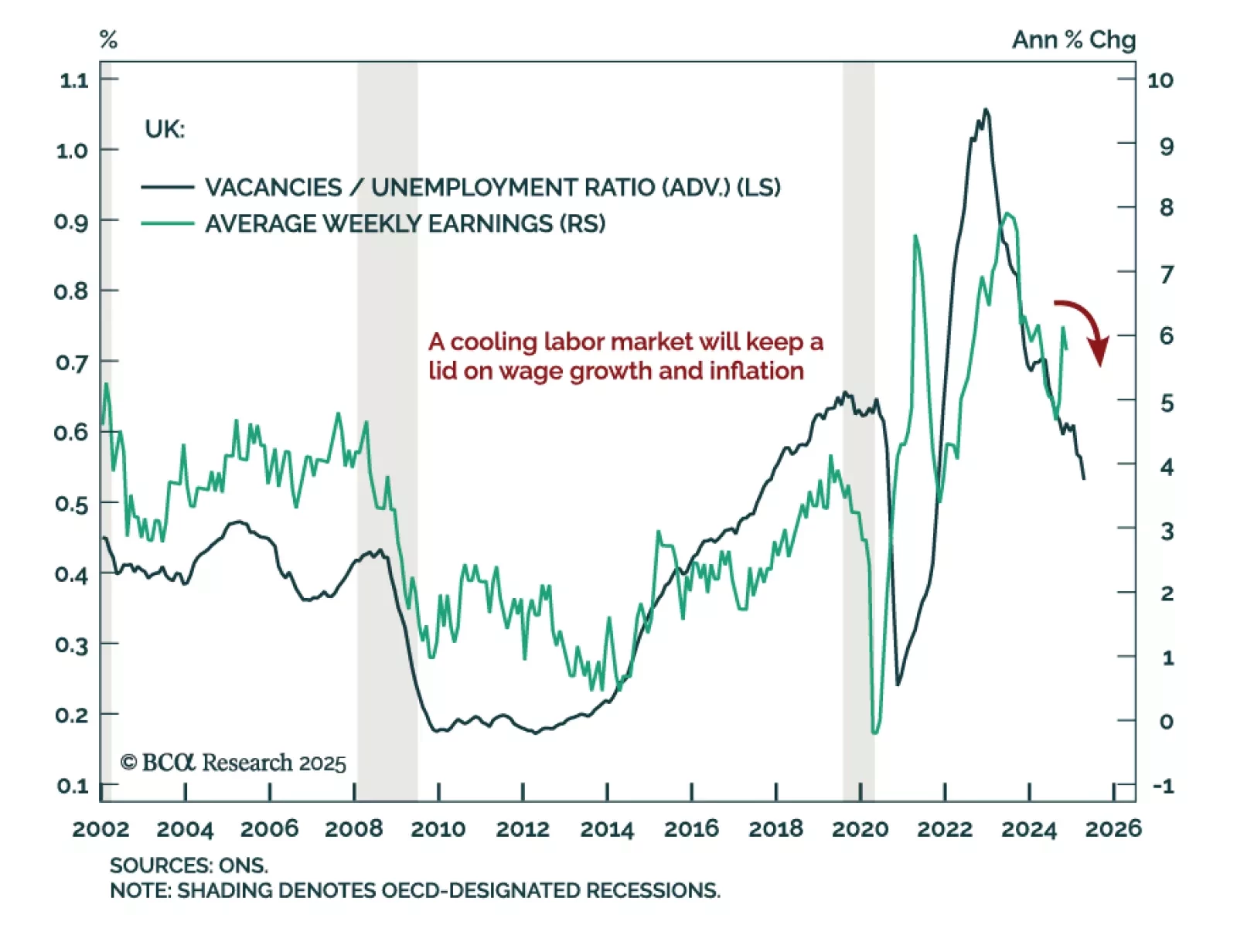

November/December UK employment data was mixed. The November unemployment rate rose 0.1% to 4.4%, in line with expectations. Payrolled employees decreased faster than expected at a 47k pace in December, surpassing the 35k contraction…

Our US Bond Strategy team put out a Strategy Insight outlining the value they see in the Treasury market. The recent rise in Treasury yields reflects increased inflation uncertainty and a higher term premium. Treasury…

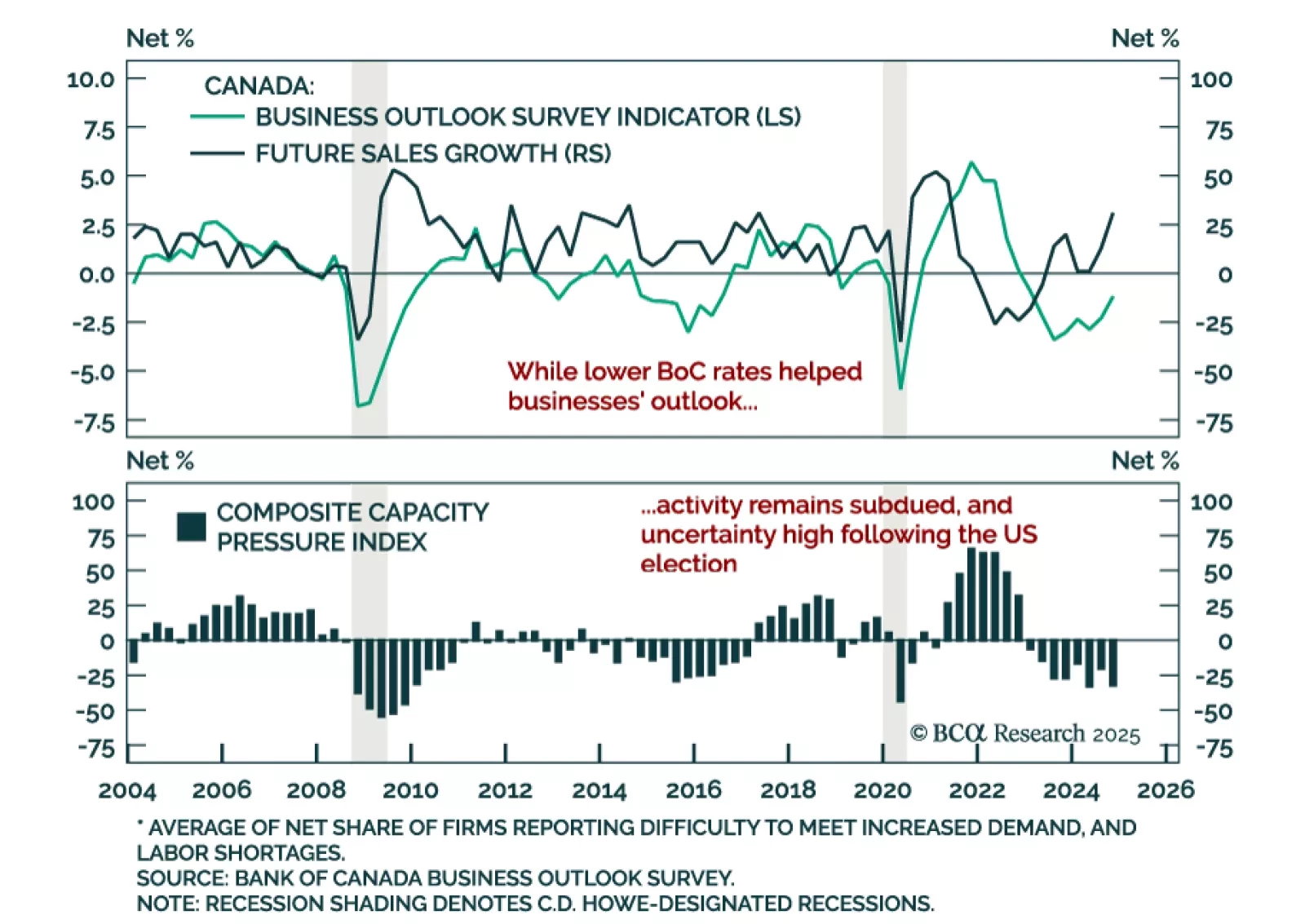

The Q4 2024 Bank of Canada’s Business Outlook Survey showed improving business optimism, with the overall index ticking up to -1.2, and a net 31% of surveyed businesses expecting higher sales, compared to 13% in Q3. Improved…

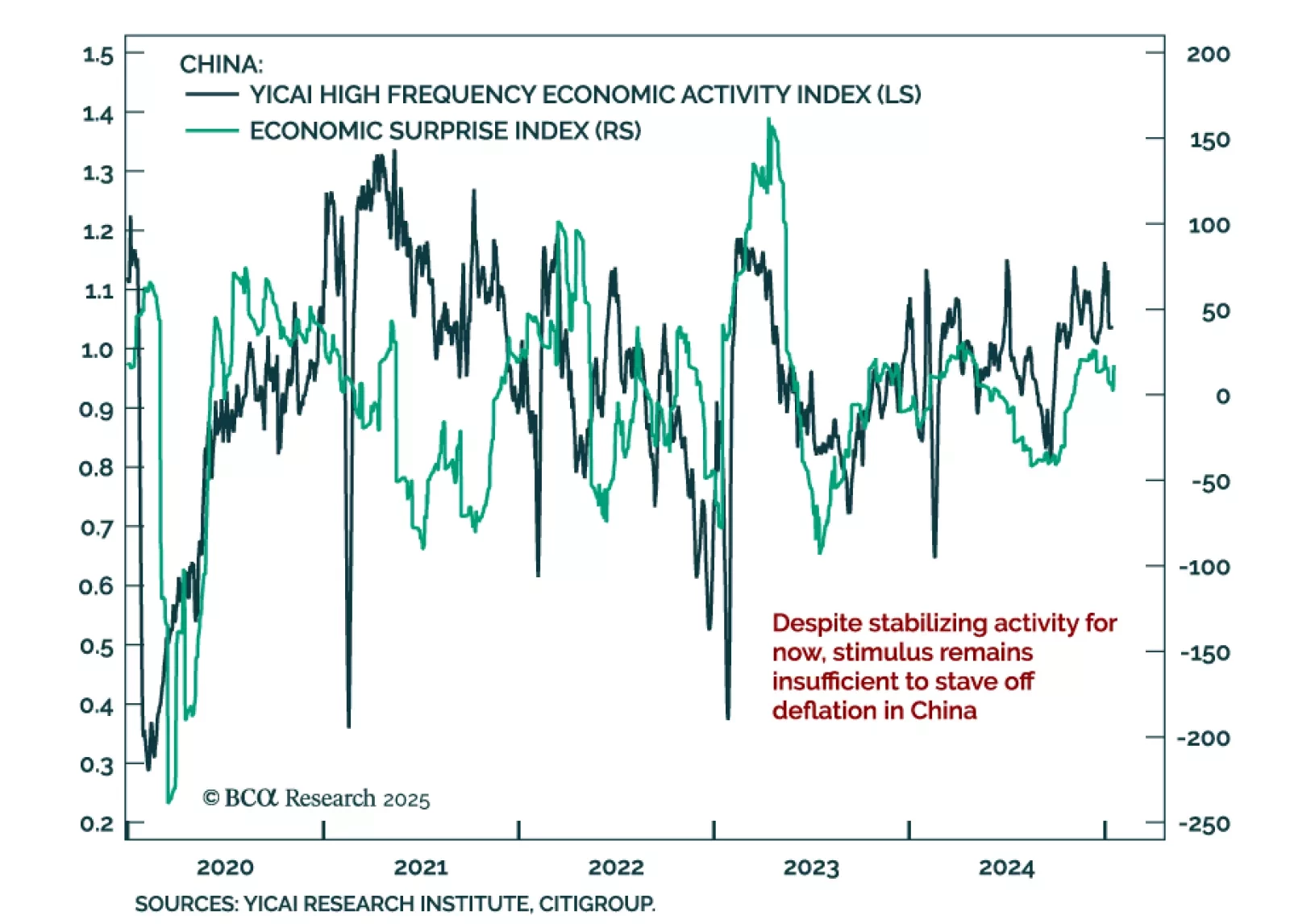

Chinese activity was decent in December, with GDP growth topping the 5% target for 2024. Industrial production growth ticked up to 6.2% y/y from 5.4% in November. Retail sales also picked up, increasing to 3.7% from 3.0% a month…

This week, our screeners cover views on Trump 2.0, defensive US equity sectors, and a pullback in Singapore equities. Our first screener aims to hedge longer term inflation risks that Trump 2.0 will likely generate, targeting US…

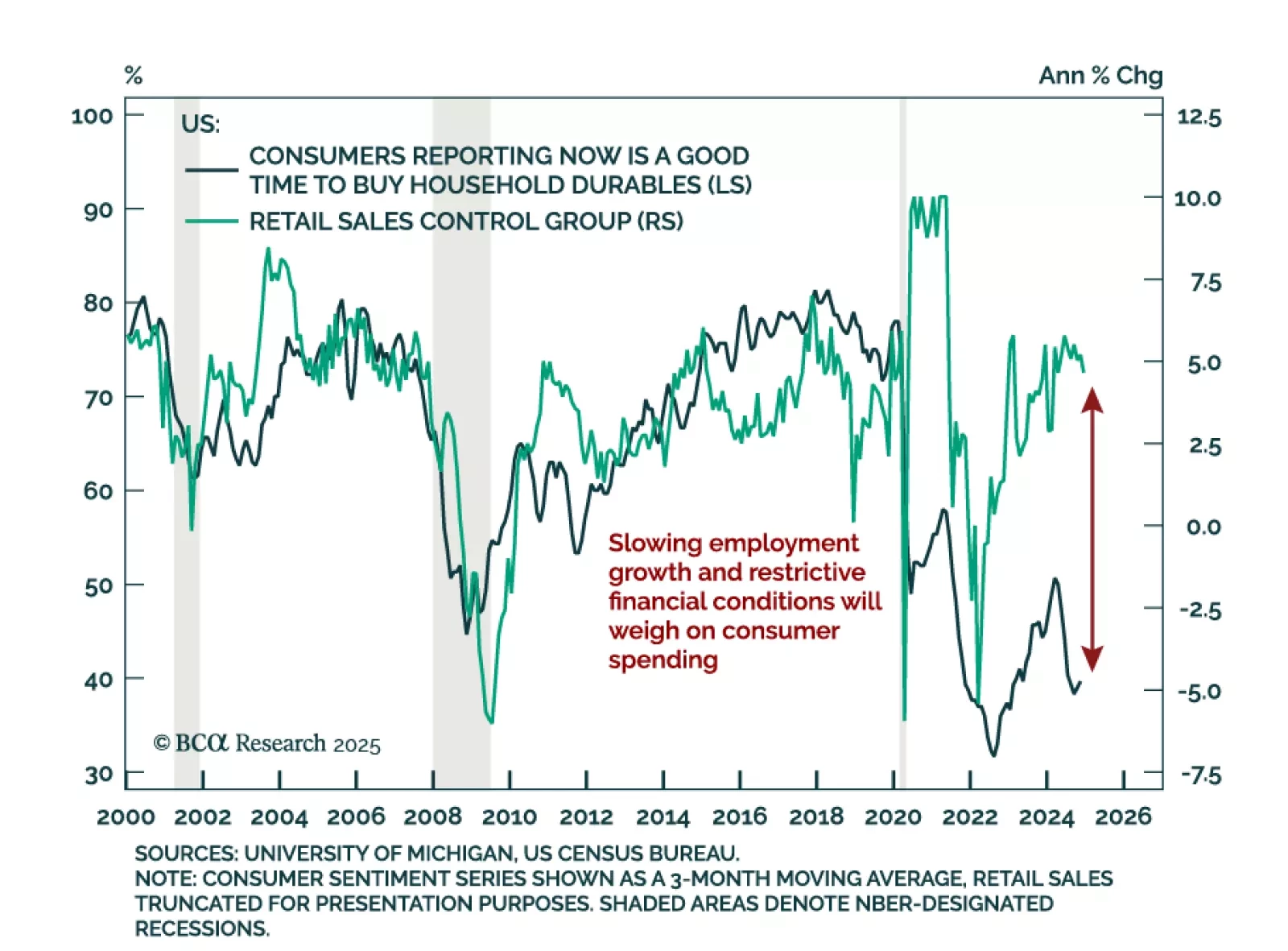

December US retail sales missed estimates, with the headline number printing at 0.4% m/m, a decline from an upwardly revised 0.8% in November. On the positive side, the control group beat estimates at 0.7%. Netting it all out,…

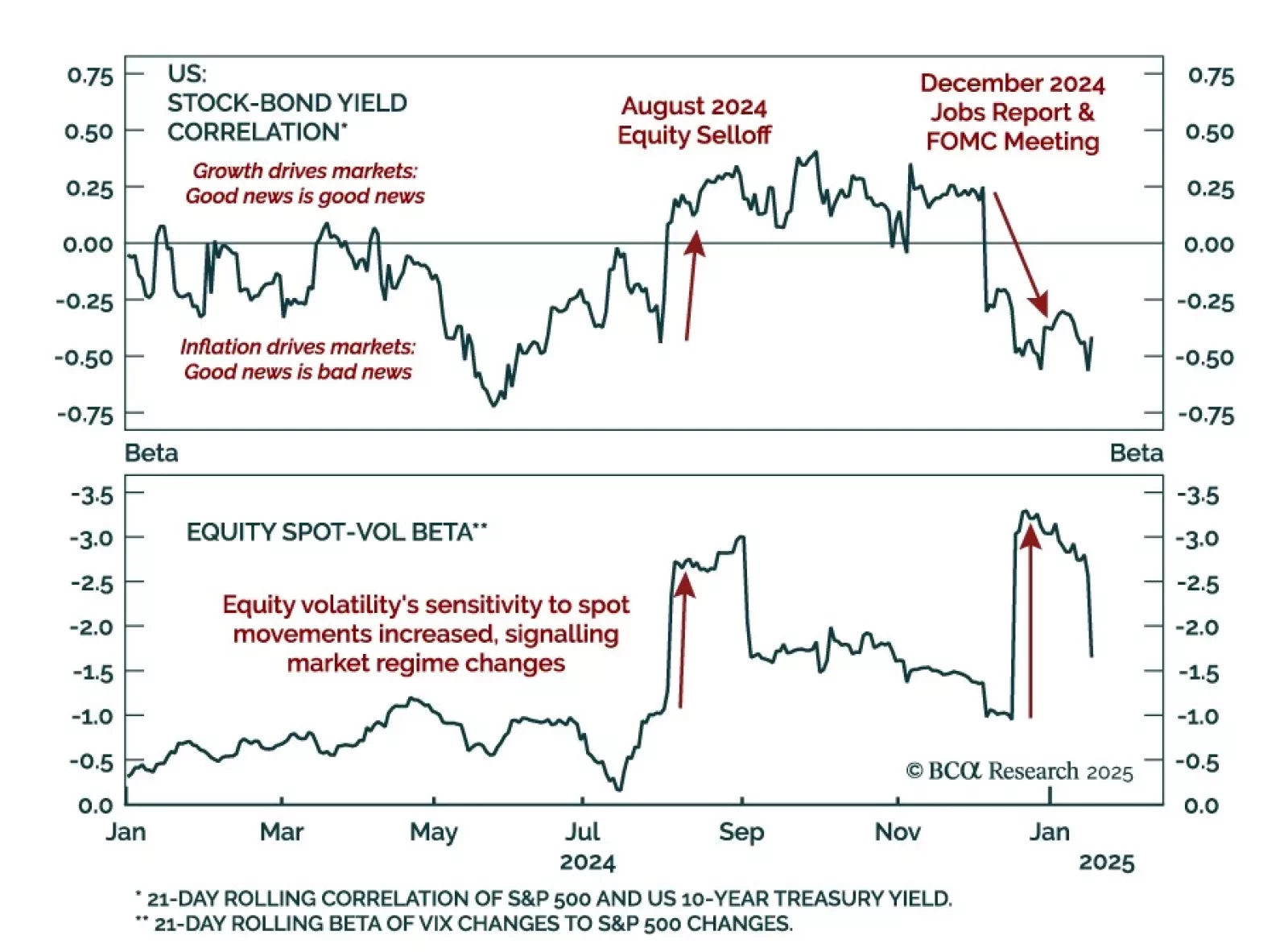

Two main market events defined 2024, highlighting how assets will react to economic data on the tactical horizon. The August 2024 selloff marked a positive shift in the stock-bond yield correlation, as higher odds of a “hard landing…

UK inflation surprised to the downside in December. Headline inflation retreated below estimates to 2.5% y/y from an eight-month high of 2.6% in November. Core inflation also decreased below estimates, printing 3.2% vs. 3.5% in…

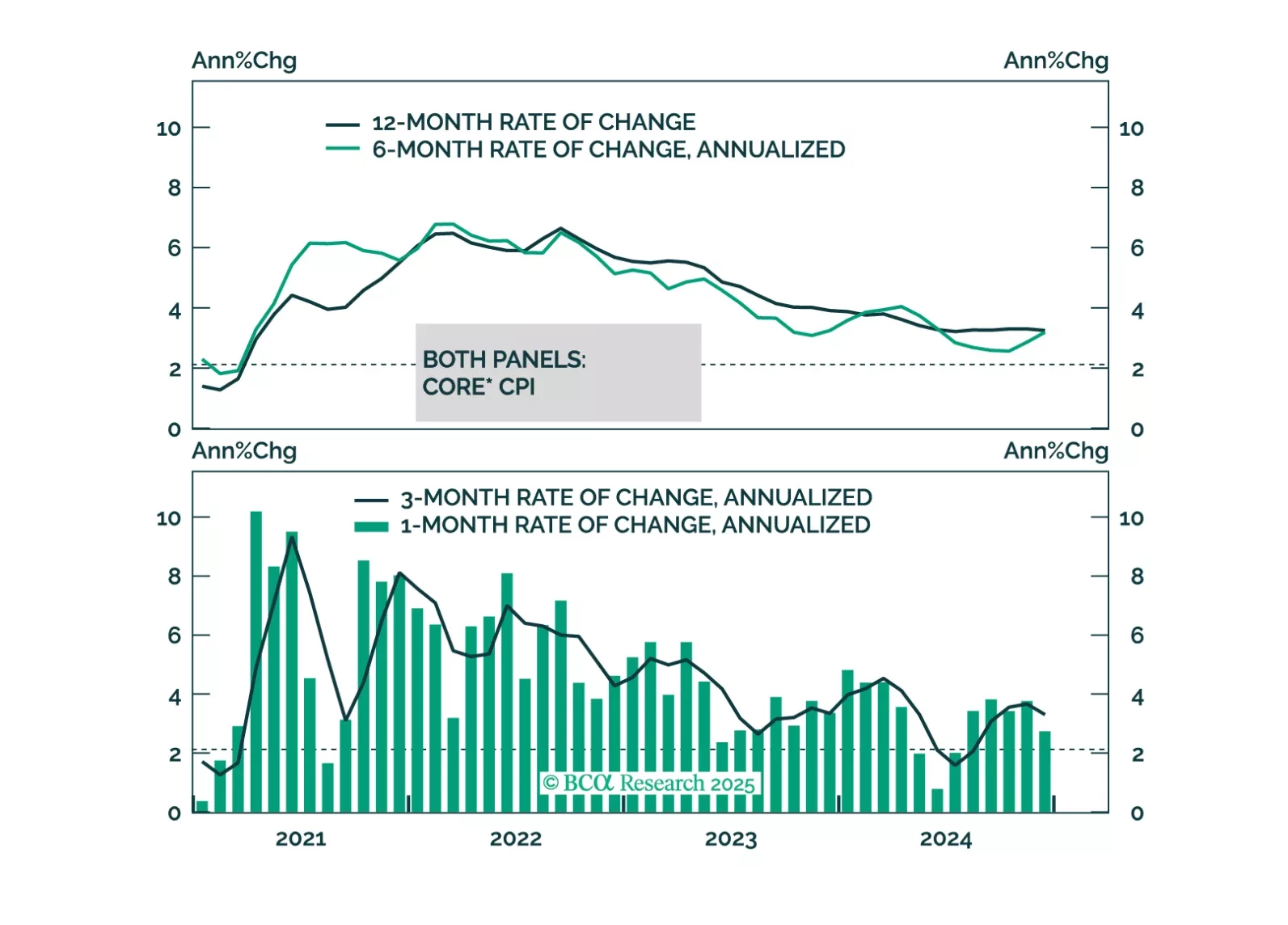

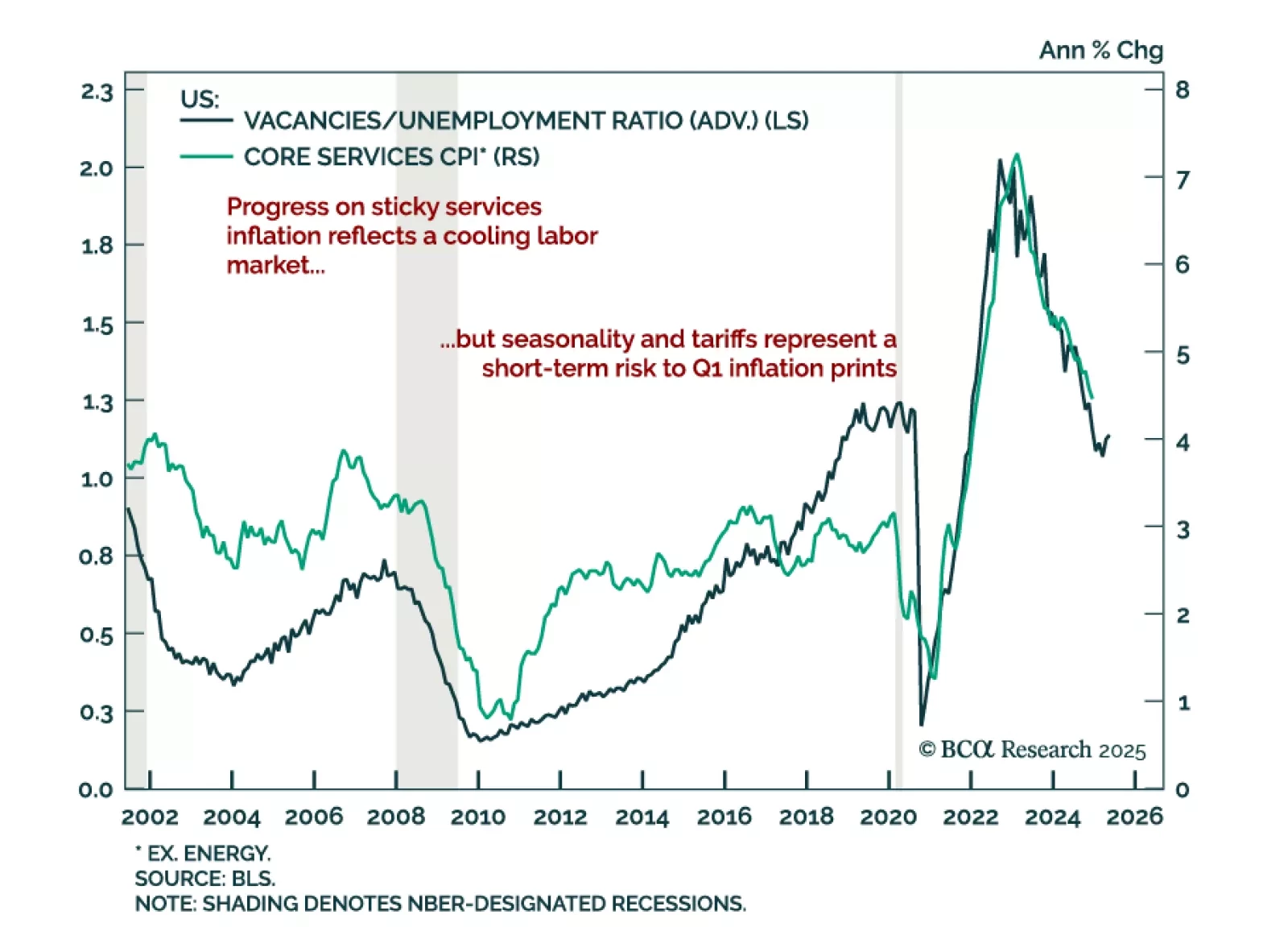

The December US CPI came in better than expected. While headline CPI met estimates of 0.4% m/m (2.9% y/y), core surprised to the downside at 0.2% m/m, decelerating to 3.2% y/y from 3.3%. Moderation in core annual inflation was driven…

Our thoughts on this morning’s CPI release and some upside risks to inflation that could flare up in the months ahead.