Highlights Portfolio Strategy Interest rates are one of the most important macro drivers of overall equity returns via valuations. BCA’s view of a selloff in the bond market is a key factor underpinning most of our 2020 high-…

Underweight The downward oscillation in the S&P homebuilders index is slowly taking shape as the index lost more than 4% versus the SPX since inception a mere eight trading days ago. While still early we are surprised by the ferocity…

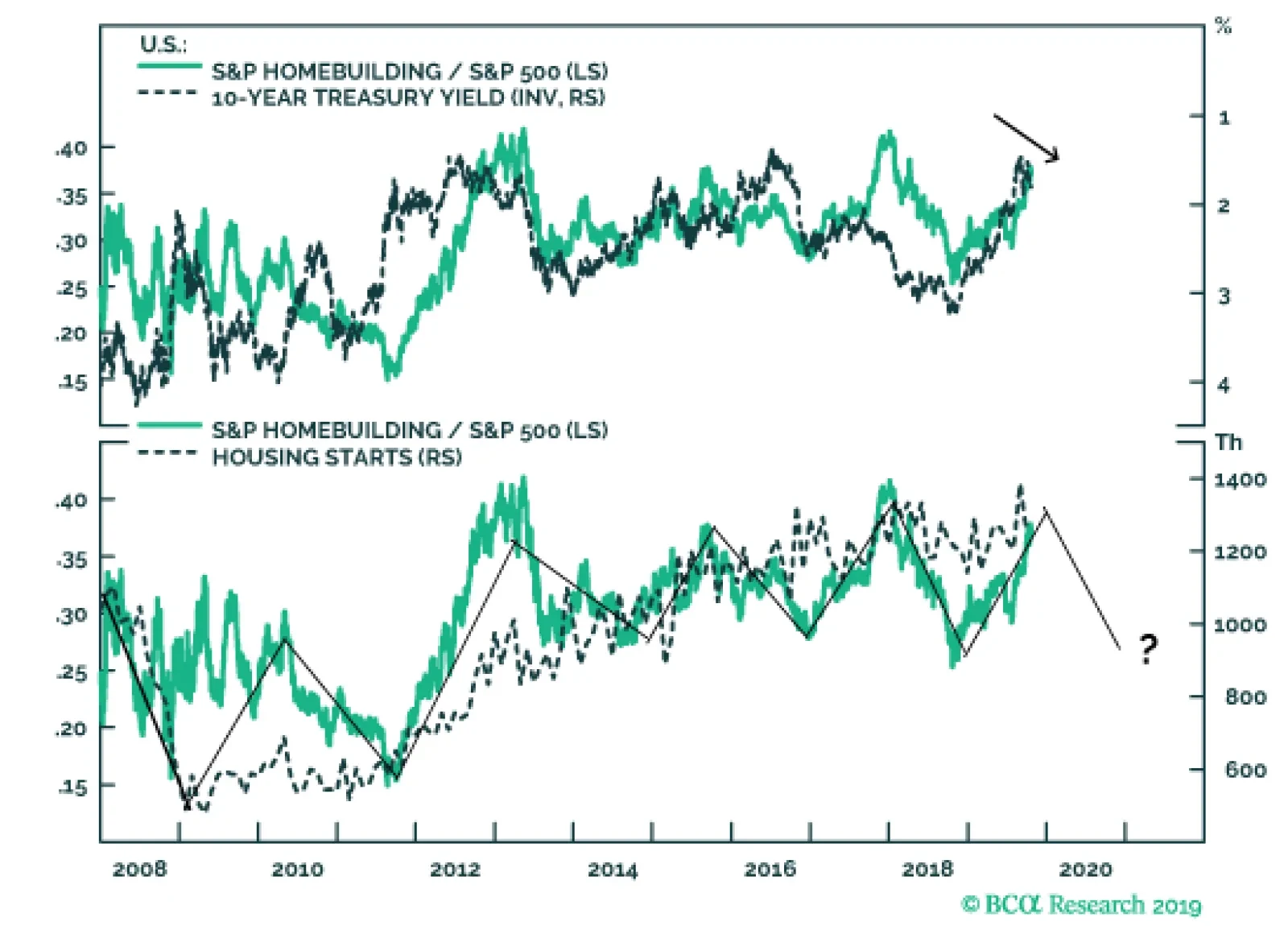

We are downgrading the niche S&P homebuilding index to underweight, as most positive profit drivers are already reflected in relative share prices. Specifically, the drop in interest rates has been more than accounted…

Underweight In yesterday’s Weekly Report1 we recommended downgrading the niche S&P homebuilding index to underweight, as most, if not all, positive profit drivers are already reflected in relative share prices. The…

Highlights Portfolio Strategy Soft housing demand, the trough in interest rates, new home price deflation and weak industry employment prospects suggest that an underweight stance is now warranted in the S&P homebuilding index.…

Highlights New structural recommendation: long GBP/USD. The substantial Brexit discount in the pound makes it a long-term buy for investors who can tolerate near-term volatility. The most powerful equity play on a fading Brexit…

Energy Stocks Are Heading North Banks Clamoring For Higher Rates And A More Hawkish Fed Homebuilding Stocks Are Catching Up To Housing Starts Will Global Trade Get “Fed-Exed”? Do Not Try To Bottom Fish……

Highlights Markets expressed disappointment over last week’s FOMC meeting, … : Equities sold off, Treasury yields slid, and the curve flattened. … but we didn’t think there was all that much to get excited…

Highlights Portfolio Strategy Despite the Fed’s supra natural powers, the deep rooted global growth slowdown will likely win the tug of war versus flush liquidity, especially if the trade war spat stays unresolved and the U.S.…

Since early March, when we first turned tactically cautious on the prospects of the broad equity market, we started applying risk metrics to our portfolio in order to protect profits. In recent weeks as our cautiousness morphed from a…