Despite a stellar Q3 earnings print, the S&P 500 had a terrible October as EPS continues to do the hard work in lifting the market (Chart 1). Chart 1EPS Doing The Heavy Lifting We bought the dip,1 consistent with our view…

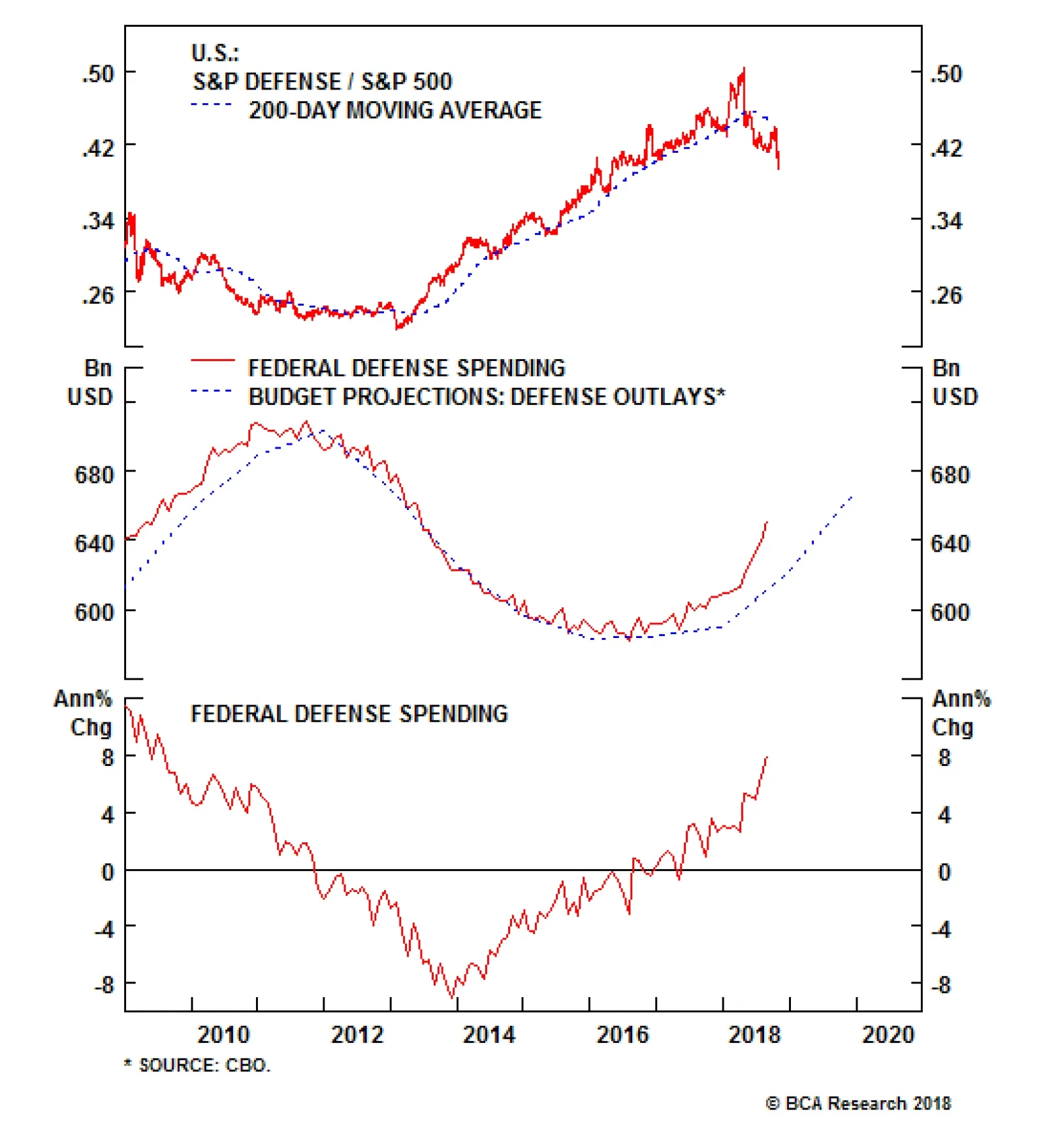

In the U.S., defense spending and investment have bottomed and will continue to accelerate. The Congressional Budget Office (CBO) continues to project that defense outlays will jump further next year. We expect that this…

Overweight 2018 has been a tough year for the S&P industrial conglomerates index as all of the key constituent members (GE, MMM and HON) have progressively either disappointed on earnings or lowered forward guidance. Further,…

Neutral We have been riding the rails juggernaut for roughly 16 months, but the time has come to get off board. As shown in the chart at the side, technical conditions are overbought and relative valuations are pricey, hovering near…

We do not want to overstay our welcome on the S&P rails index for a number of reasons. First, it is quite perplexing why this capital-intensive industry has been cutting capex as the rest of the non-financial corporate…

Highlights Portfolio Strategy Overbought technicals, pricey valuations, decelerating global growth, declining capex, rising indebtedness and softening operating metrics argue for hopping off the S&P railroads index. Rising…

Overweight - High Conviction The S&P construction machinery & heavy truck (CMHT) index has been waylaid this week and last following earnings reports that the market did not digest well, first from PCAR and most recently by…

Overweight We have been overweight the pure-play BCA defense index since late-2015 and our strategy is to add exposure on any meaningful pullbacks and keep this index as a structural overweight within the GICS1 S&P industrials…

Highlights Portfolio Strategy Debt saddled small caps have to wrestle with rising interest rates at a time when they lack a valuation cushion. Tack on their high beta status and investors should continue to avoid small caps and…