Highlights Asian and European natural gas prices will remain well bid as the Northern Hemisphere winter approaches. An upgraded probability of a second La Niña event this winter will keep gas buyers scouring markets for supplies…

Today we take a close look at the historical GICS1 level performance following the taper event in 2013. Chart 1 provides an overview of a price action of the 10-year US Treasury yield, the US dollar, and gold to provide context,…

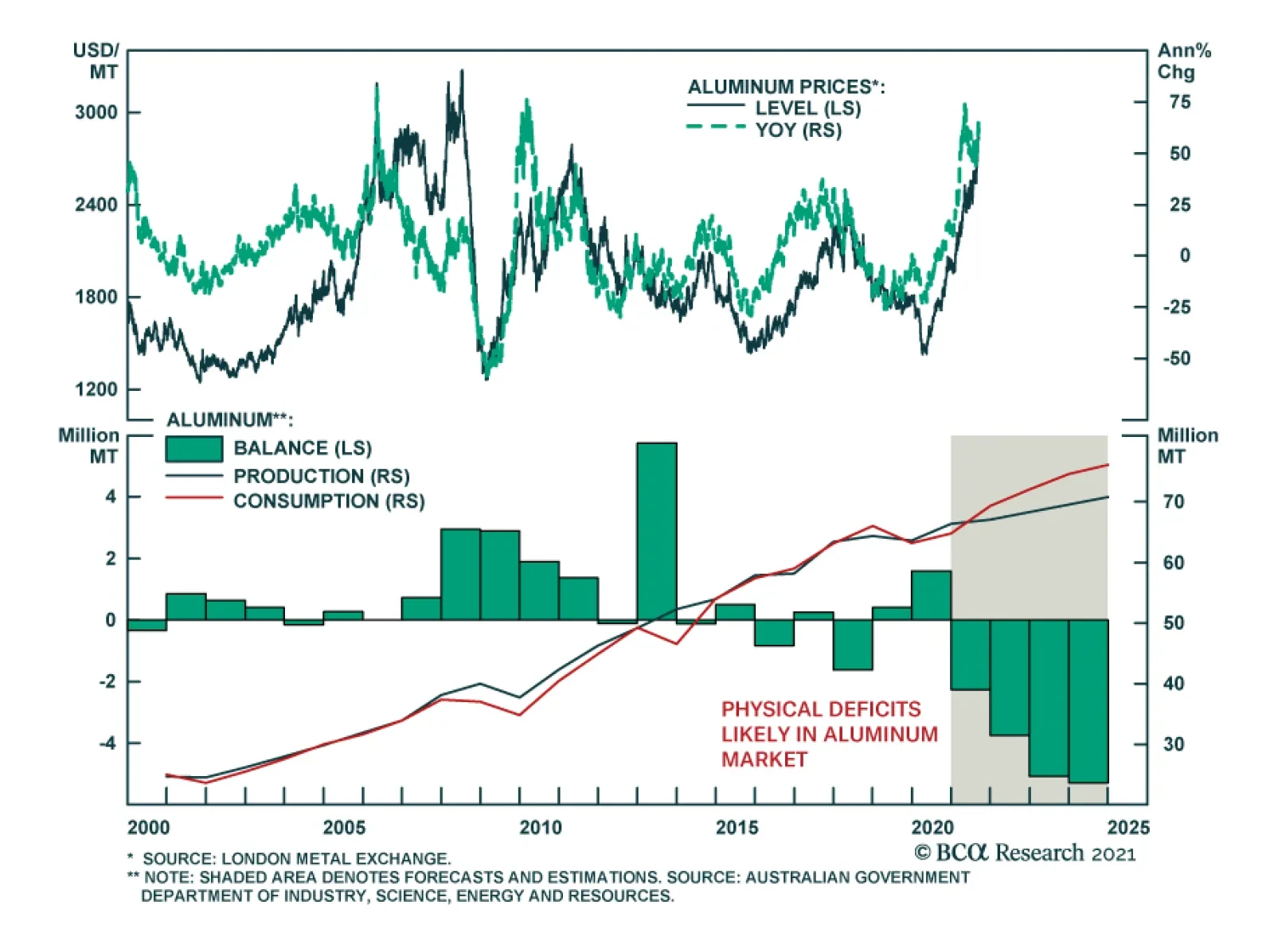

Aluminum prices recently accelerated sharply following several months of relative inactivity. The recent rally was triggered by fears of a disruption in bauxite supplies - the primary source of aluminum - following a military…

BCA Research's China Investment Strategy service recommends a new trade: long Chinese industrial stocks/short A-shares. Chinese onshore stocks in the infrastructure, materials, and industrial sectors recently advanced…

Highlights We are reviewing our recommendations. We are also introducing recommendation tables to monitor these positions. Overall, our main recommendations have generated alpha and have a positive batting average. Feature The end…

Highlights Earnings season was impressive, with 87% of companies beating analyst earnings expectations. Analysts’ targets were too low because a whopping 38% of companies provided negative forward guidance for the Q2-2021 results…

Foreword Today we are publishing a charts-only report focused on the S&P 500 and its sectors. Many of the charts are self-explanatory; to some we have added a short commentary. As with the styles Chart Pack, published a month…

Highlights Geopolitical risk is trickling back into financial markets. China’s fiscal-and-credit impulse collapsed again. The Global Economic Policy Uncertainty Index is ticking back up after the sharp drop from 2020. All of our…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…