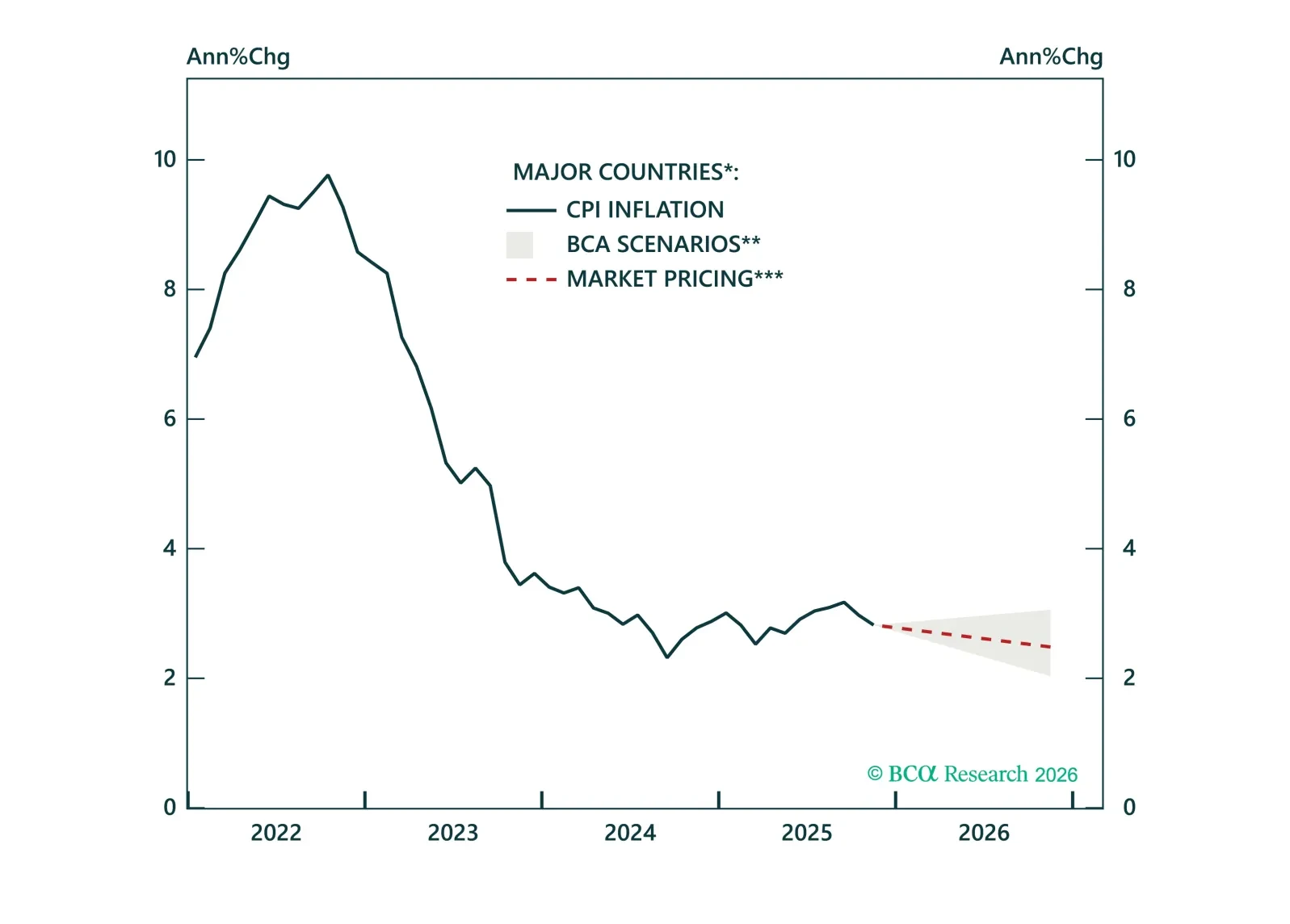

In our 2026 inflation outlook, we explain why 2026 will bring more disinflation, upside risks remain contained, and how to position in ILBs across major markets.

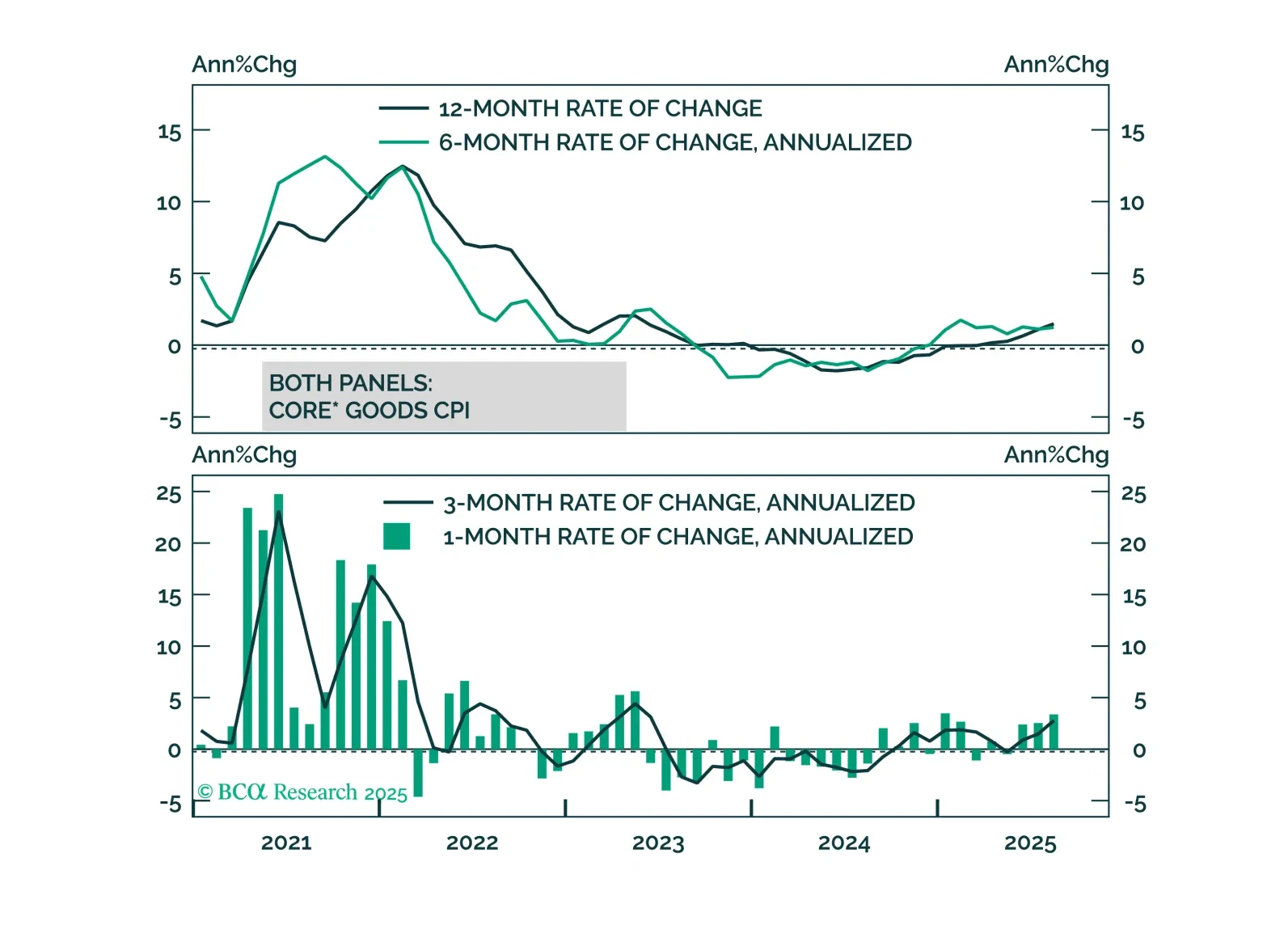

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

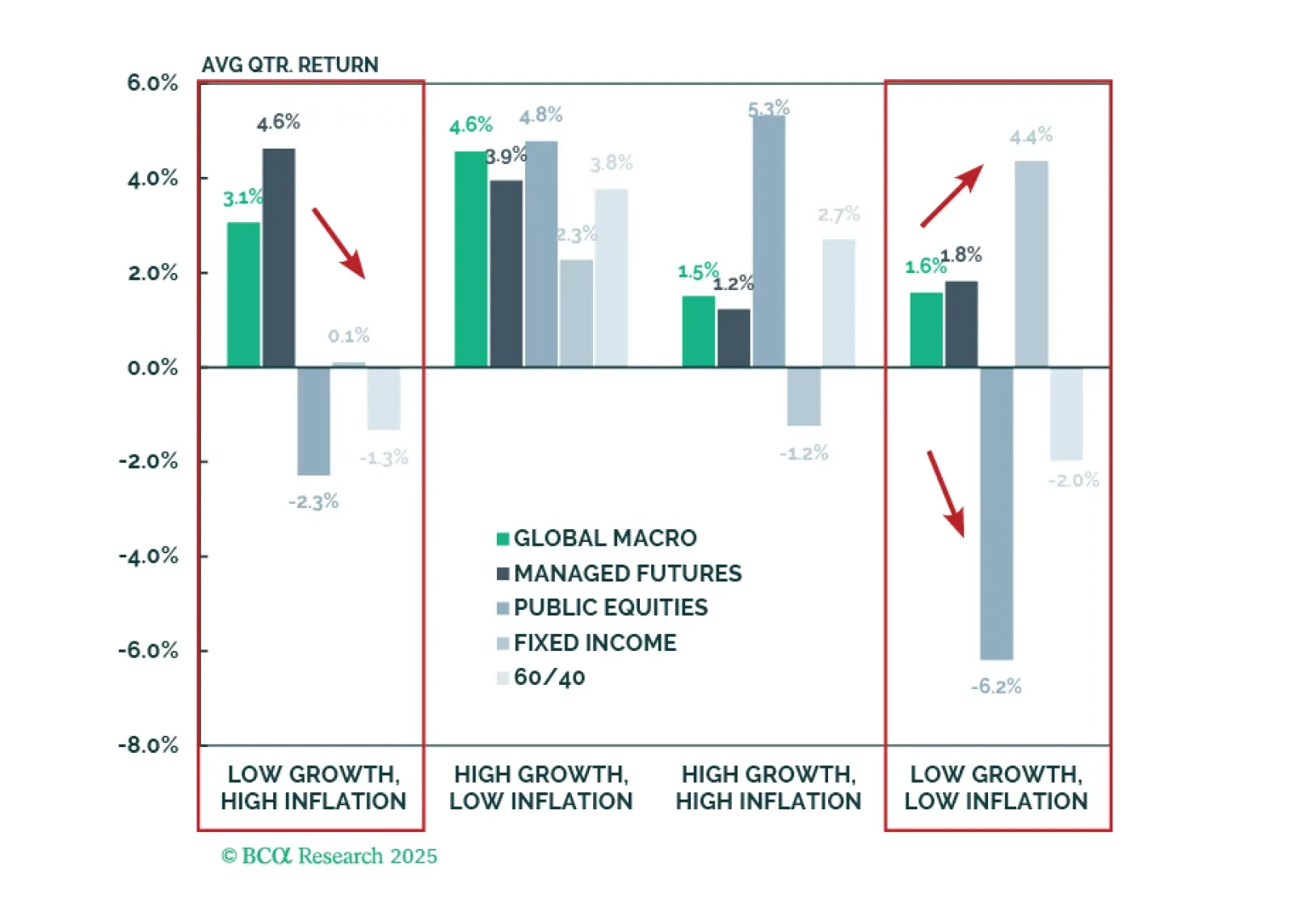

Understanding asset performance across Growth and Inflation regimes helps investors construct and manage balanced portfolios. Our first G&I Catalog report examines Hedge Fund strategies. Global Macro and Managed Futures offer the…

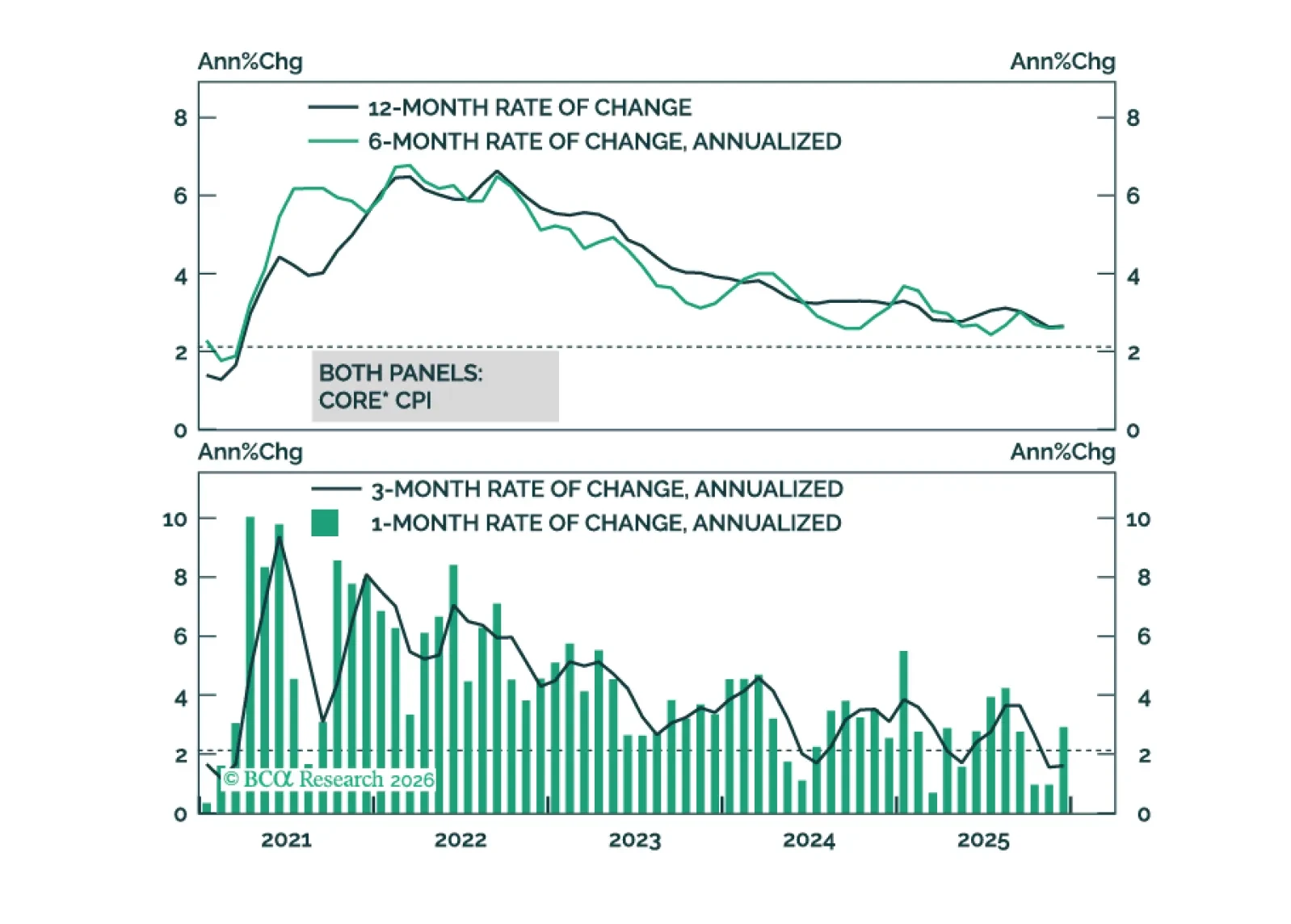

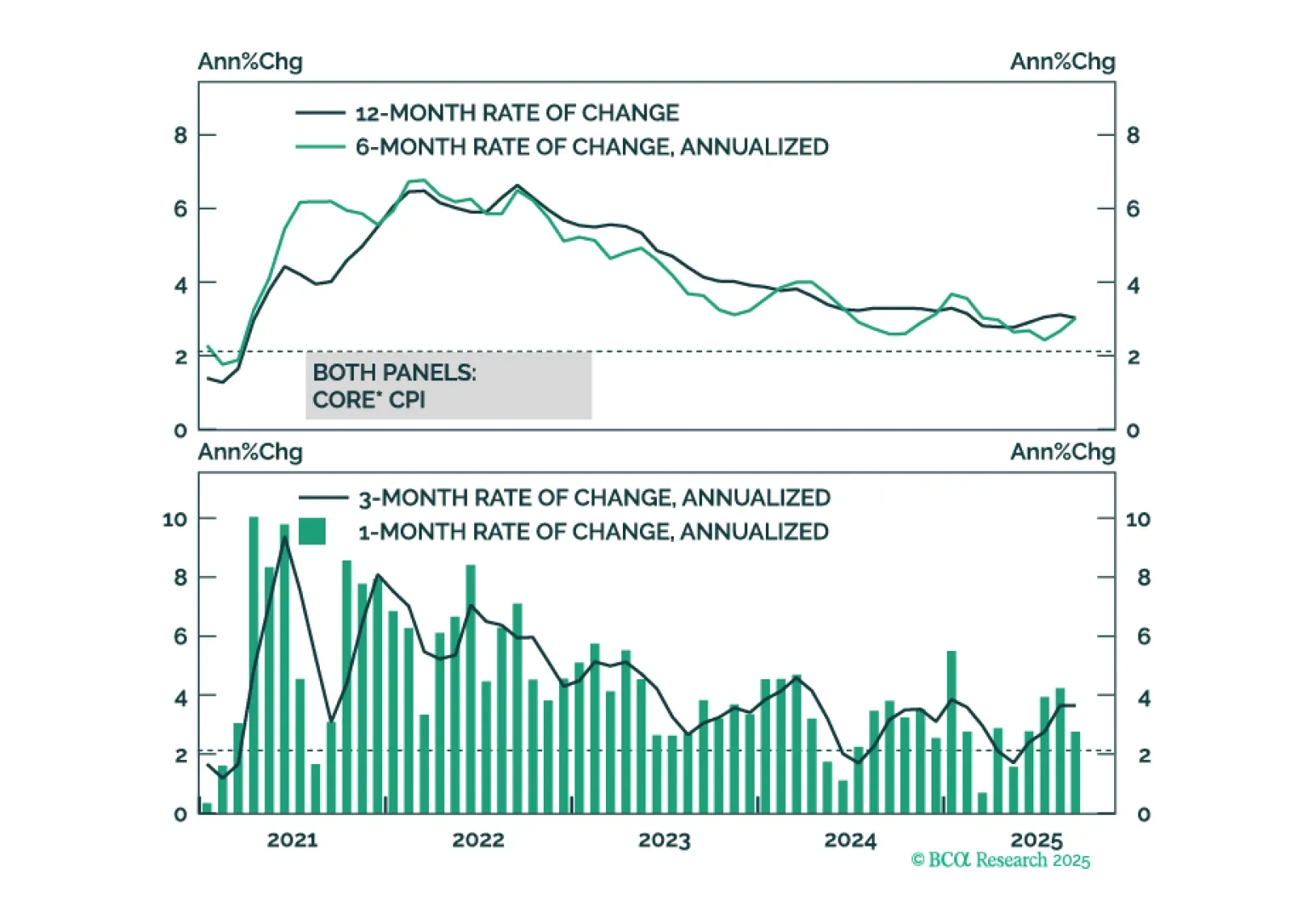

US inflation data continue to show no signs of price pressures beyond a near-term tariff effect.

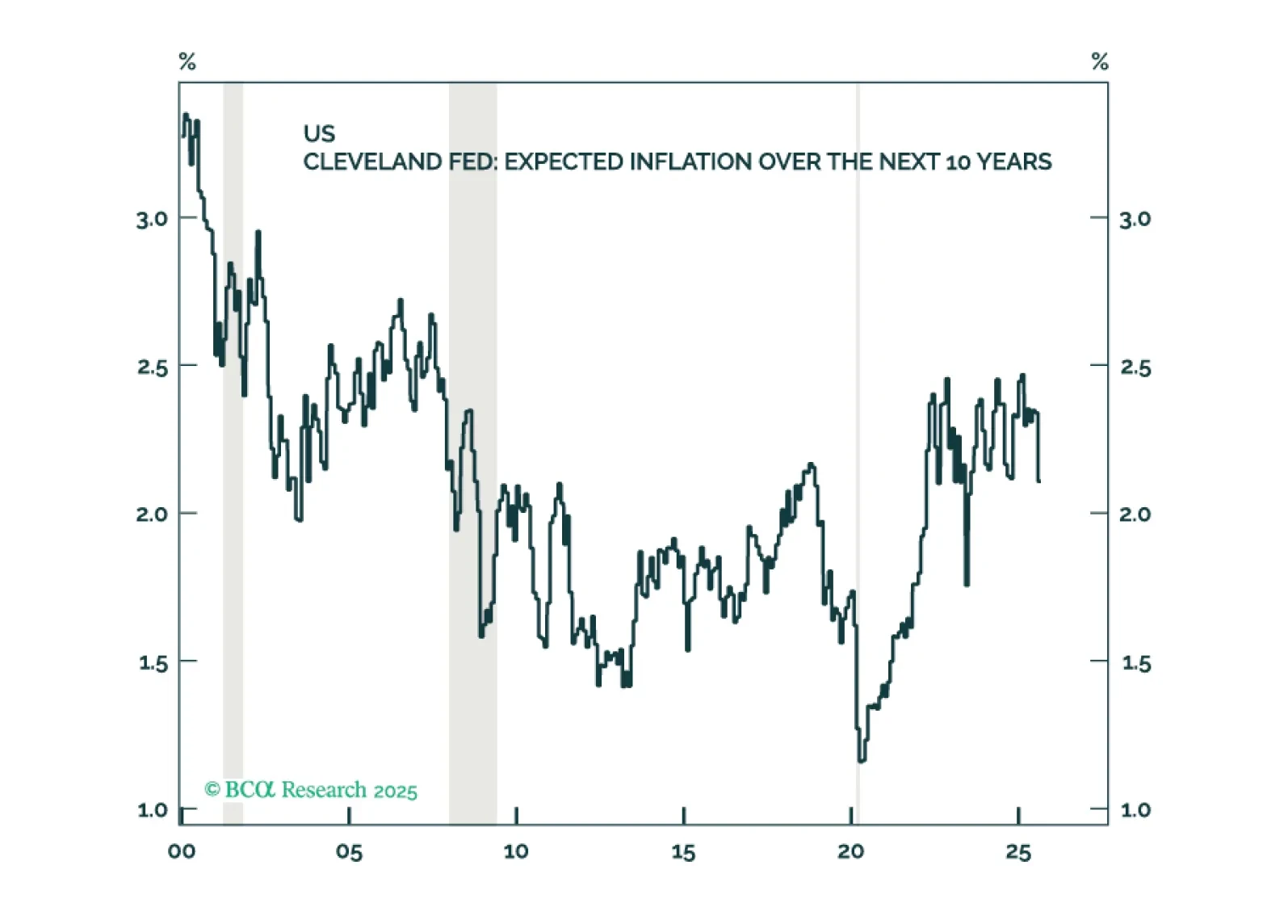

The Fed’s actions tell us that it has chosen to avoid a recession at the cost of moving its inflation goalposts to 3 percent. Thus begins the slippery slope to price instability. Long-term investors should underweight the dollar, own…

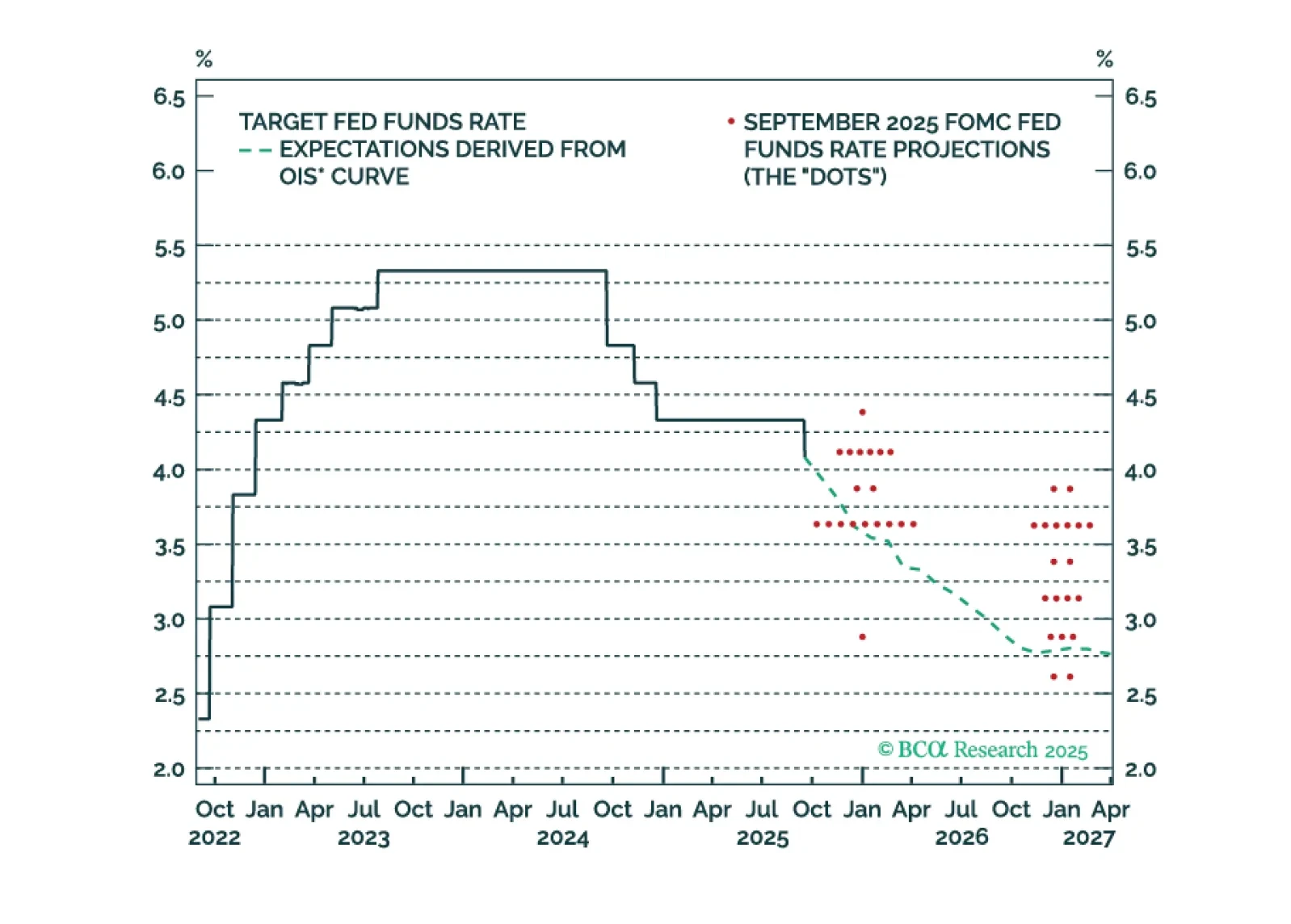

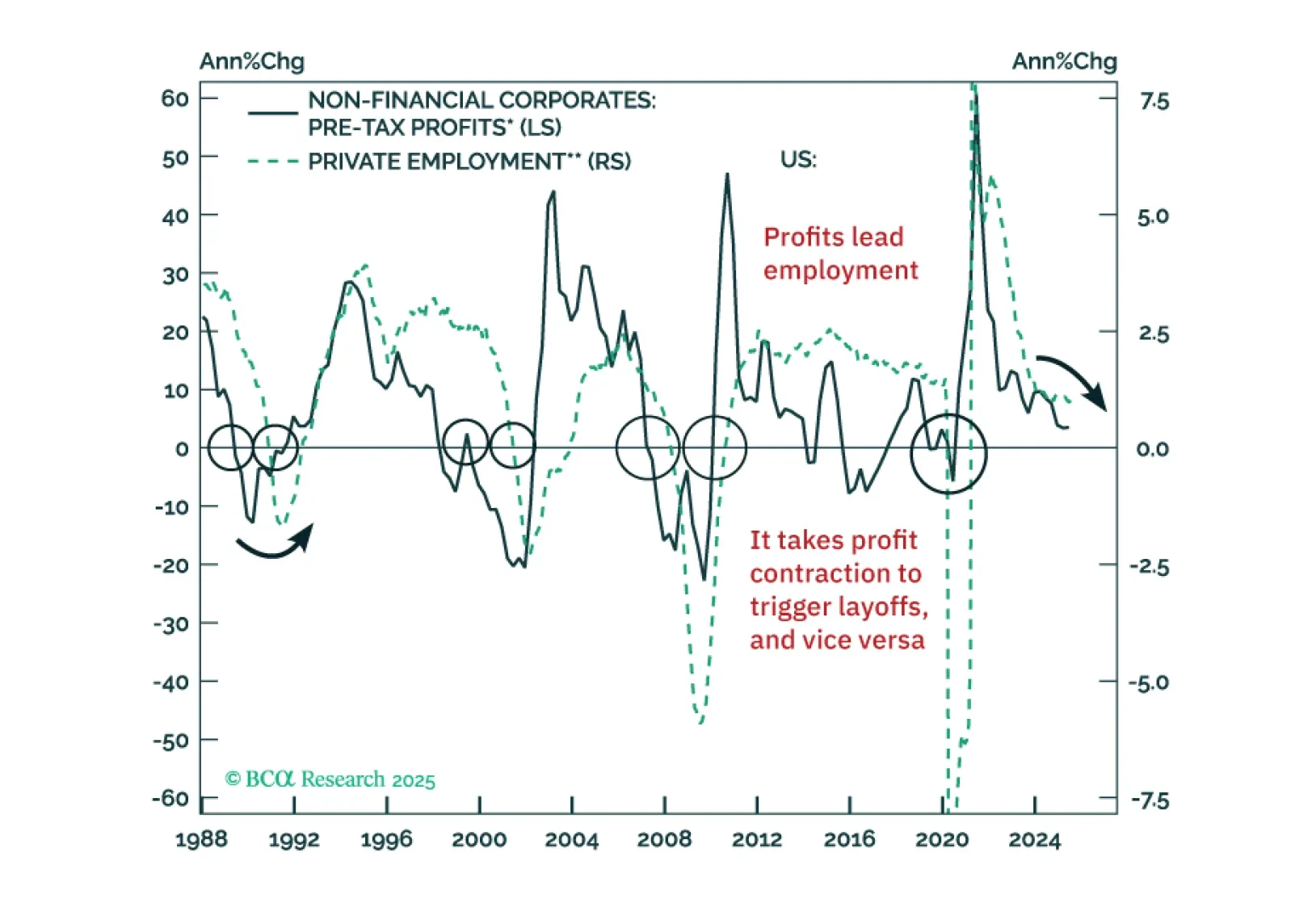

Median Fed unemployment rate projections are overly optimistic. The Fed will end up cutting more in 2026 than it currently anticipates.

High US inflation is being driven by tariffs, not domestic inflationary pressure. This argues for Fed easing and a bull-steepening of the Treasury curve.

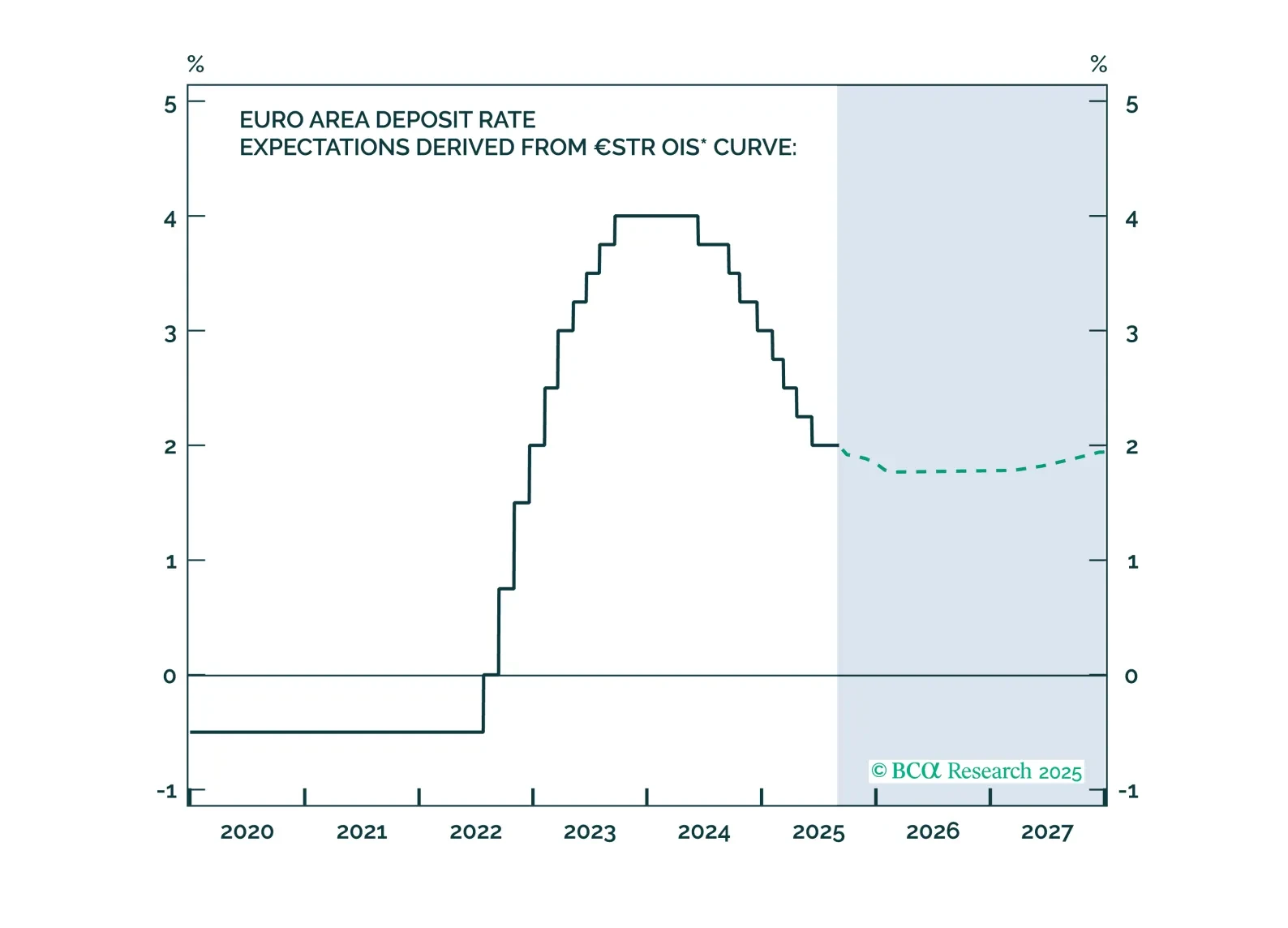

The European Central Bank has achieved a soft landing. Inflation is back to target, with well-anchored inflation expectations. The unemployment rate is historically low, and real economic growth is stable, albeit weak. Given that…

Inflation expectations in the US remain reasonably well anchored and there are few signs of a brewing wage-price spiral. Thus, the near-term risks to growth outweigh the risks of higher inflation. Looking beyond the next year or two…

We see two risks that could spoil the rally in US risk assets: (1) a tariff-driven stagflation, and (2) a US Treasury tantrum. Our negative view on EM risk assets is primarily driven by the outlook for global trade, which is set…