Overweight (High-Conviction) We have written frequently about trade tensions keeping a lid on trade-exposed sectors, with the S&P air freight index chief among them. As such, we have been anticipating a rally following the…

Highlights The long term direction for the pound is higher... ...but as the EU withdrawal bill passes through the U.K. parliament, expect a very hairy ride. The stock markets in Norway, Sweden and Denmark are driven by energy,…

Underweight - Upgrade Alert The S&P airlines index has been buffeted by headwinds arising from the increasing cost of jet fuel; as the top panel of our chart shows, the price of jet fuel is the single largest driver of airline…

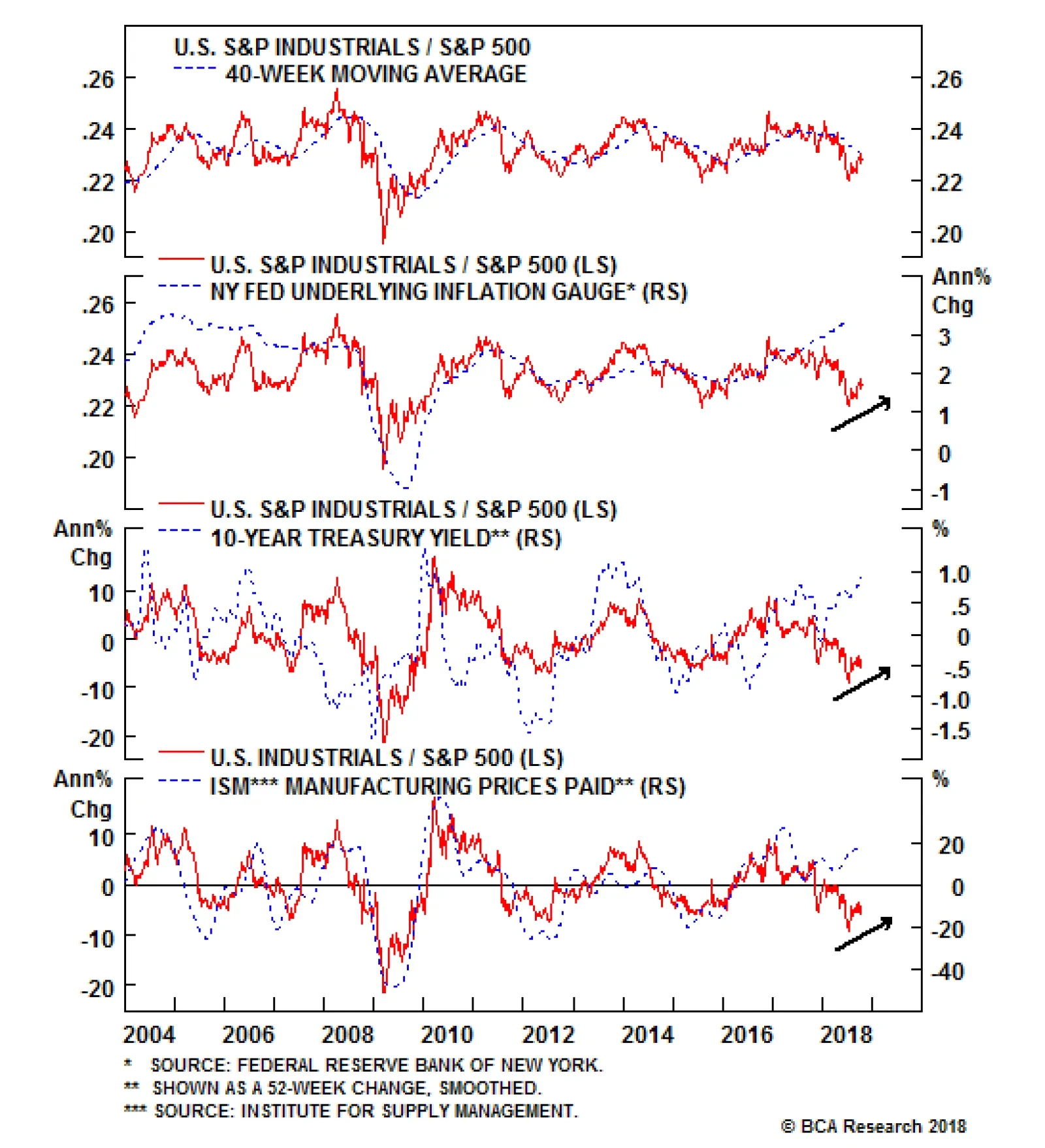

Against such a backdrop, the coming quarters should see sectors that benefit from rising interest rates and that also serve as inflation hedges outperform. This means we favor "FIT" stocks, which refers to financials,…

Highlights Portfolio Strategy A playable sector rotation opportunity has emerged, as we first argued at the recent BCA investment conference: Financials, industrials and select tech subgroups will lead the next phase of the market…

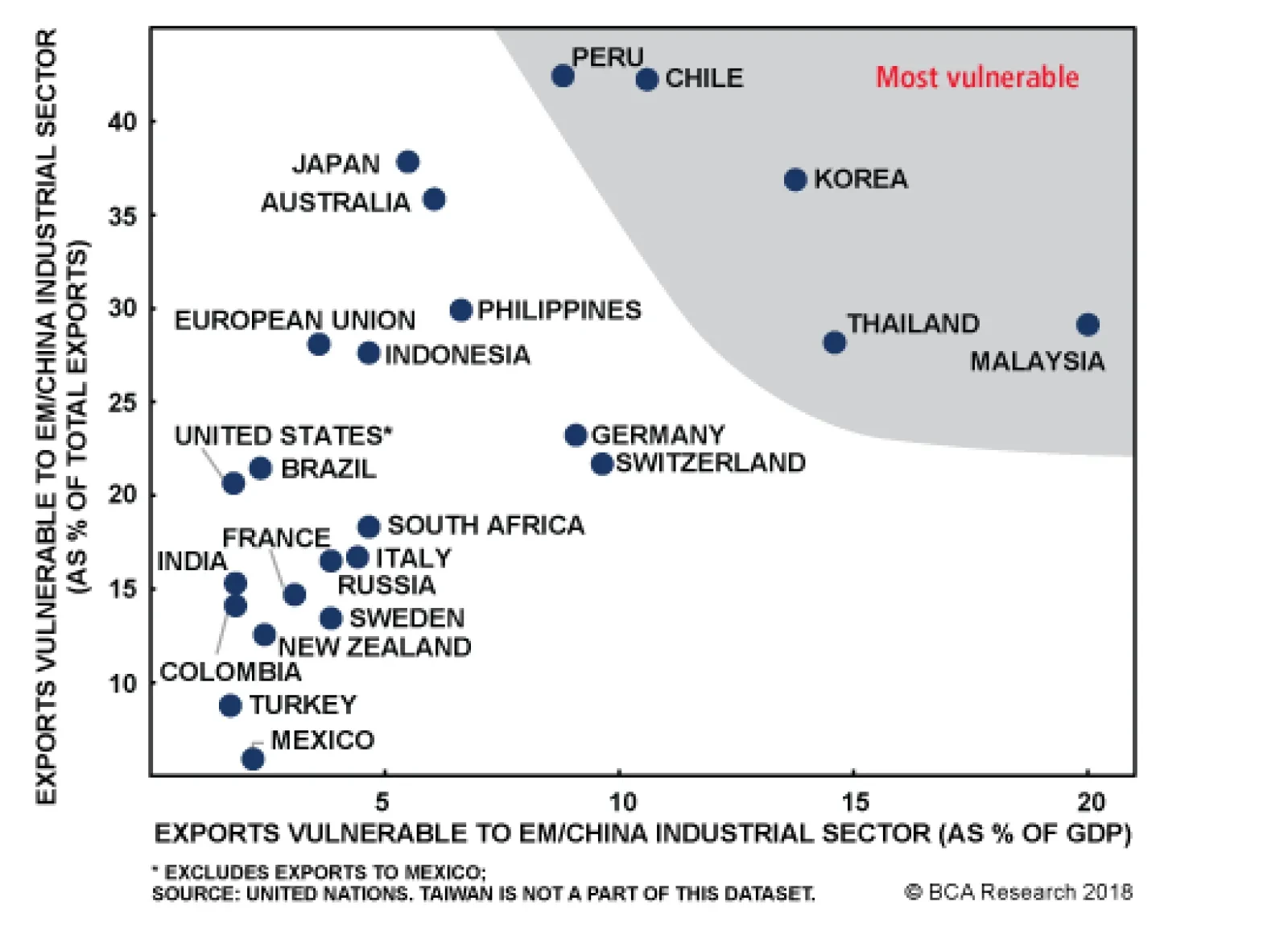

Highlights Investors who are betting on a quick resolution to the U.S./China trade war following the "new NAFTA" deal and the U.S. midterm elections have likely been taken in by false hope. Stay neutral China relative to…

Their analysis takes into account not only the destinations of shipments but also the types of goods with the focus on identifying the size of the exports that are susceptible to an EM/China industrial slowdown. The chart above…

Highlights We review last year's "Three Tantalizing Trades" and offer four additional ones: Trade #1: Long June 2019 Fed funds futures contract/short Dec 2020 Fed funds futures contract Trade #2: Long USD/CNY Trade #3…

Overweight Rail stocks in general, and Union Pacific (UNP) in particular, got a major lift yesterday when UNP announced a plan to implement the principles of Precision Scheduled Railroading (PSR) in its push to improve…