Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

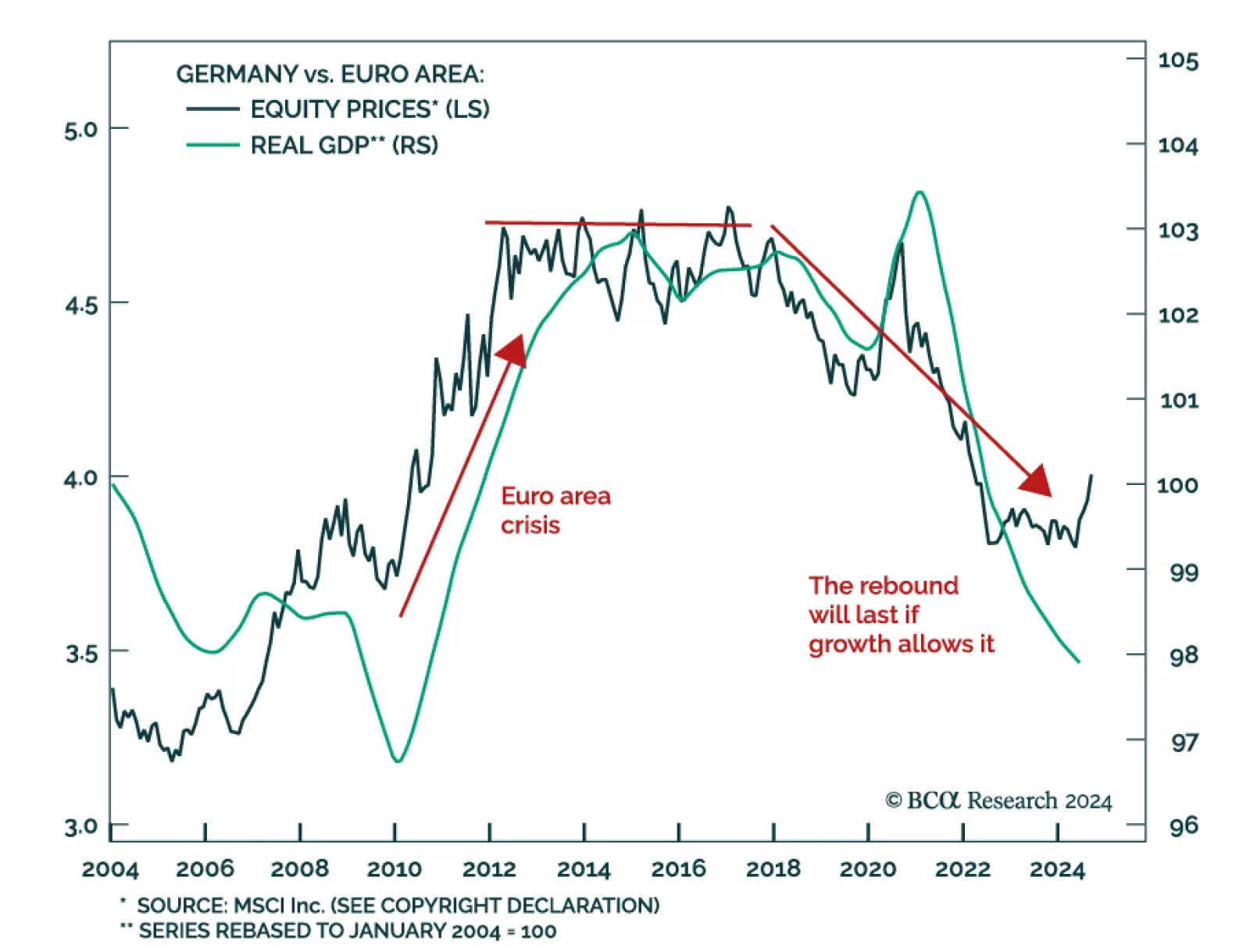

Germany’s problems are well known: Demographics, Chinese competition, underinvestment, energy dependence, and constrained fiscal policy. Our European Investment Strategy colleagues believe this bad news is priced in…

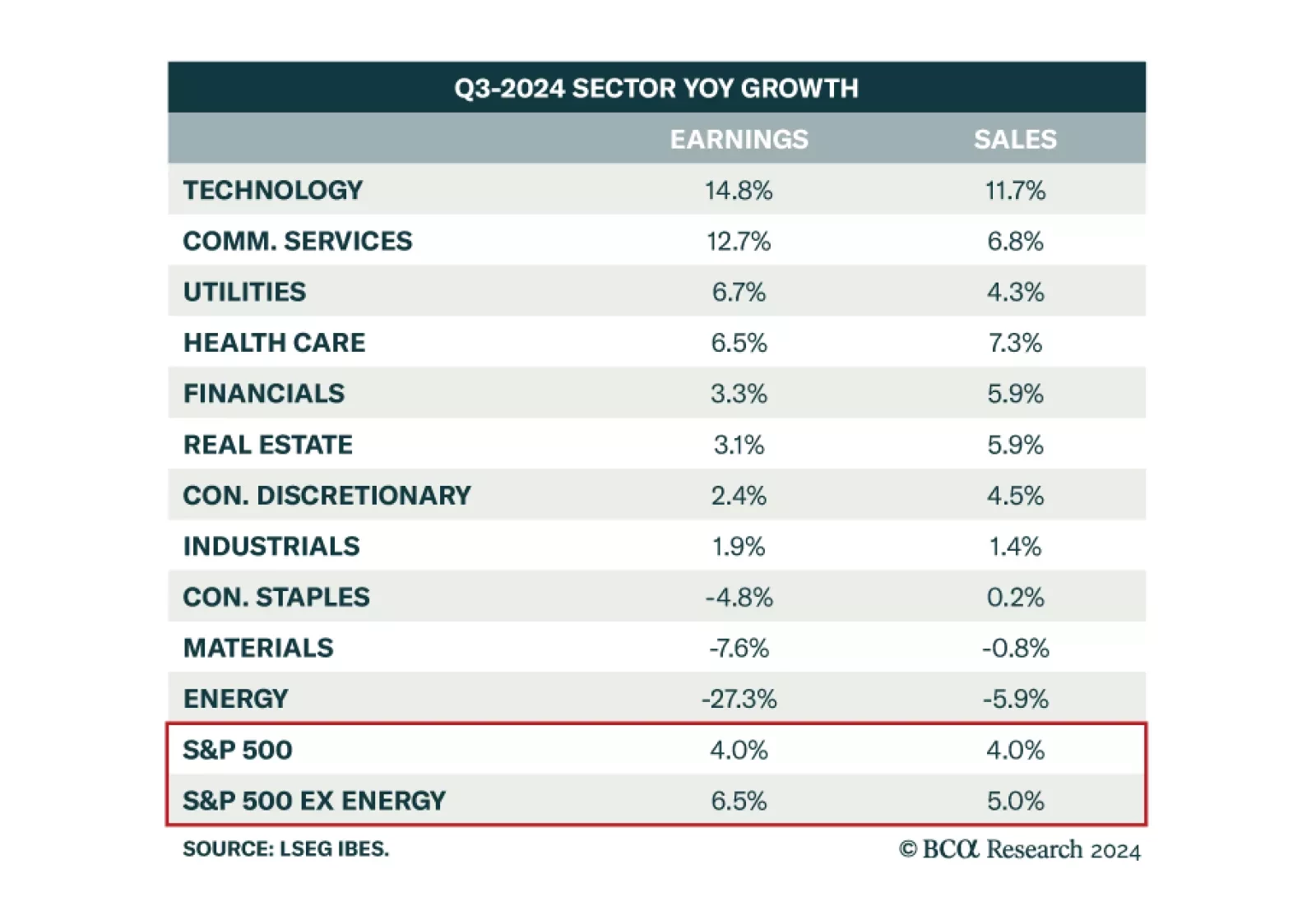

Our US Equity Strategy colleagues expect Q3 earnings to be strong enough to fuel the soft-landing narrative. Analysts expect S&P 500 earnings growth to be 4.0% year-over-year, with sales growth of 4.0% too. Yet, with…

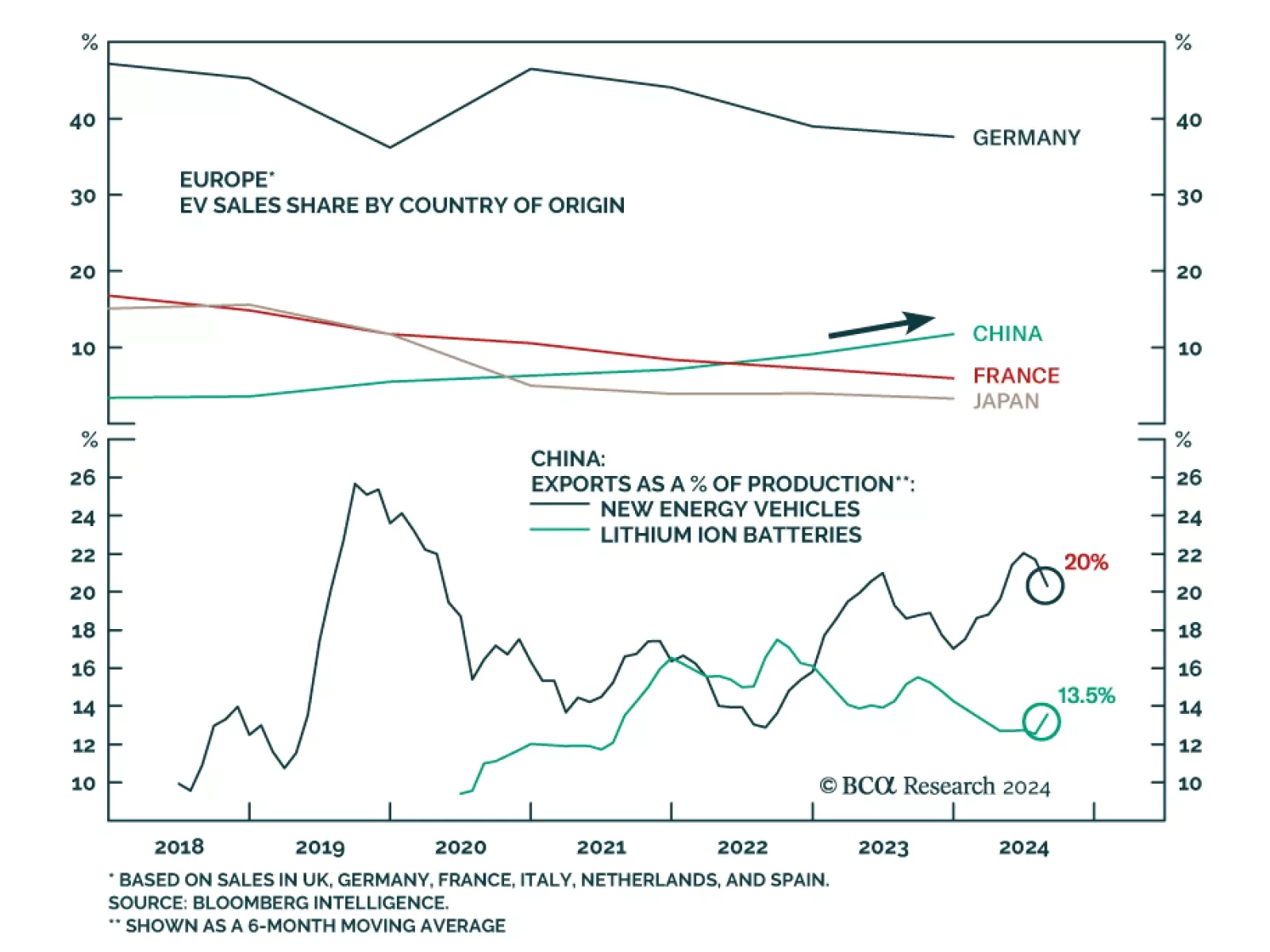

The European Commission voted to impose tariffs of up to 45% on imports of Chinese electric vehicles (EVs). The announcement follows previous tariffs imposed on Chinese EV imports back in June. This new round of economic…

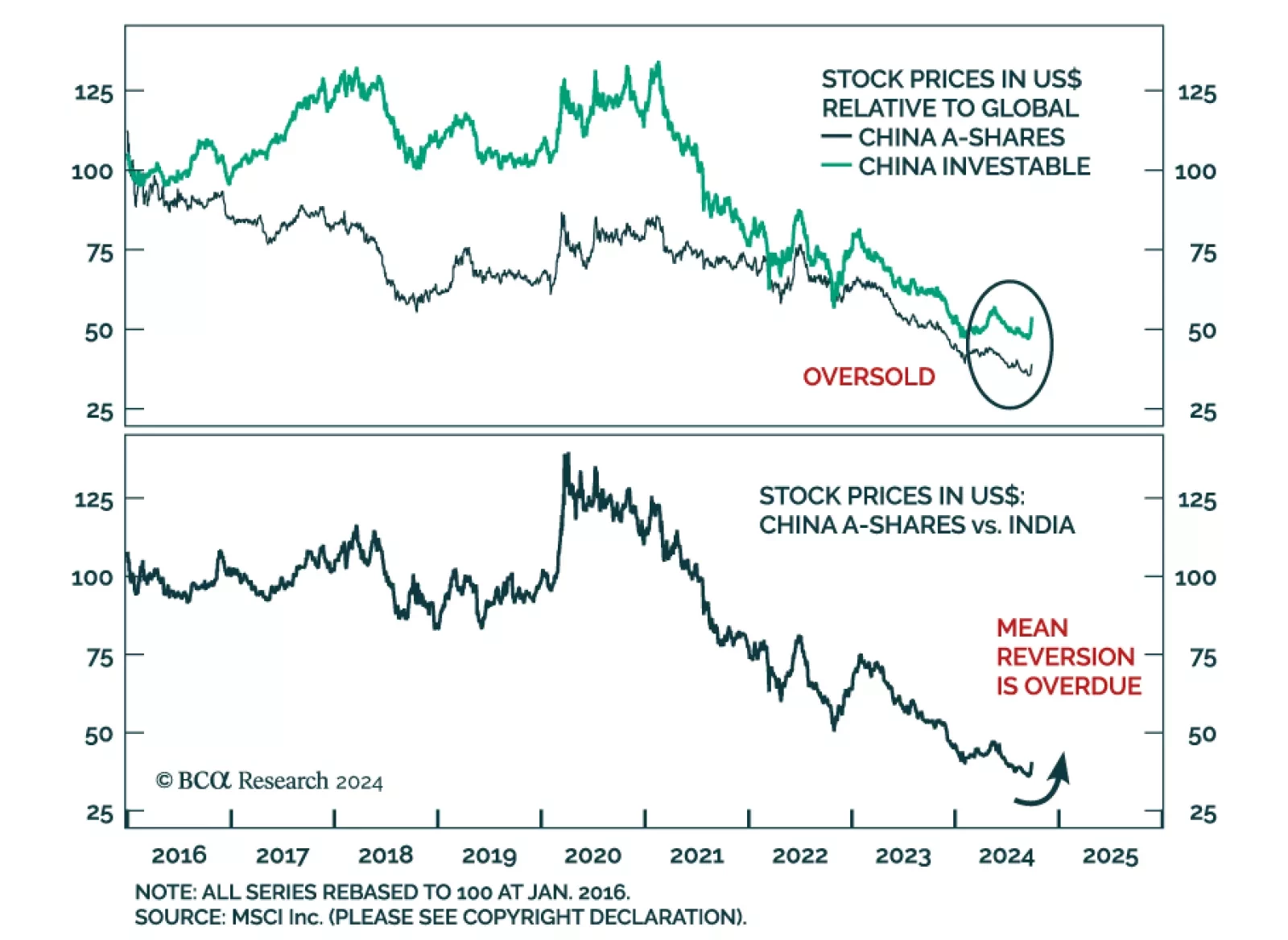

We highlighted last week that while the Politburo policy announcements are unlikely to produce a meaningful business cycle recovery in China, they nevertheless administered a shot of adrenaline to investor sentiment. Chinese…

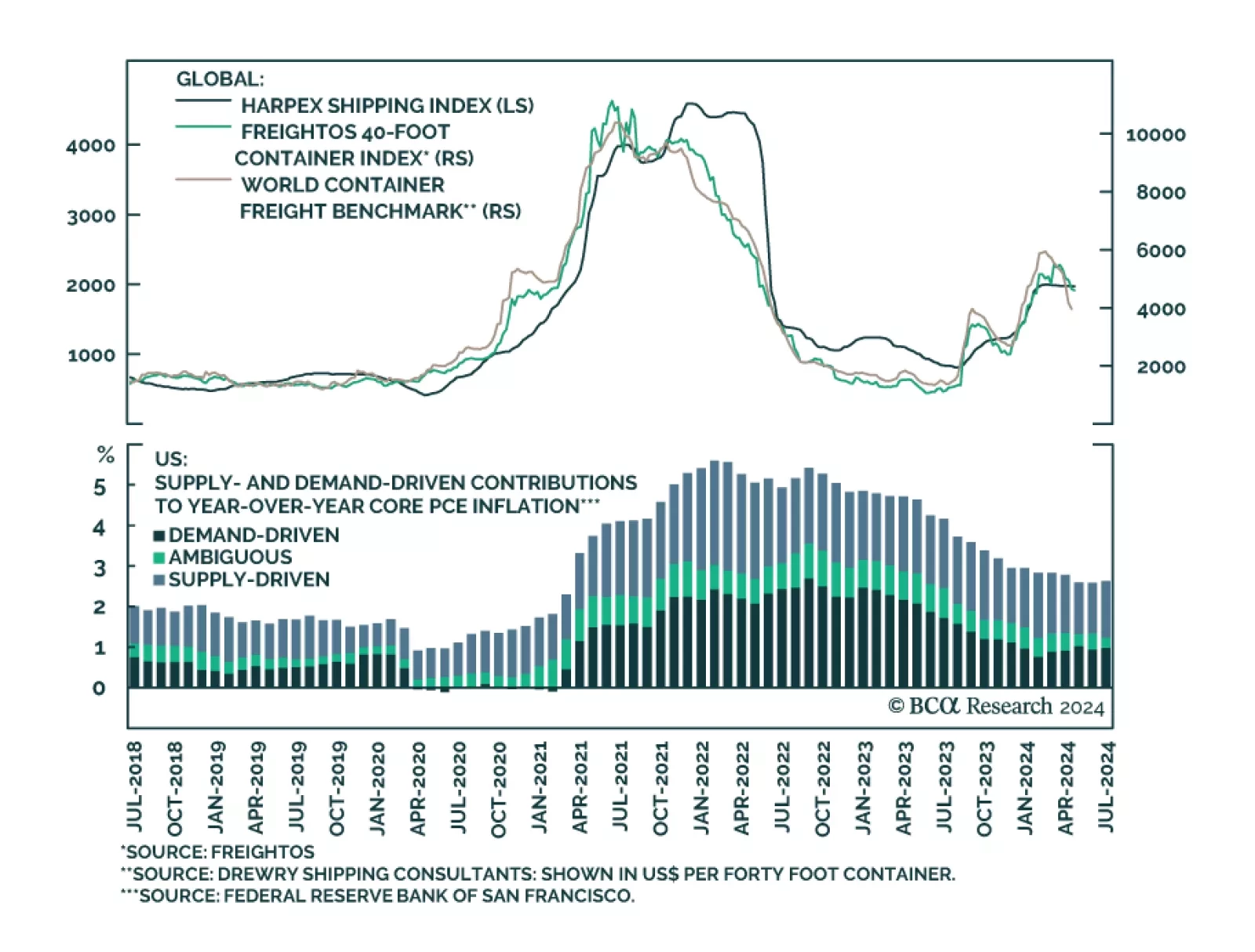

A US recession remains our base case over a cyclical investment horizon. We expect the ongoing labor market deterioration to eventually tip the economy into a recession. We therefore continue to expect the disinflationary forces…

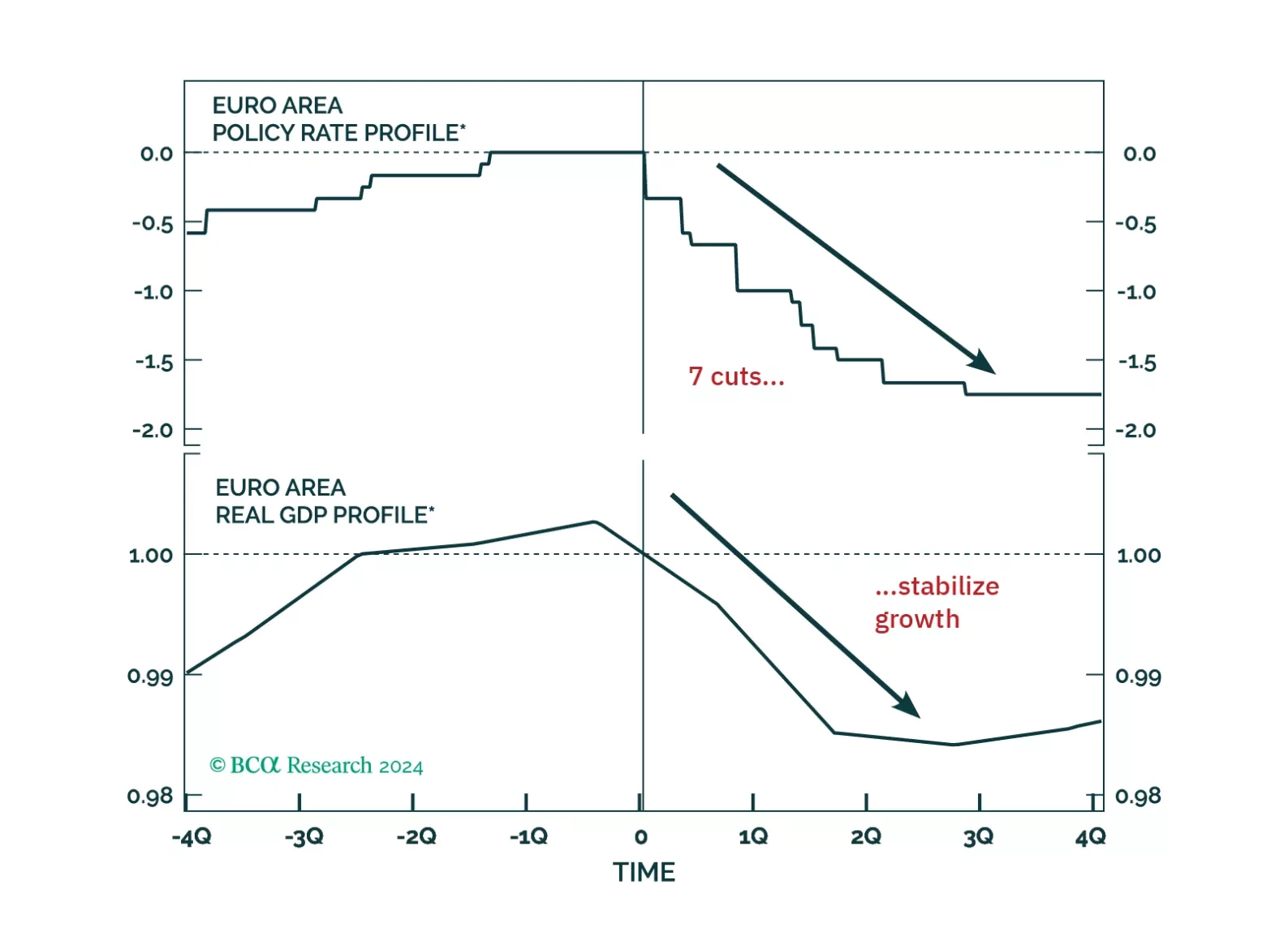

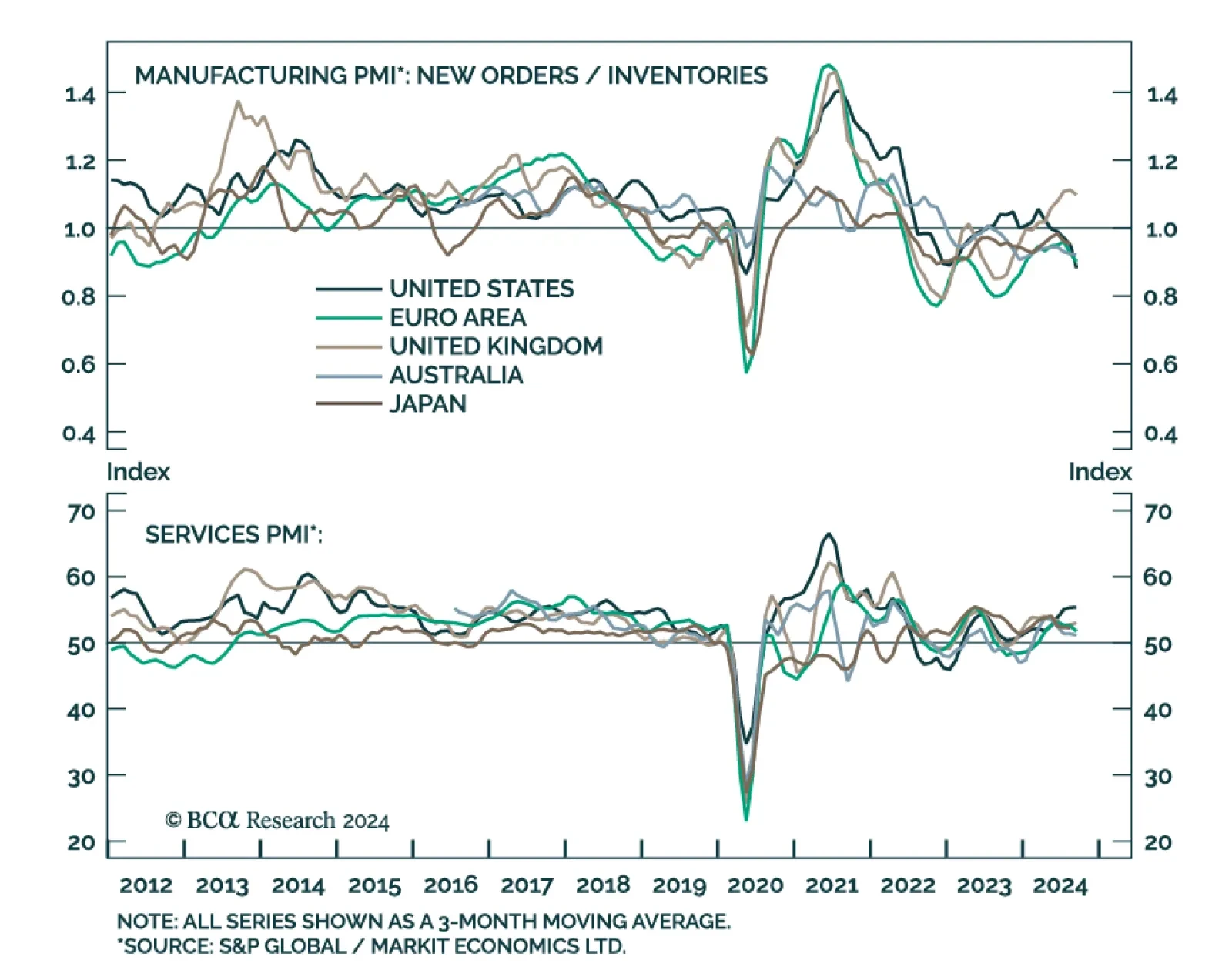

Preliminary estimates suggest that activity continued to slow across DM economies in September. Manufacturing PMIs contracted at a faster pace in the US, Eurozone, Germany, France and Australia, and grew at a slower pace in…