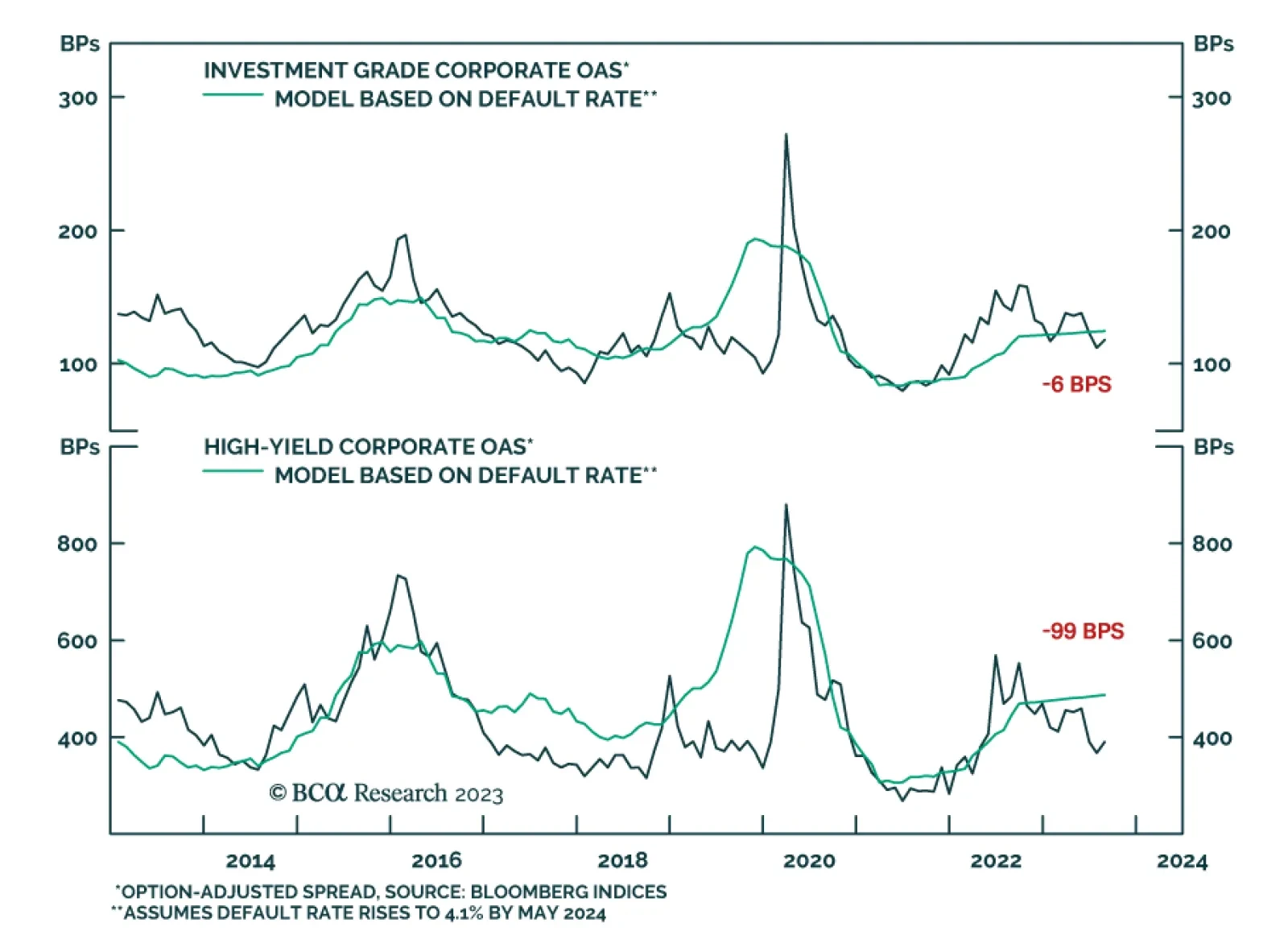

BCA Research’s US Bond Strategy service cautions against turning bullish on corporate bonds. Corporate bonds have delivered strong excess returns versus duration-matched Treasuries during the past two months. Yet the…

Our Portfolio Allocation Summary for August 2023.

This week we present our Portfolio Allocation Summary for July 2023.

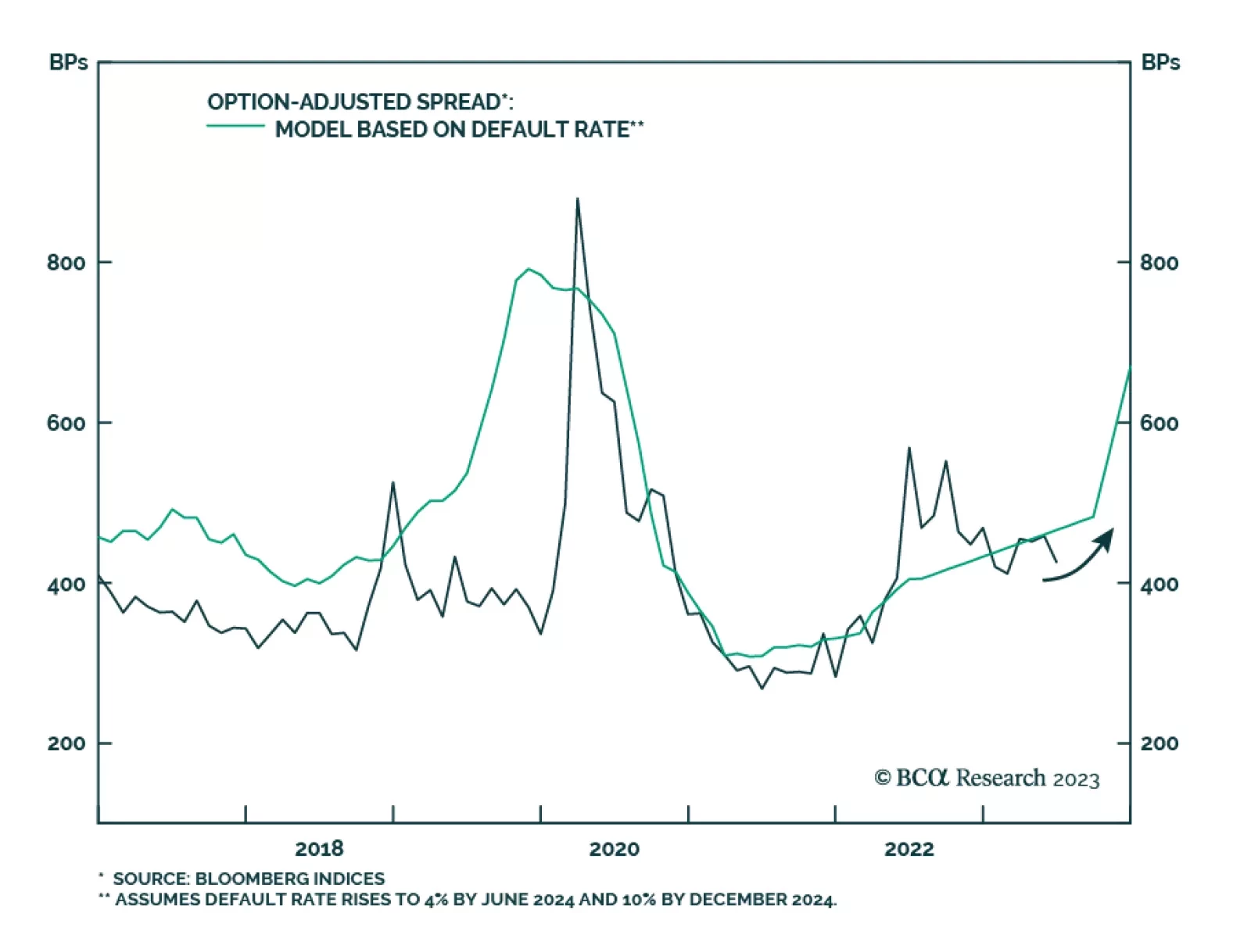

US high-yield corporate bonds have been rallying of late. The average index option-adjusted spread narrowed by 58 bps over the past three weeks. This improvement is consistent with the recent performance of other risky assets:…

This week we present our Portfolio Allocation Summary for June 2023.

This week we present our Portfolio Allocation Summary for May 2023.

This report looks at the relationship between rate risk and credit risk and how it has changed over time. It also makes the case for favoring agency MBS within an underweight allocation to US spread product.

This week we present our Portfolio Allocation Summary for April 2023.

The Fed lifted rates 25 bps yesterday while also signaling that the tightening cycle is near its peak. We discuss the short-run and long-run implications for Treasury yields.