December PCE inflation was in line with expectations, with headline inflation at 0.3% m/m (2.6% y/y) and core at 0.2% m/m (2.8% y/y). The Q4 employment cost index also came in line with expectations at 0.9% q/q. Inflation is…

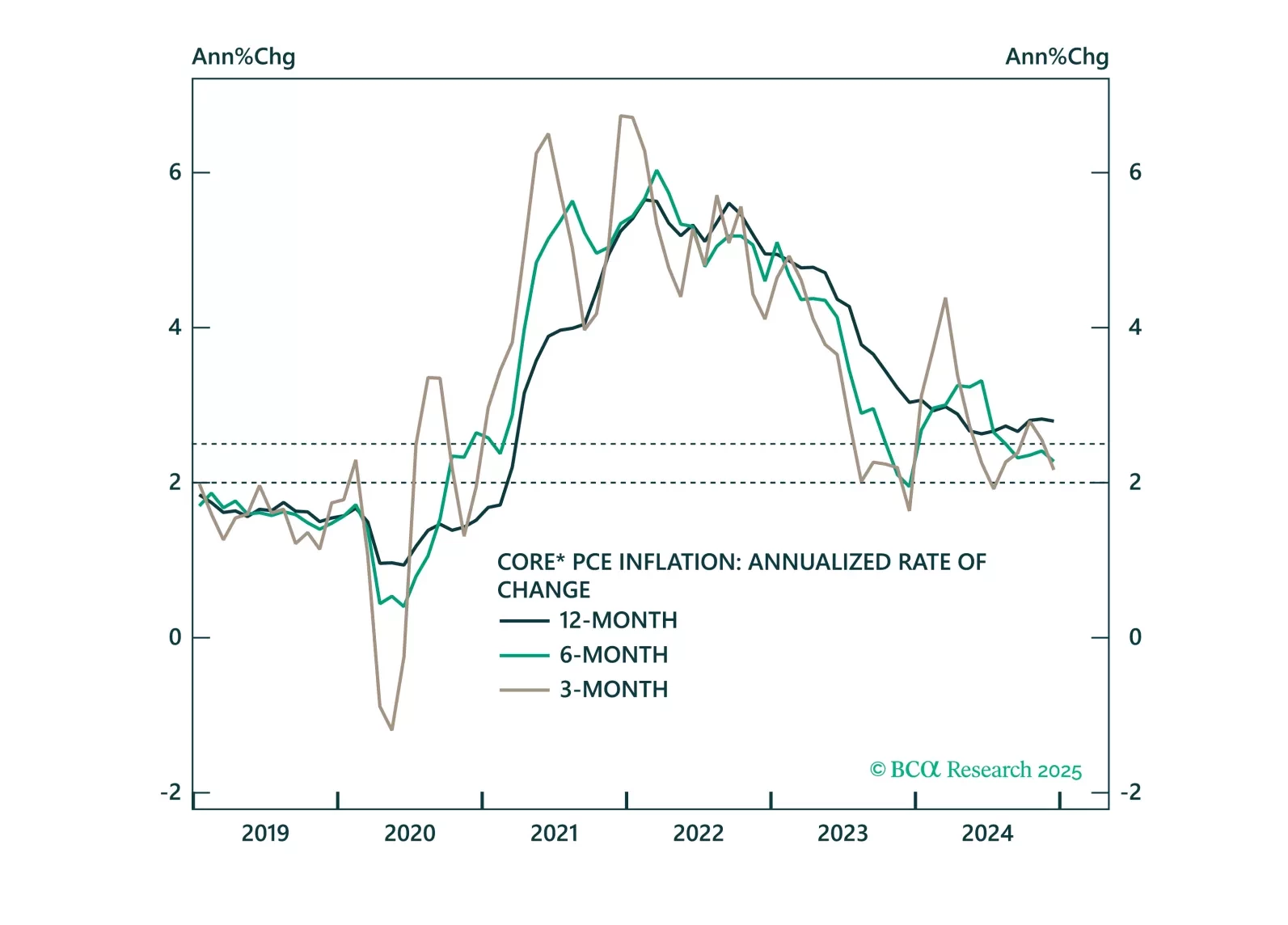

Core PCE inflation came in soft this morning and is tracking well below the Fed’s 2025 forecast. We highlight three upside risks to inflation and preview next week’s employment report.

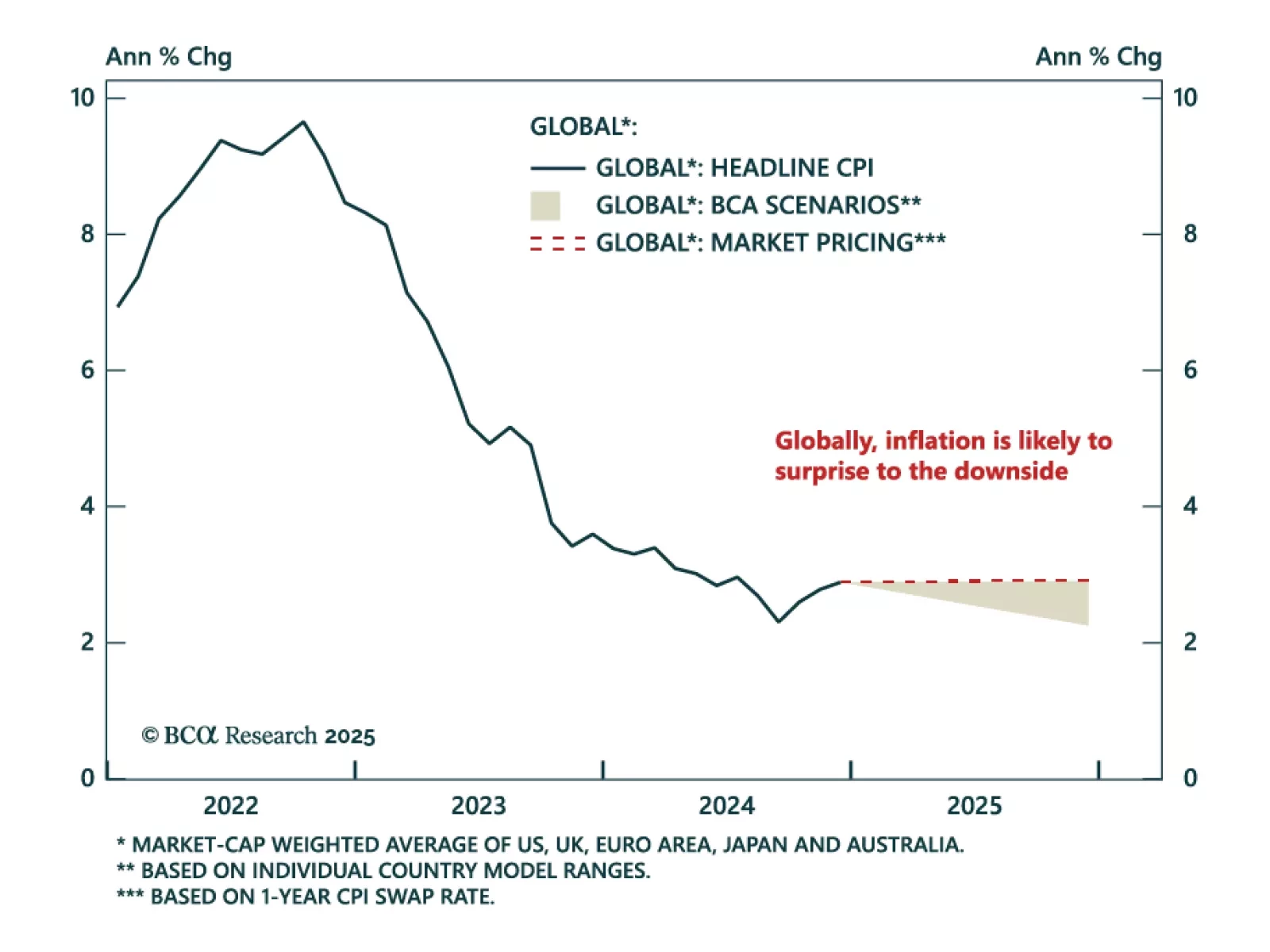

Our Global Fixed Income strategists assessed the risk of a second wave of inflation, and discussed the opportunities within the inflation-linked bond (ILB) market. Global disinflation remains on track, though energy prices and…

Advanced Q4 US GDP missed estimates, slowing down to 2.3% quarterly annualized growth from 3.1%. The weakness was however driven by inventories. Consumer spending beat estimates and accelerated to 4.2% from 3.7% in Q3. Growth is…

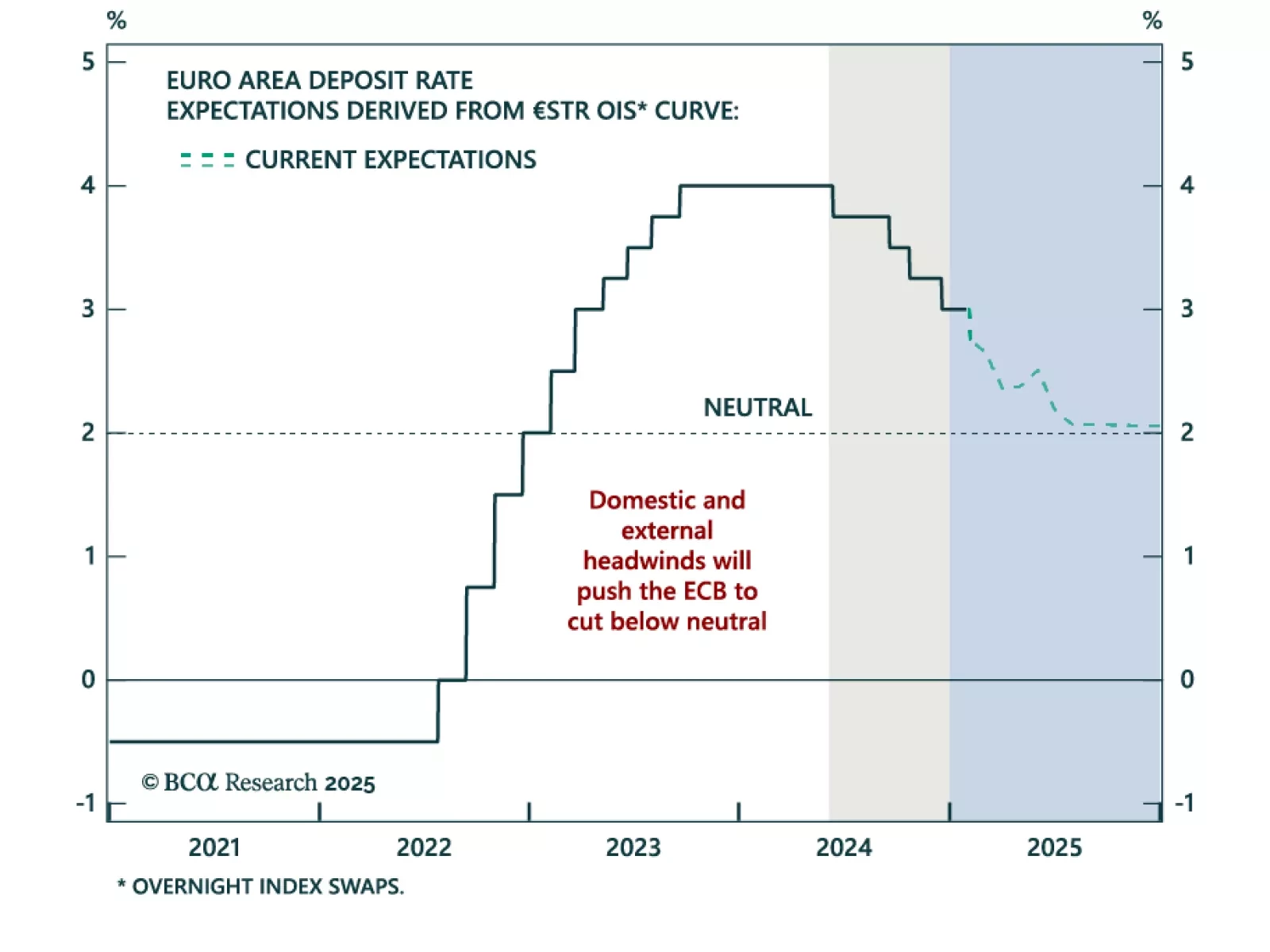

The ECB cut by 25 bps as expected, bringing the deposit facility rate to 2.75%. Despite avoiding committing to a path for policy, President Lagarde reiterated the disinflationary process is “well on track”, and did not push against…

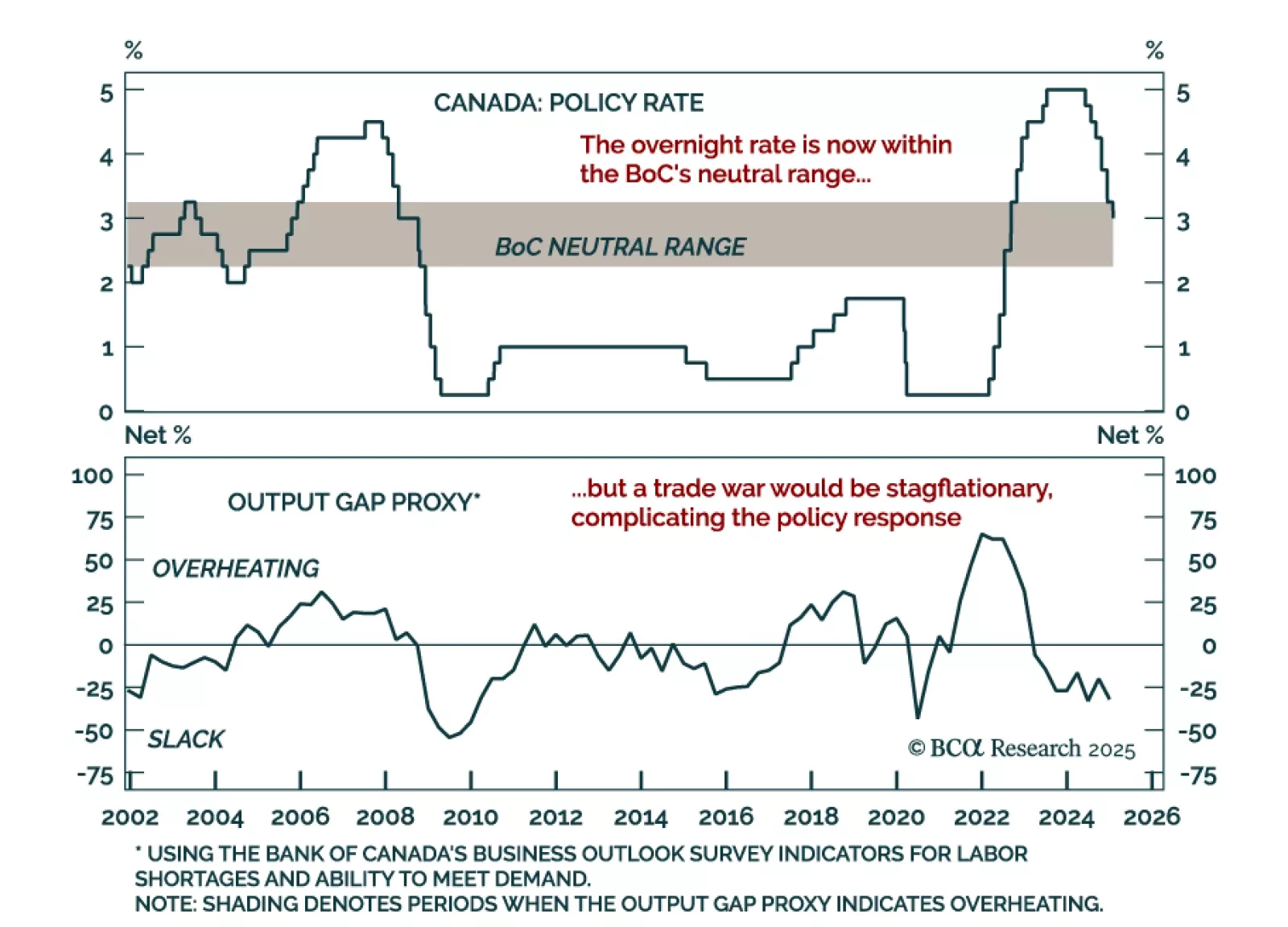

The Bank of Canada cut by 25 bps to 3% as expected, and announced the end of quantitative tightening. This sixth consecutive cut brings the policy rate further into neutral territory, estimated to be in the 2.25%-to-3.25% range.…

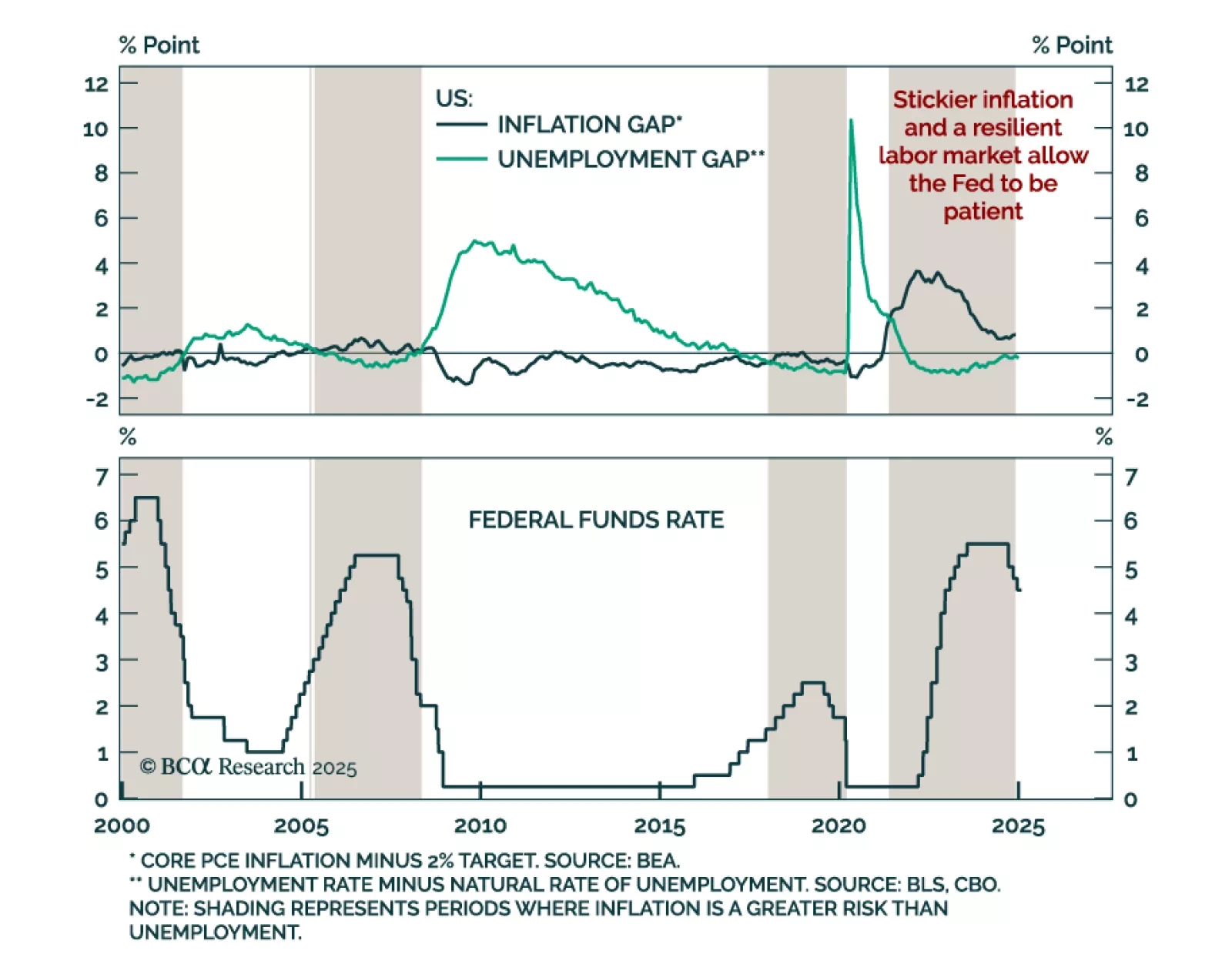

The Federal Reserve kept rates on hold in its 4.25%-to-4.5% range, as expected. The main change in the statement was the removal of the reference to progress towards the Fed’s 2% target, leaving instead a simple mention that…

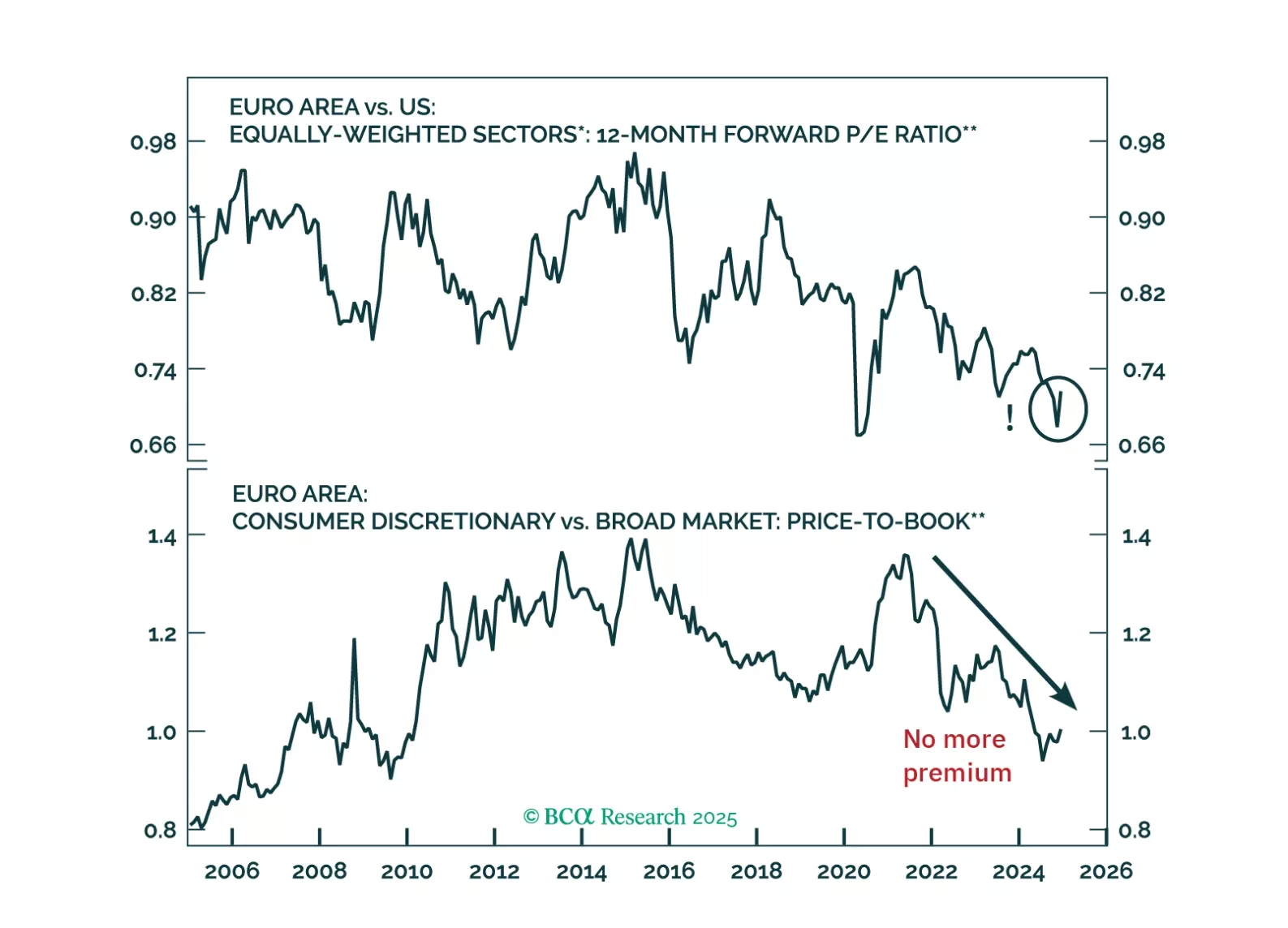

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

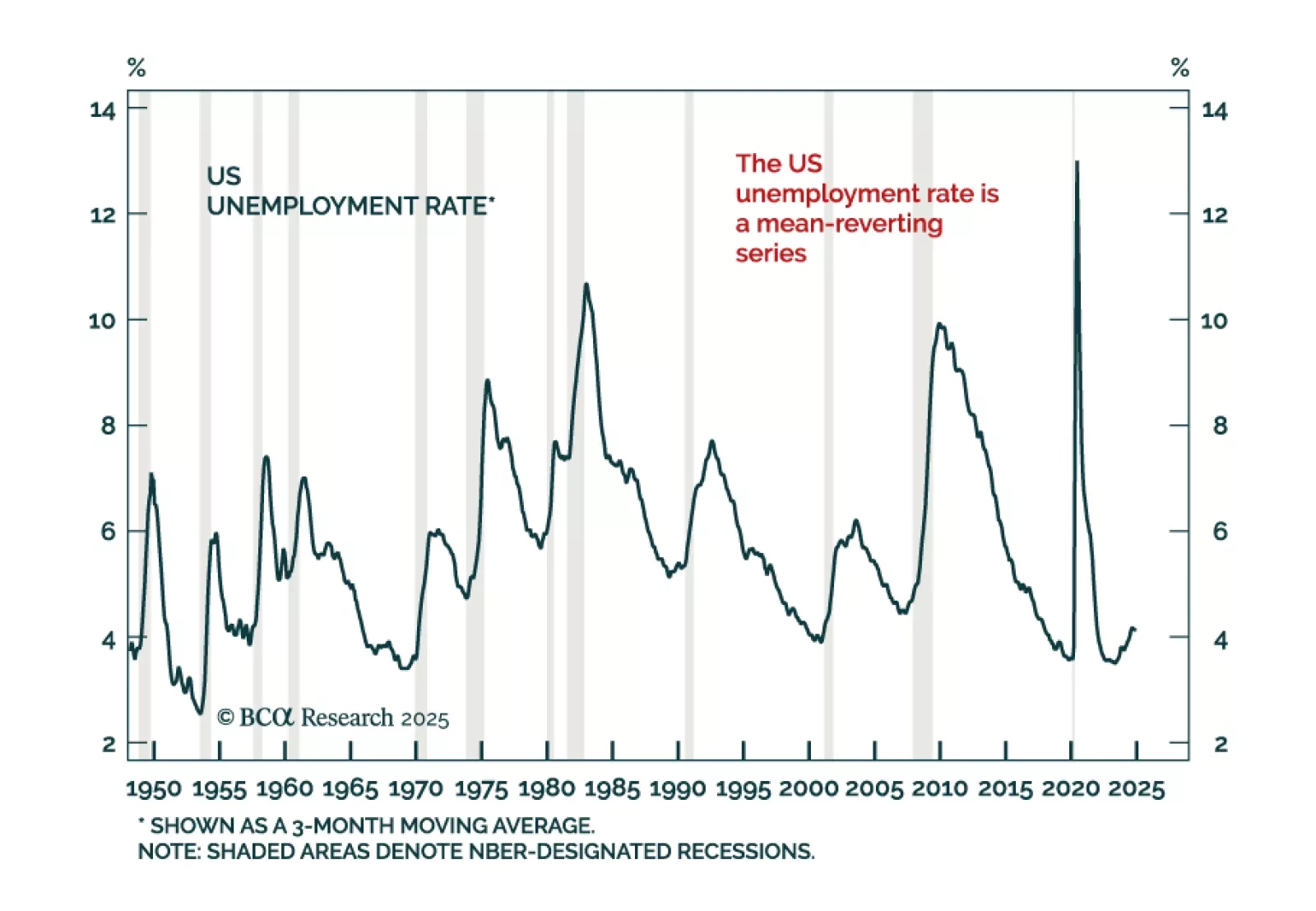

Our Global Investment strategists believe the US economy is in a more precarious position than investors realize. A slowdown in growth could raise unemployment, while stronger activity may heighten inflation worries. The…

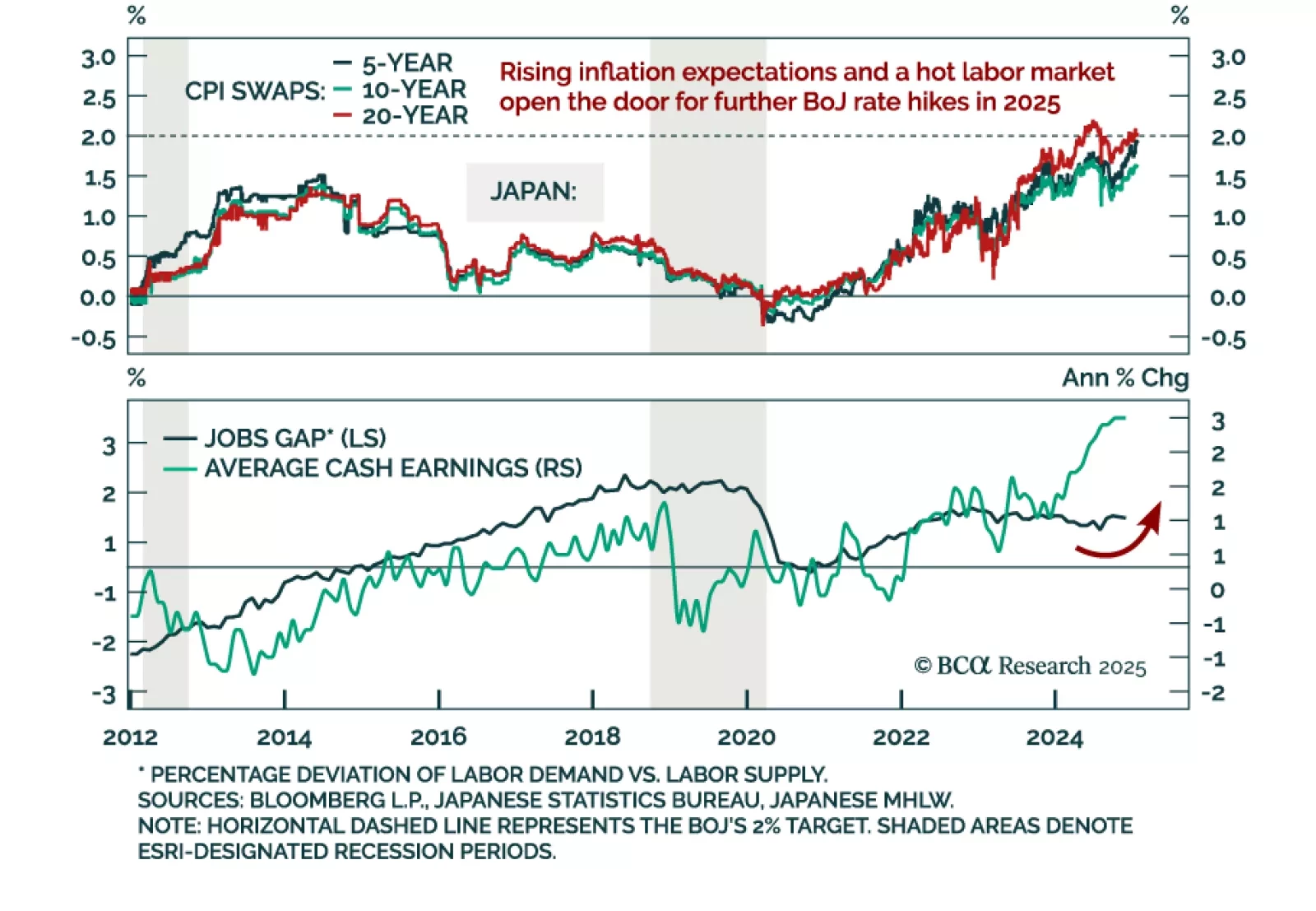

The Bank of Japan hiked rates by 25 bps as expected to 0.50%, or a 17-year high. The BoJ is currently the only G10 central bank in a hiking cycle, as the hot labor market creates sustained domestic price pressures. …