Highlights Portfolio Strategy Corporate sector selling price inflation is nil while leading wage inflation indicators signal additional labor cost increases in the coming months. The risk is that profit margins have already peaked for…

Neutral We have been offside on the high-conviction overweight call on the S&P air freight & logistics index and the recent FedEx warning suggests that profits will come under pressure for this index for the rest of…

Underweight Our previous Insight referenced the deterioration of indicators that caused us to grow more negative in last year’s downgrade of the S&P railroads index to a benchmark allocation but what kept us…

Underweight In our downgrade of the S&P railroads index late last year to a benchmark allocation, we highlighted that two of our key industry Indicators, the Railroad Indicator and our Rail Shipment Diffusion Indicator,…

The S&P transports index’s recovery rally has stalled recently and is a cause for concern for the overall market. In more detail, the recent gulf between relative share prices and the SPX has widened and warns that the overall…

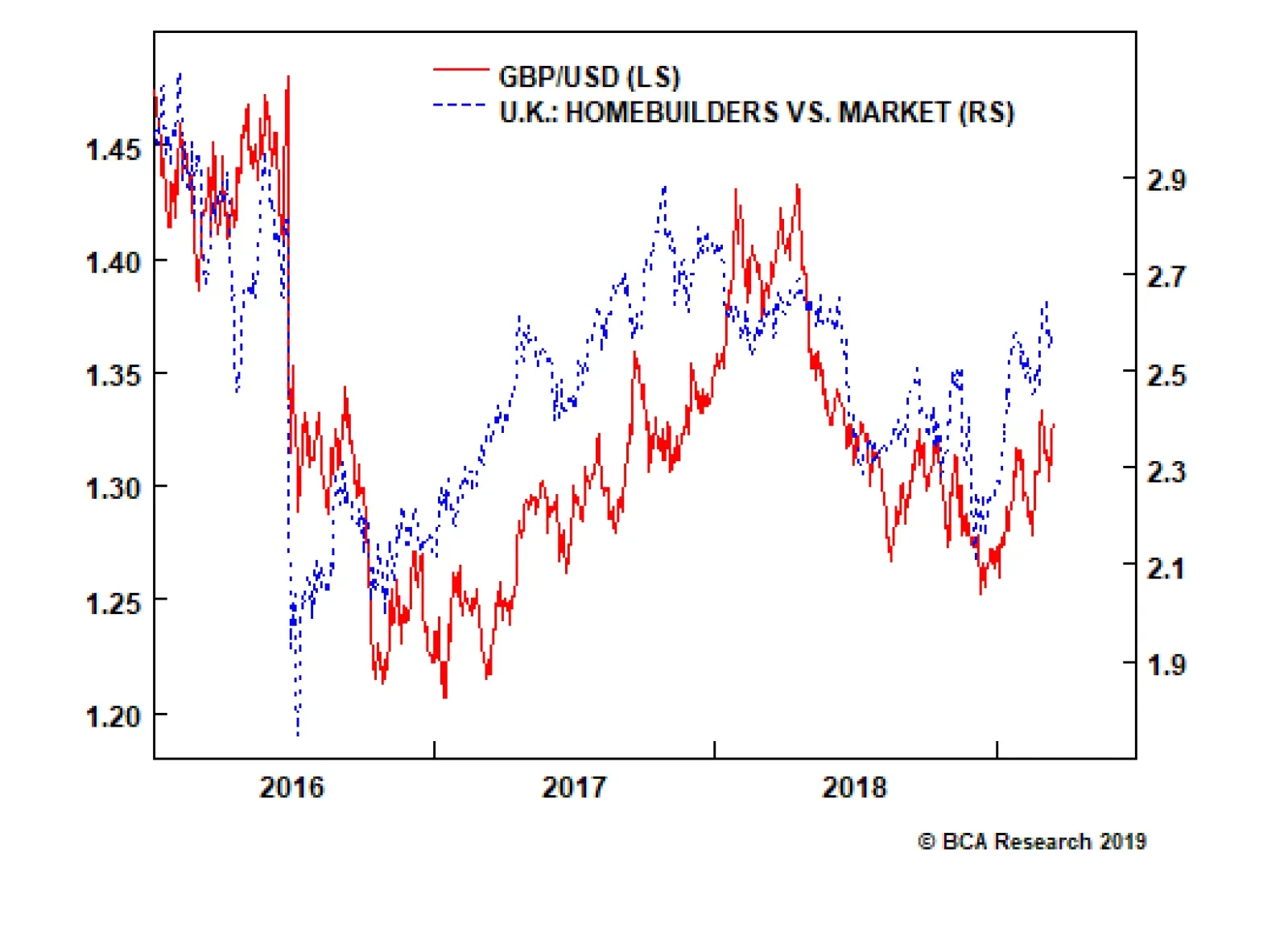

From the moment almost three years ago that the U.K. voted to leave the EU, it was clear that a rational and measured Brexit would require the U.K. to remain in a customs union with the EU. Rational and measured because a…

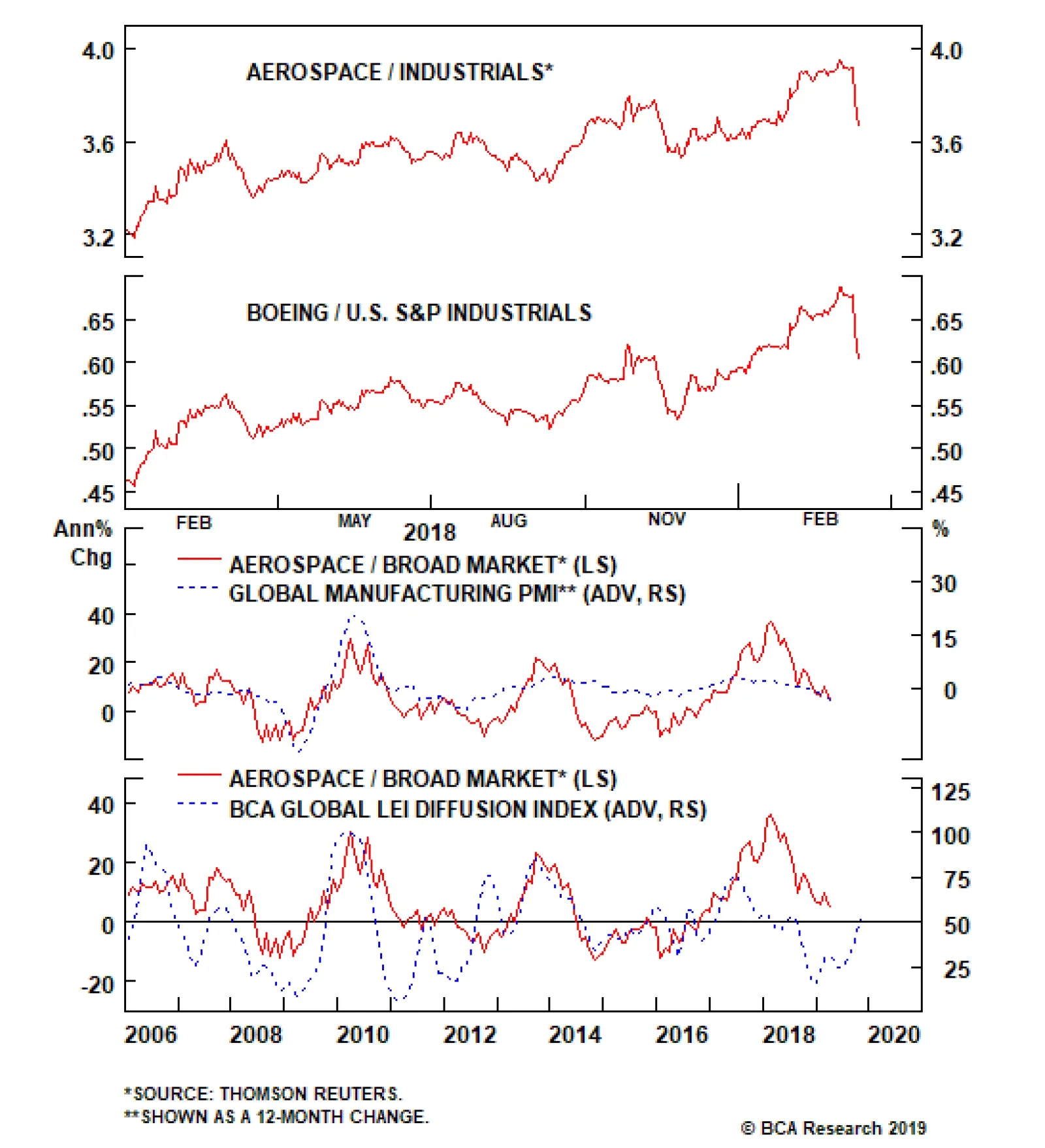

This performance is due in large part to Boeing taking on the mantle of a global trade bellwether and also dominating our BCA aerospace index. Considering the global nature of the firm, this role seems appropriate. In the…

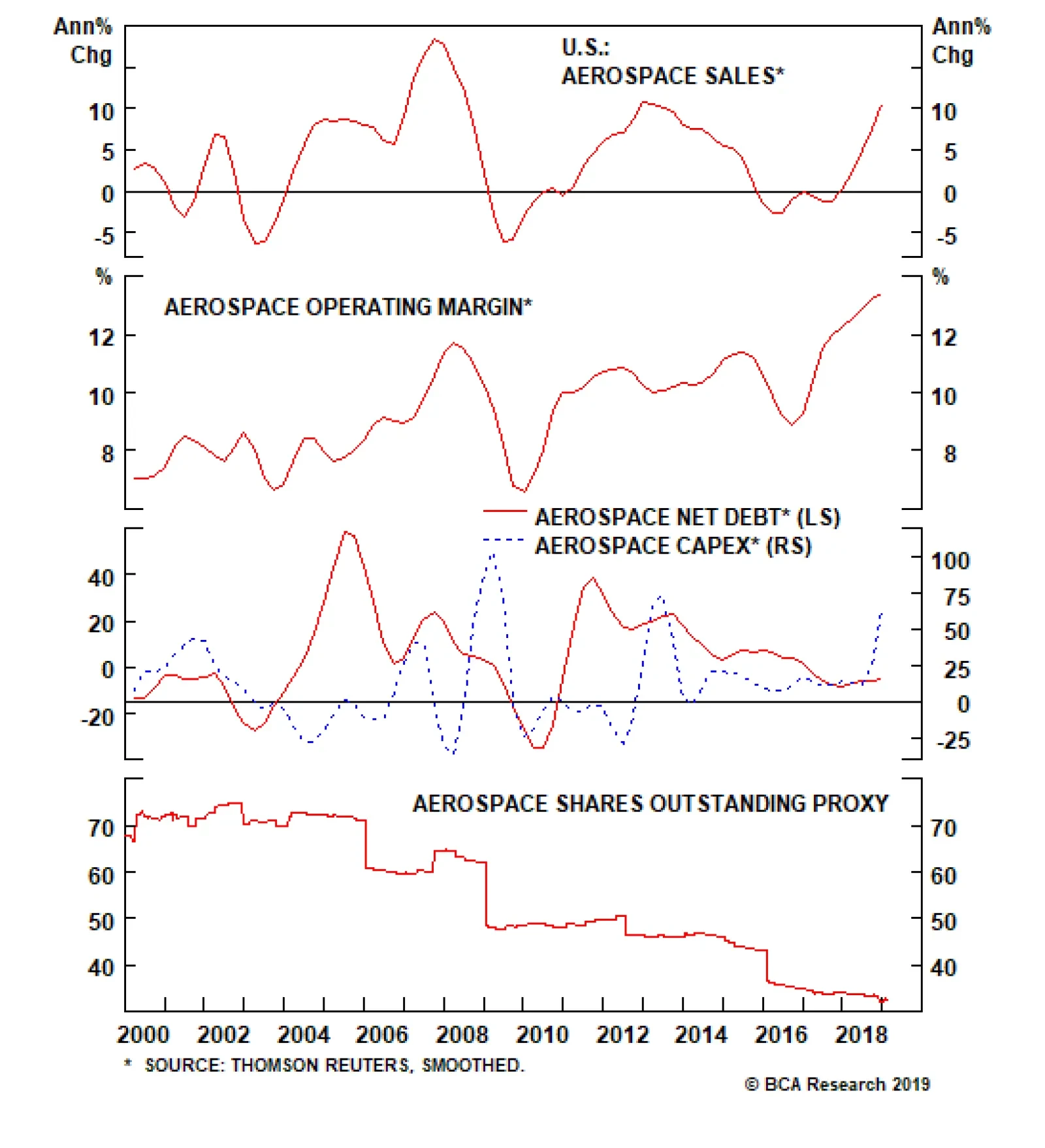

Industry sales have pushed into double-digit growth territory, while margins are hitting record levels. Our U.S. Equity Strategy team thinks the reason why earnings are so elevated has much to do with the age of the order…

Neutral In this week’s Special Report, we moved to a neutral recommendation on the BCA aerospace index. The report highlights the two pillars supporting the aerospace index and its relative performance: global trade sentiment and…