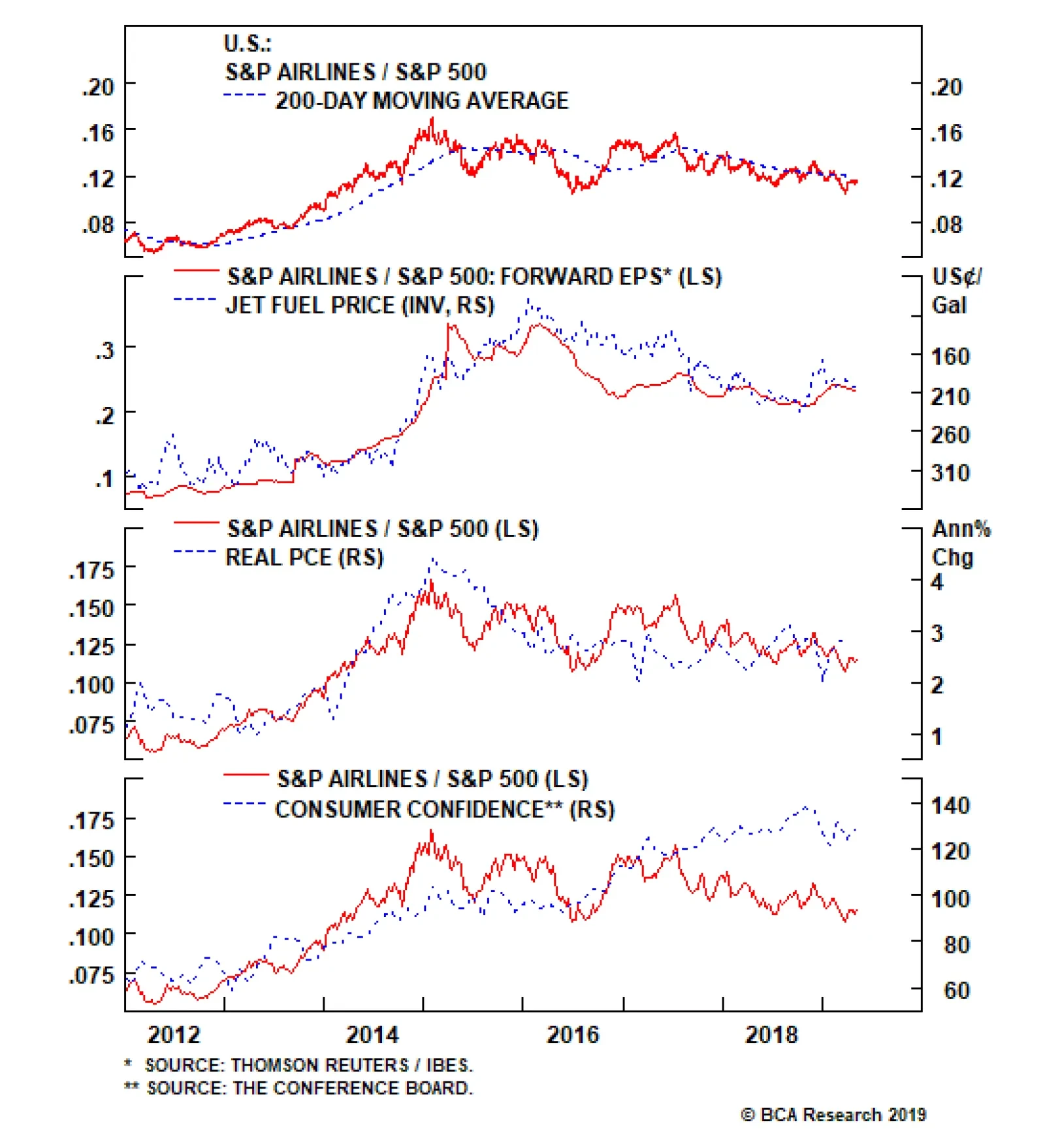

Overweight-Downgrade Alert Airline stocks bounced off a critical support level on the back of encouraging profit results (top panel). Lower kerosene prices especially for the non-hedged carriers are flowing straight to the…

Underweight Our underweight S&P railroads call has moved into the black as CSX rattled the industry and chopped 2019 revenue growth from positive 1-2% to negative 2%. While UNP’s numbers were better than expected…

Internal equity dynamics are sending a powerful signal for the broad equity market. Not only are defensives outshining cyclicals and mega caps trouncing small and micro caps, but also transports are warning that the broad…

Highlights The onset of a down-oscillation in growth strongly suggests a rotation out of the growth-sensitive Industrials and Materials into the relatively defensive Healthcare sector. But if the sharpest move in bond yields has…

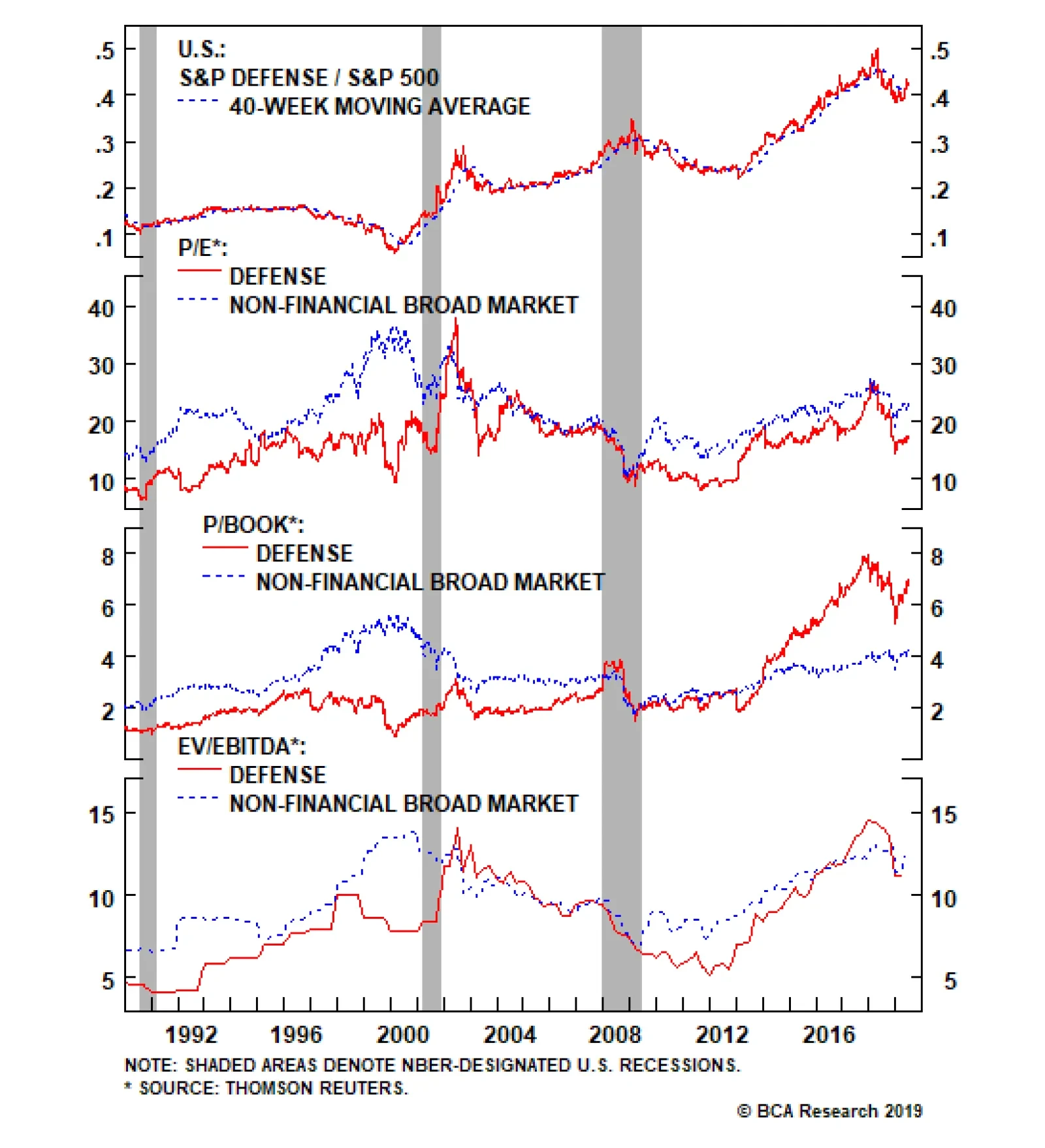

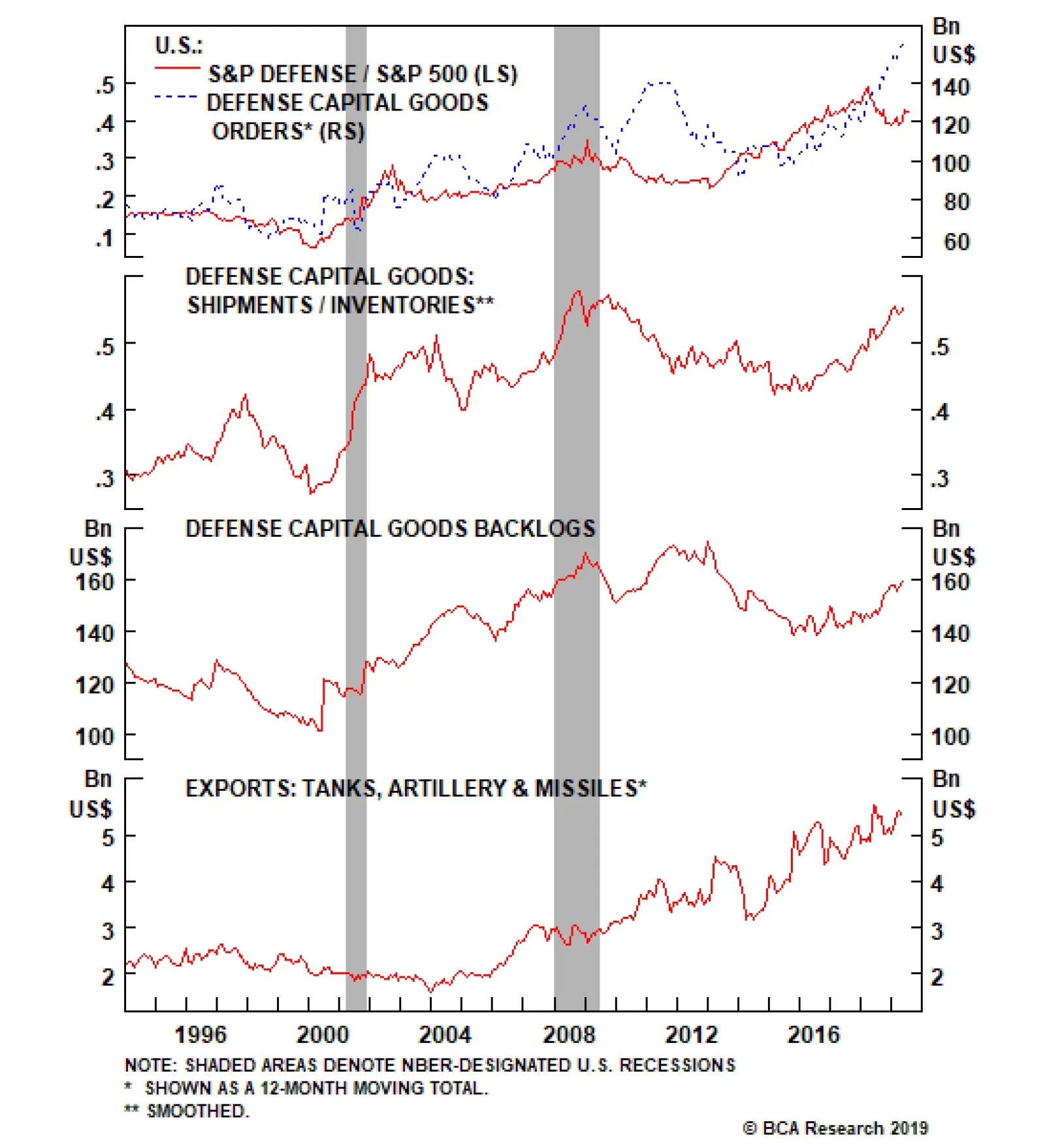

Overweight, High-Conviction We reiterate our high-conviction overweight call on the BCA Defense Index as three key demand drivers remain upbeat and will continue to underpin relative industry profitability. First, the global arms race…

Cyber security remains a global threat and governments are serious about fighting it off decisively given the sensitivity of the data sought by cyber criminals. While defense stocks are not pure-play software outfits combating…

Irrespective of the outcome of this deal, our U.S. Equity Strategy team remains overweight the pure-play BCA Defense Index on a structural basis and also reiterates its high-conviction overweight bet for this industry. Three…

Highlights Portfolio Strategy Business sector selling price inflation is sinking like a stone following the bond market’s melting inflation expectations, at a time when wage inflation continues to expand smartly. There are good…

When our U.S. Equity Strategy team moved to an overweight recommendation on the S&P airlines index last year, they noted three pillars supporting the onset of an earnings outperformance: a drubbing in oil prices significantly…

Overweight (Downgrade Alert) When we moved to an overweight recommendation on the S&P airlines index in the fall of last year, we noted three pillars supporting the onset of an earnings outperformance: a drubbing in oil prices…