Underweight High-Conviction The latest GDP release as it pertains to housing made for grim reading: residential fixed investment has subtracted from real GDP growth for five consecutive quarters, which is unprecedented outside of a…

Neutral In a report late last month, we noted that our overweight recommendation on S&P homebuilders had generated alpha in excess of 10% for our portfolio, despite being offside early. However, we further noted a…

In late-January we put on a market, sector and subindustry neutral trade preferring homebuilders to home improvement retailers (HIR) as a way to benefit from the increase in residential construction at the expense of residential…

Highlights Portfolio Strategy Firming relative demand and input cost dynamics, the Medicare For All (MFA)-induced panic selling in HMOs coupled with 5G euphoria buying in semis have set the stage for an exploitable pair trade…

Highlights Portfolio Strategy China’s ongoing reflation trifecta, rising commodity prices, a back-half of the year global growth recovery, favorable balance sheet metrics and neutral valuations and technicals all signal that the…

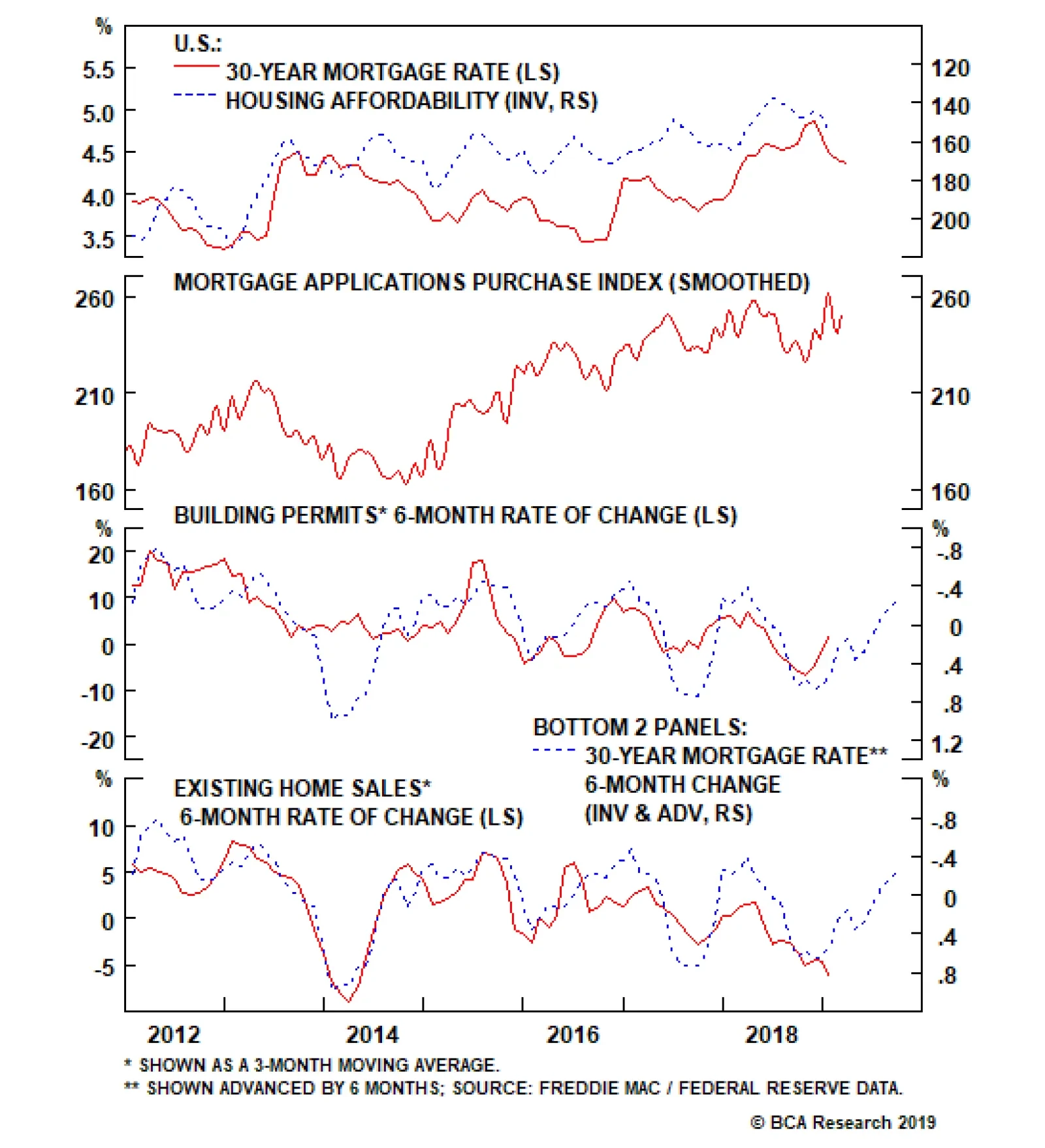

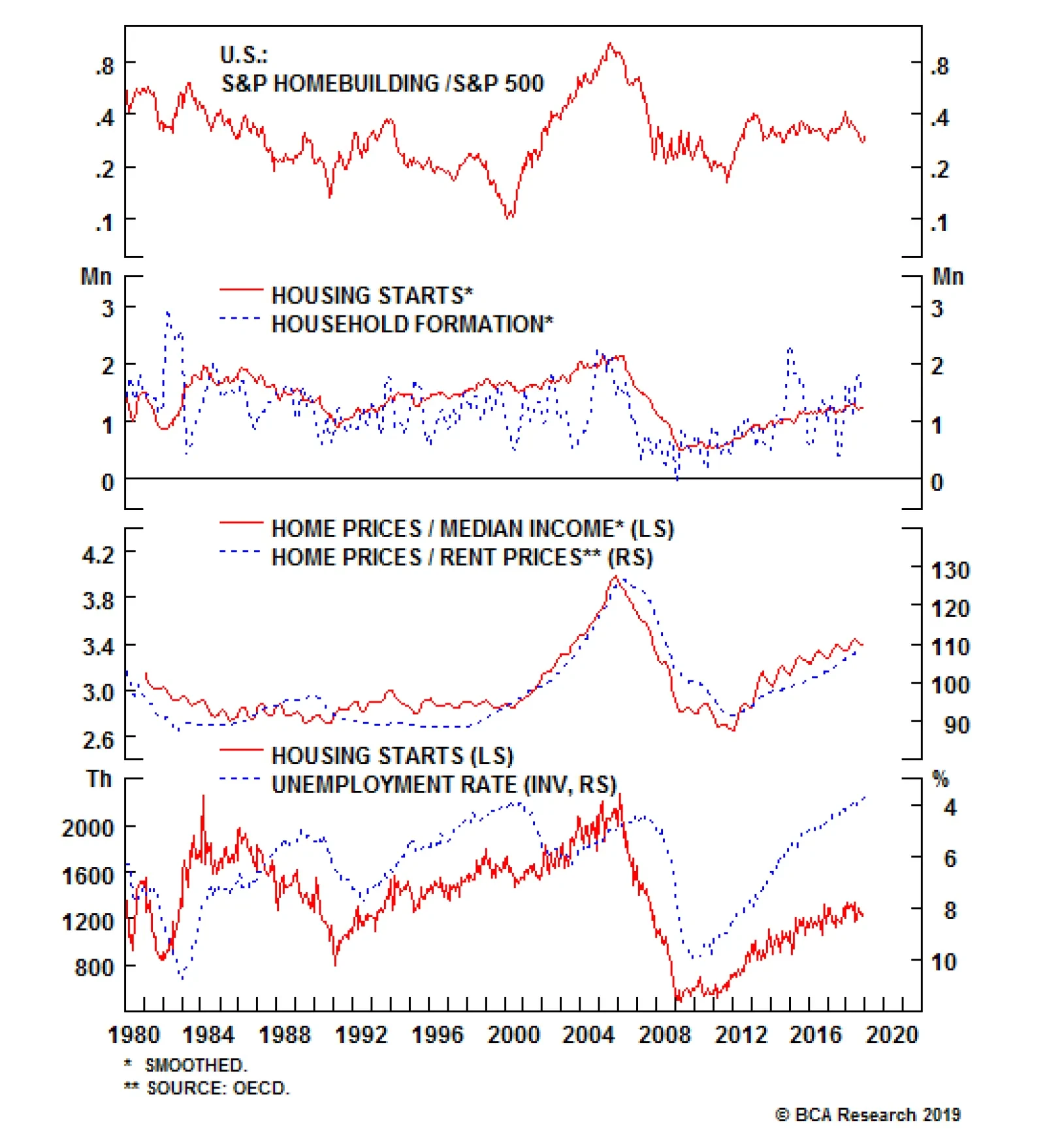

Overweight The S&P homebuilders index has been outperforming nicely so far this year on the back of renewed optimism in the domestic housing market. This is reflected in the V-shaped recovery from the end-…

The share of residential investment as a percentage of GDP has been steadily decreasing over the past 70 years, and is down to just 3% today. Although housing remains an important component of the U.S. economy and large…

Highlights A no-deal Brexit which did not cause pain pour encourager les autres would be the much graver existential threat for the EU. A U.K. parliamentary vote to extend Article 50 by a few months would not be a game changer in…

Domestic long-term housing prospects remain compelling, especially given that the GFC wrung out all the residential real estate excesses. Currently, household formation is still running higher than housing starts and building…

Highlights Portfolio Strategy We highlight our top seven reasons of why it pays to initiate a long materials/short utilities pair trade this week. Enticing long-term residential real estate prospects, a vibrant labor market, the recent…