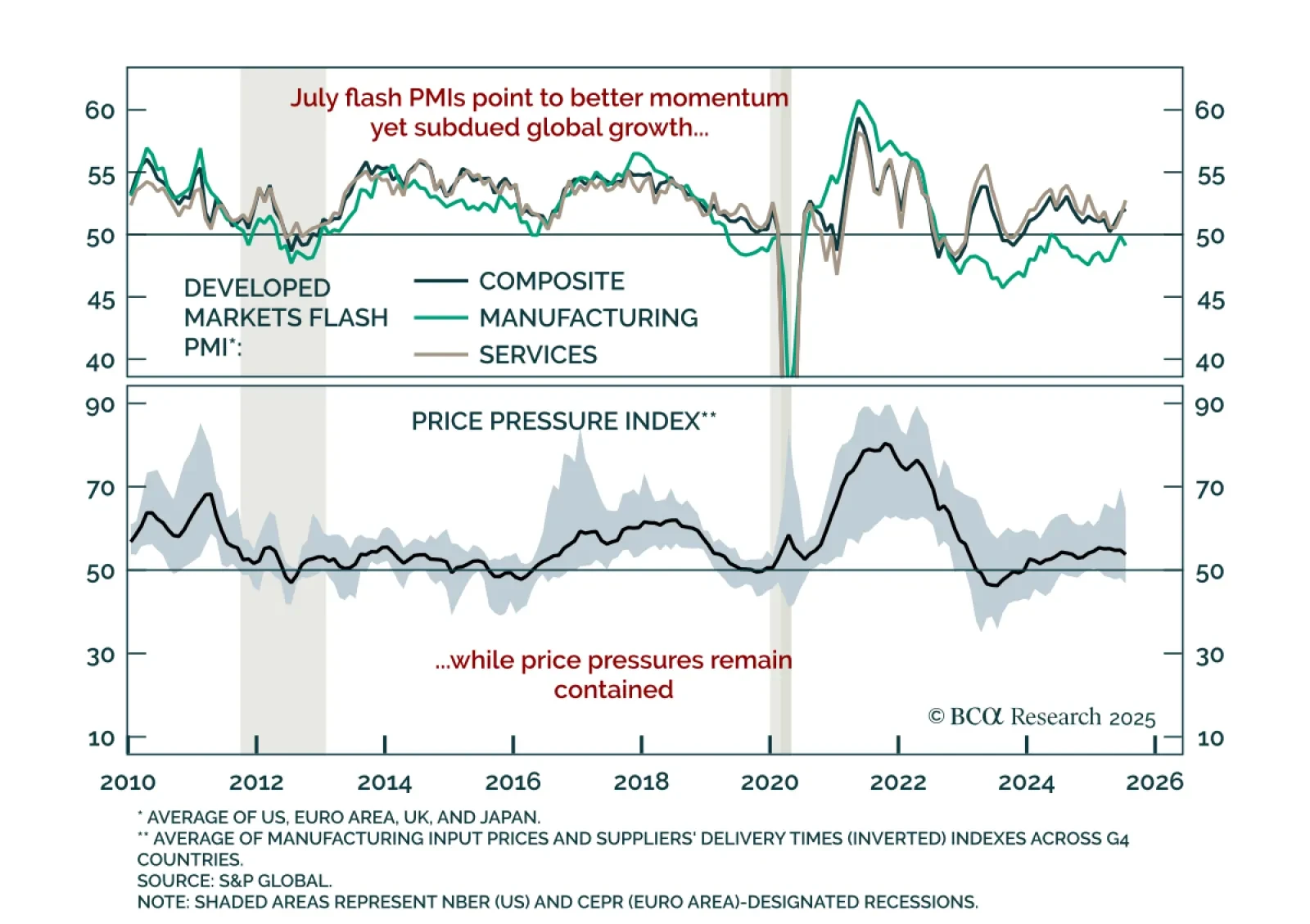

July DM flash PMIs point to improving global growth momentum led by services, but manufacturing remains weak and upside is limited, reinforcing our defensive stance. Services PMIs improved in the US, Europe, and Japan, but…

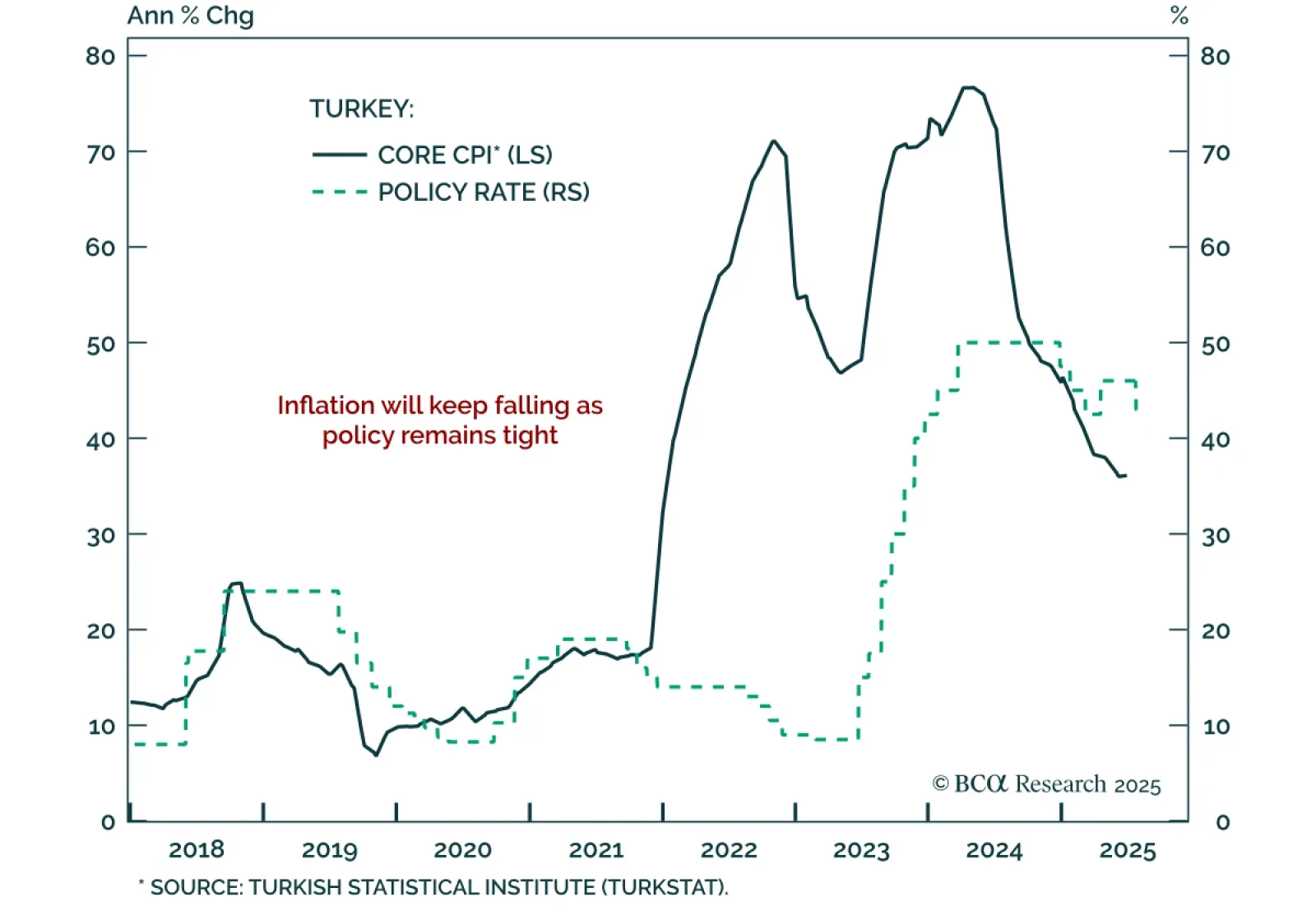

Our Emerging Markets strategists upgraded Turkey across assets, citing falling inflation, tight policy, and limited external imbalances. The Central Bank of Turkey cut its benchmark 1-week repo rate by 300 bps to 43%, citing…

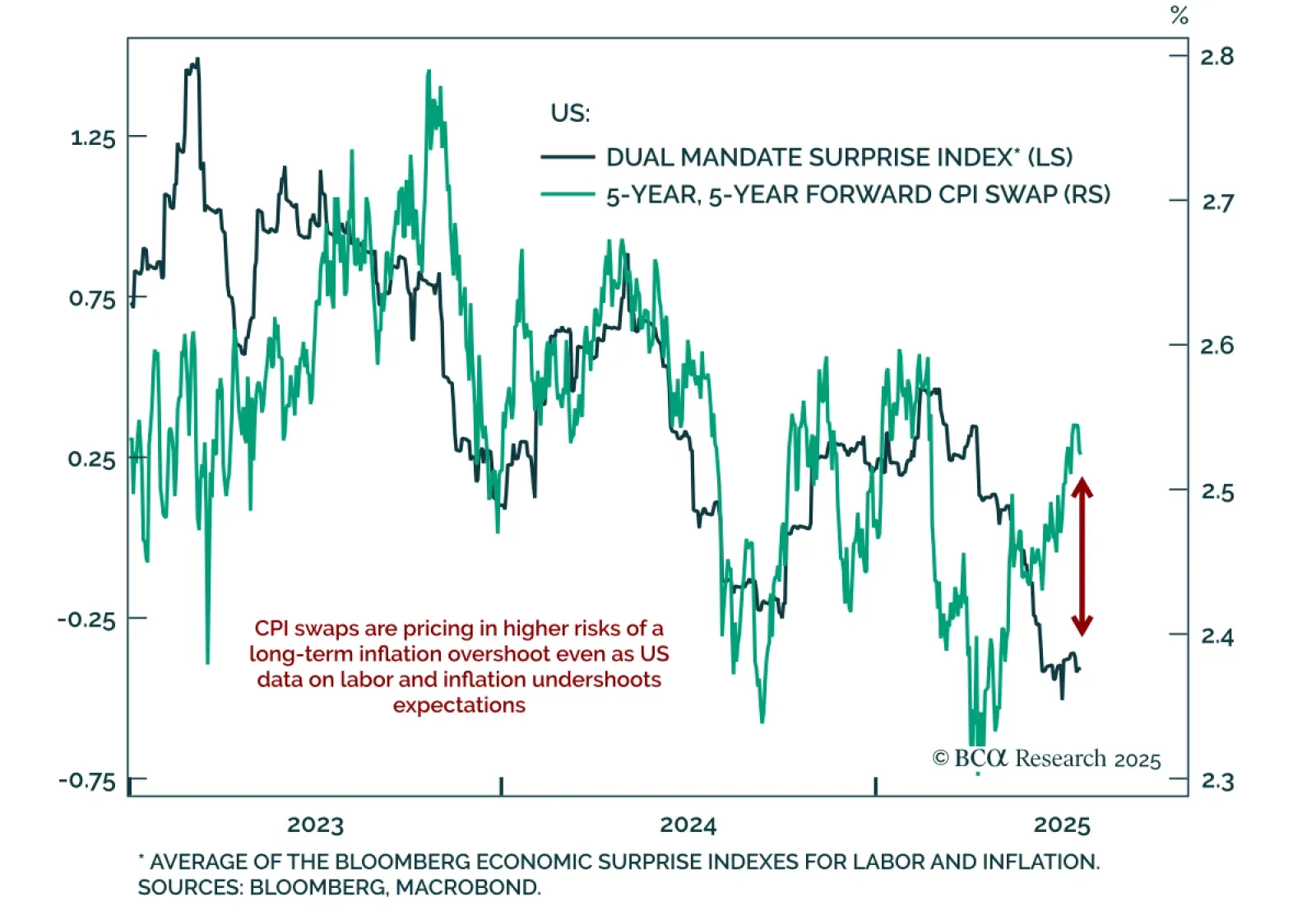

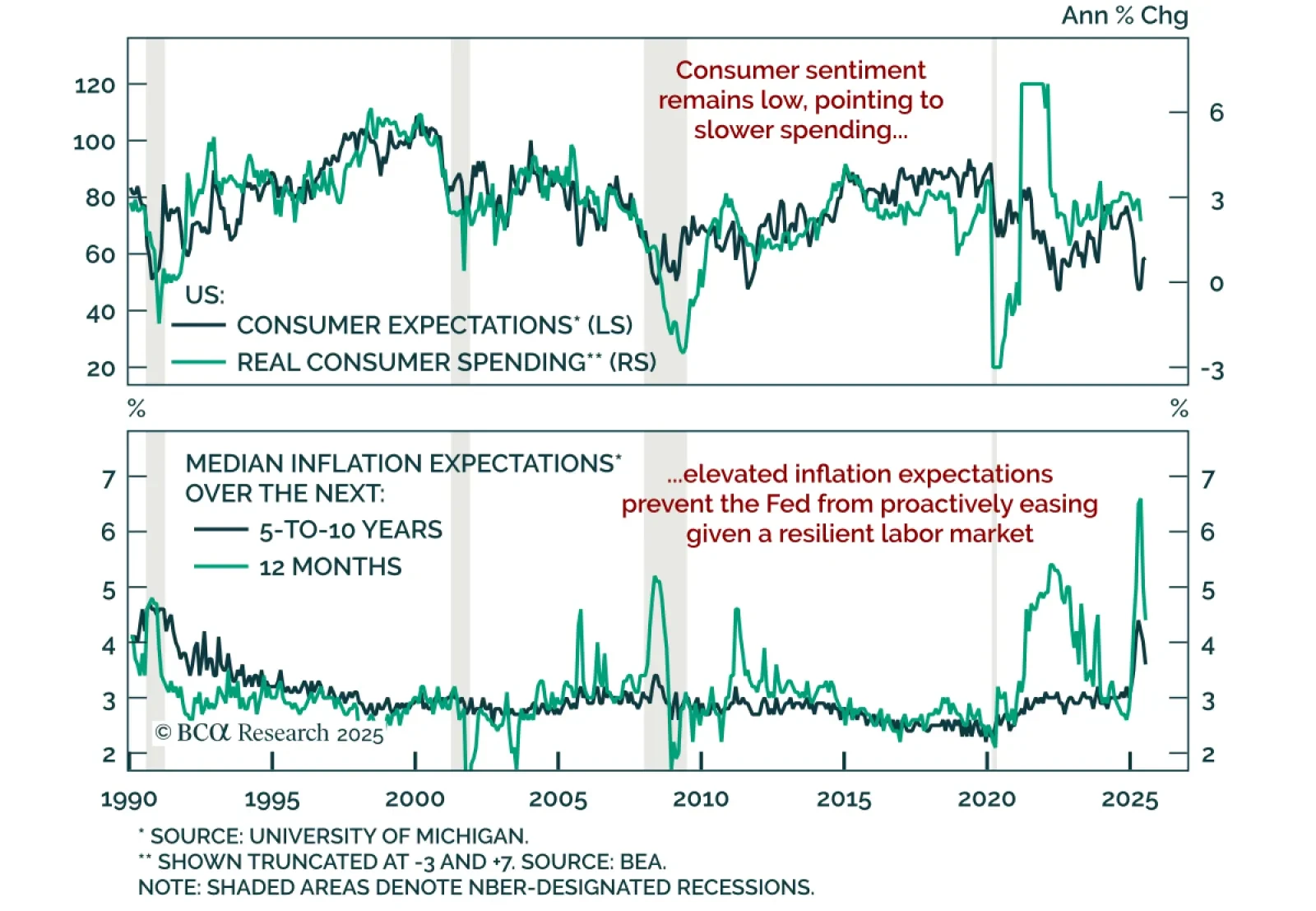

Rising political pressure on the Fed risks undermining policy credibility, risking a de-anchoring of long-term inflation expectations. The Trump administration keeps escalating attacks on Fed Chair Powell. While the Fed…

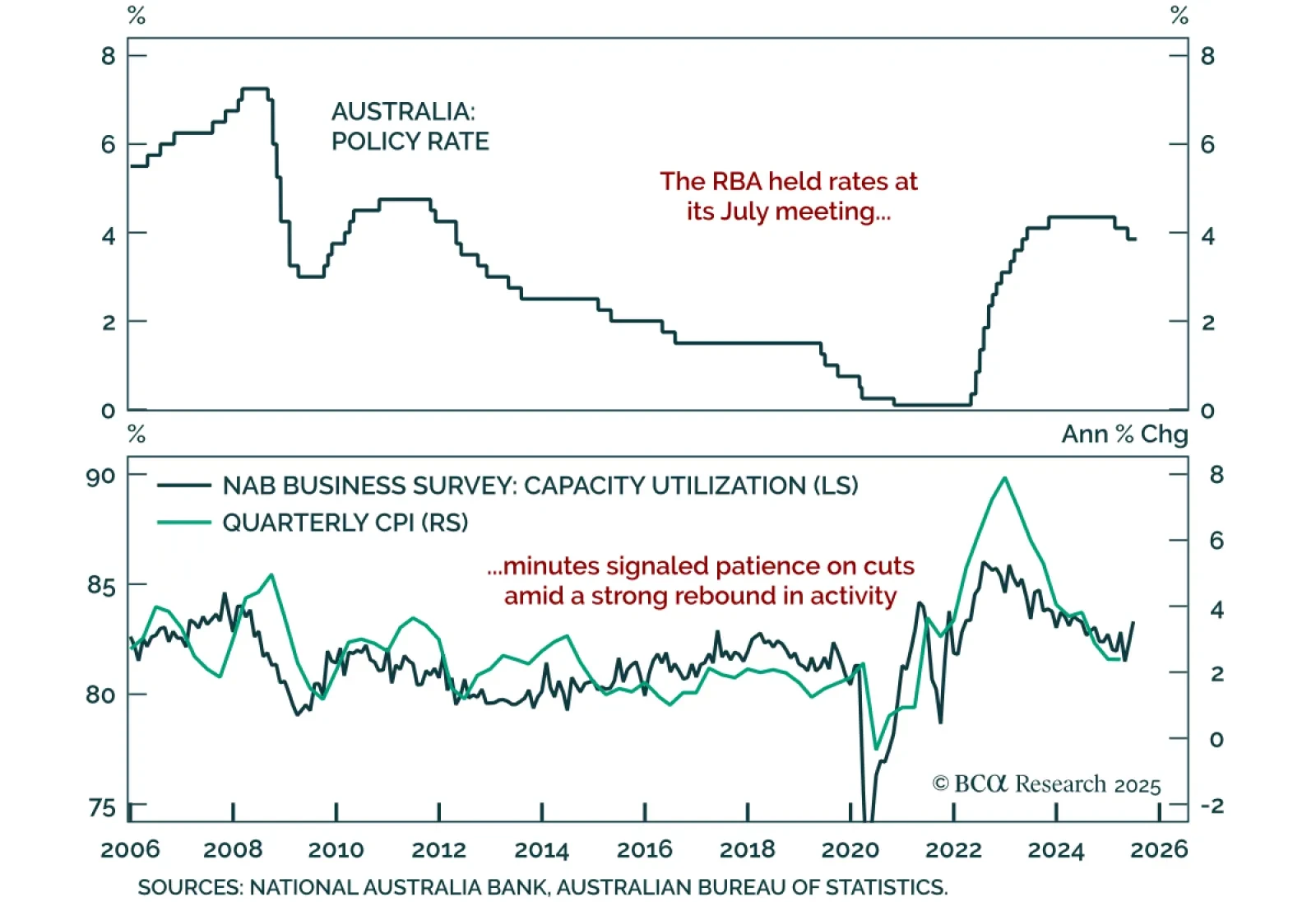

RBA minutes confirmed a cautious approach to easing, reinforcing our underweight in ACGBs and long AUD/NZD stance. The decision to hold at 3.85% surprised markets expecting a 25 bps cut. Governor Bullock had framed the decision…

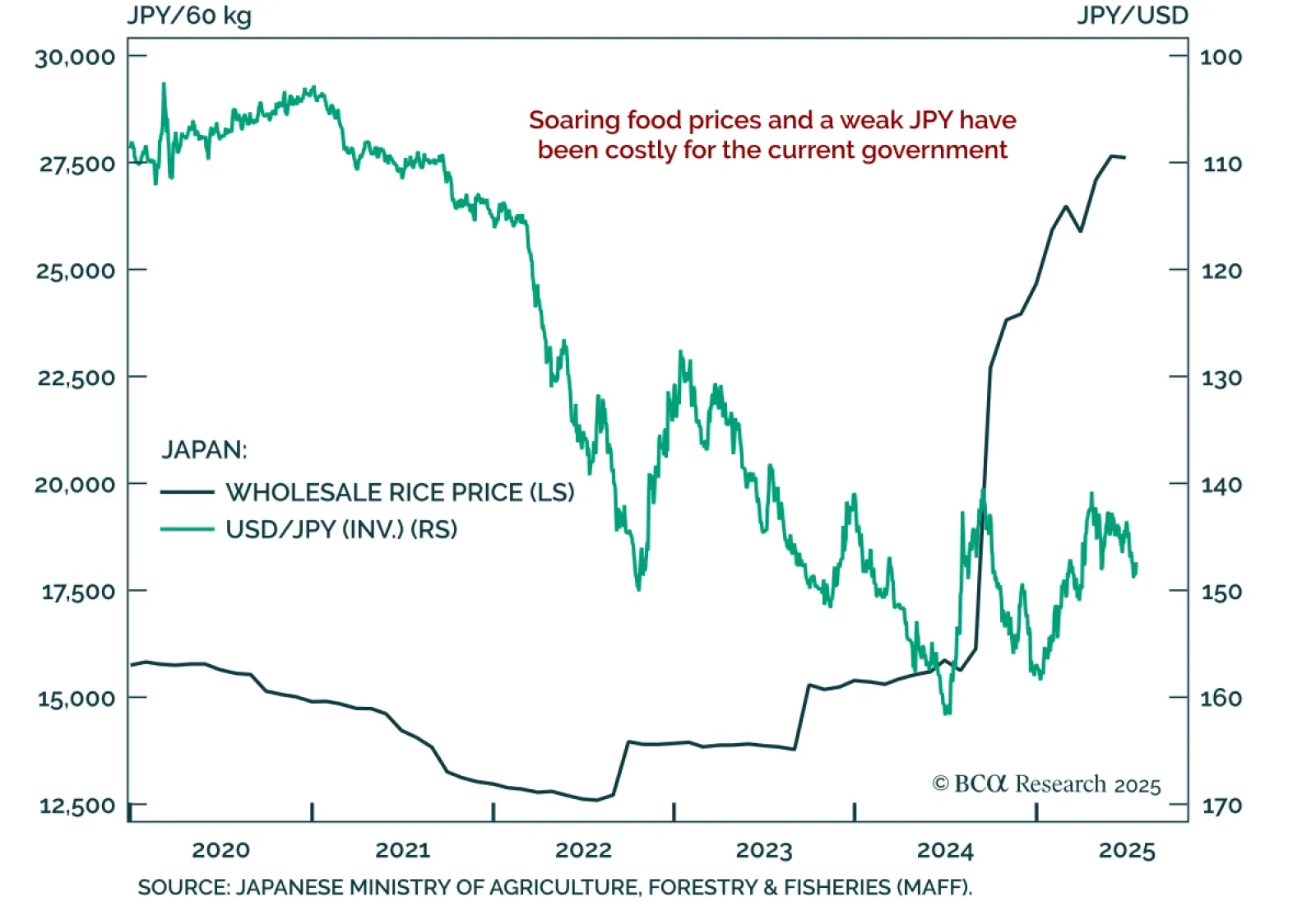

The Upper House loss of Japan’s ruling coalition reflects growing political uncertainty, reinforcing our underweight in JGBs and bullish stance on the yen. The LDP-led ruling coalition has lost control of both houses of…

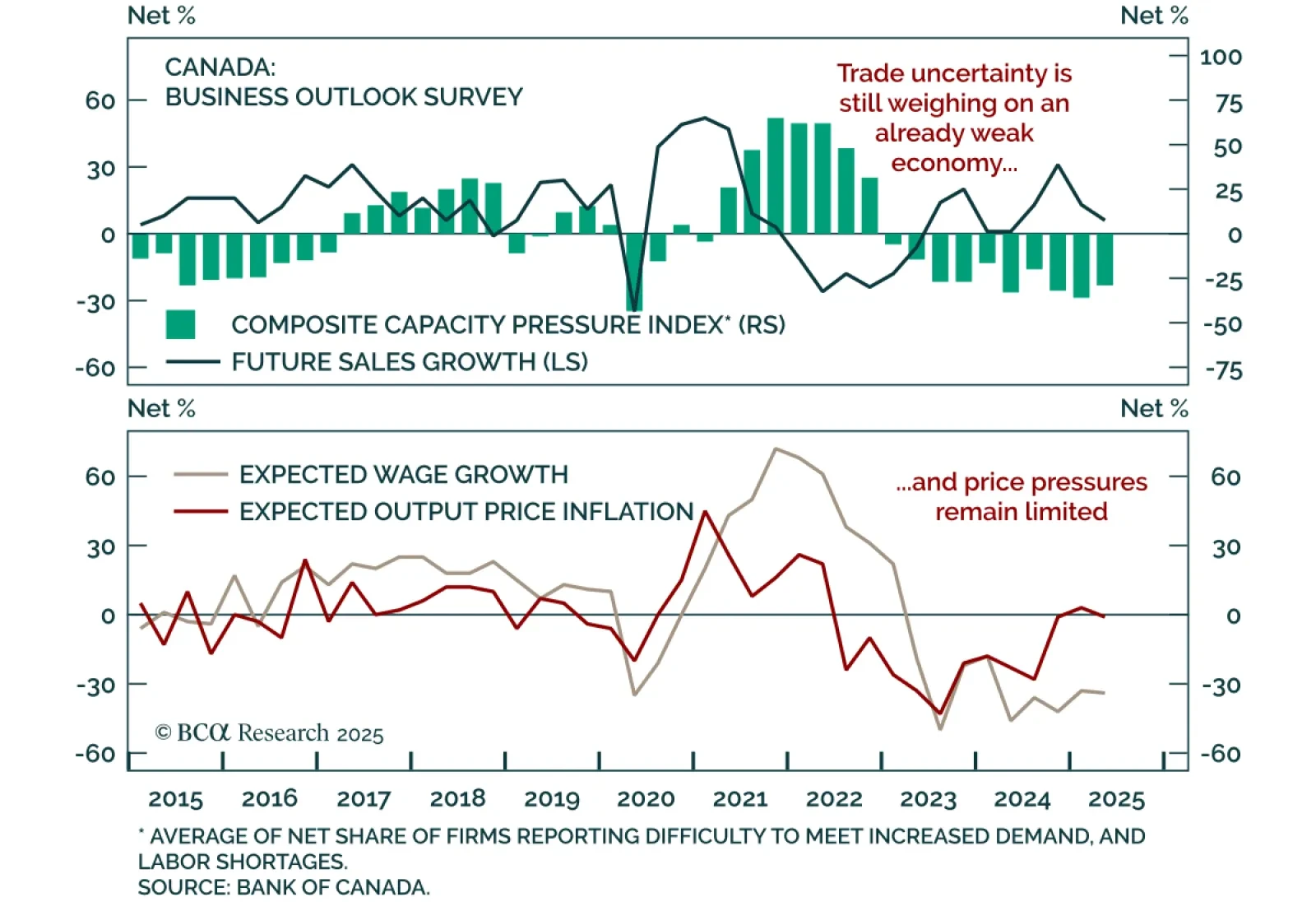

The Q2 Business Outlook Survey showed weaker sentiment and subdued hiring and investment intentions, reinforcing the case for deeper BoC rate cuts and our overweight in Canadian bonds. The BOS indicator ticked down to -2.4 from -2.1…

Consumer sentiment improved modestly in July, but remains at levels that still point to subdued spending, reinforcing our defensive stance. The preliminary University of Michigan index rose to 61.8 from 60.7 in June. Expectations…

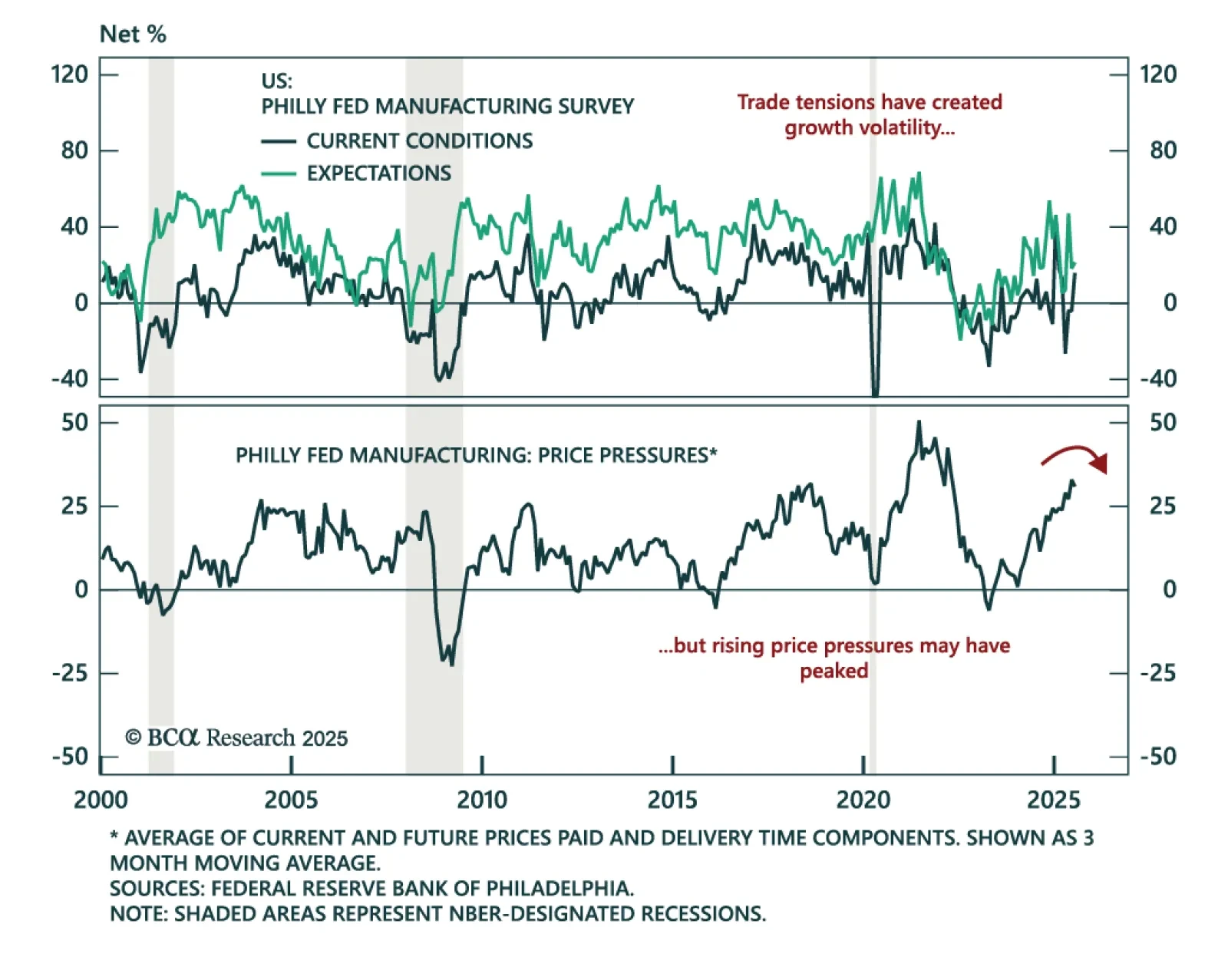

The July Philly Fed beat expectations with broad improvement in activity, but low growth, inventory buildup and margin pressure remains a risk for equities. The headline index rose to 15.9 from -4.0 in June. New orders, shipments,…

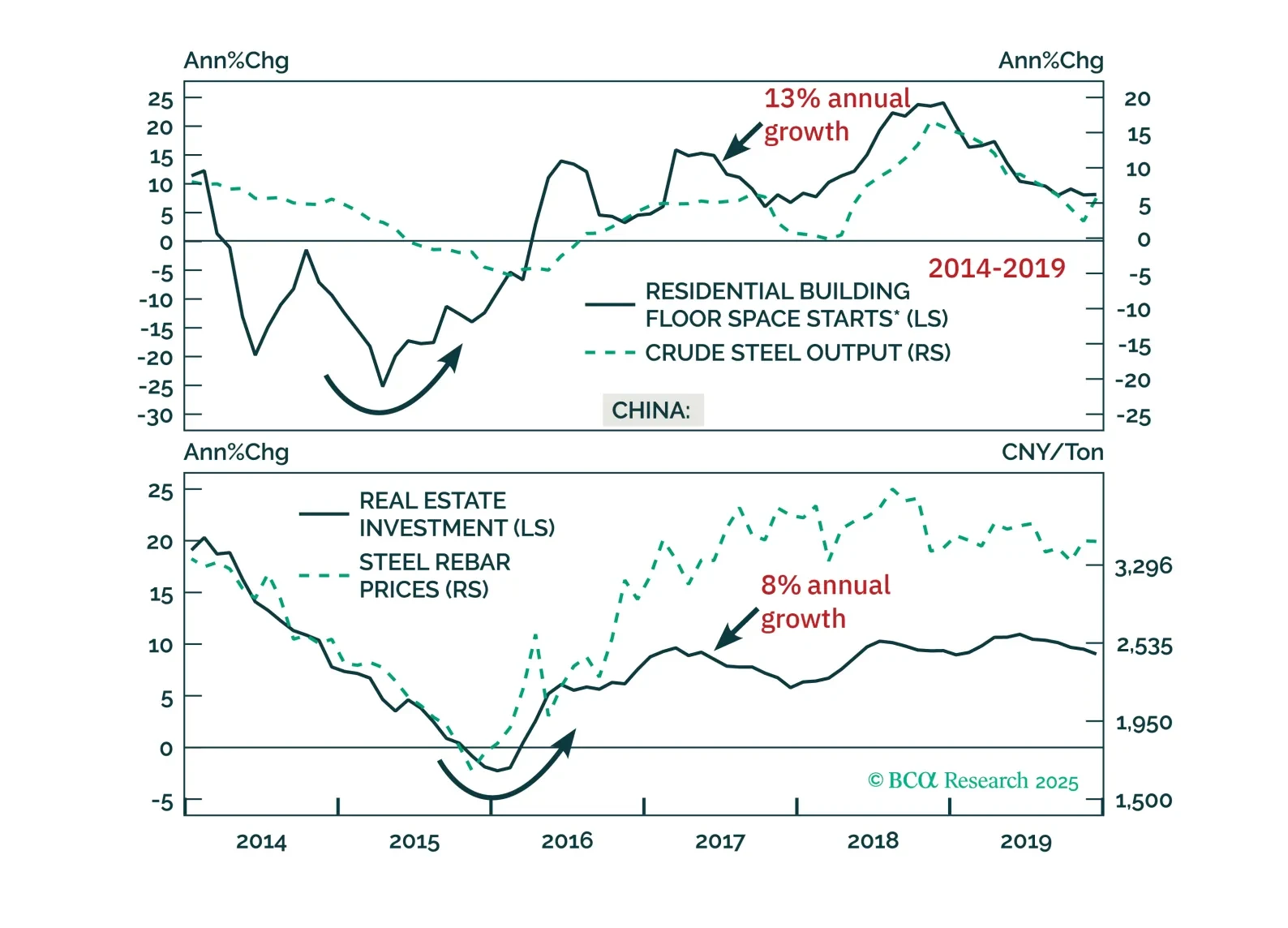

Beijing’s supply-side push faces steeper hurdles than in 2016. With limited demand support and tighter constraints on cutting capacity, today’s reforms are unlikely to pack the same punch.

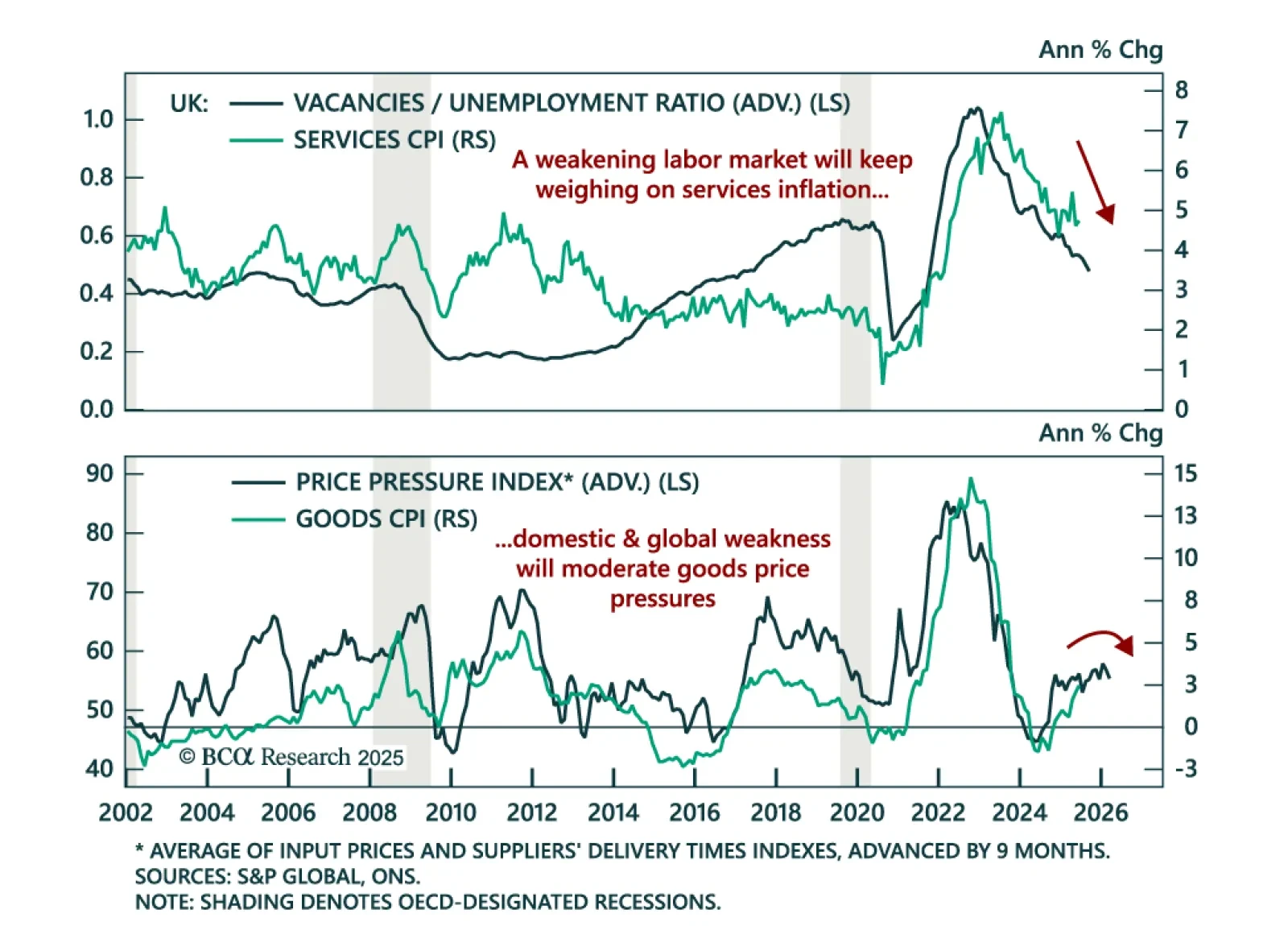

June UK CPI surprised to the upside, but weakening leading indicators point to disinflation ahead. Stay overweight Gilts. Headline inflation accelerated to 3.6% y/y from 3.4%, and core rose to 3.7% from 3.5%. Services inflation held…