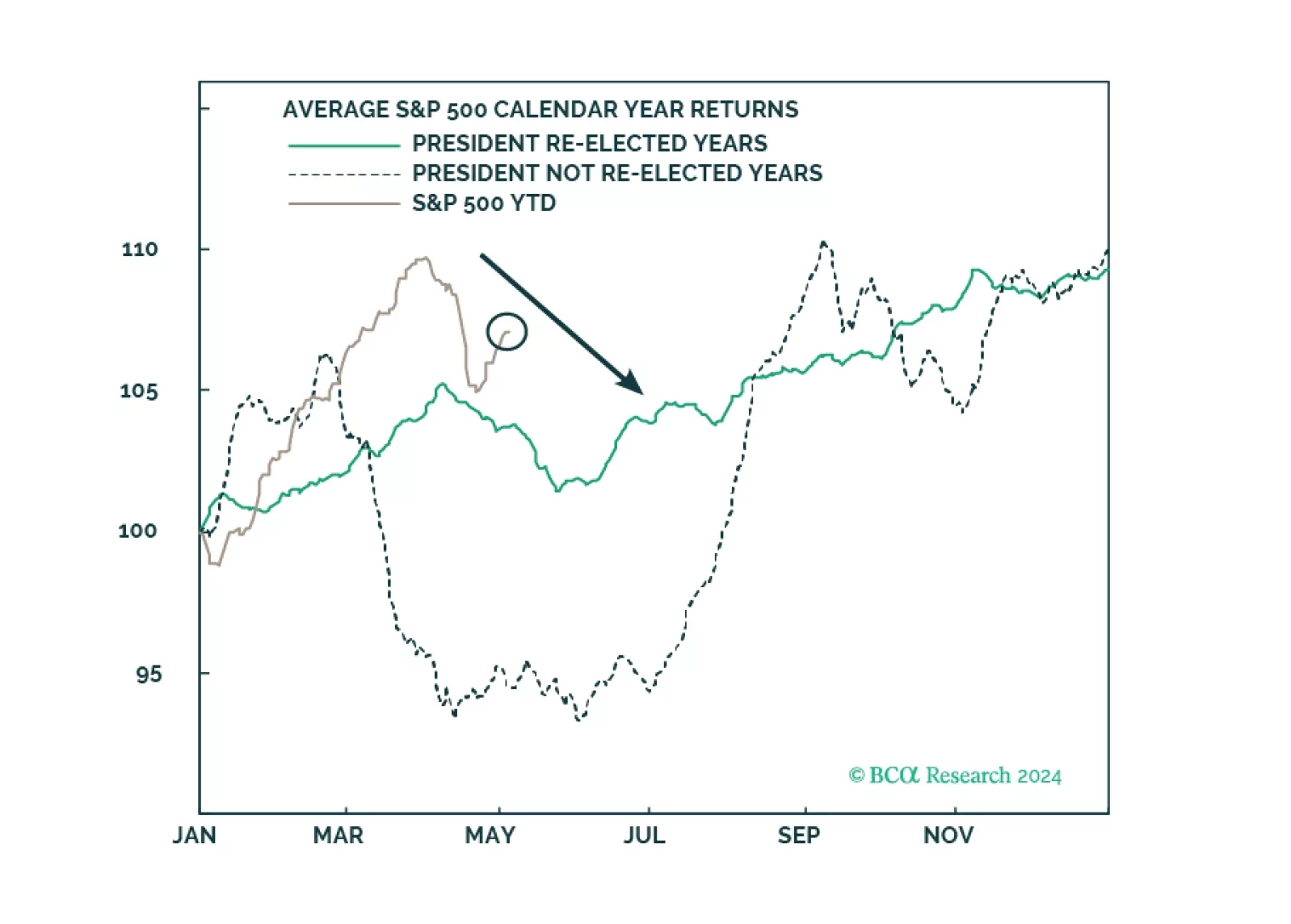

The month of November has brought us S&P 6,000! President Trump has won a “Red Sweep” (as we expected all year) and has ushered in a regime change in America. For now, we are open to chasing momentum. However, the biggest risk to…

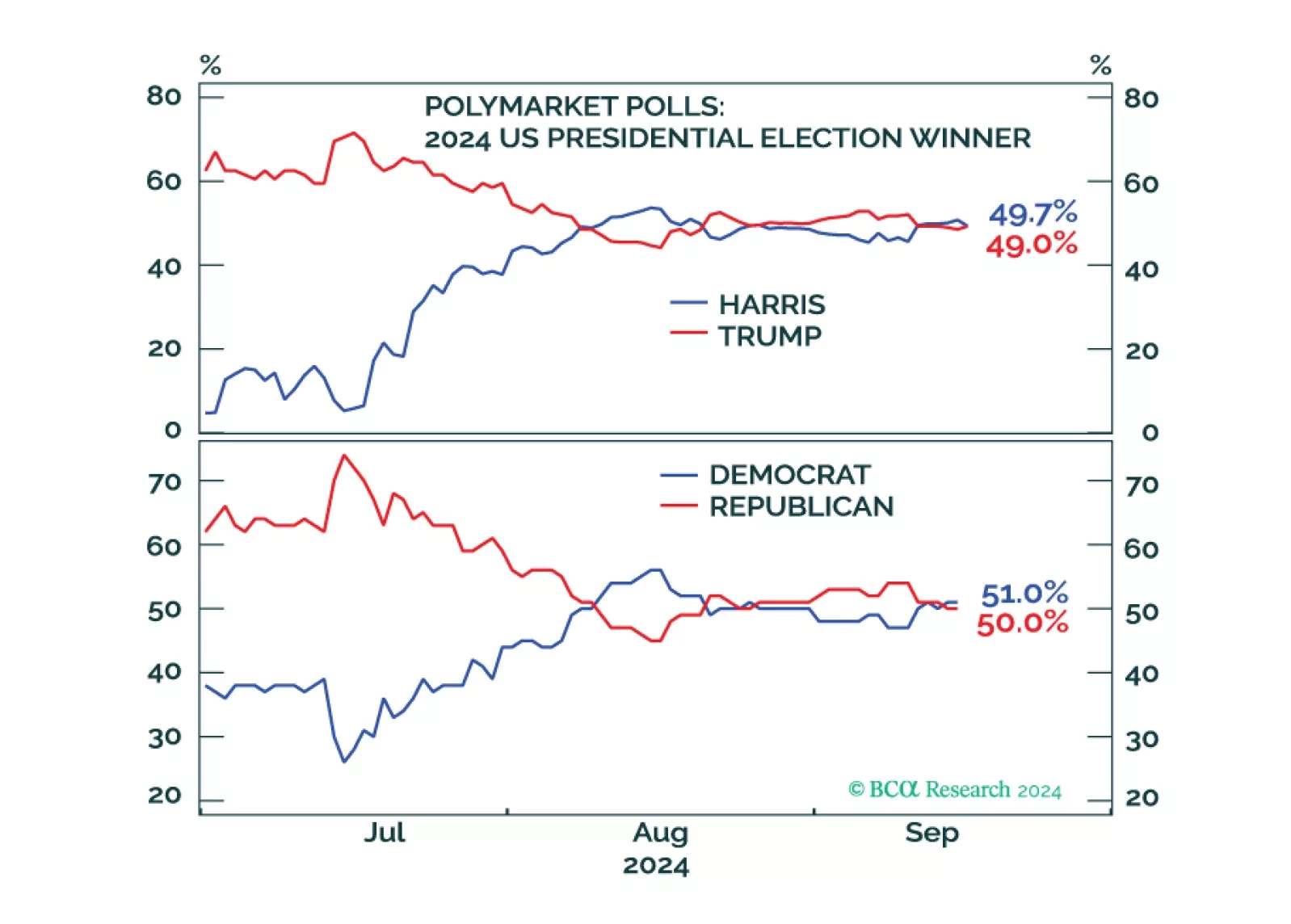

The Election Day is finally upon us. No, there is no final “silver bullet” forecast contained in this email. Just our long-term forecast of how the election will, no matter who wins, impact the markets.

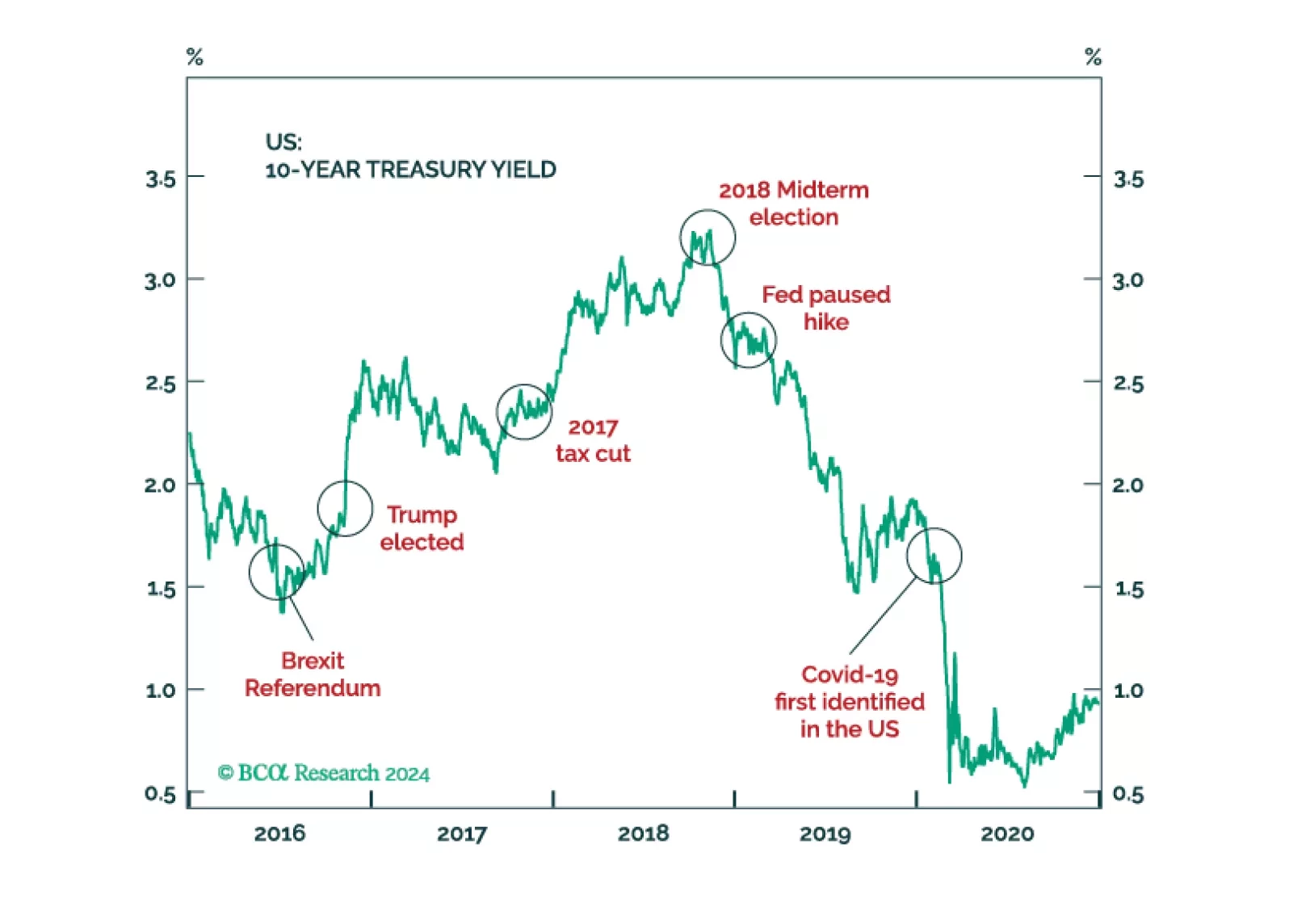

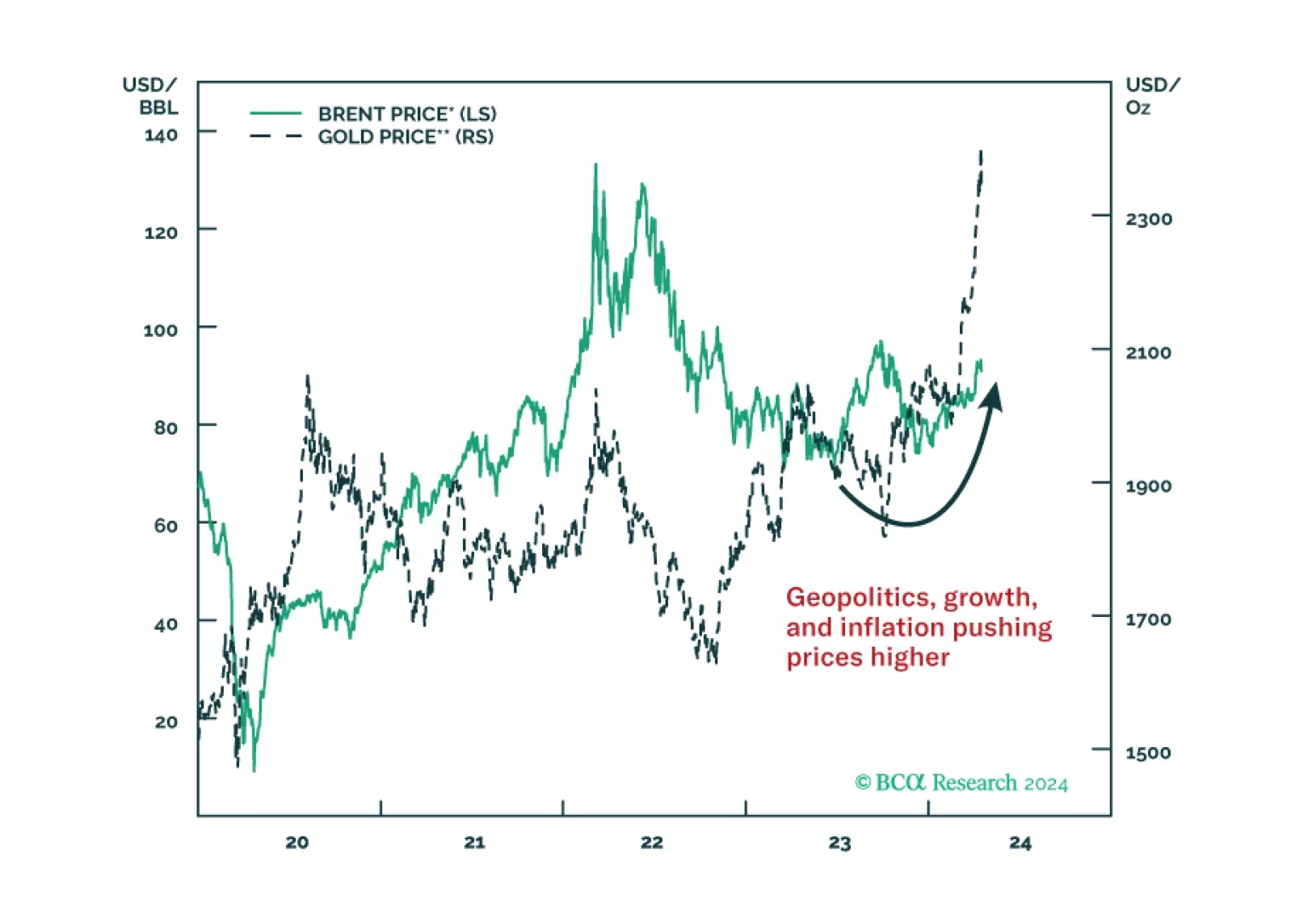

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

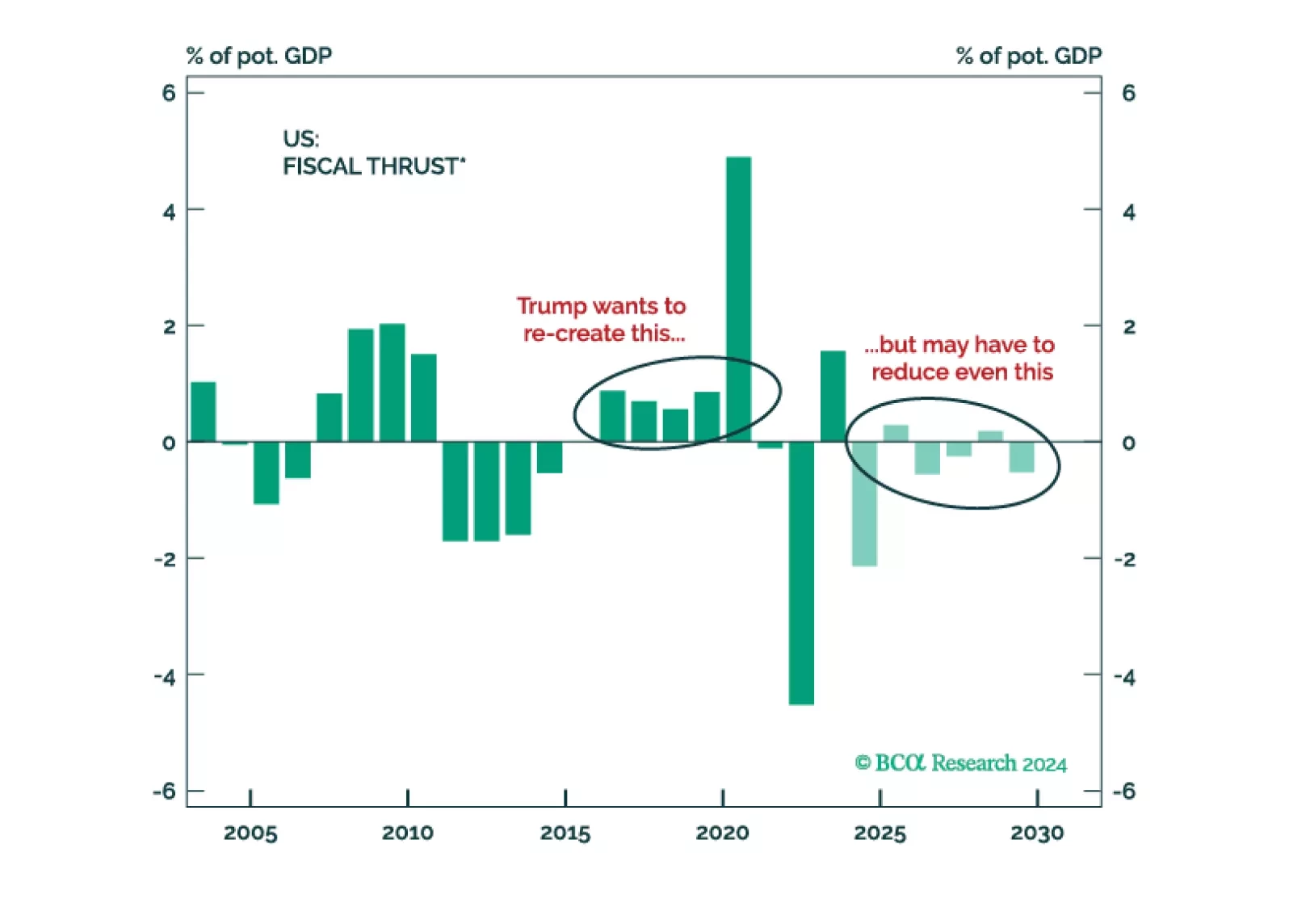

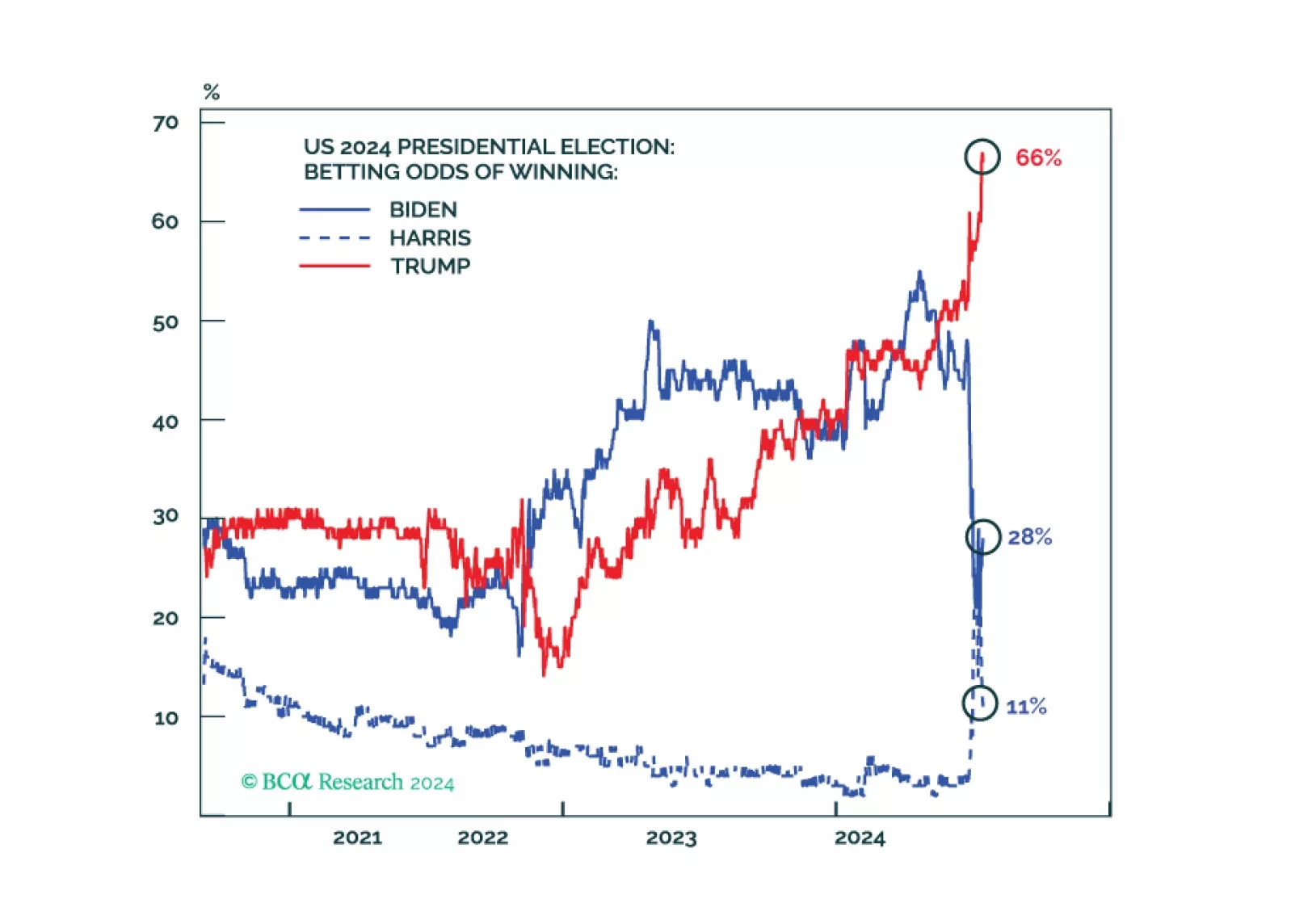

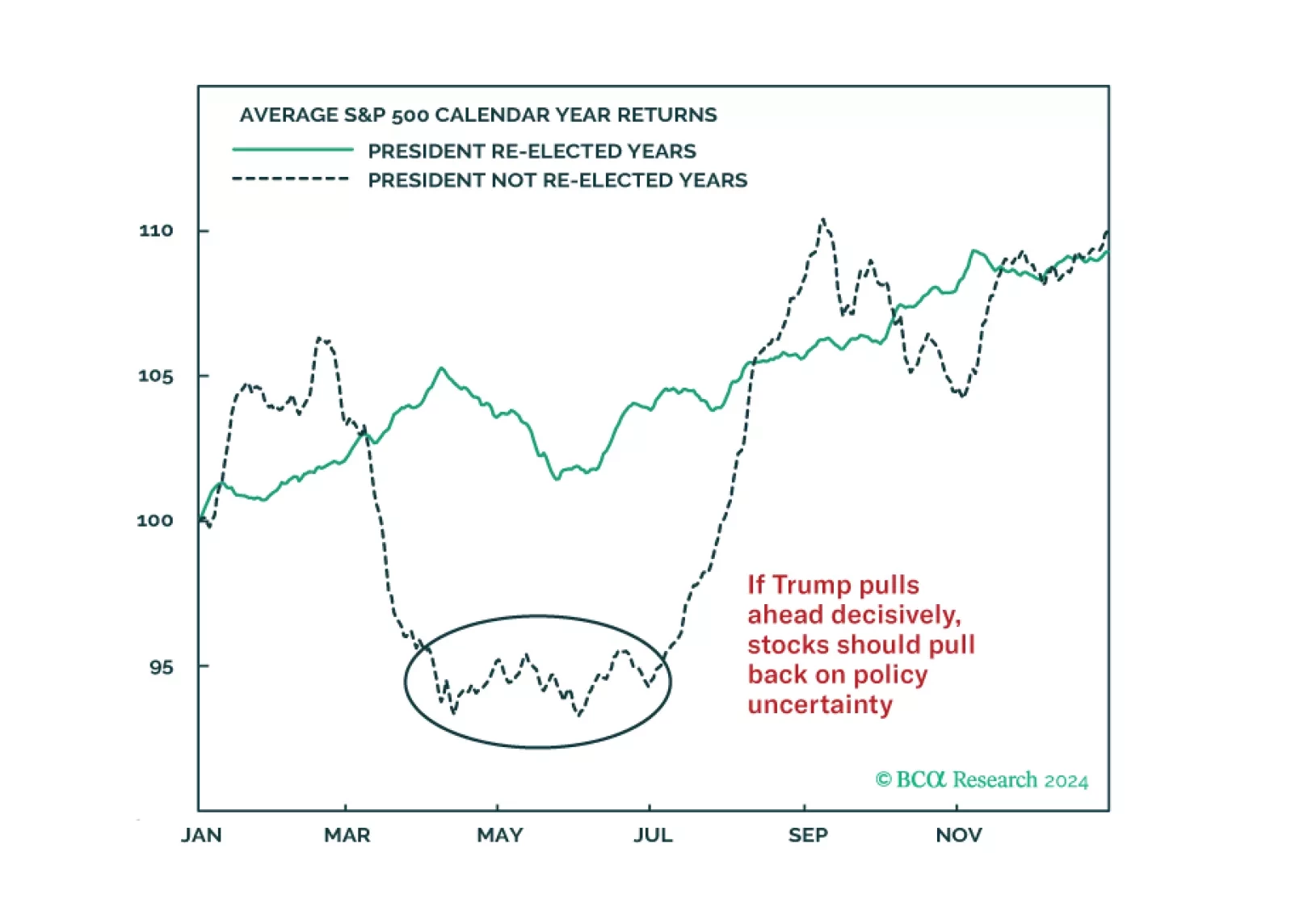

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

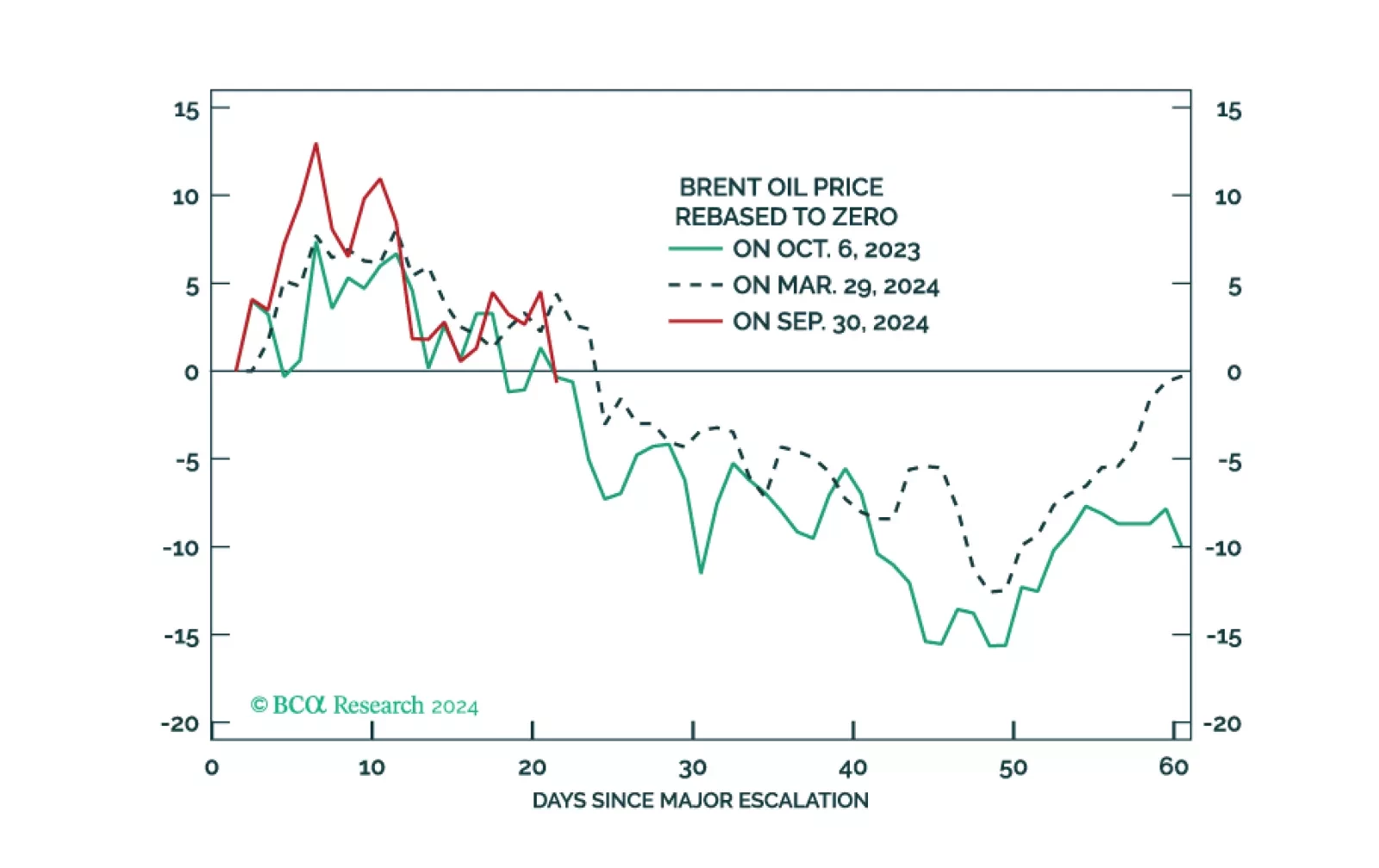

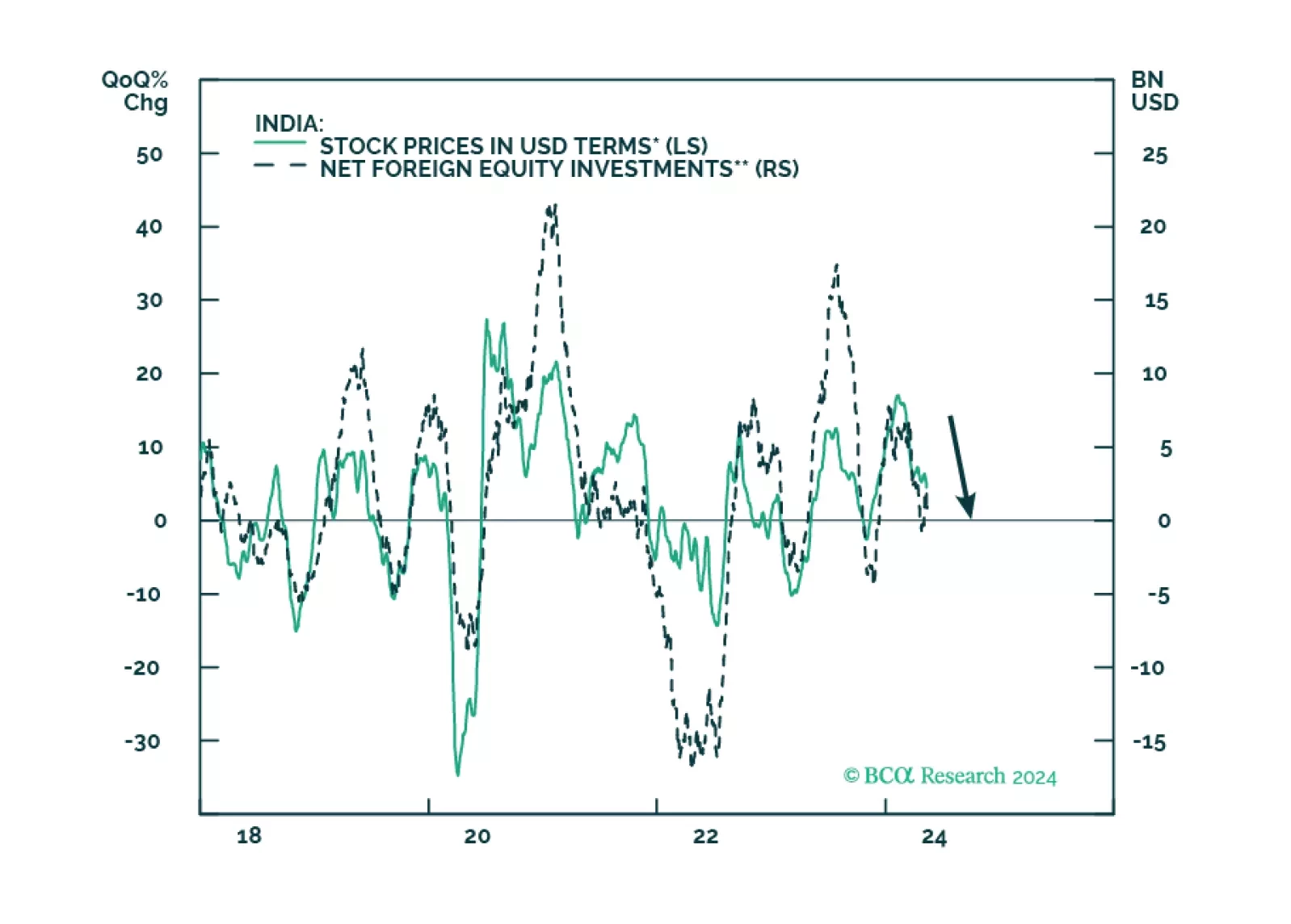

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…