Overweight While the latest ISM manufacturing survey made for grim reading, there is a corner of the manufacturing landscape that excels when overall manufacturing is in retreat: health care equipment (HCE) makers (second panel, ISM…

Overweight As a follow up to yesterday’s Insight Report where we highlighted our sanguine view on the S&P health care equipment index, a structural EM macroeconomic trend further reiterates our constructive view on the U.S.…

Overweight This past Monday we co-authored a Special Report with our sister Geopolitical Strategy service gauging the odds of “Medicare For All” becoming law. Our analysis showed that the odds of universal health care…

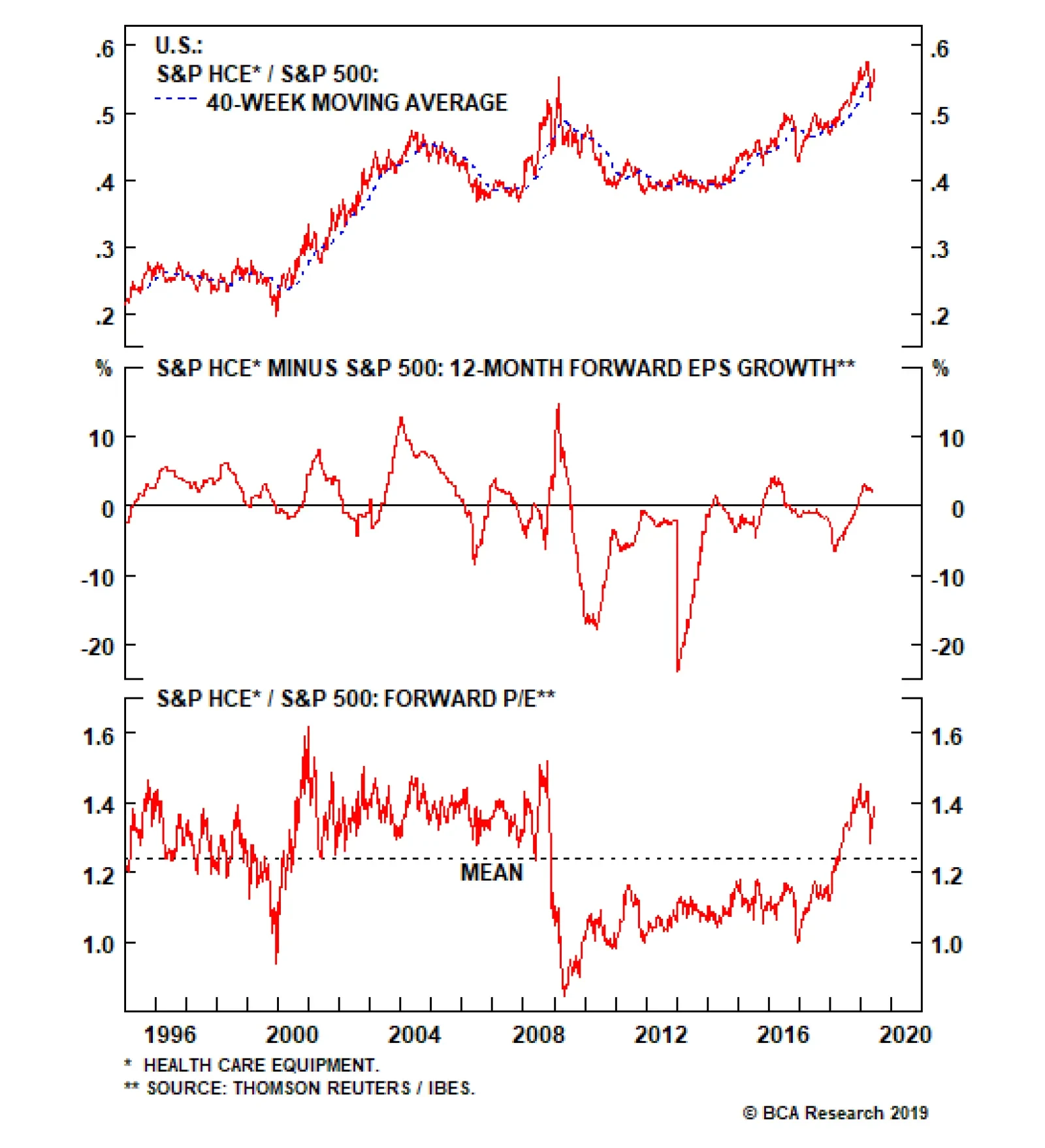

This upgrade is a combination of overwrought investors having created a buying opportunity, combined with health care’s historic outperformance at the end of the business cycle. Nevertheless, an examination of the sector…

The global PMI has historically led U.S. medical equipment exports. While the former has been decelerating for 13 consecutive months, it has been diverging from export growth for the past year. We believe this is a function of…

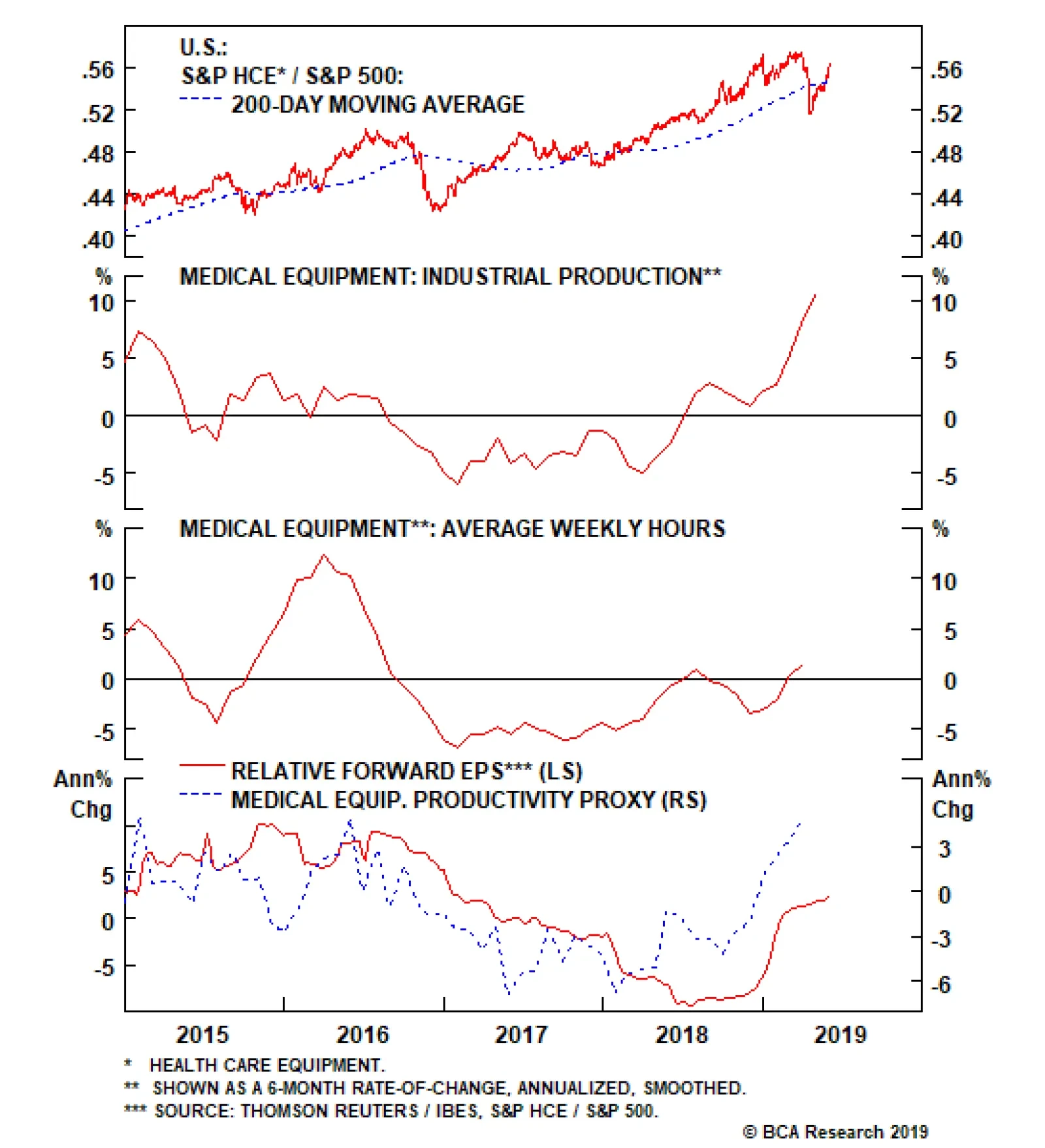

Neutral The S&P health care equipment (HCE) index has caught a bid recently, reflecting the sector's strong profit momentum, following nearly a decade of decline (second panel). We fear, however, that investors have become…

Neutral At the beginning of the summer, we downgraded the S&P health care equipment (HCE) index to neutral for three main reasons: valuations had shot higher, demand had downshifted and pricing had cooled substantially. Relative…

We are making room for the financials sector upgrade by trimming the health care sector to neutral. As discussed in recent weeks, a modest shift away from a defensive to a more balanced portfolio has been on our radar. At the beginning…

Highlights Portfolio Strategy Upgrade the financials sector to overweight. This year's consolidation phase is drawing to a close as inflation expectations stabilize. Lift the S&P banks index to overweight. Leading indicators…