Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

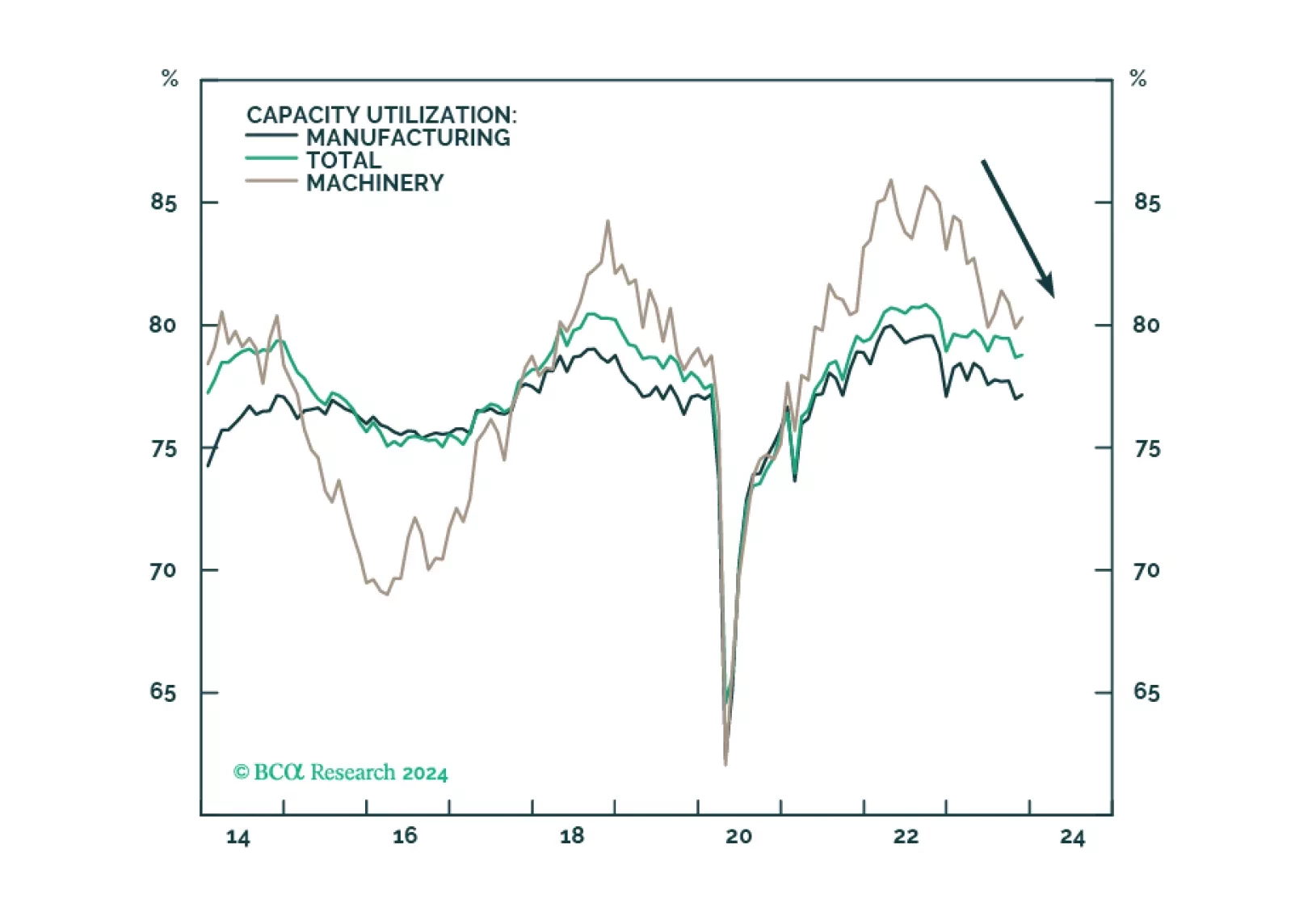

The US manufacturing renaissance, spurred on by reshoring, automation, and government spending, is running its course but progress has slowed on the back of tight monetary conditions and the manufacturing recession. The deceleration…

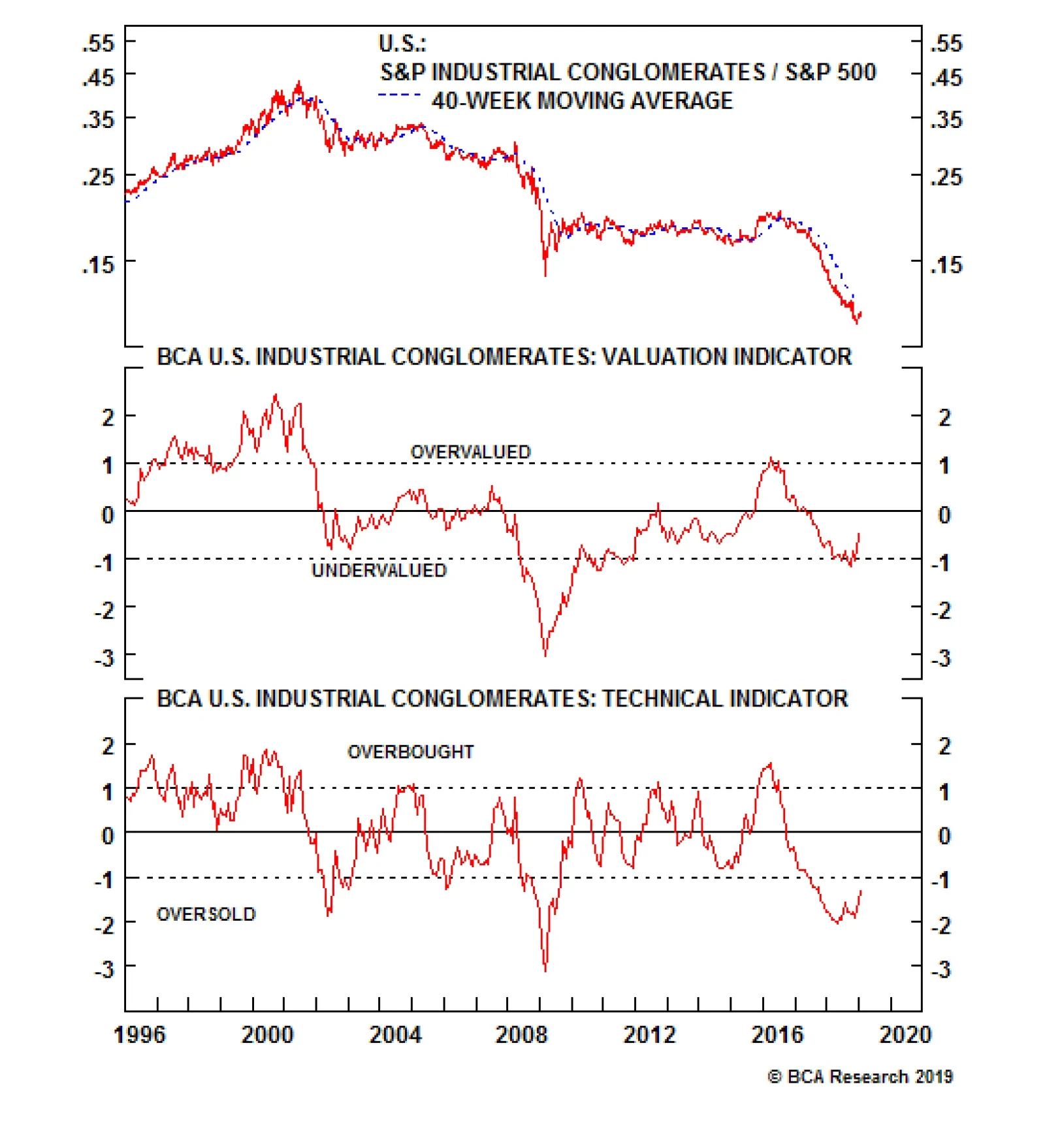

Overweight (Downgrade Alert) Last fall we felt all of the shoes had dropped in the S&P industrial conglomerates index: industrial conglomerate stalwart GE had cut their dividend to a token to $0.01 per share following…

The S&P industrial conglomerates index has been surging on the back of Q4 results that, while not reflecting particular operating strength, are better than the beaten down sector valuations would indicate. Importantly, MMM…

Overweight The S&P industrial conglomerates index has been surging on the back of Q4 results that, while not reflecting particular operating strength, are better than the beaten down sector valuations would indicate.…

Overweight Though it may be hard to see in the top panel of our chart amidst a spectacular long-term fall from grace, the S&P industrial conglomerates index has been outperforming for the past week. At first glance, much of the…

Overweight General Electric, the former heavyweight of the S&P industrial conglomerates index, found some reprieve Tuesday on the news that they had agreed to divest part of their investment in Baker Hughes as part of an overall…

Overweight 2018 has been a tough year for the S&P industrial conglomerates index as all of the key constituent members (GE, MMM and HON) have progressively either disappointed on earnings or lowered forward guidance. Further,…

Neutral In our recent initiation of coverage on the S&P industrial conglomerates sector,1 our neutral investment thesis was that the globally synchronous capital goods upcycle should mostly keep sales and profits buoyant in this…