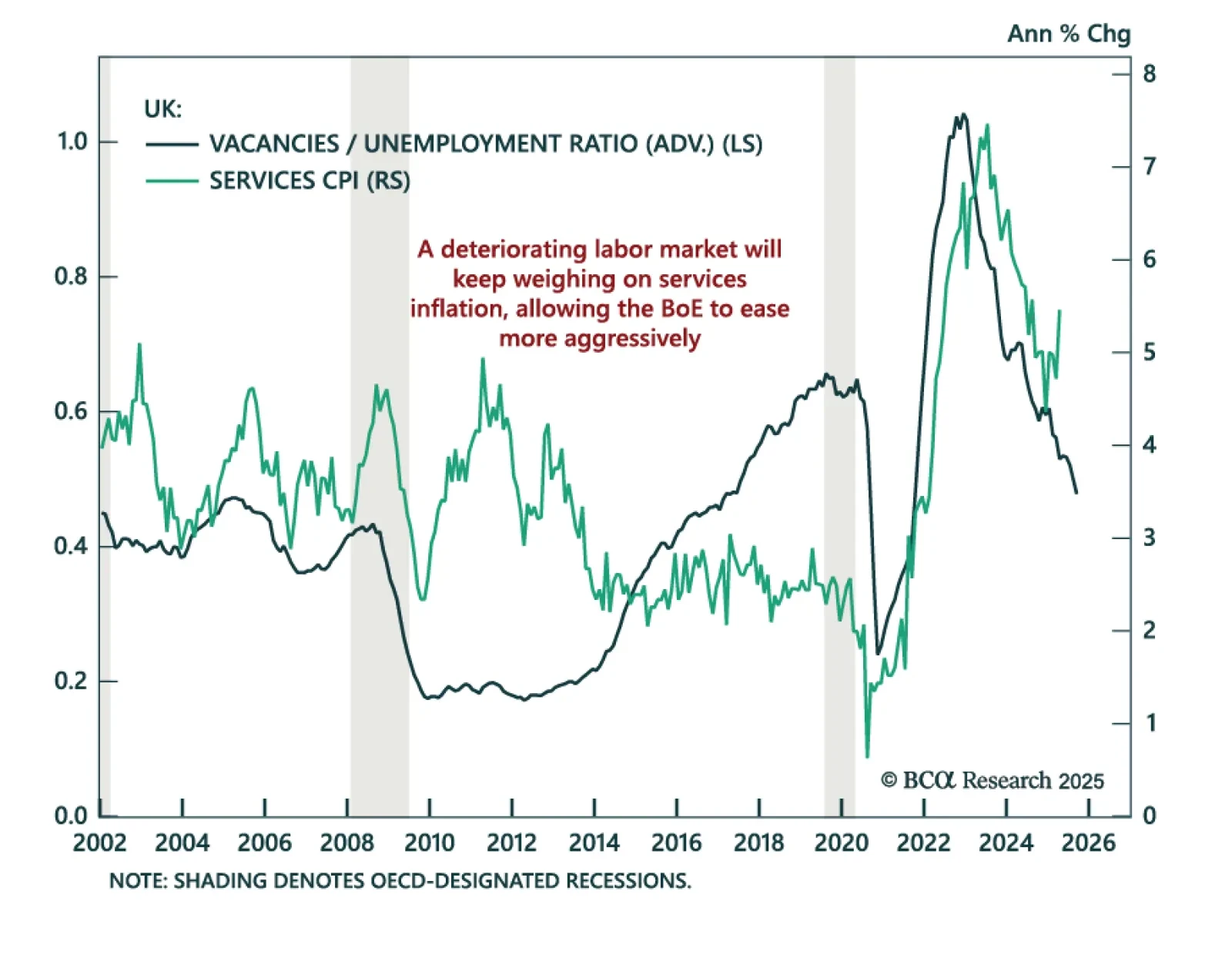

UK labor market deterioration reinforces our overweight on Gilts and dovish BoE policy trades. Payrolls fell by 109k in May, an acceleration from the 55k revised decline for April (originally reported as -33k), and job vacancies…

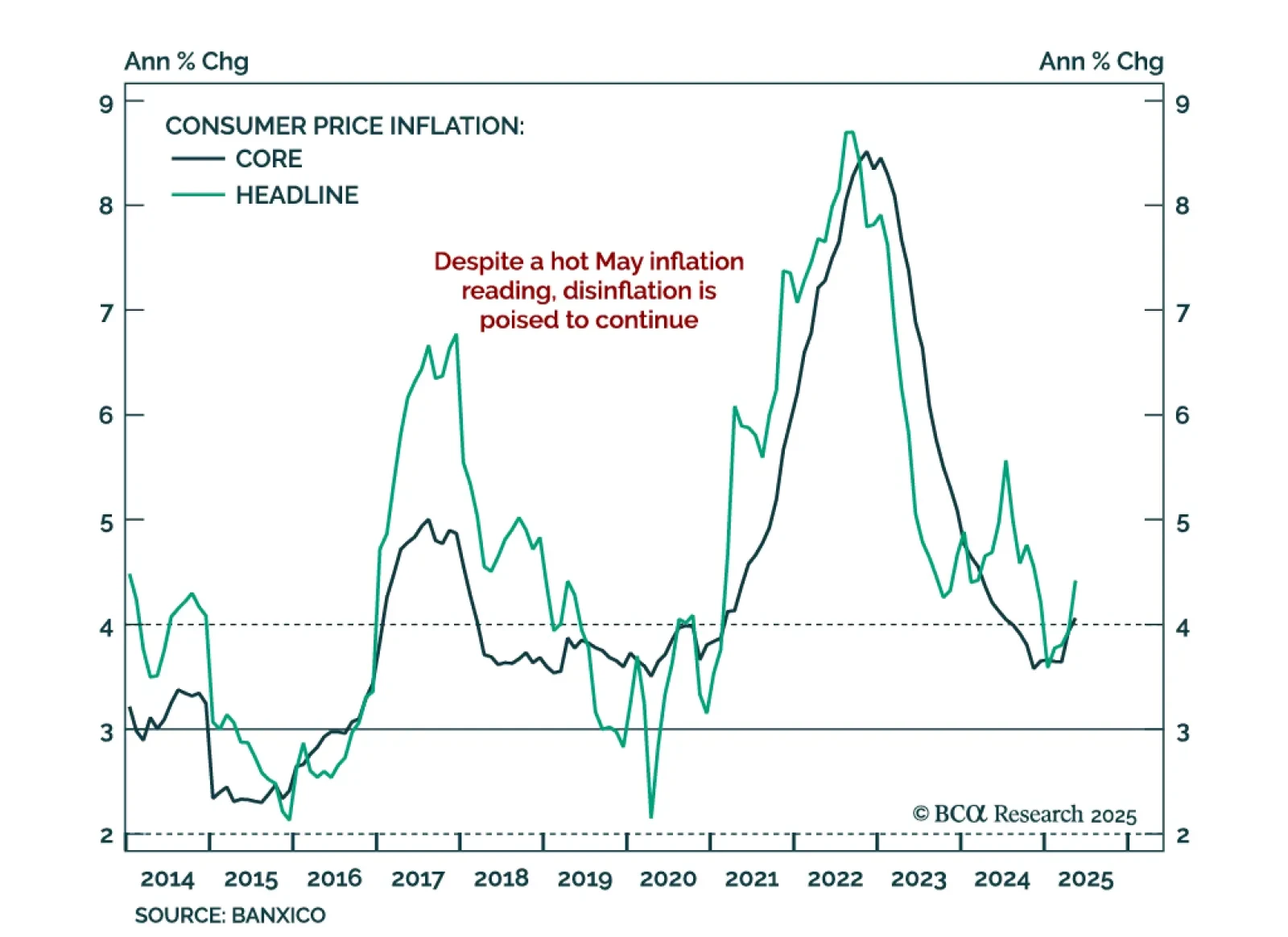

Hot May inflation should not derail Banxico’s easing cycle; we remain long Mexican local bonds. Headline inflation accelerated to 4.4% y/y from 3.9%, above expectations, while core inflation was roughly flat at 4.1% from 3.9%. The…

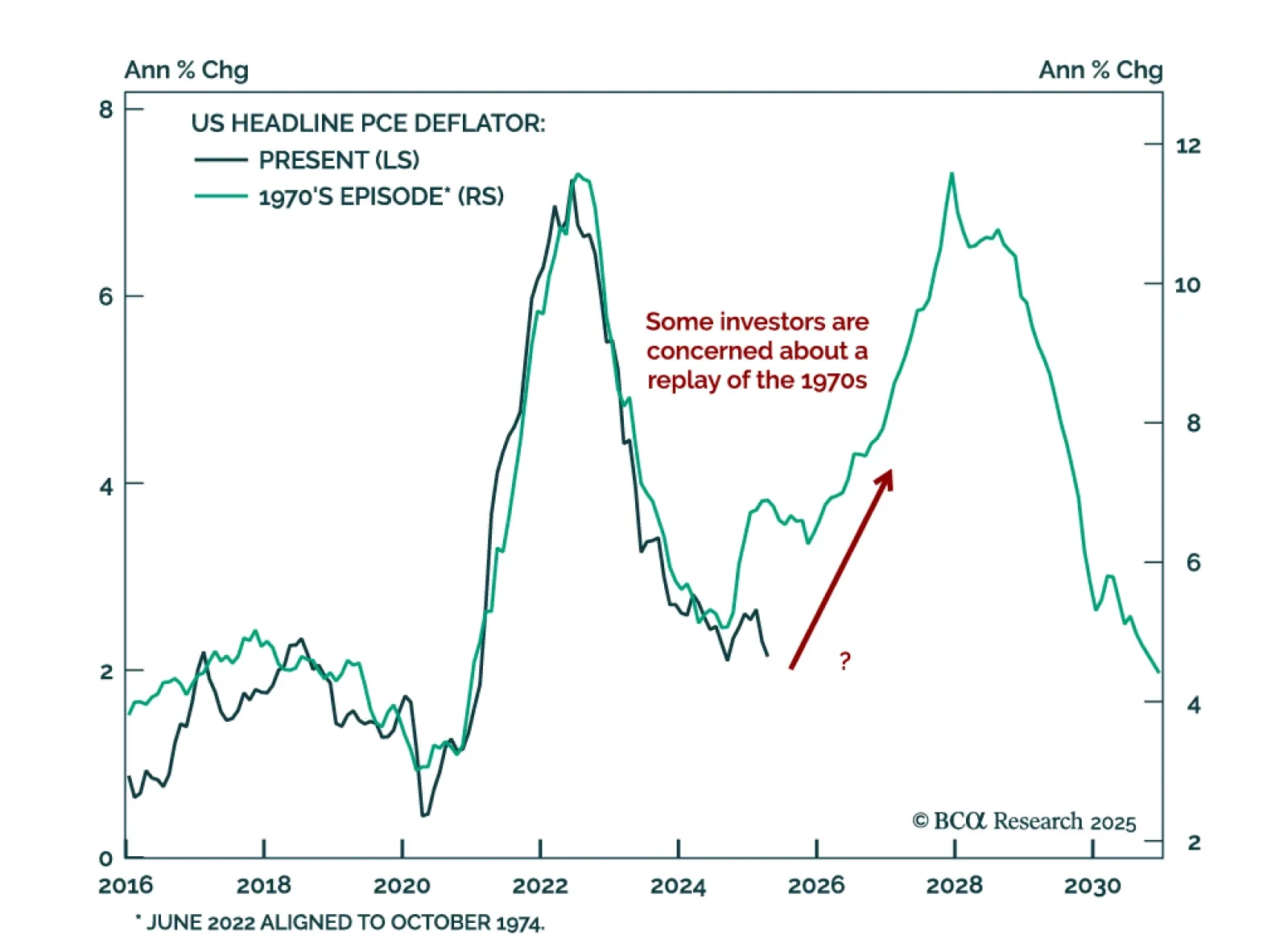

Our Special Reports Unit evaluates whether US inflation is likely to remain structurally elevated. While our base case is for inflation to hover around or modestly above 2% over the long run, there are several risks to that view.…

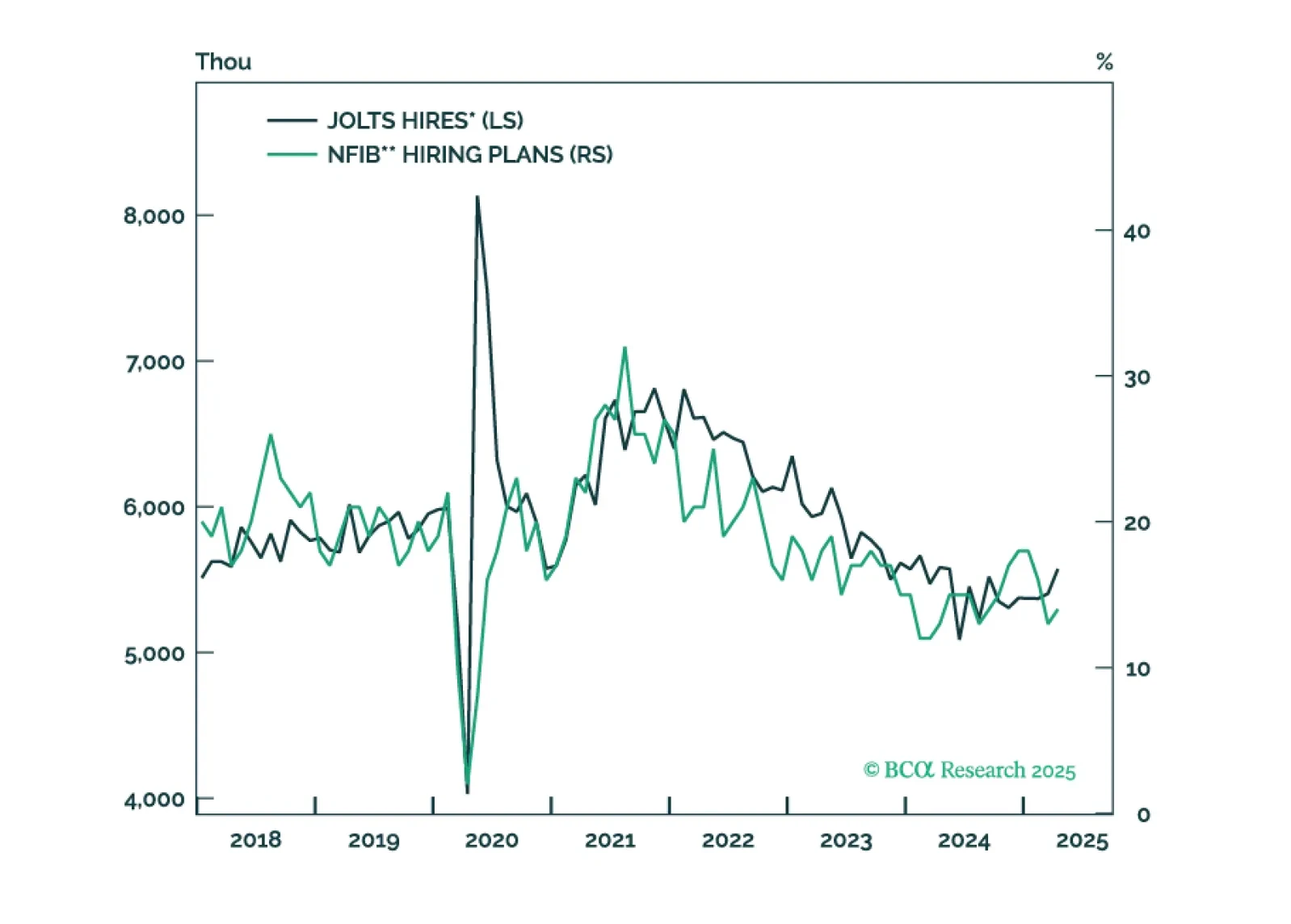

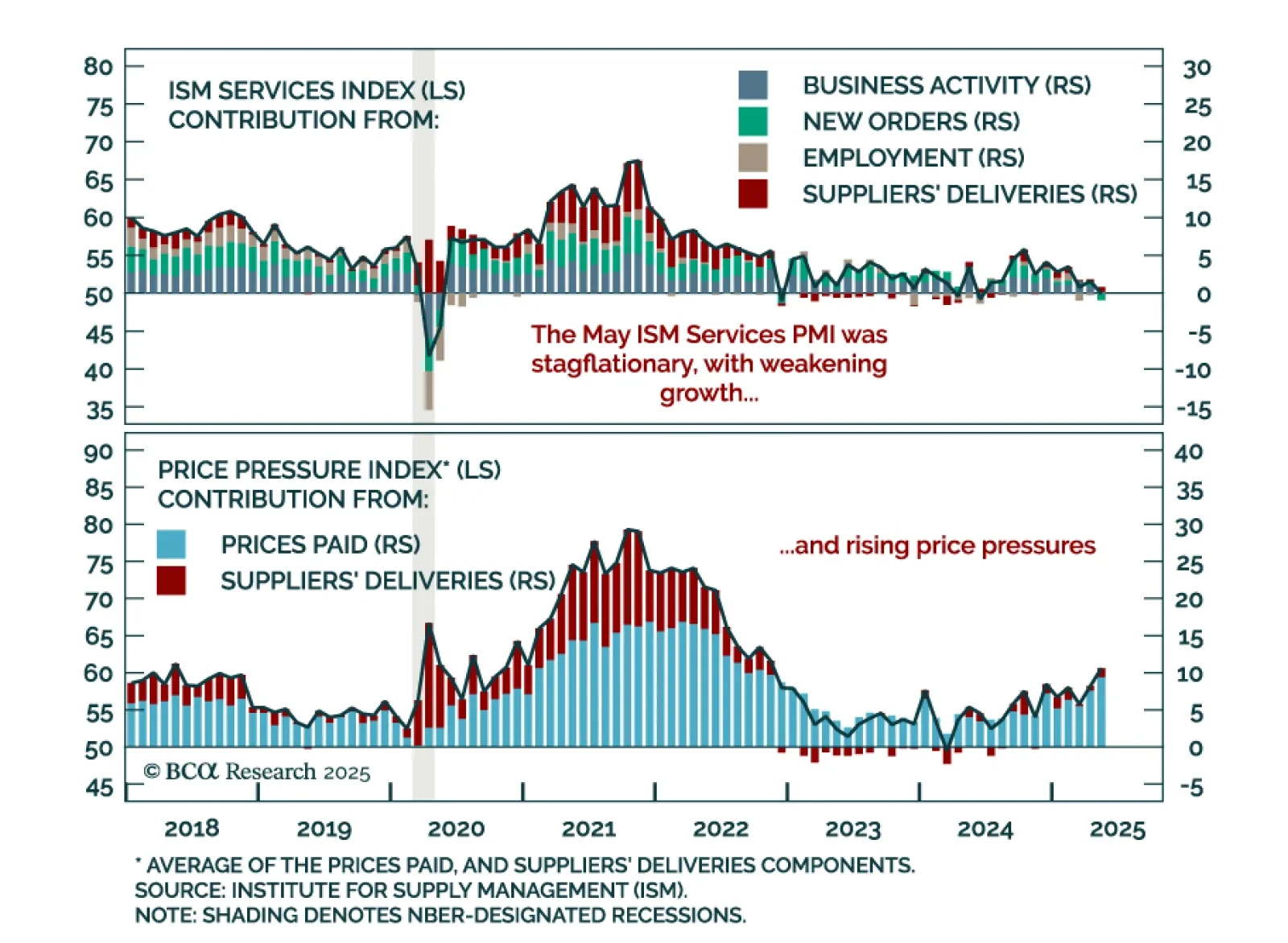

The May ISM Services PMI sent a stagflationary signal, reinforcing the case for defensive positioning. The headline index slipped into contraction at 49.9 from 51.6 in April, missing expectations. New orders collapsed to 46.4 from 52…

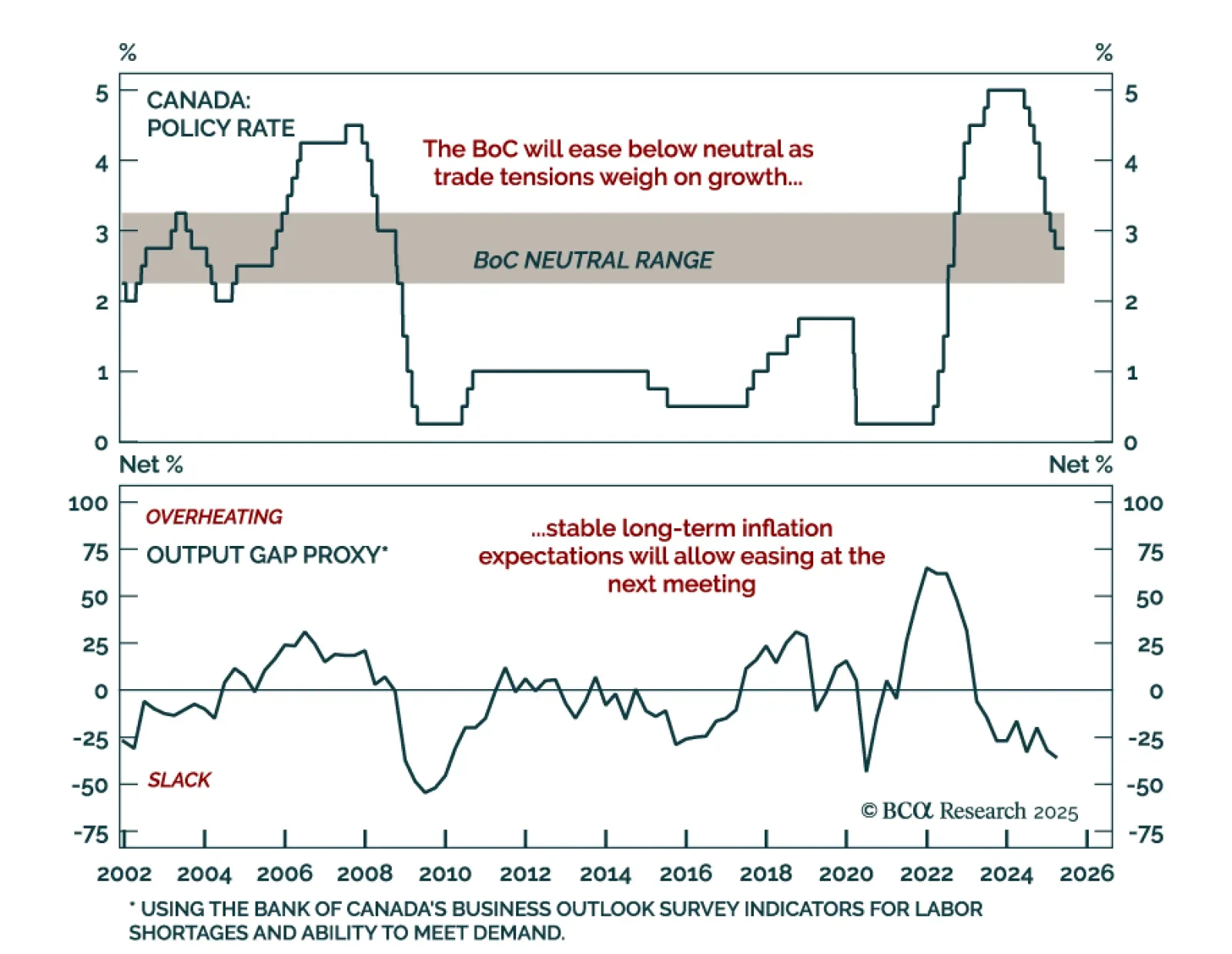

The Bank of Canada held rates at 2.75% but signaled a dovish shift, pushing us to overweight Canadian government bonds and go long CORRA futures. The policy rate remains within the BoC’s neutral range, allowing the Bank to wait for…

Our Portfolio Allocation Summary for June 2025.

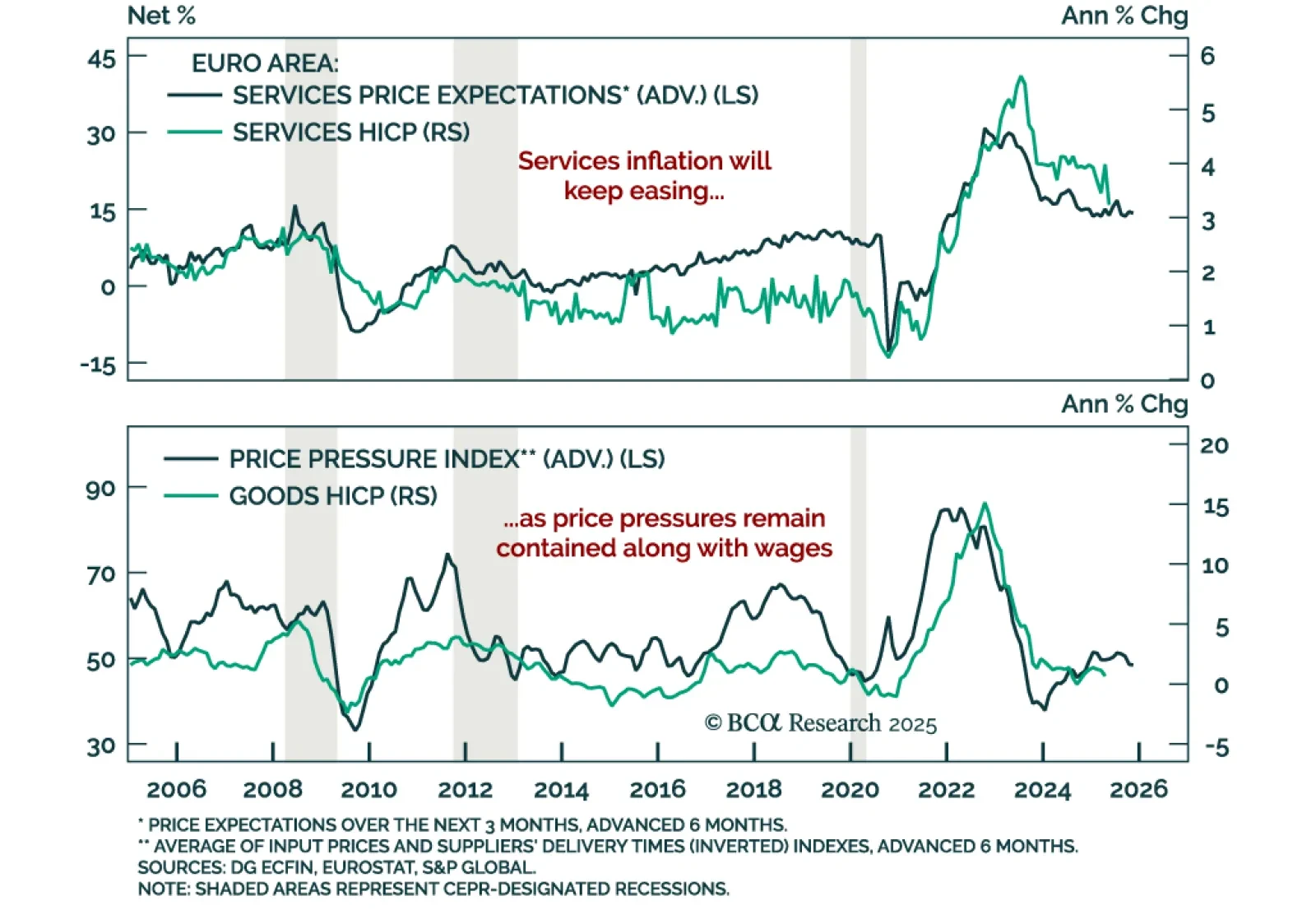

Cooler May inflation in the Eurozone and Switzerland reinforces the case for an ECB rate cut and supports our defensive positioning across European rates and FX. Headline Eurozone HICP fell to 1.9% y/y from 2.2%, with core down to 2.…

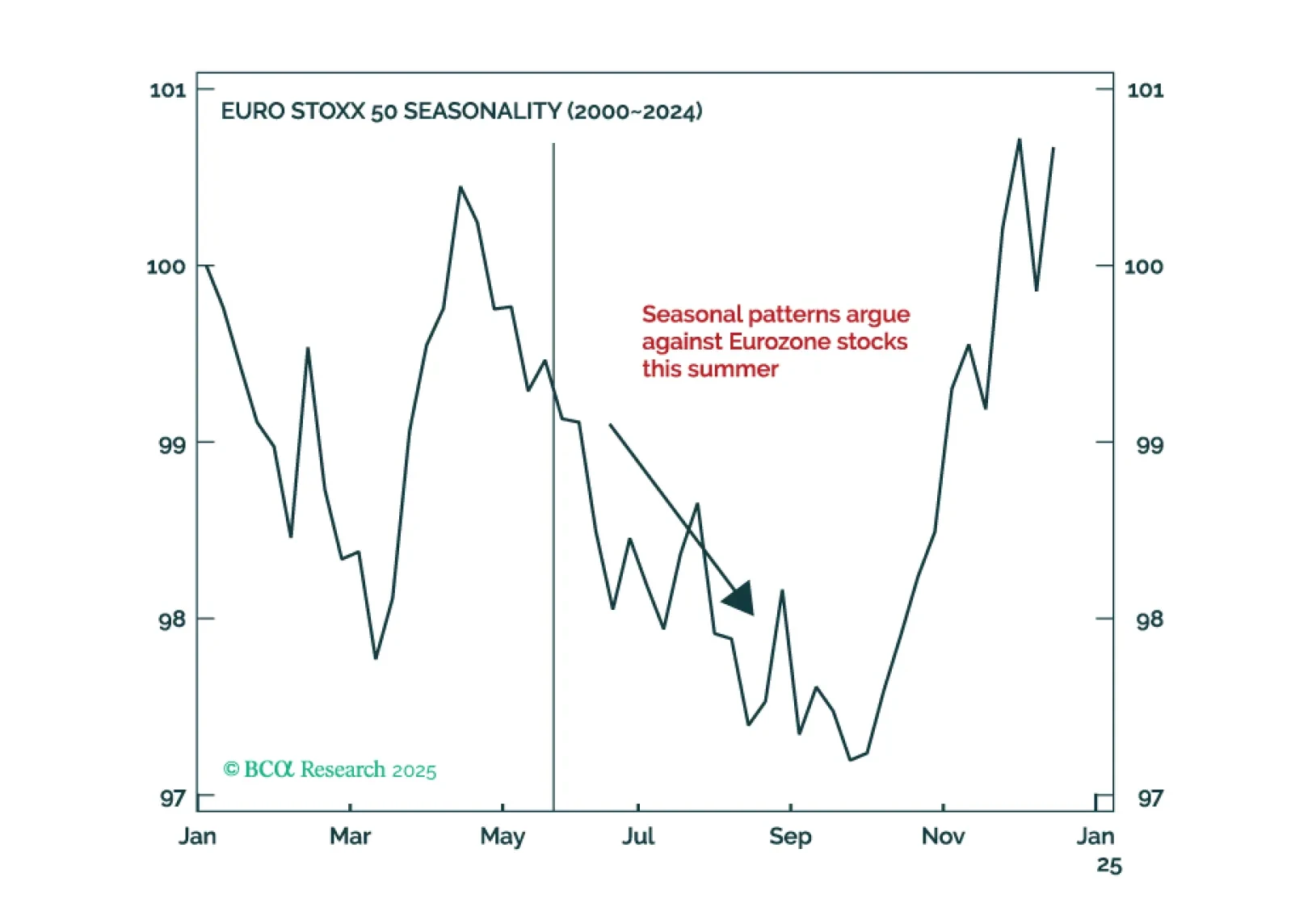

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

Bursting Japanese inflation warrants a cautious stance on the country’s bonds relative to other DM markets. Tokyo's annual core CPI reached 3.6% in May, the highest print in 44 years (excluding the post-pandemic inflation flare…

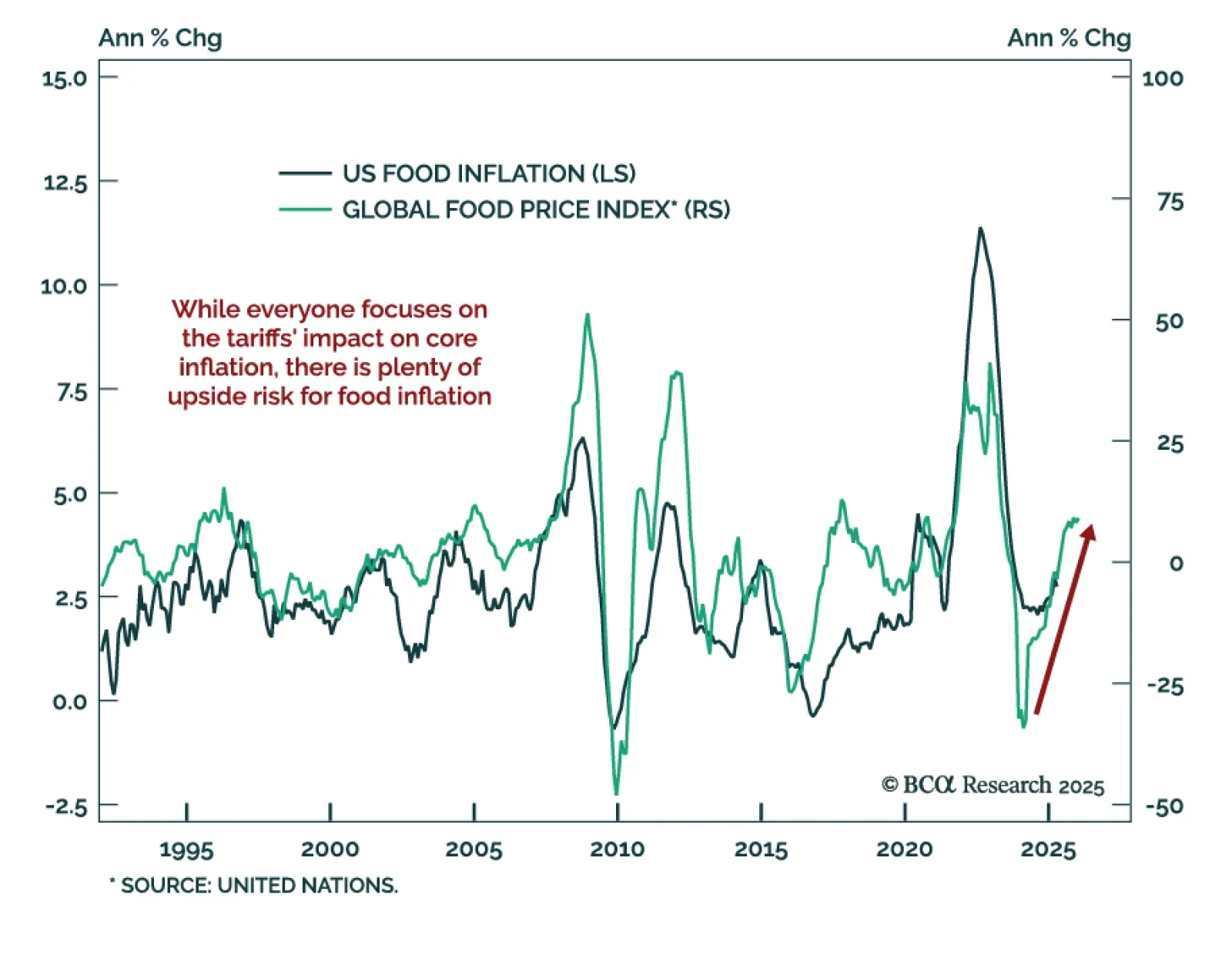

The upward trend in global food prices suggests that food inflation risks re-accelerating in the US. Historically, US food inflation lags the United Nations’ global food price index by about nine months. The annual growth in…