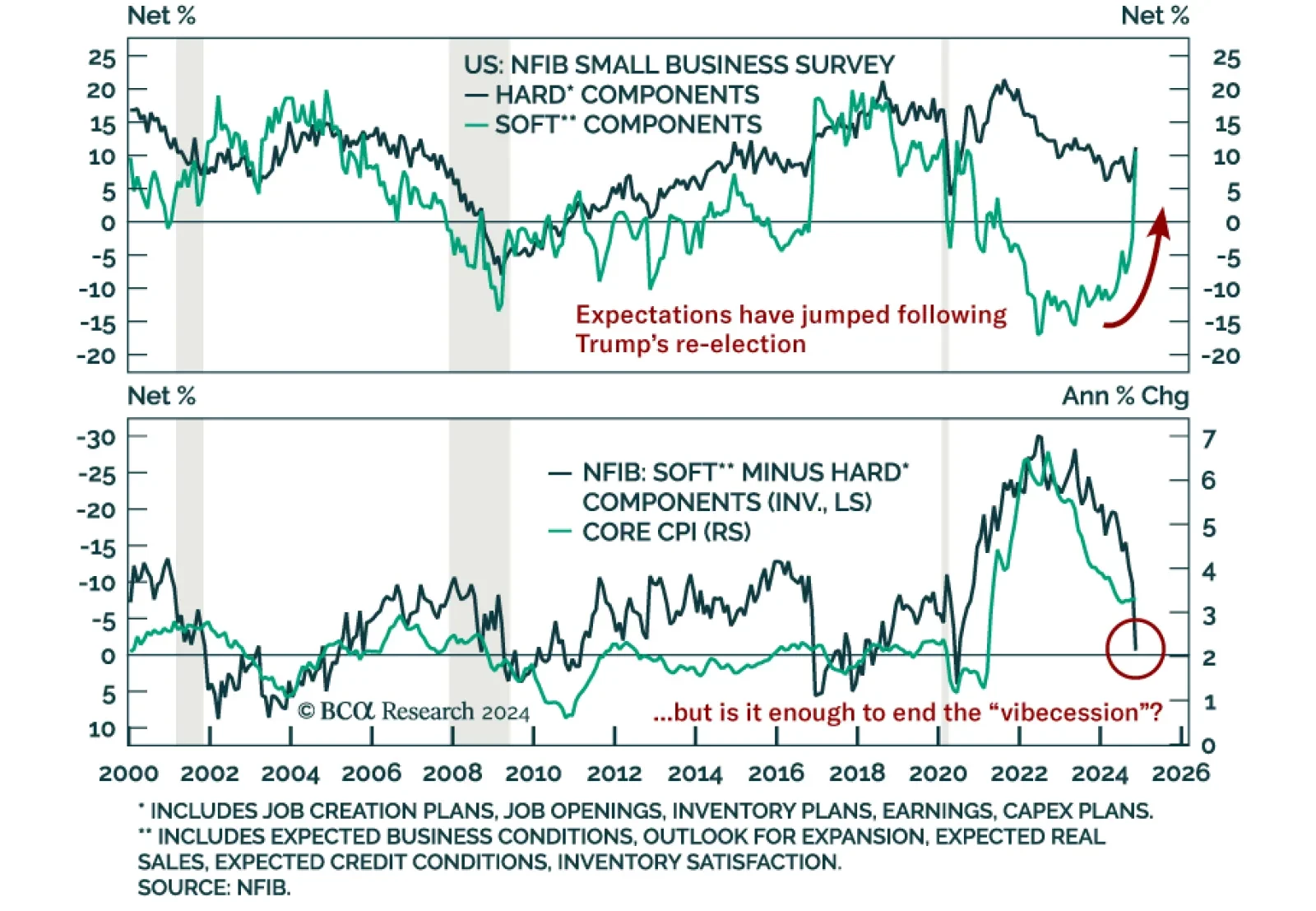

The post-COVID US recovery was different from previous cycles. Despite an ebullient economy, US consumers and firms have just not been feeling it, as reflected by the depressed signals from so-called soft, survey-based indicators…

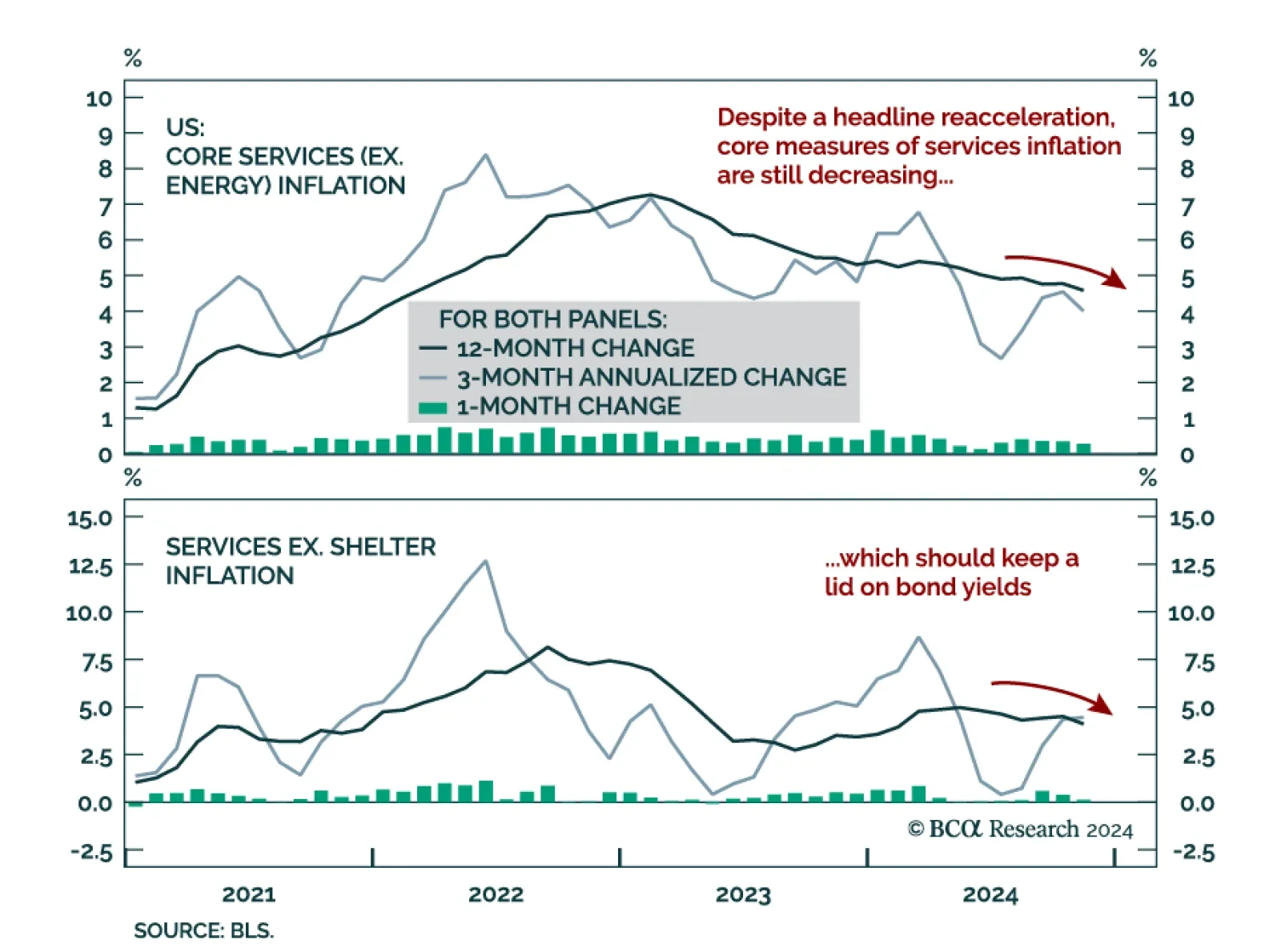

The November CPI came in line with expectations, accelerating to 0.3% m/m (2.7% y/y) from 0.2% (2.6% y/y) in October. Core also printed at 0.3% m/m, the same as October and remaining at 3.3% y/y. The acceleration was mainly…

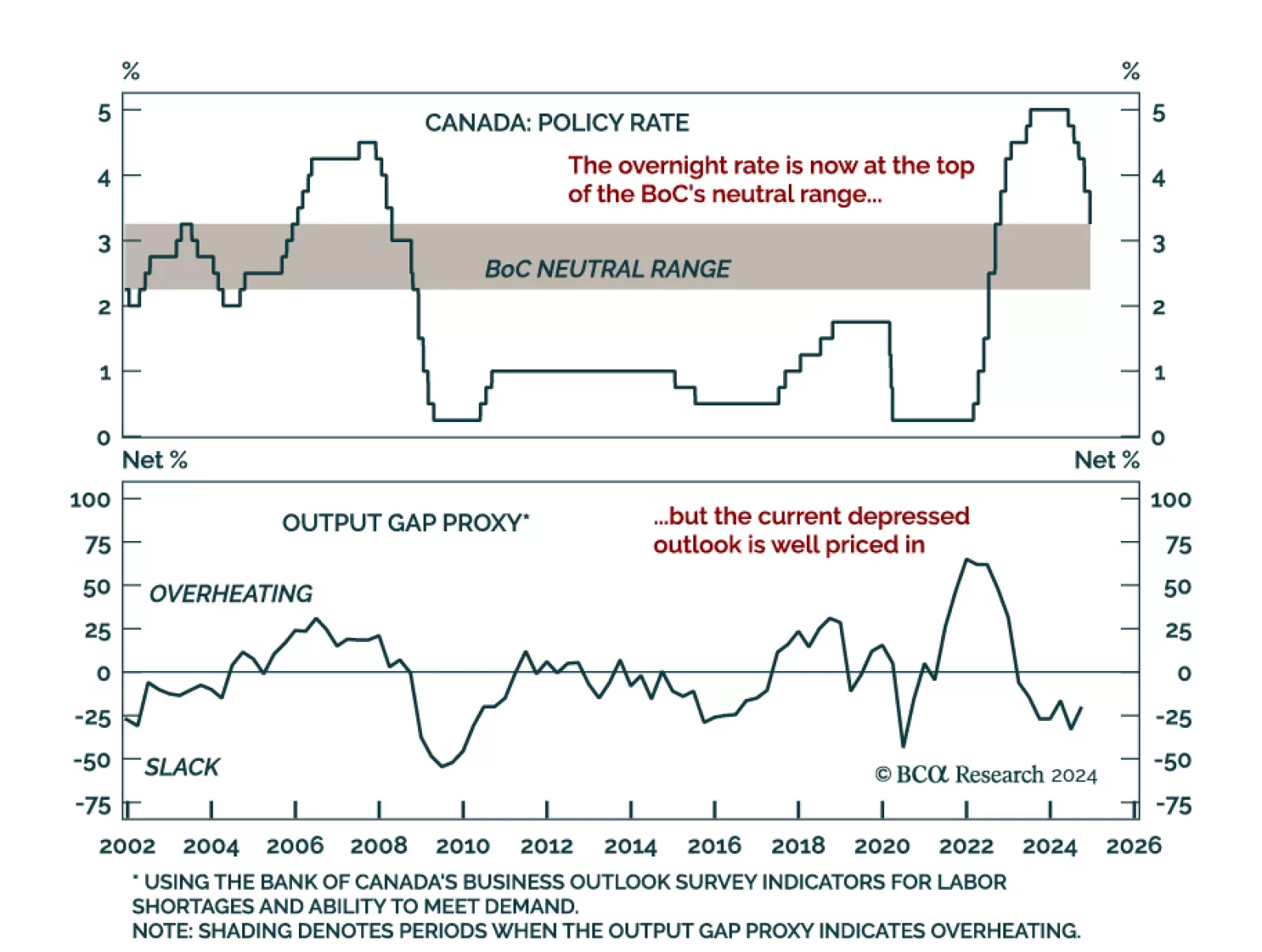

The Bank of Canada cut the overnight rate by 50 bps to 3.25%, a move predicted by economists and roughly priced in. The consecutive supersized cut brings the policy rate in the upper end of the 2.25%-to-3.25% range the BoC…