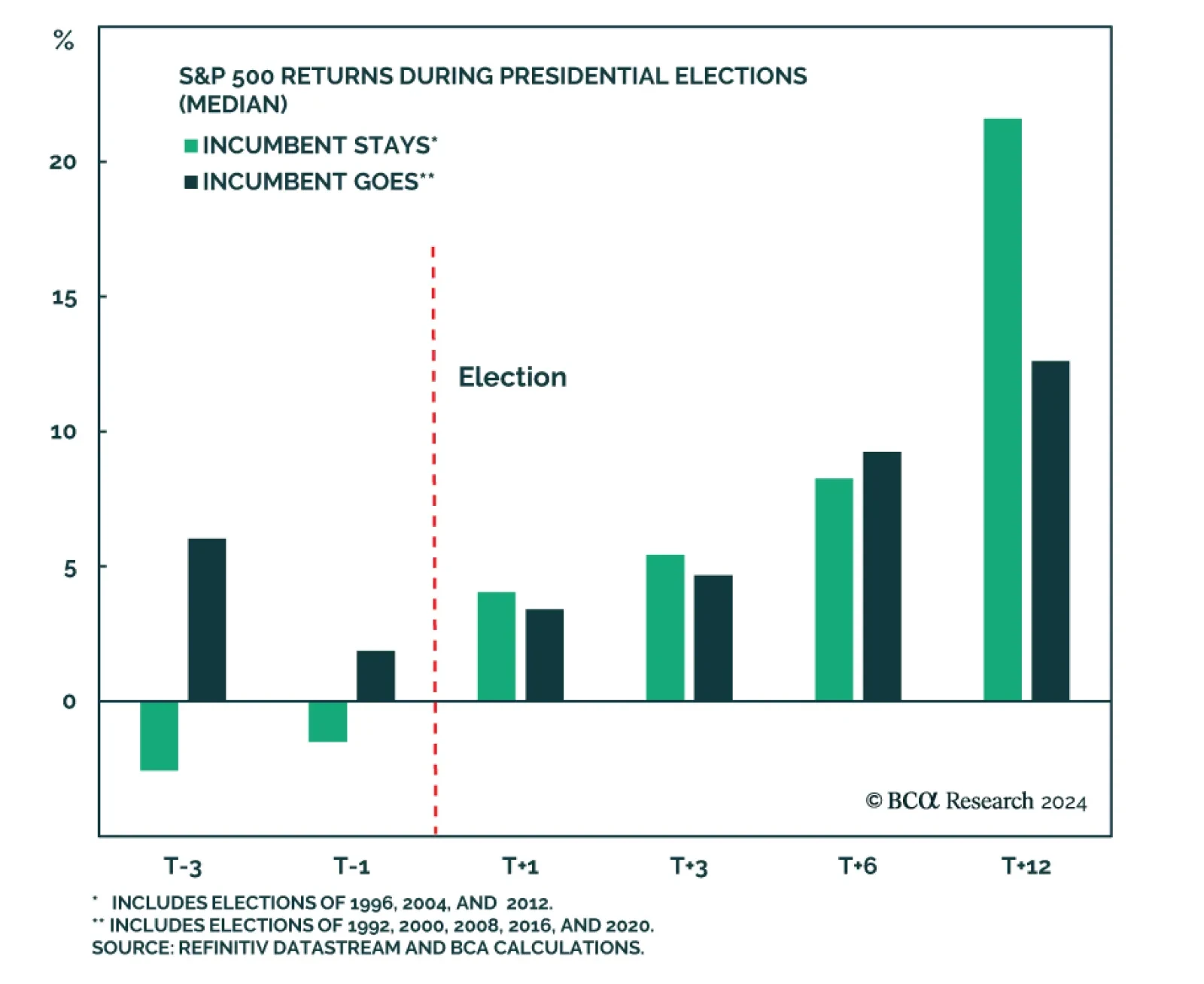

According to BCA Research’s US Political Strategy service, in the final months of an election cycle, equities underperform relative to non-election years. This extends further into Q1 of the following year due to…

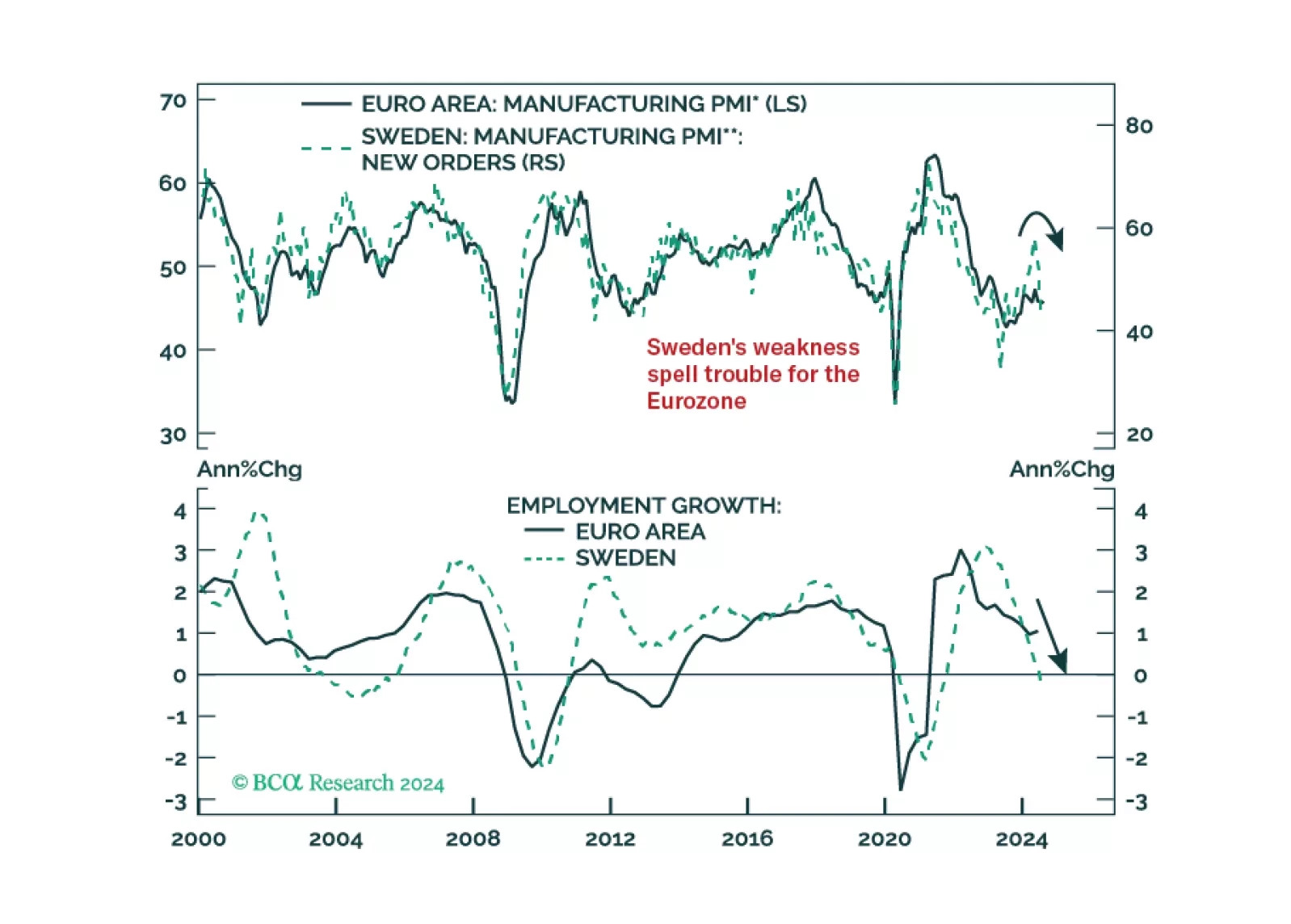

Our negative stance on European growth and assets is not devoid of risks. To gauge whether these risks warrant upgrading our growth outlook, we monitor Sweden closely. So, what is the current message from this Nordic economy?

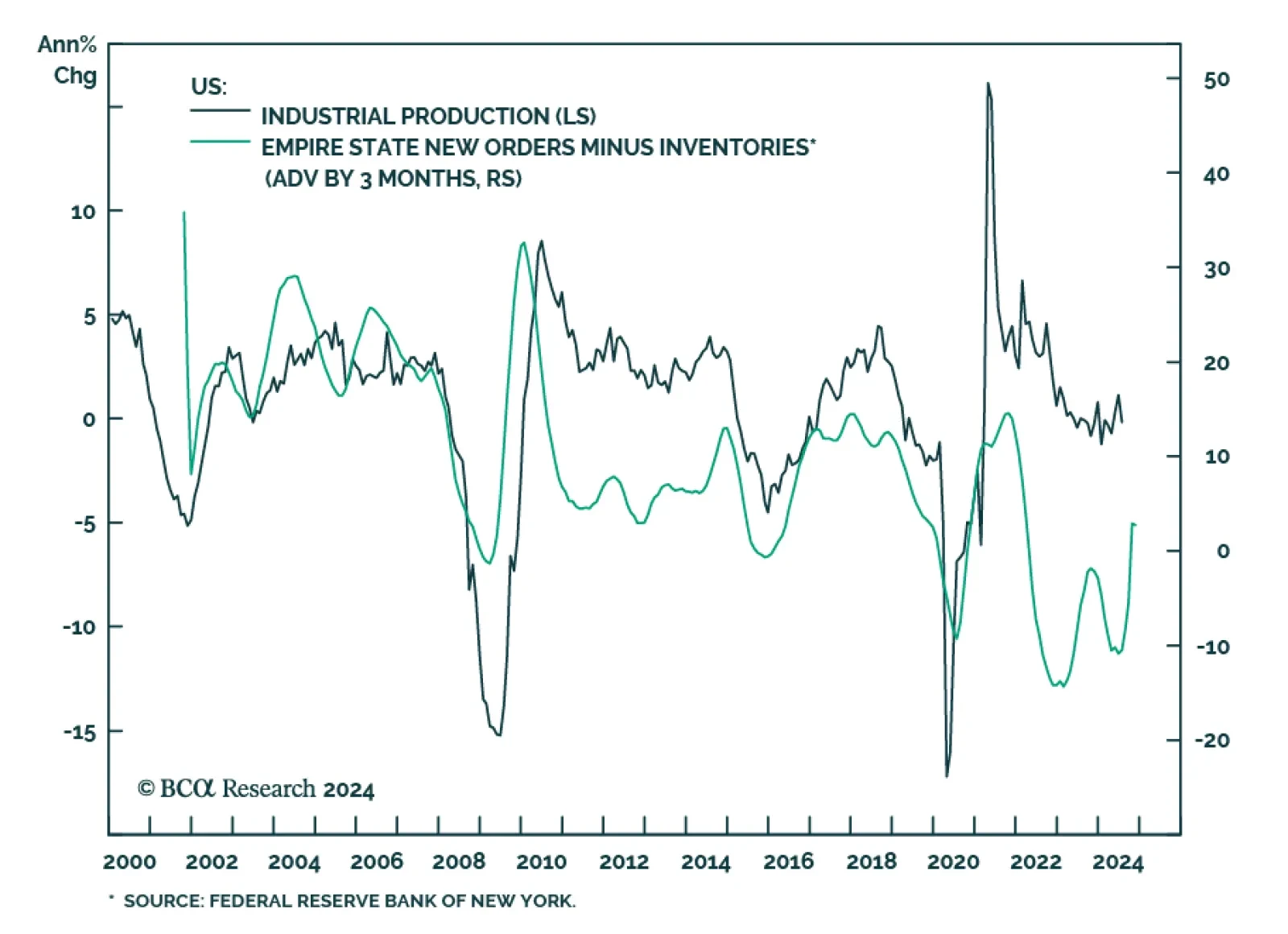

US industrial production fell by a larger-than-expected 0.6% m/m in July, the largest monthly decline so far this year. Capacity utilization also decreased a full percentage point to 77.8% Although Hurricane Beryl distorted…

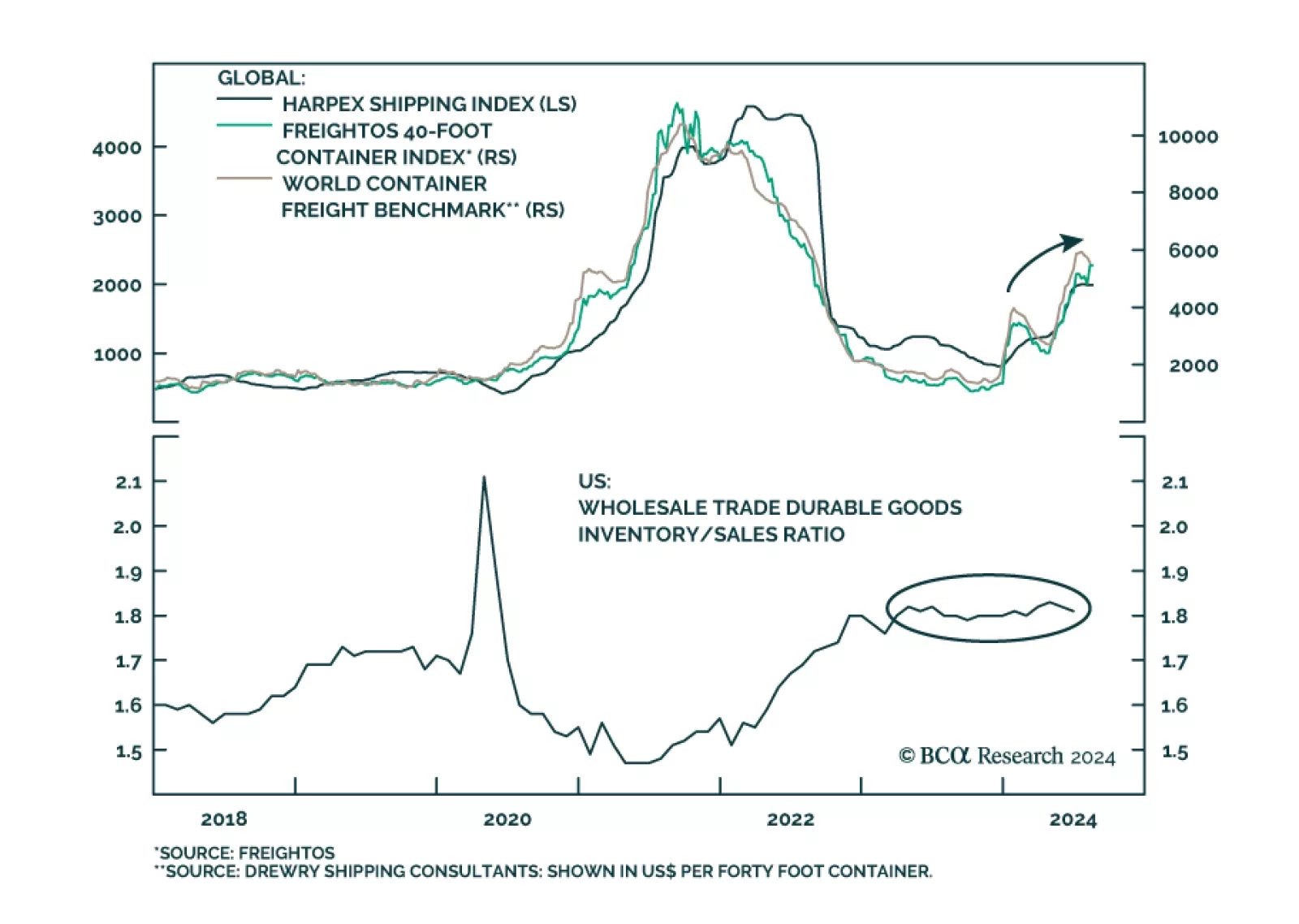

Goods prices have normalized following the pandemic binge on goods spending and have contributed to easing price pressures overall. A large drop in vehicle prices largely drove the decrease in July’s CPI and we have…

As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

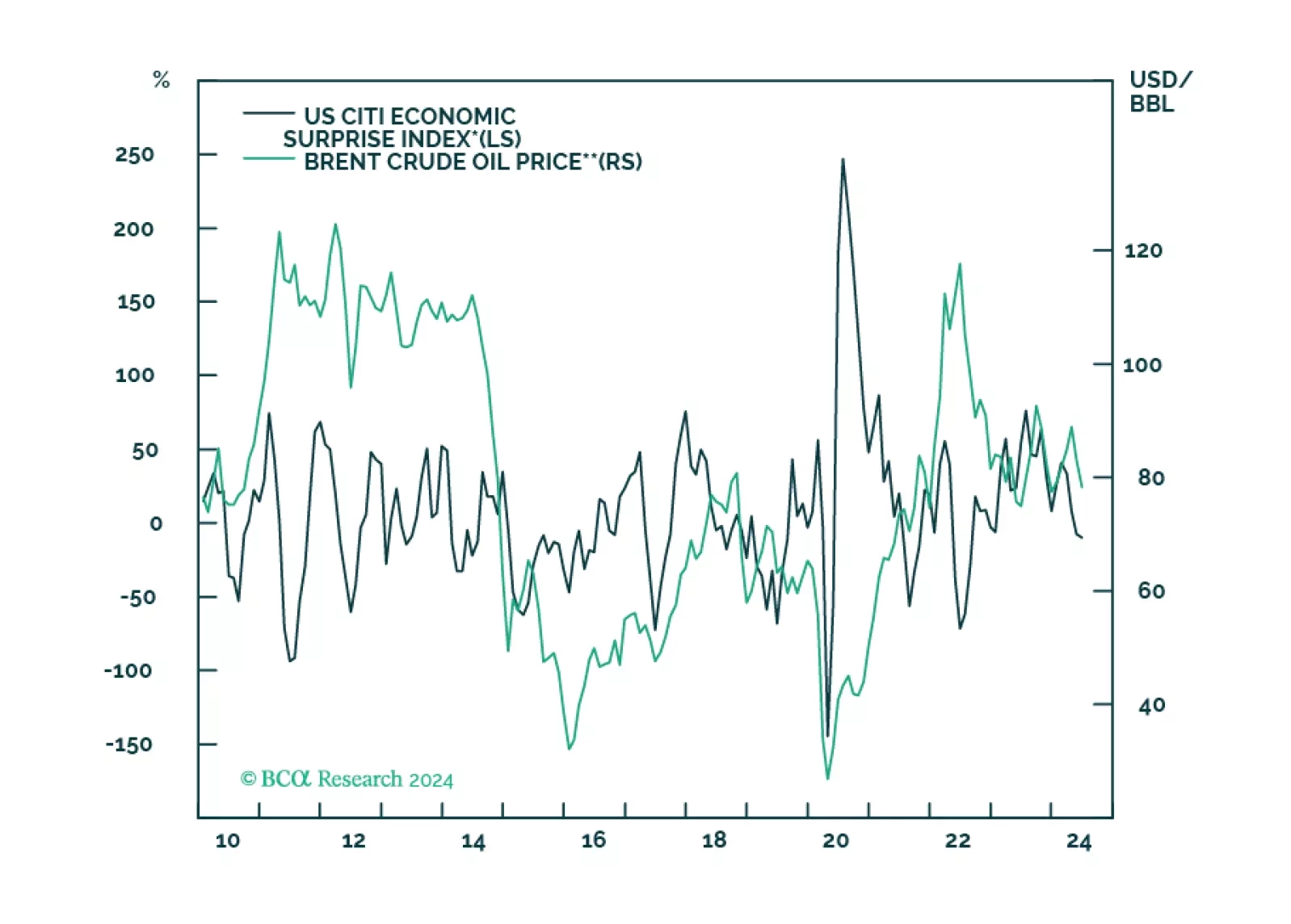

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

We close our overweights to Energy and Aerospace & Defense. The macroeconomic backdrop is deteriorating for Energy. As for A&D, the good news is already priced in.

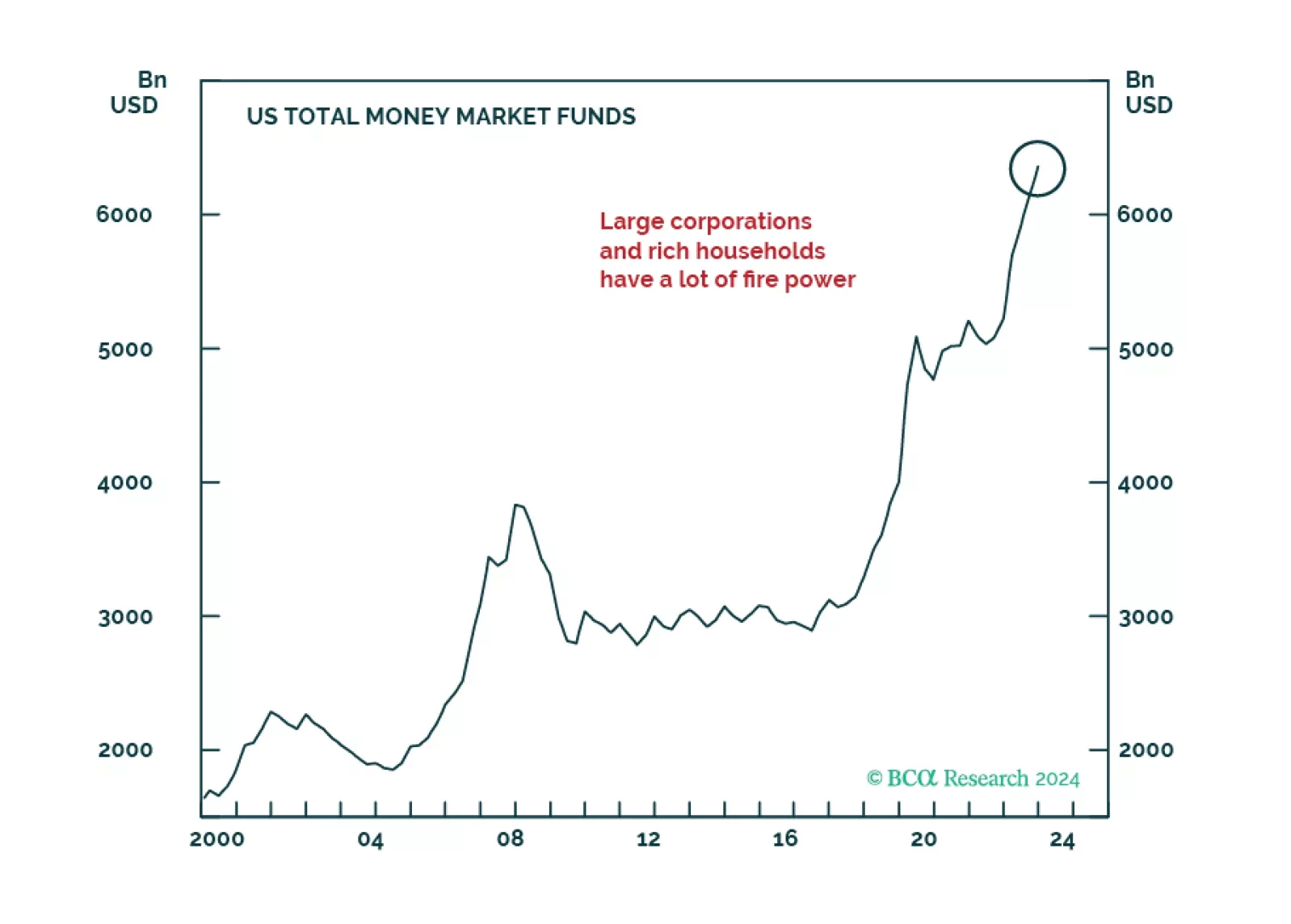

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…