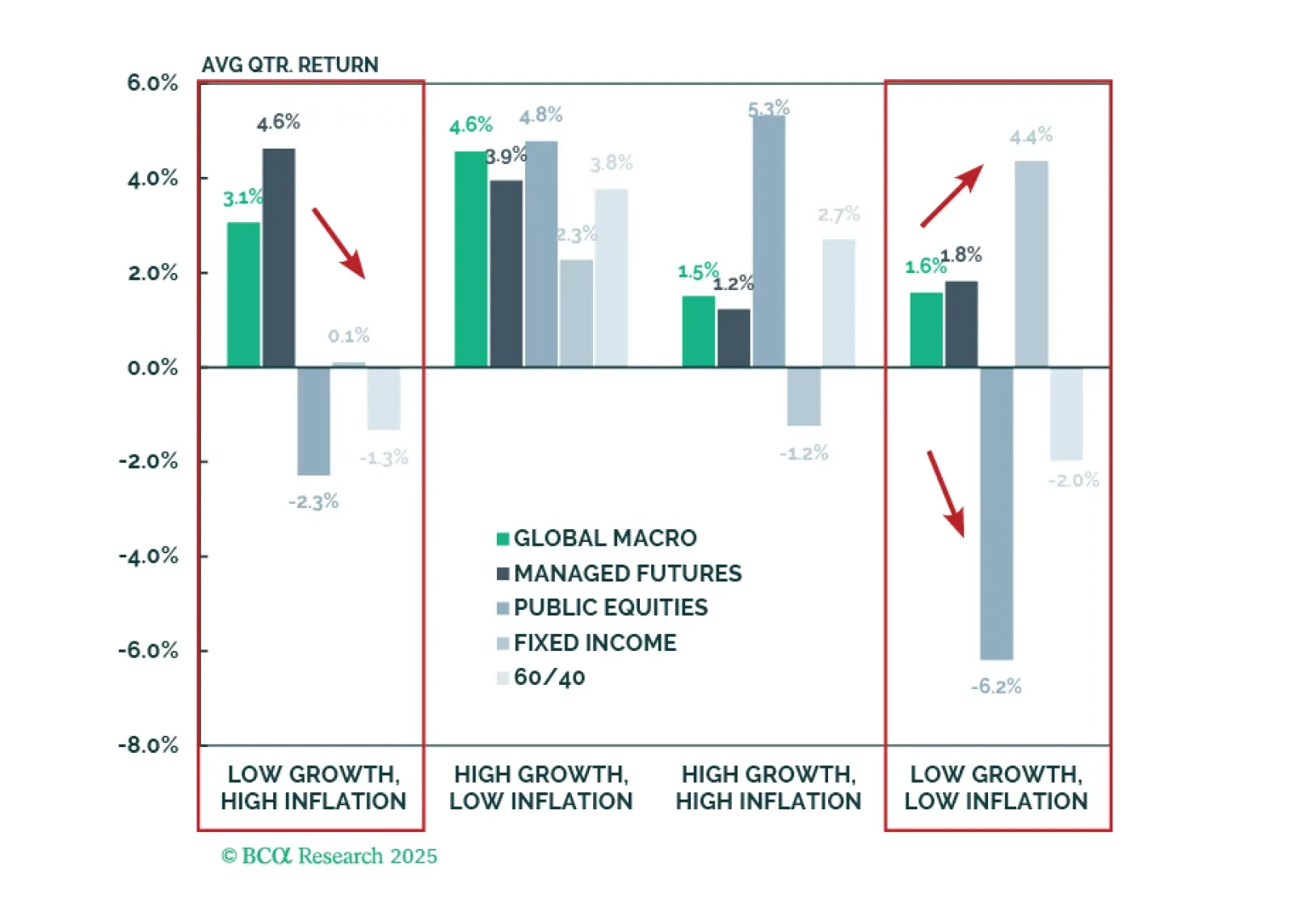

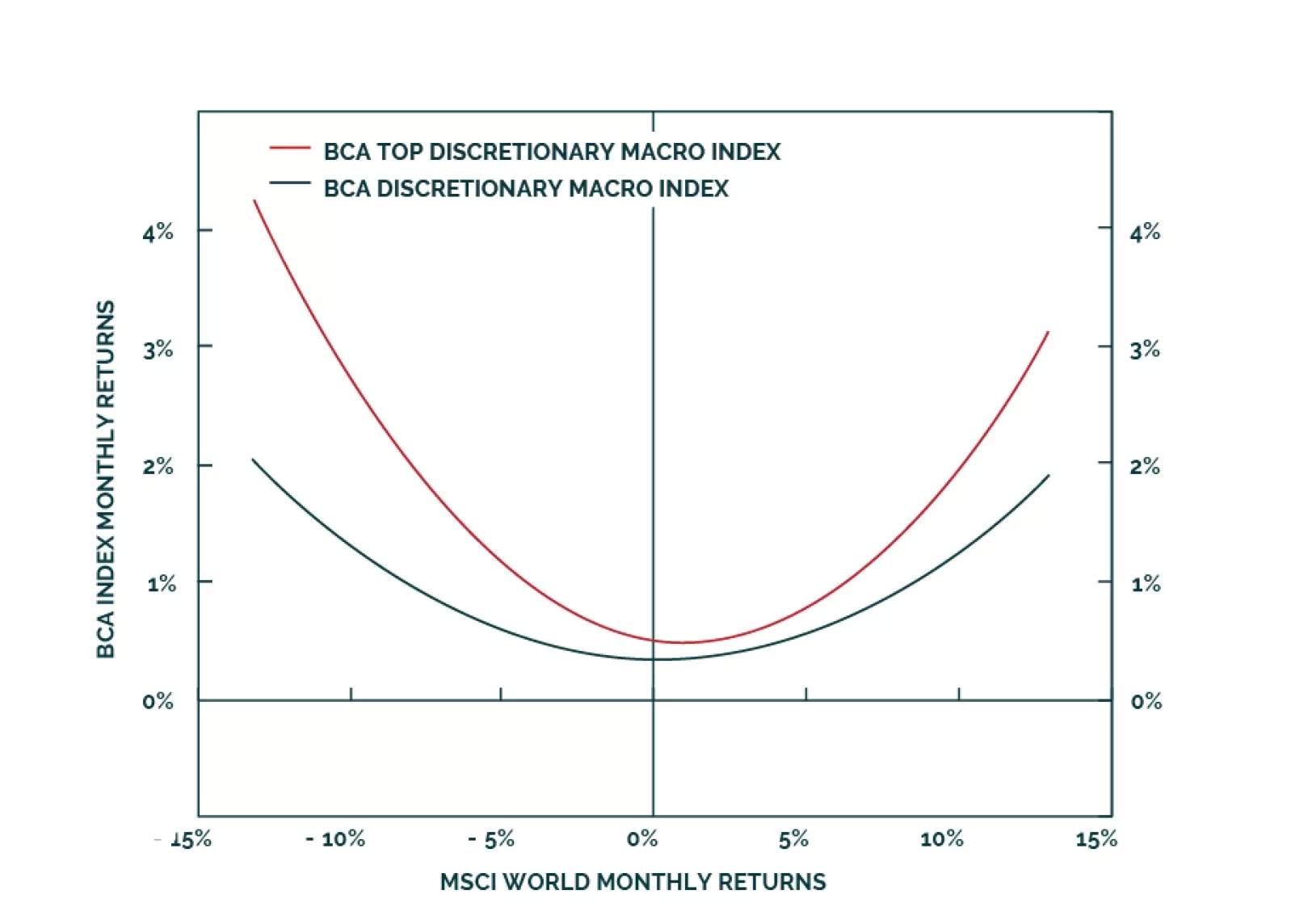

Understanding asset performance across Growth and Inflation regimes helps investors construct and manage balanced portfolios. Our first G&I Catalog report examines Hedge Fund strategies. Global Macro and Managed Futures offer the…

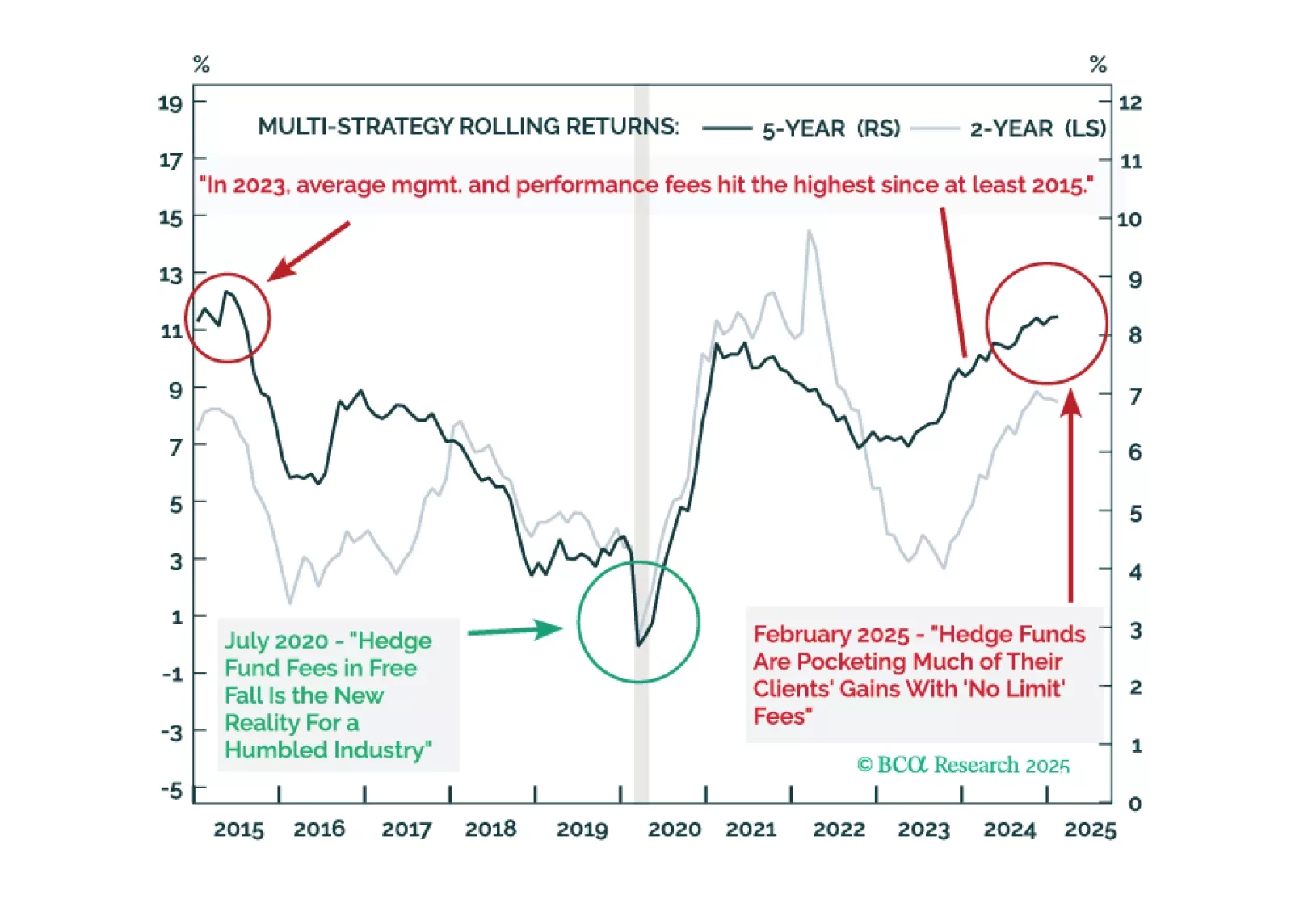

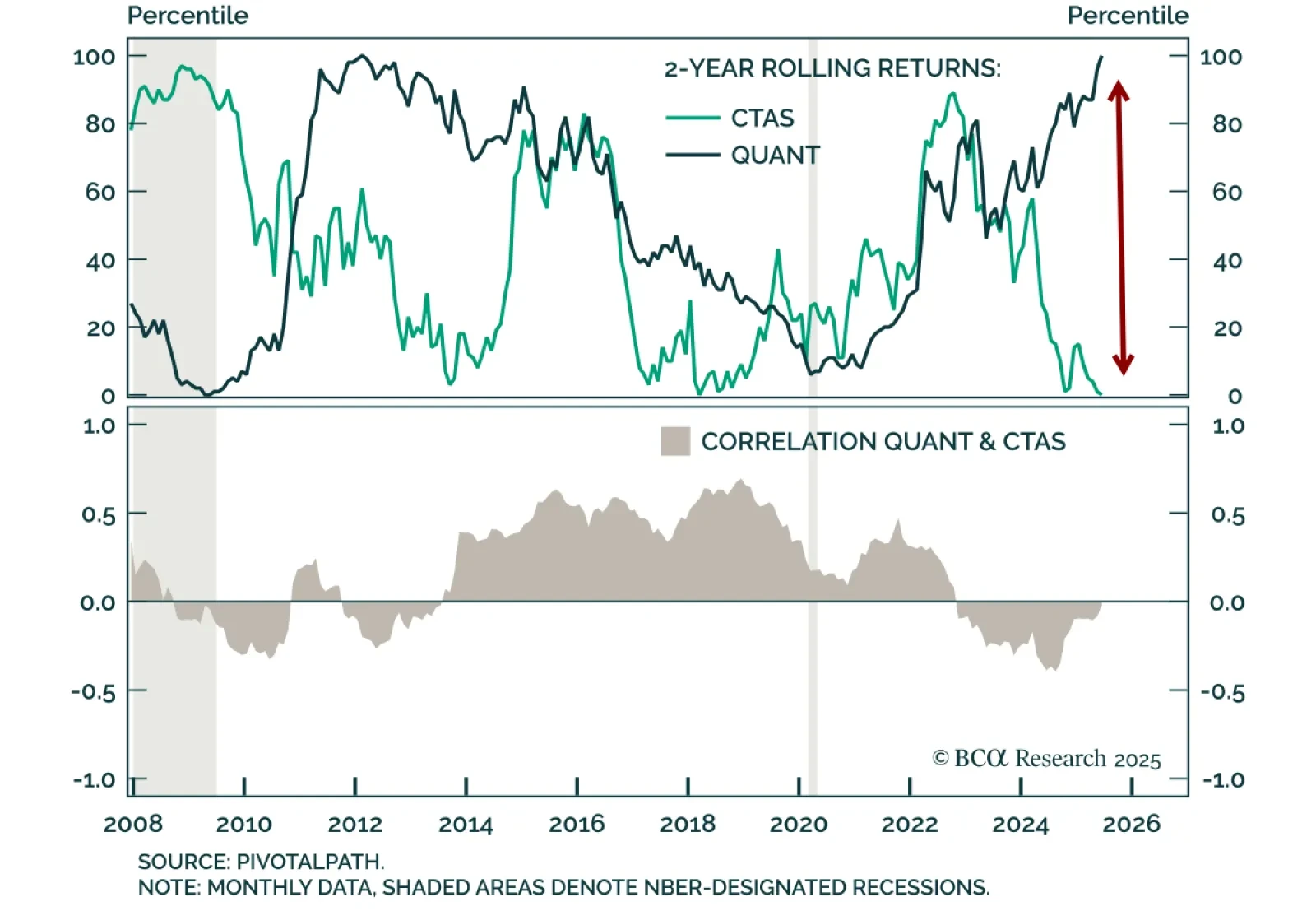

A historic divergence between systematic strategies is creating a compelling entry point into Managed Futures. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives team.…

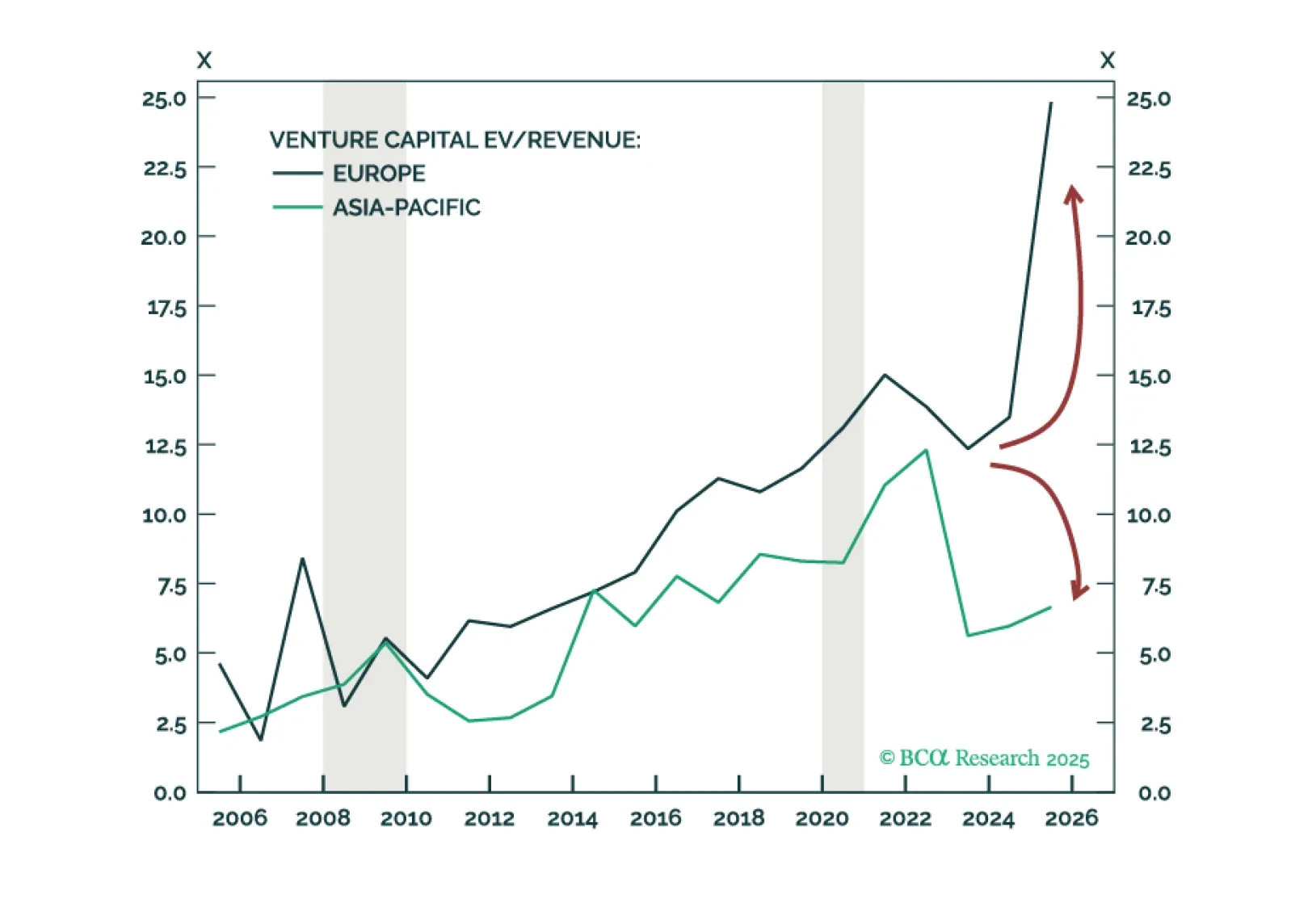

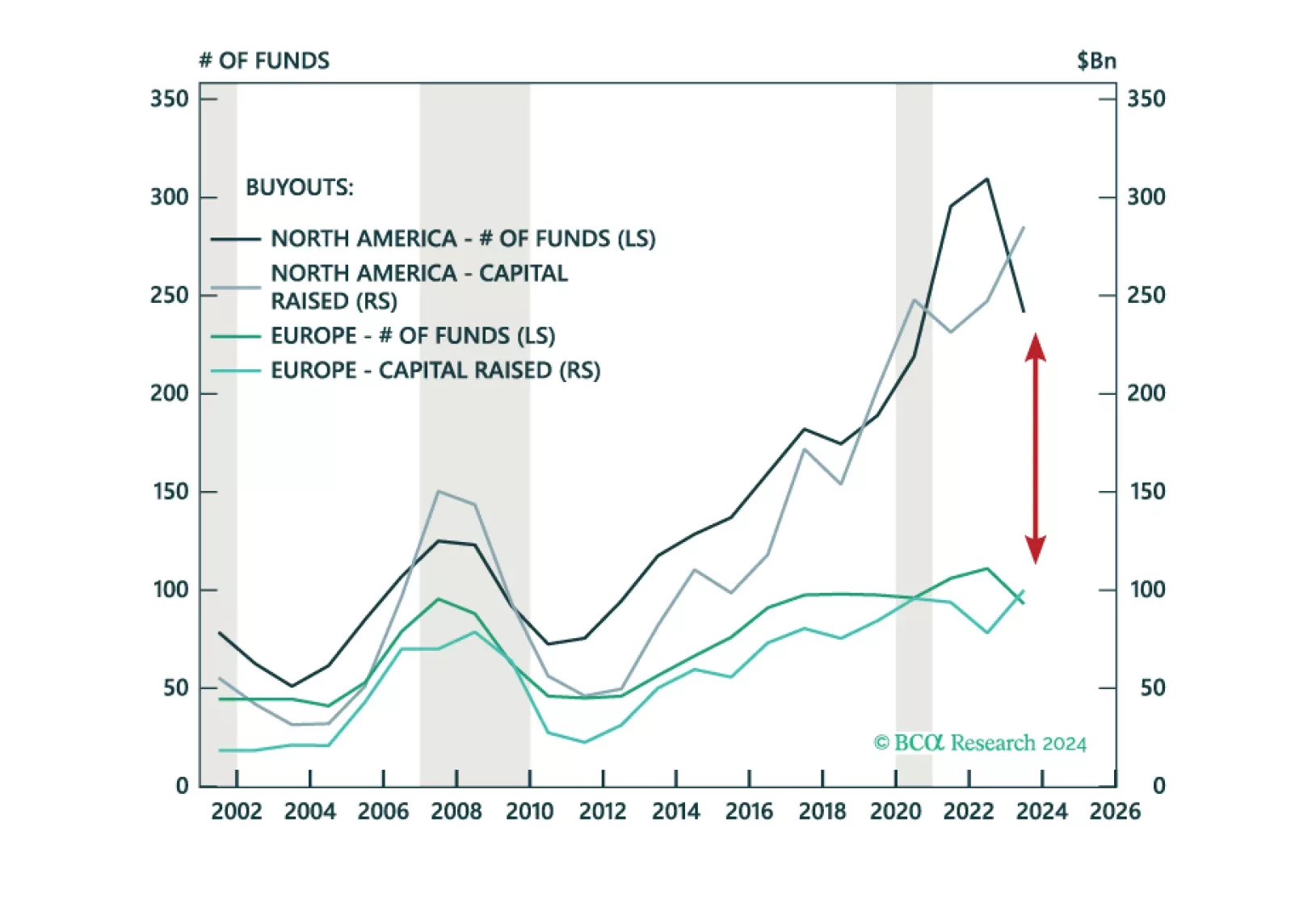

European euphoria is overdone. The most exceptional asset class in Europe is Infrastructure, but granular opportunities span other asset classes by sector and country. Venture Capital is a North America and Asia-Pacific play. We…

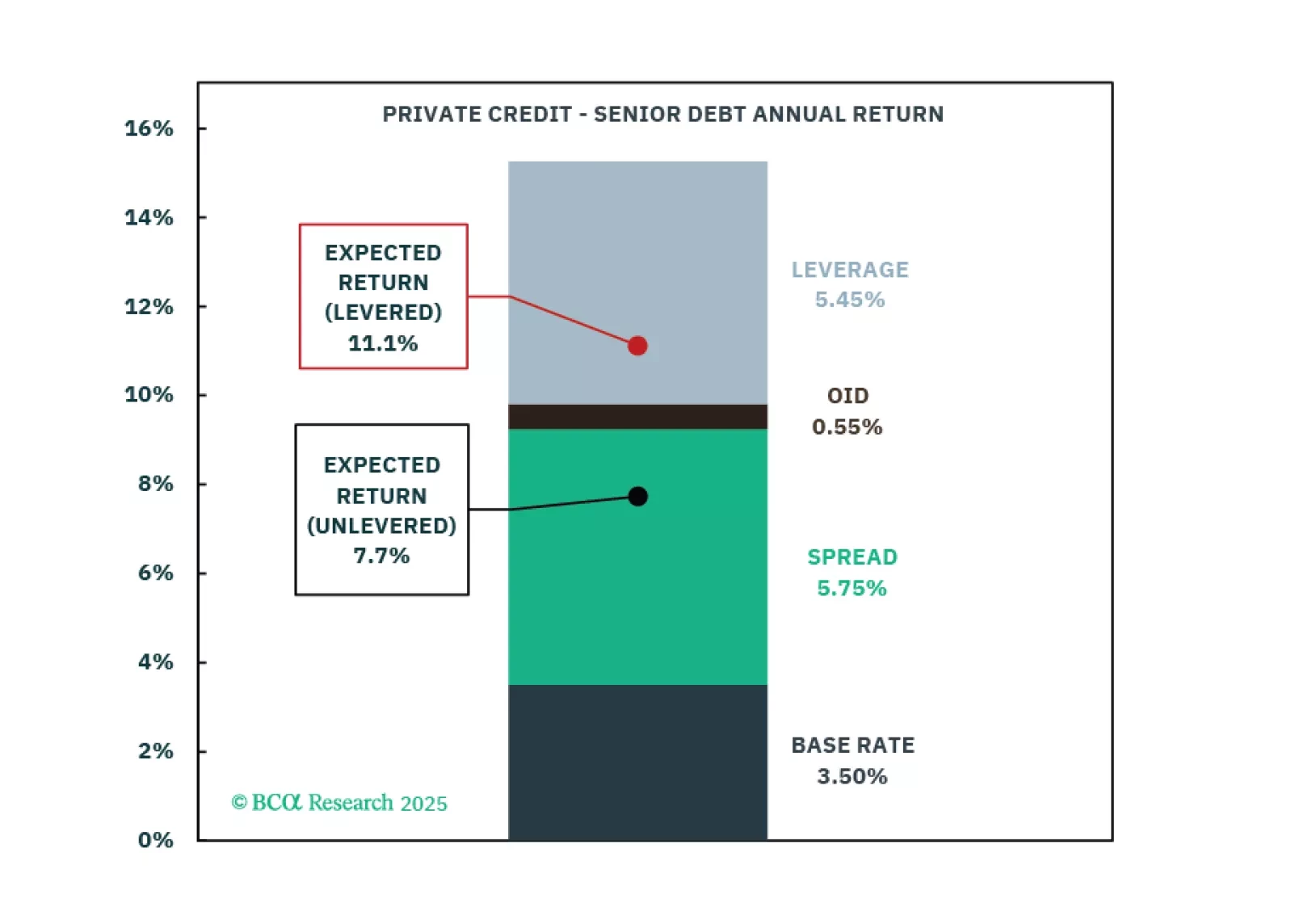

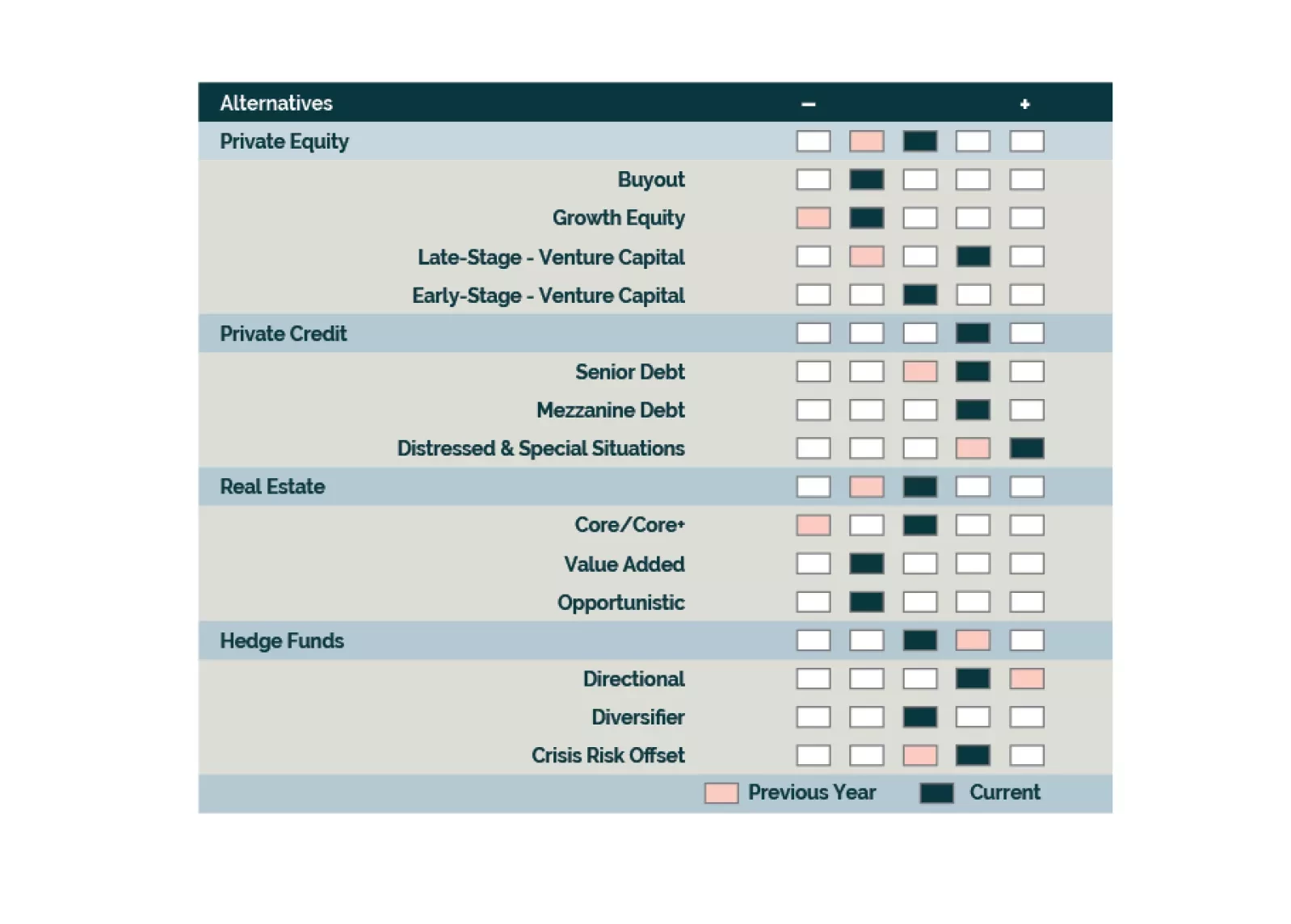

Asset class expectations show mixed shifts from 2024, with Real Estate seeing substantial upgrades and Private Equity benefiting from Venture Capital improvements. Private Credit return expectations decline from 2024 but remain…

We are growing positive on Growth assets with recession expectations increasing our optimism on entry points. Equities are led by APAC Private Equity, North America Venture Capital, and Europe Buyouts. Our outlook continues to…

We go overweight Late-Stage Venture Capital and APAC Private Equity but remain underweight North America Buyouts. We maintain our neutral outlook towards Hedge Funds and are positive on Long-Short Equity, Event Driven, and CRO…

Investors should be tactically tilting allocations towards Direct Lending, Distressed Debt, and Directional Hedge Fund strategies at the expense of Real Estate, Private Equity, and Diversifier Hedge Funds. Structural opportunities…

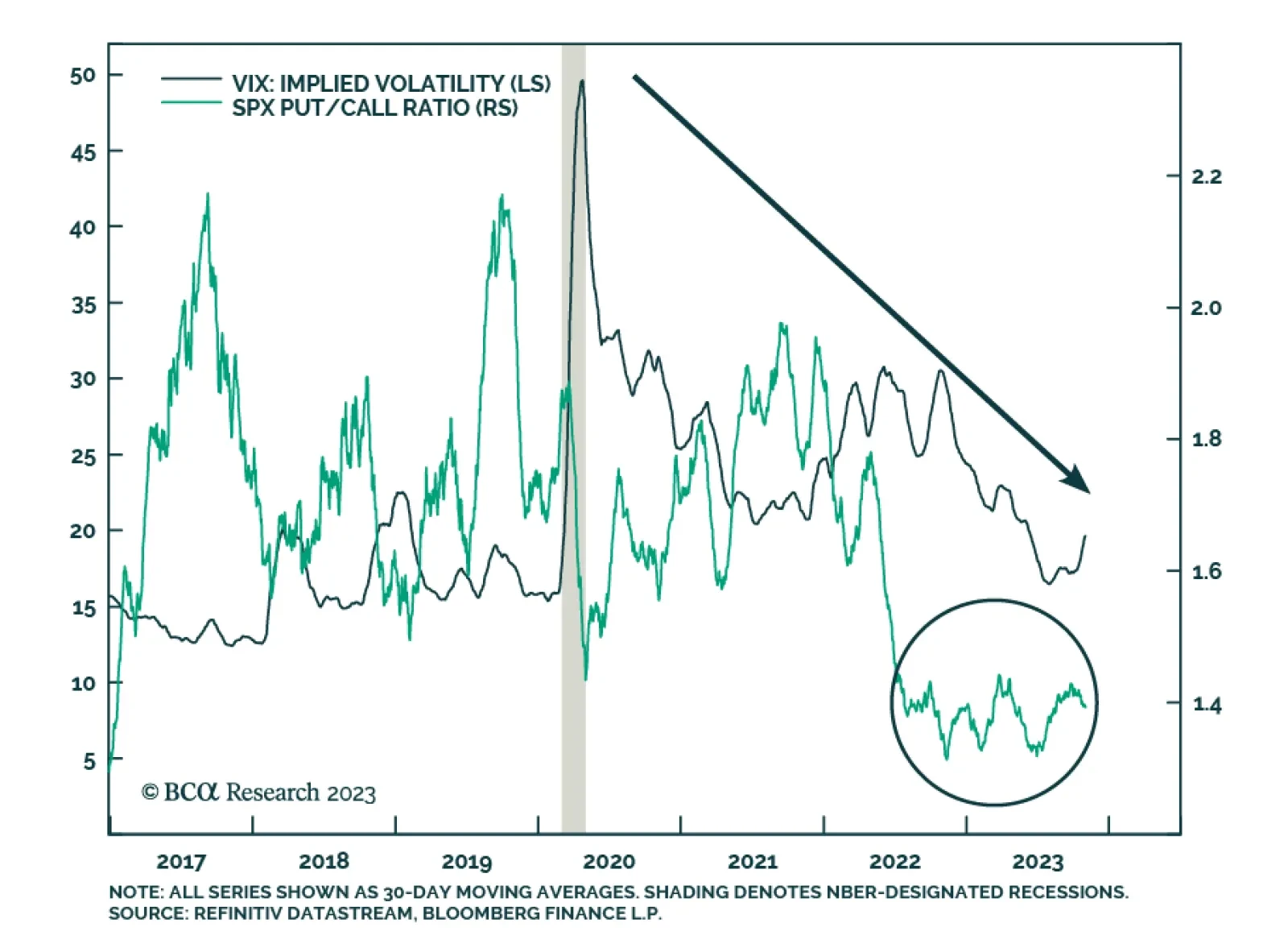

Our Private Market & Alternatives strategists recently upgraded their recommendation on Crisis Risk Offset (CRO) strategies within Hedge Funds from neutral to overweight. They are not making a tactical call around tail risk…