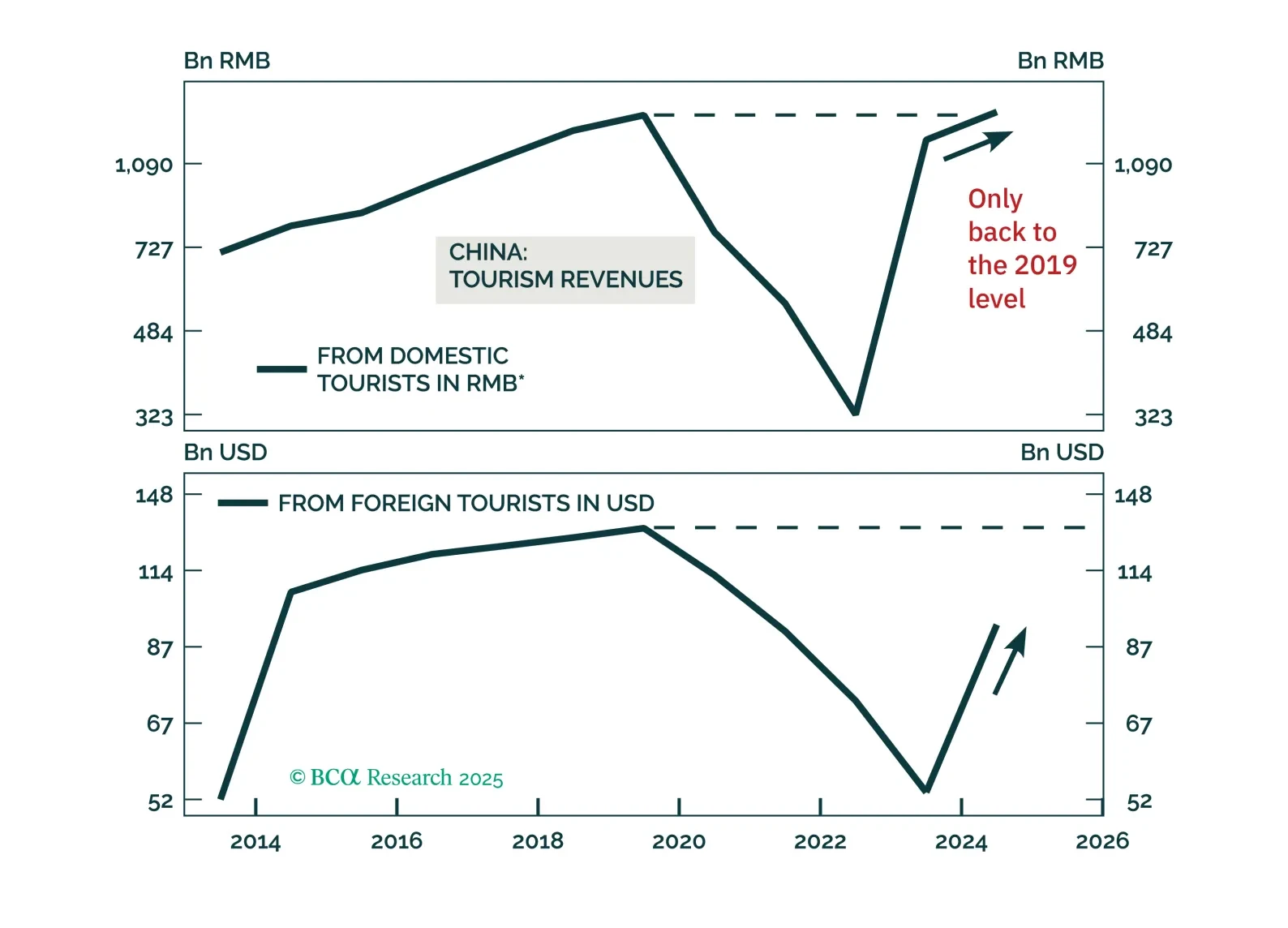

Chinese tourism will continue growing, but investors should be mindful not to overpay for Chinese tourism stocks by extrapolating their past double-digit revenue growth into the future.

In this week’s report “Adaptive Expectations: Revisiting Our Views”, we concluded that the S&P 500 is unlikely to find a bottom until inflation turns and monetary conditions stabilize, and US equities will follow a…

Highlights This is the second part of the publication, in which we provide an in-depth overview of Hotels, Restaurants, and Airlines, or the “travel complex” as we dubbed it. In last week’s report, we provided an…

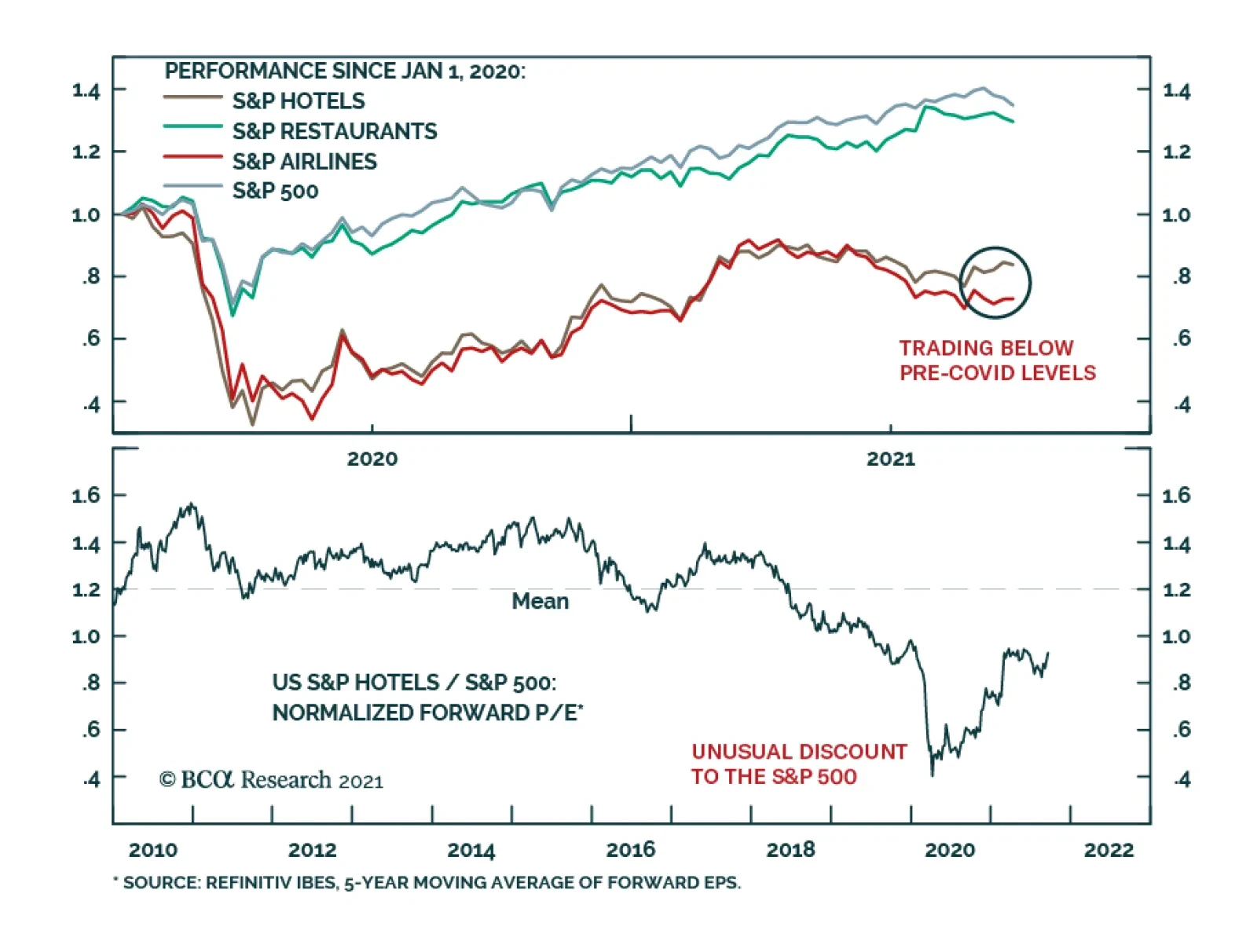

BCA Research’s US Equity Strategy service recommends overweighting the Hotels, Resorts, and Cruise Lines industry. The team summarizes this view as follows: The Delta variant is cresting. Their base case is that herd…

Highlights Covid-19 has wreaked havoc in the markets, but the Hotels, Restaurants & Leisure, and Airline industries have been most affected. These industries constitute what we call the “travel complex” as they share…

Highlights Portfolio Strategy Firming leading rail freight indicators signal that intermodal, coal and commodity (ex-coal) carloads are in high demand. Tack on the global economic reopening in the back half of the year and rising…

Dear client, Next Monday December 14, 2020 we will be hosting our last webcasts for the year “From Alpha To Omega With Anastasios”, one at 10am EST for our US, European and Middle Eastern clients and one at 8pm EST for our…

In this Monday’s Strategy Report we upgraded the S&P hotels, resorts & cruise lines index to an above benchmark allocation in light of the improving macro backdrop. Consumer sentiment has staged a W-shaped…

Dear Client, As is custom every year, next Monday November 30 instead of our regular Strategy Report you will receive BCA’s flagship publication “The Bank Credit Analyst” detailing the house views and themes for next…