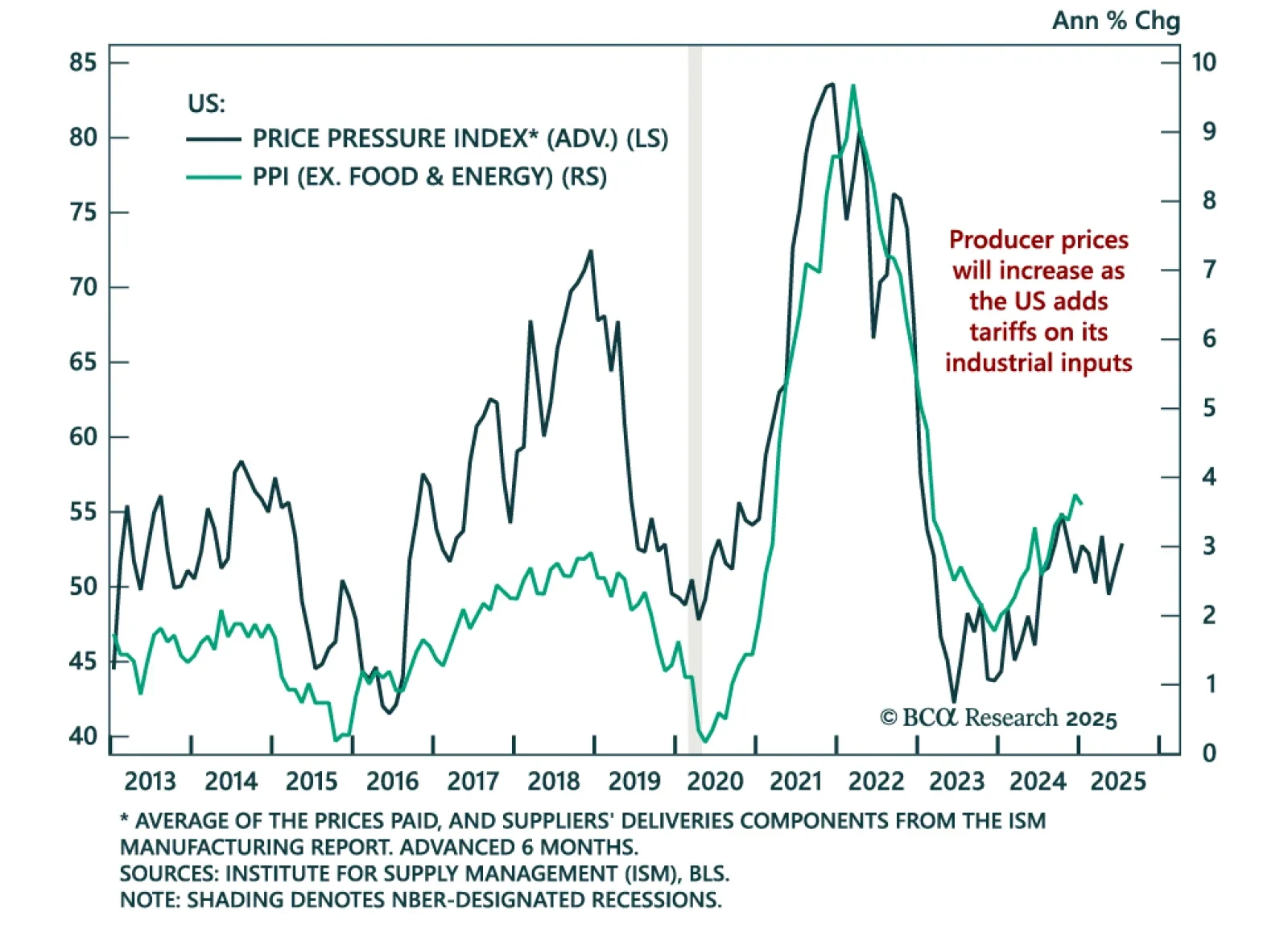

The January US Producer Price Index came in slightly hotter than estimates, but decelerated to 0.4% m/m (3.5% y/y) from an upwardly-revised 0.5% in December. Core PPI, excluding food, energy, and trade services, was also stronger…

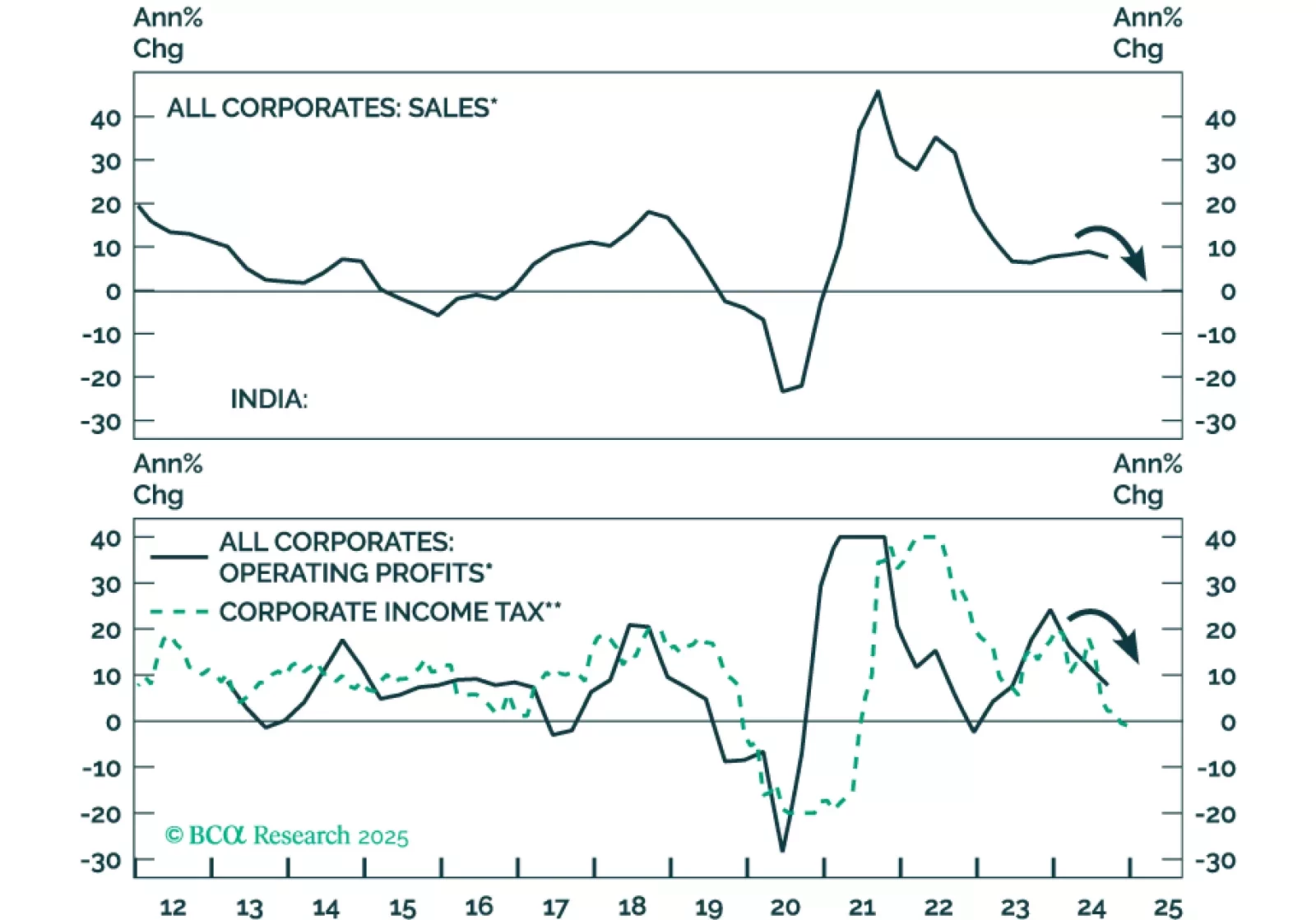

In its budget plans last week, the Indian fiscal authorities announced major tax cuts for households – the equivalent of about US$12 billion, 0.3% of GDP – to boost consumer spending. Soon thereafter, the central bank cut its policy rates…

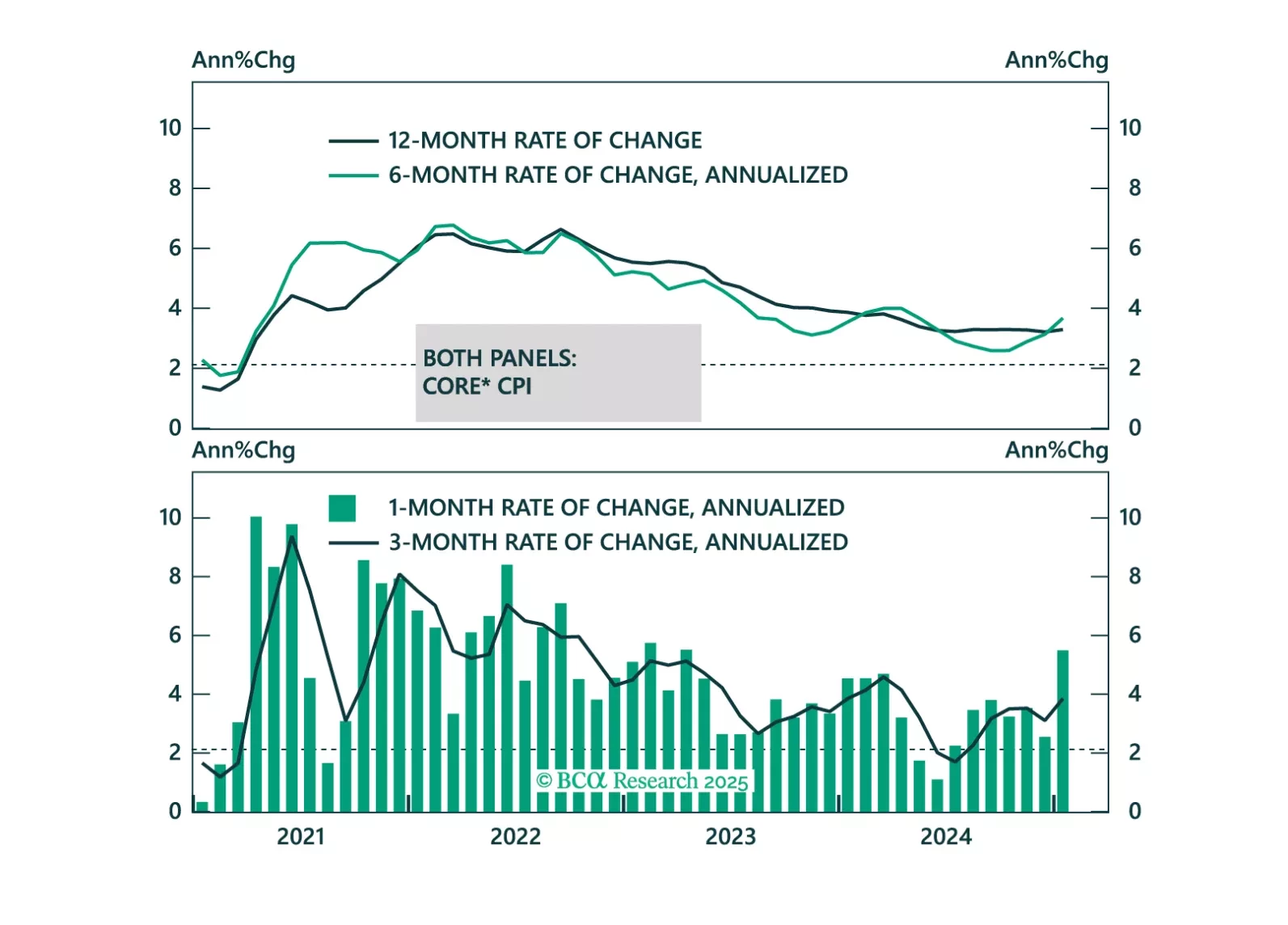

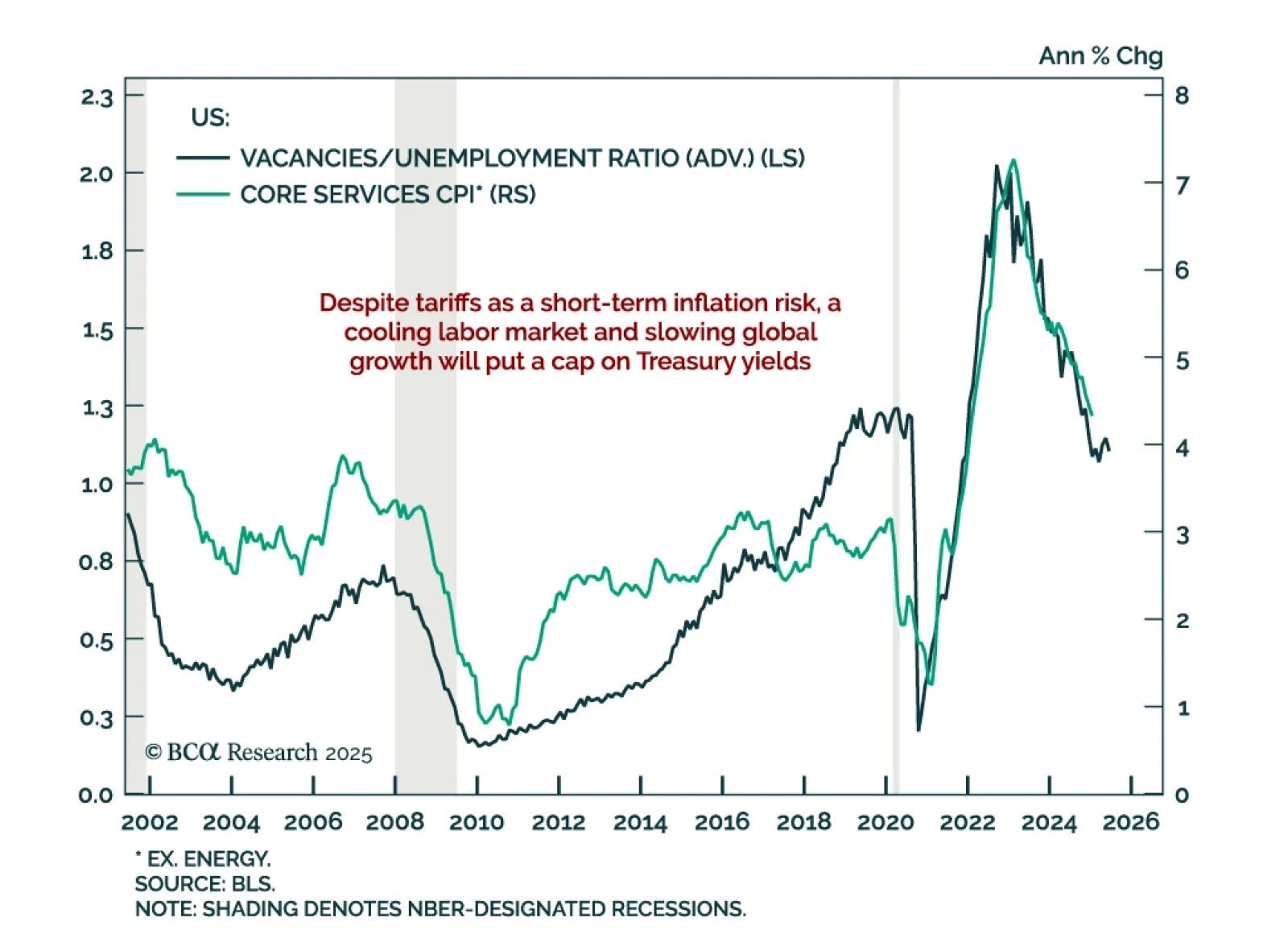

The January US CPI came in hotter than expected. Headline inflation accelerated to 0.5% m/m (3.0% y/y), and core to 0.4% m/m (3.3% y/y). Core goods and services inflation also moved higher, with the latter boosted by a sharp increase…

Some thoughts on this morning’s CPI report and its implications for the Fed and Treasury yields.

The January NFIB Small Business Optimism Index decreased more than expected to 102.8 from 105.1. After reaching near all-time highs in the wake of the election, expectations pulled back somewhat as uncertainty took center stage.…

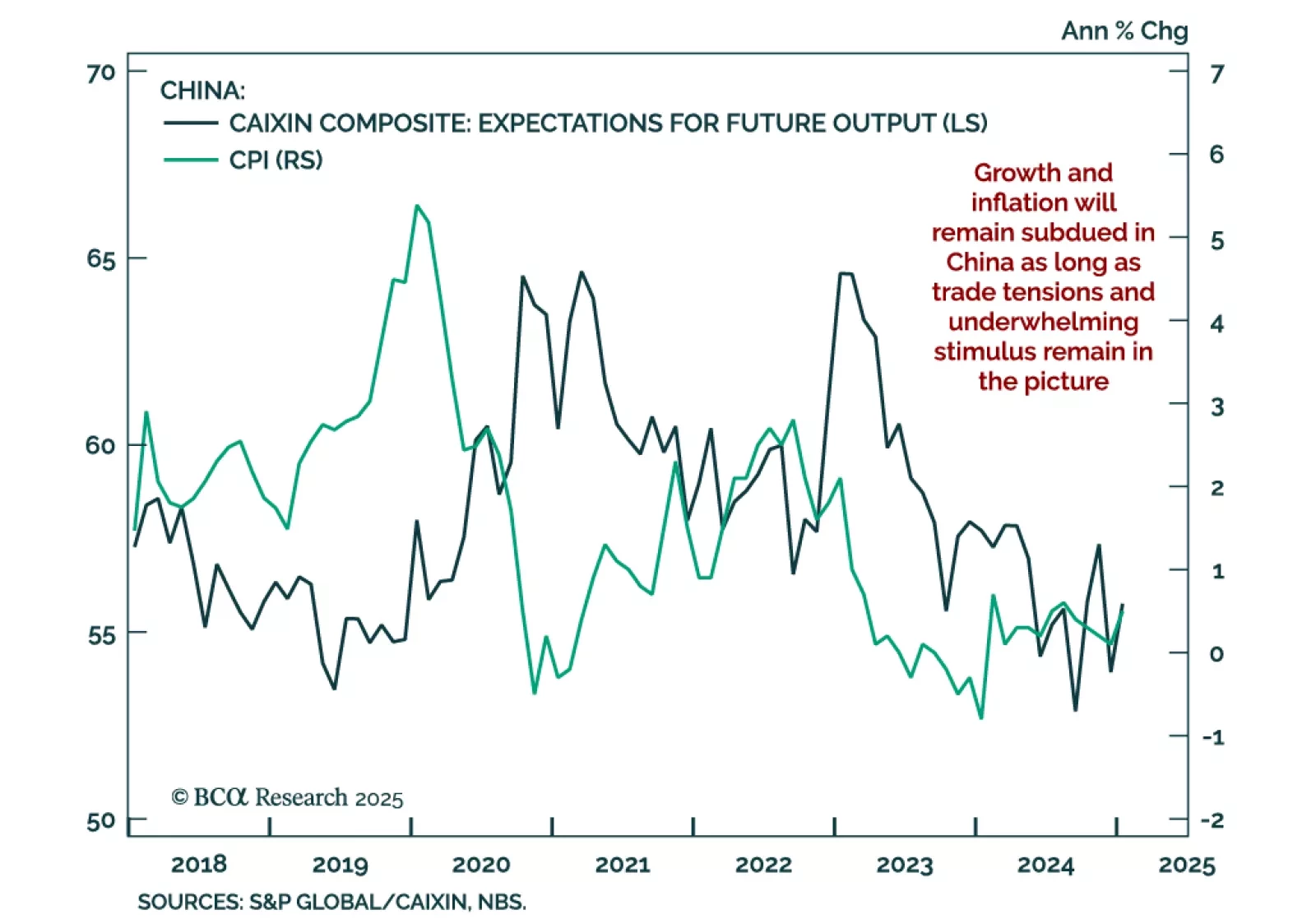

China’s January consumer prices rebounded to 0.5% y/y, and producer price deflation was unchanged at -2.3%. China’s first quarter data tends to be distorted by the Chinese New Year, as its variable dates shift consumption peaks…

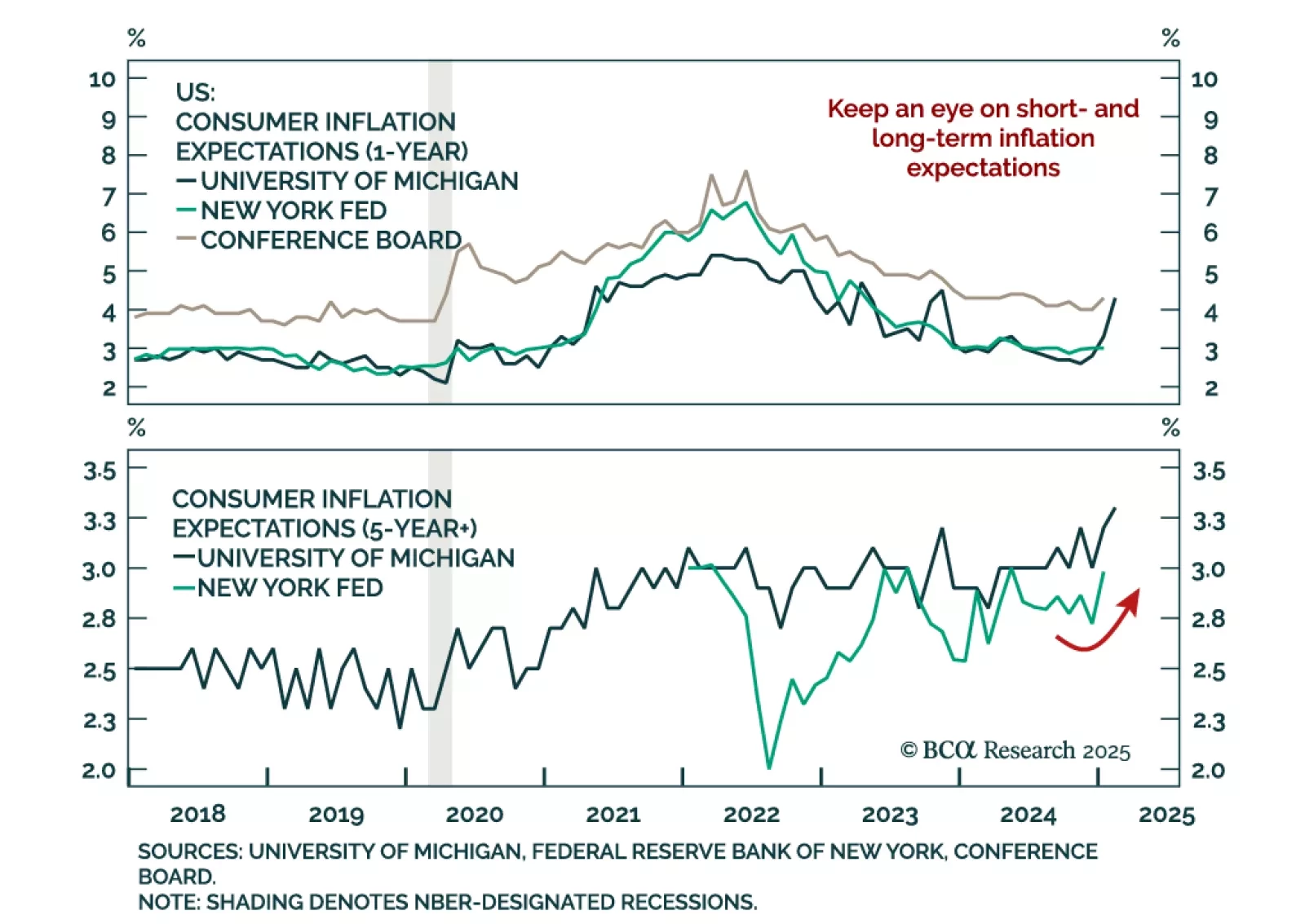

The New York Fed’s Survey of Consumer Expectations’ 1-year and 3-year inflation expectations were unchanged in January. Five-year ahead expectations however increased, as did expectations for staples inflation, while spending…

Our Emerging Market strategists published a follow-up piece to their Bessenomics note where they assess the new Treasury Secretary plan’s impact on markets. Lower interest rates are central to Bessenomics. The Trump…

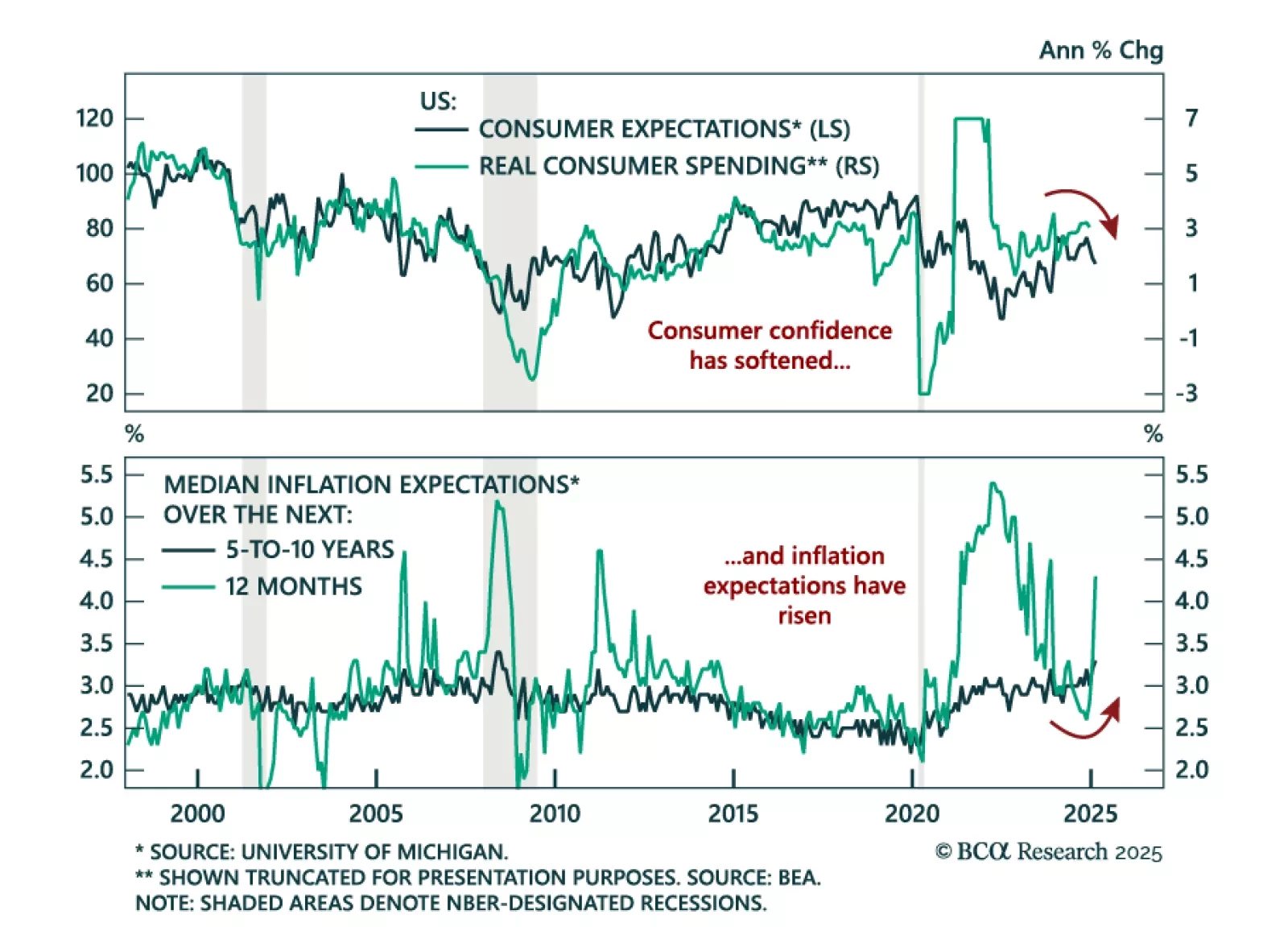

The preliminary February University of Michigan Consumer Sentiment Index missed estimates, falling to 67.8 from 71.1 in January. The decrease came from both expectations and the assessment of current conditions. Measures of 1-year…

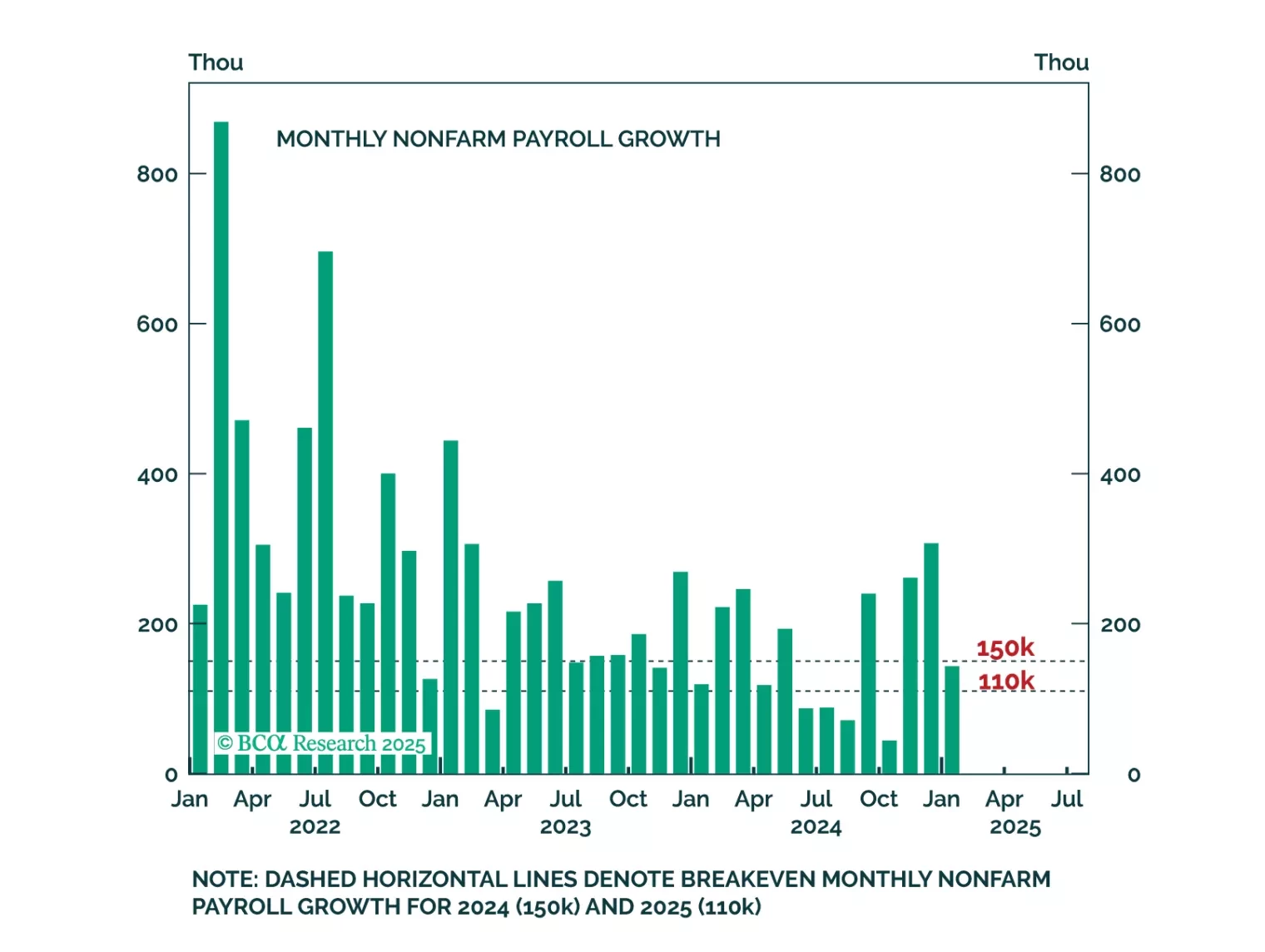

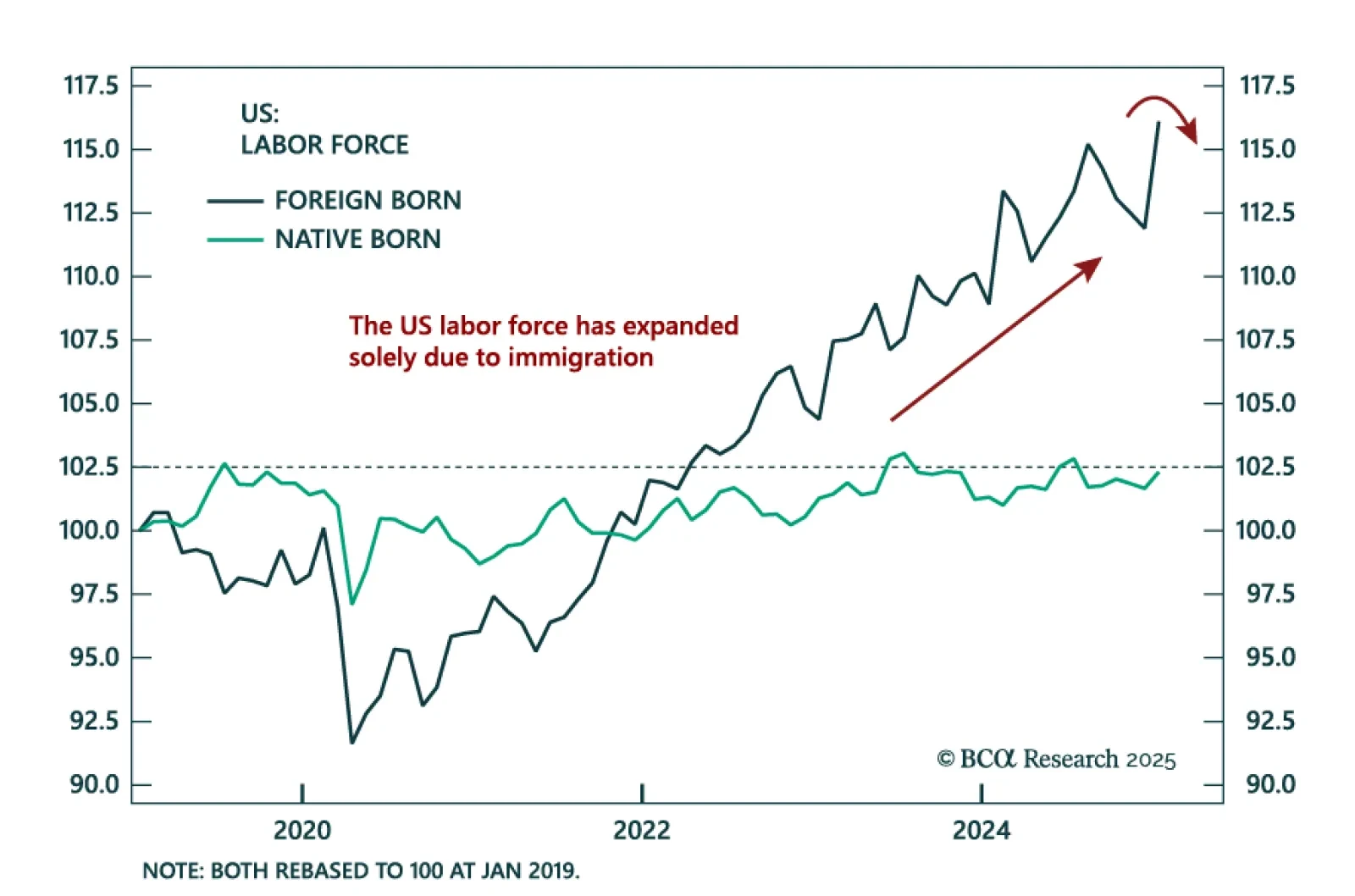

Some thoughts on this morning's employment data and Treasury Secretary Bessent's recent attempts to talk down the 10-year Treasury yield.