Overweight A tentative up-tick in EM data in general and China in particular along with improving operating metrics signal that the US/China trade war wounded machinery stocks deserve a high-conviction overweight status for 2020. In…

Highlights Portfolio Strategy Interest rates are one of the most important macro drivers of overall equity returns via valuations. BCA’s view of a selloff in the bond market is a key factor underpinning most of our 2020 high-…

Underweight This week’s Eaton Corporation weak earnings release was good news for our underweight S&P electrical components & equipment (EC&E) position. More specifically, ETN reported contracting revenues…

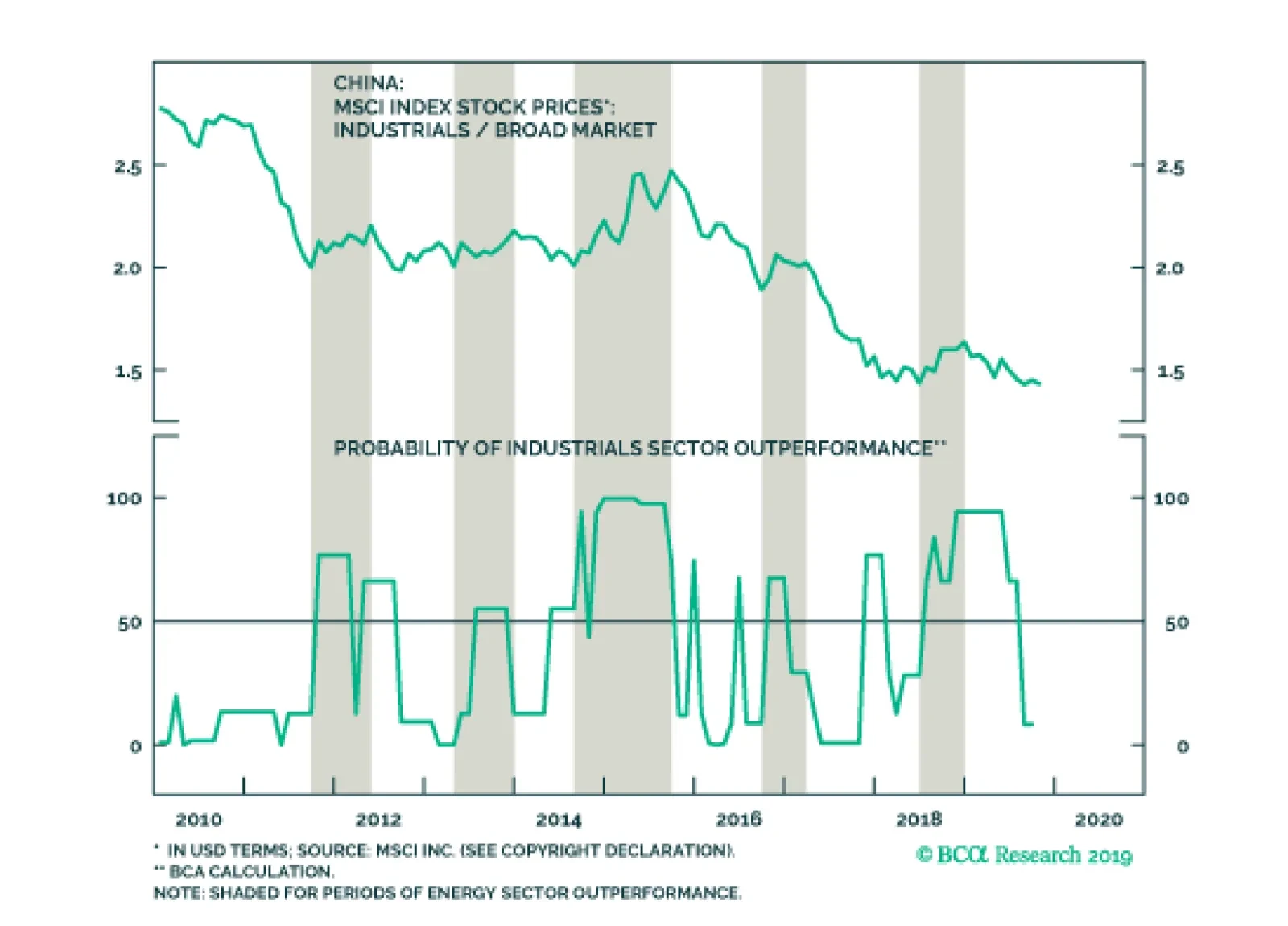

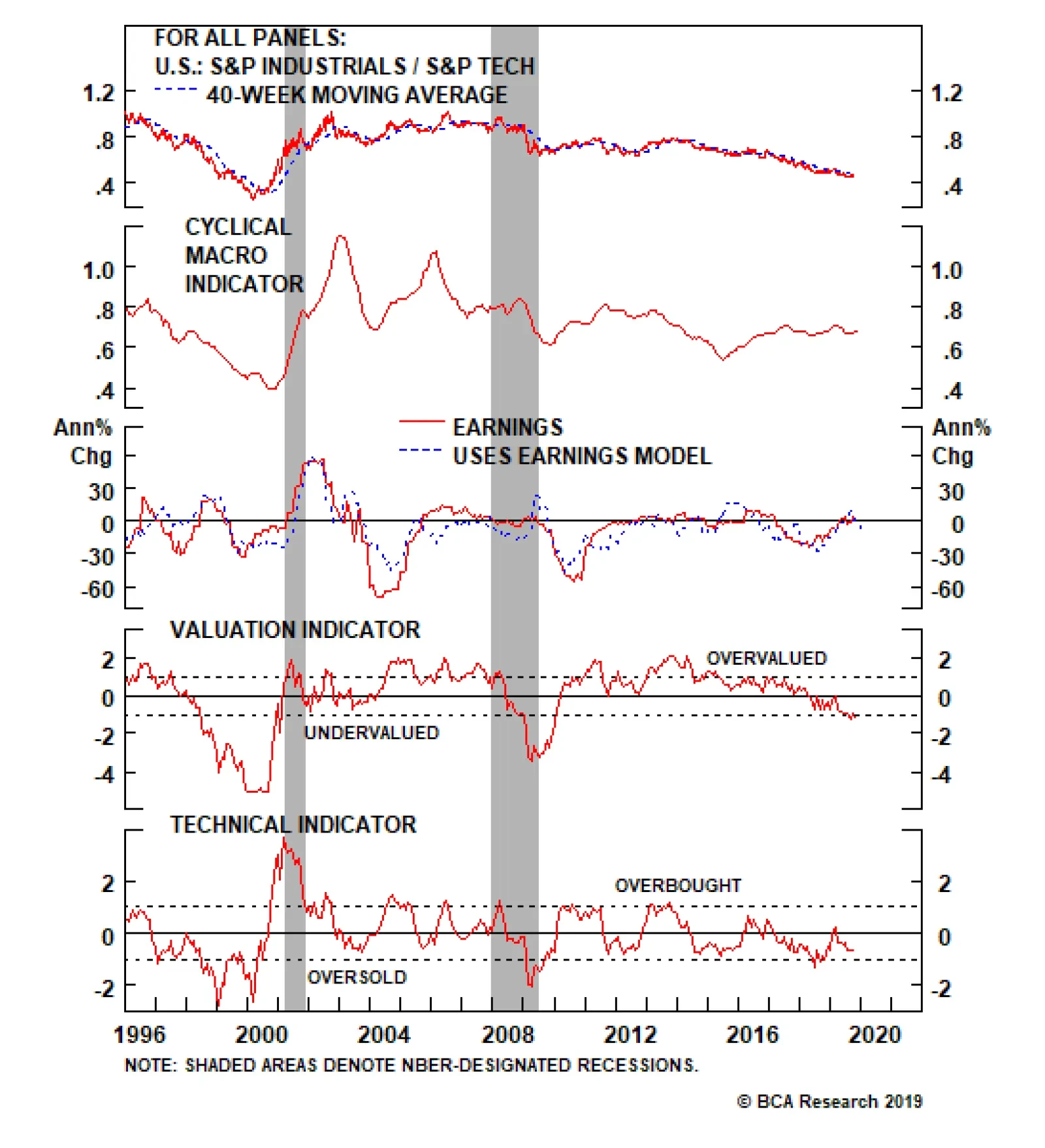

Periods of industrial sector outperformance have historically been positively correlated with relative industrial sector earnings, broad market stock prices, and prior oversold technical conditions. They have been negatively…

Highlights New structural recommendation: long GBP/USD. The substantial Brexit discount in the pound makes it a long-term buy for investors who can tolerate near-term volatility. The most powerful equity play on a fading Brexit…

A more speculative and higher octane vehicle to explore the trade war-related mispricing from Part I of this Insight is via a long S&P machinery/short S&P semiconductors pair trade. Most of the drivers mentioned in…

In this Monday’s Weekly Report we initiated a new long/short trade idea that will generate alpha regardless of the pair trade war outcome: long industrials/short tech. If the U.S. and China manage to iron out their…

If the U.S. and China cannot reach an agreement the metrics depicted in the previous Insight will not sink much further. There is an element of exhaustion and industrials would jump relative to tech on news of a breakdown in…