The ECB cut rates as expected, but rising yields and a stronger euro are tightening financial conditions just as fiscal policy shifts the macro landscape. With more rate cuts ahead and market positioning stretched, we outline the key…

Our Portfolio Allocation Summary for March 2025.

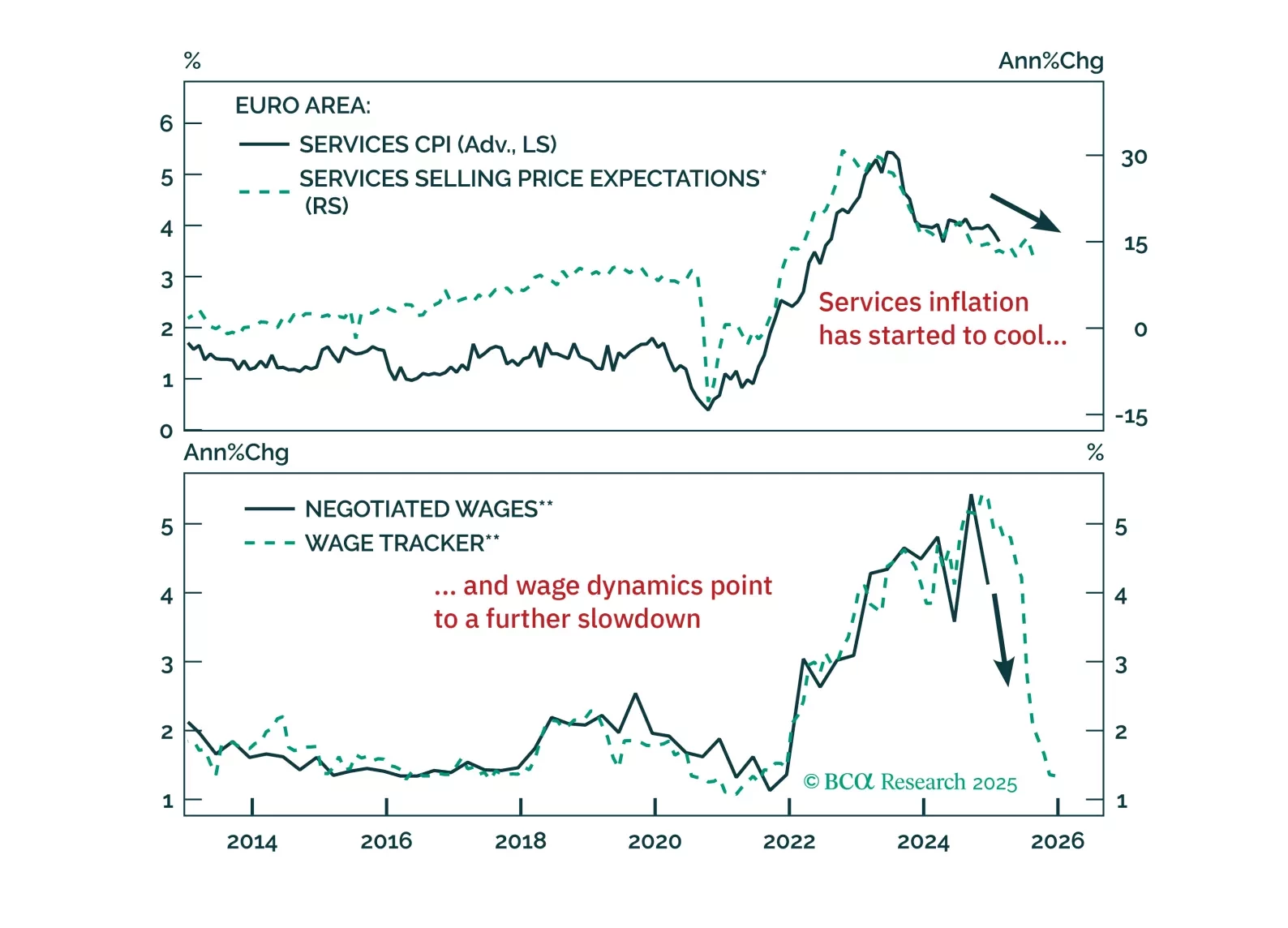

February flash inflation for the Eurozone was slightly hotter than expected but nonetheless declined, with both headline and core inflation falling 0.1% to 2.4% y/y and 2.6%, respectively. Services inflation also declined to 3.7%…

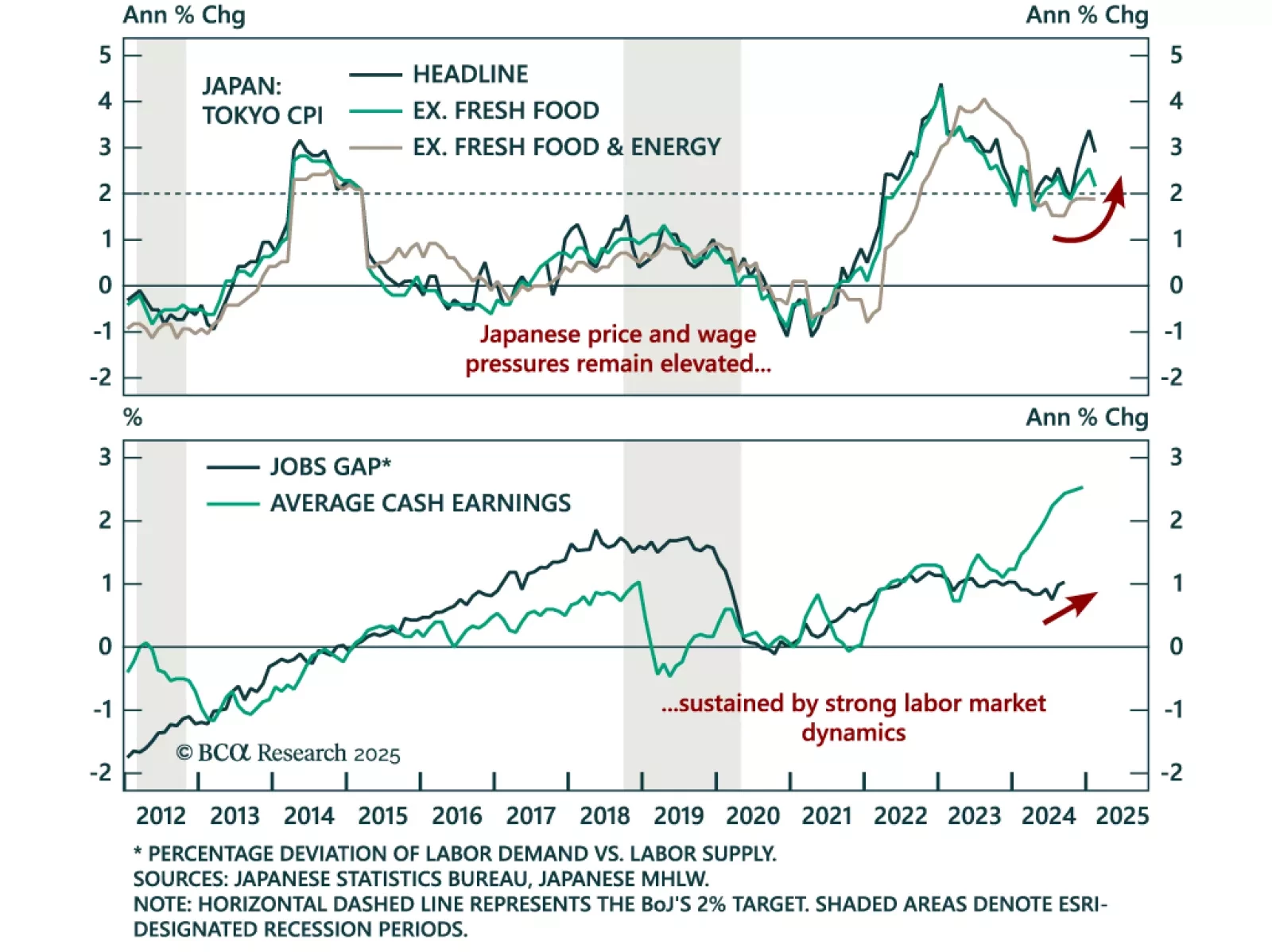

The February Tokyo CPI print came in slightly cooler than expected. Headline inflation moderated to 2.9% y/y from 3.4%, while “core core” was steady at 1.9%. The Tokyo CPI gives an advance reading on national price pressures,…

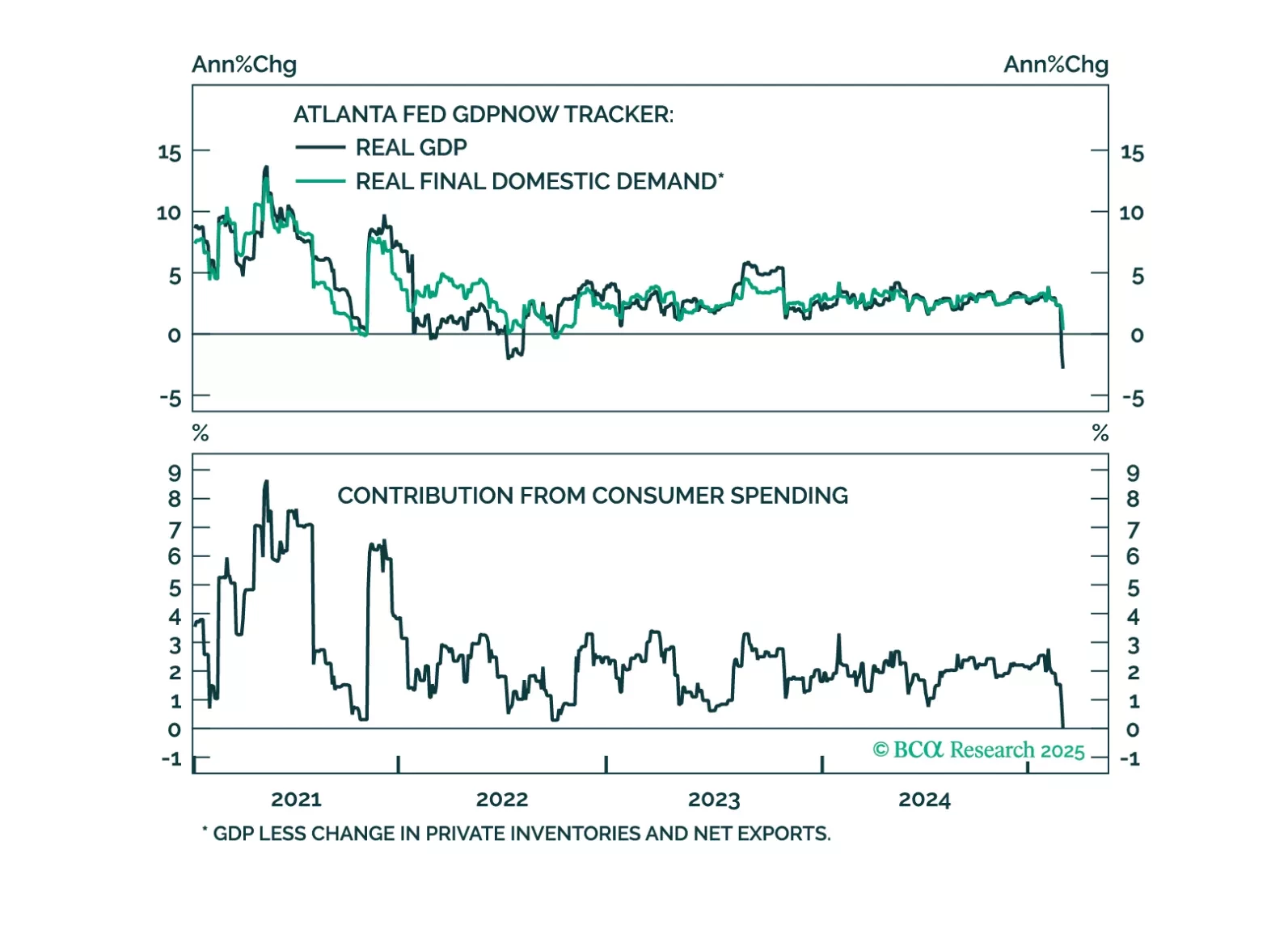

January PCE inflation was in line with expectations, with headline and core inflation rising 0.3% m/m, leaving the respective annual growth rates at 2.5% and 2.6%, near the Fed’s projection for 2025. Consumer spending missed…

Core PCE inflation was tame this morning, but with large tariffs looming we anticipate loftier inflation readings in the months ahead.

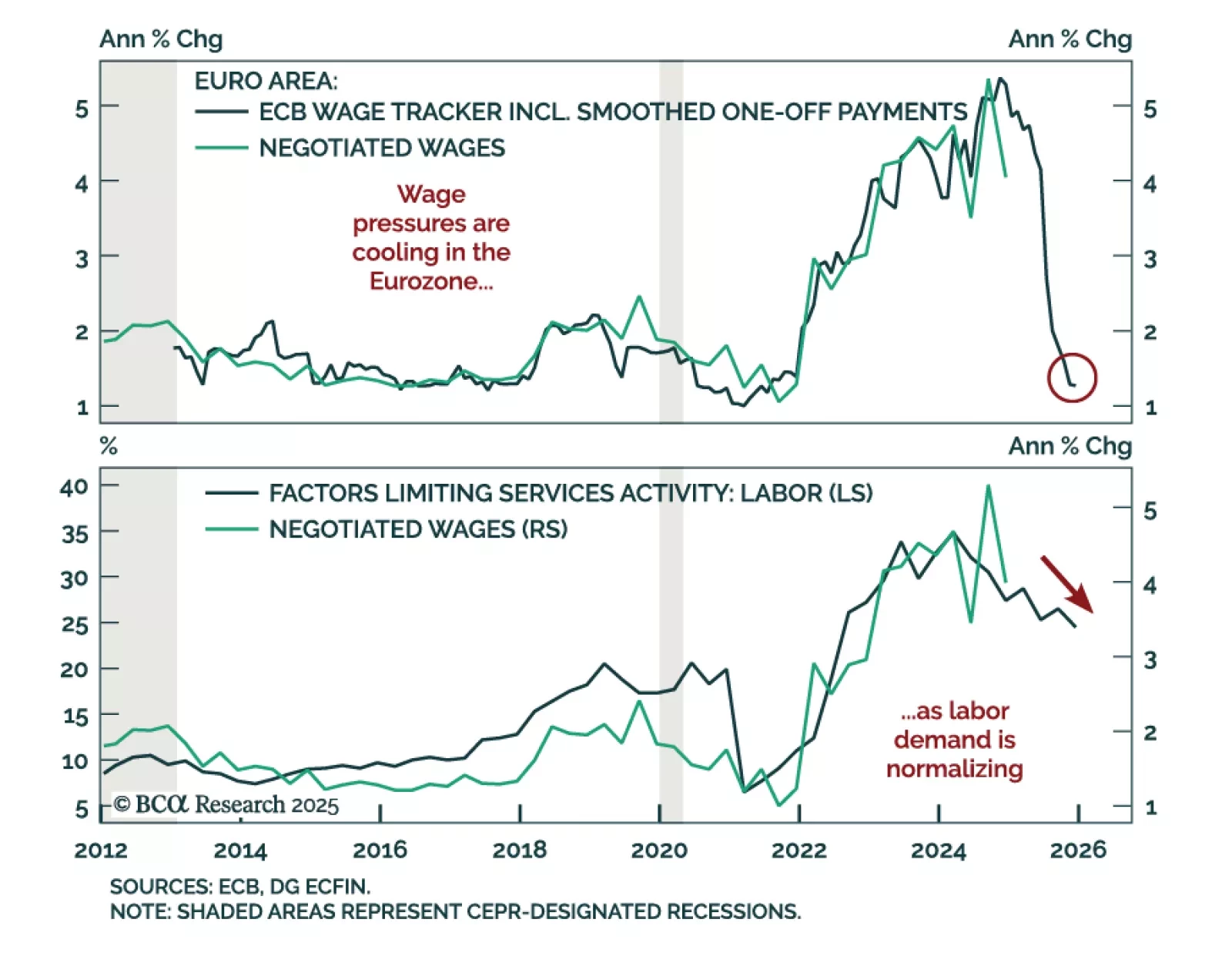

Fourth-quarter European negotiated wages growth cooled to 4.1% y/y, down from the 5.4% peak seen in Q3. The cooling is in line with the ECB’s Wage Tracker showing wage growth decelerating to 1.3% by the end of the year. Labor…

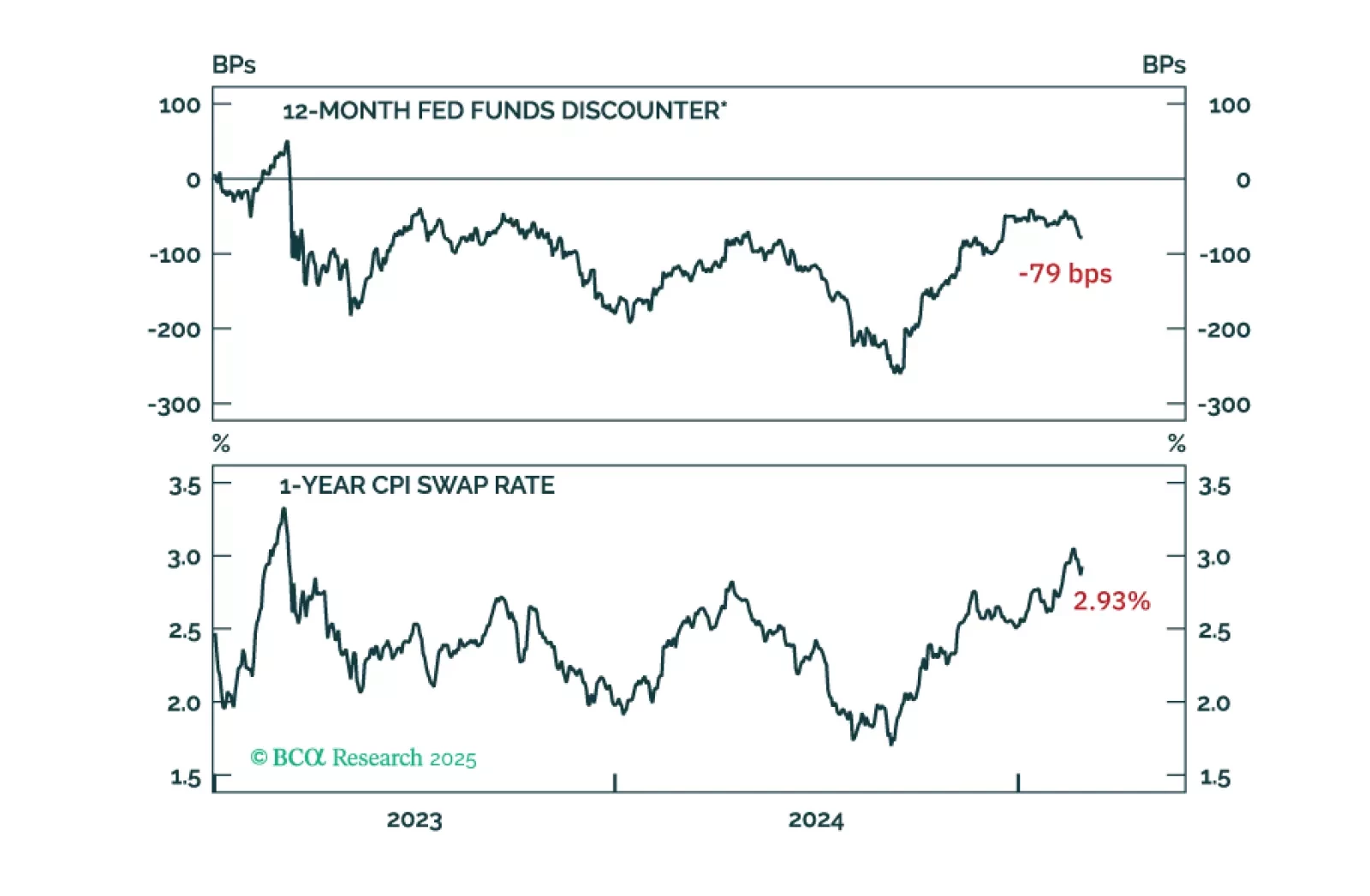

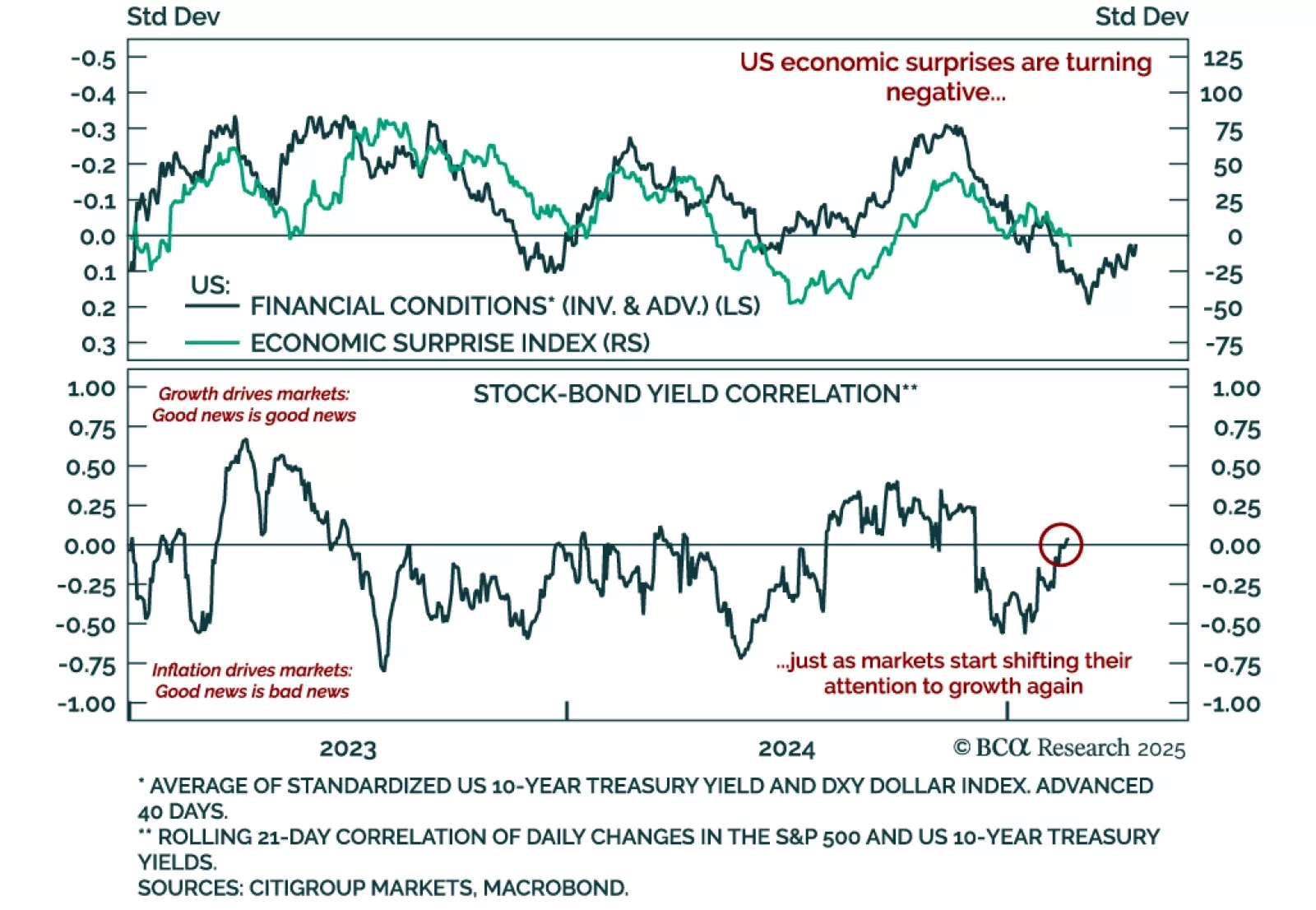

Two of our favorite indicators recently sent important signals. The first one, the short-term stock-bond yield correlation, recently drifted back to neutral territory after being negative. The correlation had been negative since…

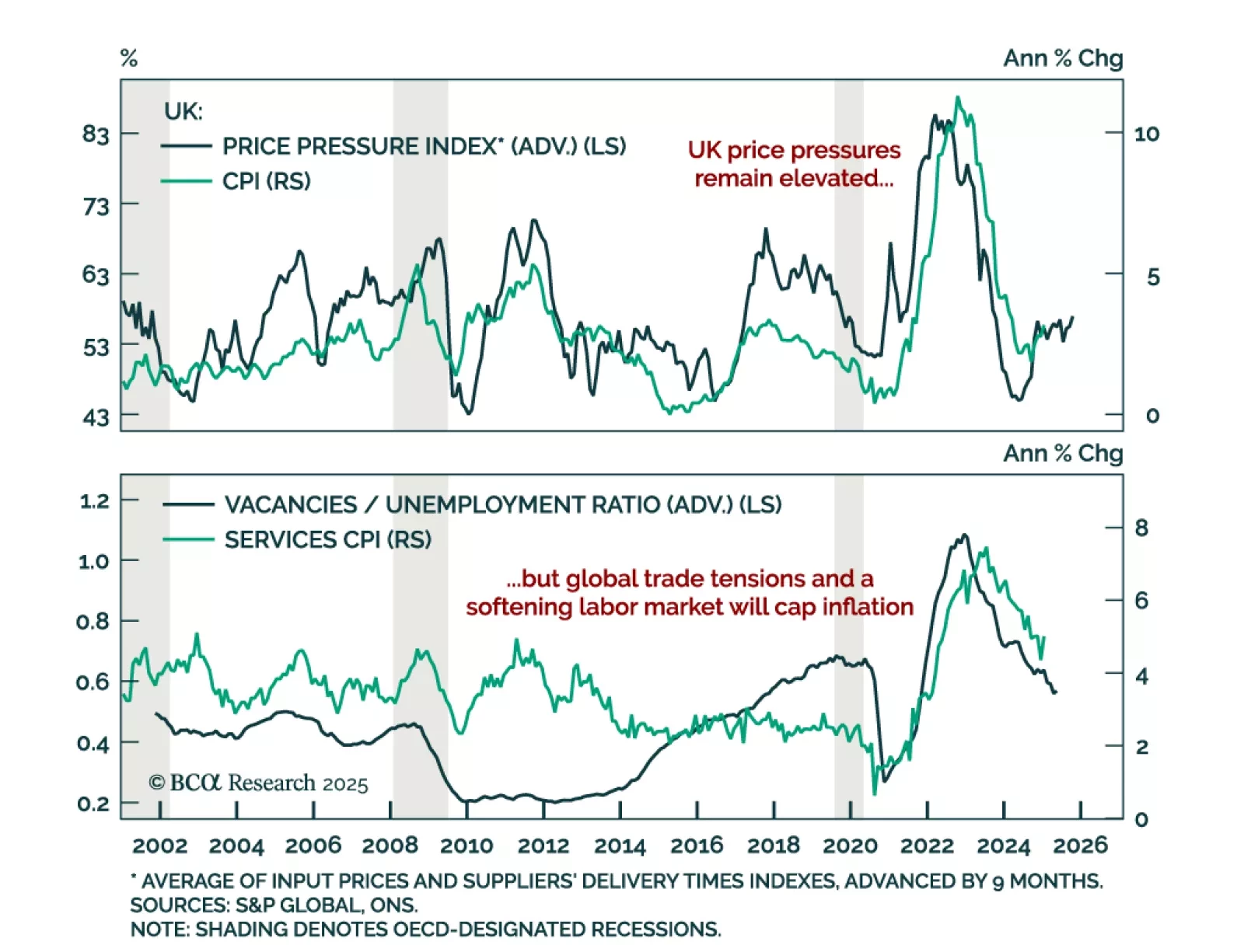

The January UK CPI was slightly hotter than expected. Headline inflation beat estimates, rising to 3.0% y/y from 2.5% in December. Core inflation also jumped but was in line with expectations at 3.7%. Services were strong, albeit…

While inflation concerns prevail in the US, Swiss inflation hit its lowest level in almost four years. Headline CPI contracted 0.1% m/m in January, leaving the annual inflation rate at 0.4%, near the bottom of the Swiss National Bank…