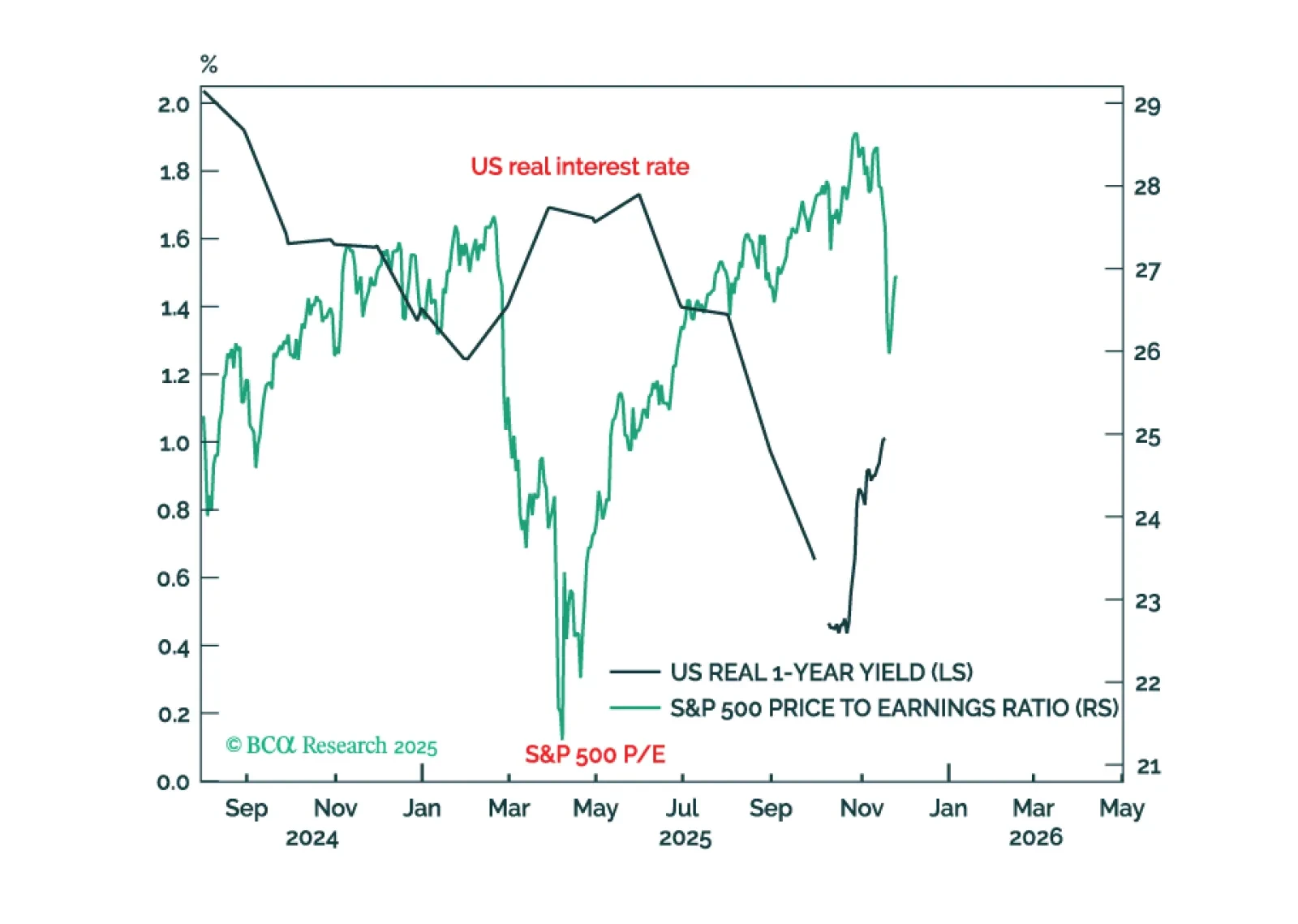

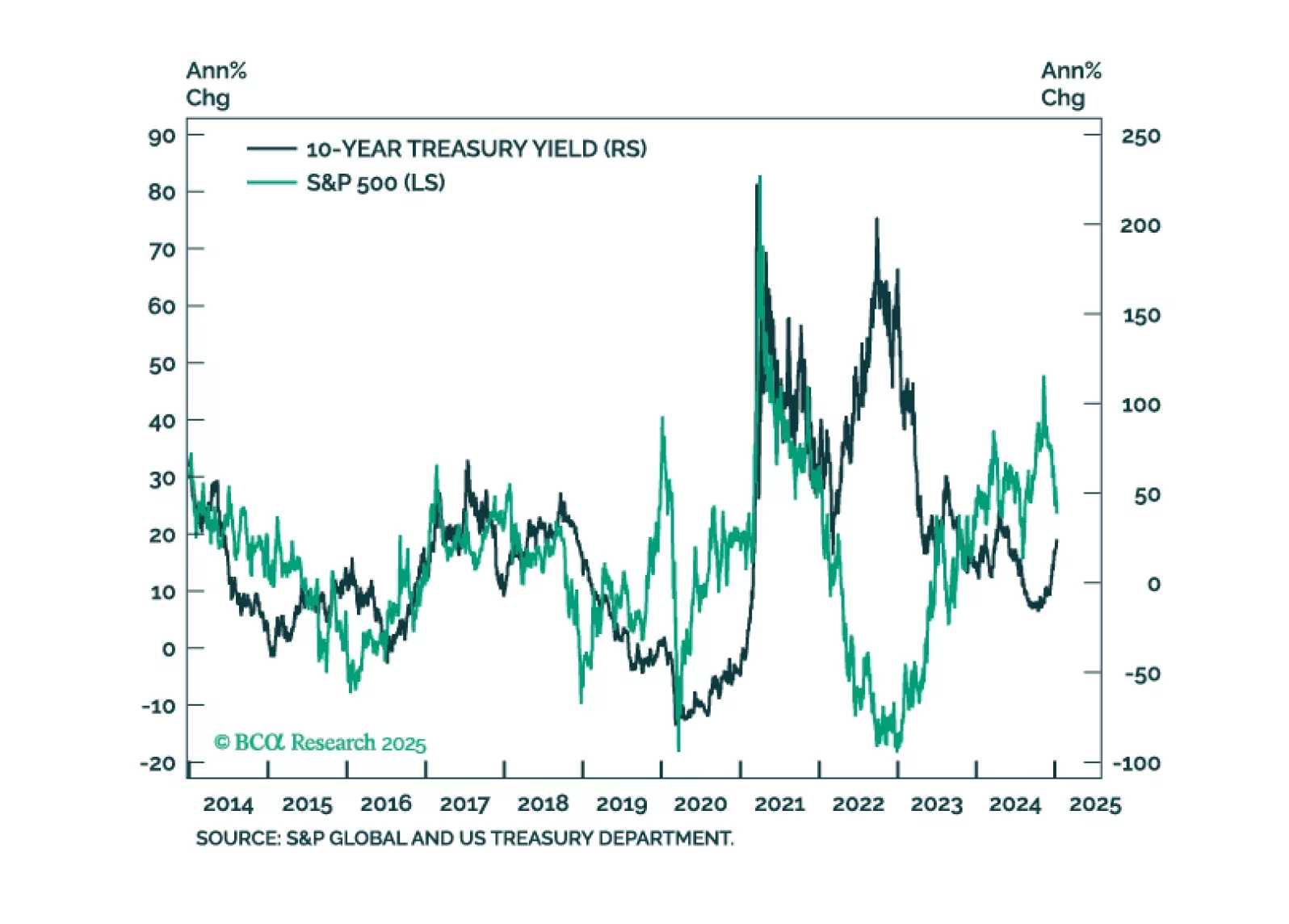

Stock market valuations are moving as a near-perfect mirror image of the US real interest rate, meaning that the Fed is underpinning the stock market. But if the market stopped believing in AI-driven profits growth, valuations would…

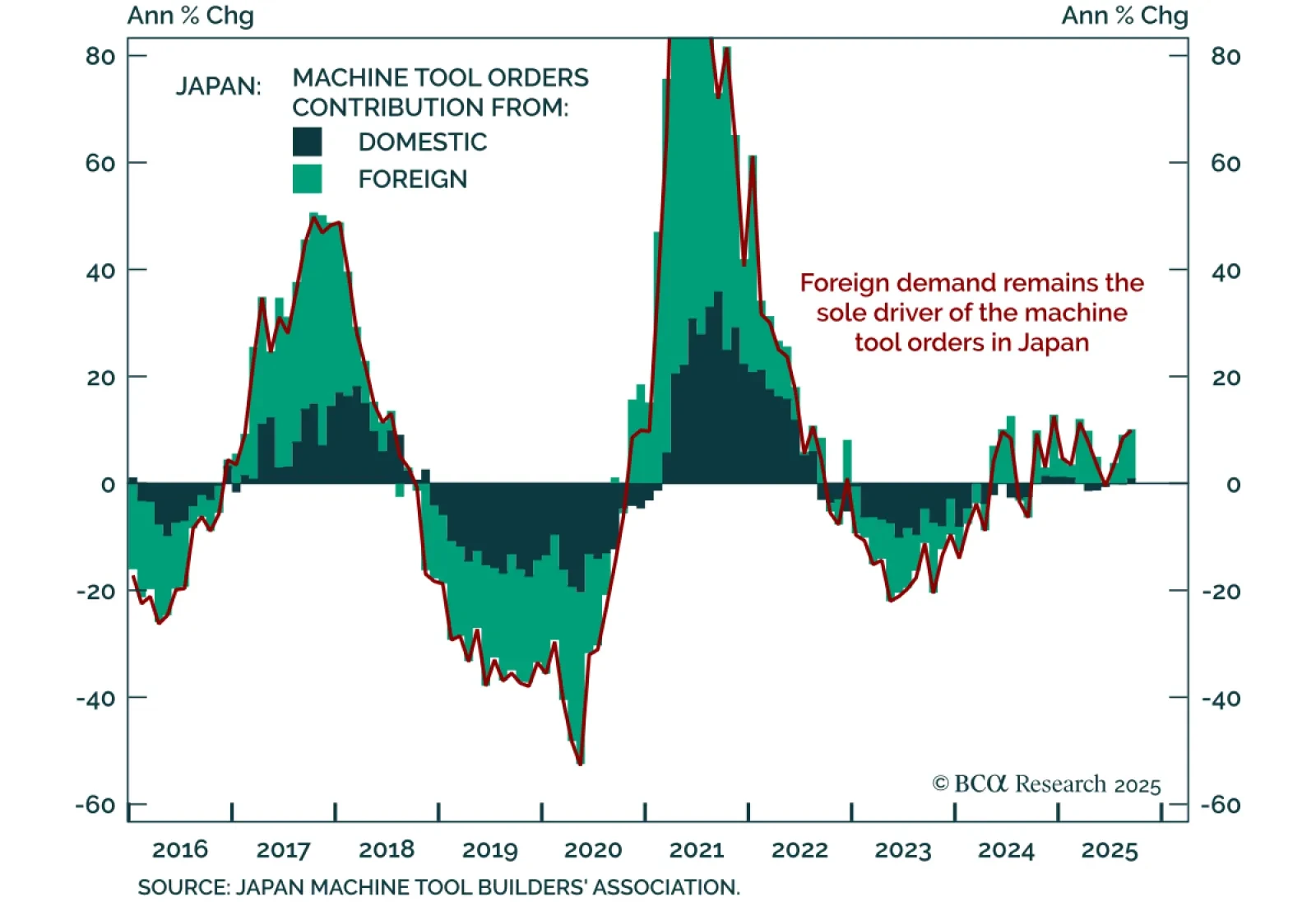

Japan’s September machine tool orders rose 9.9% year-on-year to a six-month high, led by a 13% jump in foreign exports, reinforcing the growing tailwind for Japan’s industrial sector and supporting a structural overweight yen…

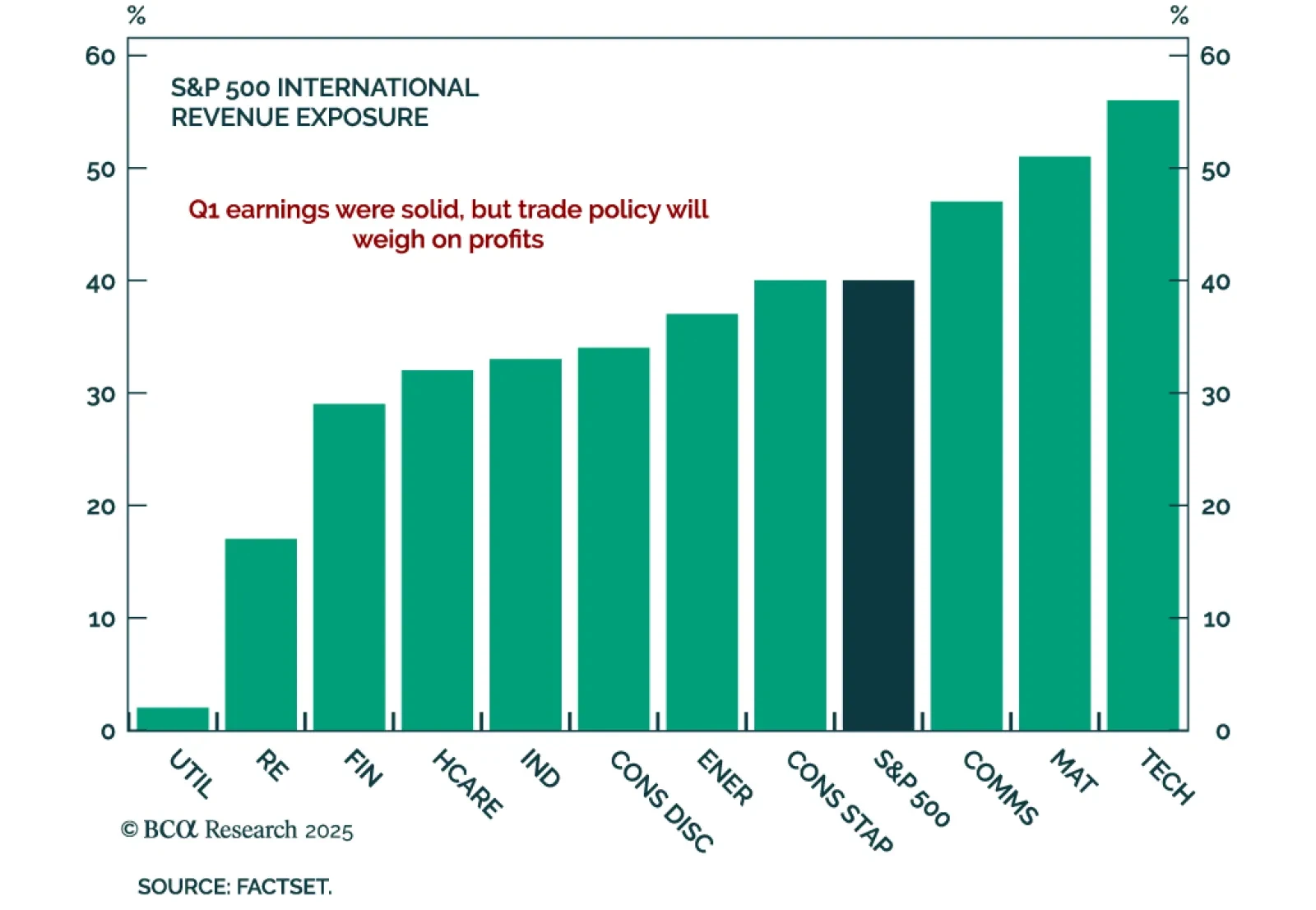

Q1 earnings point to risks for goods-focused sectors, reinforcing our US Equity strategists’ call to overweight services, upstream names, and domestic plays. With most S&P 500 companies having reported Q1 2025 earnings, the…

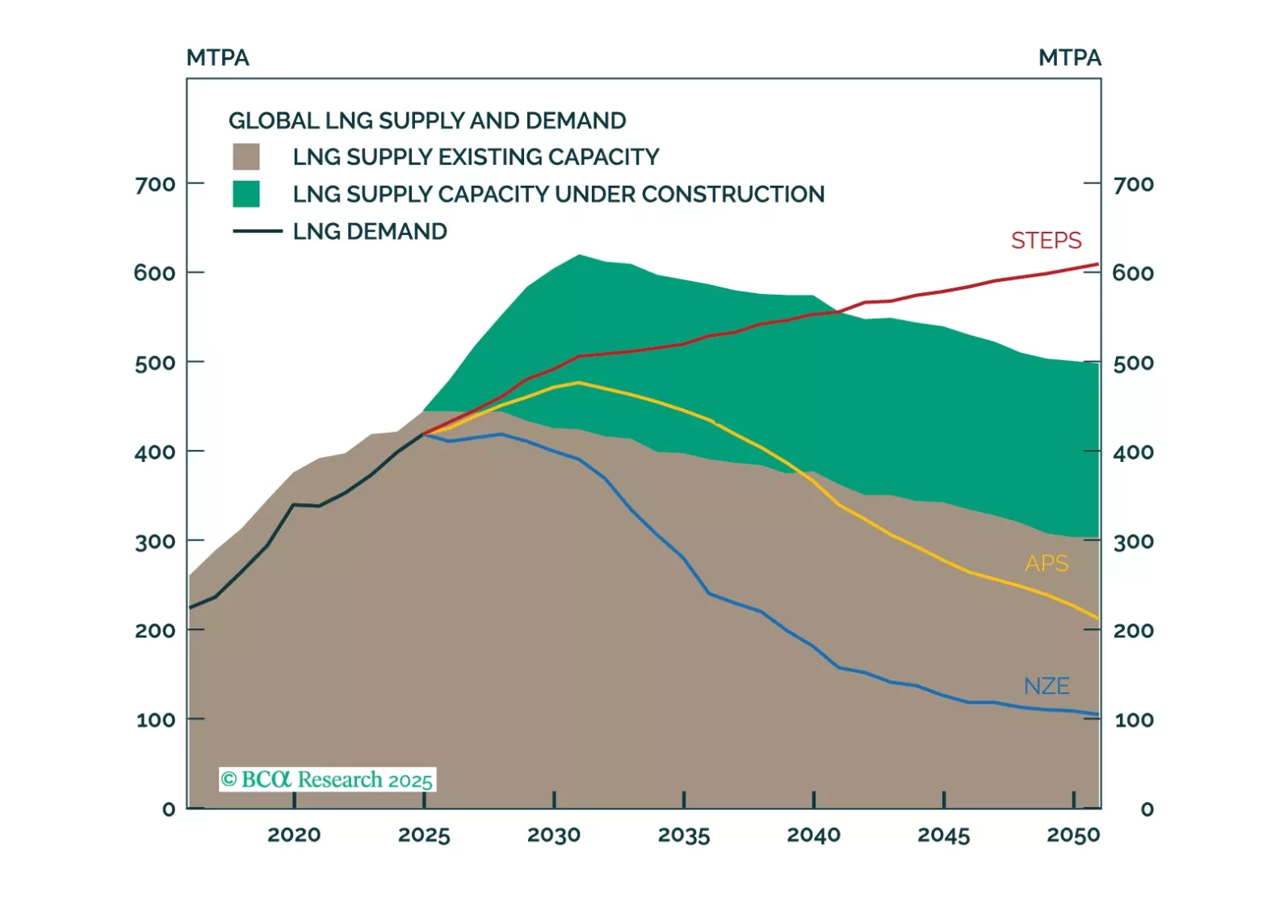

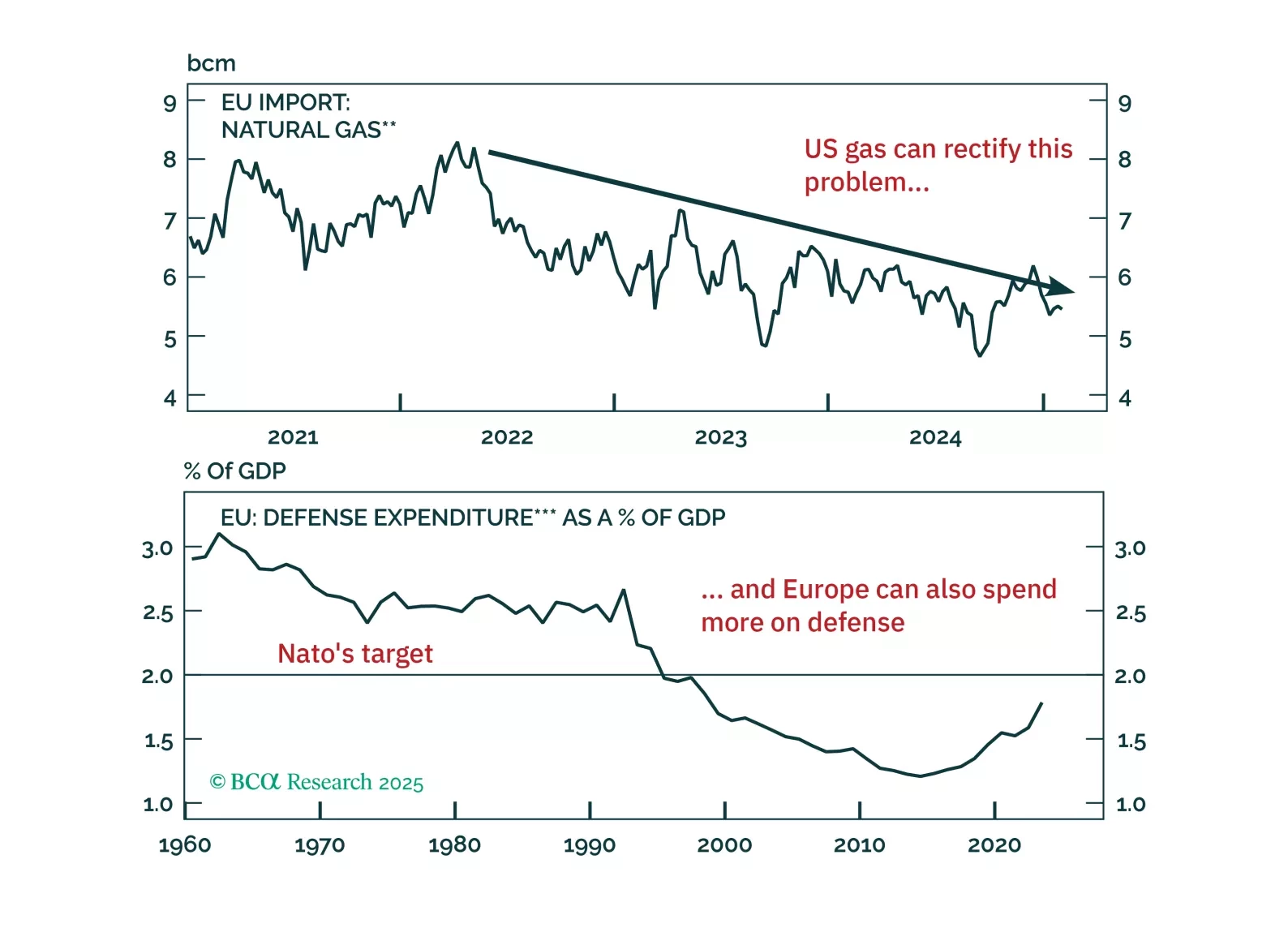

In this month’s Beta report, we continue our series supporting our bullish thesis on Europe. We take a deep dive into the aftermath of the European energy crisis – dispelling the myth that Europe faces risks of imminent…

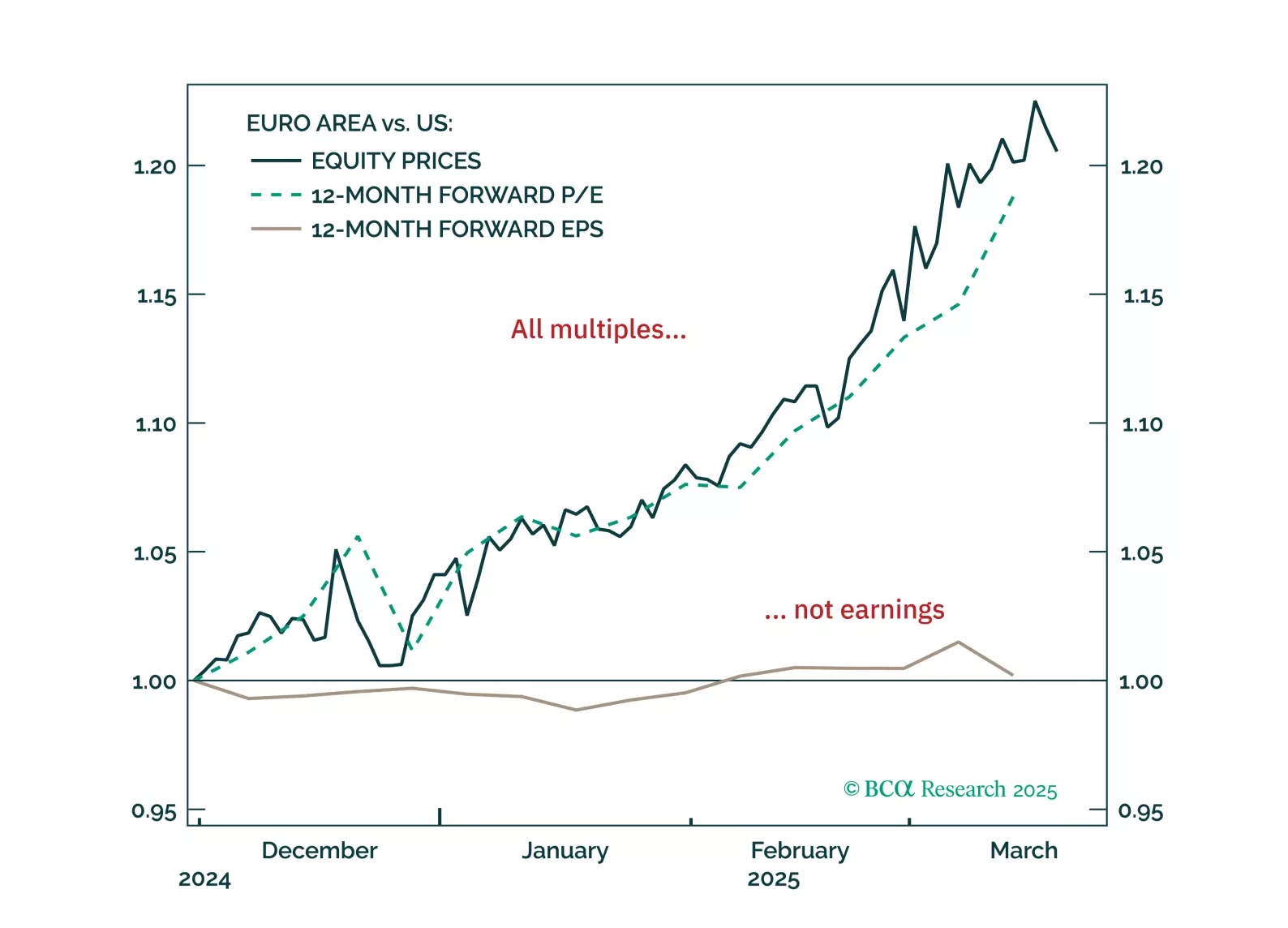

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

Europe is about to become President Trump’s next target. The good news: a US/EU trade war will be short as common ground to achieve a deal exists. The bad news: European assets remain at the mercy of heightened uncertainty. How…

In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…