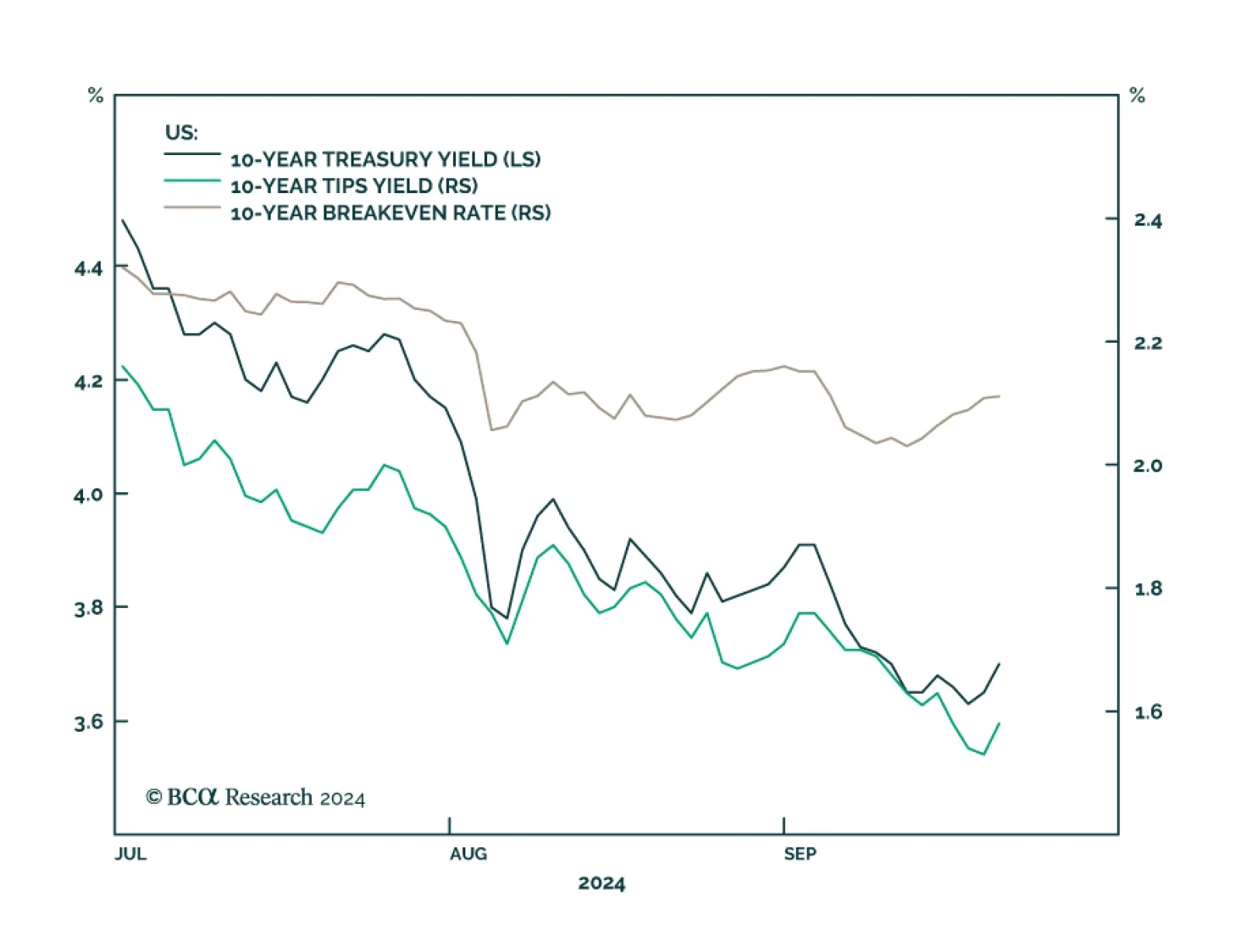

The 10-year Treasury yield rose in the aftermath of the Fed’s jumbo rate cut on Wednesday. Our US Bond strategists noted that this move reflects the fact that the downward revisions to the dots still fall short of the…

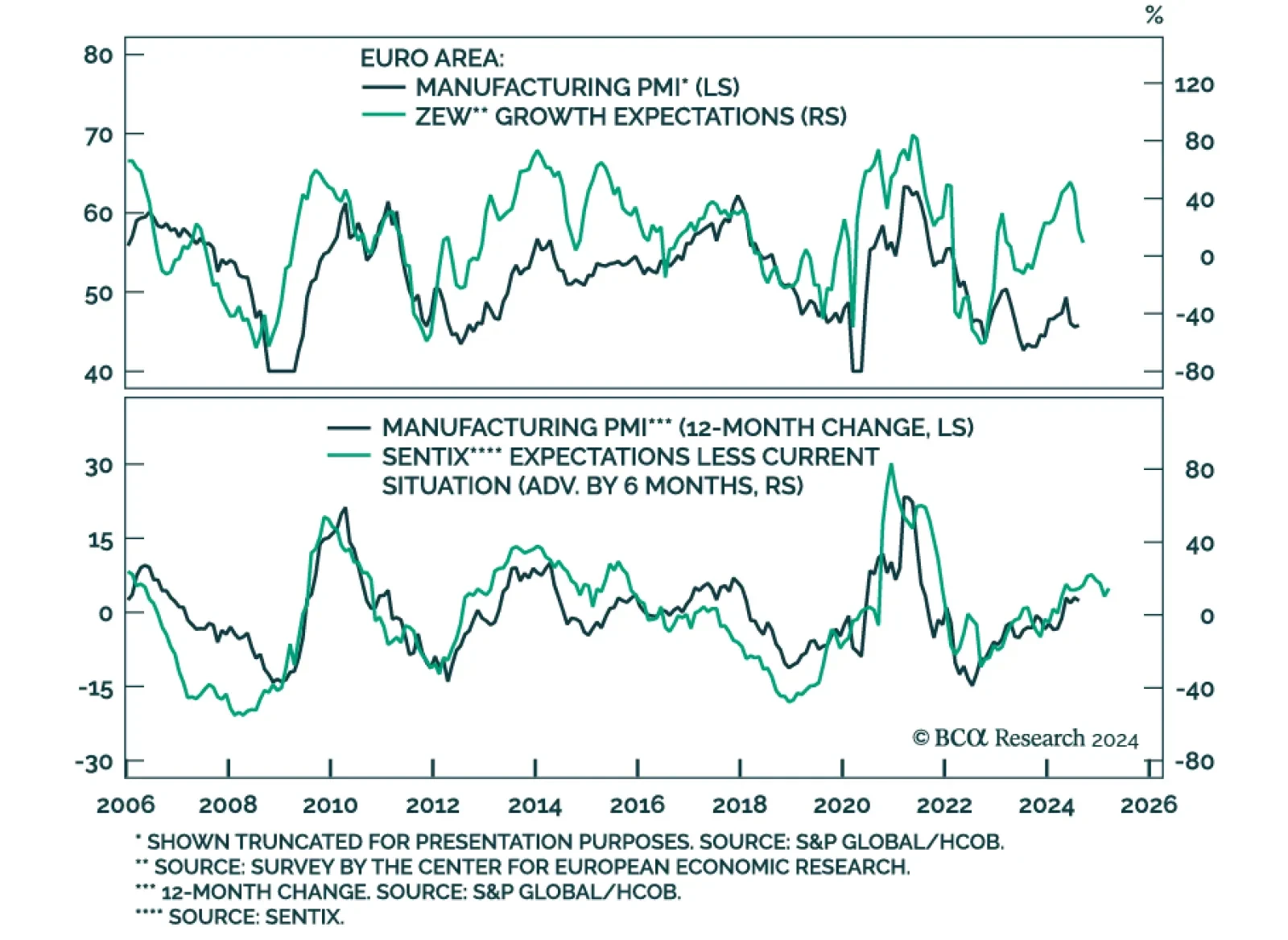

The ZEW survey of both German business expectations and current situation largely disappointed in September, decreasing by 15.6 points to 3.6 and by 7.2 points to -84.5, respectively. The ZEW survey of expectations for…

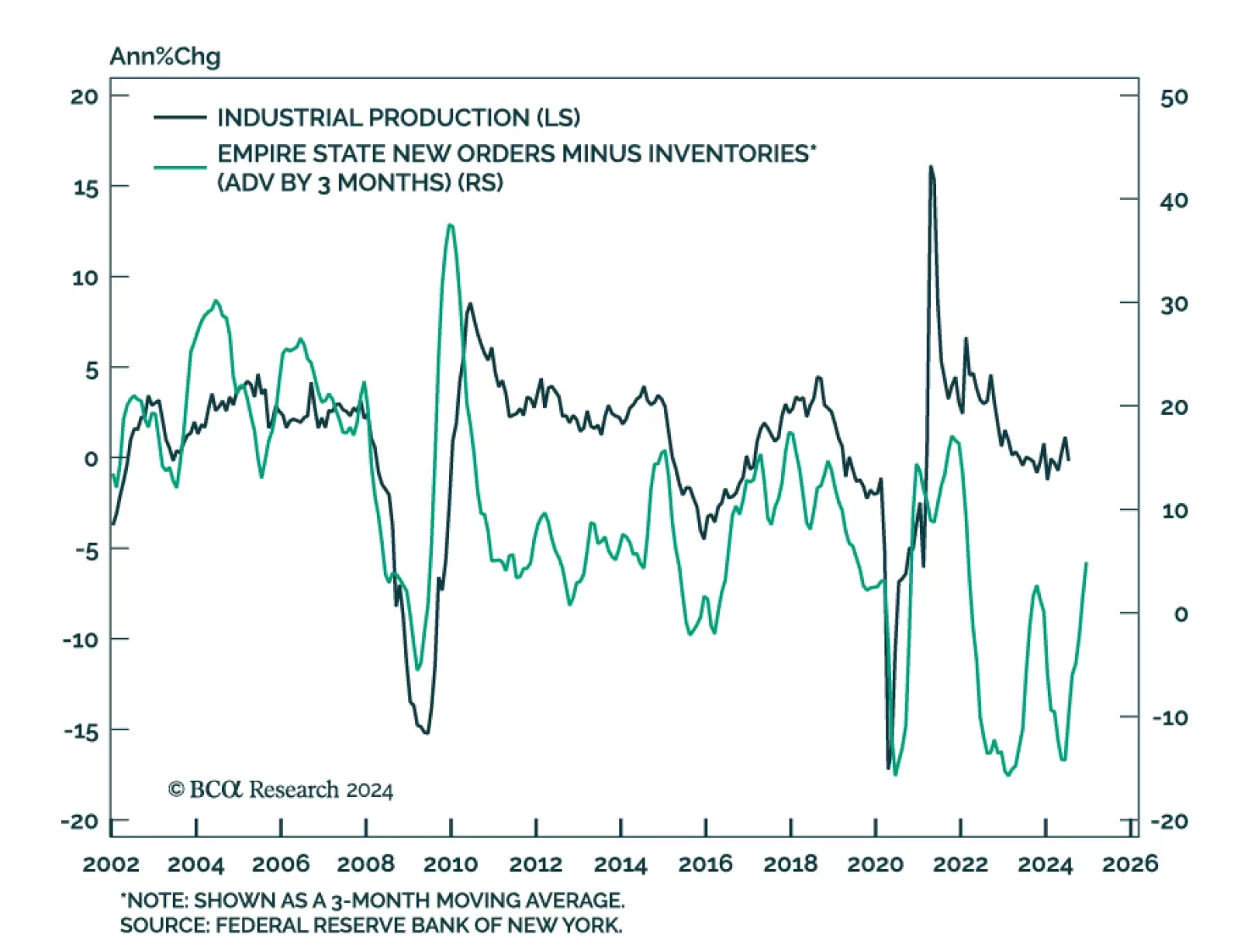

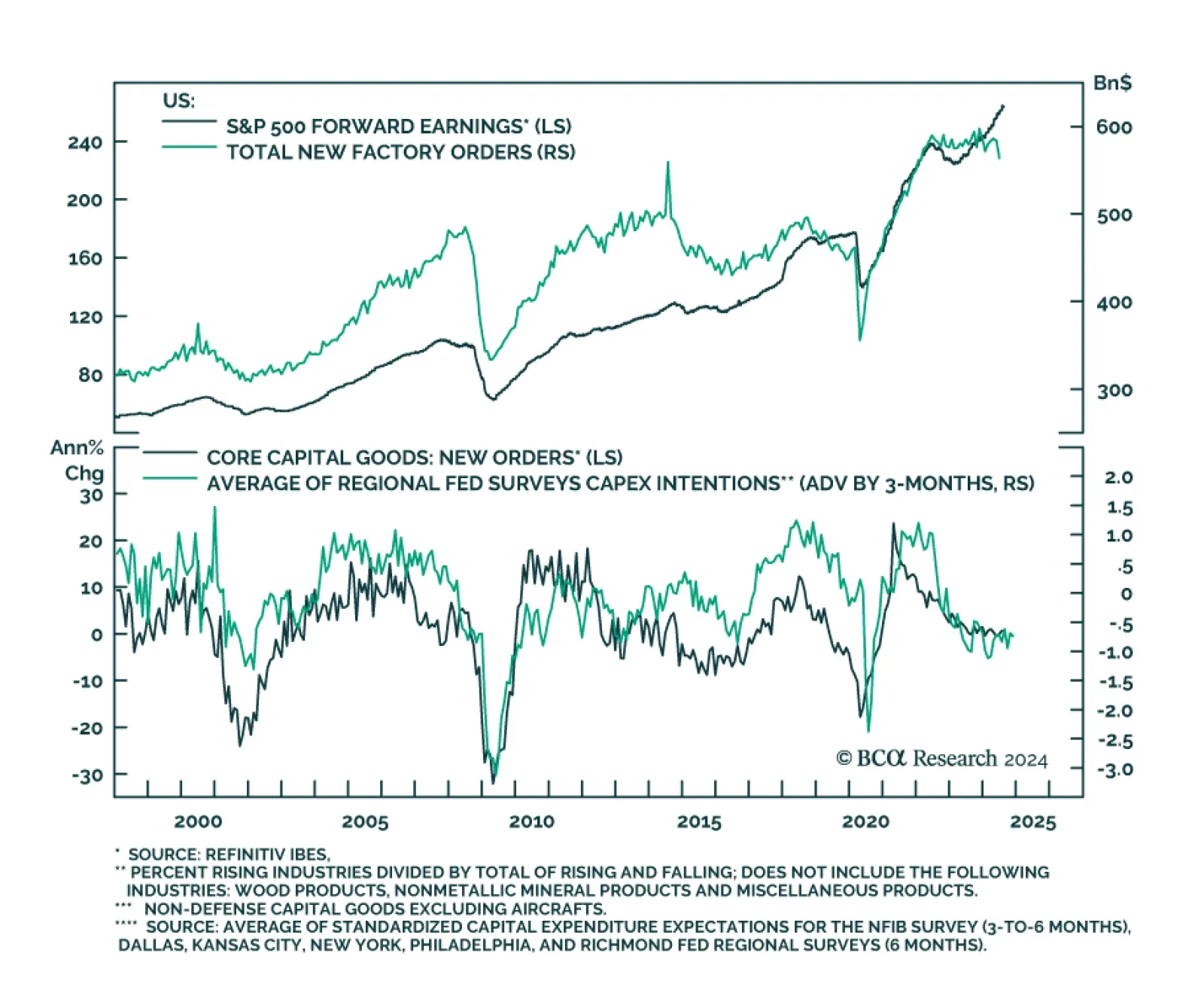

The timeliest of the regional Fed manufacturing surveys sent a positive signal about the state of US manufacturing activity in September. The Empire State manufacturing general business conditions index surprised positively.…

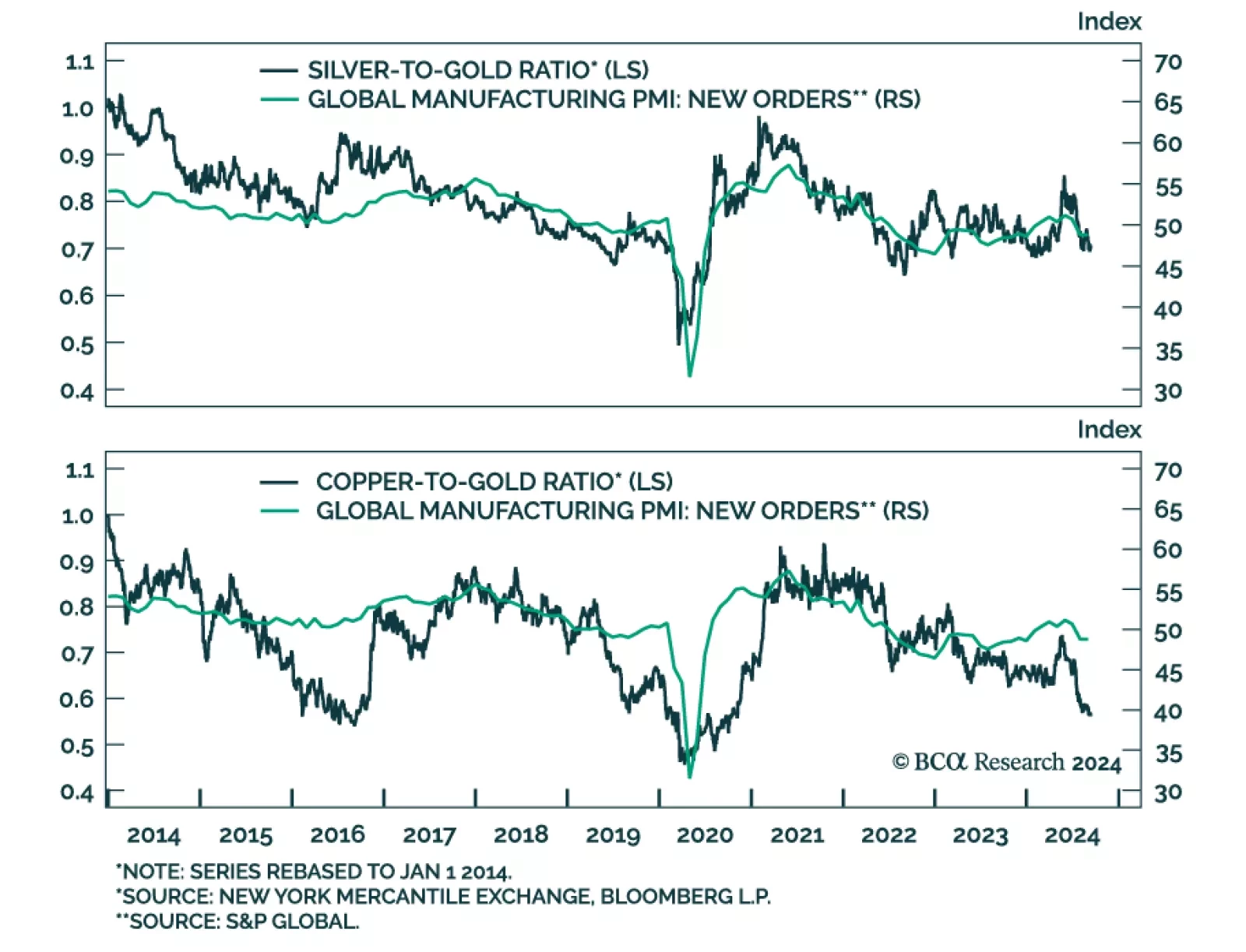

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

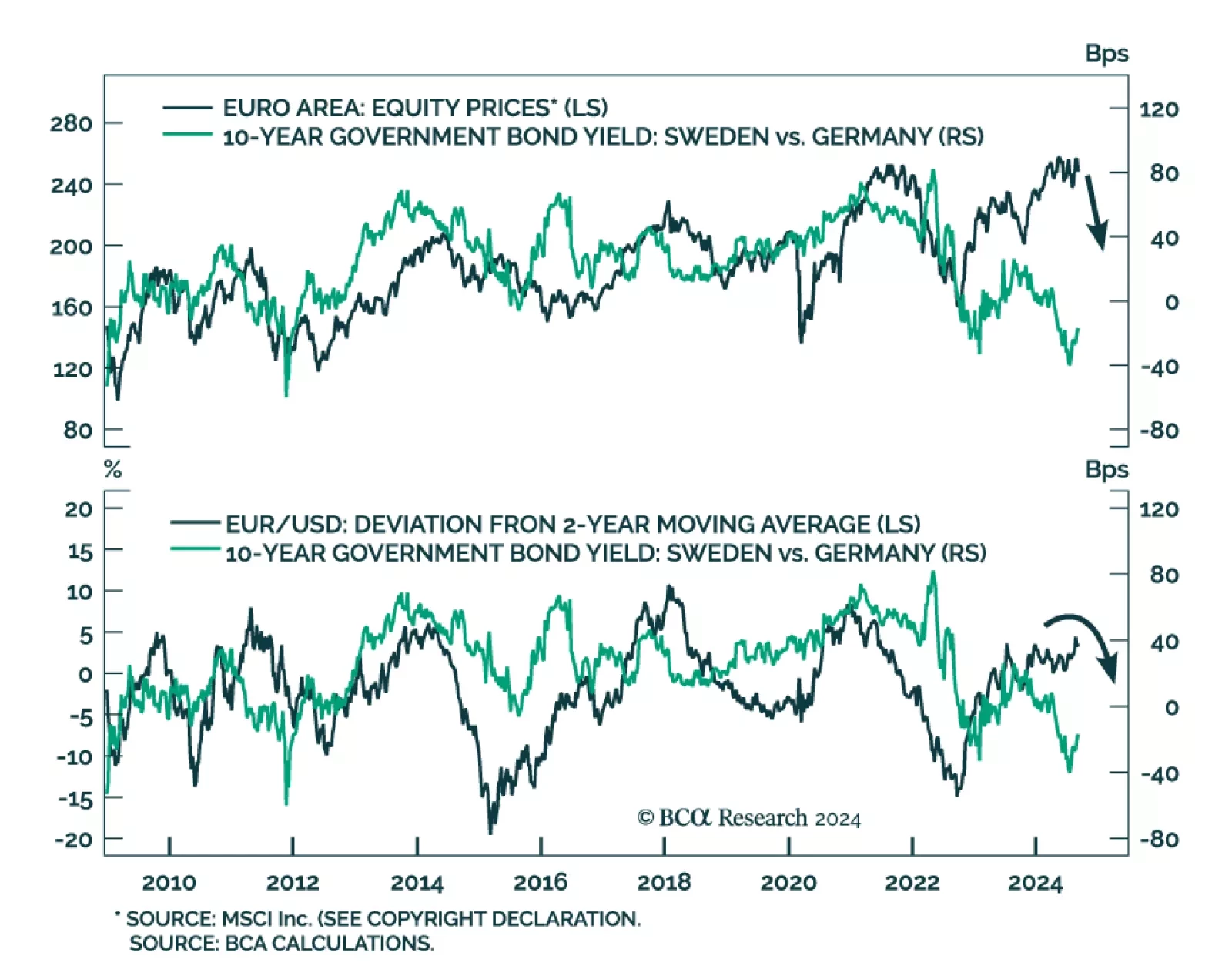

The Swedish economy’s cyclicality and sensitivity to global trade make it a reliable bellwether for global growth. Sweden is facing significant domestic weakness. Employment growth declined by 0.14% y/y in July and…

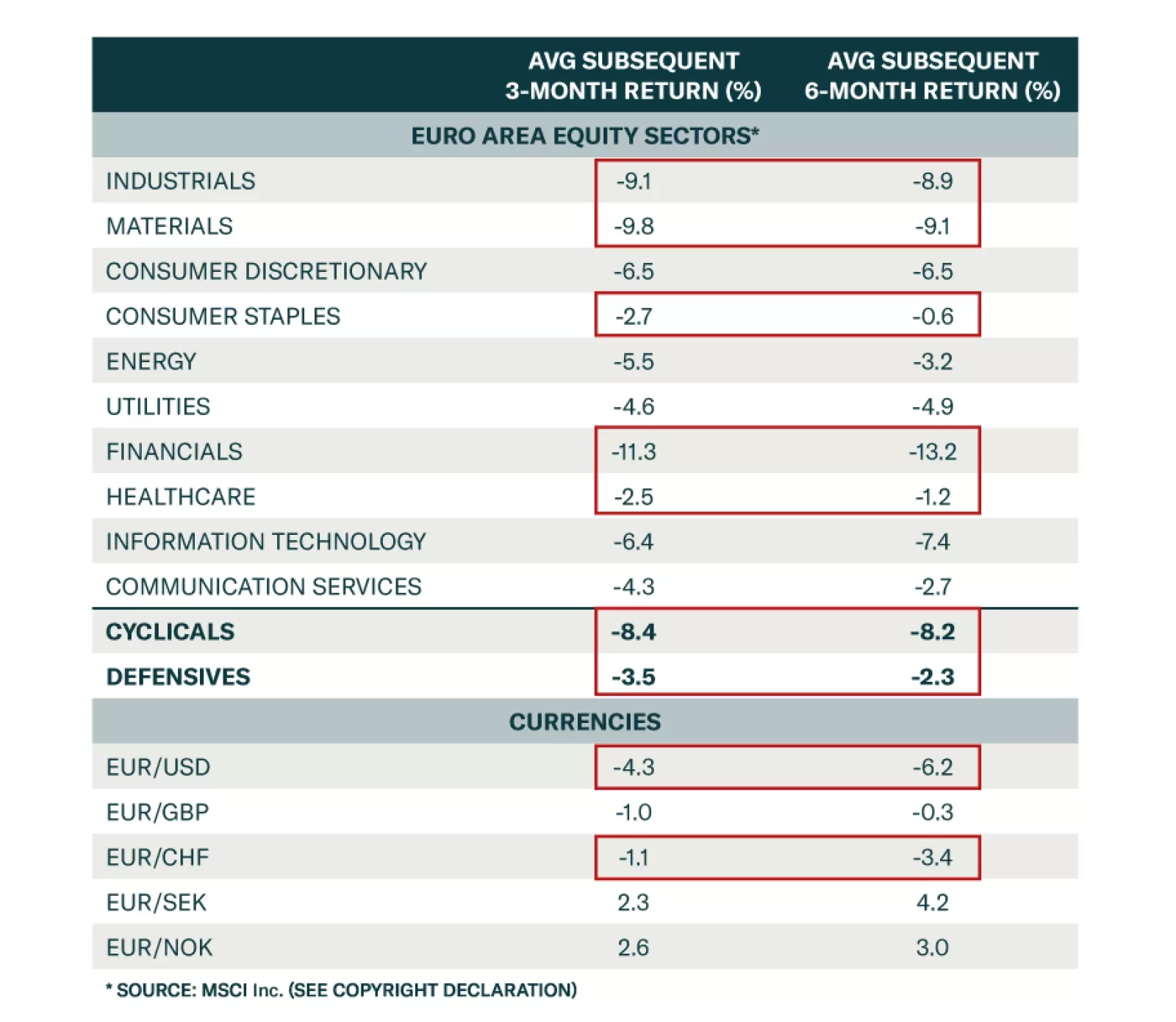

BCA Research’s European Investment strategists looked at previous episodes of carry-trade blowups and assessed the performance of the Eurozone’s key sectors, national markets, and currencies three and six months…

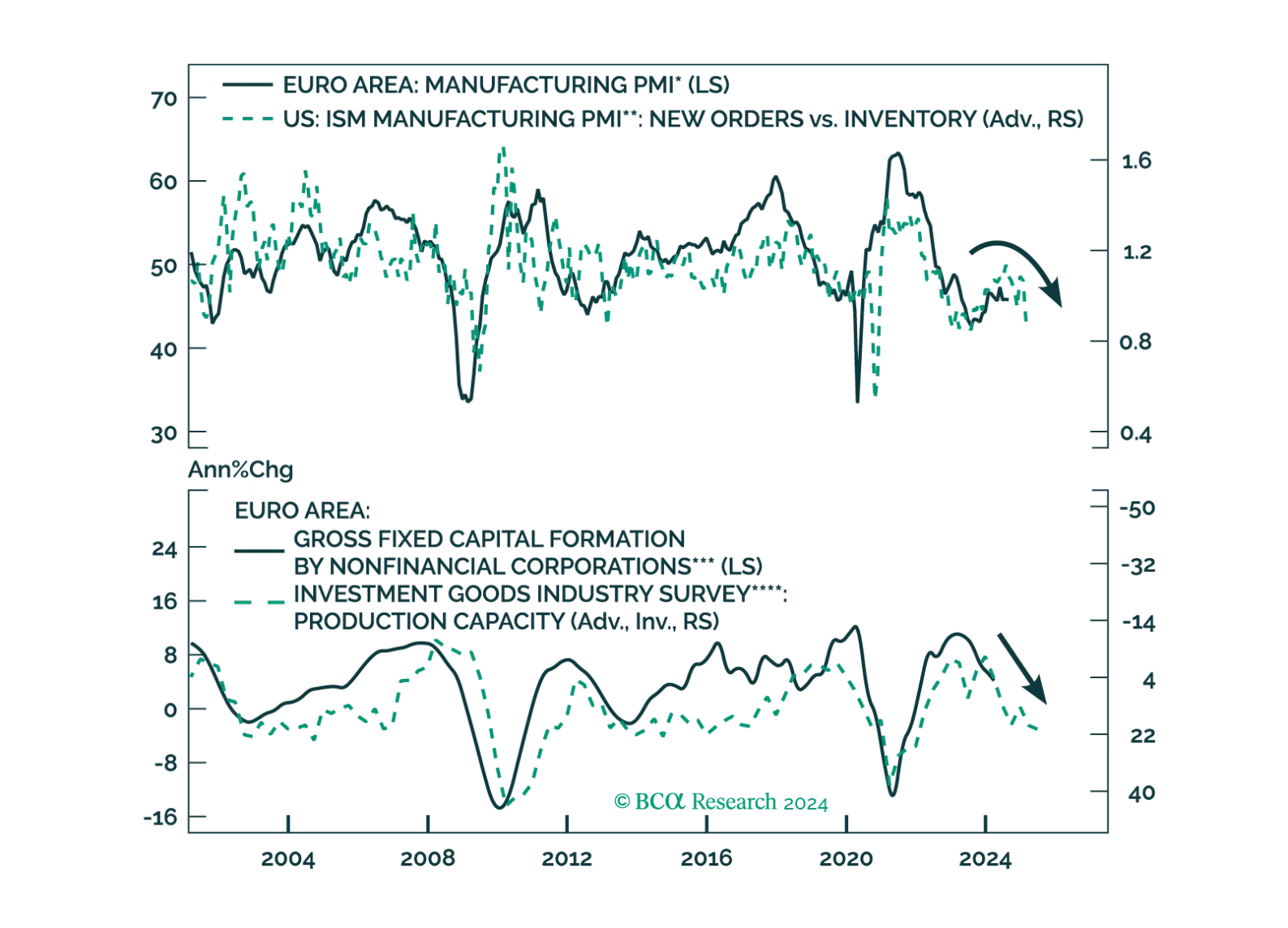

Crucial leading indicators of the global and European economies continue to deteriorate. How should investors position their European portfolios to benefit from these trends?

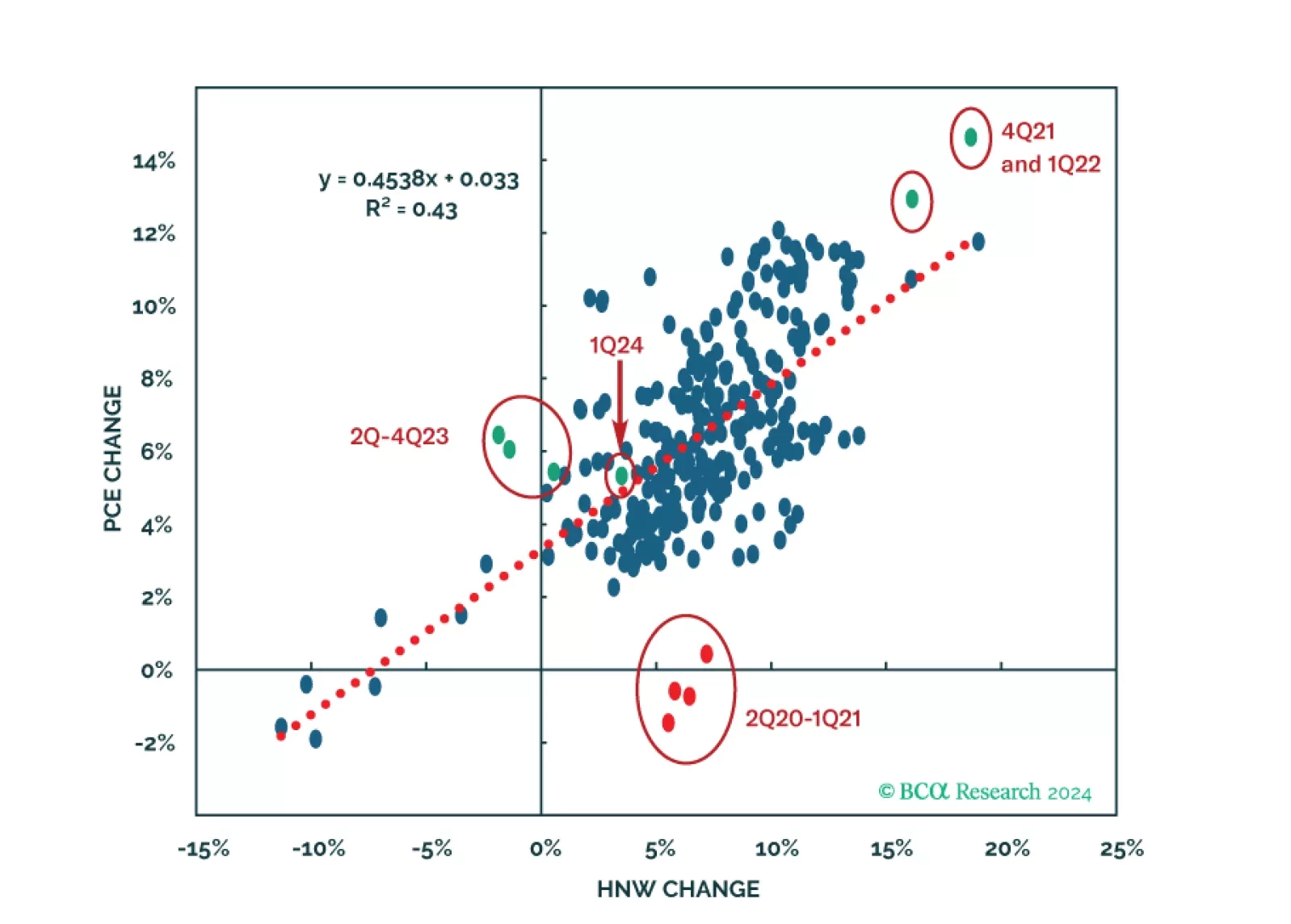

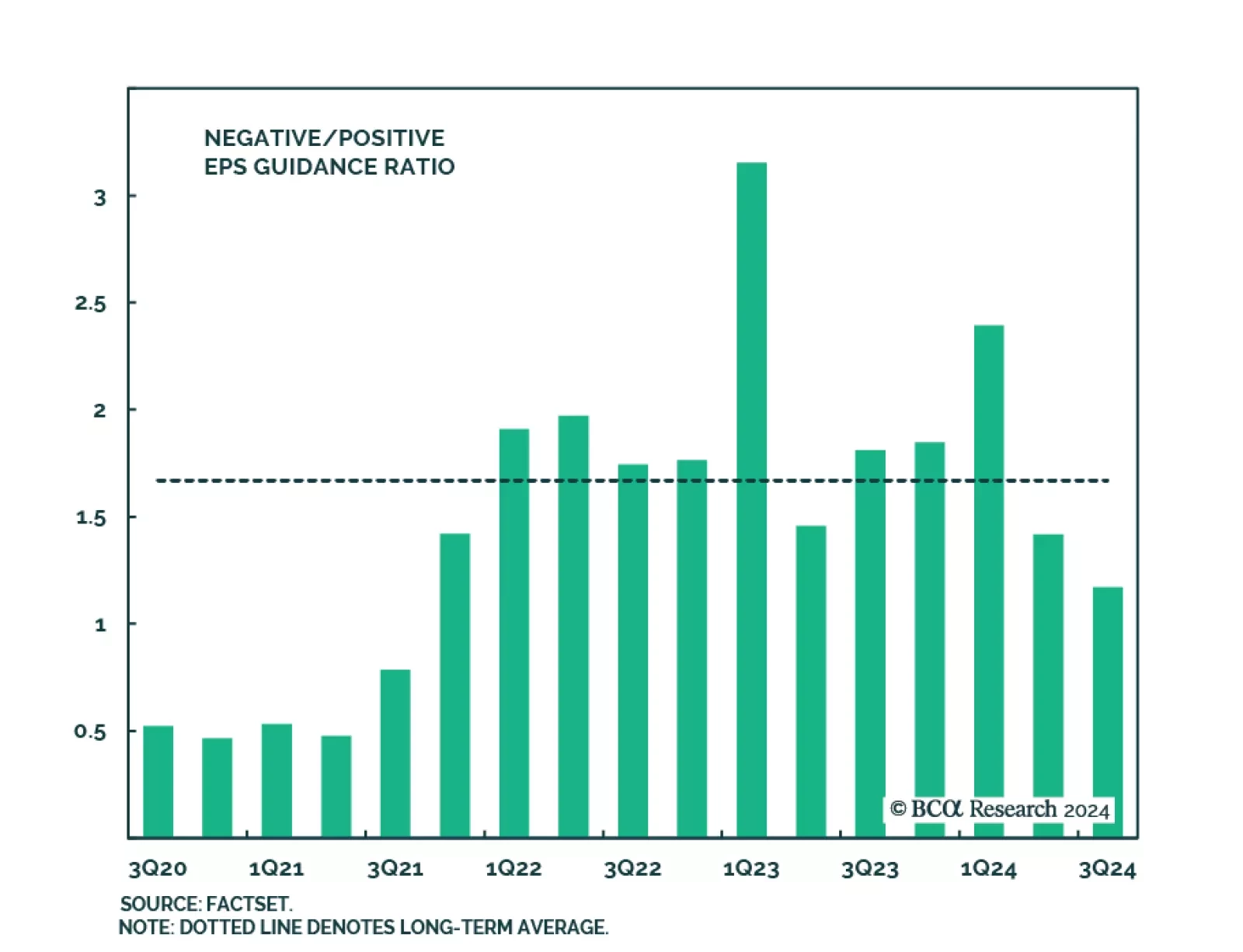

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

Preliminary estimates suggest that US durable goods orders growth rebounded sharply from a 6.9% m/m contraction to 9.9% growth in July, upending expectations of a more muted 5.0% monthly increase. However, a 34.8% m/m rise in…