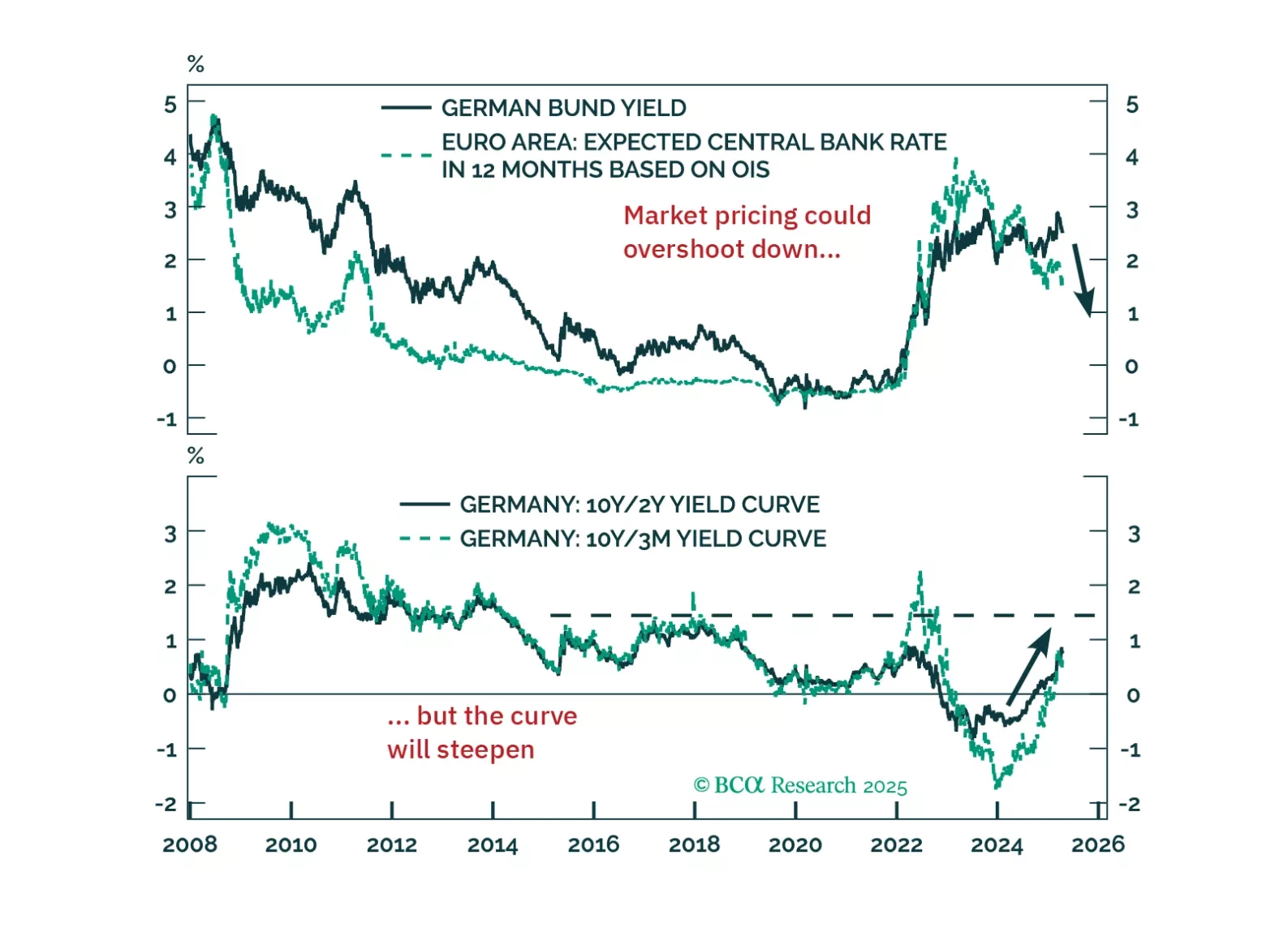

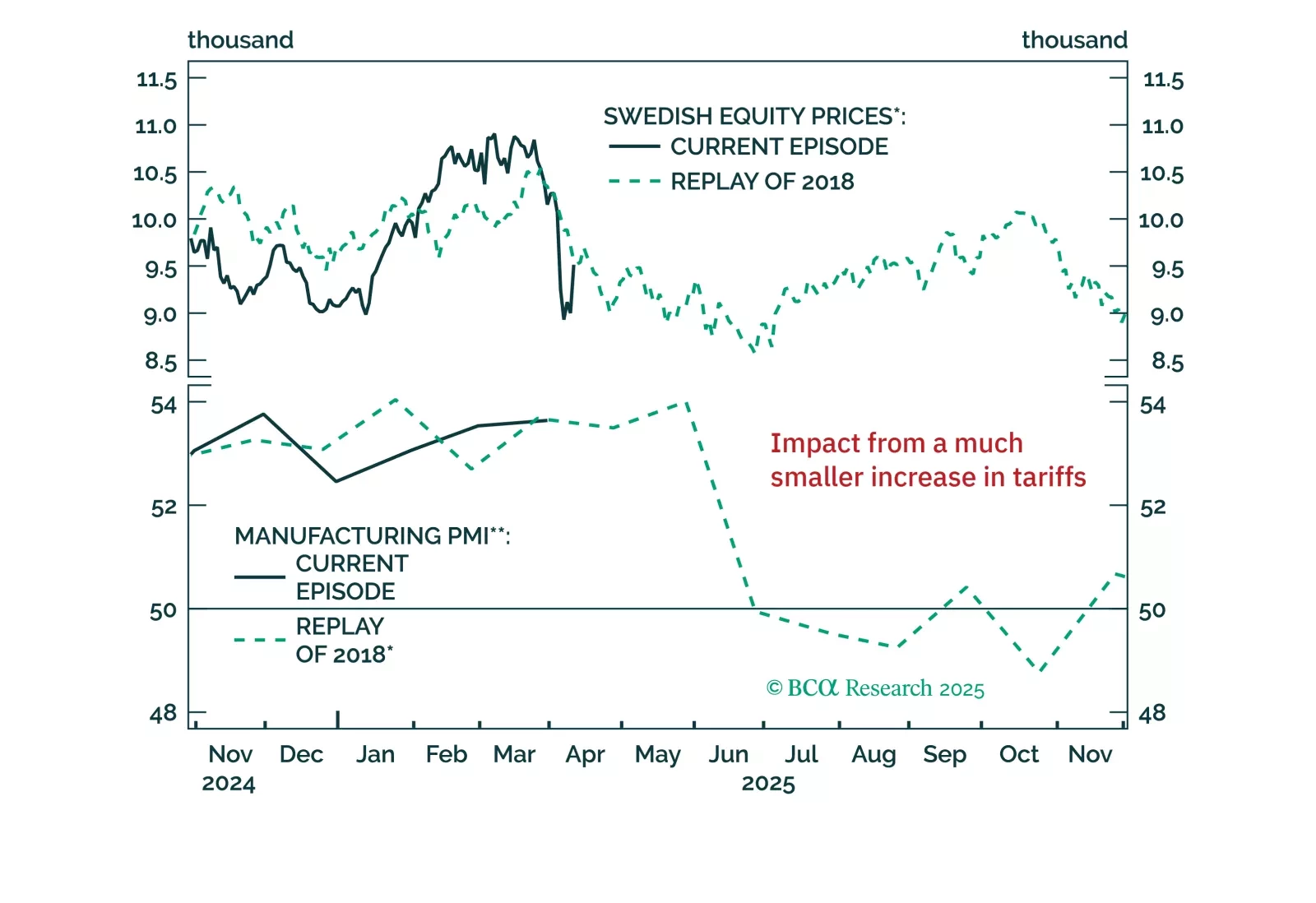

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

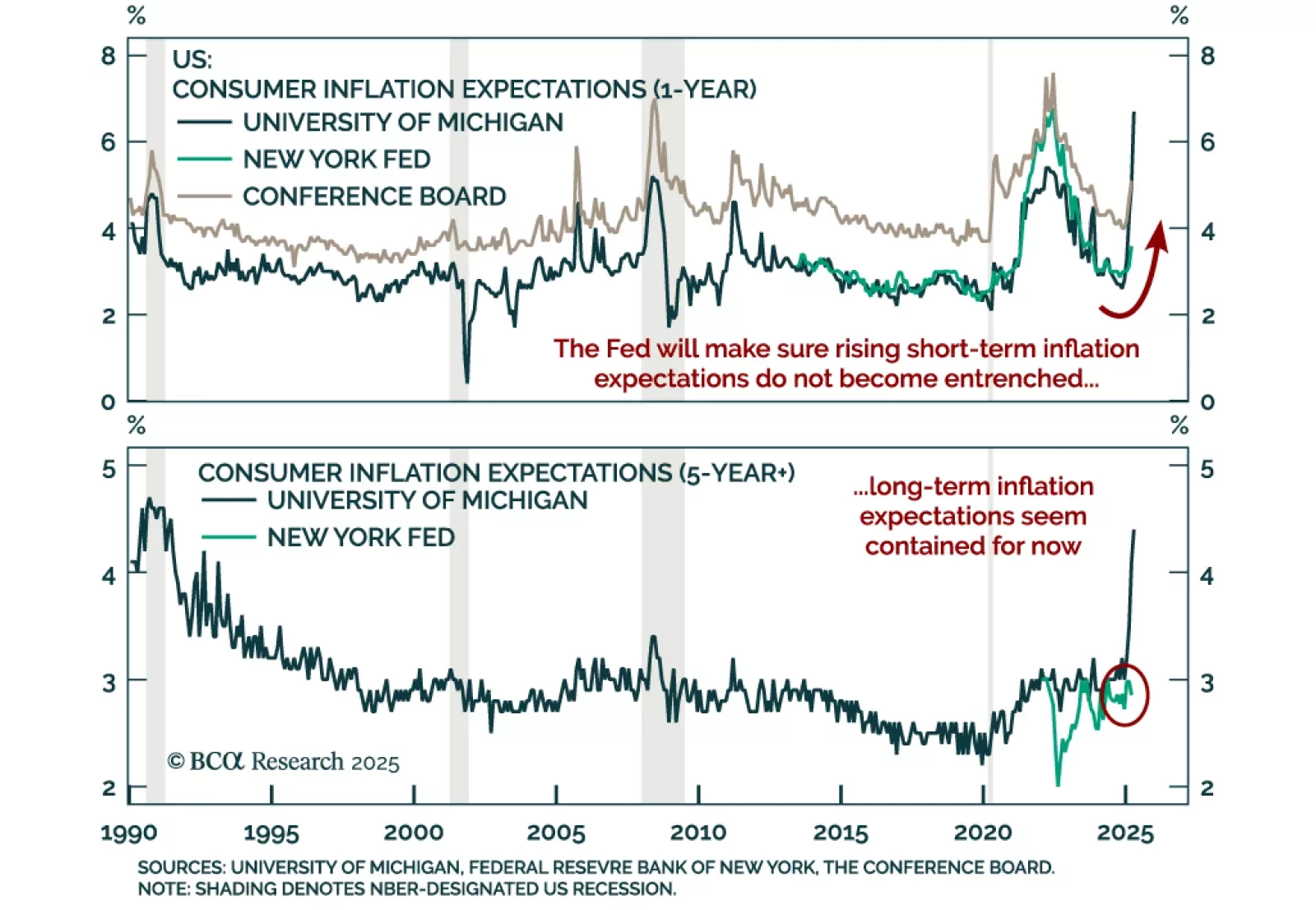

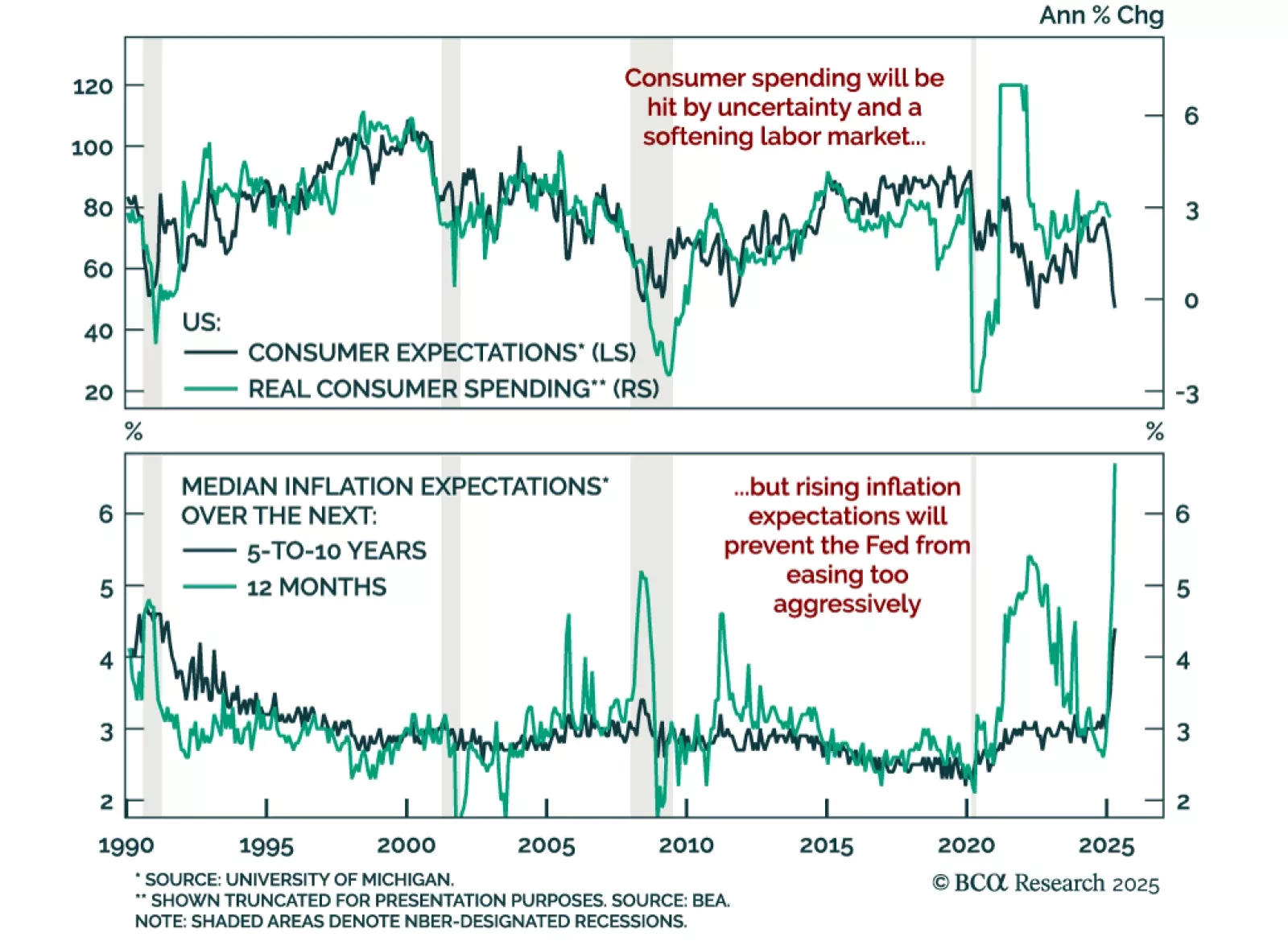

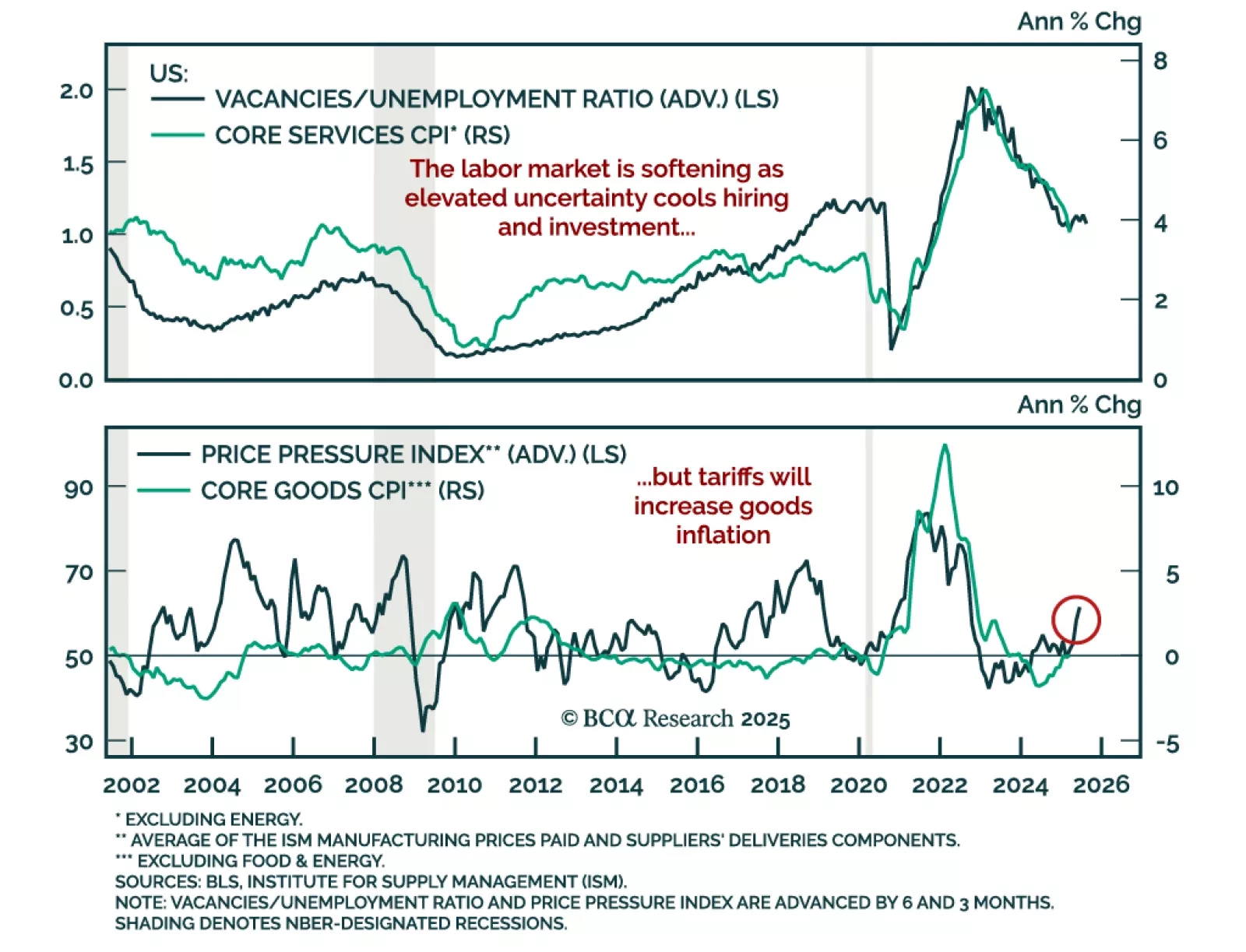

Fed Chair Jay Powell’s remarks yesterday were in-line with our base case expectation that the Fed will not cut rates proactively in the face of rising tariff-driven inflation.

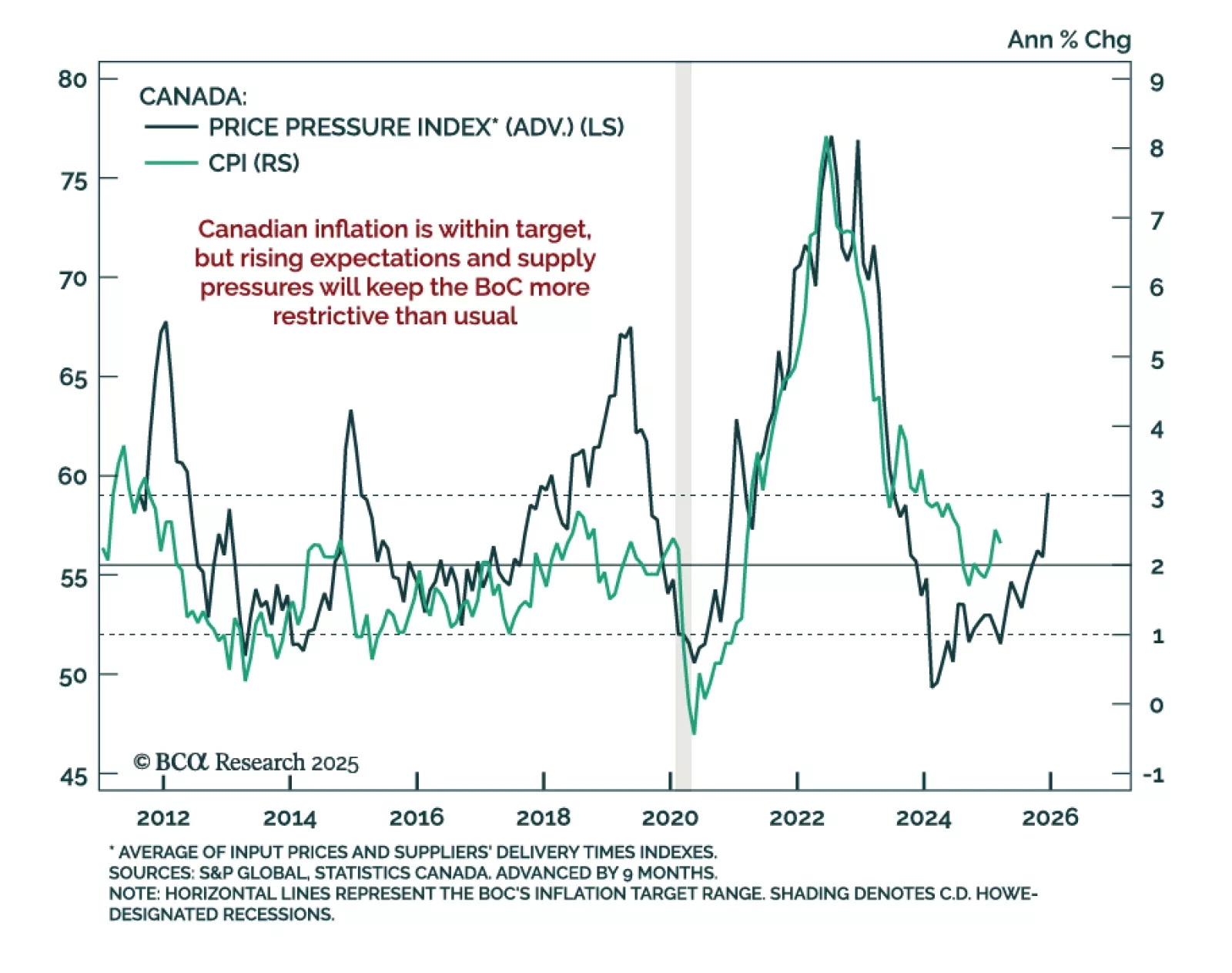

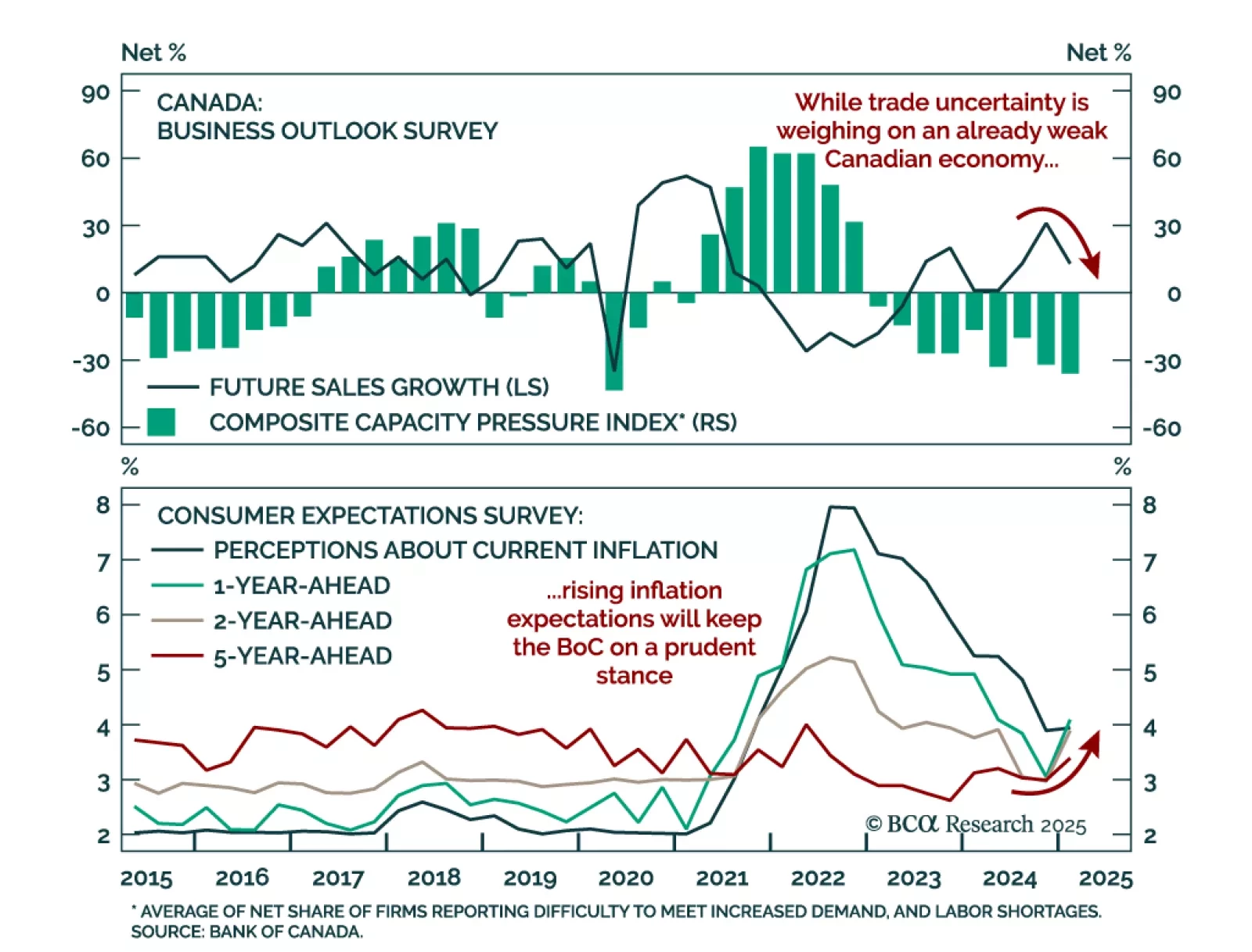

Cooler inflation will not shift the BoC’s stance, as stagflation limits potential easing, keeping us neutral on Canadian bonds. In March, headline CPI slowed more than expected to 2.3% y/y from 2.6%. However, lower energy prices…

The latest NY Fed Survey of Consumer Expectations reinforces our defensive stance, with growth concerns deepening even as long-term inflation expectations remain anchored. The survey is a useful cross-check against broader sentiment…

The sharp drop in consumer sentiment and rise in inflation expectations reinforce our defensive positioning and preference for long-duration bonds. The preliminary April University of Michigan Consumer Sentiment Index fell to 50.8…

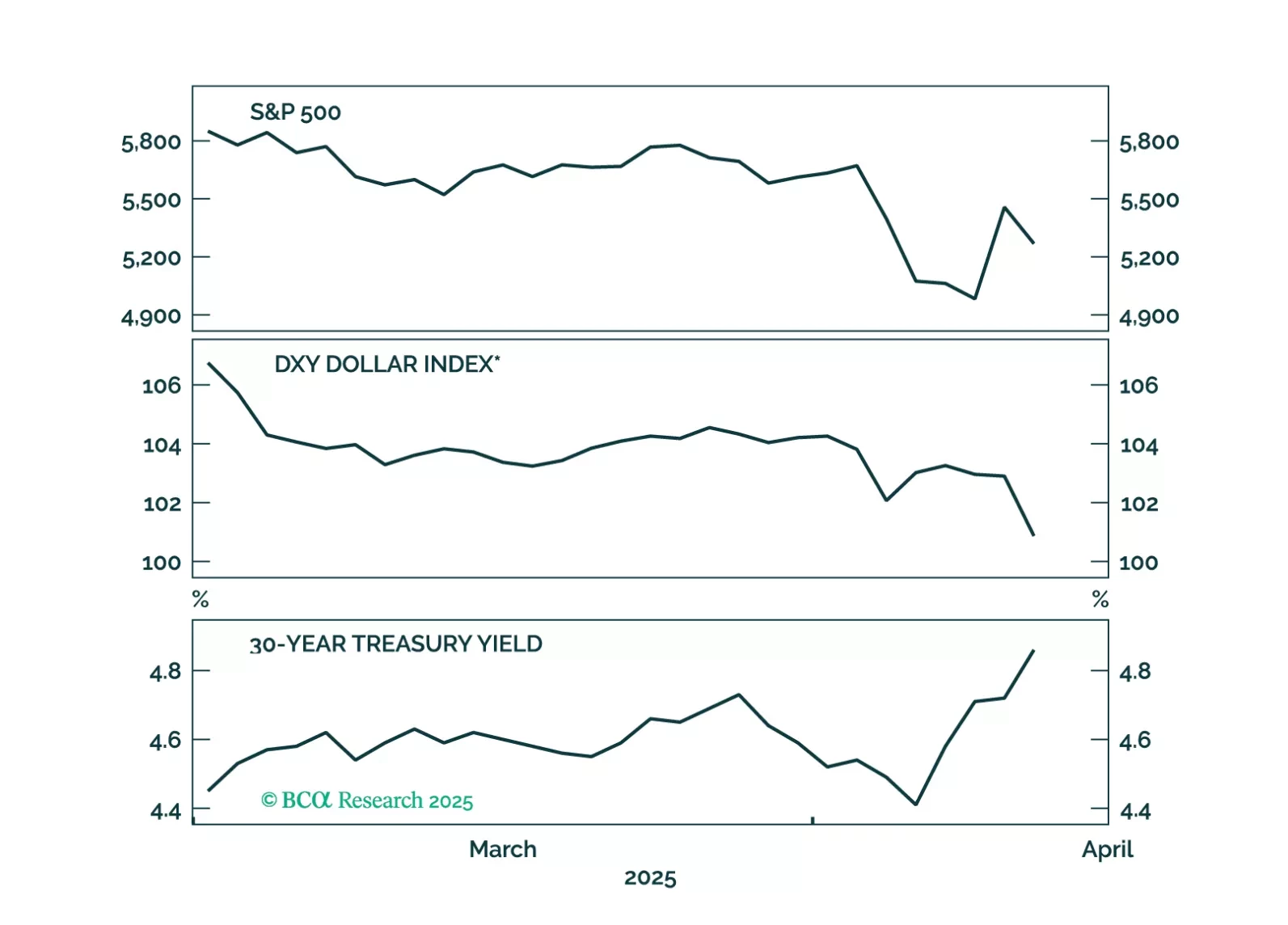

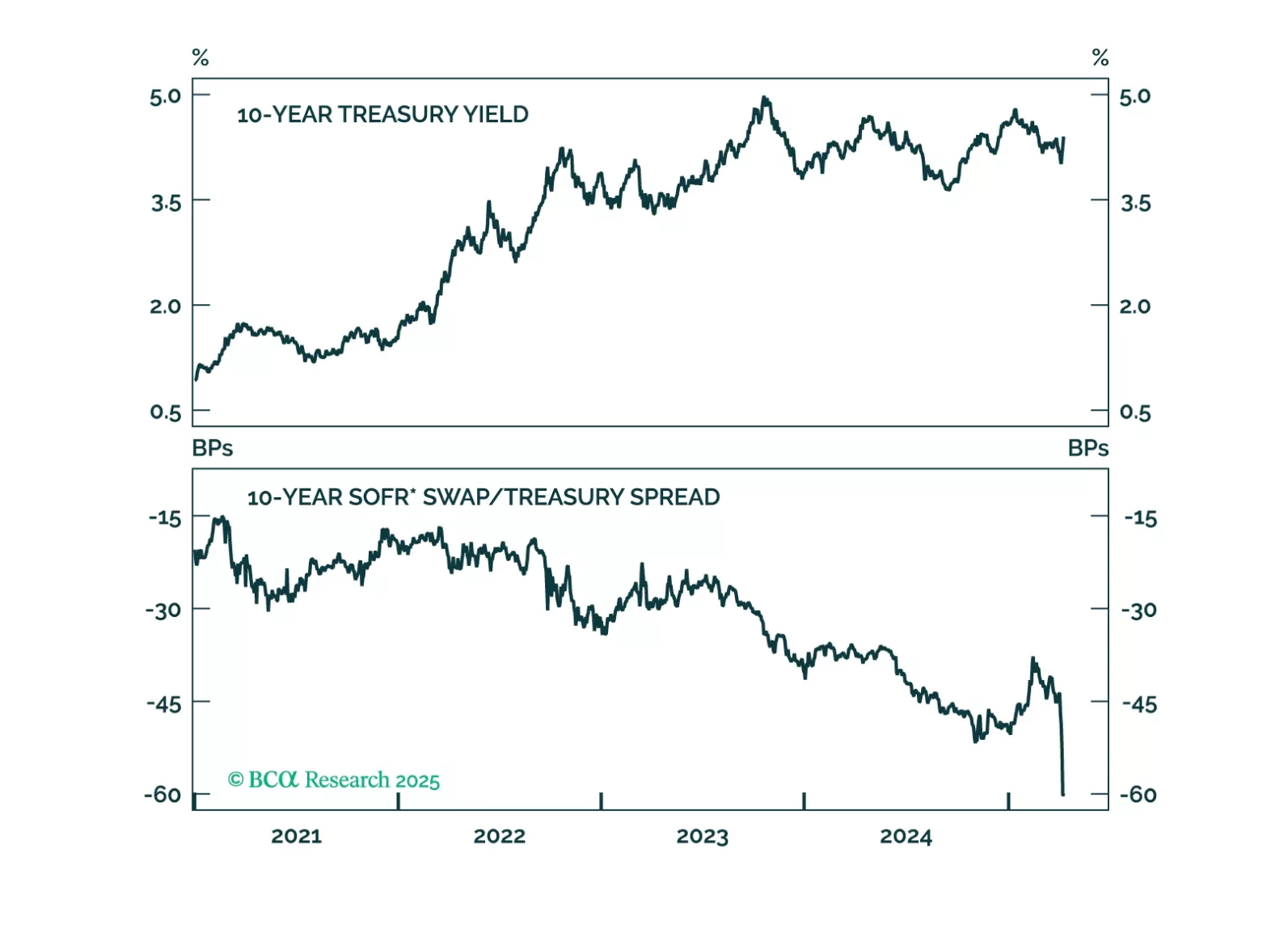

The combination of dollar weakness and rising US yields suggests global investors are questioning the safe-haven status of US Treasuries.

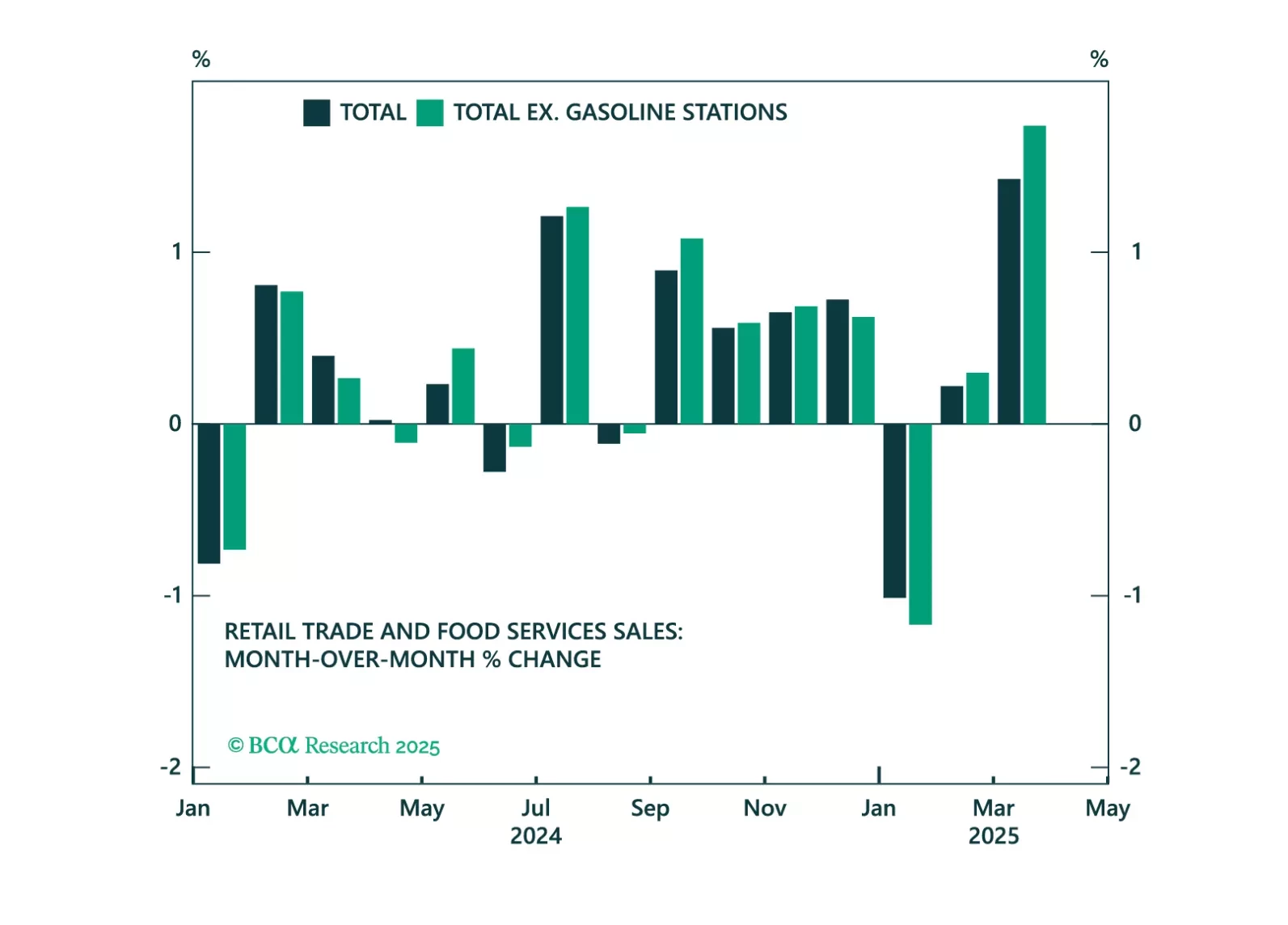

March’s cooler CPI print reinforces our defensive positioning as it points to softening growth that the Fed cannot address yet. Headline CPI came in at -0.1% m/m (2.4% y/y), and core rose just 0.1% m/m, slowing to 2.8% y/y from 3.1…

Our Portfolio Allocation Summary for April 2025.

Canada’s difficult macro outlook is already priced, supporting a neutral stance on Canadian government bonds within a global fixed-income portfolio. We continue to recommend a small long CAD/USD position, where bad news is well…