Our Portfolio Allocation Summary for January 2025.

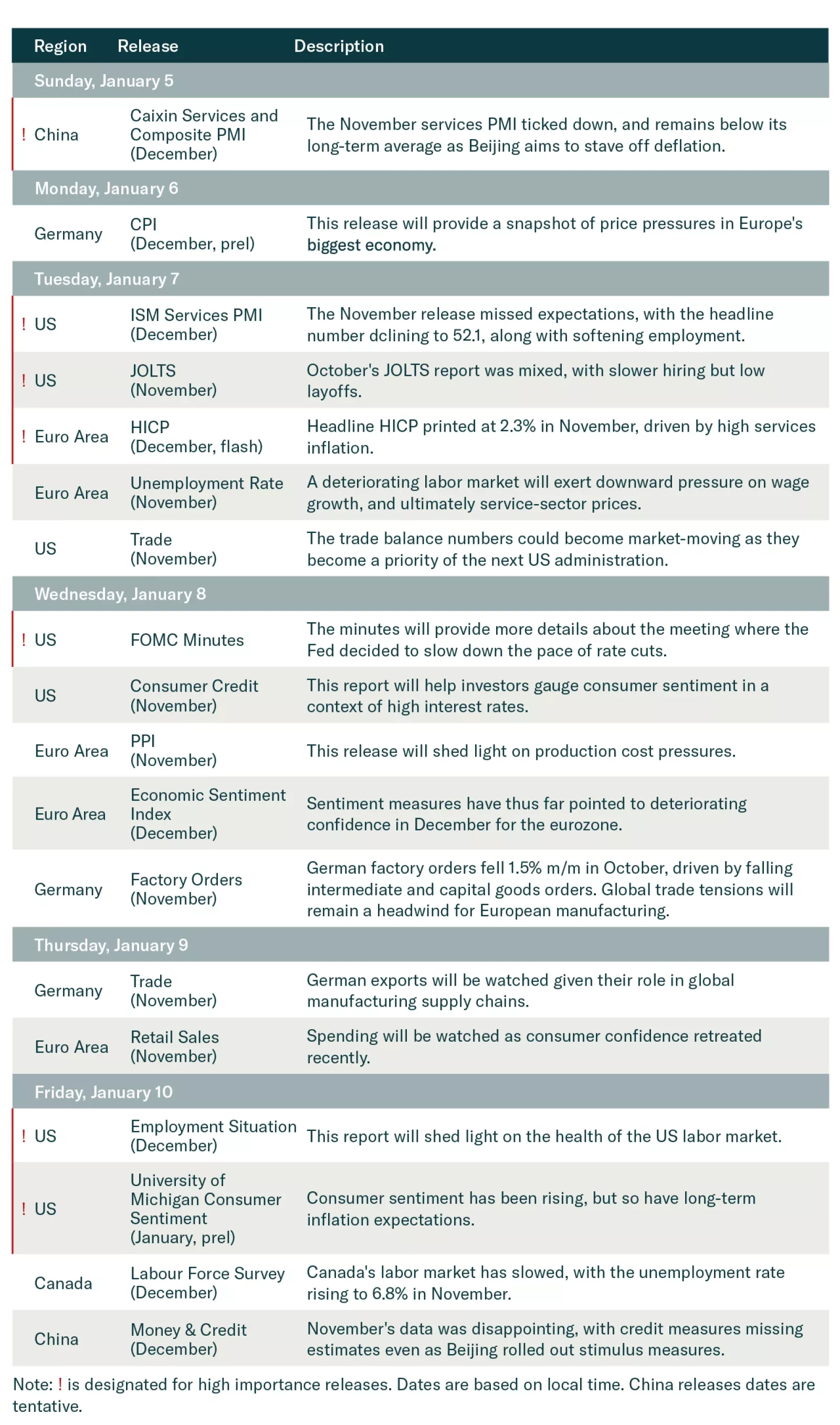

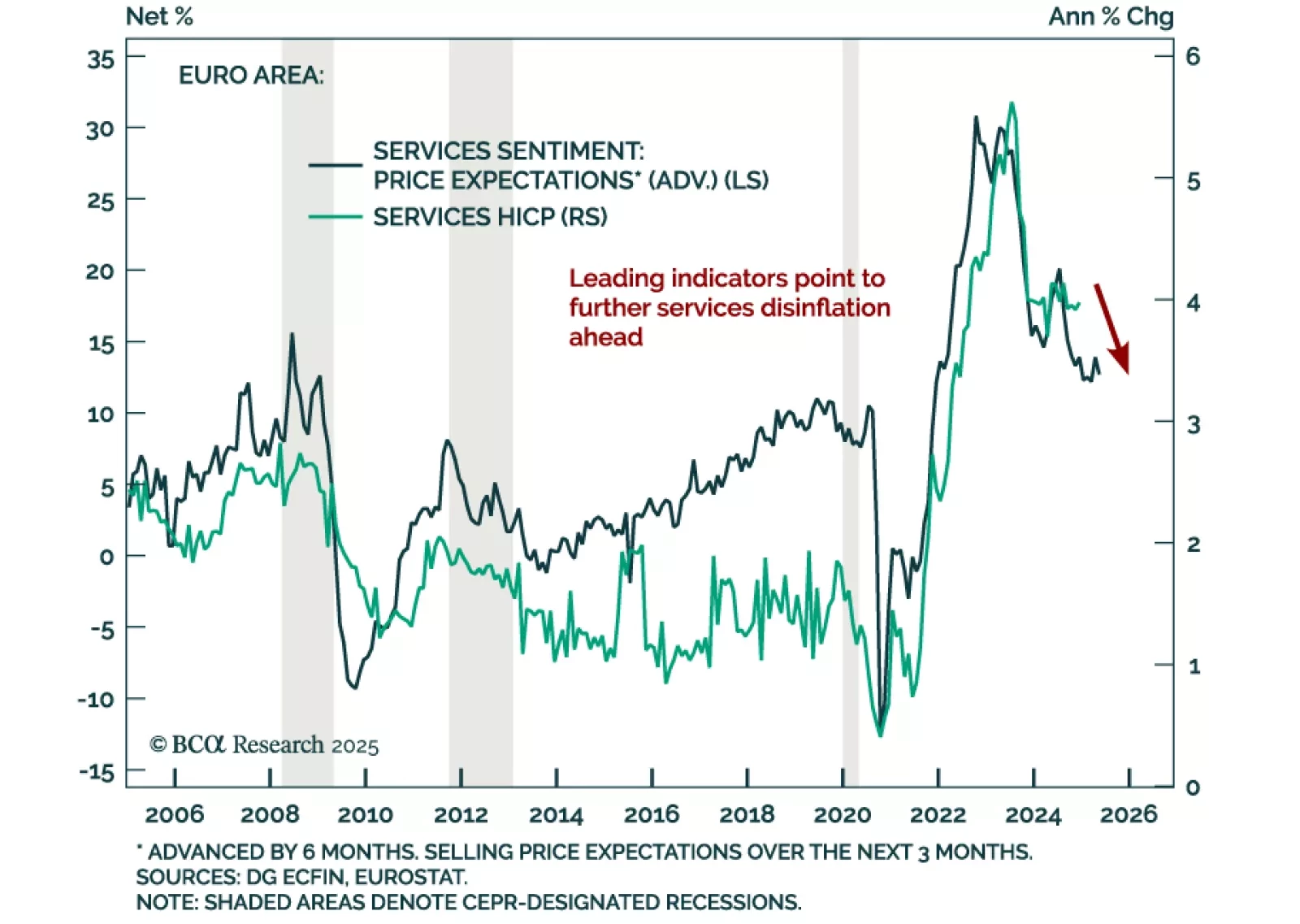

December euro area inflation met expectations, with headline HICP printing at 2.4% y/y from 2.2% in November, and core steady at 2.7%, above the ECB’s target. Services inflation remains elevated at 4.0% y/y, up from 3.9% a month…

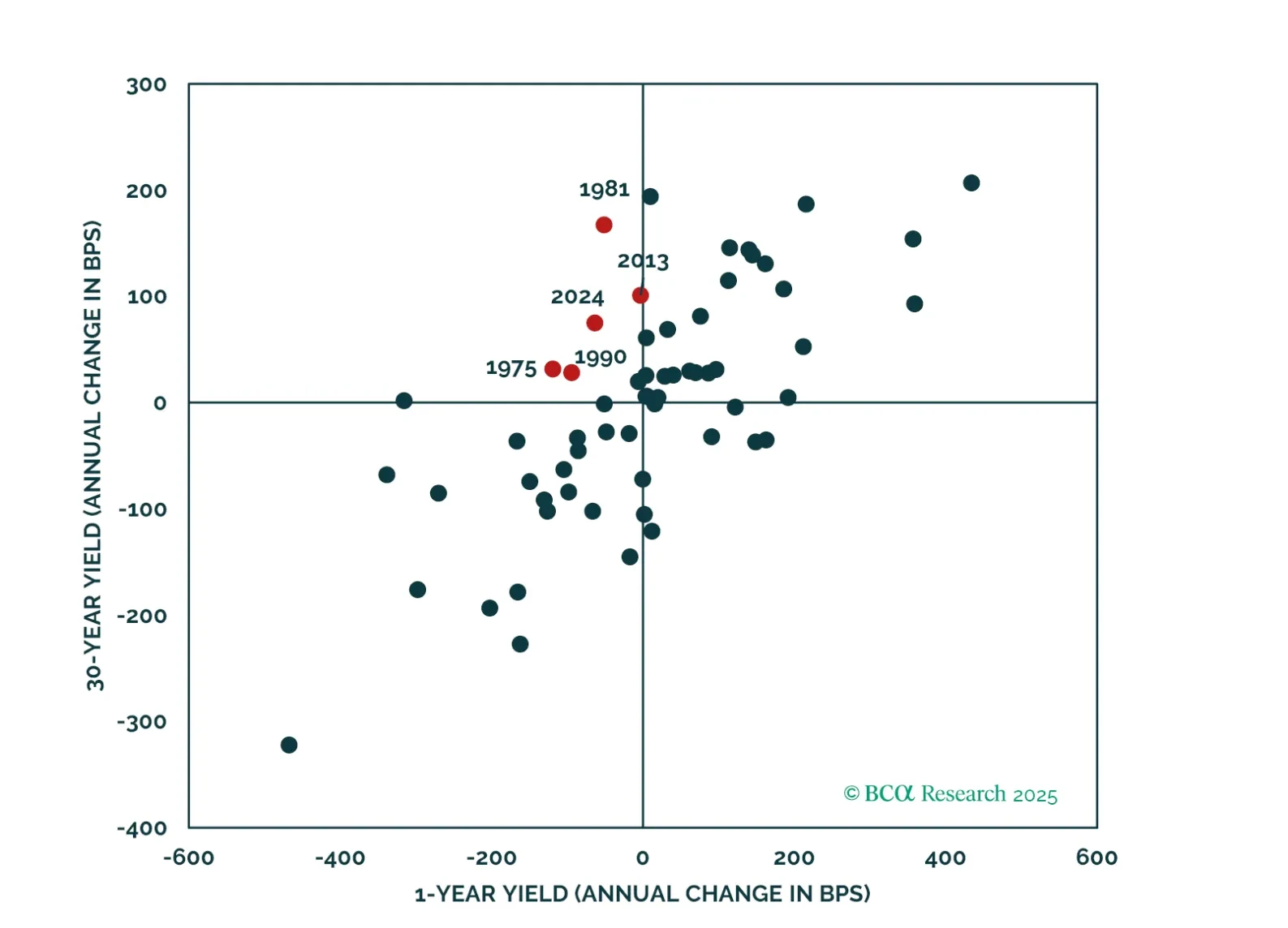

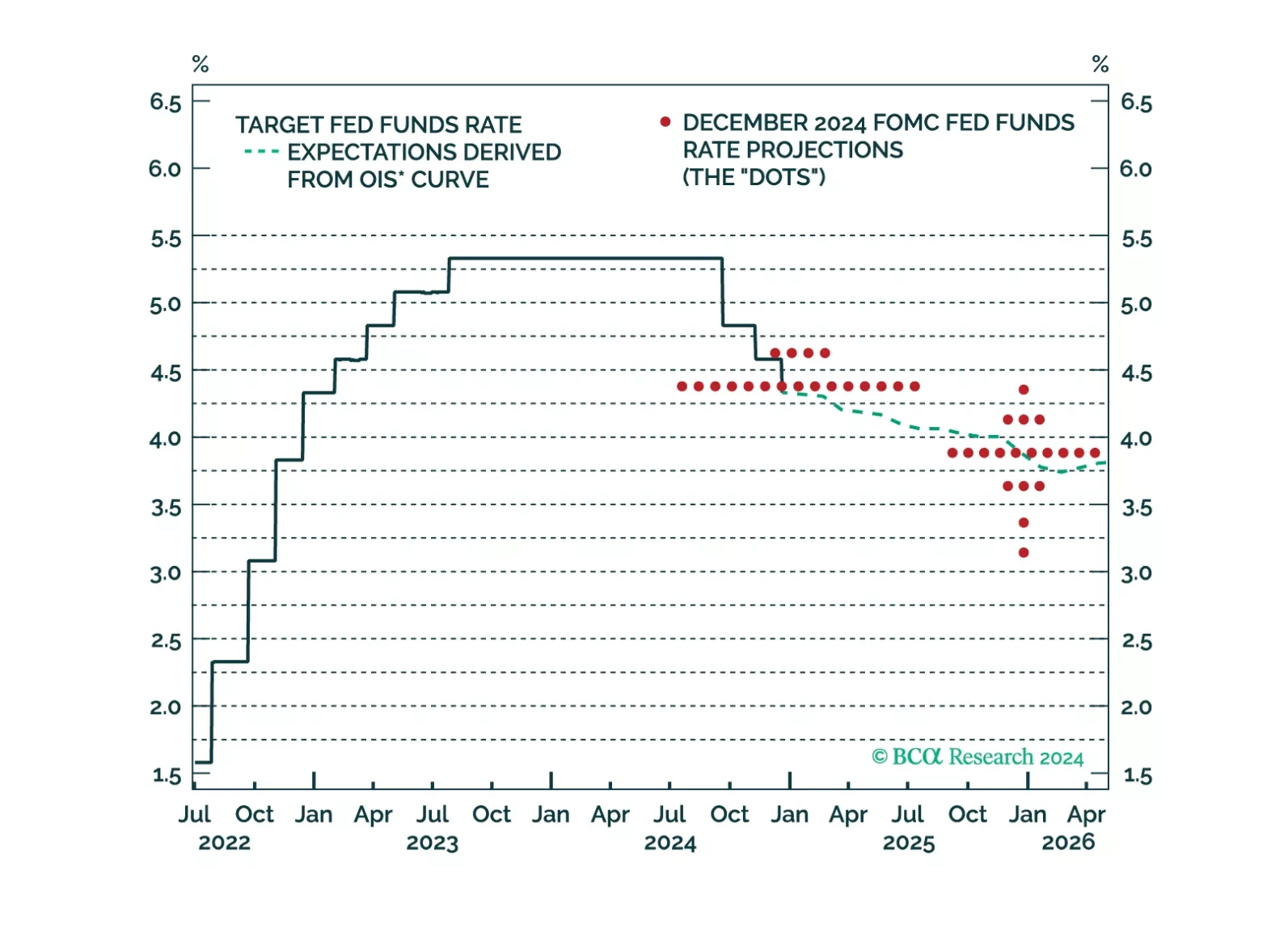

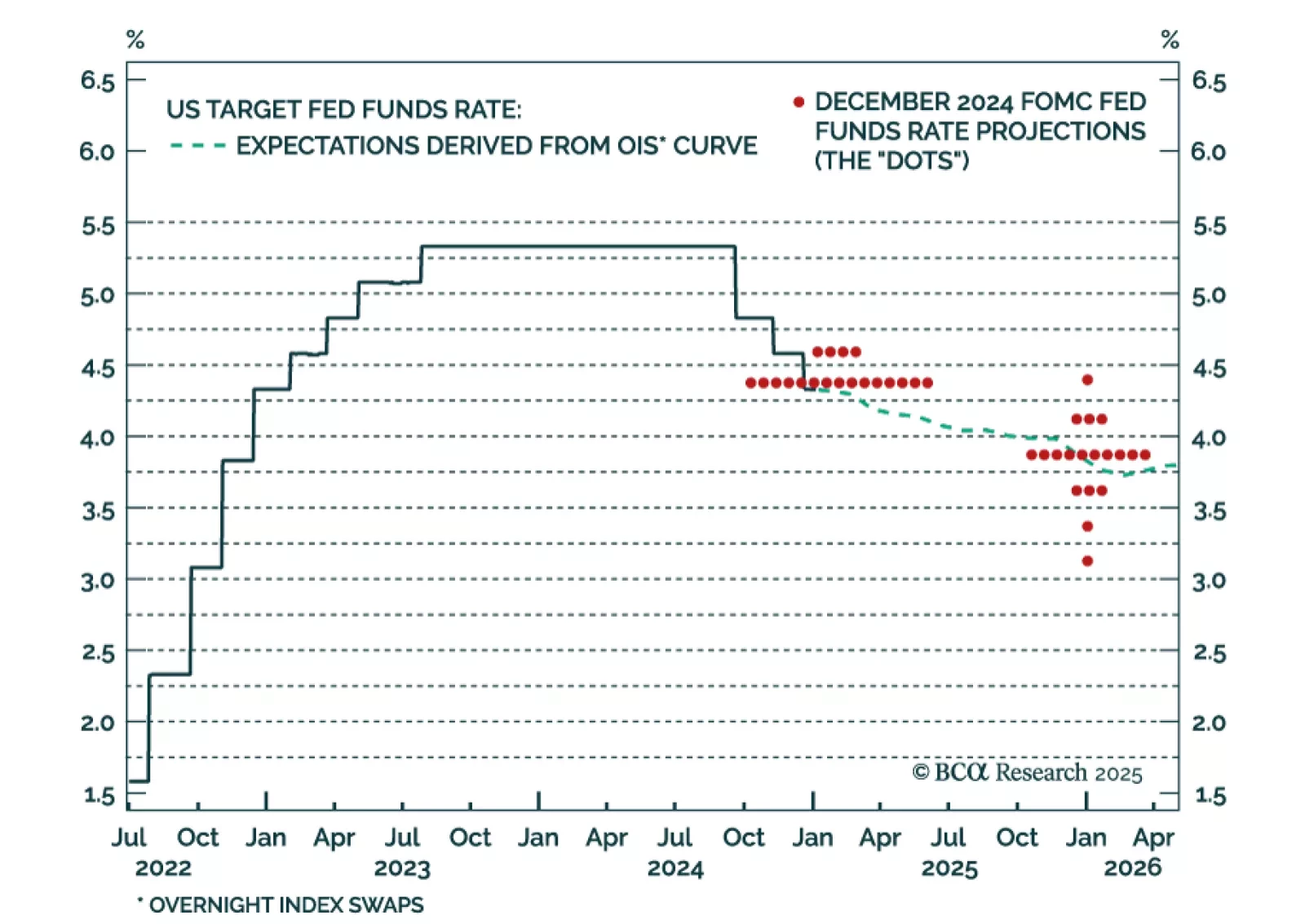

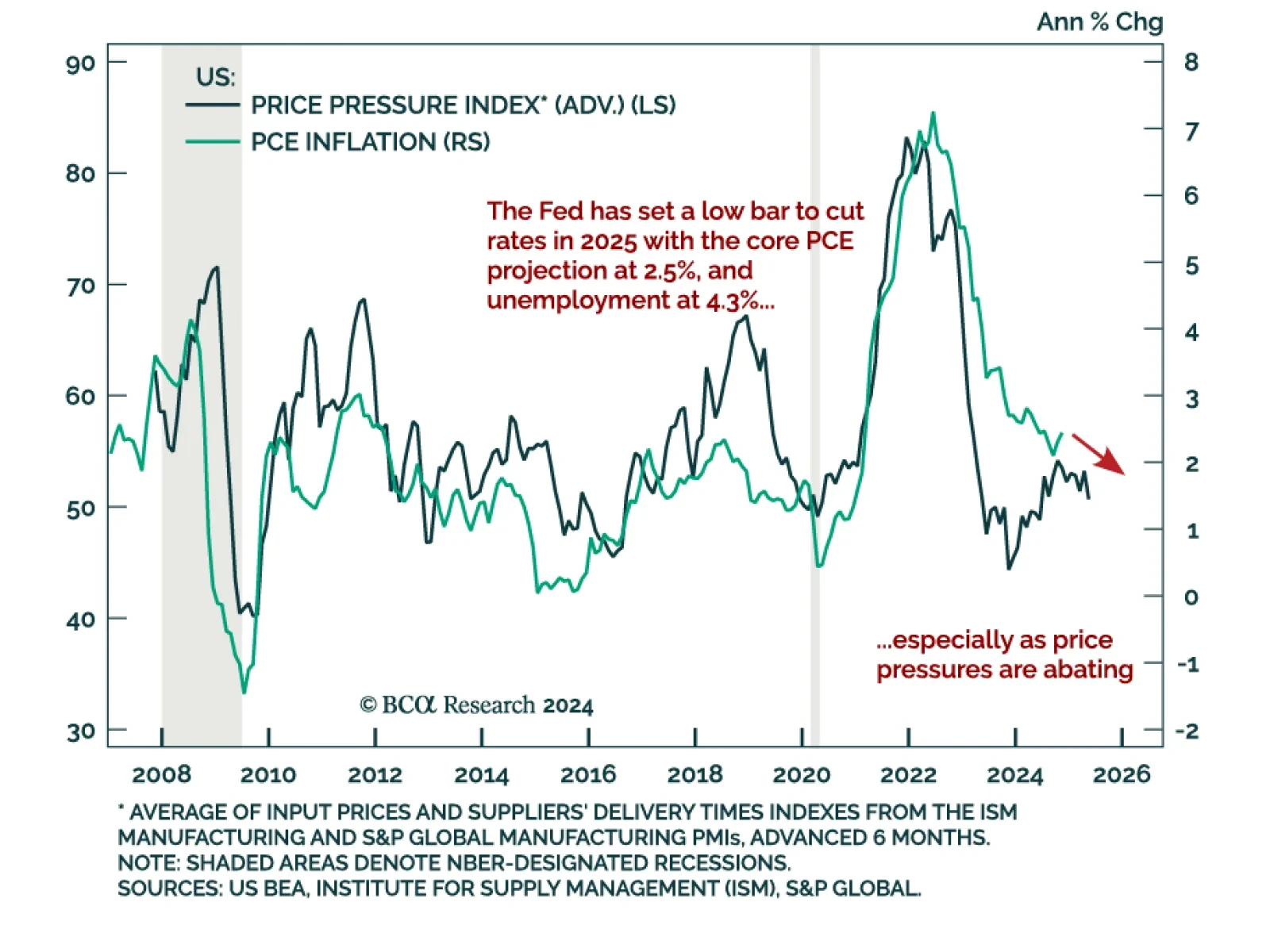

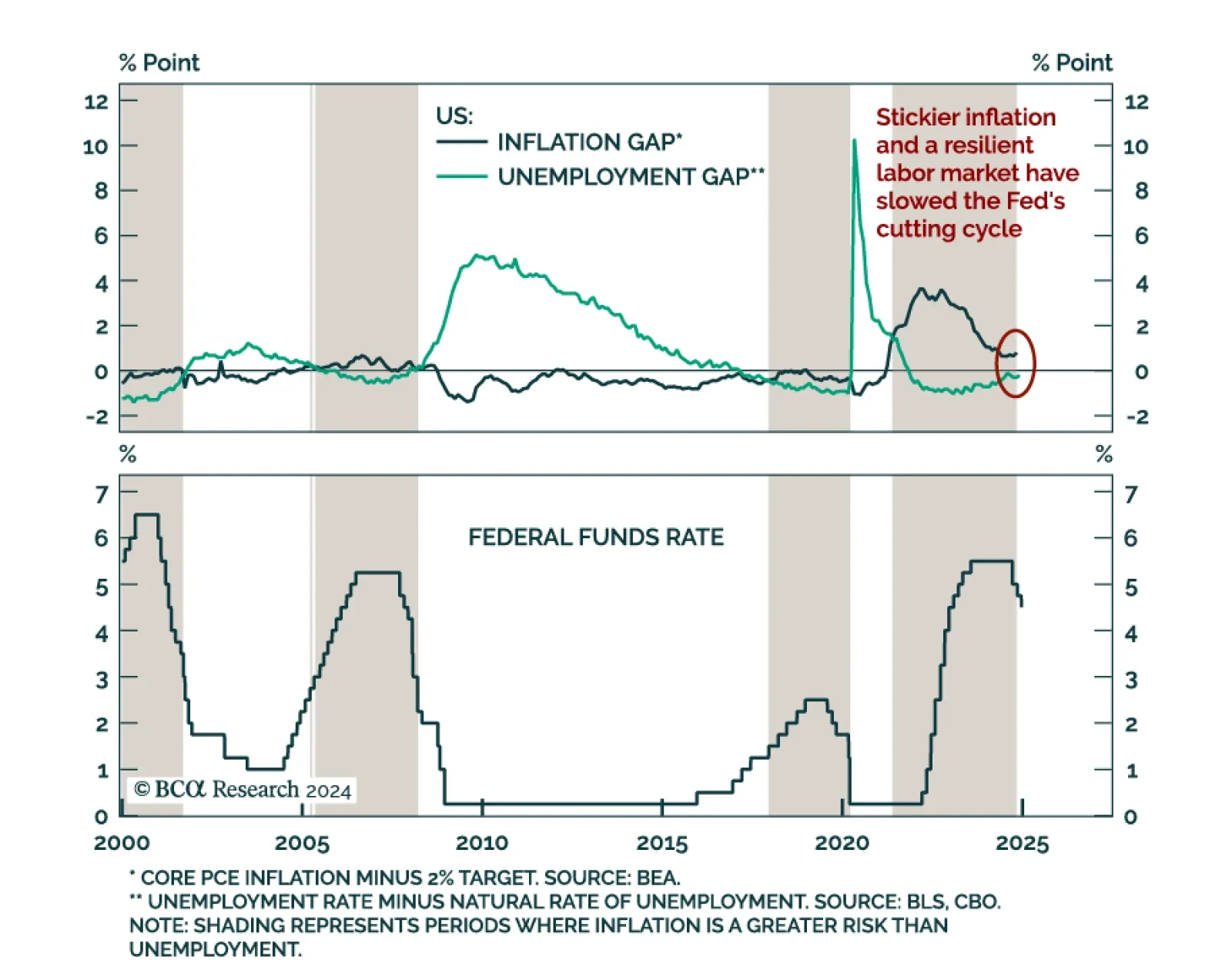

Our US Bond Strategy team published their outlook for the Fed in 2025. They expect more cuts than the 50 bps signaled by the Fed at its December meeting. Core PCE inflation is tracking well below the Fed’s 2.5% forecast, while…

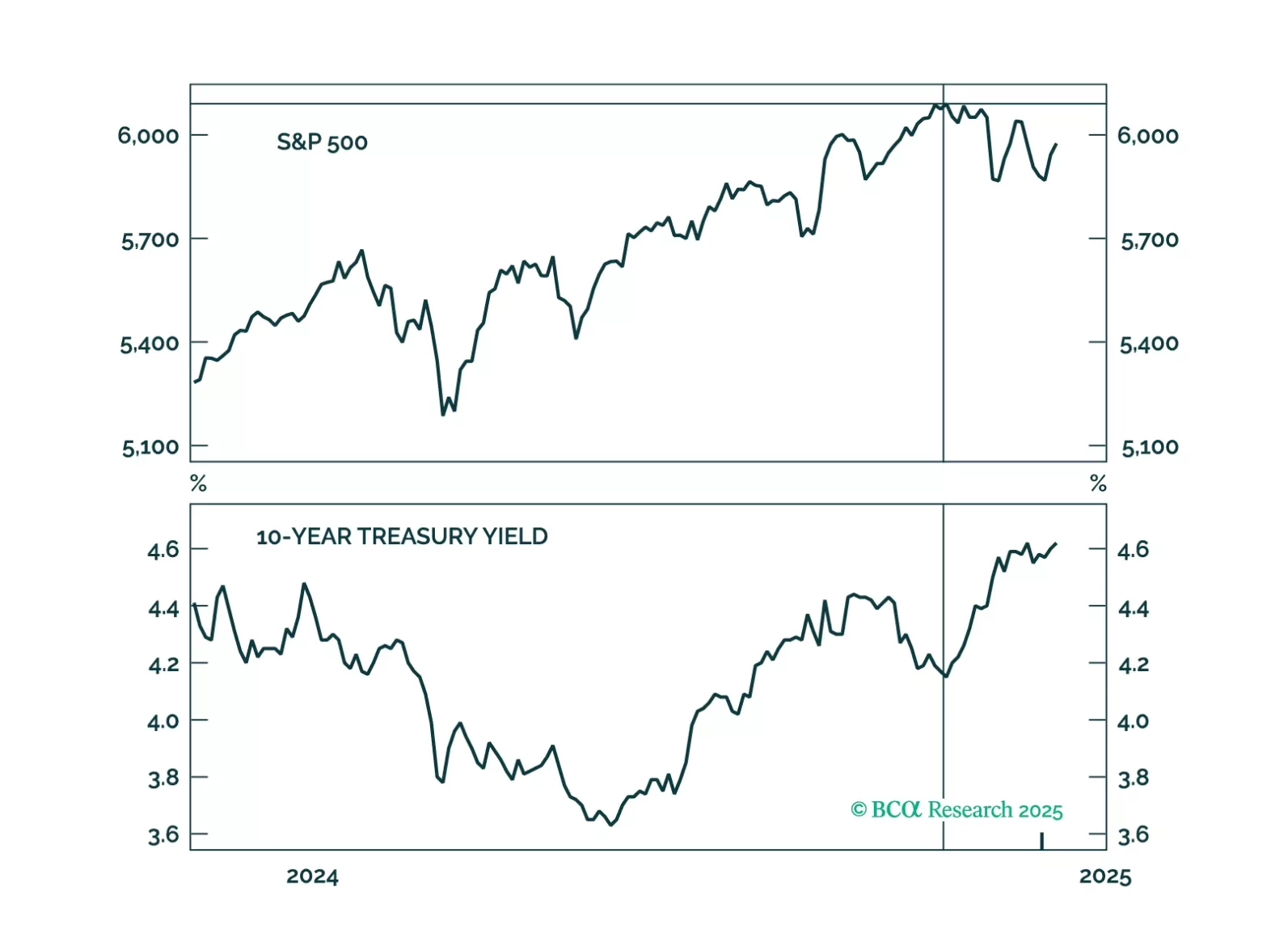

Paradoxically, raging optimism on the US economy is making a reacceleration in growth less likely in 2025. The reaction of the bond market has made the Fed rethink its cutting campaign. Markets are also constraining Trump’s agenda.…

The Fed’s preferred measure of inflation, core PCE, came in below expectations at 0.1% m/m in November, remaining steady at 2.8% y/y. The monthly advance was the lowest since May. The inflation deceleration was broad-based. Core…

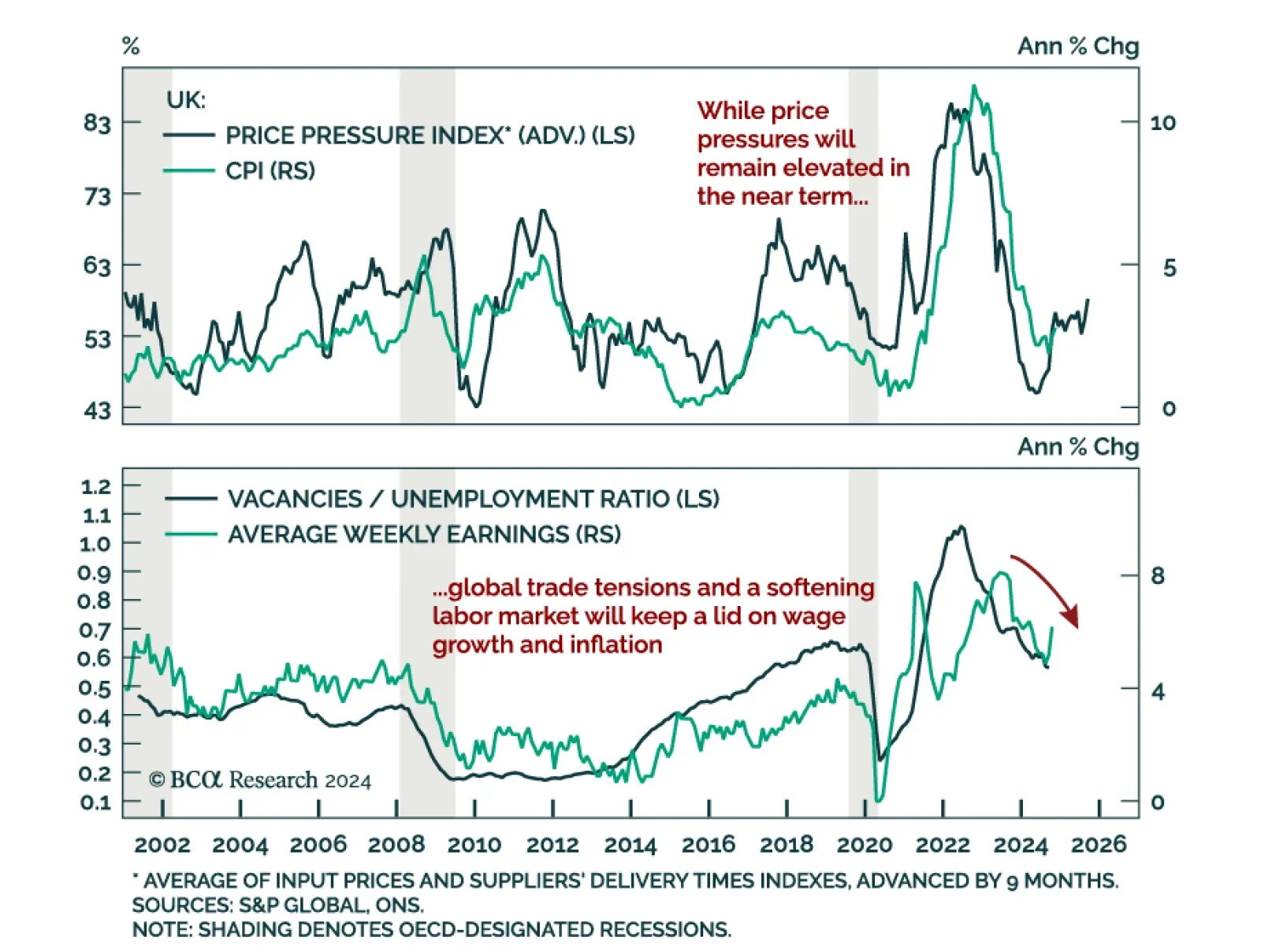

The November UK CPI, in line with estimates, hit an eight-month high, accelerating from 2.3% y/y to 2.6%. Core and services inflation were also strong at 3.5% (vs. 3.3% in October) and 5.0% (flat from October), respectively.…

The Federal Reserve cut the fed funds rate by 25 bps to a 4.25%-4.5% range, as expected. However, it was a “hawkish cut”; the FOMC signaled a slower pace of easing ahead. The statement signalled less urgency, saying…

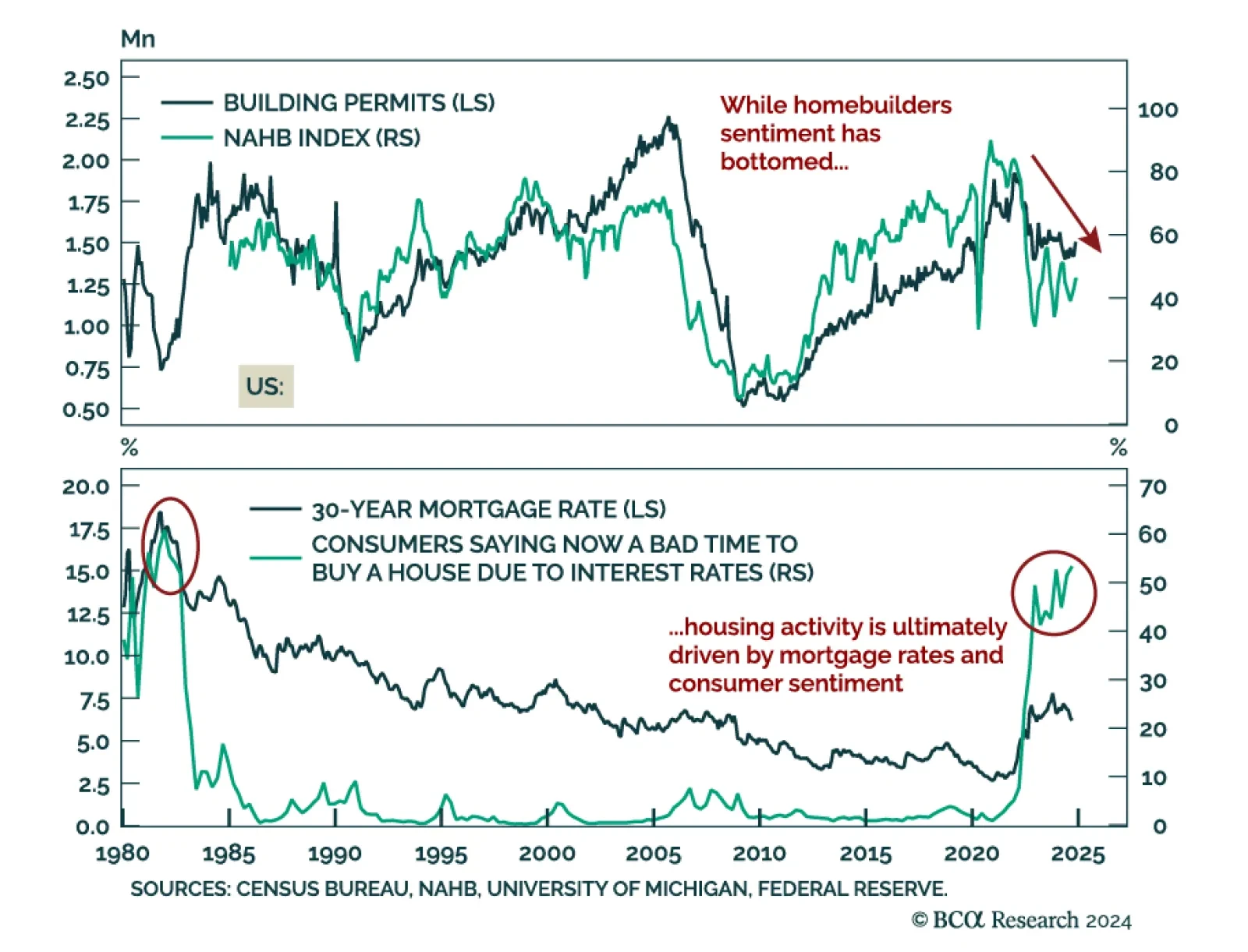

US November housing data was mixed, but still reflected a weak picture. Housing starts were down 1.8% m/m, below expectations of a 2.6% increase. However, building permits were stronger than expected, increasing 6.1%. Units under…