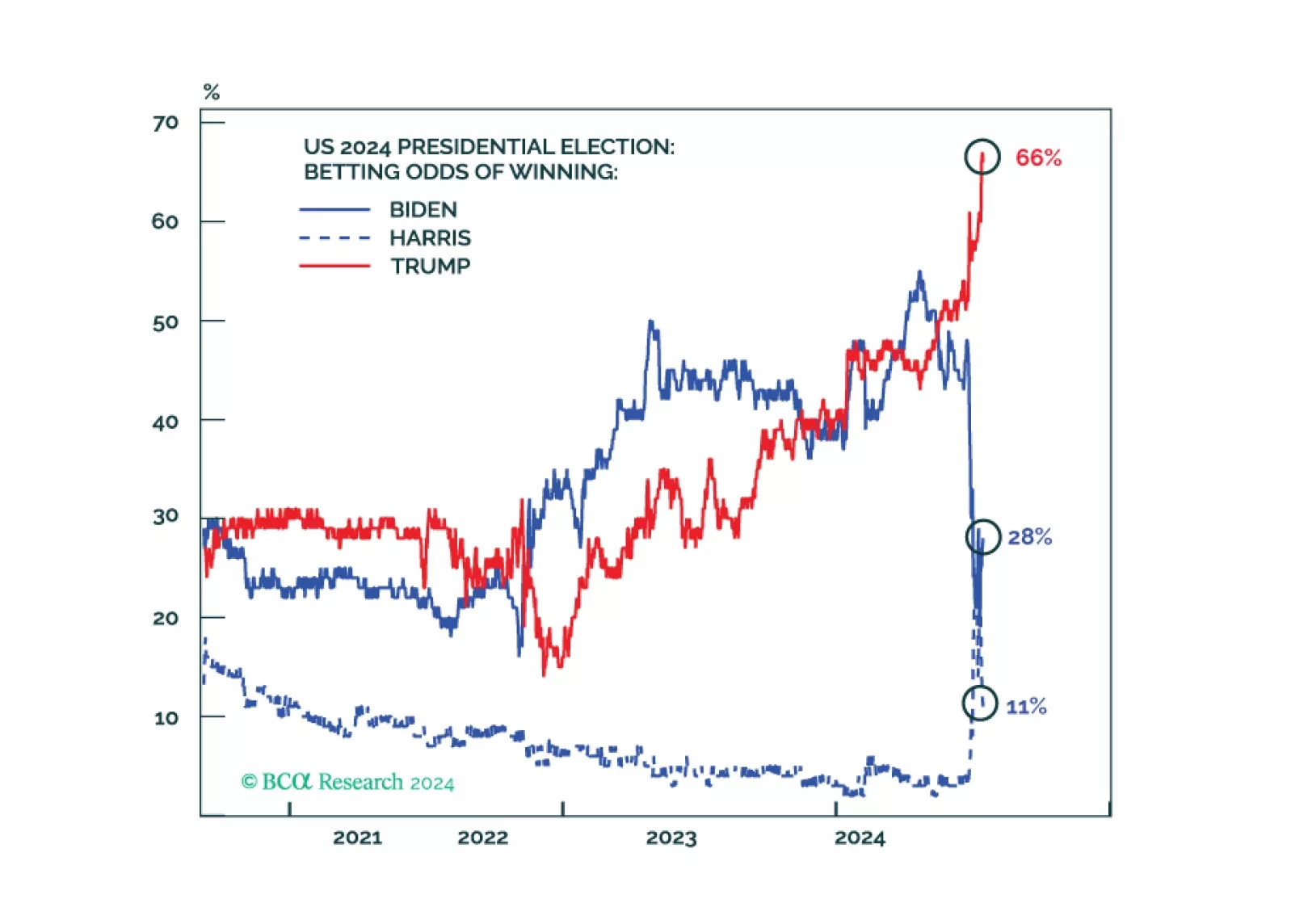

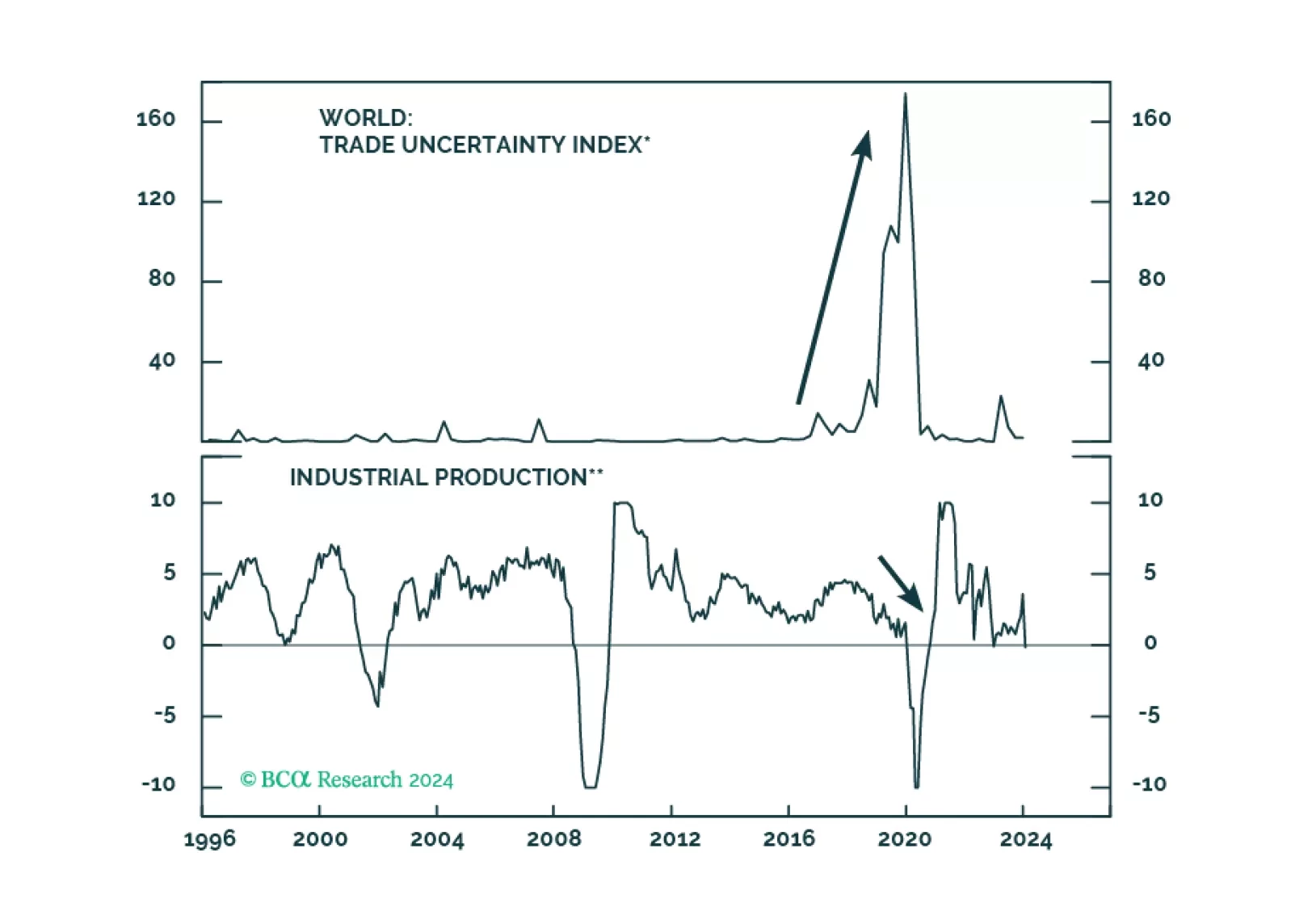

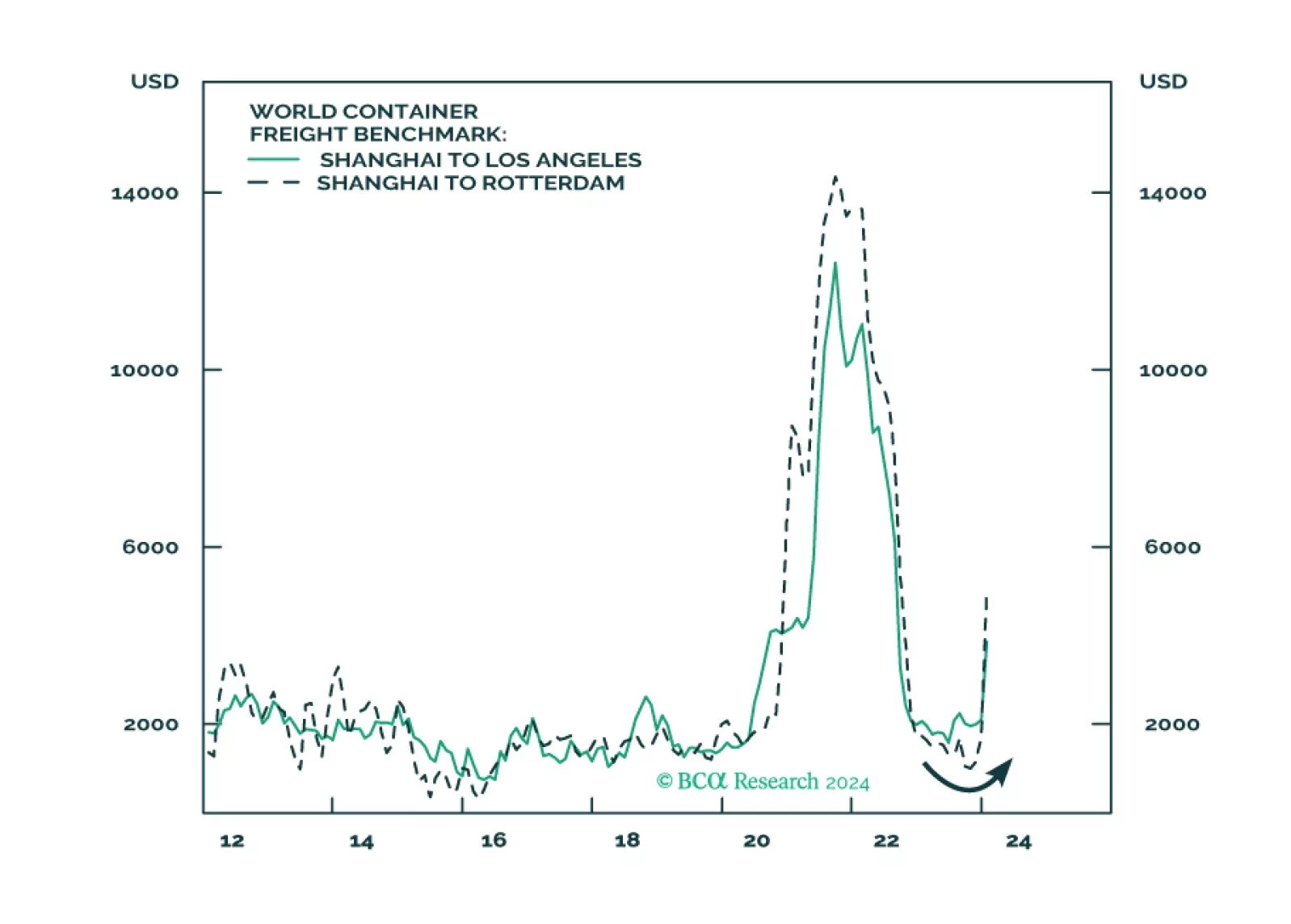

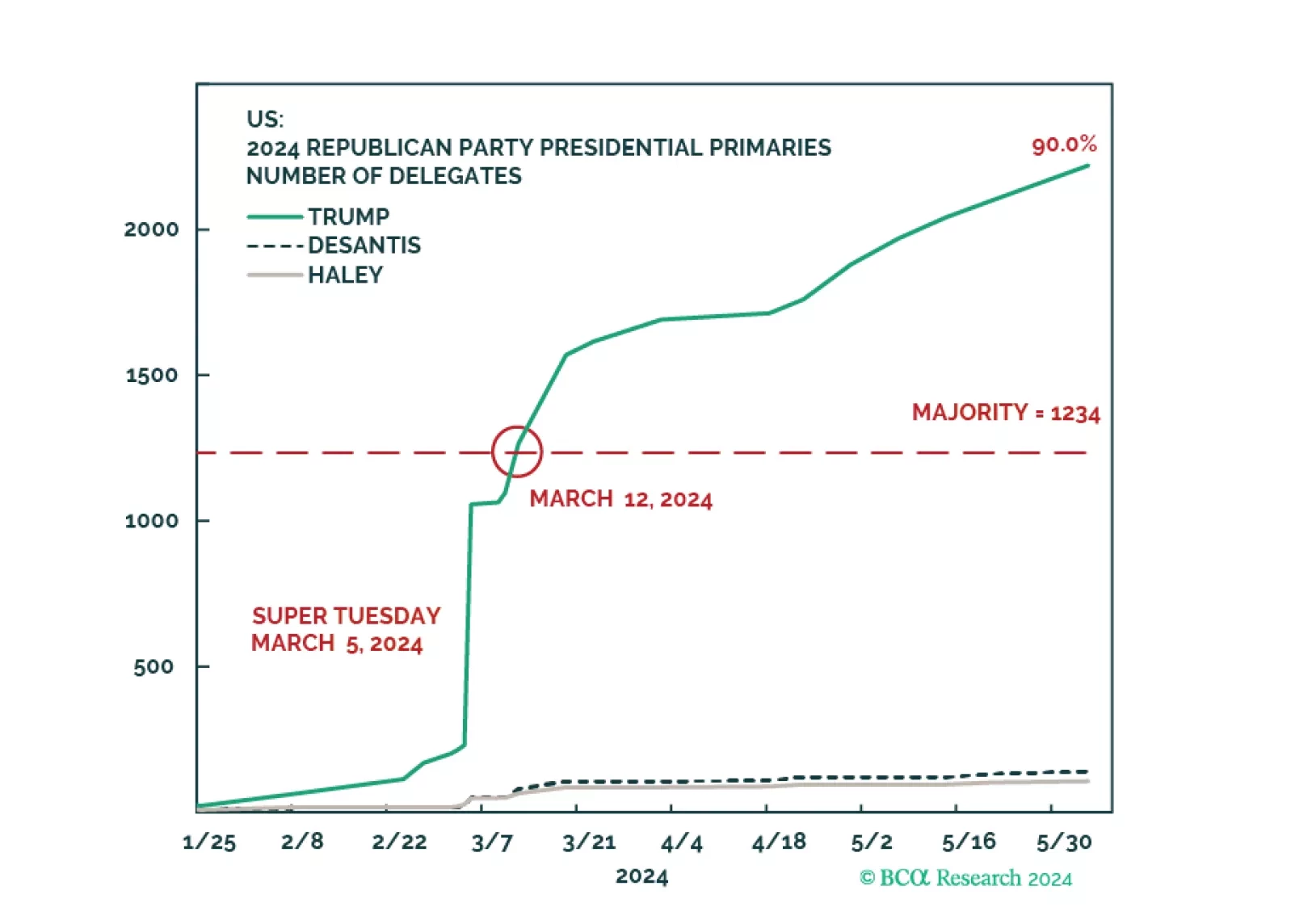

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

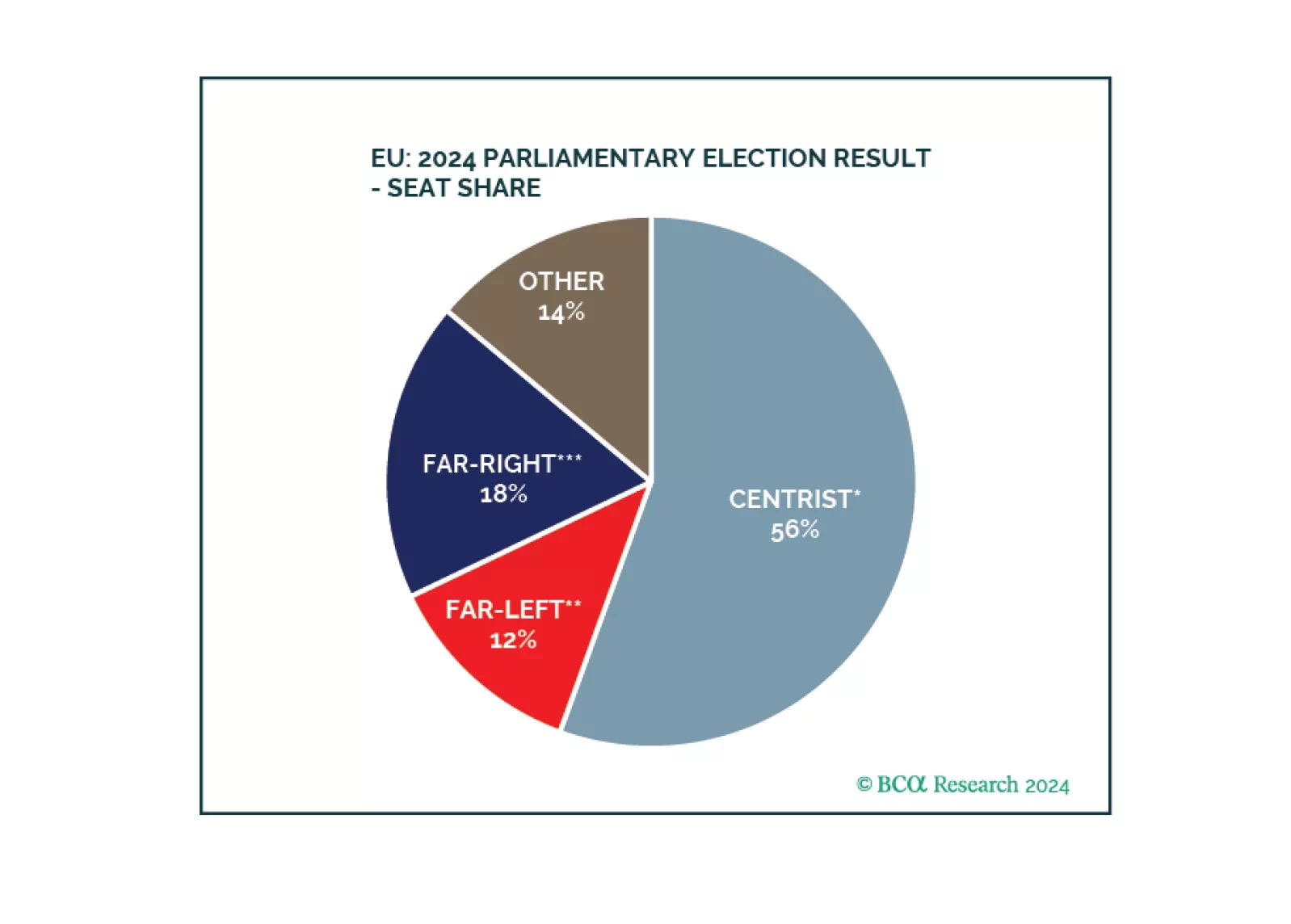

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

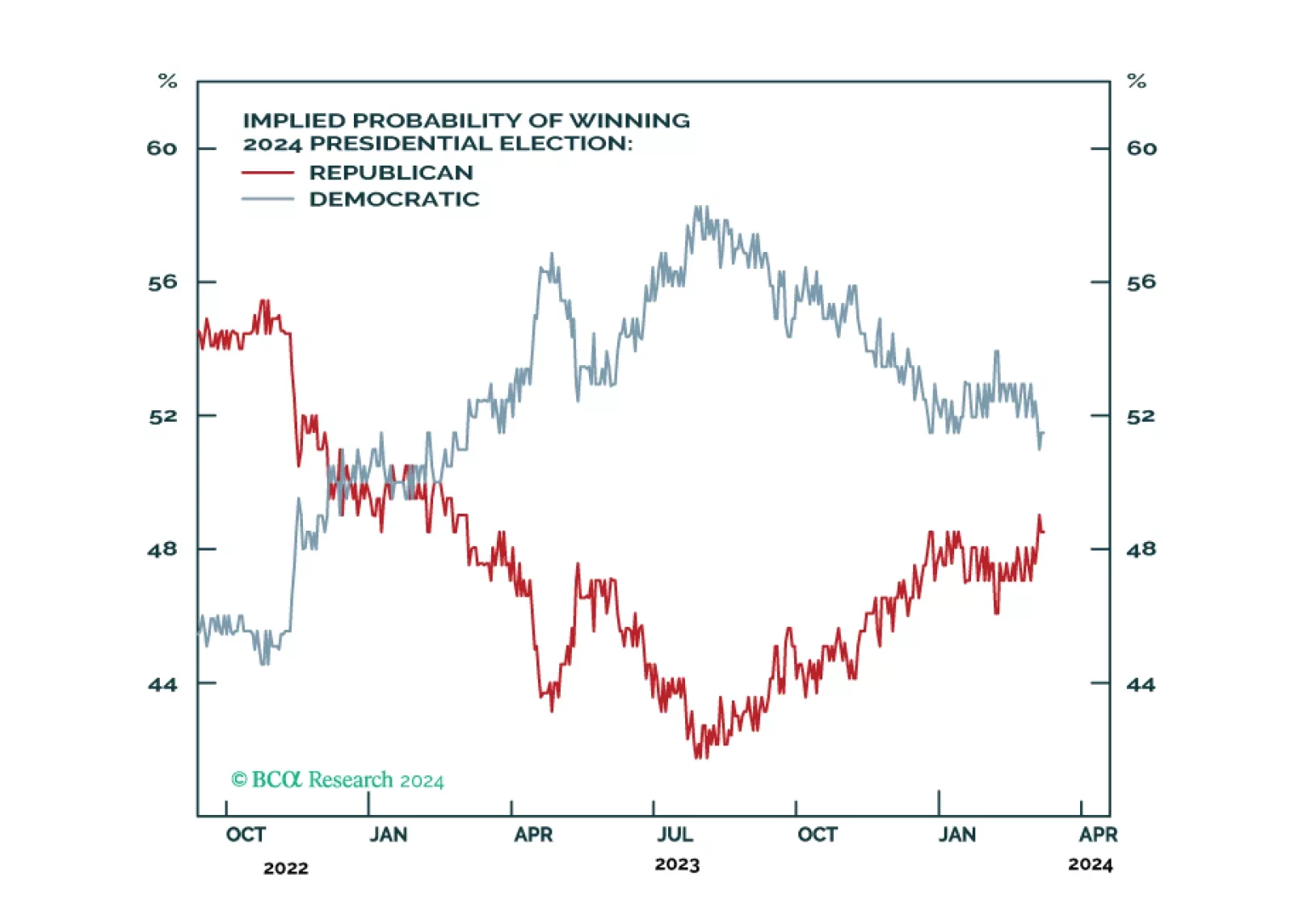

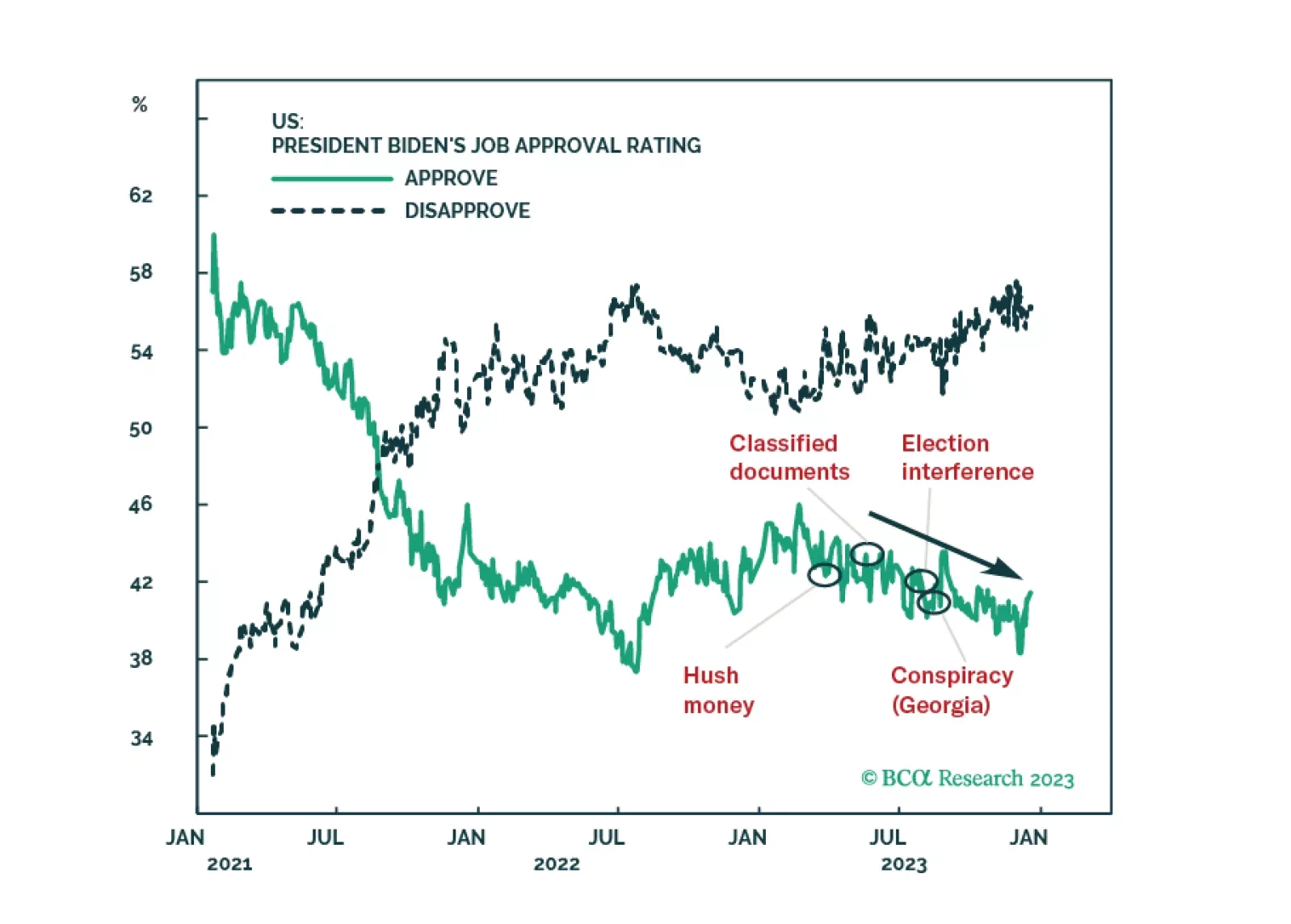

Democrats are still slightly favored for reelection as the incumbent party is presiding over a growing economy. However, Biden’s strong showing in the primary election is not lifting his popular approval yet, and that is a worrying…

Democrats remain favored for reelection in 2024, which implies gridlock and policy status quo in 2025. That is not negative for stocks in the near term. However, economic, political, and geopolitical risks will escalate from here,…

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

The market will eventually be forced to react to rising odds of a sharp US national policy reversal. Investors should overweight government bonds and defensive equity sectors.

The Republican Party’s odds of winning the 2024 election will benefit, if anything, from state courts’ attempts to exclude President Trump from primary or general election ballots. Higher odds of a change of ruling party will…