The stimulus measures driving the post-COVID expansion were beginning to wane after five years and pointing the economy in the direction of an organically occurring recession. Now that DOGE and the multi-front trade war have sped up…

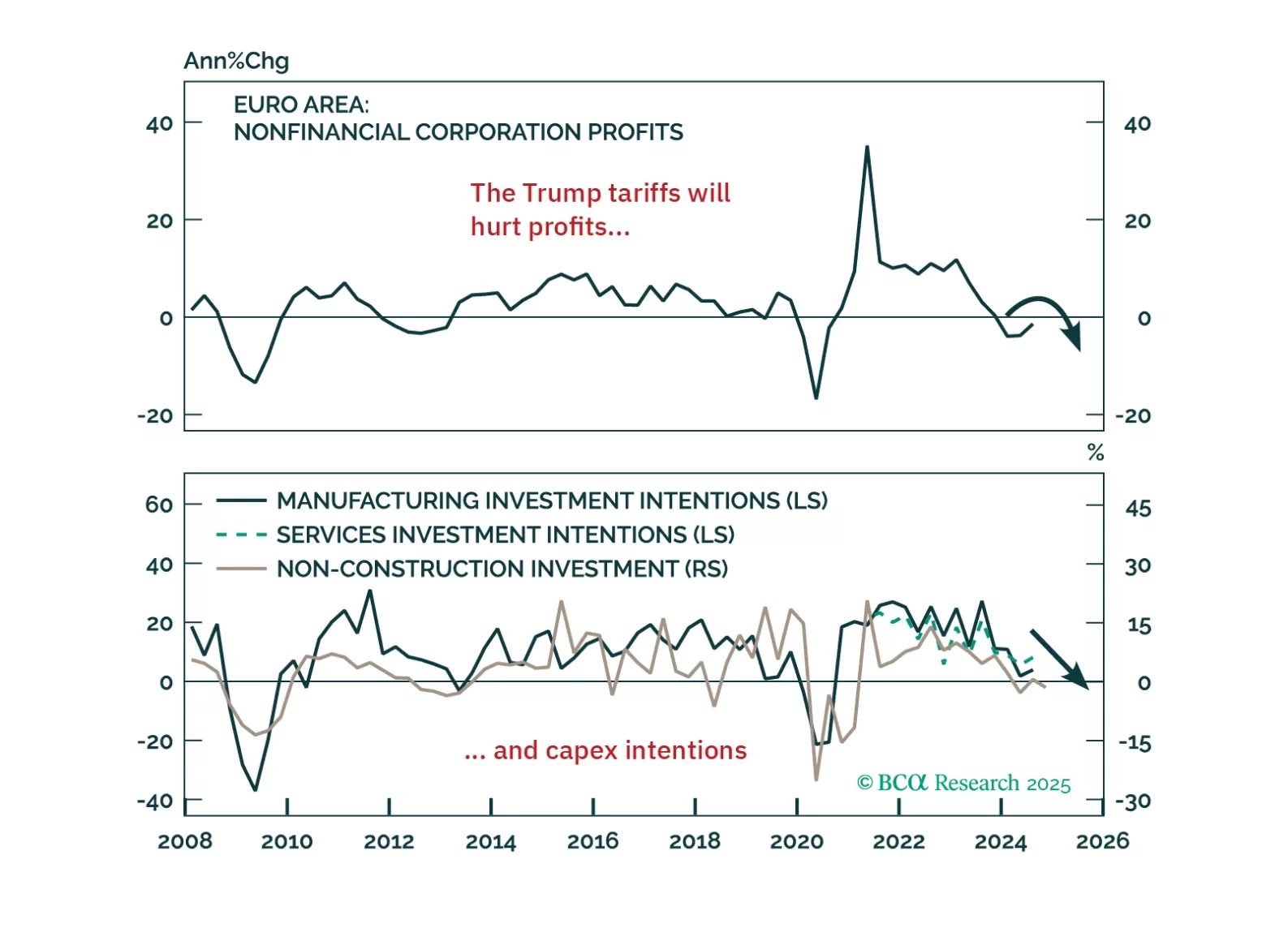

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…

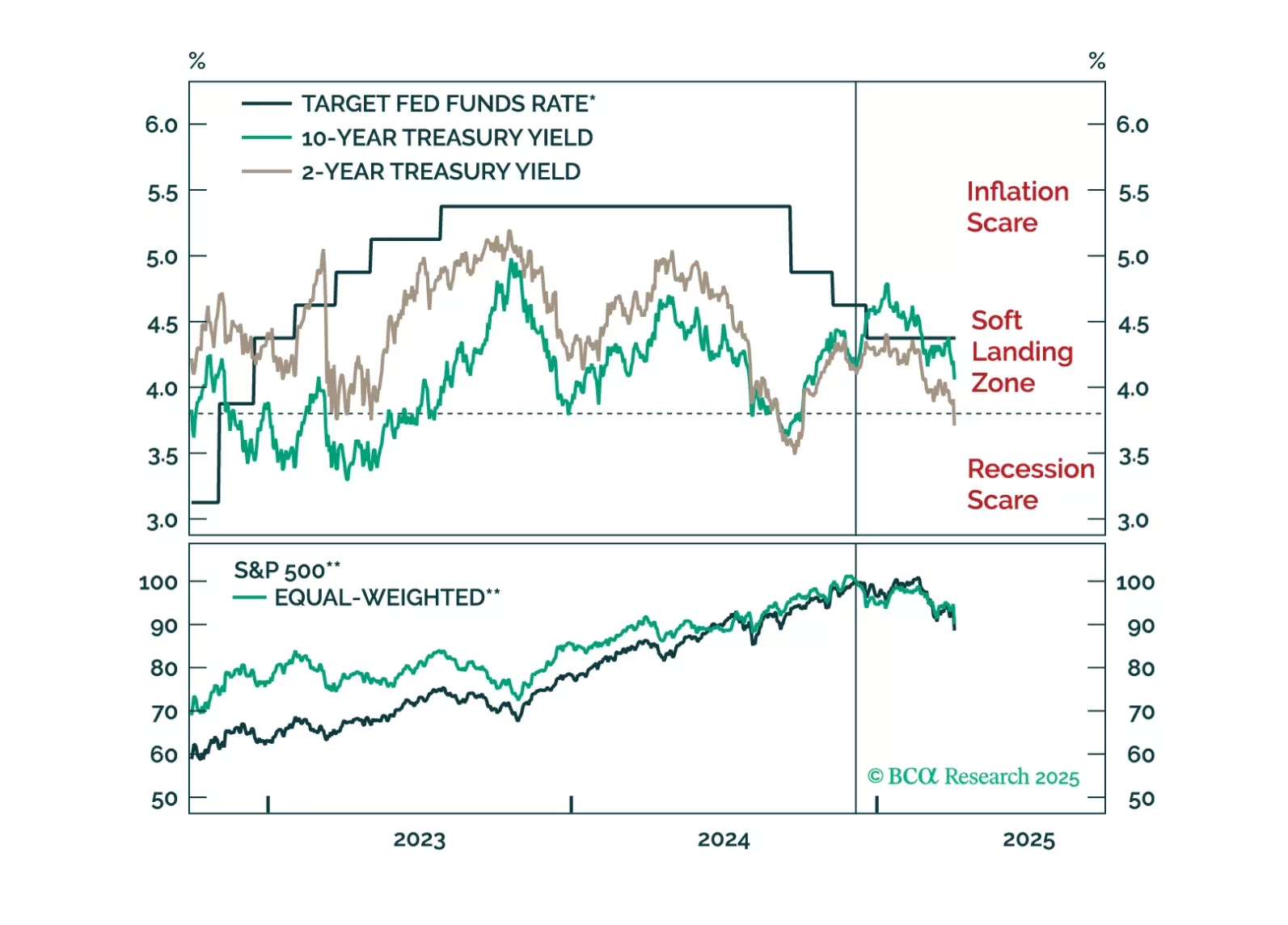

With both the Trump and Fed puts drifting lower, we reiterate our above-benchmark duration stance within a government bond overweight and favor Treasury curve steepeners. If the Trump put’s strike price is declining (See The Numbers…

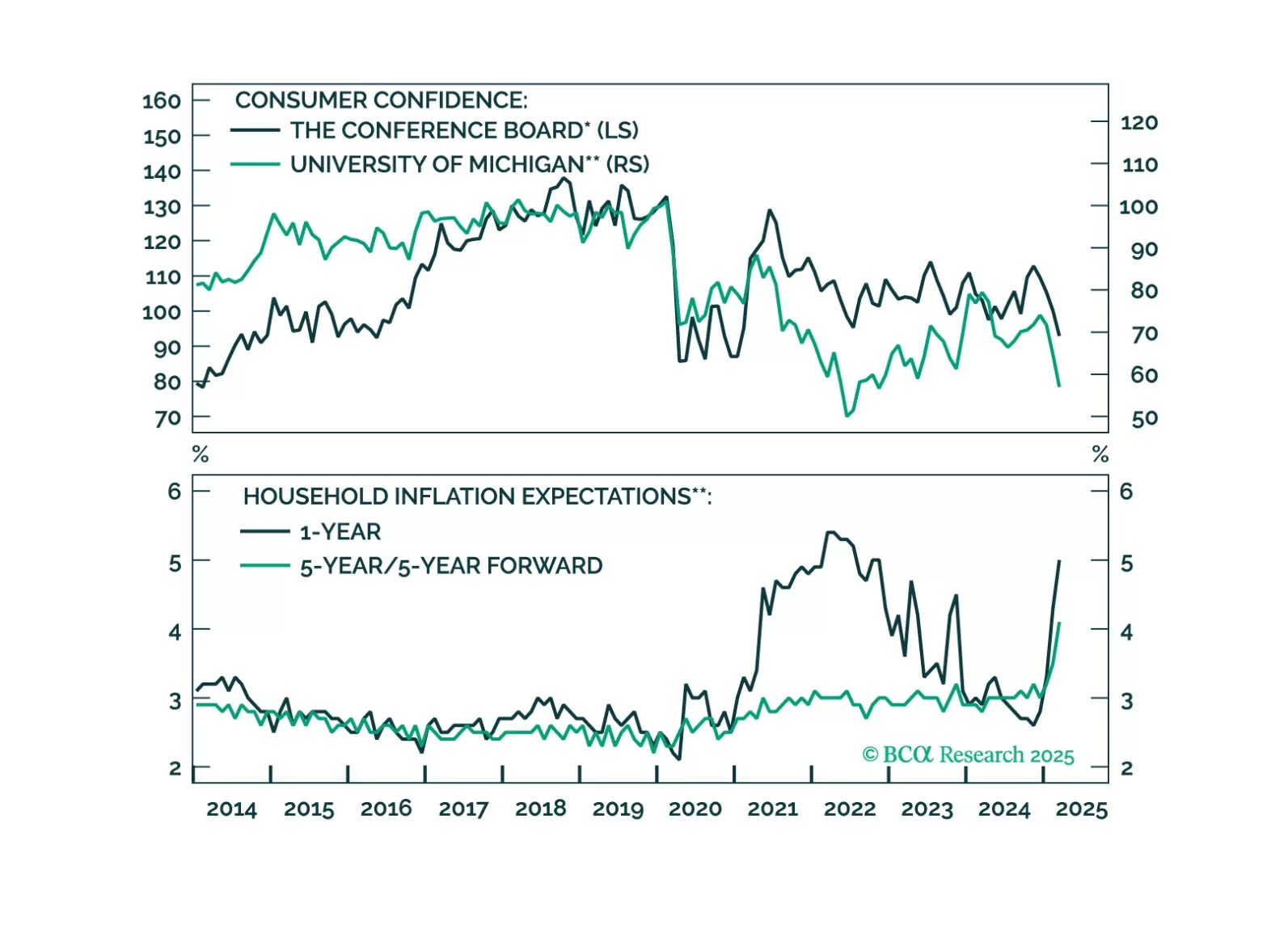

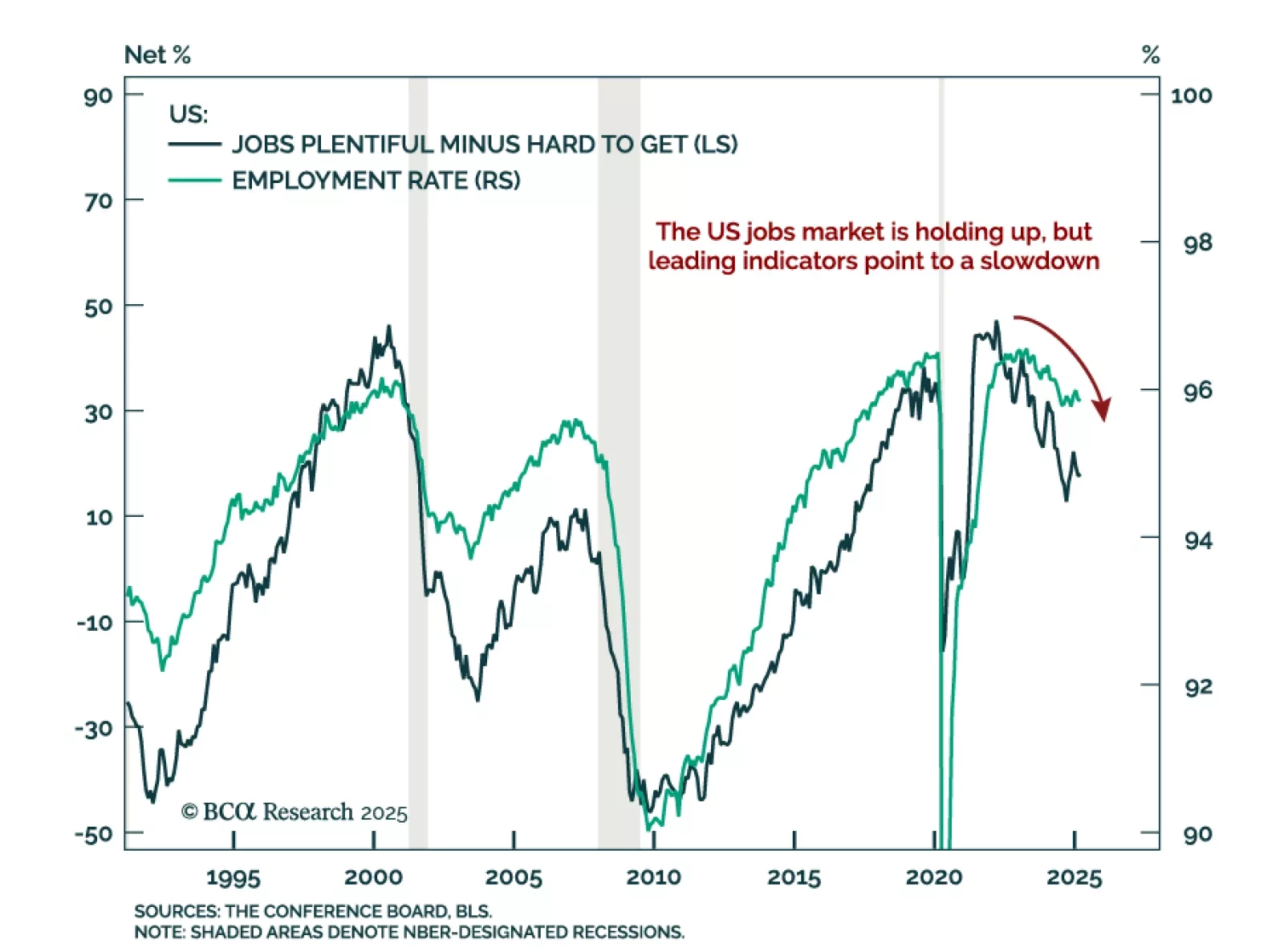

We reiterate our defensive global asset allocation, as risk assets face an asymmetric outlook whether growth slows or re-accelerates. The March US jobs report came in stronger than expected, with payrolls rising by 228k. However, the…

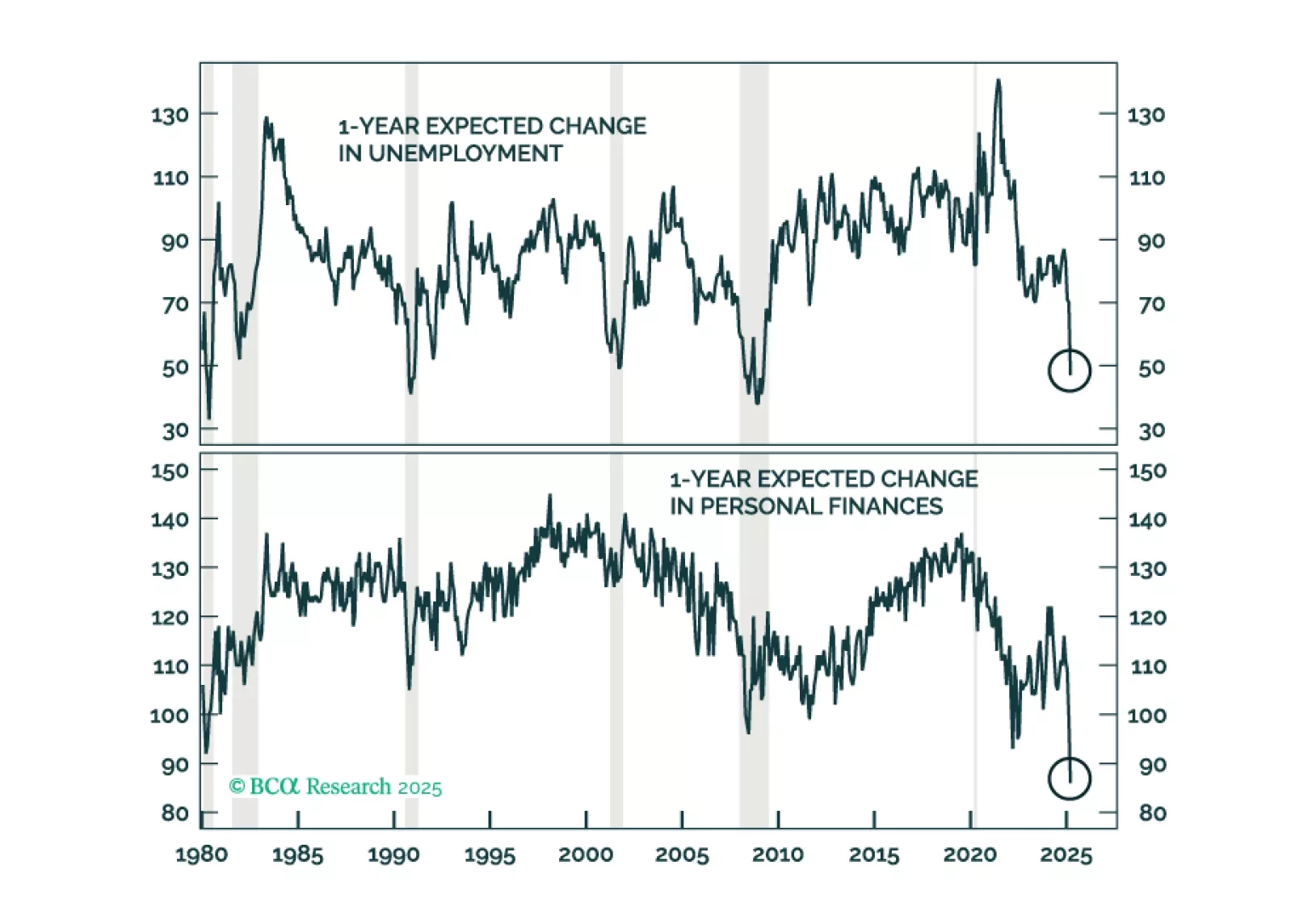

The March employment report showed strong job growth, but the labor market remains in a fragile state and the demand shock from tariffs could be the catalyst that tips it over the edge into recession.

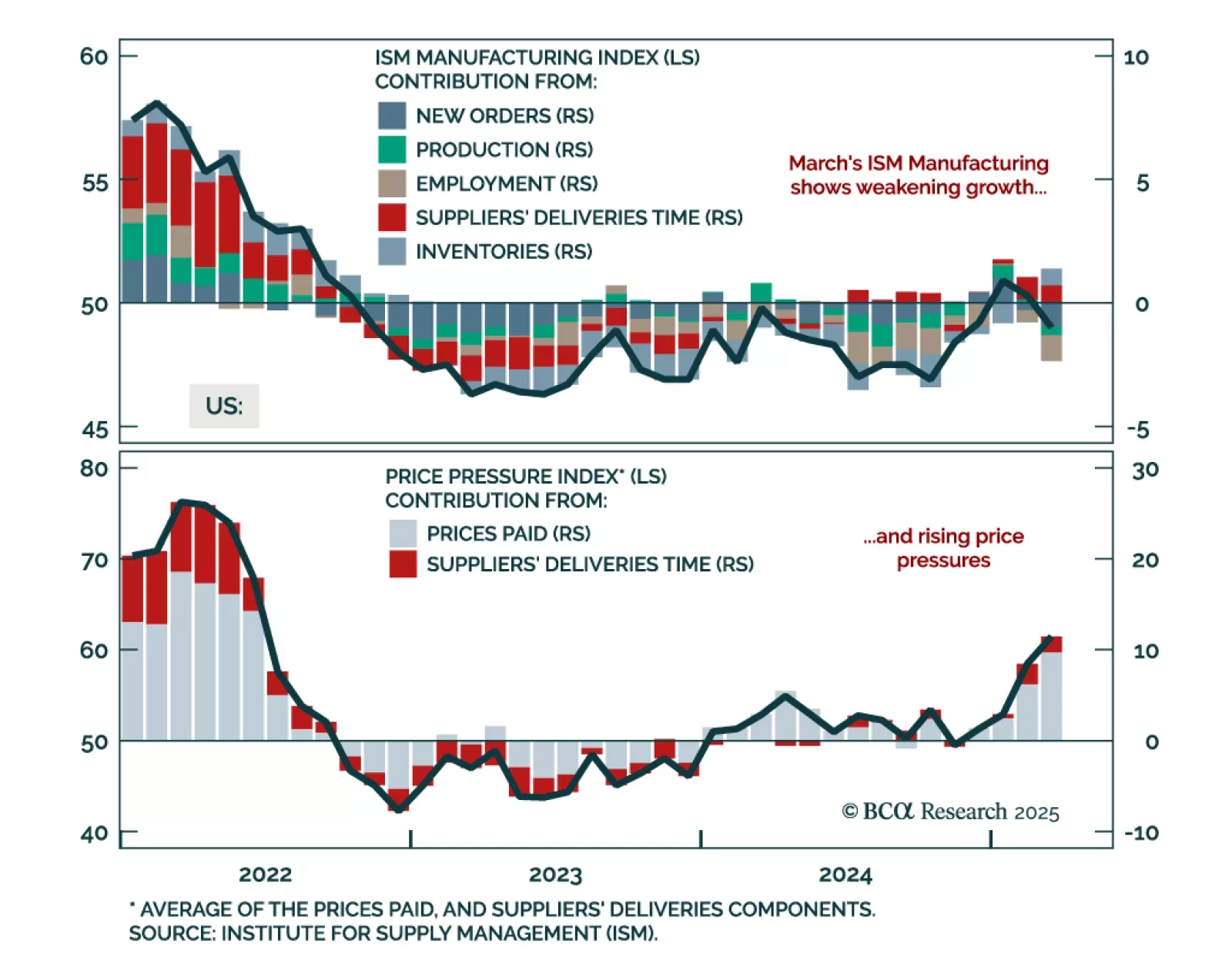

The March ISM Manufacturing adds to the recent stagflationary impulse, but markets remain focused on the growth drag, reinforcing our defensive asset allocation. The headline index fell more than expected to 49.0 from 50.3, with new…

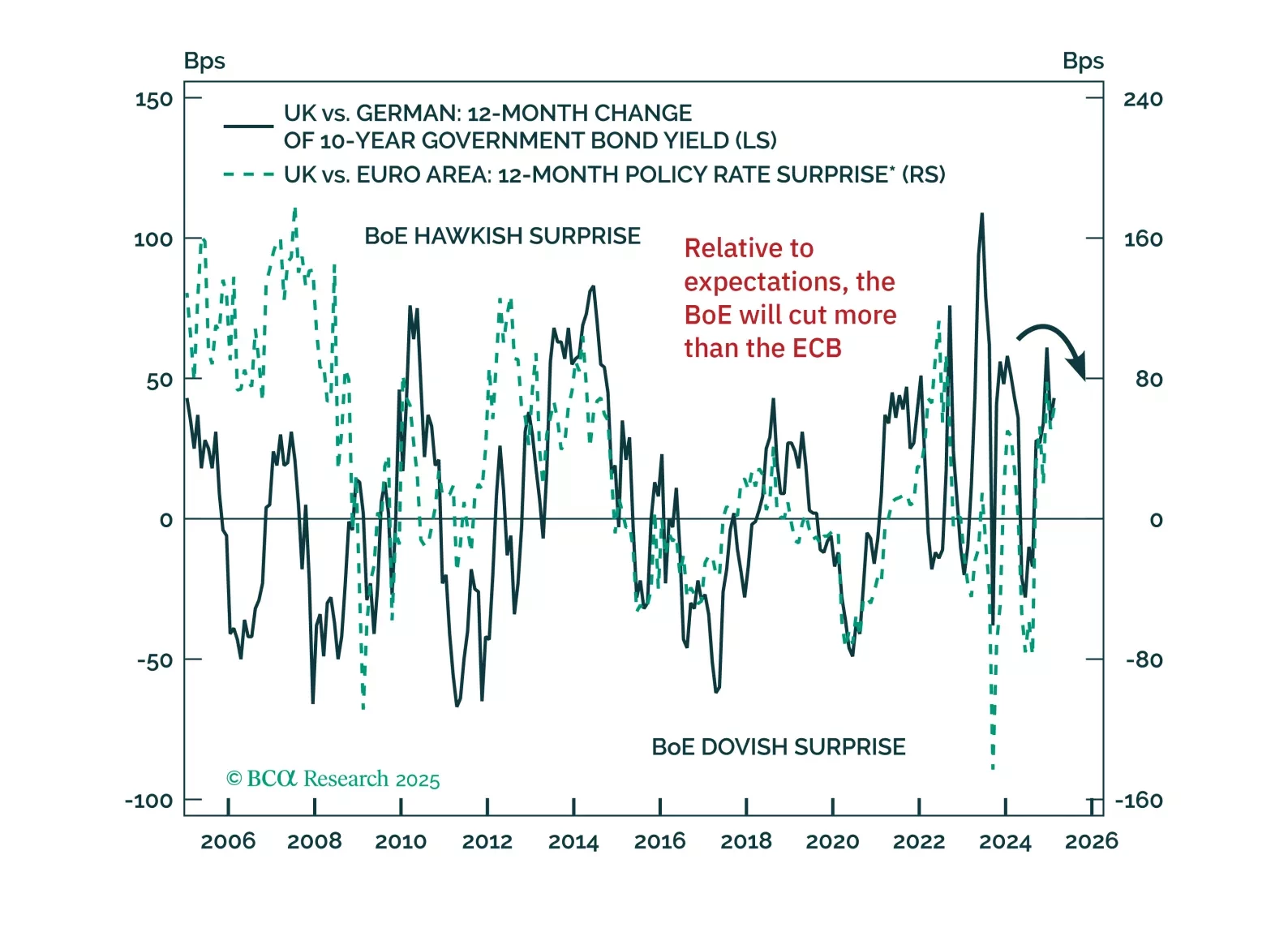

With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…

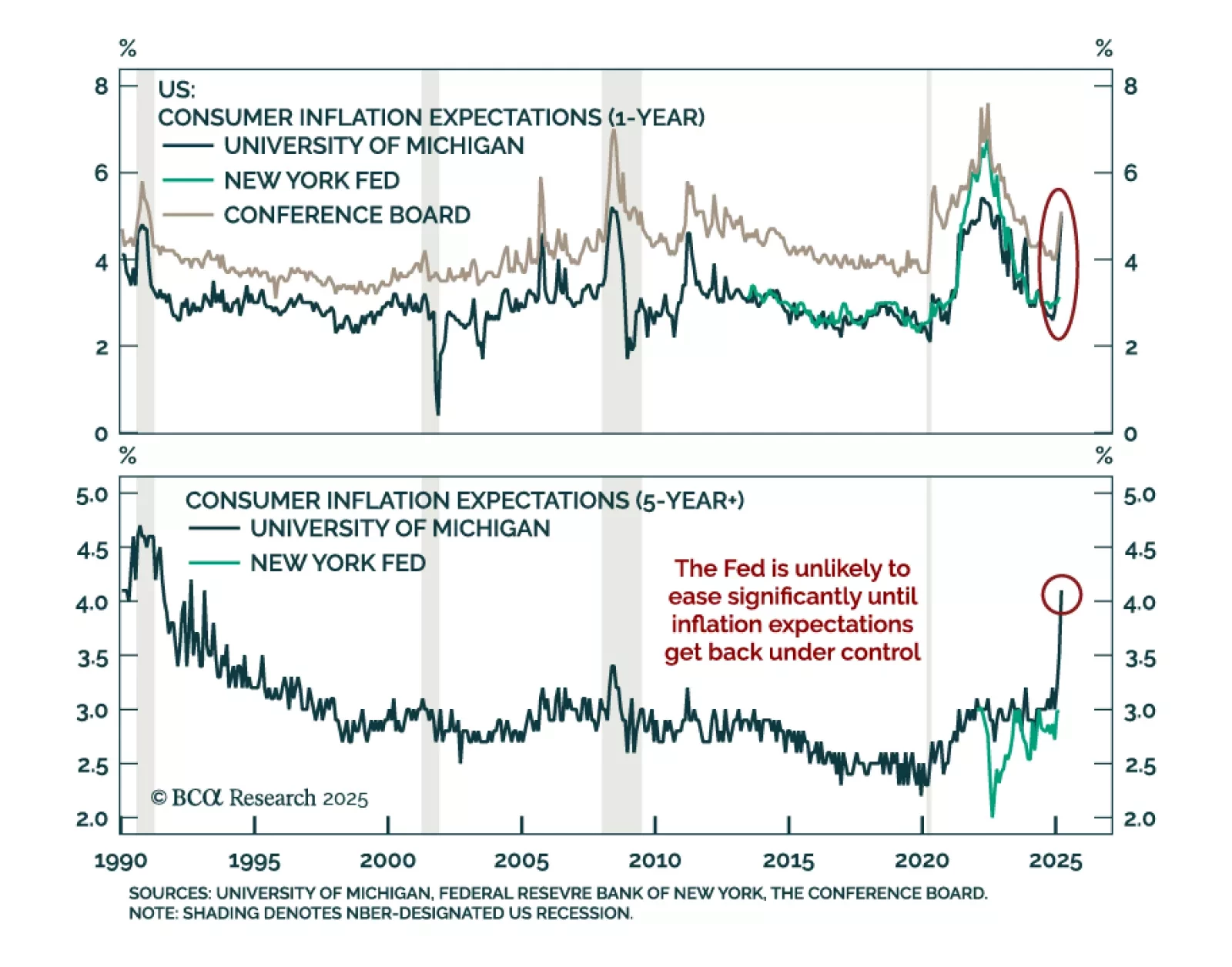

February US PCE data adds to the stagflationary tone, reinforcing our overweight duration stance and tactical short in front-end rates. Core PCE inflation rose 0.4% m/m, lifting the year-on-year rate to 2.8%, matching the Fed’s 2025…

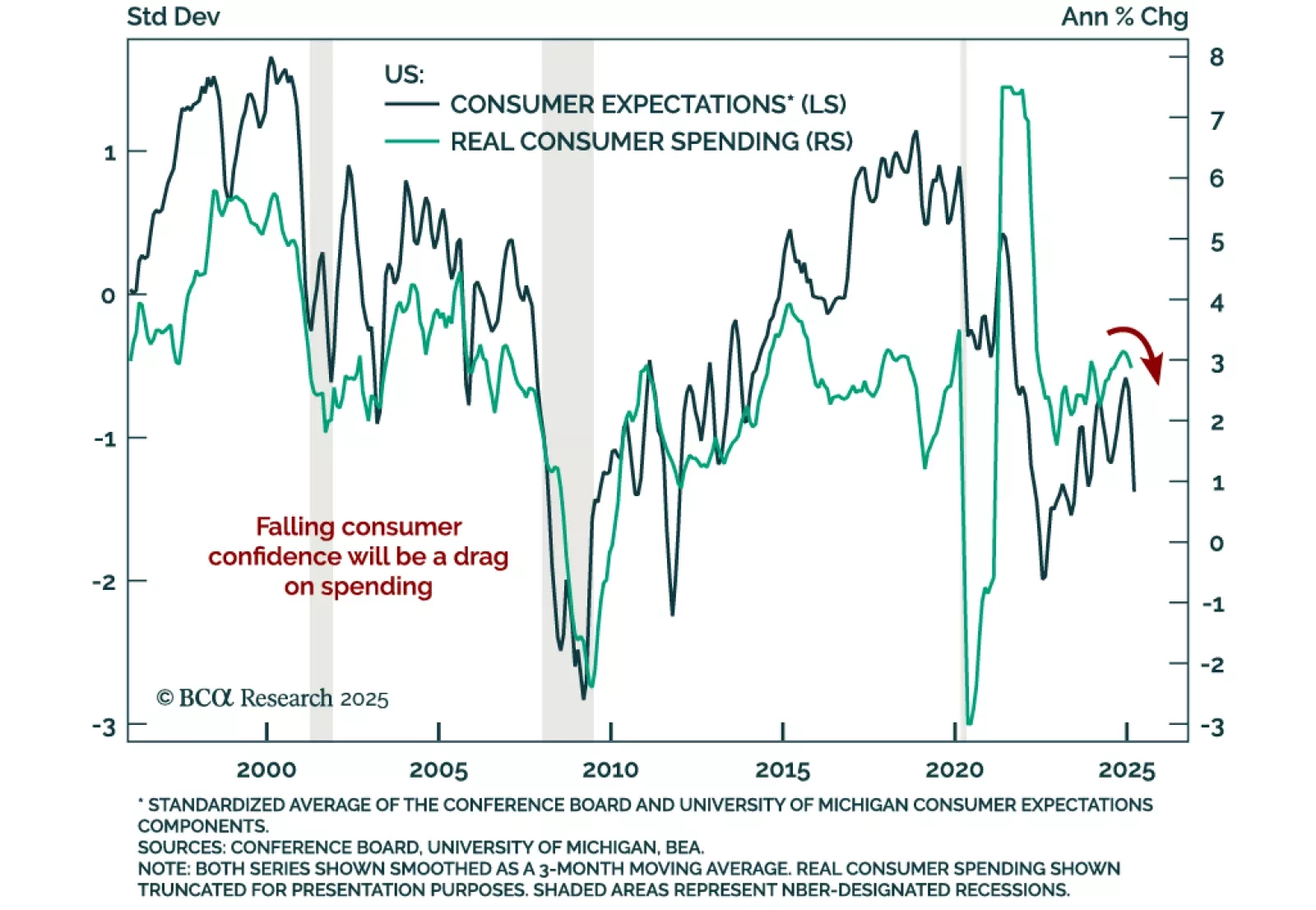

This morning’s weak consumer spending and strong inflation data reinforce our sense that the US economy is heading toward recession.

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…