In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

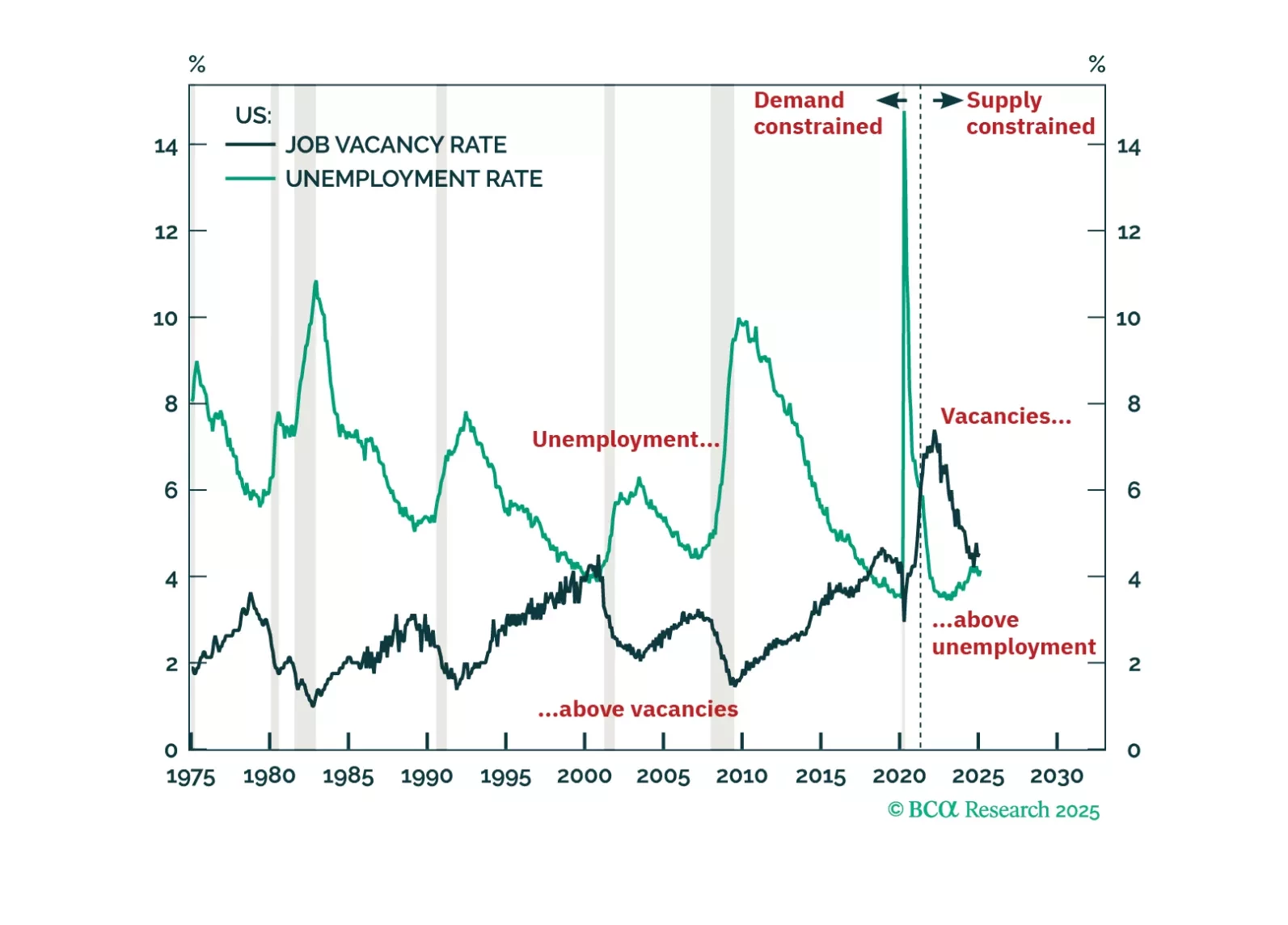

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

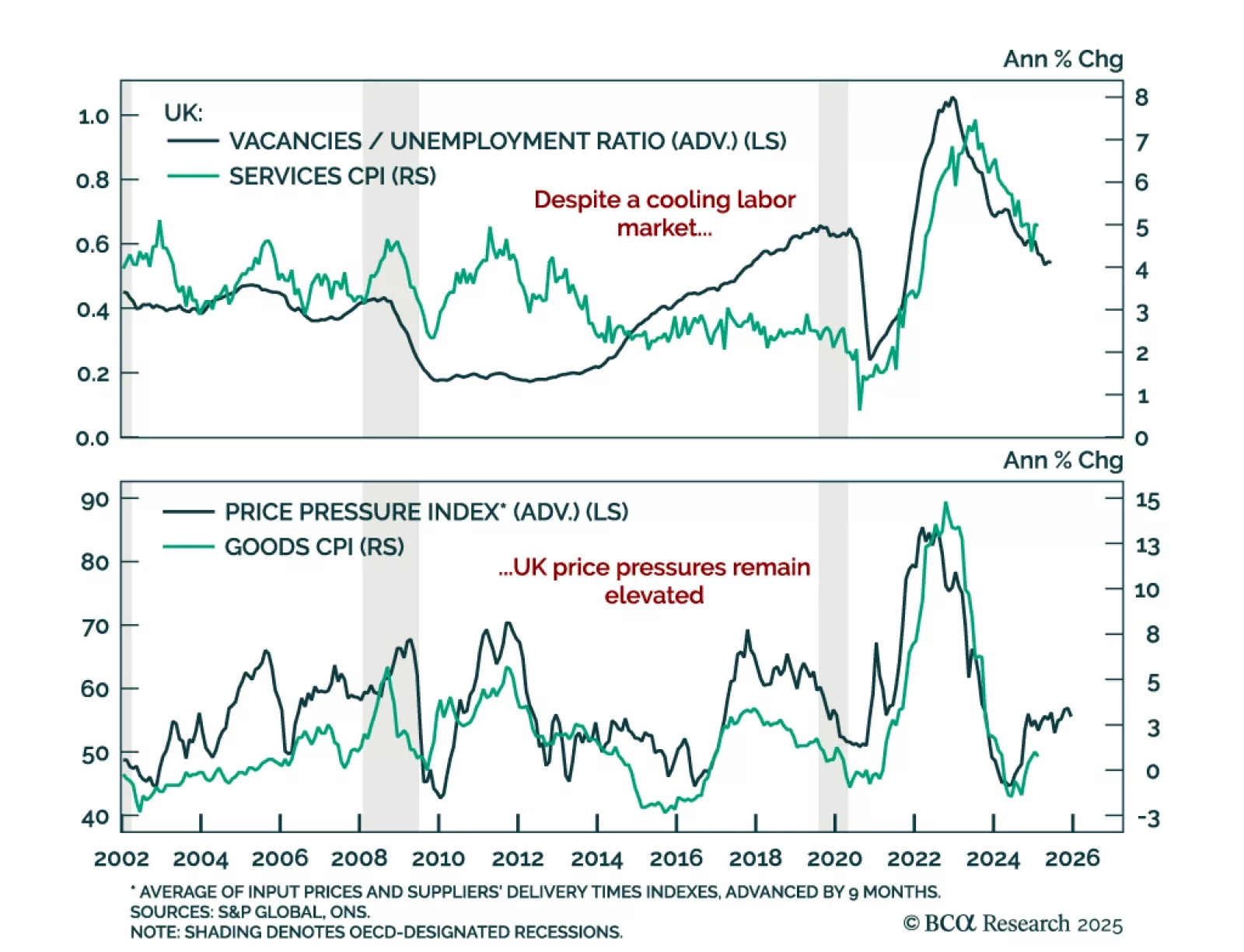

UK inflation came in cooler than expected in February, but lingering price pressures and a still-firm labor market keep the BoE sidelined, for now. Our Global Fixed-Income strategists view the BoE as the most likely DM central bank…

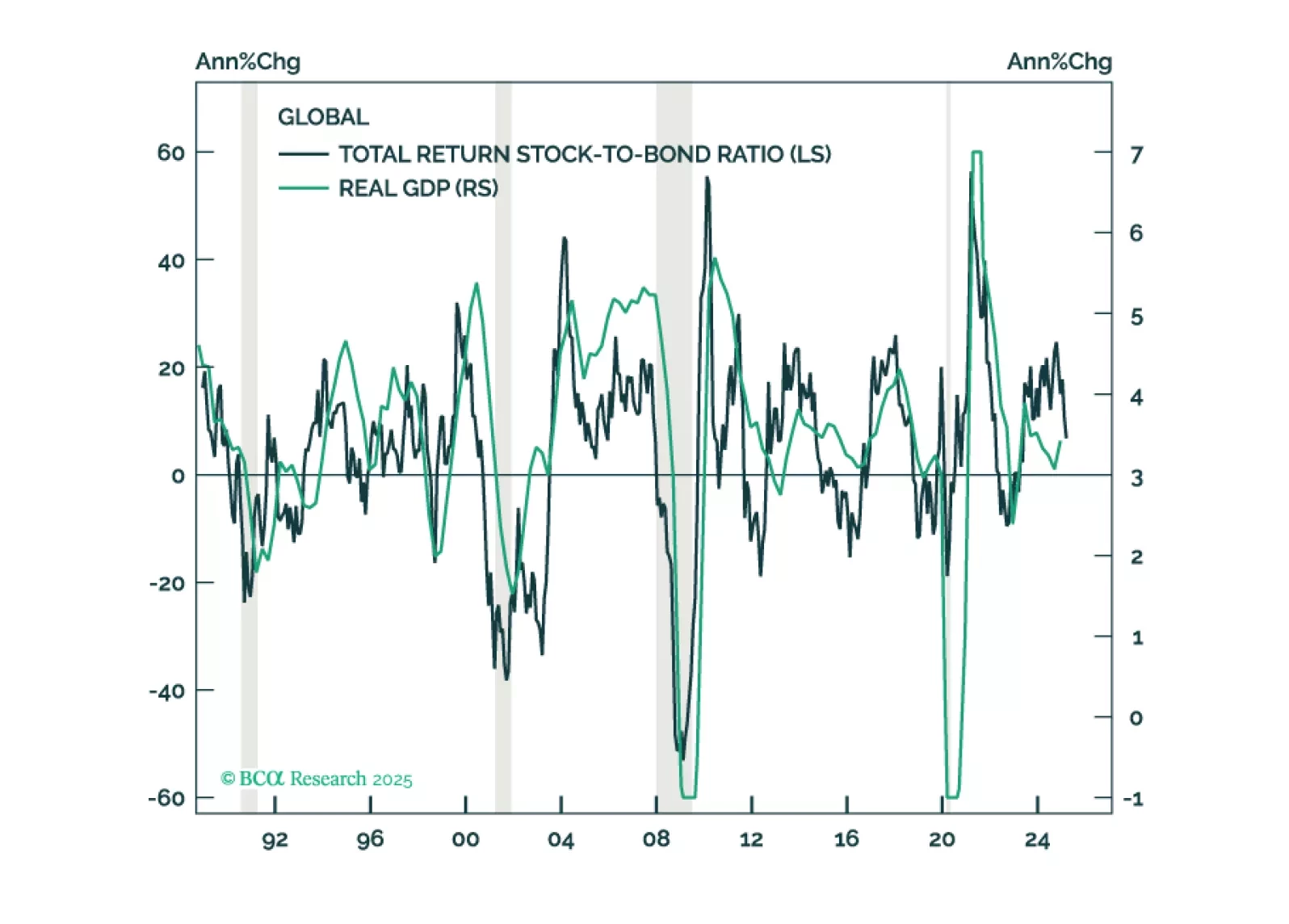

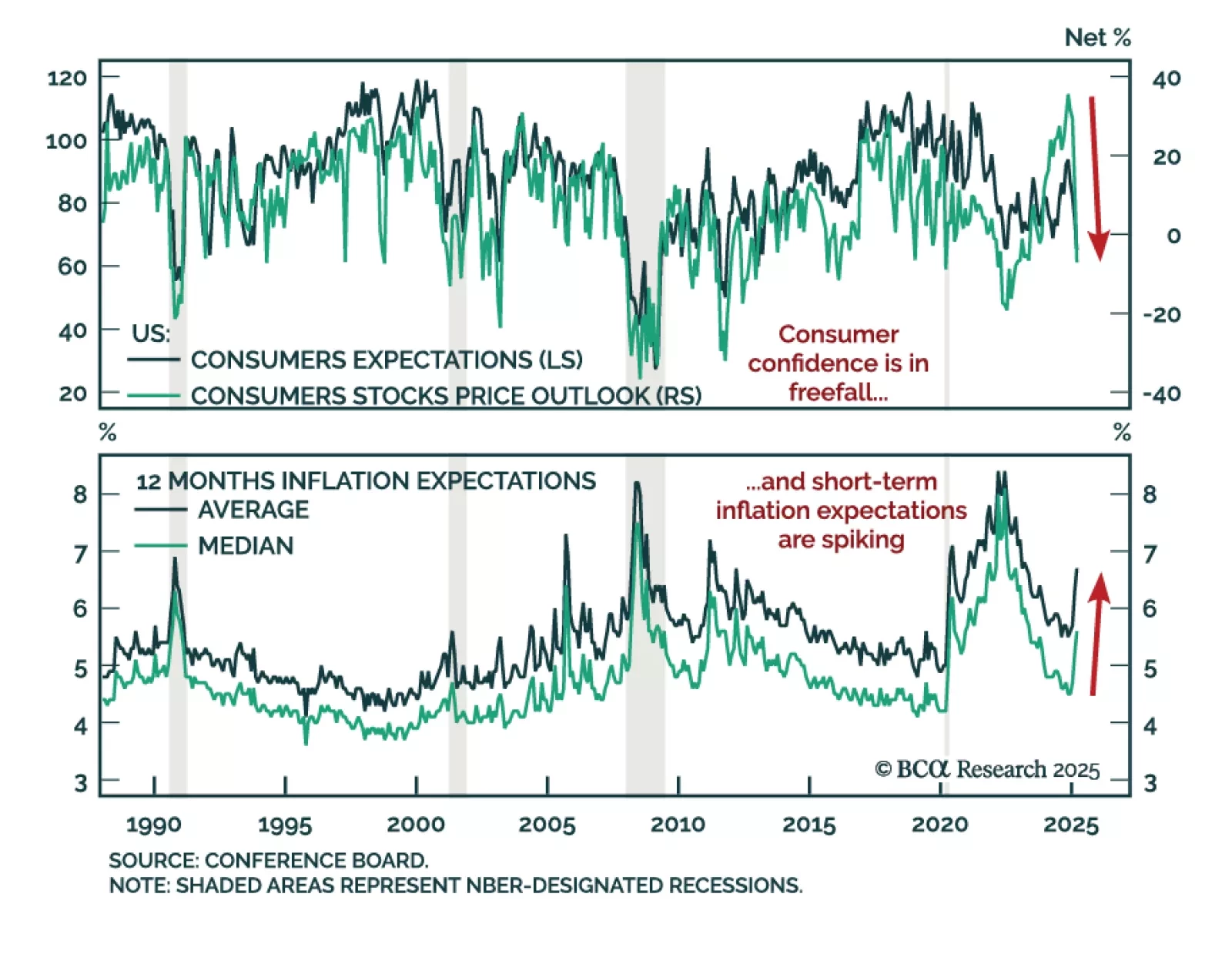

A sharp drop in consumer confidence adds to signs that a consumption slowdown is coming, threatening both US and global growth. Yet rising short-term inflation expectations will keep central banks cautious, weighing on long-term…

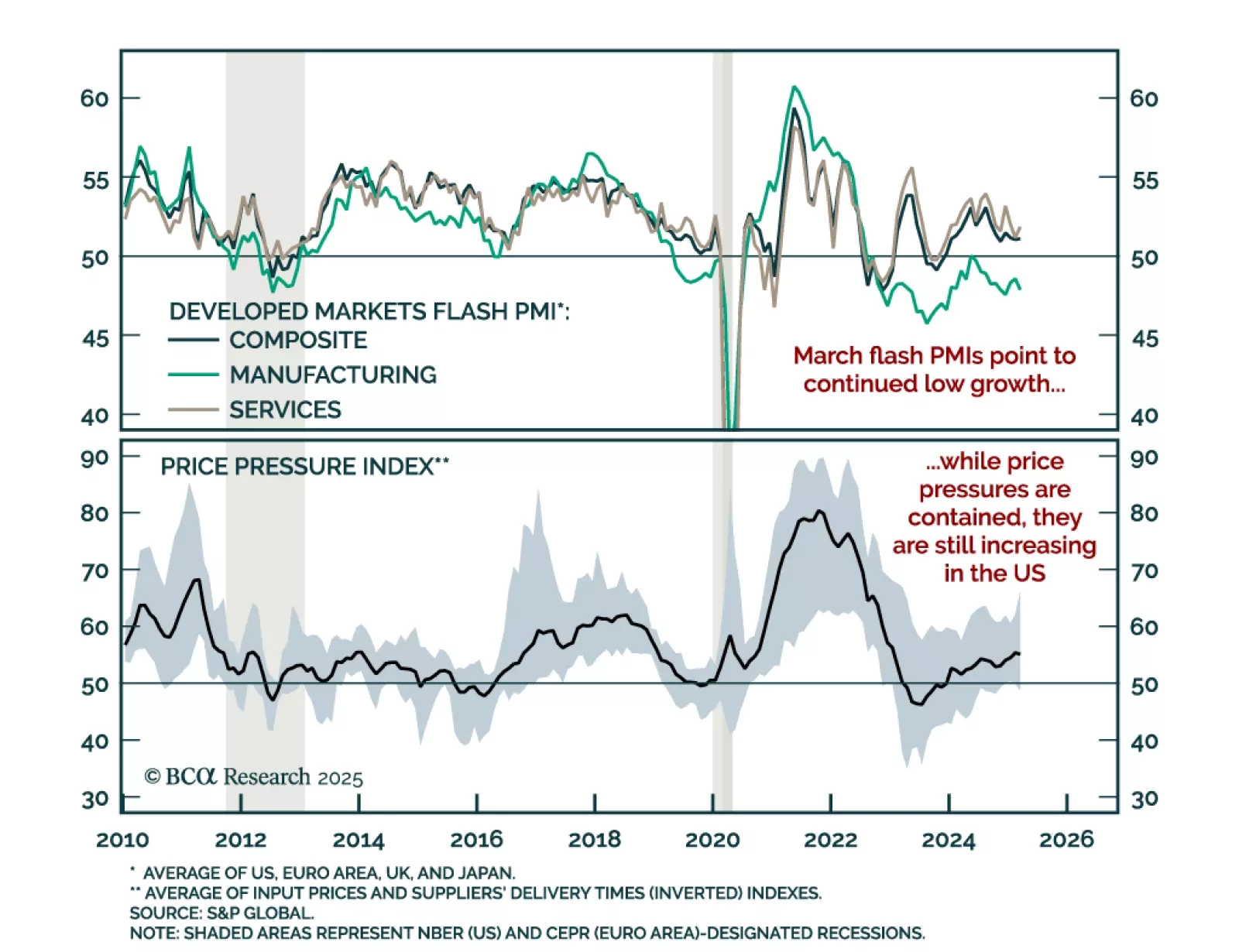

The March PMIs point to a low growth buffer outside the US as uncertainty engulfs the global economy. Aggregate price pressures were contained in March, but input prices still increased in the US. While the market reaction was risk-…

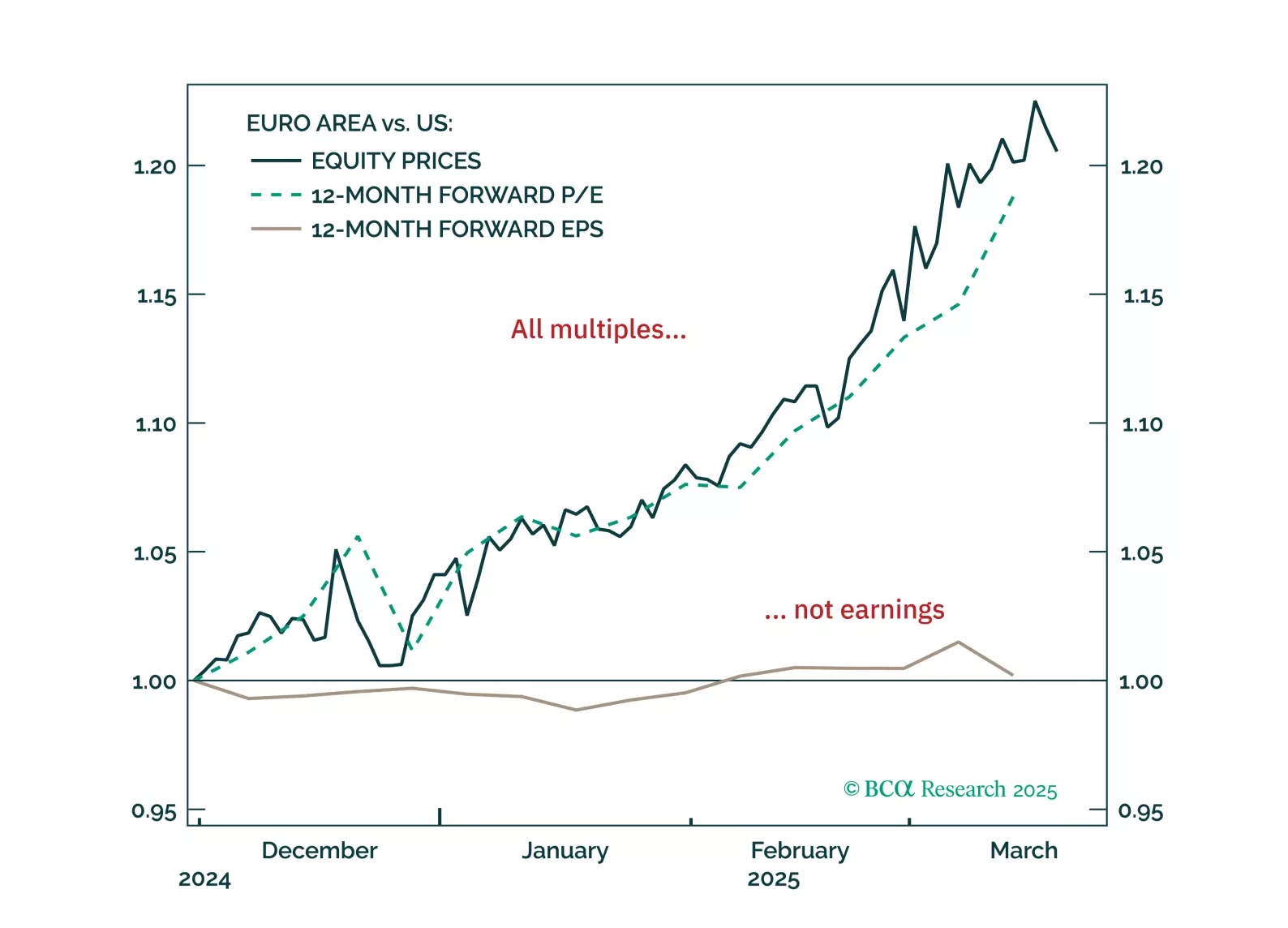

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

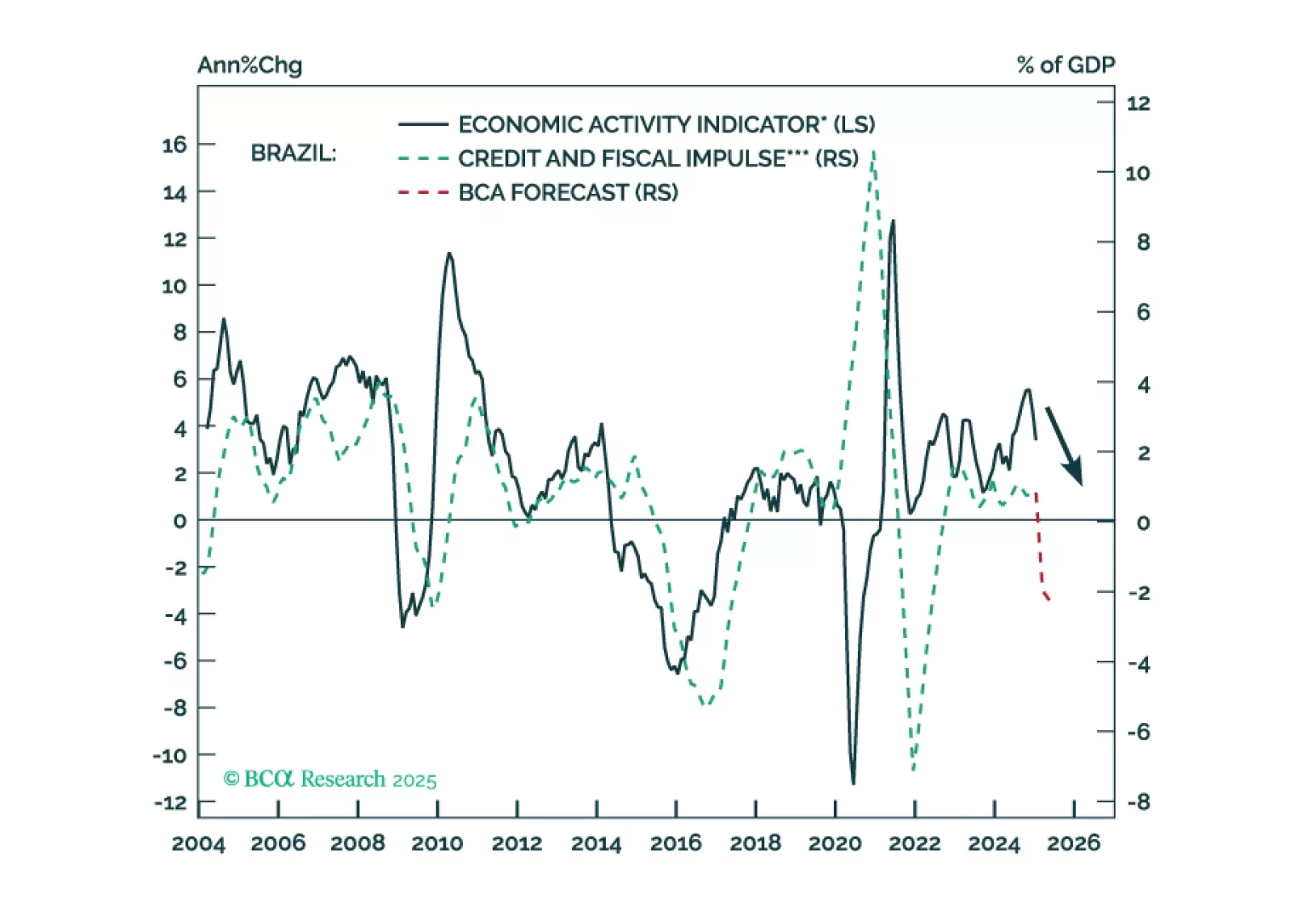

Brazilian policymakers are stuck between a rock and a hard place. There is no combination of fiscal and monetary policies that can assure decent growth, on-target inflation, a stable exchange rate, and public debt sustainability. We…

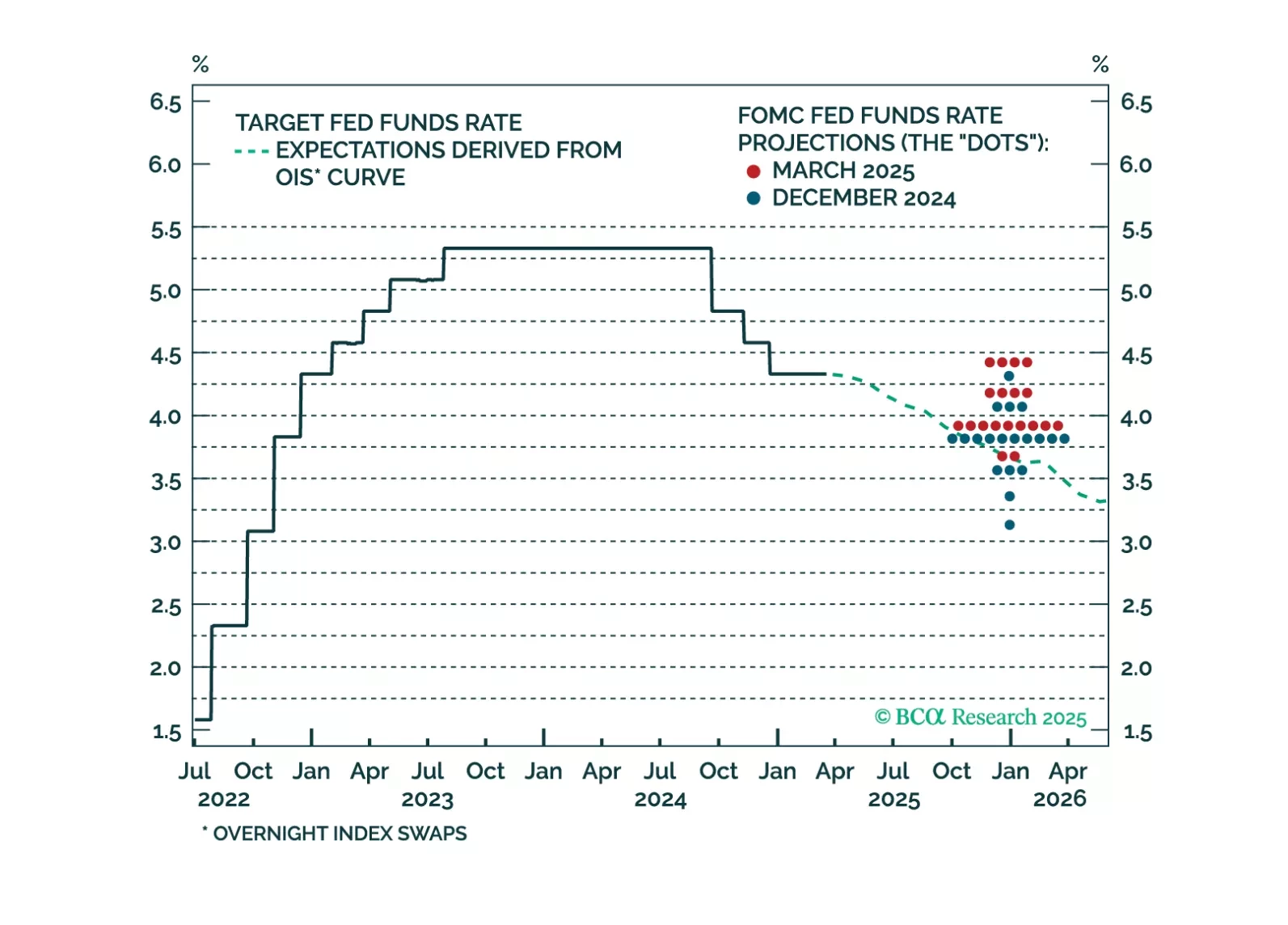

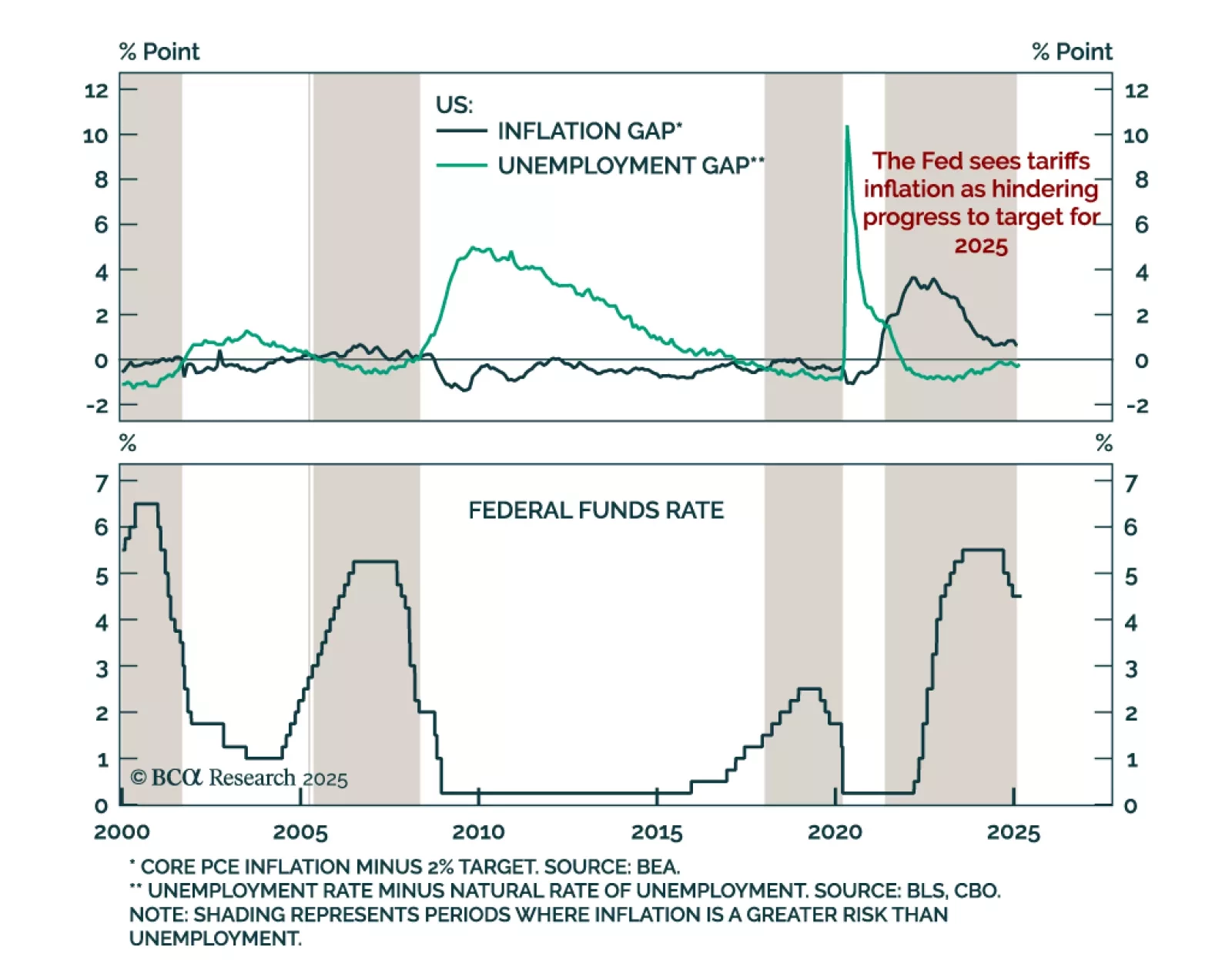

The Federal Reserve held rates at 4.25%-to-4.5% as expected, and slowed down the pace of quantitative tightening. The FOMC remains comfortable waiting and assessing the impact of recent and upcoming policy changes. The dots reflected…

The market reaction to this afternoon’s Fed meeting looks overdone. Investors could be in for a hawkish surprise when it becomes apparent that the Fed won’t ease policy into higher tariff-driven inflation prints.

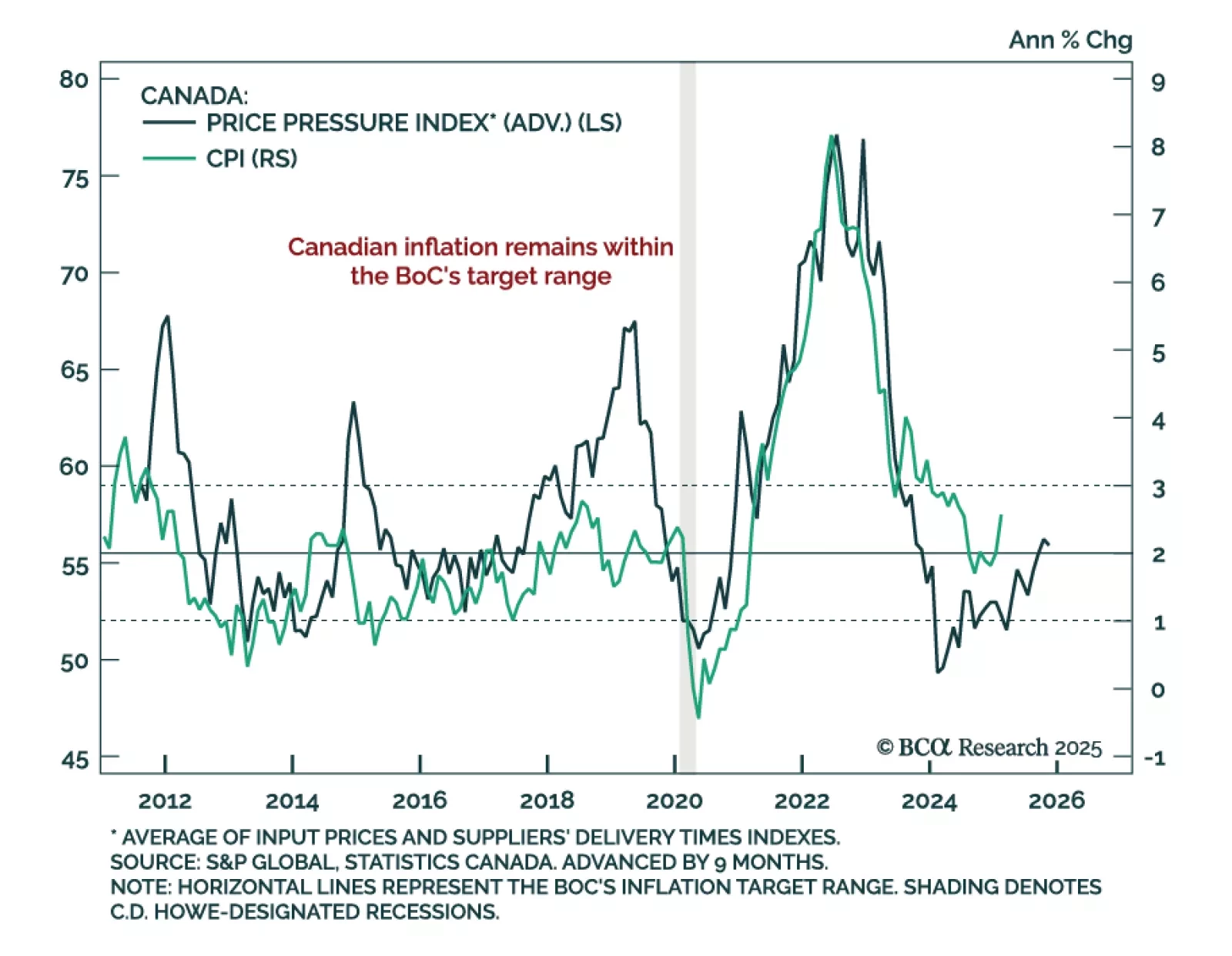

February Canadian headline inflation was stronger than expected, rising to 2.6% y/y from 1.9% in January. The Bank of Canada’s core measures were also slightly hotter than expected, both rising to 2.9% from 2.7% a month prior, near…