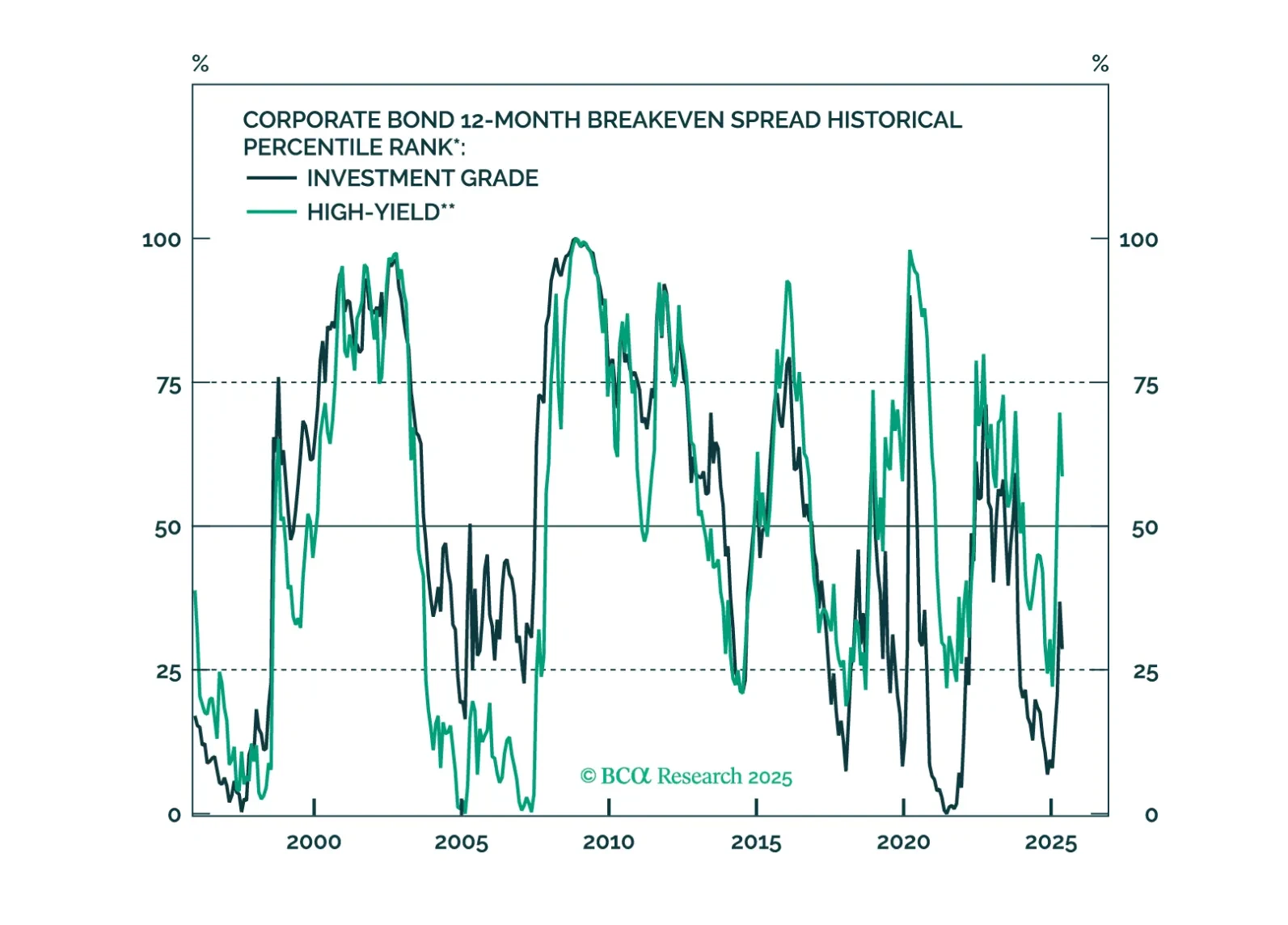

A weakening economy will apply downward pressure to Treasury yields, but the Trump term premium will keep long-dated yields higher than they would otherwise be. This makes Treasury curve steepeners the most attractive trade in US…

Our Portfolio Allocation Summary for May 2025.

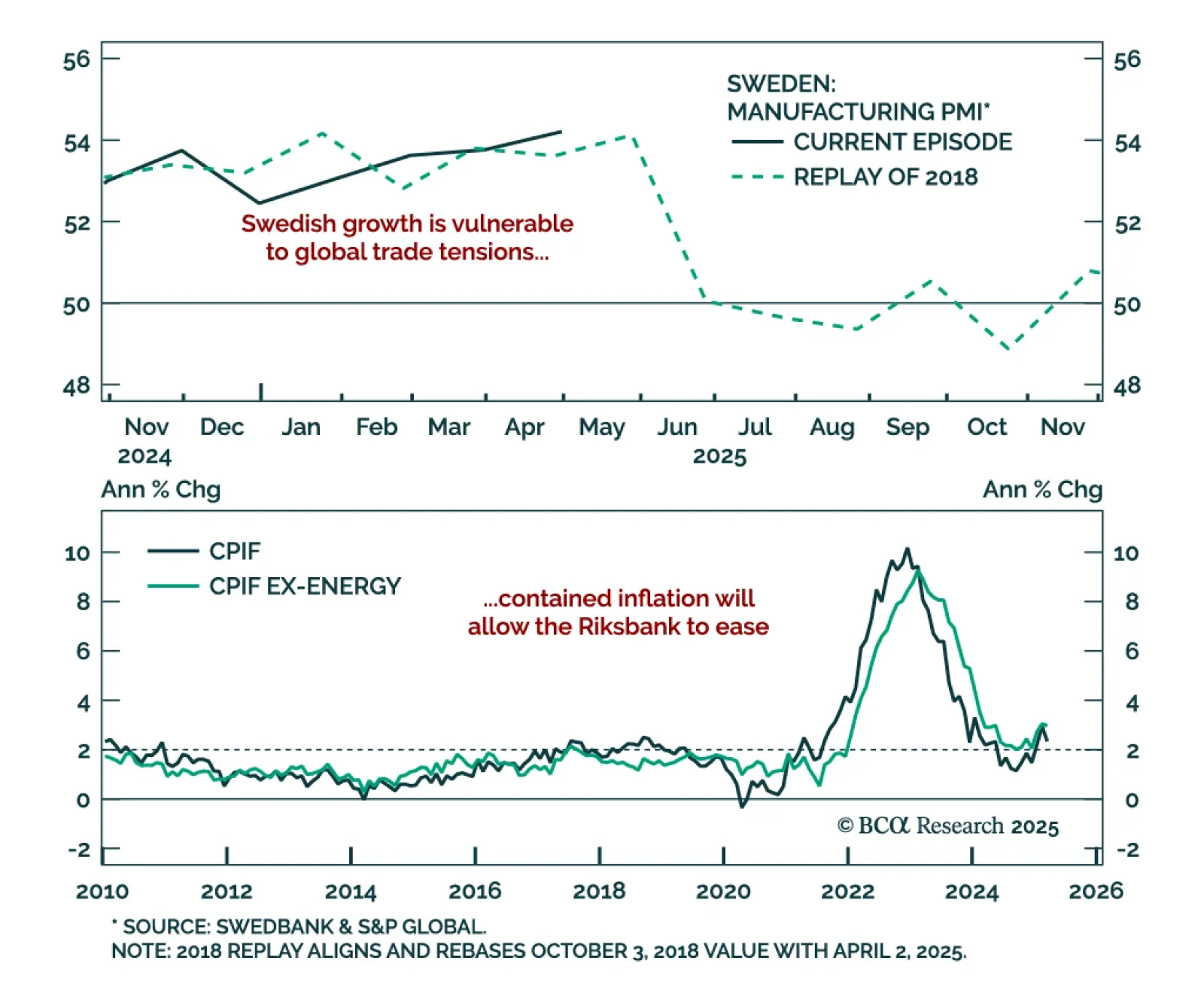

The Riksbank’s cautious stance sets up a dovish pivot, reinforcing our long Swedish bonds view and SEK fade vs. USD. The central bank held rates at 2.25% for the second time this year, with Governor Thedéen describing policy as well-…

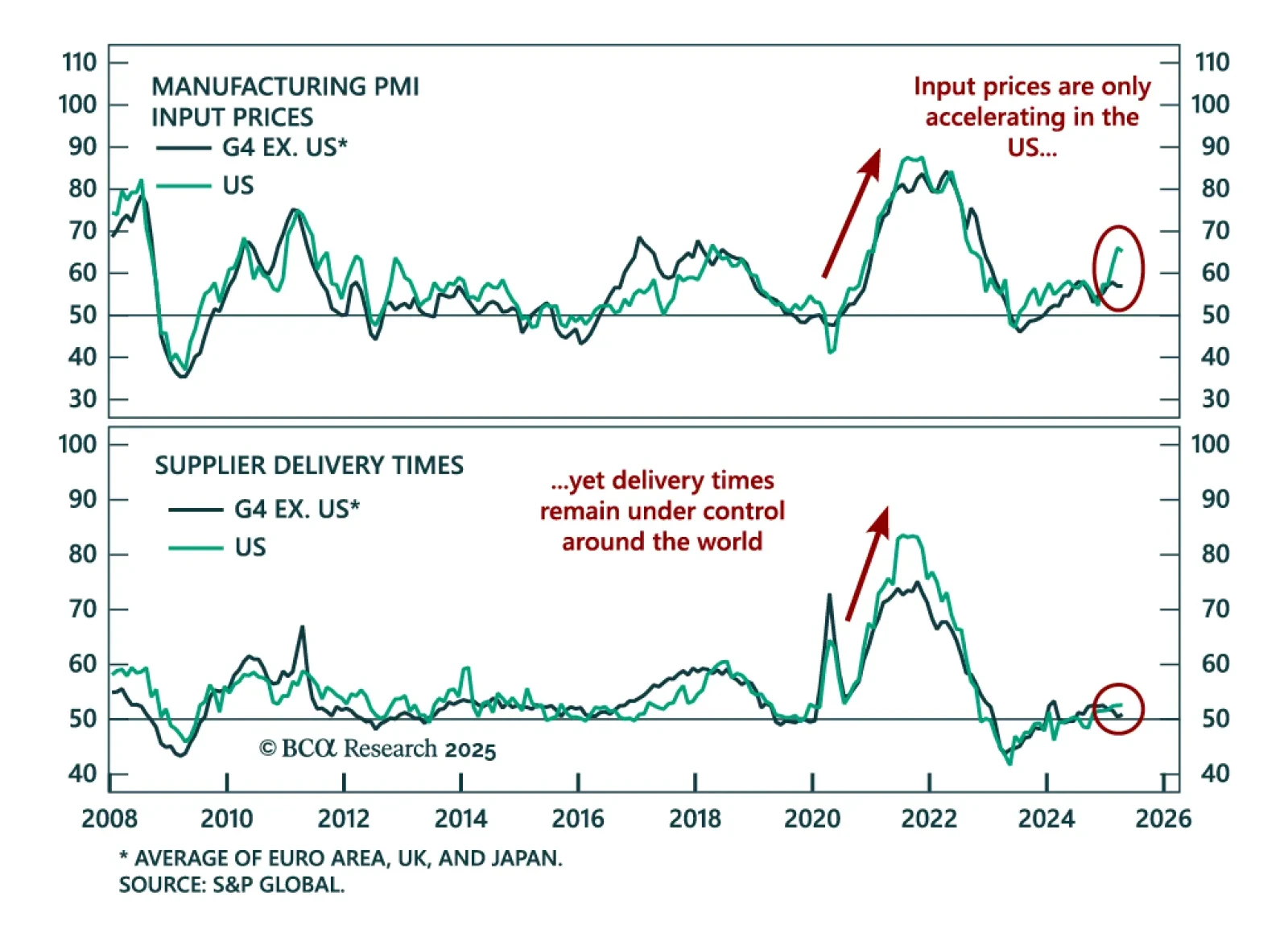

The inflation divergence between the US and Eurozone drives our call to stay long US duration. Inflation, typically a lagging indicator, blends slow-moving labor pressures with fast-moving supply drivers. The COVID inflation spike…

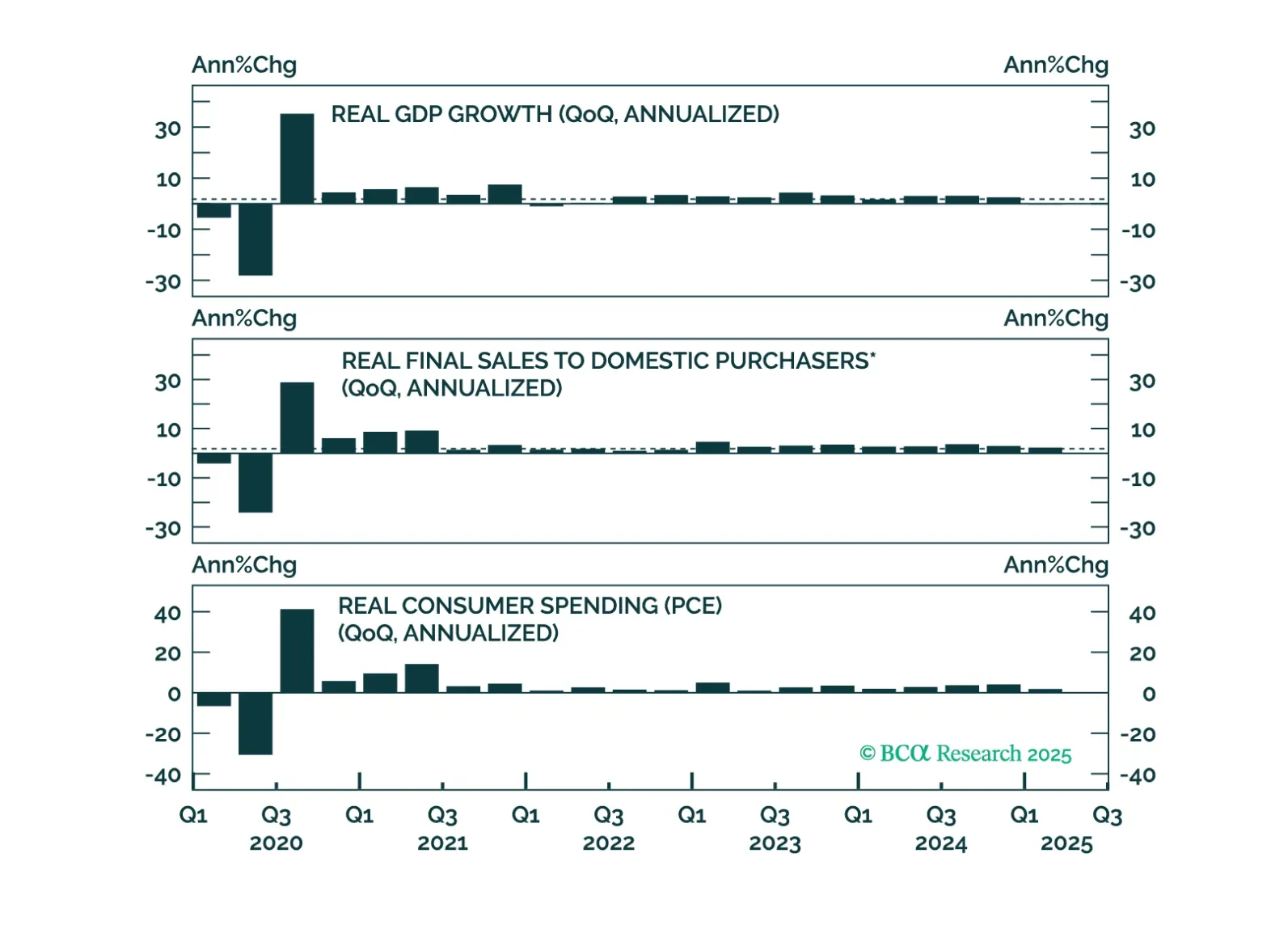

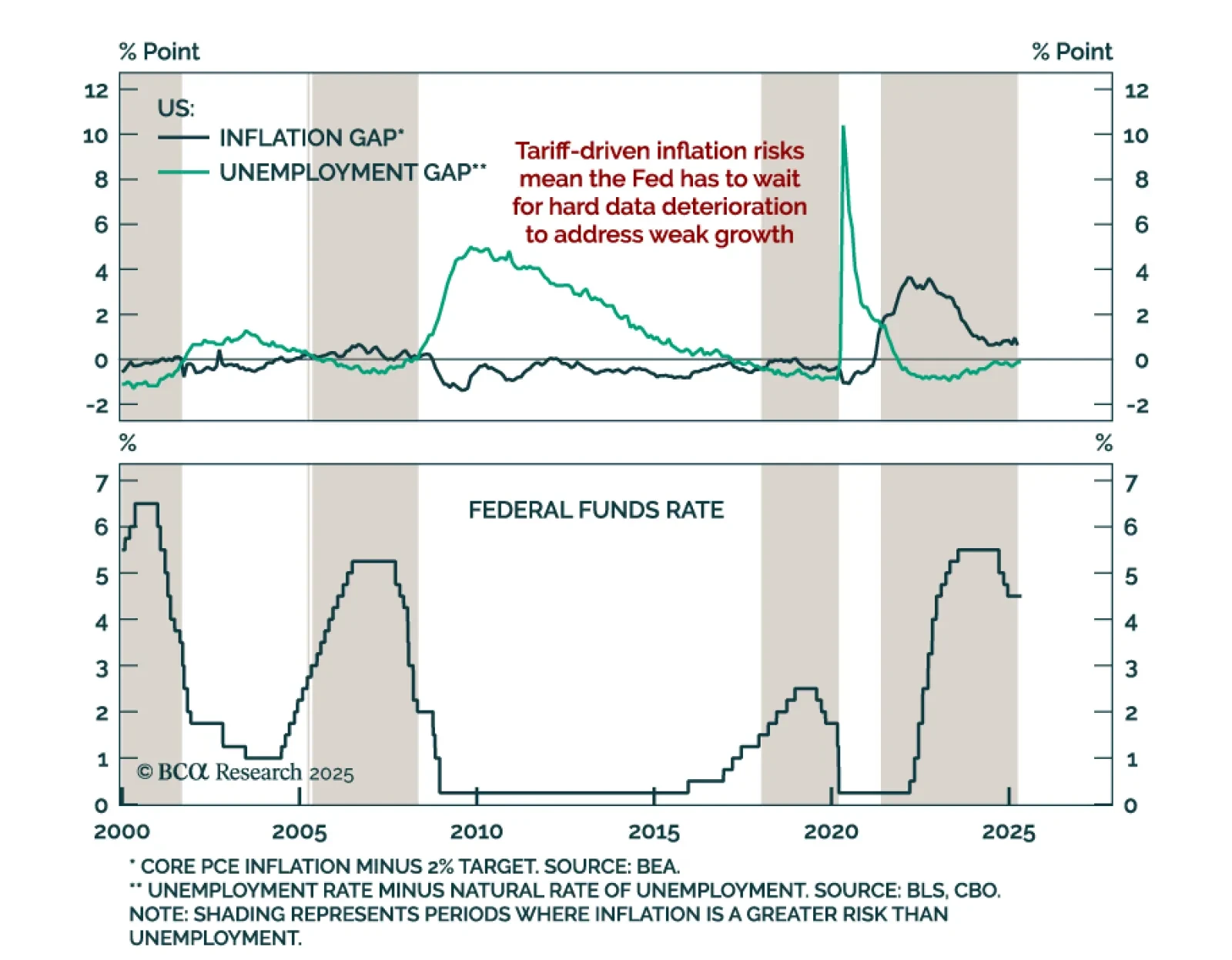

The Fed’s tight policy stance and focus on hard data reinforce our US Bond strategists’ call for above-benchmark duration and Treasury curve steepeners. As expected, the Fed held rates between 4.25% to 4.5% and flagged heightened…

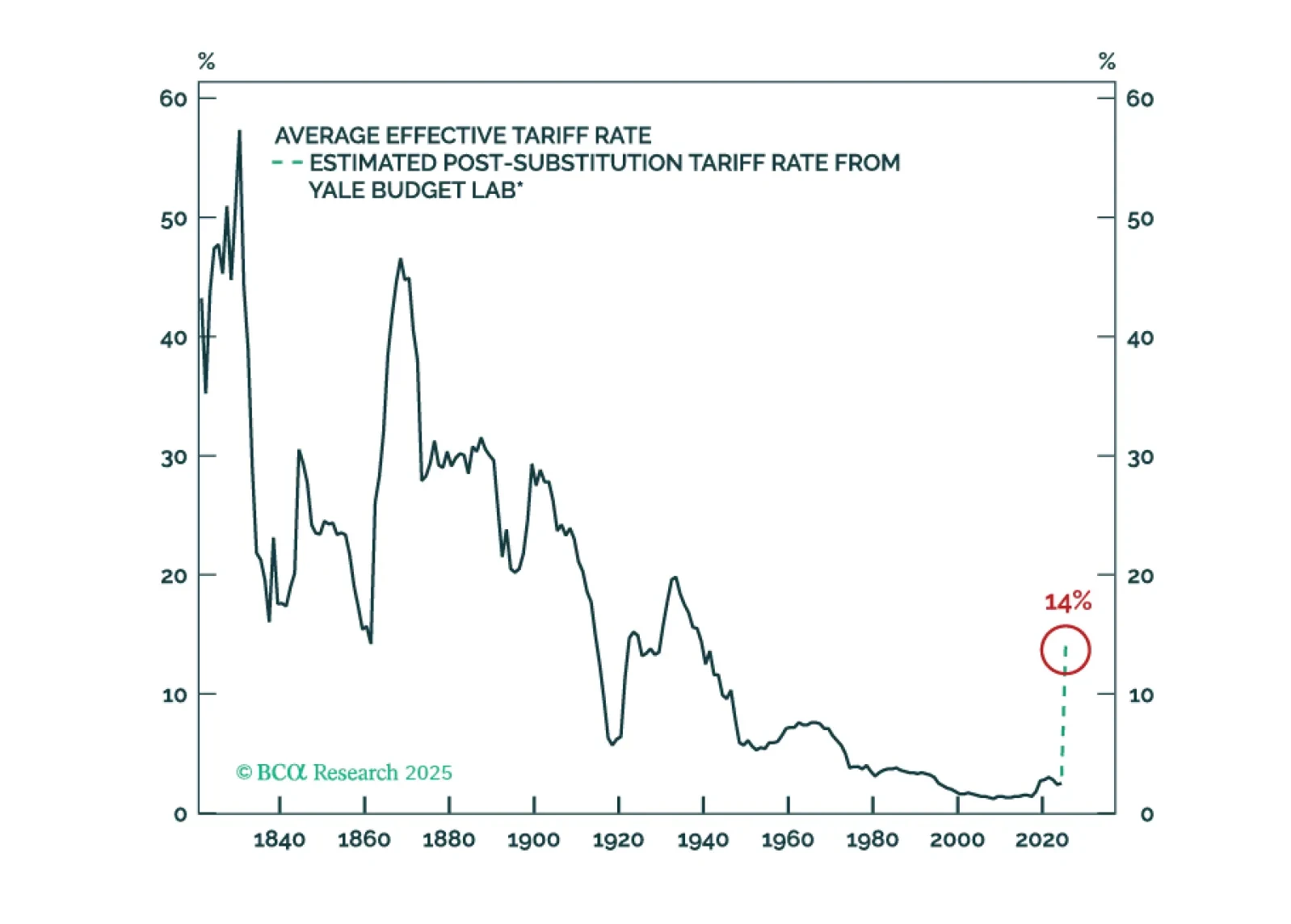

The Fed held rates steady this afternoon, and the timing of its next move will be dictated by whether the tariff shock to inflation is transitory or more long lasting.

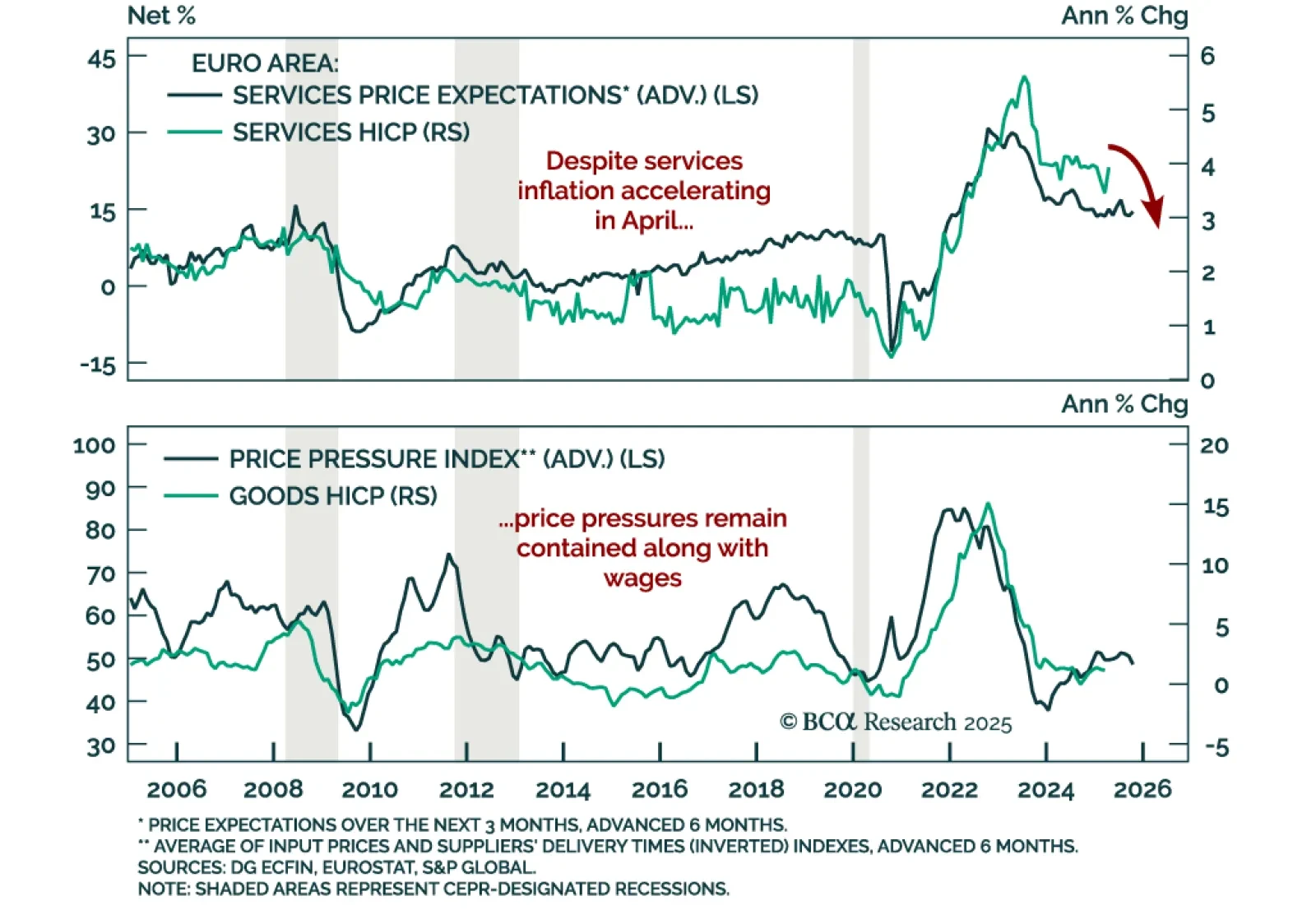

April’s Eurozone inflation data supports BCA’s bullish Bund stance and cautious view on EUR/USD. Headline HICP inflation held steady at 2.2% y/y while core ticked up to 2.7% from 2.4%. Services inflation rebounded to 3.9%,…

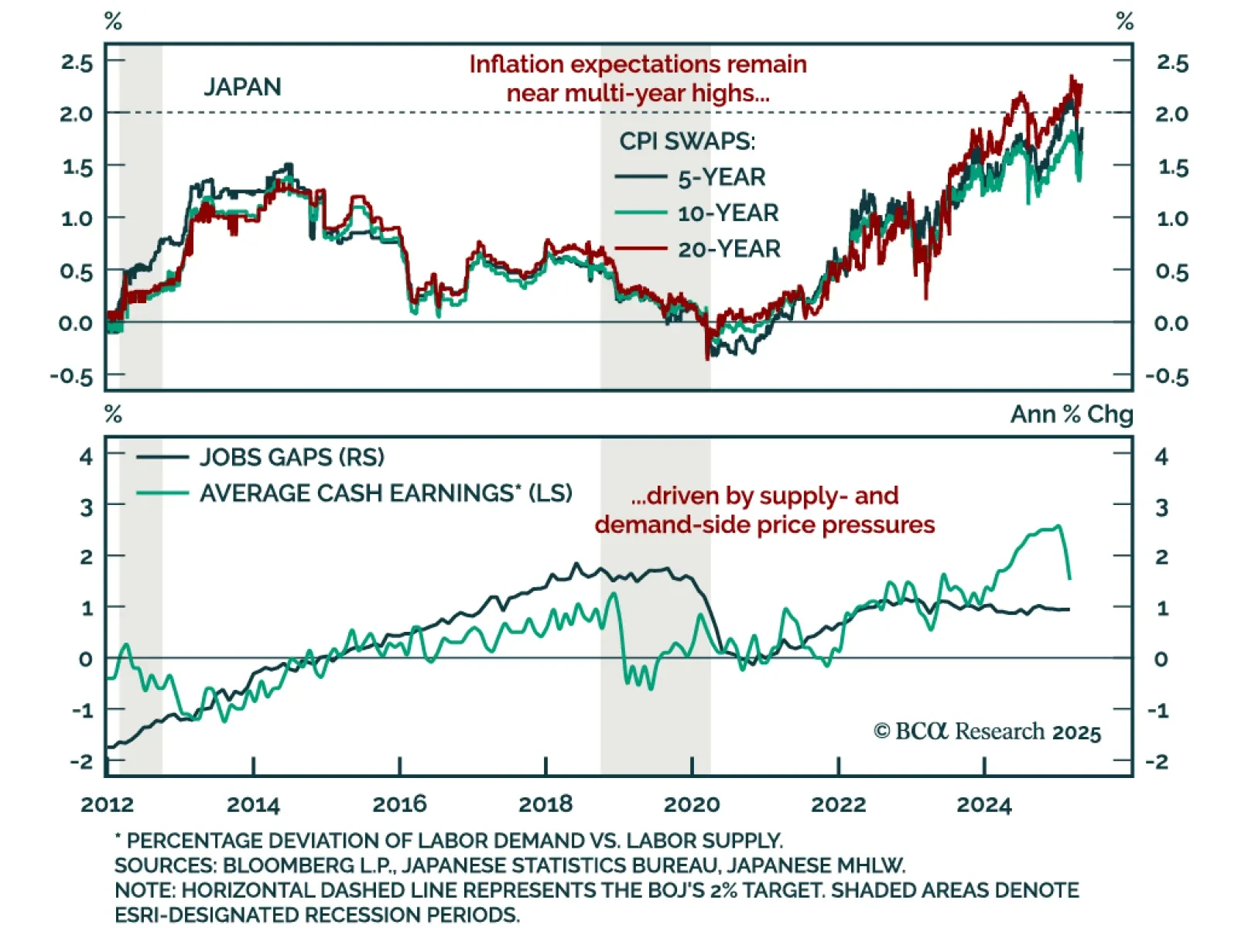

The Bank of Japan’s dovish hold does not contradict BCA’s underweight JGBs and long JPY recommendations. The BoJ left its policy rate unchanged at 0.5% for a second meeting, but slashed its GDP and inflation forecasts for 2025 and…

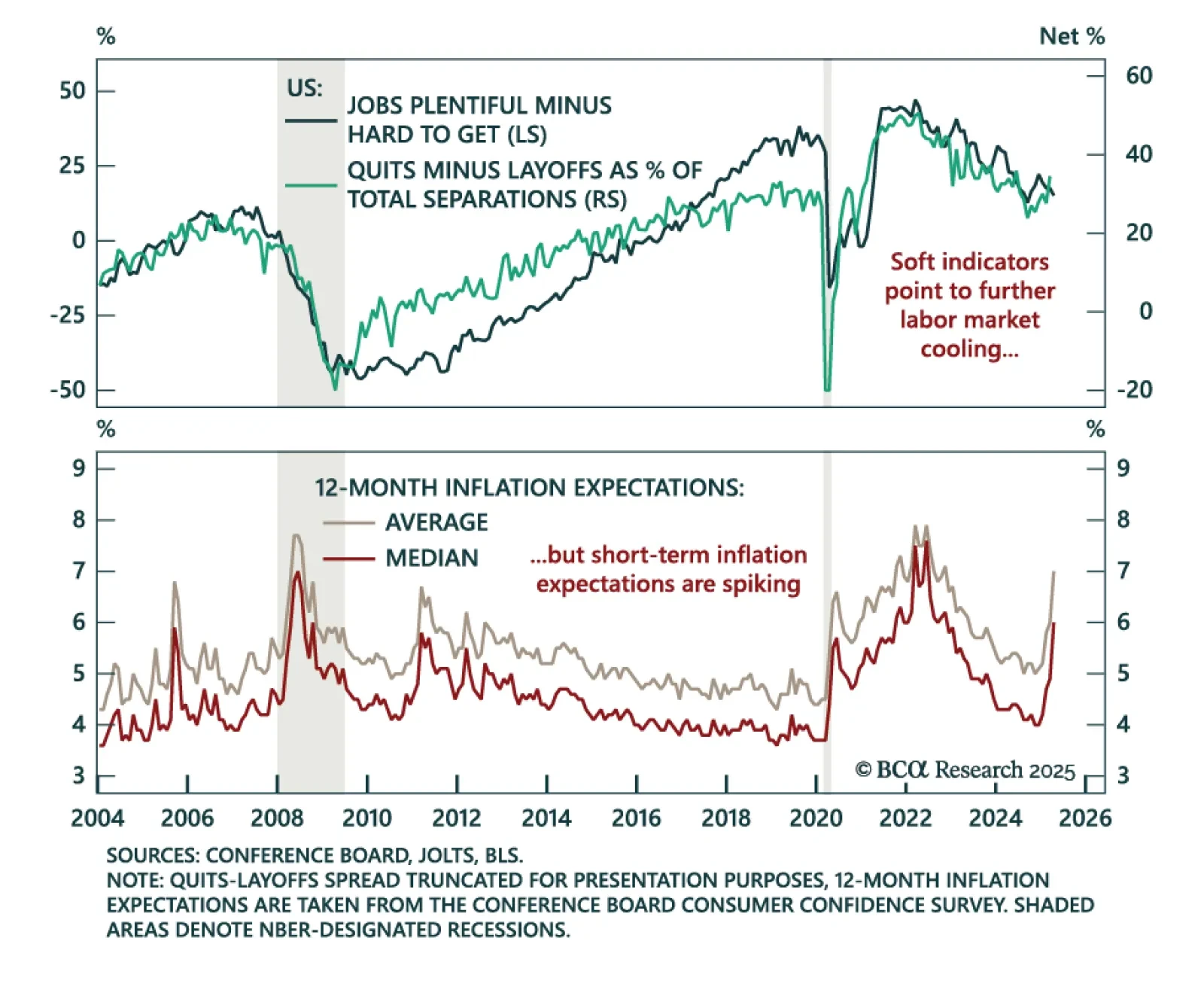

The April Conference Board survey adds to signs of labor market softening, reinforcing our defensive asset allocation. The Consumer Confidence index fell for the fifth consecutive month to 86.0 from 92.9. Expectations plunged to…