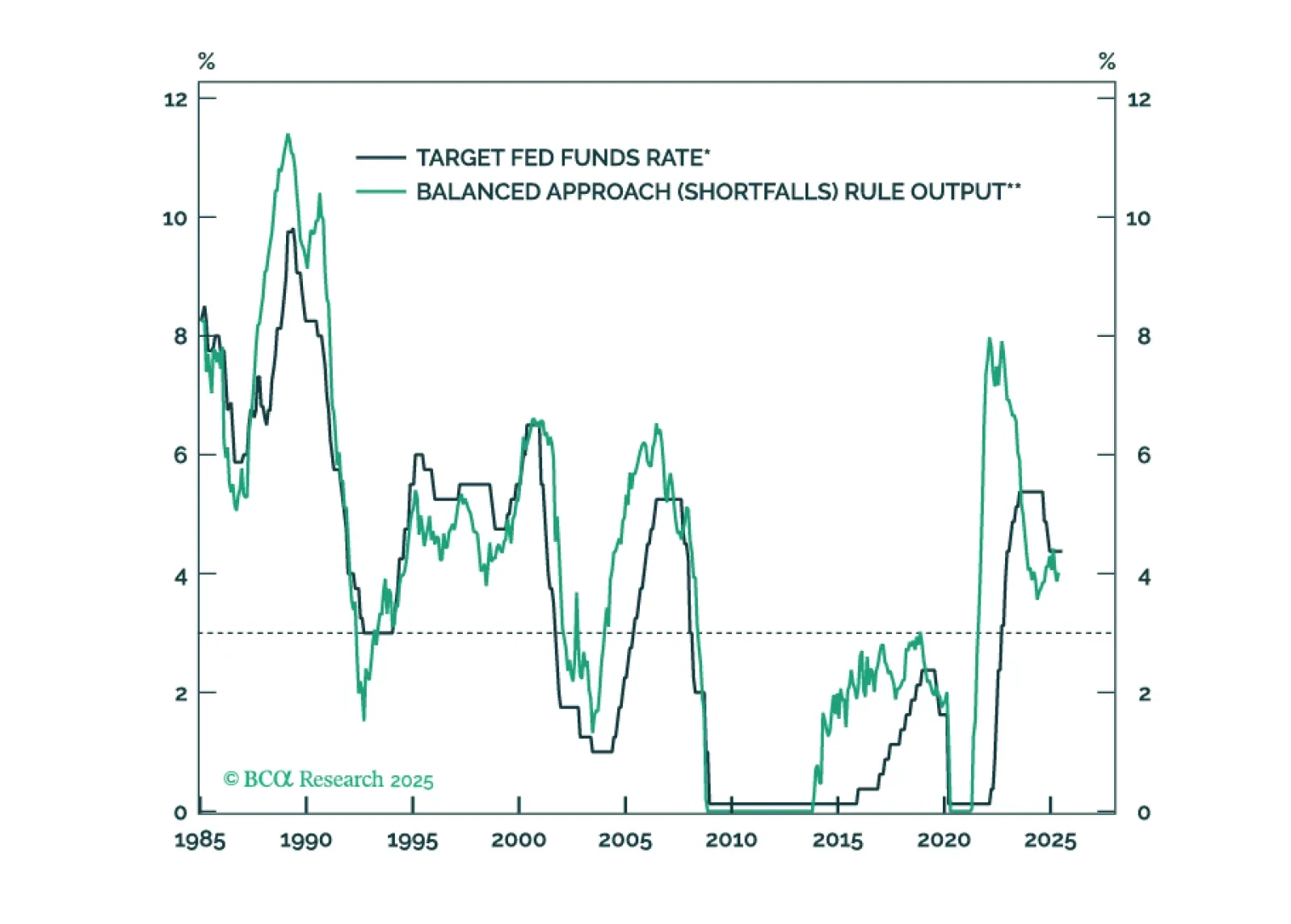

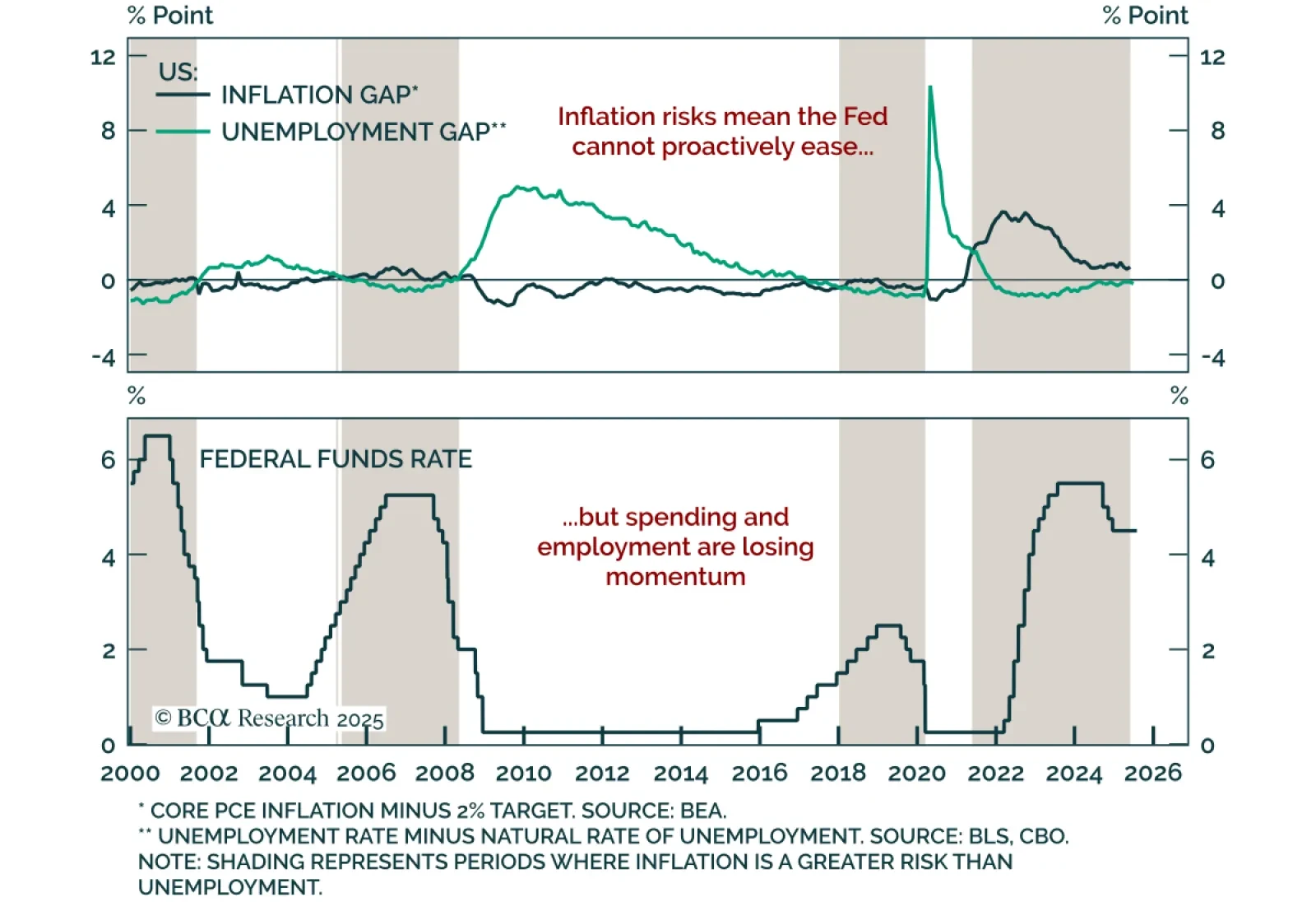

The Fed will keep rates on hold until the unemployment rate forces its hand.

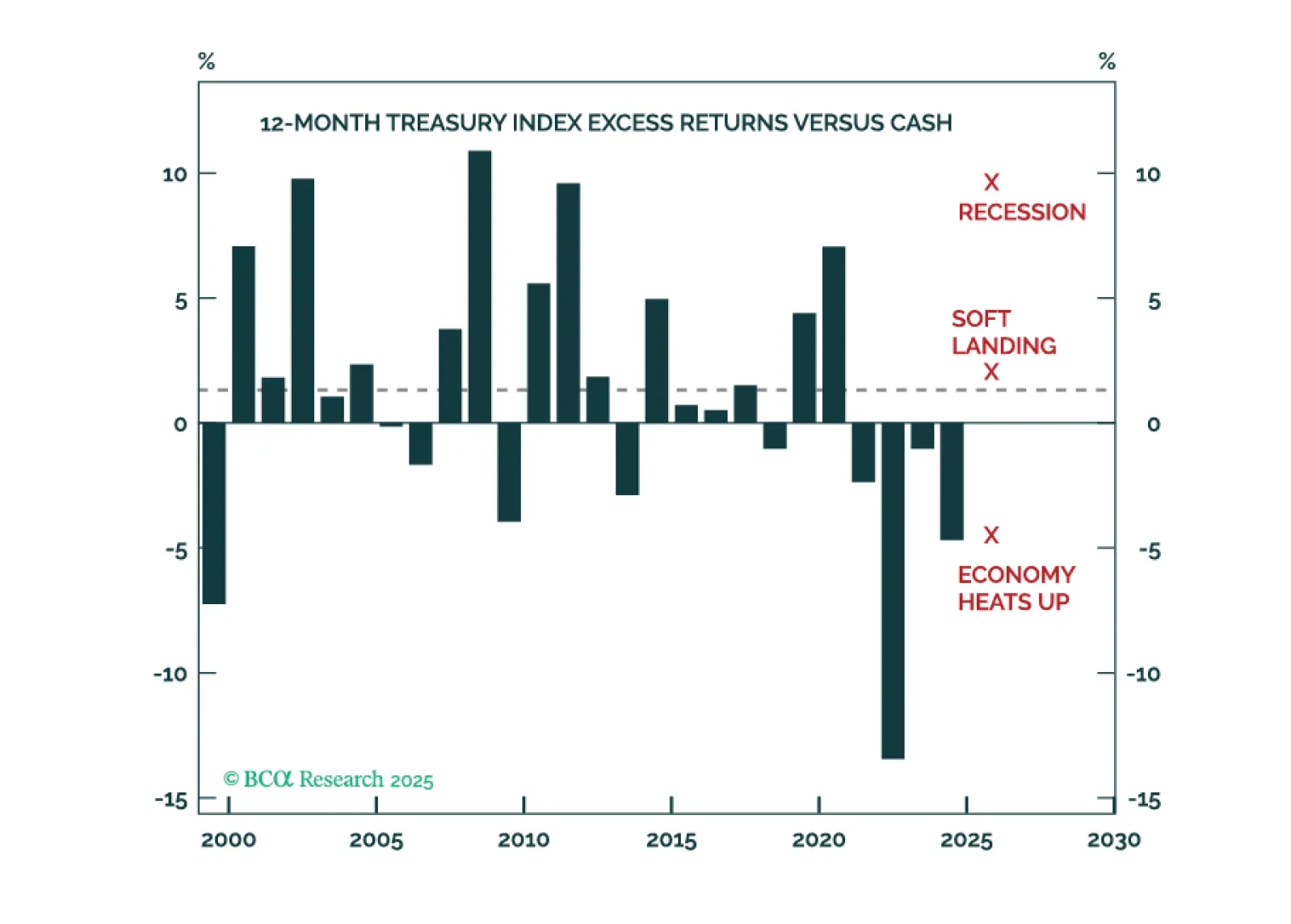

The Fed held rates steady for a fifth straight meeting, with a divided FOMC and resilient growth keeping policy on hold, supporting our long-duration stance. The target range remains at 4.25%–4.50%, with the statement reflecting only…

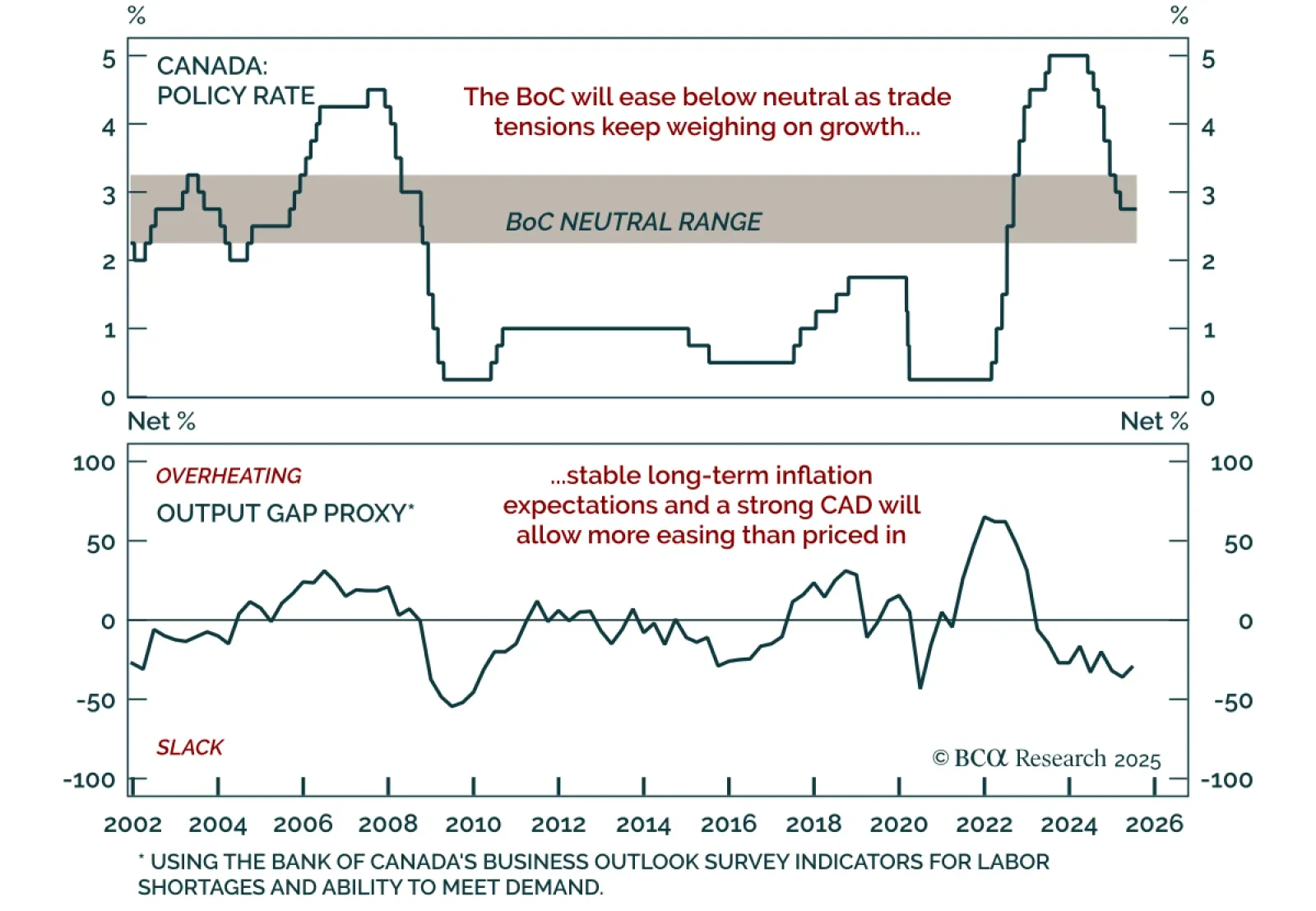

The BoC held rates at 2.75% for a third consecutive meeting, but a weak growth outlook and contained inflation reinforce our overweight in Canadian bonds. With policy within the 2.25%–3.25% neutral range, the BoC remains…

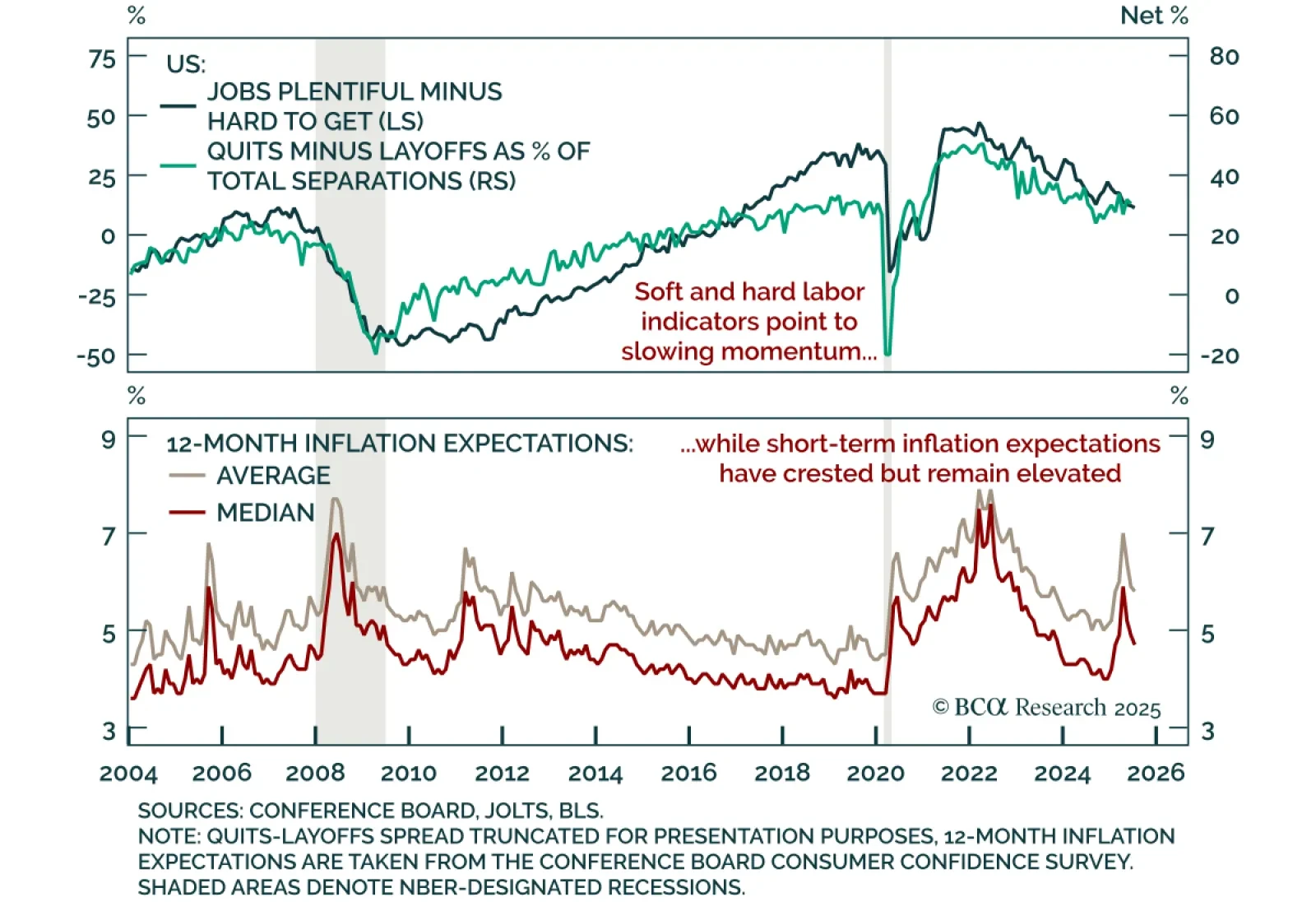

The July Conference Board Consumer Confidence report showed improved expectations but weaker current conditions, reinforcing our defensive stance and preference for downside protection. The headline index rose to 97.2 from a revised…

The June JOLTS report showed further weakening in US labor market momentum, reinforcing our overweight duration stance and preference for steepeners. Job openings fell more than expected to 7.4m from a downwardly revised 7.7m, while…

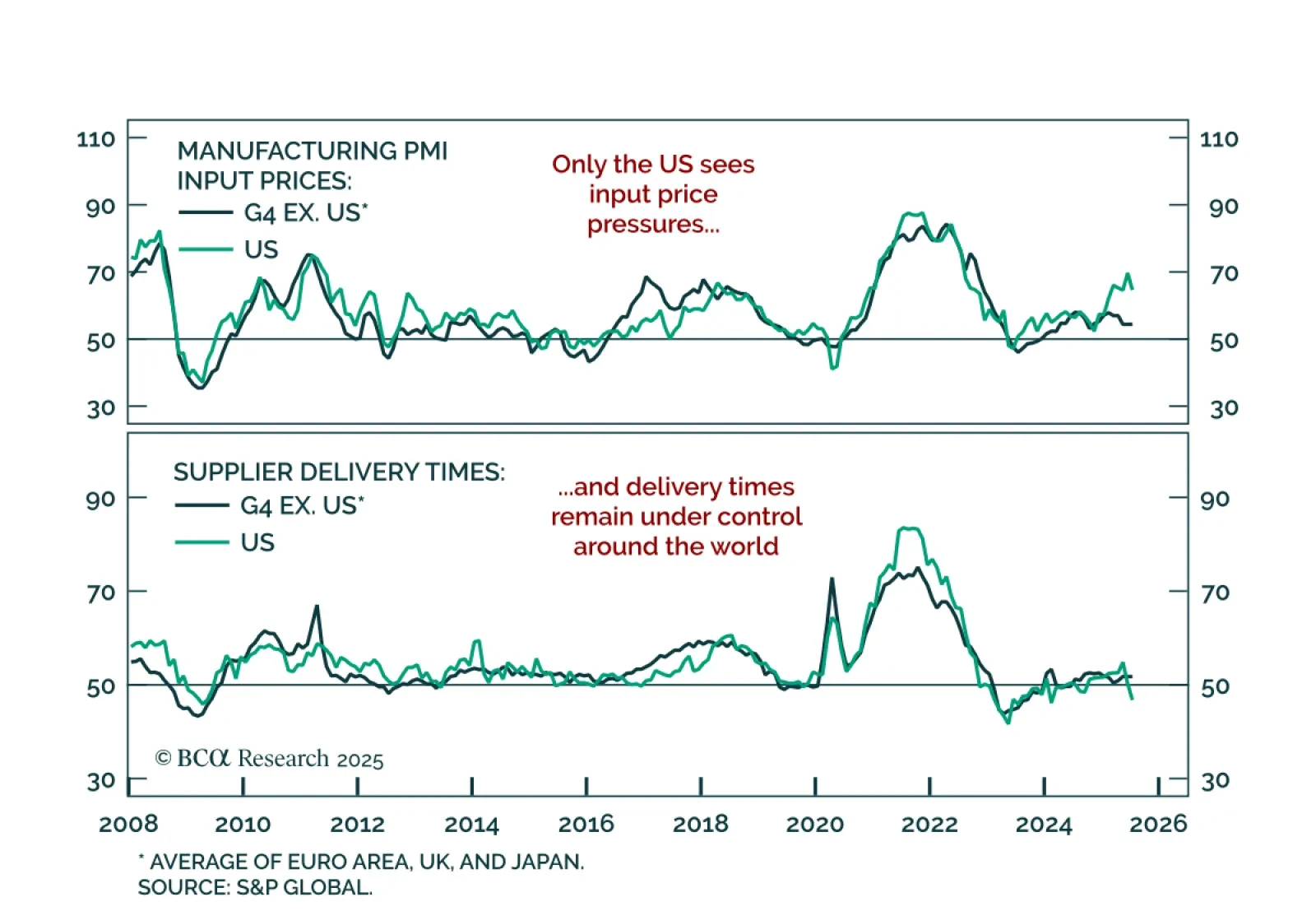

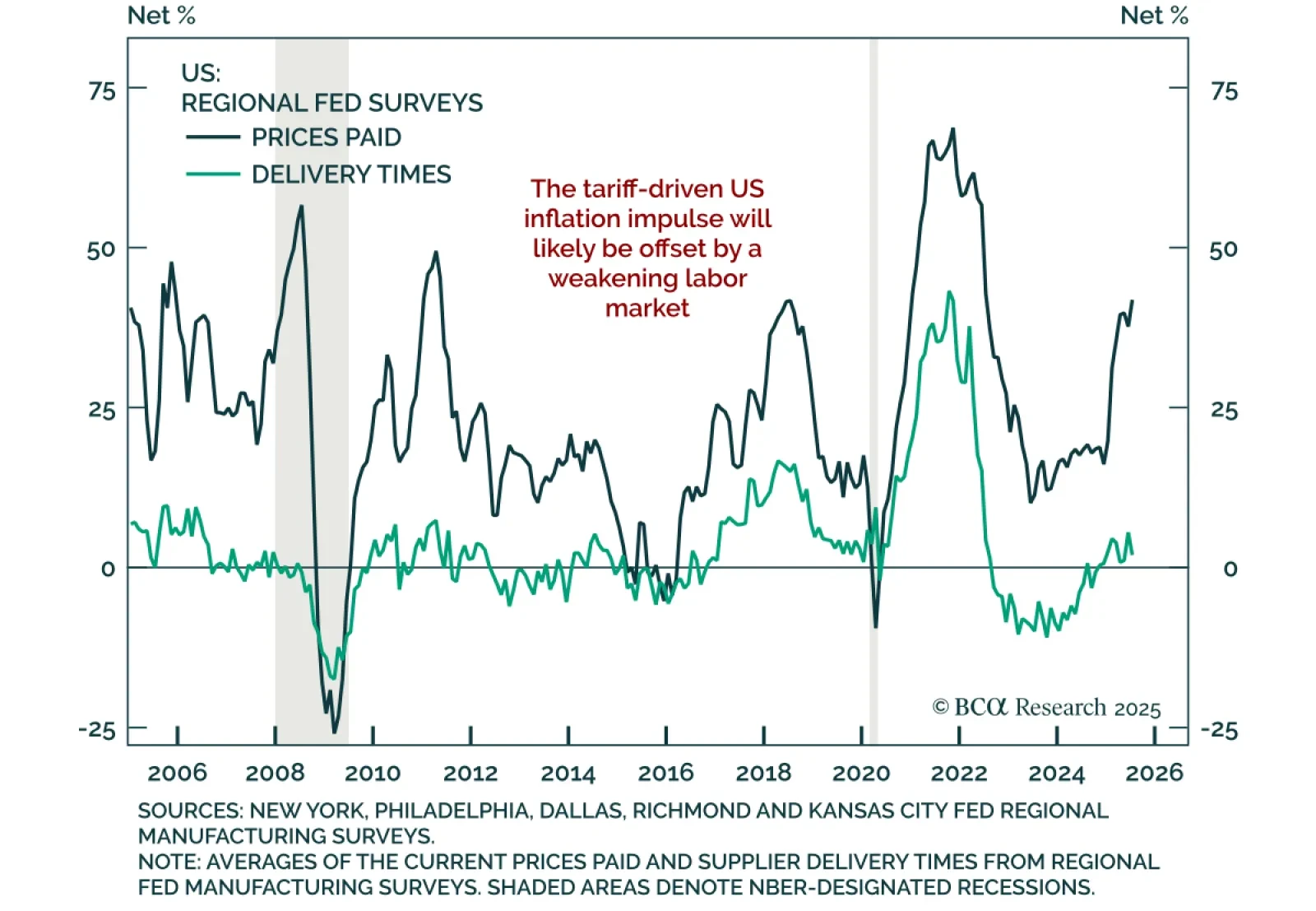

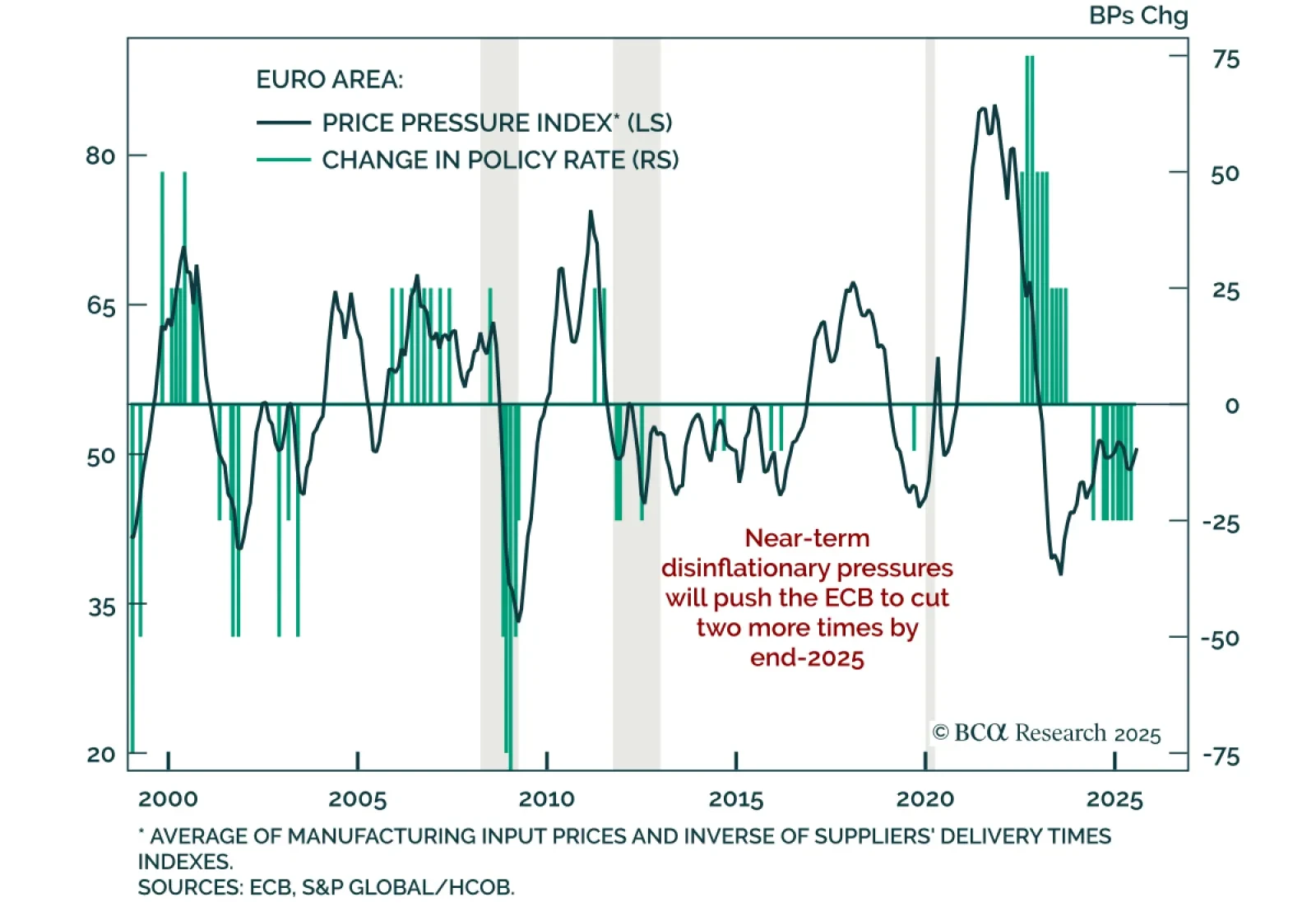

Cresting price pressures and weak global growth reinforce our long duration stance, with labor market slack limiting inflation upside across most major economies. Our price pressure indexes show moderate input inflation outside…

The July Dallas Fed survey beat expectations, pointing to a rebound in current activity, but the outlook remains subdued, supporting our modestly defensive asset allocation. The headline index rose to 0.9 from -12.7 in June, with…

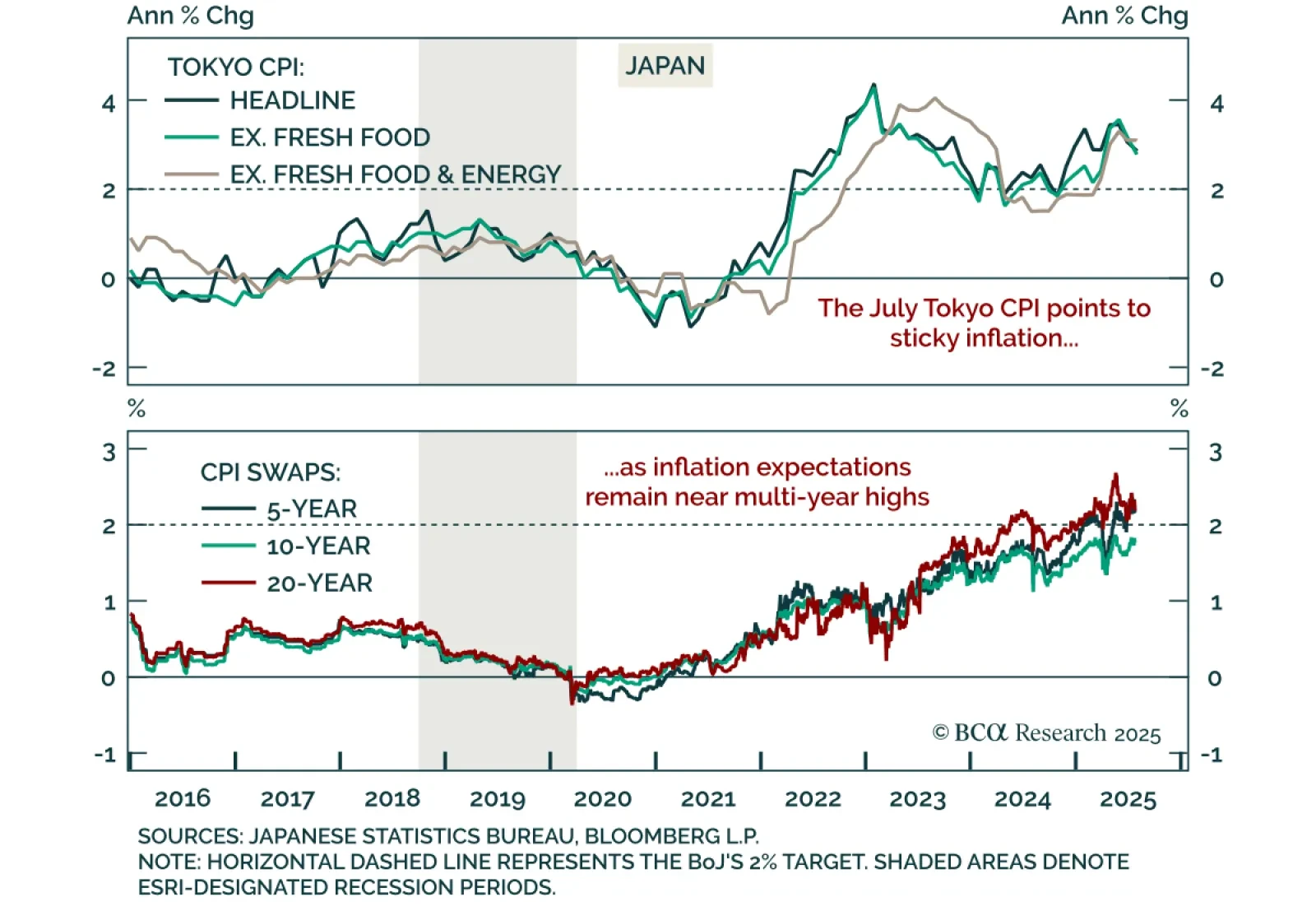

Tokyo CPI data confirms persistent inflation pressures in Japan, keeping the BoJ on a hawkish footing and reinforcing our underweight in JGBs and bullish stance on the yen. July Tokyo CPI came in broadly in line, falling to 2.9% y/y…

The ECB held rates steady for the first time in eight meetings, signaling a slower pace of easing while downside risks and entrenched disinflation support positioning for further cuts. The deposit facility rate remains at 2.0%,…