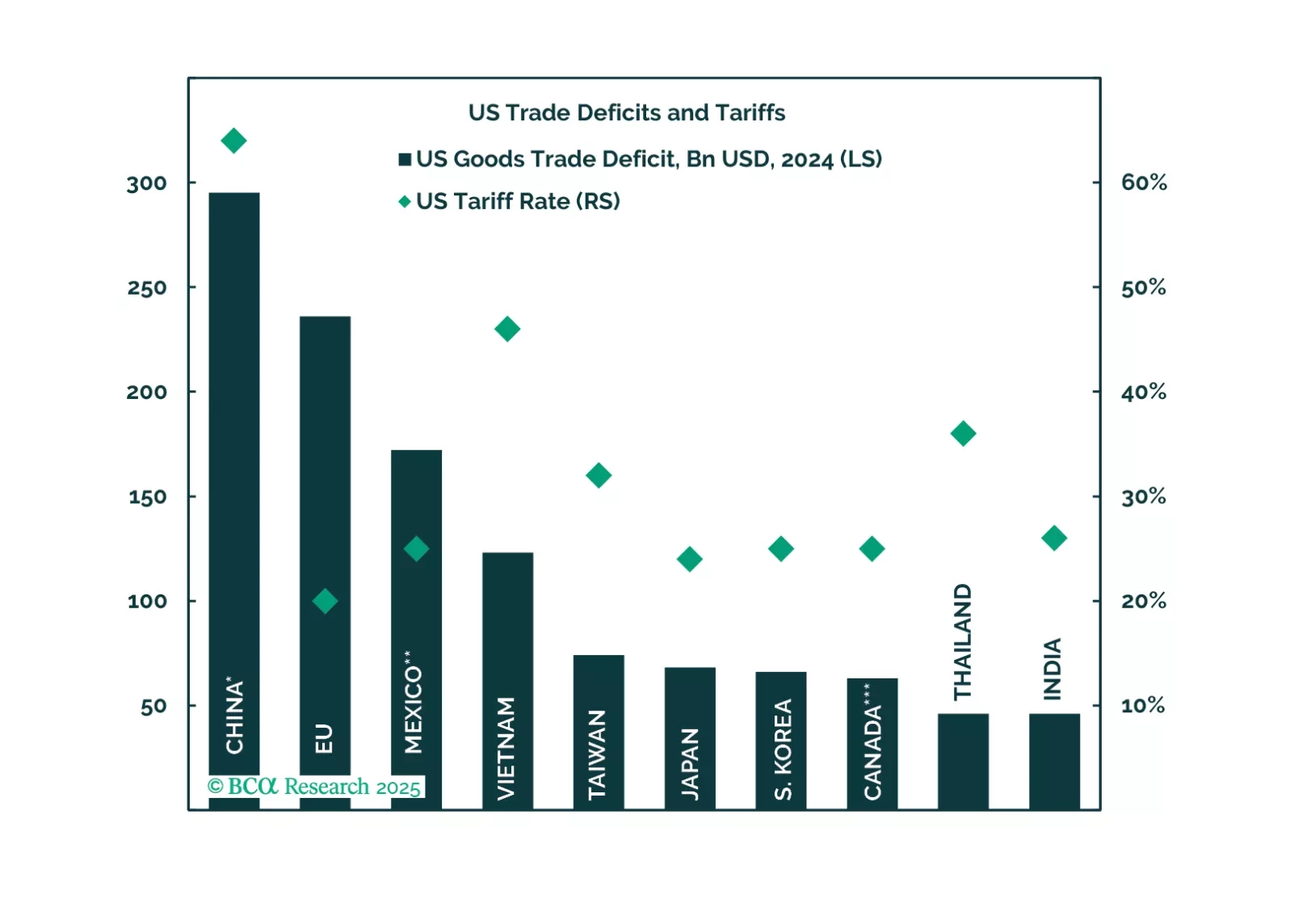

Trump's Tariff D-Day brings a negative surprise to financial markets already anxious over a declining US cyclical economy. Investors should sell risky assets, increase safe havens, and overweight US assets in the near term.

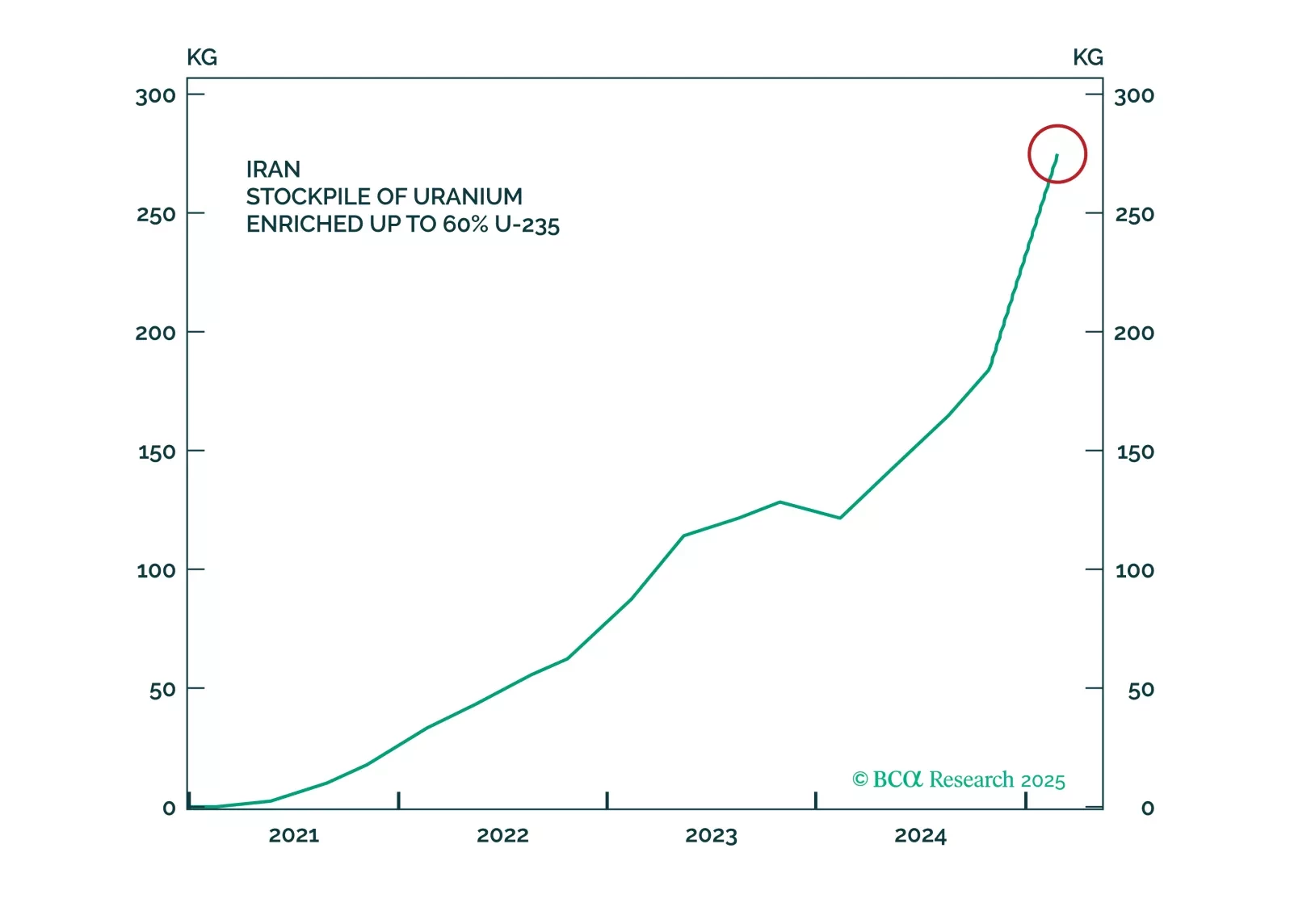

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

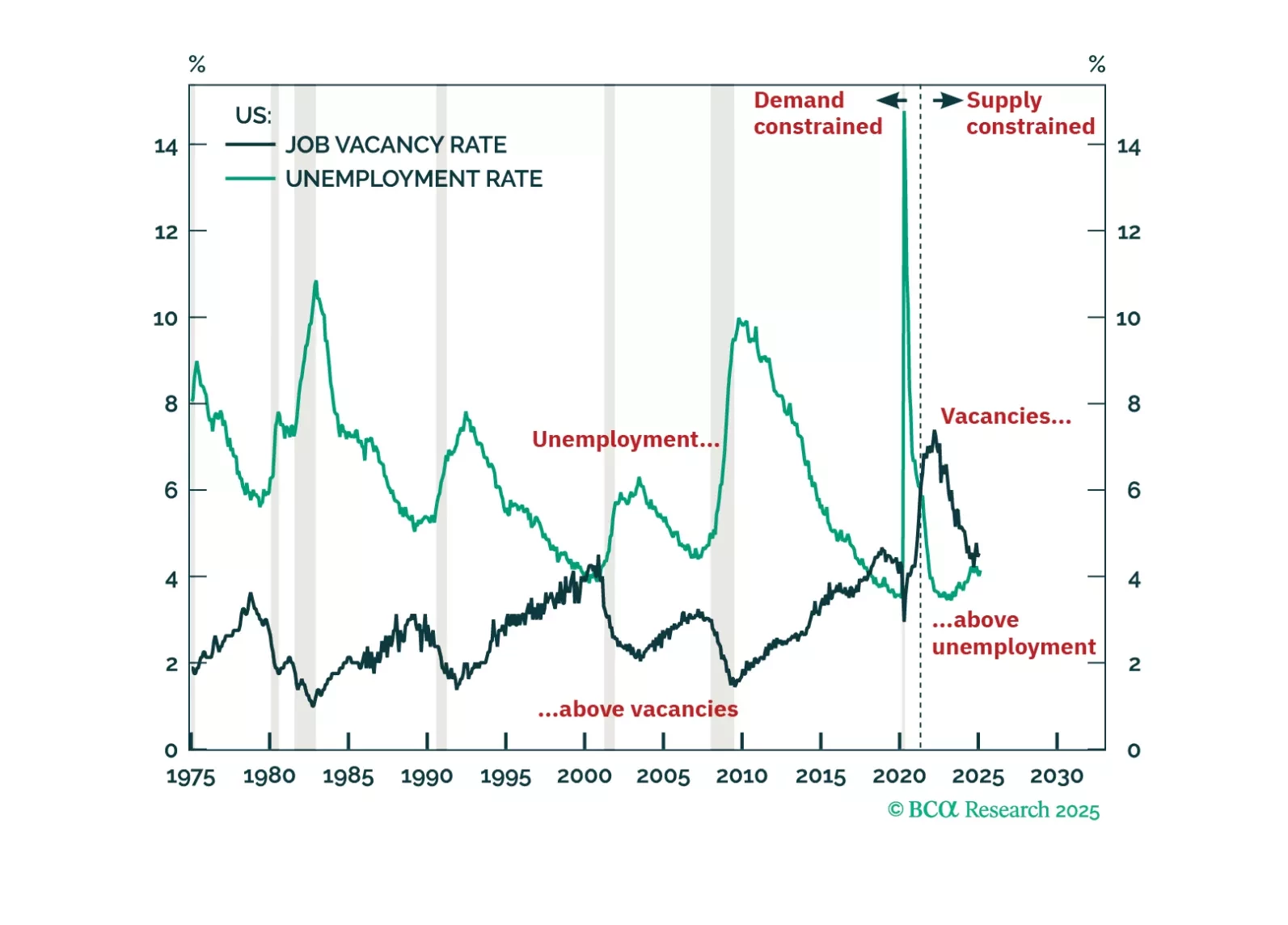

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

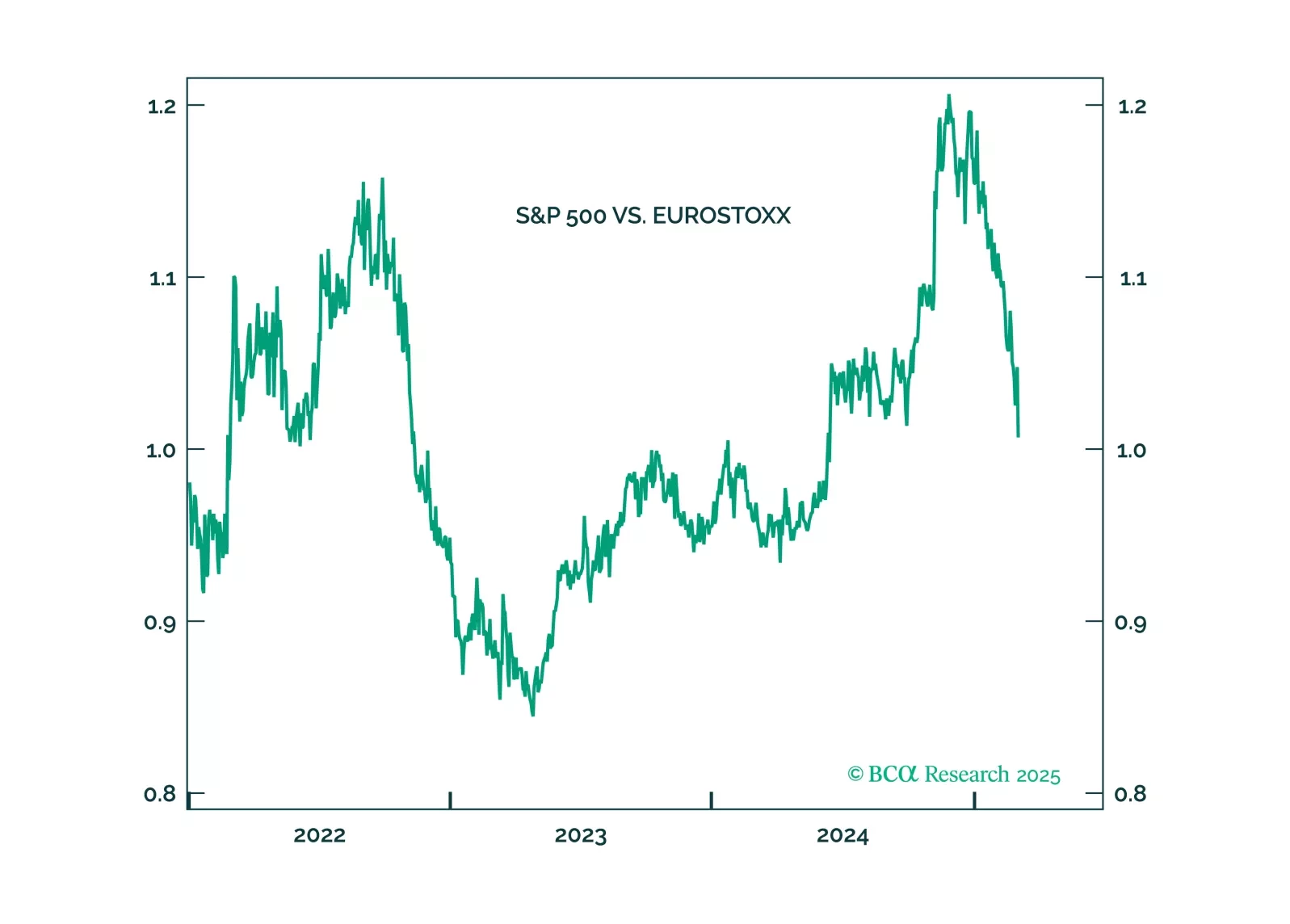

Trump will pull back from the trade war when stocks approach bear market territory. He will not withdraw from NATO. Favor European stocks on fiscal policy.

The tariffs on Canada and Mexico will come into effect as scheduled while the tariffs on China will be doubled. In the Middle East, Iranian response to any attack will threaten Middle Eastern oil supply. Meanwhile, Chinese fiscal…

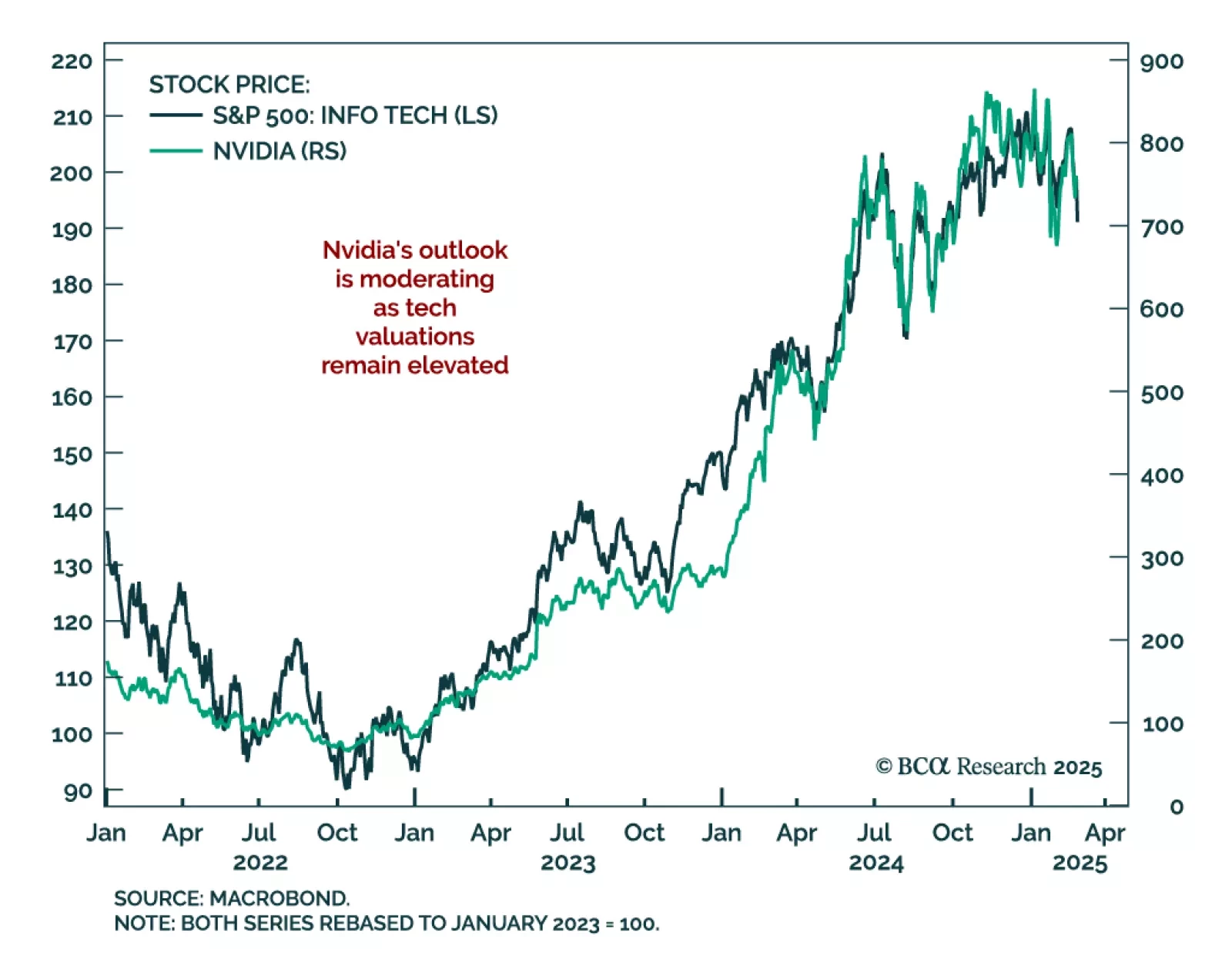

Nvidia announced good results, but Q1 sales guidance fell short of expectations. The numbers point to growth normalization as investors have been accustomed to blowout numbers. Nvidia’s meteoric rise means investors think about…

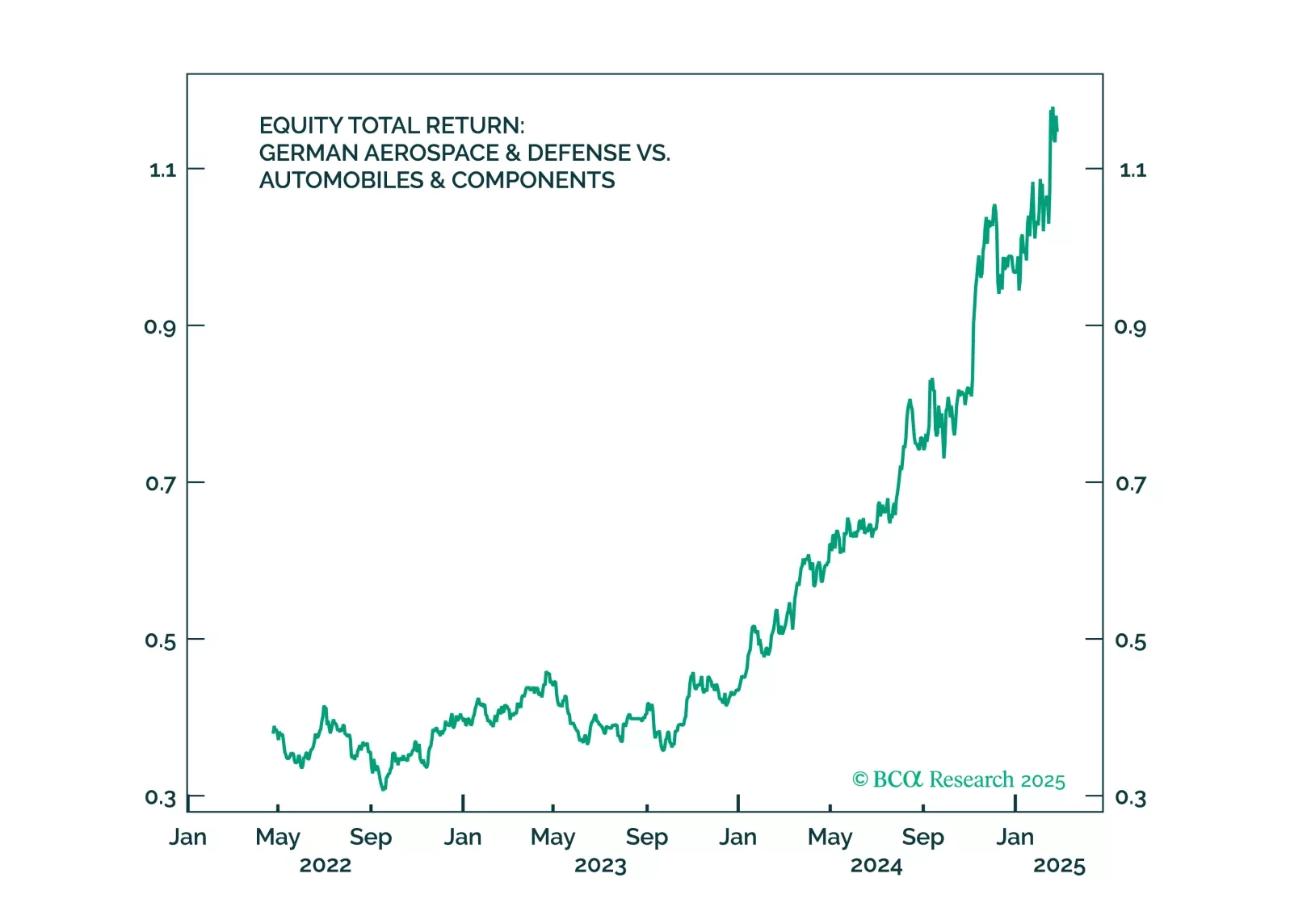

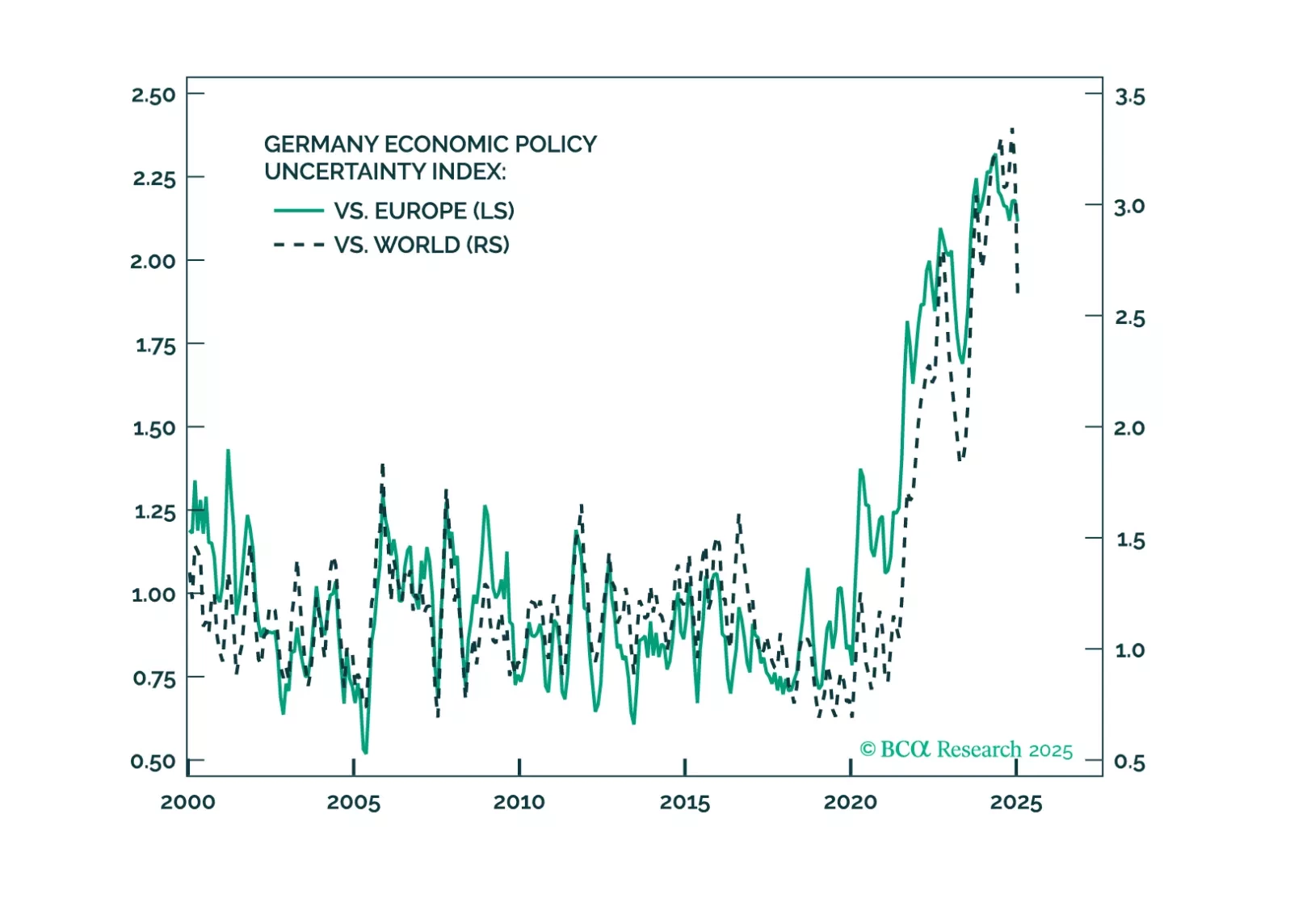

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

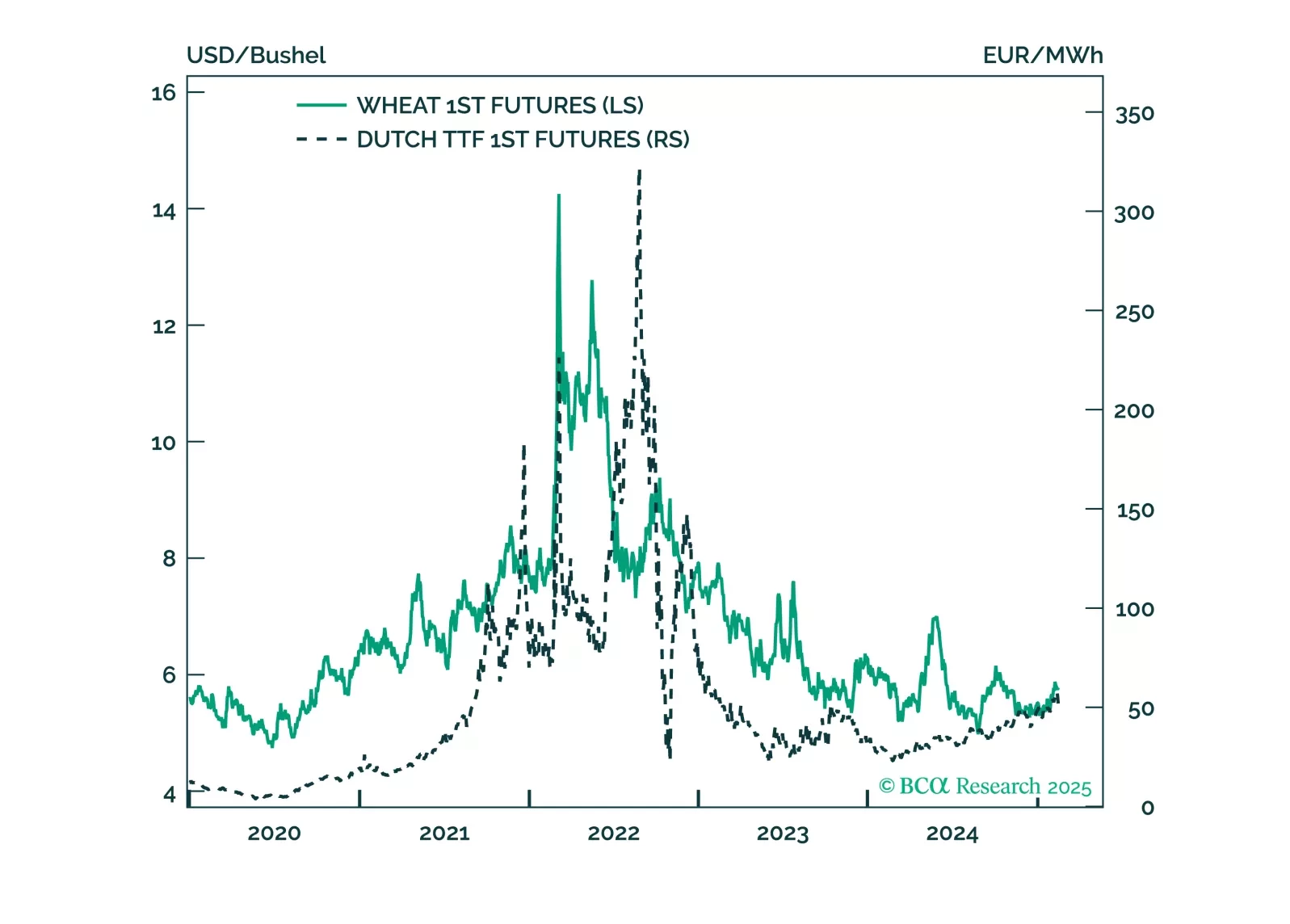

President Trump is negotiating a ceasefire in Ukraine. This will be a marginal headwind to some commodities which benefitted from the conflict like natural gas and wheat, and will be a marginal tailwind for European assets,…

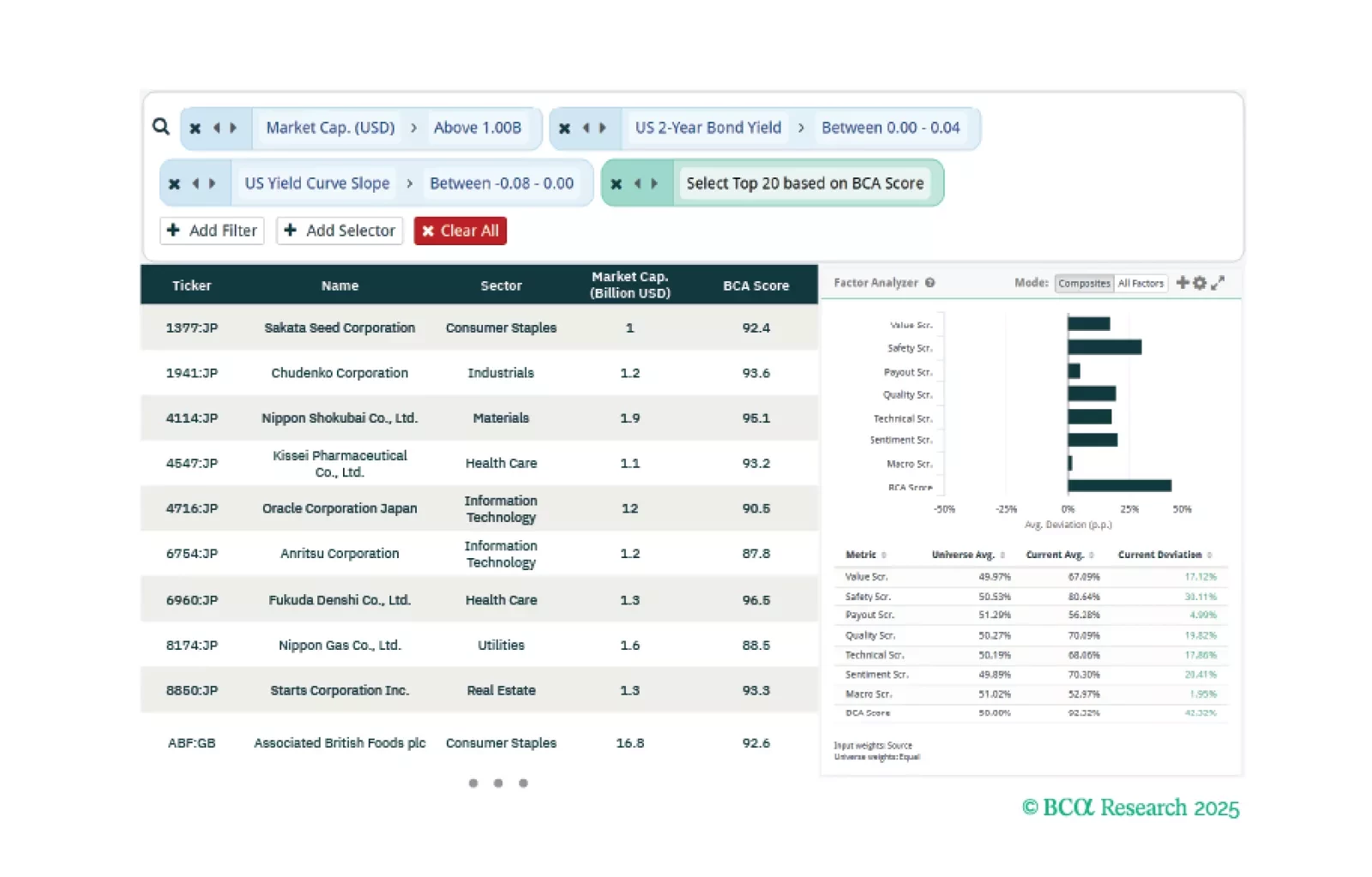

This week, our three screeners focus on providing equity insights based on the impact of tariffs, and trade policy uncertainty in general, helping clients identify stocks exposed to these shocks.