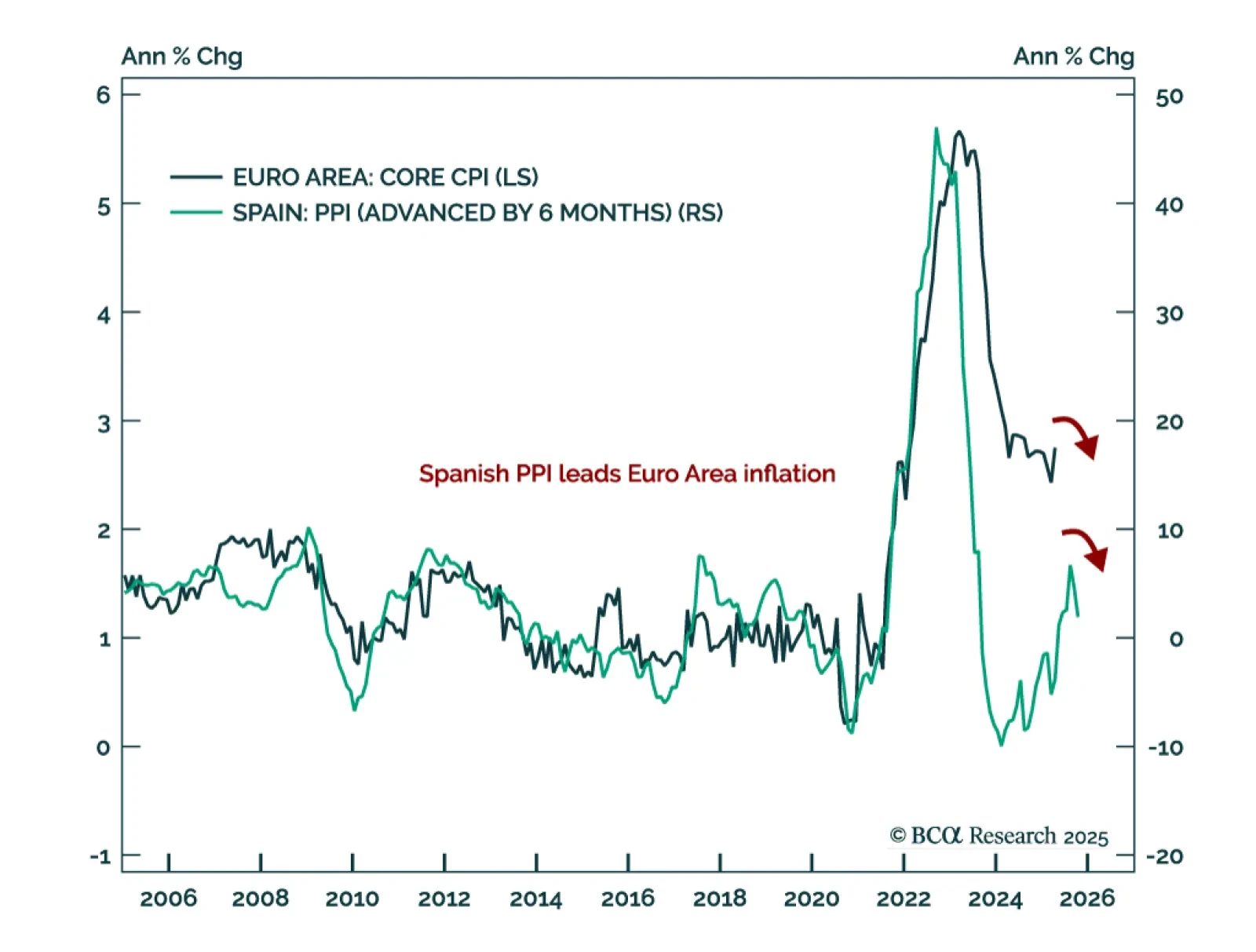

Producer prices in Spain surprised to the downside, foreshadowing a relapse in Euro Area inflation and cementing the ECB’s dovish stance. The Spanish PPI index fell to 1.9% in April, continuing the disinflation trend from the last…

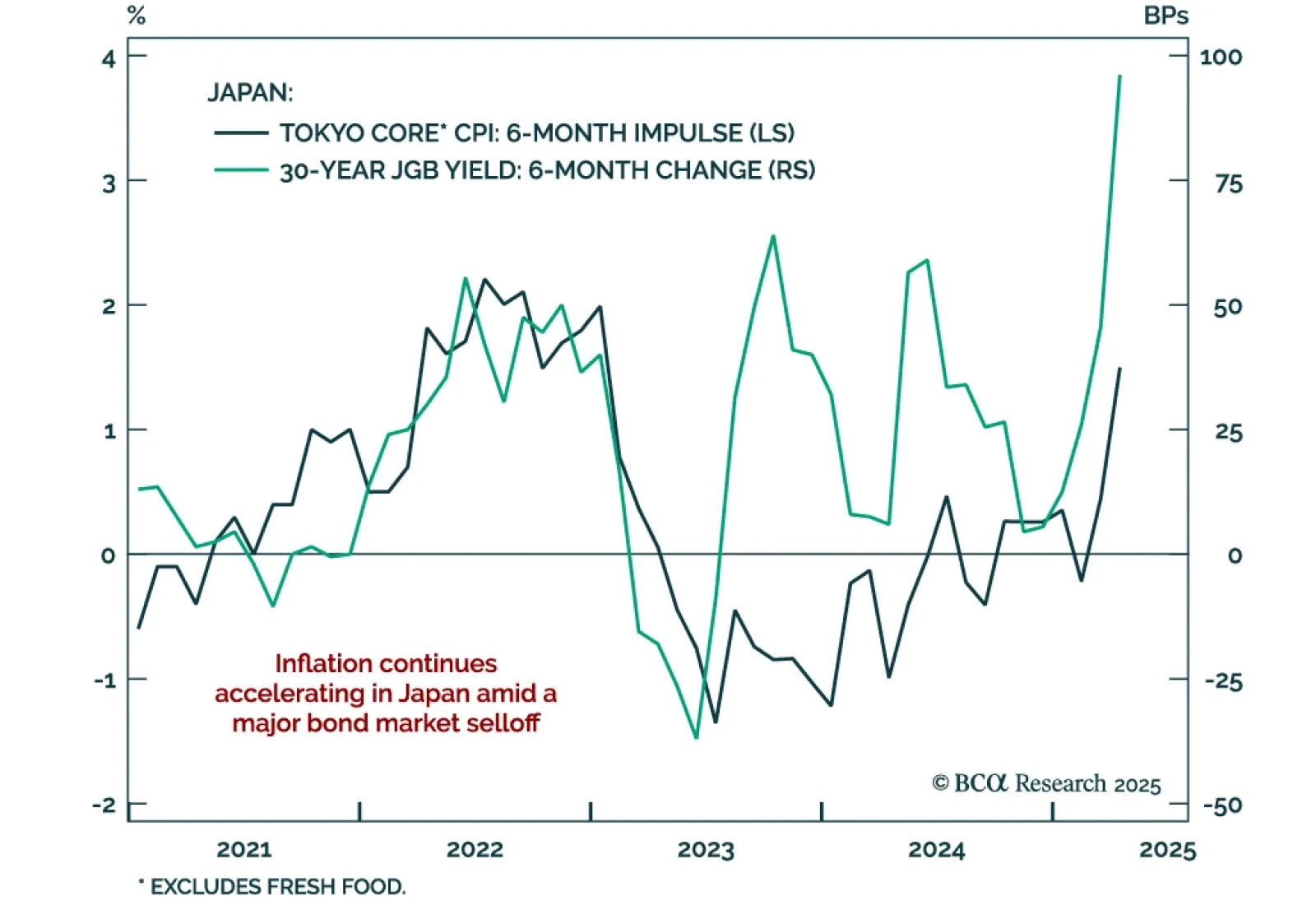

Tokyo CPI surprised to the upside in April, signaling that Japanese inflation shows no sign of deceleration and putting the Bank of Japan (BoJ) in a complicated position. Investors should remain maximum underweight in JGBs and…

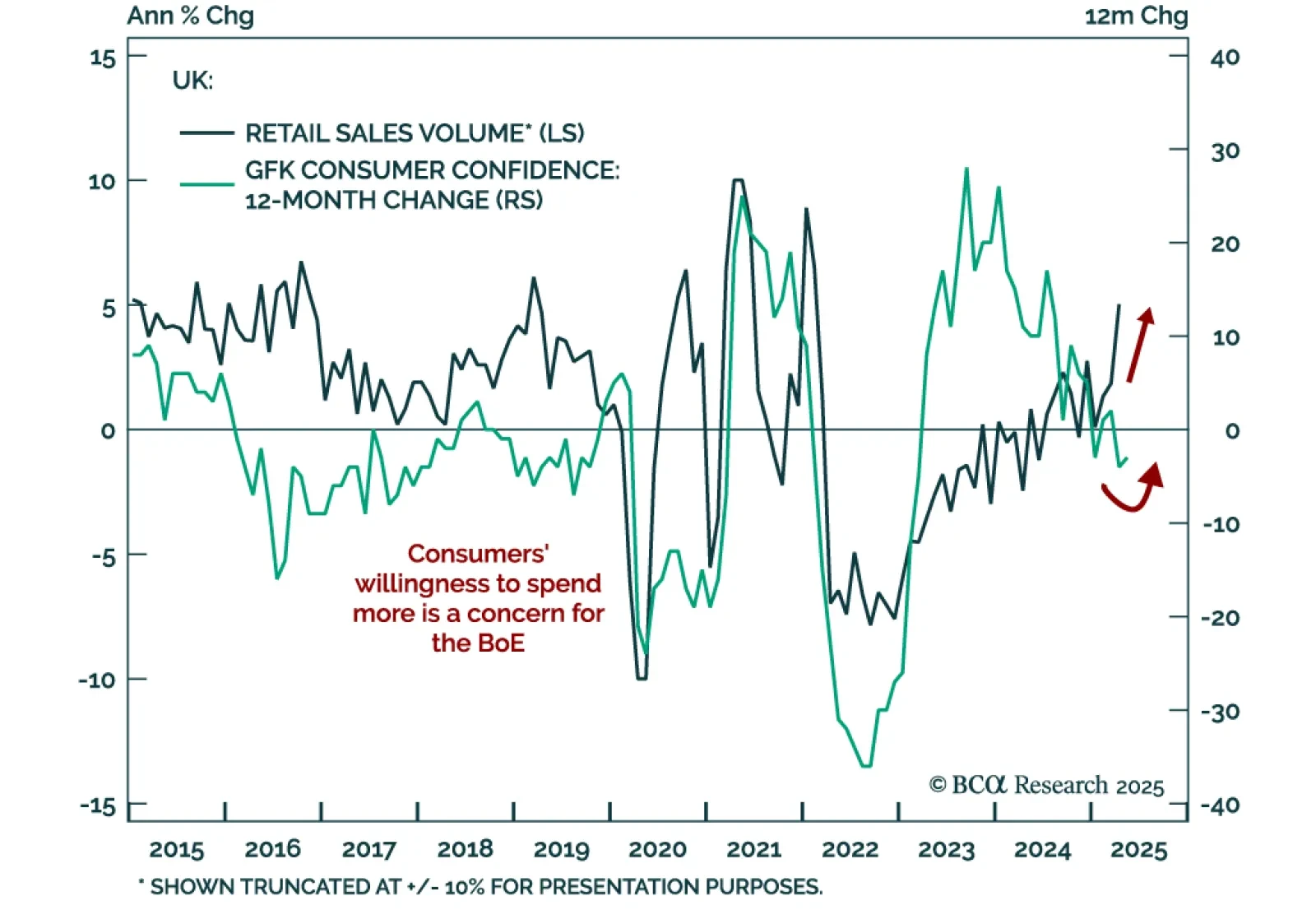

The rebound in UK retail sales and consumer confidence surprised to the upside, and suggests that the re-acceleration in inflation observed earlier this week may not be transitory. UK retail sales rose 1.2% m/m in April…

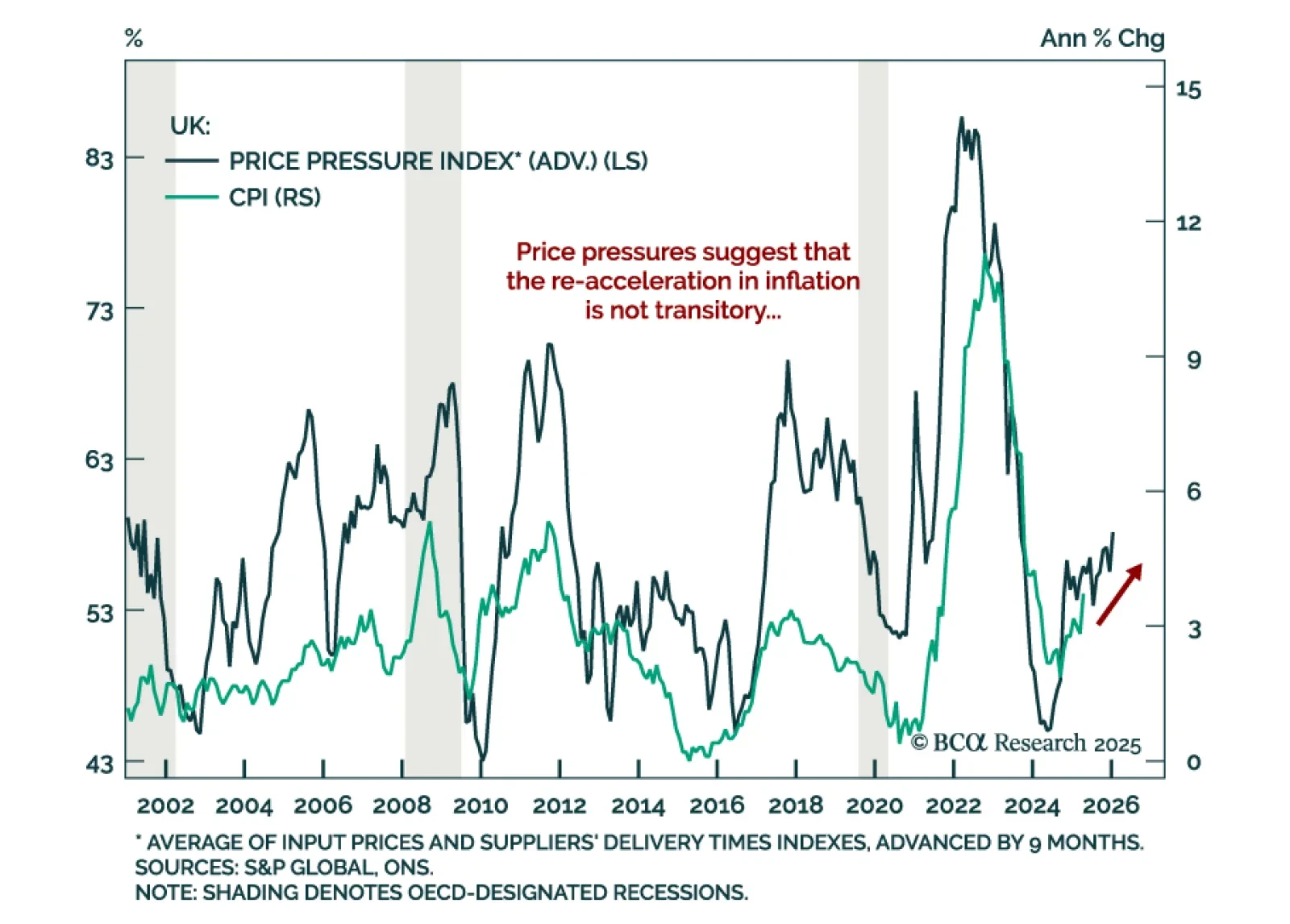

UK inflation surprised to the upside in April. Headline inflation rose to a 15-month high of 3.5%, from 2.6% the month before. Core inflation also surprised above estimates, printing 3.8% vs. 3.4% in March. Services inflation climbed…

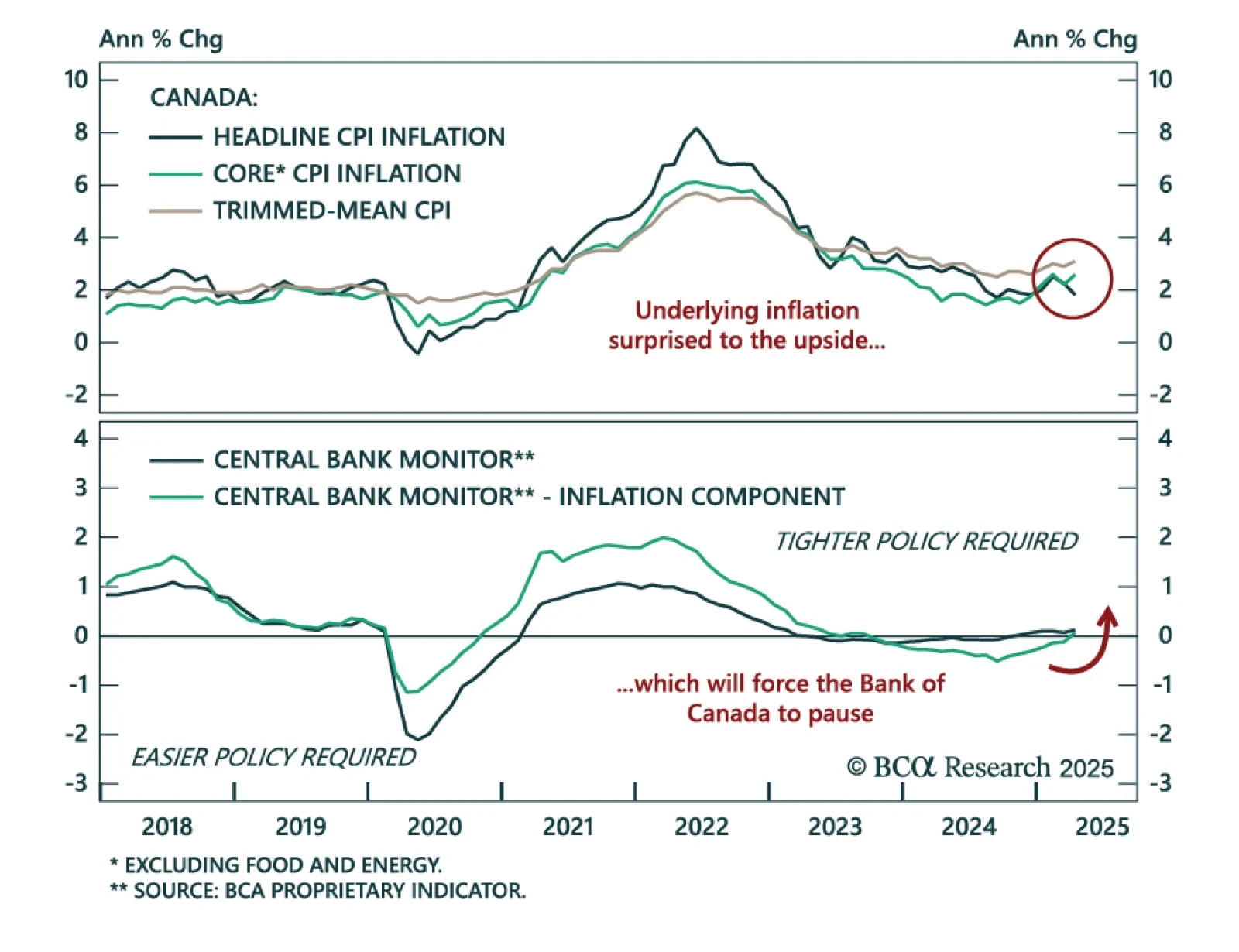

Although Canada’s headline CPI slowed to 1.7% y/y from 2.3% on Tuesday, most measures of underlying inflation surprised to the upside, thus raising the likelihood that the Bank of Canada (BoC) will stay put at its next meeting in…

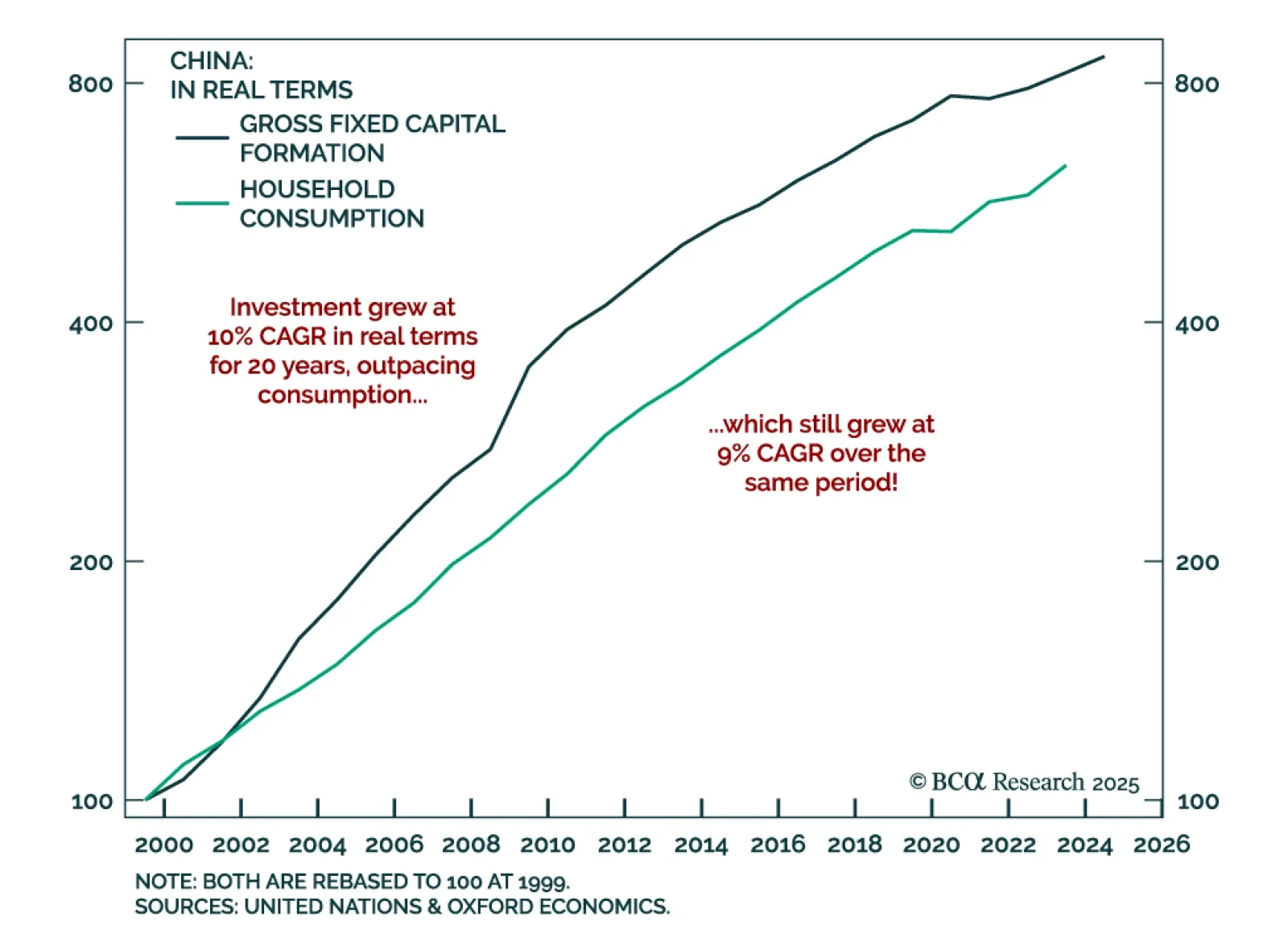

Our EM strategists warn that China’s overinvestment problem has no quick fix, keeping deflationary pressures in place and limiting upside for Chinese equities. Excessive domestic investment, driven by aggressive credit creation, is…

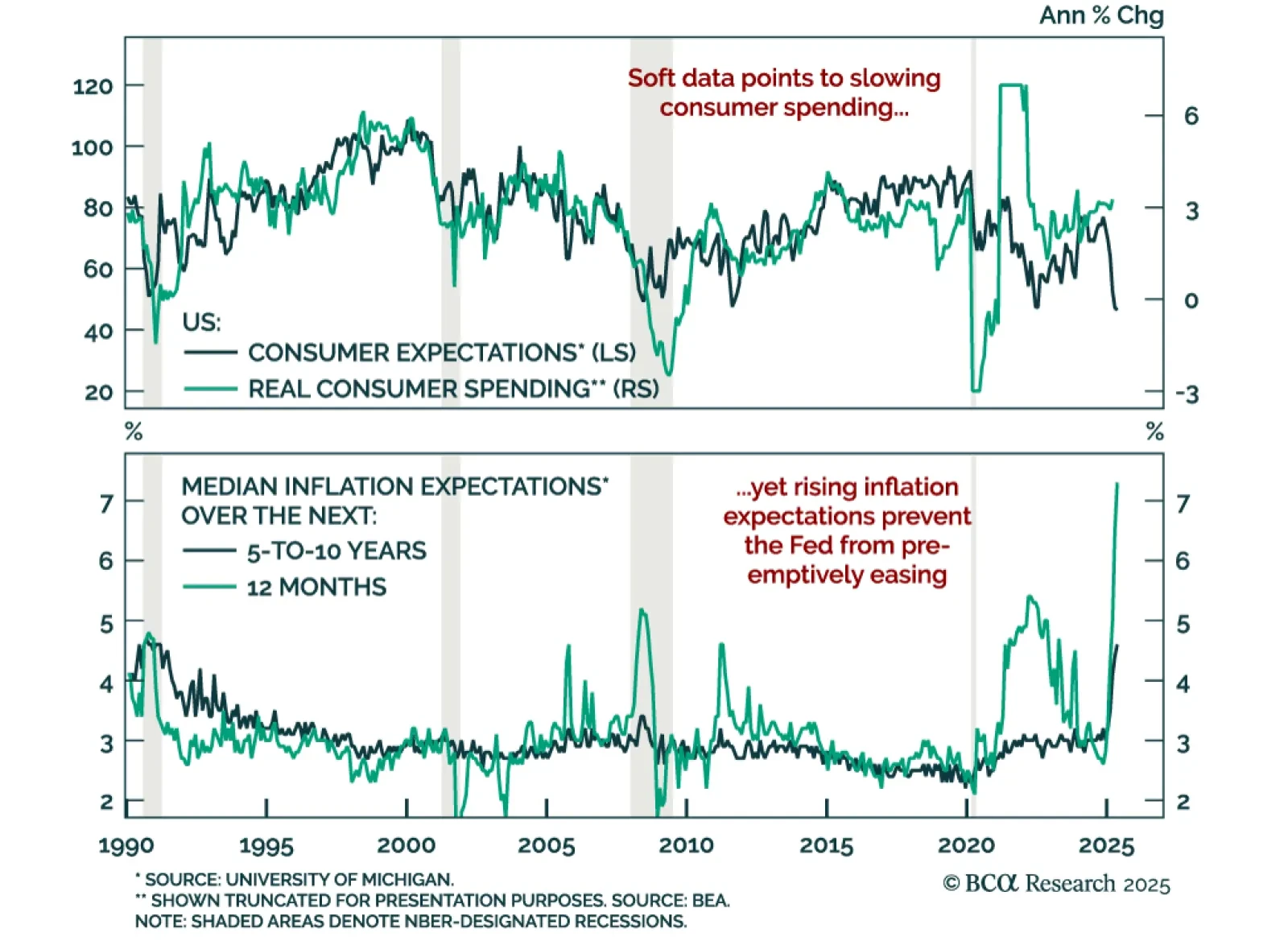

Deteriorating US consumer sentiment and surging inflation expectations add to growth concerns and reinforce our long-duration bond stance. The preliminary May University of Michigan Consumer Sentiment Index missed expectations,…

Tariff front-running behavior makes the April hard economic data difficult to interpret, but we take the strong reading from Food Services spending as a signal that the US consumer has not yet buckled.

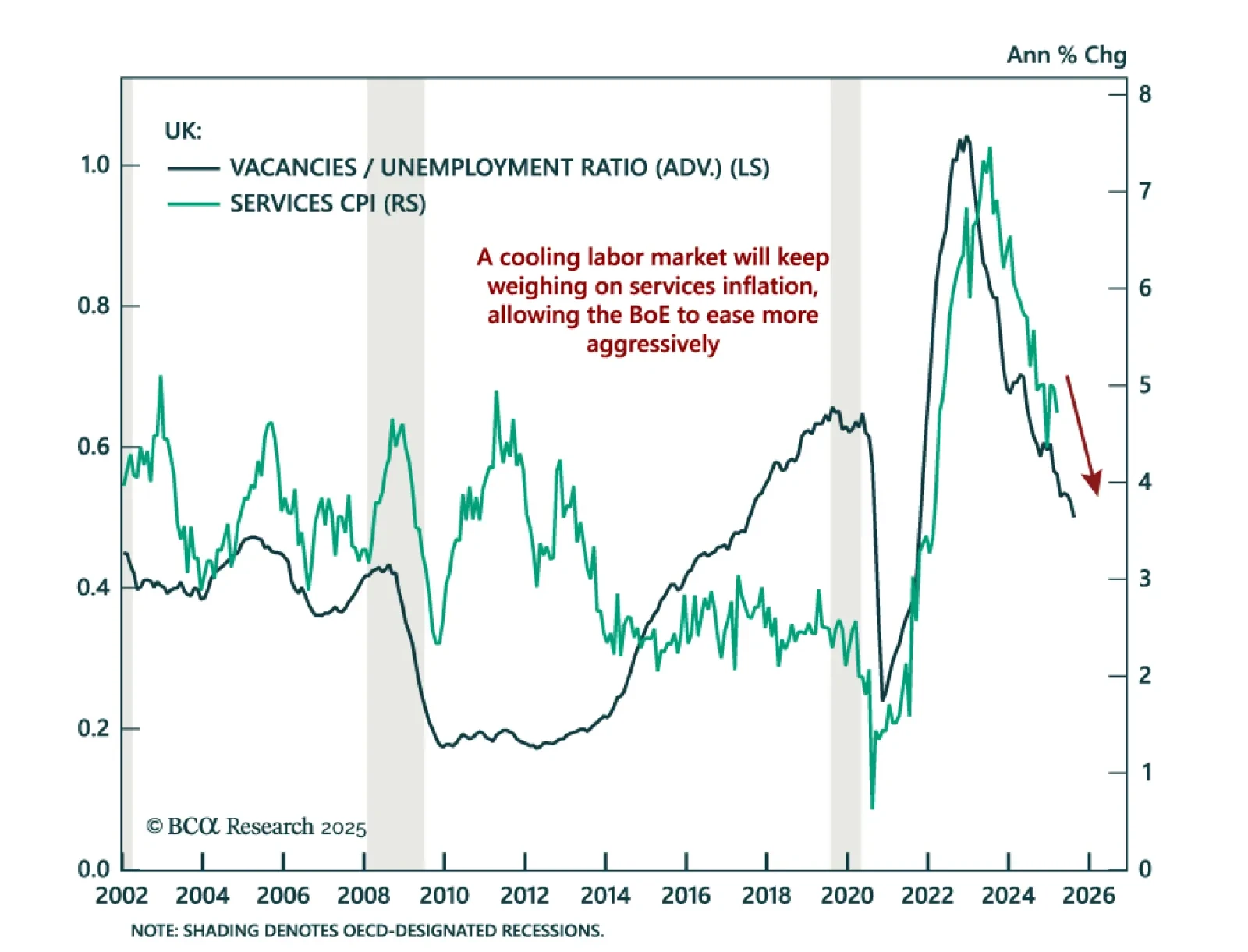

UK labor market weakness is reinforcing the case for BoE cuts and supporting our overweight in UK Gilts. April payrolls fell by 33k, marking a third consecutive monthly decline, while job vacancies remain below pre-COVID levels for…