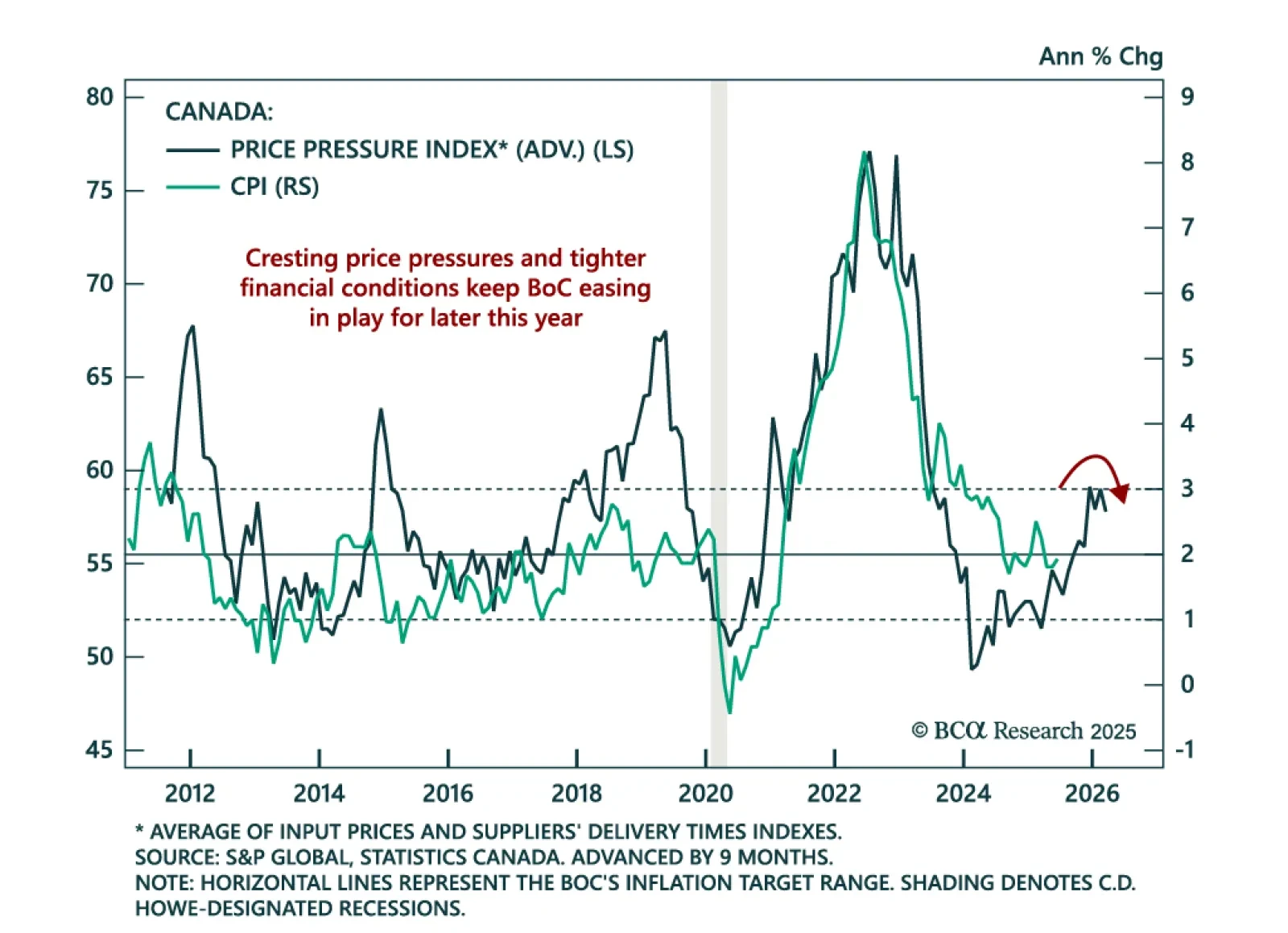

Canada’s inflation re-acceleration makes a BoC July cut unlikely, but softening growth and tight financial conditions keep easing on the table. June headline inflation rose to 1.9% y/y from 1.7%, roughly in line with expectations.…

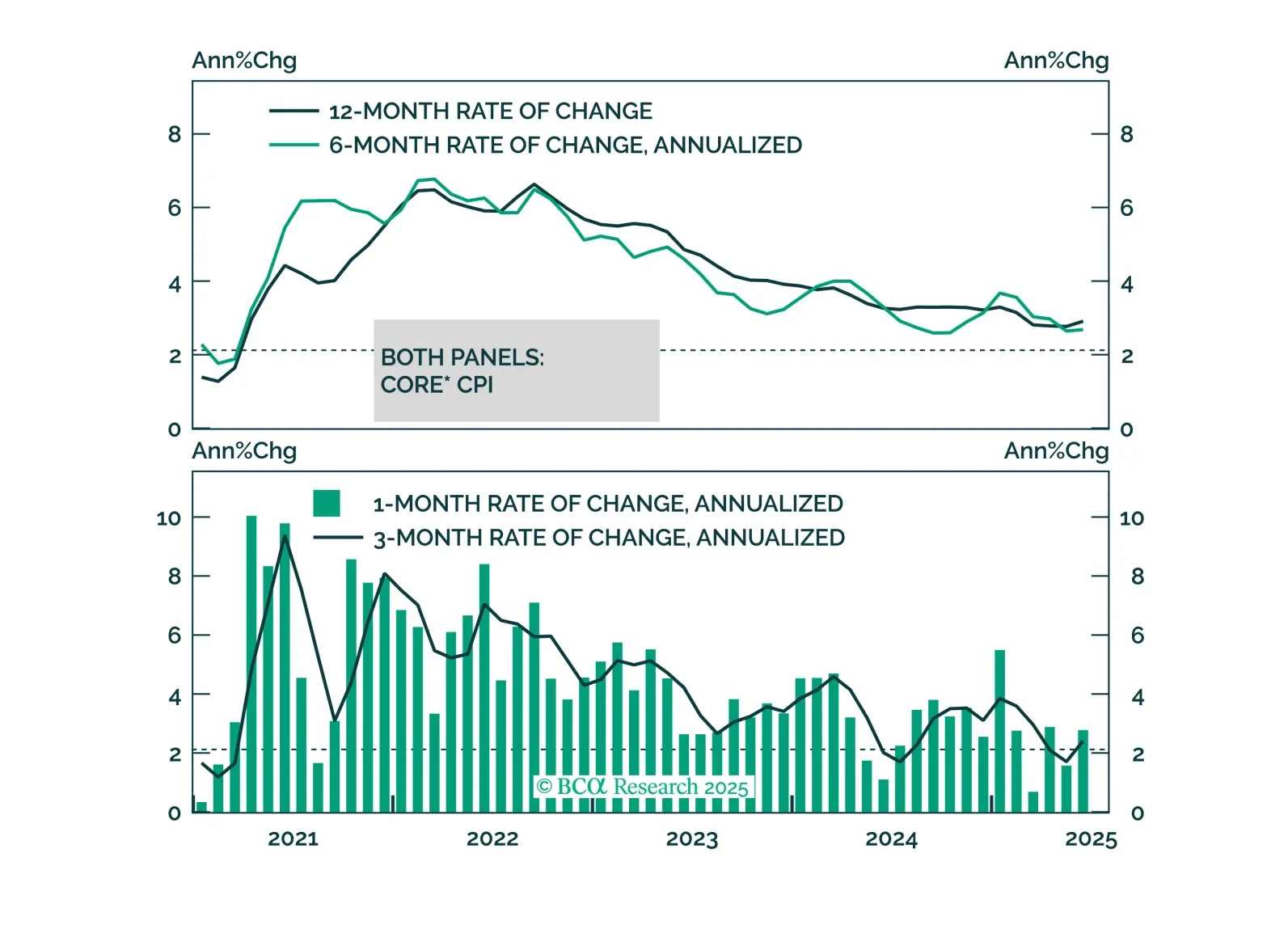

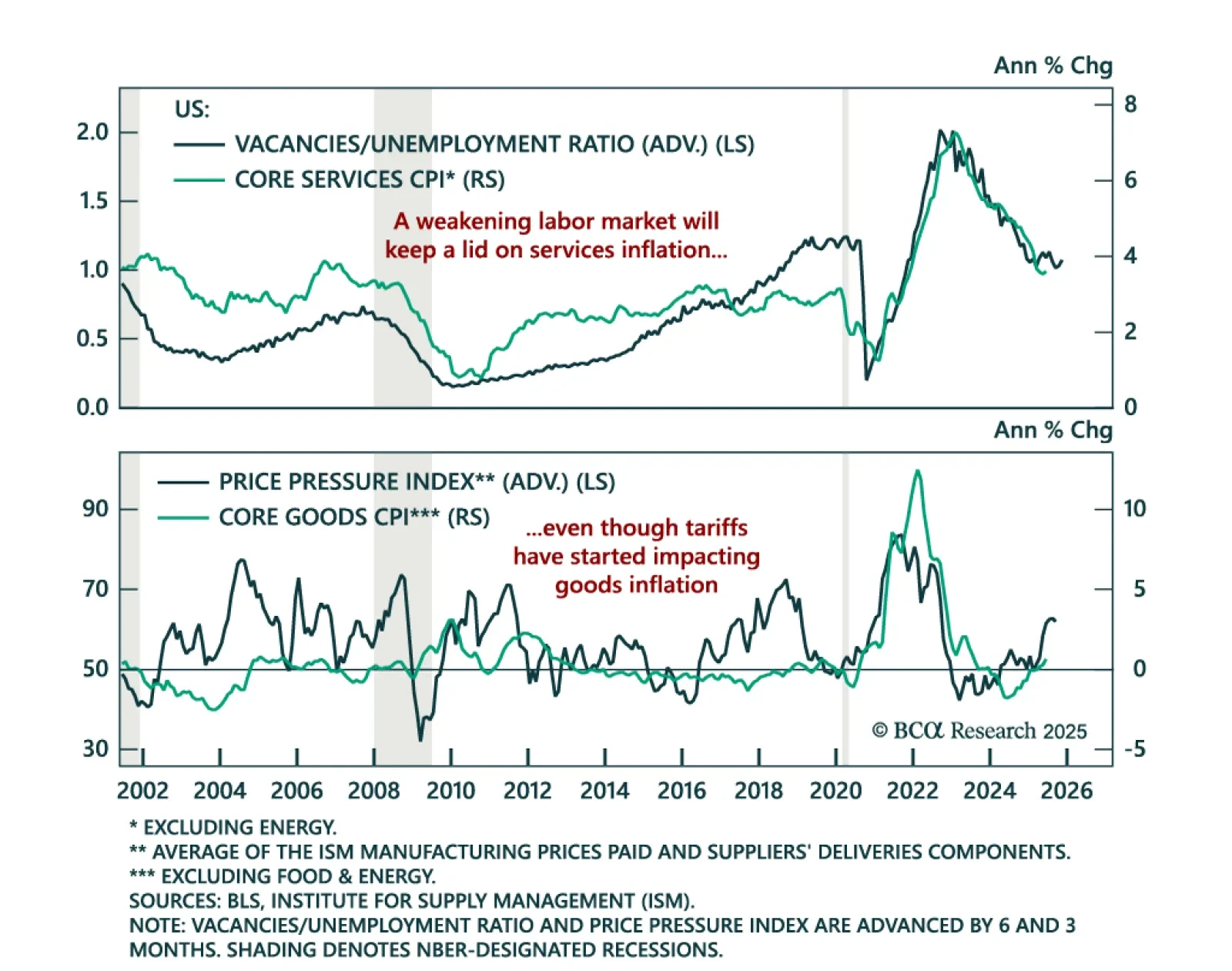

June CPI was broadly in line with expectations, with tariff passthrough building in goods but broader inflation pressures likely to remain contained. Headline inflation came in slightly above expectations at 2.7% y/y (0.3% m/m),…

We discuss the implications of this morning’s CPI report and the relative attractiveness of 2/5 Treasury curve steepeners.

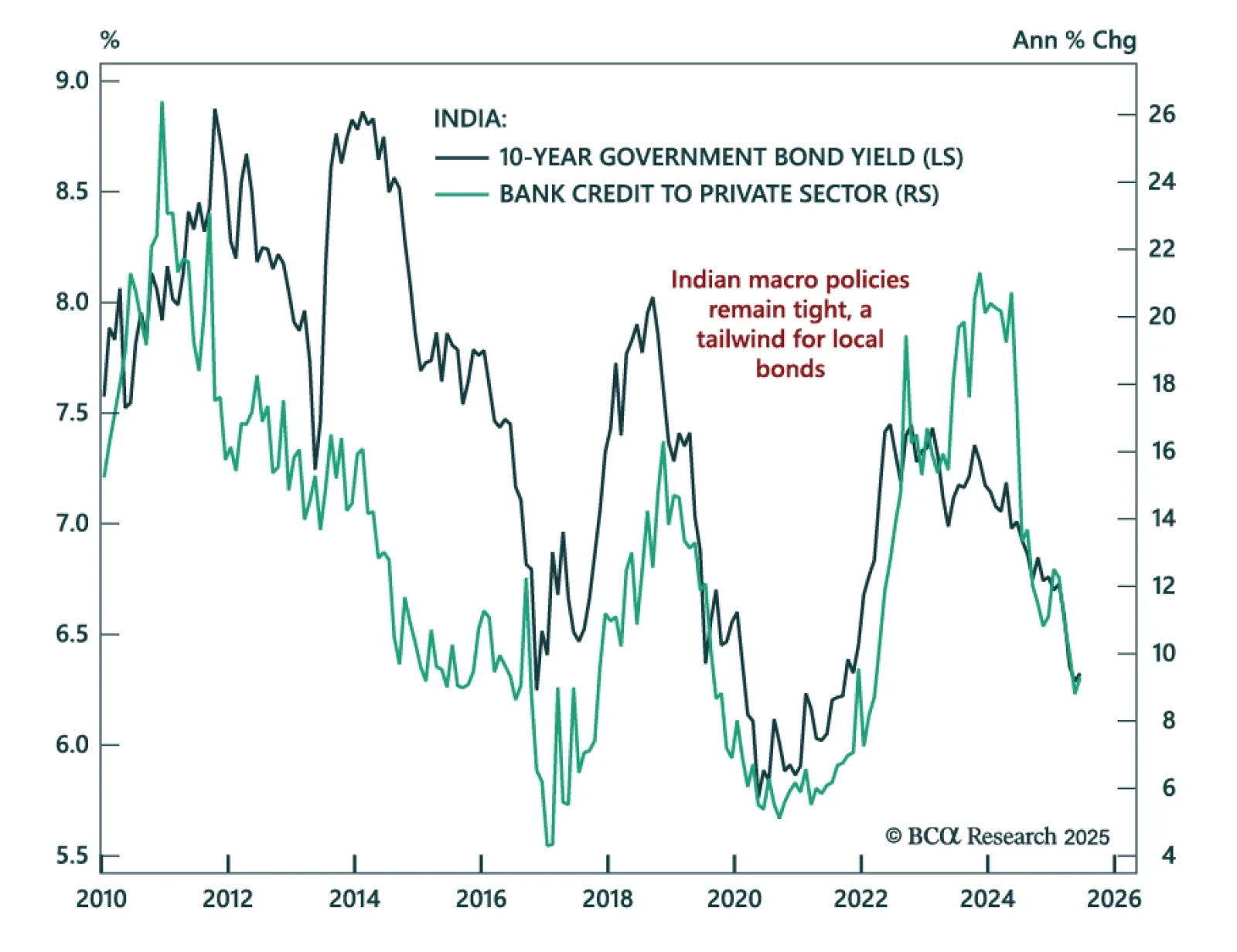

With inflation at a six-year low and restrictive policy weighing on growth, our EM strategists remain long Indian bonds and underweight equities. Headline CPI fell to 2.1% y/y, largely driven by lower food prices, bringing inflation…

We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

Our Portfolio Allocation Summary for July 2025.

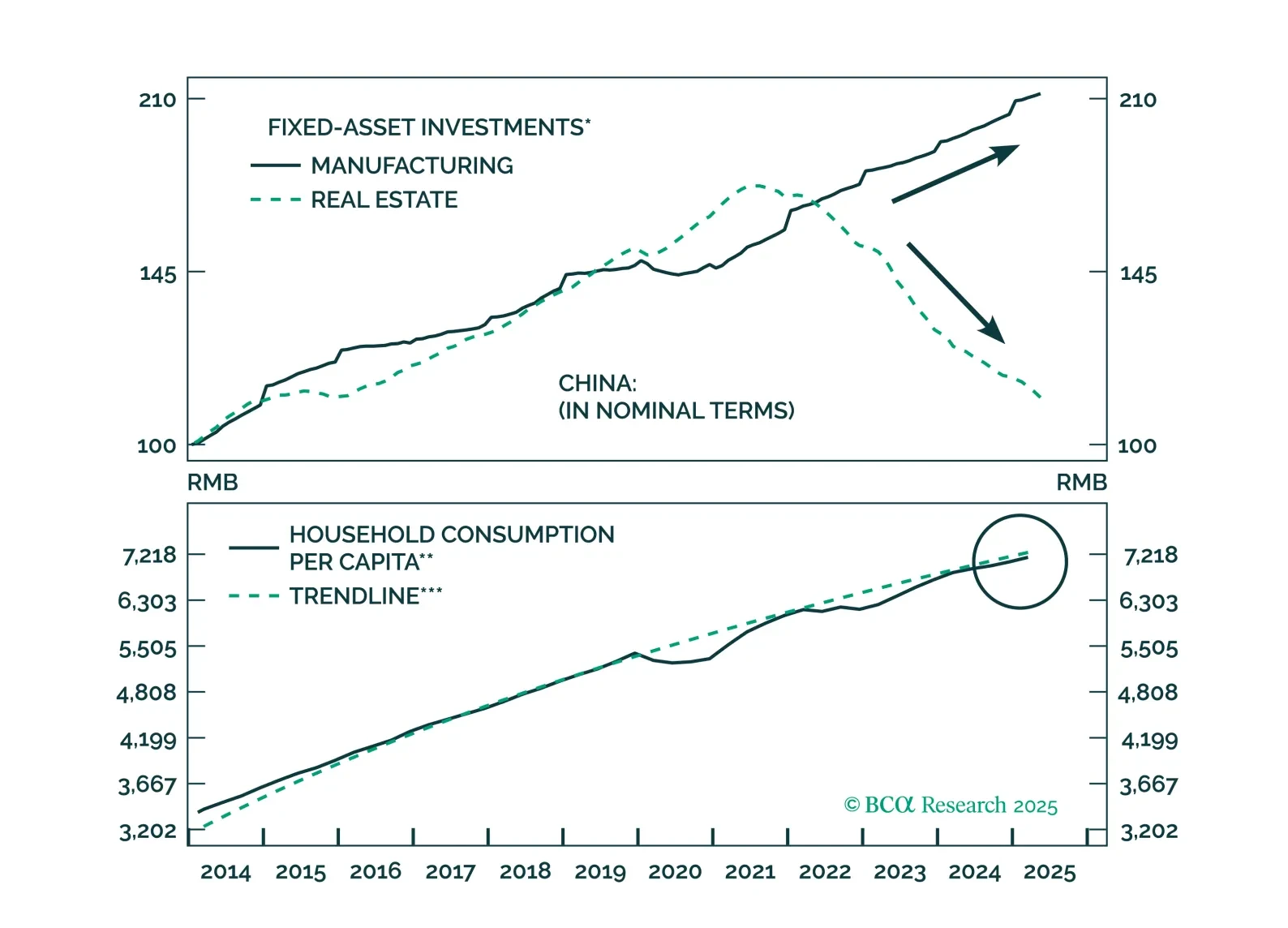

This report analyzes China’s persistent deflation, which is rooted in supply-side forces. Consumption support will be slow and incremental, keeping deflationary pressures elevated for the next 6–12 months.

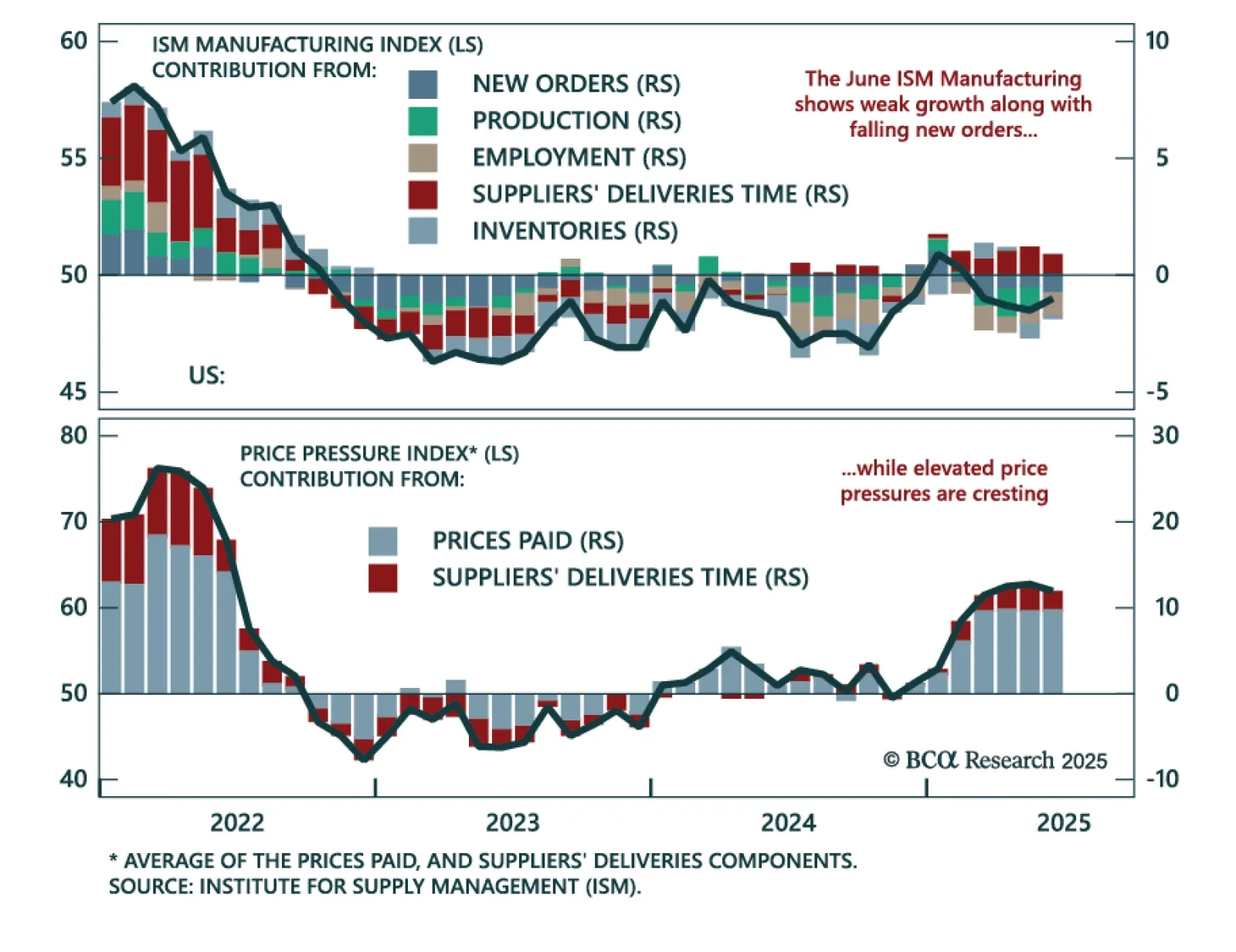

The June ISM points to sluggish US manufacturing and reinforces long duration positioning amid peaking price pressures. The index rose modestly to 49.0 from 48.5 in May, with the rebound driven by slightly higher production and…

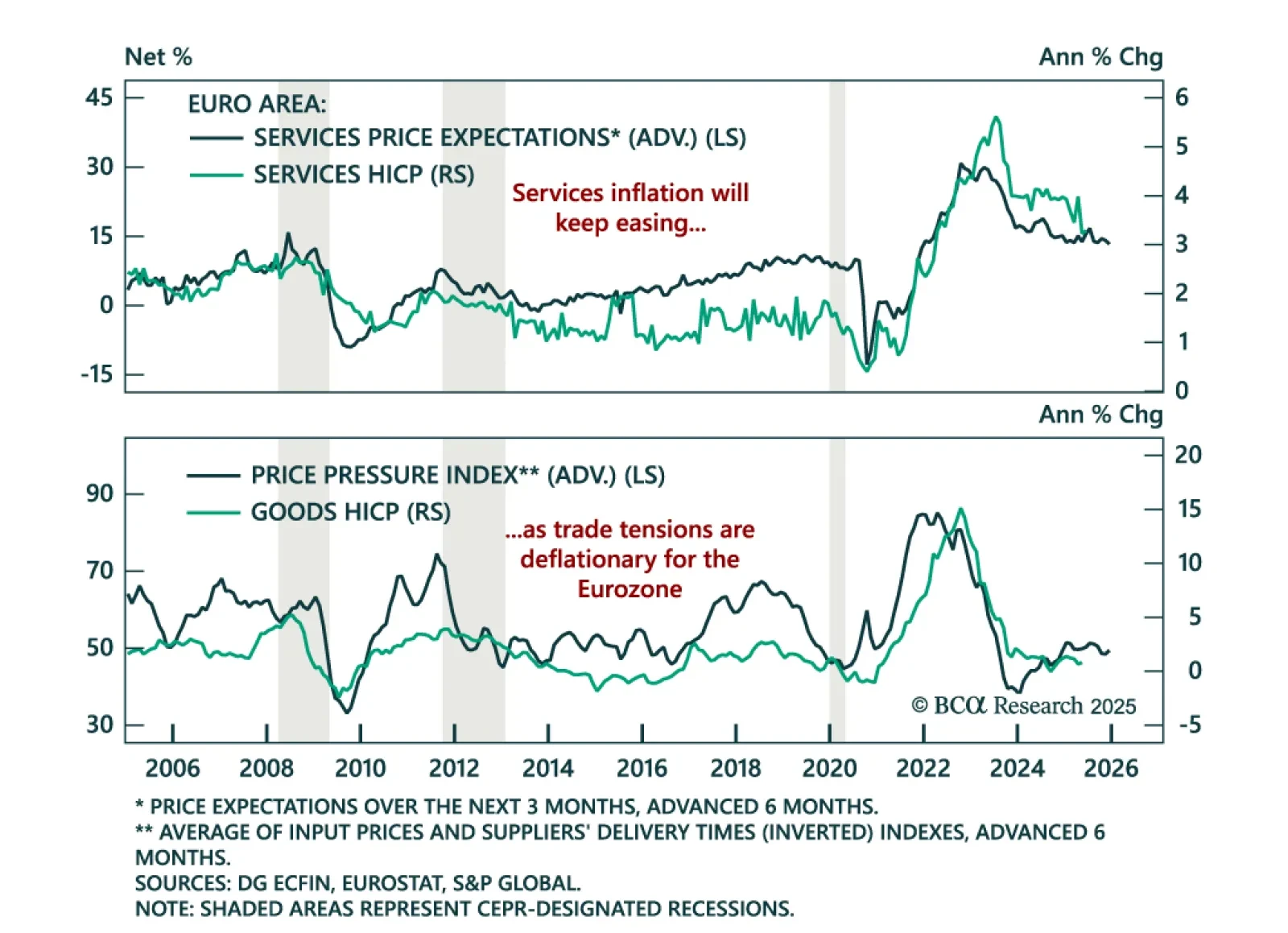

June Eurozone inflation data and soft growth backdrop support further ECB easing and reinforce the case for long European bond exposure. Flash HICP inflation ticked up to 2.0% y/y from 1.9%, while core inflation held steady at 2.3%,…